Current Report Filing (8-k)

June 24 2020 - 4:17PM

Edgar (US Regulatory)

0000907471false--09-3000009074712020-06-232020-06-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 23, 2020

META FINANCIAL GROUP, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

0-22140

|

42-1406262

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

5501 South Broadband Lane, Sioux Falls, South Dakota 57108

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (605) 782-1767

|

|

|

|

|

|

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d- 2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4 (c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $.01 par value

|

CASH

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On June 23, 2020, Brett L. Pharr was appointed as Co-President and Chief Operating Officer of MetaBank, National Association (the “Bank”), a wholly-owned subsidiary of Meta Financial Group, Inc. (the “Company”), effective immediately. Mr. Pharr will report to Bradley C. Hanson, who will continue to lead the Company as President and Chief Executive Officer and the Bank as Co-President and Chief Executive Officer. Mr. Pharr previously served as Executive Vice President and Head of Governance, Risk and Compliance for the Company.

In connection with Mr. Pharr’s appointment to the offices described above, as of the date of his appointment his salary for fiscal 2020 was increased to $400,000 per year and he was granted 6,000 restricted stock awards which will vest in three equal annual installments beginning on October 15, 2020. In addition, Mr. Pharr will be eligible for an annual incentive opportunity of up to 130% of his annual salary (prorated to reflect participation for one quarter of the Company’s fiscal year ending September 30, 2020), to be earned based on the achievement of certain annual performance targets and payable in a mix of cash and restricted stock awards that have a three-year vesting schedule.

Biographical information for Mr. Pharr, 58, is included in the Company’s proxy statement for its 2020 annual meeting of stockholders, filed with the Securities and Exchange Commission on January 15, 2020 (the “Proxy Statement”), and is hereby incorporated by reference. There are no arrangements among Mr. Pharr and any other persons pursuant to which he was appointed to the offices described above, and he does not have any relationships or related party transactions with the Company required to be disclosed pursuant to Item 404(a) of Regulation S-K.

A copy of the Company’s press release issued on June 23, 2020 announcing the appointment of Mr. Pharr to the offices described above and certain other organizational changes with respect to the Company is attached to this Current Report on Form 8-K as Exhibit 99.1 and incorporated herein by reference.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On June 23, 2020, the Board of Directors (the “Board”) of the Company amended and restated the Company’s bylaws. The Second Amended and Restated By-laws of the Company, which became effective immediately upon adoption by the Board, includes amendments intended to:

•Permit annual meetings to be held, at the Board’s discretion, by means of remote communication in compliance with applicable Delaware law;

•Update the requirements related to advance notice by stockholders of director nominations and other business to be brought before an annual meeting of stockholders, including:

◦to require that such notice must be delivered or mailed to and received at the Company’s principal executive offices not less than 90 nor more than 120 days prior to the first anniversary of the preceding year’s annual meeting (provided that the date of the annual meeting is advanced by no more than 20 days, nor delayed by more than 50 days, from the anniversary date of the preceding year’s annual meeting); and

◦to update the scope of information required to be provided by stockholder proponents with respect to the stockholder proponent, stockholder associated persons, and director nominees, as applicable;

•Establish that the number of directors constituting the Board as fixed from time to time by the Board shall be no less than five nor more than 12 directors;

•Clarify that the Company may have separate individuals in the roles of Chief Executive Officer and President, clarify the respective rights and powers of the Chief Executive Officer and President, and provide that the Chief Executive Officer must be a member of the Board rather than the President;

•Remove the requirements related to the nominating committee of the Board, which are more properly contained in the committee’s charter as with the other committees established by the Board; and

•Make certain additional changes to clarify, conform and update the bylaws, including among other things with respect to the procedures for the resignation and removal of officers, the duties and powers of certain officers, the use of share certificates, and the use of electronic means of communications and signatures.

The foregoing summary is qualified in its entirety by reference to full text of the Second Amended and Restated By-Laws of the Company, copies of which are filed hereto as Exhibit 3.1 in unmarked form and as Exhibit 3.2 in redline form showing the amendments described above.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

|

|

|

Exhibit Number

|

Description

|

|

|

Second Amended and Restated By-Laws of Meta Financial Group, Inc.

|

|

|

Second Amended and Restated By-Laws of Meta Financial Group, Inc., redlined to show amendments from previously existing bylaws.

|

|

|

Press release dated June 23, 2020

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document and included in Exhibit 101).

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

META FINANCIAL GROUP, INC.

|

|

|

|

|

|

Date: June 24, 2020

|

By:

|

/s/ Glen W. Herrick

|

|

|

|

Glen W. Herrick

|

|

|

|

Executive Vice President and Chief Financial Officer

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

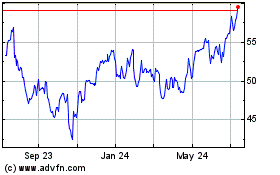

Pathward Financial (NASDAQ:CASH)

Historical Stock Chart

From Jun 2024 to Jul 2024

Pathward Financial (NASDAQ:CASH)

Historical Stock Chart

From Jul 2023 to Jul 2024