Form 8-K - Current report

November 17 2023 - 4:05PM

Edgar (US Regulatory)

0001023459false00010234592023-11-172023-11-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

November 17, 2023

(Date of the earliest event reported)

Simulations Plus, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| California | 001-32046 | 95-4595609 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

42505 10th Street West, Lancaster, California 93534-7059

(Address of principal executive offices) (Zip Code)

661-723-7723

Registrant's telephone number, including area code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14z-12 under Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | SLP | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01 Regulation FD Disclosure

Simulations Plus, Inc., a California corporation (the “Company”), will be participating at an investor conference hosted by BTIG on November 20, 2023. A copy of the investor presentation that will be utilized at the conference is attached to this Current Report on Form 8-K (the “Report”) as Exhibit 99.1. The presentation has also been posted to the Company’s website in the “Investors” section.

In accordance with General Instructions B.2 of Form 8-K, the information in this Report, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, except as expressly set forth by specific reference in such filing to this Report.

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

This Report, including the disclosures set forth in Exhibit 99.1 attached hereto, contains certain forward-looking statements that involve substantial risks and uncertainties. When used herein, the terms “anticipates,” “expects,” “estimates,” “believes” and similar expressions, as they relate to us or our management, are intended to identify such forward-looking statements.

Forward-looking statements in this Report or reports hereafter furnished, including in other publicly available documents filed with the Securities and Exchange Commission (the “Commission”), to the Company’s stockholders and other publicly available statements issued or released by us involve known and unknown risks, uncertainties and other factors which could cause our actual results, performance (financial or operating) or achievements to differ from the future results, performance (financial or operating) or achievements expressed or implied by such forward-looking statements. Such future results are based upon management’s best estimates based upon current conditions and the most recent results of operations. These risks include, but are not limited to, the risks set forth herein and in such other documents filed with the Commission, each of which could adversely affect our business and the accuracy of the forward-looking statements contained herein. Our actual results, performance or achievements may differ materially from those expressed or implied by such forward-looking statements.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | |

| SIMULATIONS PLUS, INC. |

| |

| Dated: November 17, 2023 | By: /s/ Will Frederick |

| Will Frederick |

| Chief Financial Officer |

Investor Presentation NASDAQ: SLP Q4 FY23 Update

With the exception of historical information, the matters discussed in this presentation are forward-looking statements that involve a number of risks and uncertainties. Words like “believe,” “expect” and “anticipate” mean that these are our best estimates as of this writing, but that there can be no assurances that expected or anticipated results or events will actually take place, so our actual future results could differ significantly from those statements. Factors that could cause or contribute to such differences include, but are not limited to: our ability to maintain our competitive advantages, acceptance of new software and improved versions of our existing software by our customers, the general economics of the pharmaceutical industry, our ability to finance growth, our ability to continue to attract and retain highly qualified technical staff, our ability to successfully integrate the recently acquired Immunetrics business with our own, as well as expenses we may incur in connection therewith, and a sustainable market. Further information on our risk factors is contained in our quarterly and annual reports and filed with the U.S. Securities and Exchange Commission. Safe Harbor Statement

SLP Mission: Improve Health Through Innovative Solutions We create value for our customers by accelerating development timelines and reducing the cost of drug development R&D through innovative science-based software and consulting solutions that optimize treatment options and improve patient lives. 3

Leading Provider of Software and Consulting Services in the Biosimulation Market AI-powered technology solutions optimize the outcomes of drug discovery, development, research, and regulatory submissions processes. Our software-based technology both models and simulates how drugs and diseases behave in humans and in other species. 18+ SOFTWARE SOLUTIONS SLP At a Glance 25+ YEARS OVER 25 YEARS IN BUSINESS AND CONTINUING THE COMMITMENT TO IMPROVE PUBLIC HEALTH THROUGH INNOVATIVE SOLUTIONS OUR CLIENTS TRUST OUR EXPERT CONSULTING THAT SUPPORTS DRUG RECOVERY, CLINICAL DEVELOPMENT RESEARCH AND REGULATORY SUBMISSIONS 300+ CLIENTS WE PROVIDE VALIDATED AI AND MACHINE LEARNING, MODELING AND SIMULATION SOFTWARE FOR NOVICE AND EXPERT USERS ALIKE 18+ SOFTWARE SOLUTIONS 4 4

SLP Investment Highlights Industry Leader in Large and Growing Market Biosimulation Technology Leader Leveraging AI Compelling Customer Value Proposition Strong Competitive Position and Barriers to Entry Seasoned Management Team and Scientific Leadership Attractive Financial Profile +++ +++ 5

Drug Discovery & Development The Drug Discovery and Development Industry can be broken down into several subindustries, including: 1. TARGET DISCOVERY AND VALIDATION 2. LEAD COMPOUND IDENTIFICATION AND OPTIMIZATION 3. PRE-CLINICAL DEVELOPMENT 4. CLINICAL TRIALS 5. REGULATORY REVIEW & APPROVAL 6. COMMERCIALIZATION 7. POST-APPROVAL SURVEILLANCE AND LIFE CYCLE MGMT. Each of these subindustries represents a different stage of the drug development process and involves different tasks, such as: ✓ identifying targets for drug development ✓ synthesizing and testing compounds ✓ conducting clinical trials ✓ seeking regulatory approval for marketing and sales. The subindustries within drug discovery and development are highly interdependent, with progress in one stage often impacting the progress in other stages. 6

Drug Development Challenges | SLP Biosimulation Solution Our core mission – accelerating the development and delivery of better, safer, and more effective drugs SIMULATIONS PLUS SOLUTIONS Simulations Plus offers AI-powered technology solutions to help optimize the outcomes of the drug discovery, development, research and regulatory approval processes to bring drugs to market faster Simulations Plus solutions can help increase the number of candidates approved by streamlining the drug development process, creating efficiencies that lead to drug efficacy and safety, higher regulatory approval, improved commercial success and much more CHALLENGES The median cost of developing a new drug averages $1.5 to $2 billion and the timeline can range from 10-15 years. On average only 11% of all drug candidates are approved Source: Company research – – + + 7

Biosimulation Overview Biosimulation is software-based technology that models and simulates how drugs and diseases behave in the human body Biosimulation combines core principles in biology, chemistry and pharmacology with proprietary mathematical algorithms to predict how biology and drugs interact with one another. Models can start in vitro (without animal or human testing) but are developed through the development cycle incorporating animal and human test results along the way. Model uses include lead optimization, dose regimens, clinical trial protocol development, clinical trial simulation, bioequivalence evaluation, toxicity assessment and many more. + + 8

Large and Growing Market Spending for biosimulation products continues to increase given need to bring drugs to market faster Biosimulation market valued at $2.8B in 2022 and is expected to expand at a 16.9% CAGR from 2022 - 2030 Strategy to grow addressable market within the Biosimulation TAM through both internal R&D investment and strategic acquisitions • SLP is growing faster than the Biosimulation TAM • Biosimulation growing at 4-5x total R&D spend Highly fragmented and underpenetrated market with only a few larger players • The global biosimulation market is segmented based on product, application, delivery model, and end users. $200B GLOBAL PHARMA AND BIOTECH SPEND (3% CAGR) + + + $9.8B BIOSIMULATION TAM BY 2030 $700M-$800M SLP ADDRESSABLE 9 Source: Company research

Secular Trends Driving Sustained Long-Term Growth Biosimulation taking greater percentage of drug development spend annually Scarcity of blockbuster drug opportunities drive industry focus to smaller market targets requiring increased development efficiency Increased scrutiny and rising cost of animal studies and human clinical Increased adoption of Modeling & Simulation by regulatory agencies and decision making based on Modeling & Simulation input Increasing use cases for application of Modeling & Simulation methods to impact decision making Drivers include: + + + + + 10

End-to-End Solutions Across the Development Life Cycle Decrease development uncertainty, cost and time C O N FI D E N C E L E V E L O F D R U G A P P R O V A L TIME D R U G A P P ROVA L Discovery Pre-clinical Clinical Drug Approval CHEMINFORMATICS PHARMACOMETRICS PBPK / PBBM/ QST/ QSP “…combining models and data results in higher confidence in clinical performance at an earlier time in development.” U.S. Food and Drug Administration REGULATORY 11

Strong Competitive Position 18 LEADING POSITION IN LARGE, GROWING, FRAGMENTED AND UNDERPENETRATED MARKET LARGE, GROWING AND DIVERSE CUSTOMER BASE MOST COMPREHENSIVE AND WIDELY RECOGNIZED TOOLS IN THE INDUSTRY 300+ CUSTOMERS ACCUMULATED PUBLIC AND PRIVATE DATA THAT INFORMS OUR ALGORITHMS AND MODELS + + + + + 12

Fiscal 2023 Highlights ▪ Strong revenue and earnings results for fiscal 2023 ▪ Conditions in our market remain similar to what we have seen past several quarters – Small biotech slowdown – Large Pharma spending cautiousness ▪ Integration of Immunetrics going well ▪ Achieved revenue and adjusted diluted earnings per share guidance $0.49 Diluted EPS $59.6M Revenue 35% Adj. EBITDA1 as % of Revenue $20M Backlog $0.67 Adjusted Diluted EPS1 1 Refer to Non-GAAP Disclosures in the appendix 13

▪ Employee Engagement and Development ▪ Product Development ▪ ERP Processes and Technology ▪ Acquisitions (Immunetrics Q4) ▪ Investment Opportunities ▪ Strategic Partnerships and Alliances ▪ $0.06 per share paid Feb. 6th ▪ $0.06 per share paid May 1st ▪ $0.06 per share paid Aug. 7th ▪ $0.06 per share paid Nov. 6th ▪ $50M share repurchase program ▪ $20M accelerated share repurchase (ASR) in Q3 INTERNAL INVESTMENT CORPORATE DEVELOPMENT DIVIDEND PAYMENTS SHARE REPURCHASES We are committed to investing in our employees, products, and providing value to our shareholders Fiscal 2023 Capital Allocation Strategy 14

▪ QSP is a critical and growing field ▪ Immunetrics has increased the range of therapeutic areas addressed by our QSP software and services offerings by more than 50% ▪ Ideal fit as the business leverages our existing infrastructure by expanding its therapeutic resources into largely underserved areas, including immunology and oncology ▪ Immunetrics chose Simulations Plus for its well- respected reputation ▪ Integration is going very well Integration and consolidation efficiencies Fiscal 2023 M&A | Immunetrics Acquisition and Integration 15

ENVIRONMENT HUMAN CAPITAL Reduced footprint of US-based facilities by 35% from 19,300 sf to 12,400 sf. Established a process to gather GHG emissions data points and set targets for expected SEC disclosure requirements. Implemented LearnUpon LMS and Adobe e-signature to reduce in- person training travel and printed materials with virtual on-demand programs using digital materials. SOCIAL GOVERNANCE Updated company privacy policy and processes in the PDP Program to reflect changes to global personal data protection laws. Developed and published Human Rights Policy to support our commitment to human rights. Expanded University+ program to 307 free software licenses across 51 countries to further education in our industry and support the next generation of scientists. Established a paid parental leave program to support working parents. Implemented employee engagement & recognition software to further promote and foster a culture of appreciation and inclusion. Conducted employee engagement survey to ensure culture alignment and success of internal programs and benefits. Engaged a third-party consulting firm to carry out a board evaluation process and joined NACD to support ongoing director education. Implemented pay vs. performance analysis for SEC disclosure of company financial performance measure used to determine executive compensation. Updated Code of Conduct policy to reflect that we and our business partners meet the standards of business governance, environmental sustainability, and human rights. Fiscal 2023 ESG Achievements 16 Strategic priorities that align with our mission and values and the four pillars of sustainability

Attractive Financial Profile Delivering Double-Digit Revenue Growth / Industry Leading Margins REVENUE $ in millions $29.7 $34.0 $41.6 $46.4 $53.9 $59.6 14.9% GROSS MARGIN % EBITDA MARGIN % FY18 FY19 FY20 FY21 FY22 FY23 5 Yr CAGR FY18 FY19 FY20 FY21 FY22 FY23 6 Yr Avg 73.1% 73.4% 74.4% 77.2% 79.9% 80.0% 76.4% 43.3% 39.1% 34.4% 31.2% 33.3% 19.2% 33.4% Double digit revenue growth Strong recurring revenue supported by a 90%+ Software Fee Renewal Rate High gross/EBITDA margins to drive strong operating leverage High-margin, recurring revenue over the life of the client relationship Product mix skews toward higher margin software sales $115.5 million in cash and short- term investments to fund growth + + + + + + 17

Fiscal 2024 Guidance Guidance Total Revenue $66M to $69M Total Revenue Growth 10% to 15% Software Revenue Mix 55% to 60% Services Revenue Mix 40% to 45% Diluted EPS $0.66 to $0.68 18

Seasoned Management Team and Scientific Leadership Highly experienced management team with deep life science industry expertise, track record of growth and strong returns Shawn O’Connor Chief Executive Officer Will Frederick Chief Financial Officer Brett Howell, Ph.D. President Quantitative Systems Pharmacology Solutions (QSP) Jill Fiedler-Kelly, M.S., FISoP President Clinical Pharmacology & Pharmacometrics Services Solutions (CPP) John DiBella, M.S President Physiologically Based Pharmacokinetic (PBPK) Solutions, Cheminformatics Solutions, Regulatory Strategies Solutions Jonathan Chauvin, Ph.D. President Clinical Pharmacology & Pharmacometrics Software Solutions (CPP) Josh Fohey Vice President, Business Development 19

Organizational Structure Aligned to Support Customers 20 CEO & President Business Units Clinical Pharmacology & Pharmacometrics (CPP) Physiologically Based Pharmacokinetics (PBPK) Quantitative Systems Pharmacology (QSP) Cheminformatics Shared Services Chief Revenue Officer Sales Marketing Chief Financial Officer G&A Regulatory Strategies

WELL POSITIONED TO ACHIEVE OUR FY24 GOALS Delivering on our commitment to scientific leadership Challenges being addressed 21 • Internal R&D investment • Expanding industry and regulatory partnerships • MIDD+ – 3rd annual SLP sponsored conference Enhancing our client facing capabilities Focus on Capital Allocation CONTINUED LEADERSHIP POSITION IN BIOSIMULATION MARKET Conclusion • Growth and maturity of business development team • Focus on expanding our local coverage of EU market • Focus on supporting accelerated growth in distributor network • Software renewal timing changes on track • Small biotech churn • General market dynamics: inflation, recession & forex • ASR program has been completed • Immunetrics acquisition completed in Q4

Appendix

Non-GAAP Definitions 23 Adjusted EBITDA Adjusted EBITDA is defined as earnings (loss) before interest, taxes, depreciation and amortization, stock-based compensation, (gain) loss on currency exchange, any acquisition- or financial-transaction-related expenses, and any asset impairment charges. Currency exchange excluded represents the exchange rate fluctuations on the foreign currency denominated transactions. The impact of transactions in foreign currency represents the effect of converting revenue and expenses occurring in a currency other than the functional currency. The Company believes that the non-GAAP financial measures presented facilitate an understanding of operating performance and provide a meaningful comparison of its results between periods. The Company’s management uses non-GAAP financial measures to, among other things, evaluate its ongoing operations in relation to historical results, for internal planning and forecasting purposes and in the calculation of performance-based compensation. Adjusted EBITDA represents a measure that we believe is customarily used by investors and analysts to evaluate the financial performance of companies in addition to the GAAP measures that we present. Our management also believes that Adjusted EBITDA is useful in evaluating our core operating results. However, Adjusted EBITDA is not a measure of financial performance under accounting principles generally accepted in the United States of America and should not be considered an alternative to net income or operating income as an indicator of our operating performance or to net cash provided by operating activities as a measure of our liquidity. The Company’s Adjusted EBITDA measure may not provide information that is directly comparable to that provided by other companies in its industry, as other companies in its industry may calculate non-GAAP financial results differently, particularly related to nonrecurring, unusual items. Adjusted Diluted EPS Adjusted diluted EPS is calculated based on net income excluding the impact of any acquisition- or financial-transaction-related expenses, any asset impairment charges, and tax provisions / benefits related to the previous items. The Company excludes the above items because they are outside of the Company’s normal operations and/or, in certain cases, are difficult to forecast accurately for future periods. The Company believes that the use of non-GAAP measures helps investors to gain a better understanding of the Company’s core operating results and future prospects, consistent with how management measures and forecasts the Company’s performance, especially when comparing such results to previous periods or forecasts.

Cheminformatics and PBPK Solutions LEAD SELECTION PHARMACOLOGY TREATMENT REGIMEN SAFETY CLINICAL EFFICACY ADMET DMPK SERVICES PBPK / PBBM Preclinical Regulatory Consulting 24

Quantitative Systems Pharmacology Solutions LEAD SELECTION PHARMACOLOGY TREATMENT REGIMEN SAFETY CLINICAL EFFICACY ADMET DMPK SERVICES QSP Consulting QST Consulting 25

Clinical Pharmacology & Pharmacometrics Solutions LEAD SELECTION PHARMACOLOGY TREATMENT REGIMEN SAFETY CLINICAL EFFICACY ADMET DMPK SERVICES Pharmacometrics Clinical Pharmacology Clinical Regulatory Consulting 26

Services Overview Provides customers with specialized knowledge and expertise Delivers complementary capabilities to software application solutions Helps clients minimize or eliminate questions posed by regulatory reviews while decreasing cost and time to develop detailed reports Drives operational efficiencies for customers leading to timelier and more streamlined decision-making and regulatory reporting Covers PBPK, Clinical Pharmacology & Pharmacometrics, QSP and Regulatory Strategies disciplines Offers specialized therapeutic, modeling and regulatory knowledge Brings specialized knowledge and expertise to help extend customers’ internal capabilities Average contract size of approximately $200k + + + + + + + + 27

Workplace Recognition Awards 28

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

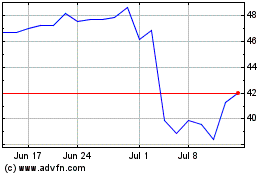

Simulations Plus (NASDAQ:SLP)

Historical Stock Chart

From Apr 2024 to May 2024

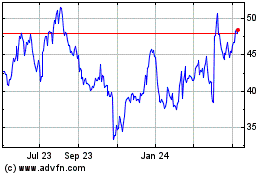

Simulations Plus (NASDAQ:SLP)

Historical Stock Chart

From May 2023 to May 2024