As filed with the Securities and Exchange Commission

on January 25, 2024

Registration No. 333-________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

RADCOM Ltd.

(Exact name of registrant as specified in its charter)

| Israel |

|

Not Applicable |

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

24 Raoul Wallenberg Street

Tel Aviv 69719, Israel

(Address of Principal Executive Offices)(Zip Code)

RADCOM LTD. 2023 EQUITY INCENTIVE PLAN

(Full title of the plans)

RADCOM Inc.

Six Forest Avenue

Paramus, New Jersey 07652

(201) 518-0033

(Name and address of agent for service)(Telephone

number, including area code, of agent of service)

Copies of all communications, including all

communications sent to the agent for service, should be sent to:

| Howard E. Berkenblit |

|

Shy S. Baranov |

| Sullivan & Worcester LLP |

|

Gornitzky & Co. Law Offices |

| One Post Office Square |

|

20 HaHarash St. |

| Boston, Massachusetts 02106 |

|

Tel Aviv 6761310, Israel |

| (617) 338-2800 |

|

(011) 972-3-710-9191 |

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large

accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company”

in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ☐ |

Accelerated filer ☒ |

| Non-accelerated filer ☐ |

Smaller reporting company ☐ |

| |

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY NOTE

RADCOM Ltd. (the “Company”)

previously filed a Registration Statement on Form S-8 (the “Prior Registration Statement”) with the Securities and

Exchange Commission (the “Commission”) to register under the Securities Act of 1933, as amended (the “Securities

Act”), an aggregate of 1,500,000 Ordinary Shares, par value NIS 0.20 per share (“Ordinary Shares”), of the

Company to be offered and sold pursuant to the Company’s 2023 Equity Incentive Plan (the “2023 Plan”). The Prior

Registration Statement was filed with the Commission on March 30, 2023 (File No. 333-270983).

This Registration Statement has been prepared and

filed pursuant to General Instruction E to Form S-8, for the purpose of effecting the registration under the Securities Act of additional

1,500,000 Ordinary Shares, to be offered and sold pursuant to the 2023 Plan.

Pursuant to General Instruction E to Form S-8,

the contents of the Prior Registration Statement related to the 2023 Plan is incorporated by reference herein, and made a part of this

Registration Statement, except as amended hereby.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The Commission allows the Company to “incorporate

by reference” the information the Company files with or submits to it, which means that the Company can disclose important information

by referring to those documents. The information incorporated by reference is considered to be part of this Registration Statement, and

later information filed with or submitted to the Commission will update and supersede this information.

The following documents are incorporated herein

by reference:

| (1) |

The Company’s Annual Report on Form 20-F for the year ended December 31, 2022, filed with the Commission on March 30, 2023; |

| |

|

| (2) |

The GAAP financial statements included in Exhibit 99.1 to the Company’s reports of foreign private

issuer on Form 6-K furnished to the Commission on May

10, 2023, August 2, 2023,

and November 8, 2023,

the first paragraph and the section titled “Risks Regarding Forward-Looking Statements” of the press release attached

as Exhibit 99.1 to the Company’s report of foreign private issuer on Form 6-K furnished to the Commission on May

1, 2023, the first paragraph of the press release attached as Exhibit 99.1 to the Company’s report of foreign private issuer

on Form 6-K furnished to the Commission on May

22, 2023 and the Company’s reports of foreign private issuer on Form 6-K furnished to the Commission on June

29, 2023, August 3, 2023;

and January 25, 2024; and |

| |

|

| (3) |

The description of the Company’s Ordinary Shares contained in the Company’s

Registration Statement on Form 8-A filed pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

on September 19, 1997, as amended by Exhibit 2.2 to the Company’s Annual Report on Form 20-F for the year ended December 31,

2019, and including any further amendment or report filed which updates such description. |

All documents subsequently filed by the Company

pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, prior to the filing of a post-effective amendment which indicates

that all securities offered have been sold or which deregisters all securities then remaining unsold, and any reports on Form 6-K subsequently

submitted by the Company to the Commission during such period (or portions thereof) that are identified in such forms as being incorporated

into this Registration Statement, shall be deemed to be incorporated by reference herein and to be a part hereof from the date of filing

of such documents.

Any statement contained in a document incorporated

or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement

to the extent that a statement contained herein, (or in any other subsequently filed document which also is incorporated or deemed to

be incorporated by reference herein), modifies or supersedes such statement. Any such statement so modified or superseded shall not be

deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

Item 8. Exhibits.

EXHIBIT INDEX

Exhibit

Number |

|

Description |

| |

|

|

| 4.1 |

|

Memorandum of Association, as amended (incorporated herein by reference to the (i) Registration Statement on Form F-1 of RADCOM Ltd. (File No. 333-05022), filed with the Commission on June 12, 1996, (ii) Form 6-K of RADCOM Ltd., filed with the Commission on April 1, 2008 and (iii) Exhibit 99.2 to Form 6-K of RADCOM Ltd., filed with the SEC on November 23, 2015). |

| |

|

|

| 4.2 |

|

Amended and Restated Articles of Association, as amended (incorporated herein by reference to the Form 20-F of RADCOM Ltd. for the fiscal year ended December 31, 2016, filed with the Commission on March 30, 2017). |

| |

|

|

| 5.1 |

|

Opinion of Gornitzky & Co. |

| |

|

|

| 23.1 |

|

Consent of Kost Forer Gabbay & Kasierer, a member firm of Ernst & Young Global, dated January 25, 2024. |

| |

|

|

| 23.2 |

|

Consent of Gornitzky & Co. (included in Exhibit 5.1). |

| |

|

|

| 24.1 |

|

Power of Attorney (included in the signature pages hereof). |

| |

|

|

| 99.1 |

|

RADCOM Ltd. 2023 Equity Incentive Plan (incorporated herein by reference to the Annual Report on Form 20-F of the Company for the fiscal year ended December 31, 2022, filed with the Commission on March 30, 2023). |

| |

|

|

| 107 |

|

Filing Fee Table |

SIGNATURES

Pursuant to the requirements of the Securities

Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form

S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the city

of Tel Aviv, State of Israel, on January 25, 2024.

| |

RADCOM Ltd. |

| |

|

|

| |

By: |

/s/ Hadar Rahav |

| |

Name: |

Hadar Rahav |

| |

Title: |

Chief Financial Officer |

POWER OF ATTORNEY

The undersigned officers and directors of RADCOM

Ltd. hereby constitute and appoint each of Hadar Rahav and Eyal Harari with full power of substitution, each of them singly his or her

true and lawful attorneys-in-fact and agents to take any actions to enable RADCOM Ltd. to comply with the Securities Act, and any rules,

regulations and requirements of the Commission, in connection with this registration statement on Form S-8, including the power and authority

to sign for the undersigned in his name in the capacities indicated below any and all further amendments to this registration statement

and any other registration statement filed pursuant to the provisions of Rule 462 under the Securities Act.

Pursuant to the requirements of the Securities

Act, this Registration Statement has been signed below by the following persons in the capacities and on the dates indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/ Rachel Bennun |

|

Chairman, Director |

|

January 25, 2024 |

| Rachel Bennun |

|

|

|

|

| |

|

|

|

|

| /s/ Eyal Harari |

|

Chief Executive Officer |

|

January 25, 2024 |

| Eyal Harari |

|

(principal executive officer) |

|

|

| |

|

|

|

|

| /s/ Hadar Rahav |

|

Chief Financial Officer |

|

January 25, 2024 |

| Hadar Rahav |

|

(principal financial and accounting officer) |

|

|

| |

|

|

|

|

| /s/ Andre Fuetsch |

|

Director |

|

January 25, 2024 |

| Andre Fuetsch |

|

|

|

|

| |

|

|

|

|

| /s/ Matty Karp |

|

Director |

|

January 25, 2024 |

| Matty Karp |

|

|

|

|

| |

|

|

|

|

| /s/ Oren Most |

|

Director |

|

January 25, 2024 |

| Oren Most |

|

|

|

|

| |

|

|

|

|

| /s/ Rami Schwarz |

|

Director |

|

January 25, 2024 |

| Rami Schwartz |

|

|

|

|

| |

|

|

|

|

| /s/ Yaron Ravkaie |

|

Director |

|

January 25, 2024 |

| Yaron Ravkaie |

|

|

|

|

| Authorized Representative in the United States: |

|

|

|

|

| |

|

|

|

|

| RADCOM Inc. |

|

|

|

|

| |

|

|

|

|

| /s/ Eyal Harari |

|

|

|

January 25, 2024 |

| Name: |

Eyal Harari |

|

|

|

|

| Title: |

Director |

|

|

|

|

Exhibit

5.1

|

Shy Baranov, Adv.

baranov@gornitzky.com

| +972-3-7109191 |

| |

| |

| |

January 25, 2024

RADCOM Ltd.

24 Raoul Wallenberg St.,

Tel Aviv, Israel 6971920

Re: Registration Statement on Form S-8

Ladies and Gentlemen:

We

have acted as Israeli counsel to RADCOM Ltd., an Israeli company (the “Company”), in connection with its preparation

of a Registration Statement on Form S-8 (the “Registration Statement”) under the United States Securities Act of 1933,

as amended (the “Act”), pertaining to the registration of 1,500,000 Ordinary Shares, nominal value NIS 0.20 per share,

of the Company (the “Plan Shares”) which may be issued under the Company’s 2023 Equity Incentive Plan (the “Plan”).

In

connection with this opinion letter, we have examined originals or copies, certified or otherwise identified to our satisfaction, of:

(i) the form of the Registration Statement; (ii) copies of the memorandum of association and articles of association of the Company, as

currently in effect; (iii) the Plan; (iv) confirmation by the Company’s General Counsel confirming the adoption of resolutions of

the board of directors of the Company reserving the Plan Shares under the Plan and which relate to the Registration Statement; and (v)

such other corporate records, agreements, documents and other instruments, and such certificates or comparable documents of public officials

and of officers and representatives of the Company and have made inquiries of such officers and representatives, as we have deemed necessary

or appropriate as a basis for the opinion set forth herein. In such examination, we have assumed the genuineness of all signatures, the

legal capacity of all natural persons, the authenticity of all documents submitted to us as originals, the conformity to original documents

of all documents submitted to us as certified, conformed, facsimile or photostatic copies and the authenticity of the originals of such

latter documents. As to all questions of fact relevant to the opinion set forth herein, we did not independently establish or verify such

facts and we have relied upon certificates or comparable documents of officers or representatives of the Company. We have further assumed

that the documents or copies thereof examined by us are true, complete and up-to-date and have not been amended, supplemented, rescinded,

terminated or otherwise modified and that each individual grant under the Plan that has been made prior to the date hereof or will be

made after the date hereof was and will be duly authorized by all necessary corporate action.

We

are admitted to practice law in the State of Israel and the opinion expressed herein is expressly limited to the laws of the State of

Israel.

Based

upon the foregoing and subject to the qualifications, limitations and assumptions stated herein, we are of the opinion that the Plan Shares,

when issued and paid for pursuant to the terms of the Plan, the terms of any agreements relating to such issuance and the terms of the

awards with respect thereto, will be validly issued, fully paid and nonassessable.

This

opinion letter is rendered as of the date hereof, and we disclaim any obligation to advise you of any change of law that occurs, or of

any facts, circumstances, events or developments of which we become aware, after the date of this opinion letter, even if they would alter,

affect or modify the opinion expressed herein.

We

hereby consent to the filing of this opinion letter as Exhibit 5.1 to the Registration Statement. In giving such consent, we do not admit

that we are in the category of persons whose consent is required under Section 7 of the Act or the rules and regulations of the United

States Securities and Exchange Commission promulgated thereunder.

| |

Very truly yours, |

| |

|

| |

/s/ Gornitzky & Co. |

| |

Gornitzky & Co. |

Exhibit 23.1

Consent of Independent Registered Public Accounting

Firm

We consent to the incorporation by reference in

the Registration Statement (Form S-8) pertaining to the RADCOM Ltd. 2023 Equity Incentive Plan of our reports dated March 30, 2023, with

respect to the consolidated financial statements of RADCOM Ltd. and the effectiveness of internal control over financial reporting of

RADCOM Ltd. included in its Annual Report (Form 20-F) for the year ended December 31, 2022, filed with the Securities and Exchange Commission.

| Tel-Aviv, Israel |

/s/ KOST FORER

GABBAY & KASIERER |

| January 25, 2024 |

KOST FORER GABBAY & KASIERER |

| |

A Member of EY Global |

Exhibit 107

Calculation of Filing

Fee Tables

Form S-8

(Form Type)

RADCOM Ltd.

(Exact Name of Registrant

as Specified in its Charter)

Newly Registered Securities

| | |

Security

Type | |

Security

Class Title | |

Fee

Calculation | |

Amount

Registered (1) | | |

Proposed

Maximum

Offering

Price

Per Share | | |

Proposed

Maximum

Aggregate

Offering Price | | |

Fee Rate | | |

Amount of

Registration

Fee | |

| Newly Registered Securities | |

| Fees to Be Paid | |

Equity | |

Ordinary Shares, NIS 0.20 par value per share | |

Rule 457(h) | |

| 1,500,000 | (2) | |

$ | 8.12 | (3) | |

$ | 12,180,000 | | |

$ | .00014760 | | |

$ | 1,797.77 | |

| | |

Total Offering Amounts | |

| | | |

| | | |

$ | 12,180,000 | | |

| | | |

$ | 1,797.77 | |

| | |

Total Fees Previously Paid | |

| | | |

| | | |

| | | |

| | | |

$ | - | |

| | |

Total Fee Offsets | |

| | | |

| | | |

| | | |

| | | |

$ | - | |

| | |

Net Fee Due | |

| | | |

| | | |

| | | |

| | | |

$ | 1,797.77 | |

| (1) |

Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement also covers an indeterminate number of additional securities which may be offered and issued to prevent dilution resulting from stock splits, stock dividends, recapitalizations or similar transactions. |

| (2) |

Represents Ordinary Shares reserved for issuance upon the exercise of options and restricted shares that may be granted under the plan to which this Registration Statement relates. |

| |

|

| (3) |

The fee is based on the number of Ordinary Shares which may be issued under the Company’s 2023 Equity Incentive Plan that this Registration Statement on Form S-8 relates to and is estimated in accordance with Rule 457(c) and (h) under the Securities Act solely for the purpose of calculating the registration fee based upon the average of the high and low sales price of the Ordinary Shares as reported on the Nasdaq Capital Market on January 18, 2024. |

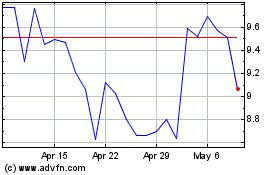

Radcom (NASDAQ:RDCM)

Historical Stock Chart

From Apr 2024 to May 2024

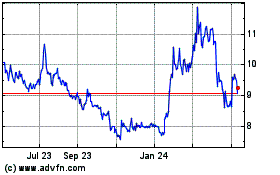

Radcom (NASDAQ:RDCM)

Historical Stock Chart

From May 2023 to May 2024