Mitcham Industries (MIND) - Zacks #1 Rank Top Performers

January 03 2012 - 7:00PM

Zacks

Mitcham Industries, Inc. (MIND) finished a mixed day in the

market with a gain of 3.9%, which made it one of the top-performing

Zacks #1 Rank companies. Volume was north of 375,000 shares,

compared to the daily average of around 315,000.

MIND is a geophysical equipment supplier that offers new and

"experienced" seismic equipment to the oil and gas industry,

seismic contractors, environmental agencies, government agencies

and universities.

In early December, the company reported a solid fiscal

third-quarter performance that led to sharp gains in earnings

estimates. The Zacks Consensus Estimate for this fiscal year,

ending January 2012, has increased nearly 26% in 30 days to $1.76

per share.

As for next fiscal year, ending January 2013, the Zacks

Consensus Estimate of $2.34 per share has moved higher by 16.4% in

the past month. Analysts currently expect profit growth of around

33% for next fiscal year over this fiscal year.

The quarterly report that sparked this upward momentum included

earnings per share of 52 cents, which bettered the Zacks Consensus

Estimate by a cool 100%. Total revenue advanced 40% to $28 million

from $20 million year over year.

MIND attributed the strong quarter to strong customer demand and

increased utilization in Latin America. The company also enjoyed

increased activity in the U.S. thanks to 3D imaging, along with

strong demand in certain international markets like the Pacific Rim

and North Africa.

MITCHAM INDS (MIND): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

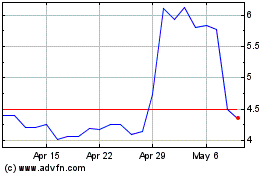

MIND Technology (NASDAQ:MIND)

Historical Stock Chart

From Apr 2024 to May 2024

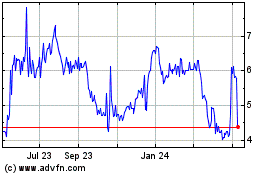

MIND Technology (NASDAQ:MIND)

Historical Stock Chart

From May 2023 to May 2024