UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of the Securities

Exchange

Act of 1934 (Amendment No. )

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

| ☐ |

Preliminary

Proxy Statement |

| |

|

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

| ☐ |

Definitive

Proxy Statement |

| |

|

| ☒ |

Definitive

Additional Materials |

| |

|

| ☐ |

Soliciting

Material Pursuant to Section 240.14a-12 |

| NOVO

INTEGRATED SCIENCES, INC. |

| (Name

of Registrant as Specified In Its Charter) |

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment

of Filing Fee (Check the appropriate box): |

| |

|

| ☒ |

No

fee required. |

| |

|

| ☐ |

Fee

computed on the table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) |

Title

of each class of securities to which transaction applies: |

| |

|

| (2) |

Aggregate

number of securities to which transaction applies: |

| |

|

| (3) |

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was determined): |

| |

|

| (4) |

Proposed

maximum aggregate value of transaction: |

| |

|

| (5) |

Total

fee paid: |

| ☐ |

Fee

paid previously with preliminary materials. |

| |

|

| ☐ |

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its

filing. |

| (1) |

Amount

Previously Paid: |

| |

|

| (2) |

Form,

Schedule or Registration Statement No.: |

| |

|

| (3) |

Filing

Party: |

| |

|

| (4) |

Date

Filed: |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest reported): September 21, 2023

Novo

Integrated Sciences, Inc.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-40089 |

|

59-3691650 |

| (State

or other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

Incorporation) |

|

File

Number) |

|

Identification

Number) |

11120

NE 2nd Street, Suite 200, Bellevue, WA 98004

(Address

of principal executive offices)

(206)

617-9797

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2.)

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☒ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CF$ 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange on which Registered |

| Common

Stock |

|

NVOS |

|

Nasdaq

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

7.01. Regulation FD Disclosure.

On

September 21, 2023, Novo Integrated Sciences, Inc. (the “Company”) issued a press release providing an update on certain

actions and events, including with regard to the upcoming annual meeting of stockholders, the recent debt financing, future projections

and objectives, the SWAG agreement, the $57,000,000 RC note, and the GIMEG project. The press release is attached hereto as Exhibit 99.1

and is incorporated herein by reference.

The

information included in this Item 7.01, including Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section

18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that

section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or

the Exchange Act, except as shall be expressly set forth by specific reference in such a filing. The information set forth under this

Item 7.01 shall not be deemed an admission as to the materiality of any information in this Current Report on Form 8-K that is required

to be disclosed solely to satisfy the requirements of Regulation FD.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Novo

Integrated Sciences, Inc. |

| |

|

|

| Dated:

September 21, 2023 |

By: |

/s/

Robert Mattacchione |

| |

|

Robert

Mattacchione |

| |

|

Chief

Executive Officer |

Exhibit

99.1

Novo

Integrated Sciences Provides Update on Certain Current Actions and Events

September

29, 2023 Shareholder Meeting Voting Update

BELLEVUE,

Wash., September 21, 2023 - Novo Integrated Sciences, Inc. (NASDAQ: NVOS) (the “Company” or “Novo”), today

provides an update with respect to certain actions and events, as follows:

| ● |

Annual Meeting

Shareholder Voting. For shareholders that have not voted in connection with the upcoming September 29, 2023 annual shareholder

meeting, please vote as soon as possible. For shareholders that hold through a brokerage account, your broker should have provided

you with voting instructions. If not, please contact your broker ASAP to quickly receive the necessary information to cast your vote

electronically. |

| ● |

Recent Debt

Financing. We believe the recently arranged debt financing allows for adequate operational runway while we await the expected more

substantial financing previously disclosed and updated below. Management views the debt structure as advantageous to the Company as

(i) it does NOT include any warrants or inducement shares, (ii) it does NOT provide for a pre-payment penalty, and (iii) potential

conversion shares have not been registered. |

| ● |

Future Projections

and Objectives. As the Company moves forward on a number of operational and growth initiatives, including expanding jurisdictional

presence, food-based agriculture, international proprietary product offerings, and development of eldercare/senior living communities,

we anticipate significant revenue growth and positive net income over the next 12-36 months with potential for hyper-growth. |

| ● |

Parties

continue to work toward closing SWAG Agreement. Although the SWAG Agreement has not yet closed, the parties continue to work together

with the intention of closing the transaction and maximizing the net positive cash effect to the Company. As previously disclosed,

Novo entered into a share purchase agreement (the “SWAG Agreement”) with SwagCheck Inc. (“SWAG”) and the shareholders

of SWAG, pursuant to which Novo agreed to purchase 100% of SWAG’s outstanding shares. SWAG holds a specific right of purchase

of a precious gem collection as provided for in an agreement between SWAG and a Court-appointed Successor Receiver for the United States

District Court for the Central District of California. |

| ● |

Novo expects

to receive an initial draw on $57,000,000 RC Note. With the Company’s previously disclosed “Clear to Close” status

of an unsecured 15-year $70,000,000 promissory note for debt funding of $57,000,000 which provides for a yield (non-compounding) of

1.52% (zero coupon) per annum, the Company expects to receive a “first draw” advance against the coupon in the near future

with the expectation of a full draw shortly thereafter. |

| ● |

GIMEG project

in early stages of development. The Company is in discussions to secure the initial senior living community location under our

national growth initiative. As previously announced, the Company has a funding commitment for a direct investment of $40,000,000 from

Sheikh Khaled bin Mohammad bin Fahad Al Thanayan through Gulf International Minerals and Energy Group (GIMEG). The funding is expected

to result in project-specific joint ventures for development of elder care and senior living community facilities in Canada. |

About

Novo Integrated Sciences, Inc.

Novo

Integrated Sciences, Inc. is pioneering a holistic approach to patient-first health and wellness through a multidisciplinary healthcare

ecosystem of services and product innovation. Novo offers an essential and differentiated solution to deliver, or intend to deliver,

these services and products through the integration of medical technology, advanced therapeutics, and rehabilitative science.

We

believe that “decentralizing” healthcare, through the integration of medical technology and interconnectivity, is an essential

solution to the rapidly evolving fundamental transformation of how non-catastrophic healthcare is delivered both now and in the future.

Specific to non-critical care, ongoing advancements in both medical technology and inter-connectivity are allowing for a shift of the

patient/practitioner relationship to the patient’s home and away from on-site visits to primary medical centers with mass-services.

This acceleration of “ease-of-access” in the patient/practitioner interaction for non-critical care diagnosis and subsequent

treatment minimizes the degradation of non-critical health conditions to critical conditions as well as allowing for more cost-effective

healthcare distribution.

The

Company’s decentralized healthcare business model is centered on three primary pillars to best support the transformation of non-catastrophic

healthcare delivery to patients and consumers:

| ● |

First Pillar:

Service Networks. Deliver multidisciplinary primary care services through (i) an affiliate network of clinic facilities, (ii) small

and micro footprint sized clinic facilities primarily located within the footprint of box-store commercial enterprises, (iii) clinic

facilities operated through a franchise relationship with the Company, and (iv) corporate operated clinic facilities. |

| ● |

Second Pillar:

Technology. Develop, deploy, and integrate sophisticated interconnected technology, interfacing the patient to the healthcare practitioner

thus expanding the reach and availability of the Company’s services, beyond the traditional clinic location, to geographic areas

not readily providing advanced, peripheral based healthcare services, including the patient’s home. |

| ● |

Third Pillar:

Products. Develop and distribute effective, personalized health and wellness product solutions allowing for the customization of patient

preventative care remedies and ultimately a healthier population. The Company’s science-first approach to product innovation

further emphasizes our mandate to create and provide over-the-counter preventative and maintenance care solutions. |

Innovation

through science combined with the integration of sophisticated, secure technology assures Novo Integrated Sciences of continued cutting-edge

advancement in patient-first platforms.

For

more information concerning Novo Integrated Sciences, please visit www.novointegrated.com.

Twitter,

LinkedIn, Facebook, Instagram, YouTube

Forward-Looking

Statements

This

press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, Section

21E of the Securities Exchange Act of 1934, as amended, or the Private Securities Litigation Reform Act of 1995. All statements other

than statements of historical facts included in this press release are forward-looking statements. In some cases, forward-looking statements

can be identified by words such as “believe,” “intend,” “expect,” “anticipate,” “plan,”

“potential,” “continue,” or similar expressions. Such forward-looking statements include risks and uncertainties,

and there are important factors that could cause actual results to differ materially from those expressed or implied by such forward-looking

statements. These factors, risks, and uncertainties are discussed in Novo’s filings with the Securities and Exchange Commission.

Investors should not place any undue reliance on forward-looking statements since they involve known and unknown uncertainties and other

factors which are, in some cases, beyond Novo’s control which could, and likely will, materially affect actual results, levels

of activity, performance or achievements. Any forward-looking statement reflects Novo’s current views with respect to future events

and is subject to these and other risks, uncertainties and assumptions relating to operations, results of operations, growth strategy

and liquidity. Novo assumes no obligation to publicly update or revise these forward-looking statements for any reason, or to update

the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information

becomes available in the future. The contents of any website referenced in this press release are not incorporated by reference herein.

Chris

David, COO & President

Novo Integrated Sciences, Inc.

chris.david@novointegrated.com

(888) 512-1195

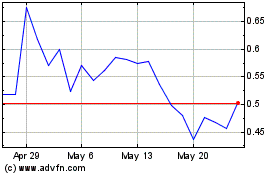

Novo Integrated Sciences (NASDAQ:NVOS)

Historical Stock Chart

From Apr 2024 to May 2024

Novo Integrated Sciences (NASDAQ:NVOS)

Historical Stock Chart

From May 2023 to May 2024