UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED

IN STATEMENTS FILED PURSUANT

TO § 240.13d-1(a)

AND AMENDMENTS THERETO FILED PURSUANT TO

§ 240.13d-2(a)

(Amendment No. )1

LM Funding America, Inc.

(Name

of Issuer)

Common Stock, par value $0.001 per share

(Title of Class of Securities)

502074404

(CUSIP Number)

Eric Strachan

Mint Capital Advisors Ltd.

Western Road

Nassau, The Bahamas

1-242-676-3471

(Name, Address and Telephone Number of Person

Authorized to Receive Notices

and Communications)

October 2, 2023

(Date of Event Which Requires

Filing of This Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box ☒.

Note: Schedules

filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See

§ 240.13d-7 for other parties to whom copies are to be sent.

1

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to

the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided

in a prior cover page.

The information required

on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject

to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Mint Capital Advisors Ltd. |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

WC |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

The Bahamas |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

2,080,000* |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

0 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

2,080,000* |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

0 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

2,080,000* |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

13.3% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

CO |

|

*

Includes 1,040,000 shares of Common Stock issuable upon the exercise of the Common Warrants.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Esmerelda, Inc. |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

WC |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

Ontario, Canada |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

10,000 |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

0 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

10,000 |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

0 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

10,000 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

Less than 1% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

CO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

MAAB Global Limited |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

WC |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

Ontario, Canada |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

226,960 |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

0 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

226,960 |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

0 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

226,960 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

1.6% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

CO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

MSW Projects Limited |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

WC |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

Ontario, Canada |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

0 |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

91,000 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

0 |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

91,000 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

91,000 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

Less than 1% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

CO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Bruce Bent |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

WC, PF |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

Canada |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

550,960 |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

0 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

550,960 |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

0 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

550,960 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

3.8% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

IN |

|

The following constitutes

the Schedule 13D filed by the undersigned (the “Schedule 13D”).

| Item 1. | Security and Issuer. |

This statement relates to

the common stock, par value $0.001 per share (“Common Stock”), of LM Funding America, Inc., a Delaware corporation (the “Issuer”).

The principal executive offices of the Issuer are located at 1200 West Platt Street, Suite 100, Tampa, Florida 33606.

| Item 2. | Identity and Background. |

| (a) | This Schedule 13D is filed by: |

| i. | Mint Capital Advisors Ltd., a limited company organized in the Bahamas (“Mint Capital”); |

| ii. | Esmerelda, Inc., a corporation incorporated under the laws of Ontario, Canada (“Esmerelda”); |

| iii. | MAAB Global Limited, a corporation incorporated under the laws of Ontario, Canada (“MAAB Global”); |

| iv. | MSW Projects Limited, a corporation incorporated under the laws of Ontario, Canada (“MSW Projects”); |

| v. | Bruce Bent, with respect to the shares of Common Stock directly beneficially owned by him and as sole

director and shareholder of Esmerelda, MAAB Global, and MSW Projects; |

Each of the foregoing is

referred to as a “Reporting Person” and collectively as the “Reporting Persons”. Each of the Reporting Persons

is party to that certain Joint Filing and Solicitation Agreement, as further described in Item 6 and filed as an exhibit to this Schedule

13D. Accordingly, the Reporting Persons are hereby filing a joint Schedule 13D.

| (b) | The principal business address of Mint Capital is Western Road, Nassau, The Bahamas. The principal business

address of each of Esmerelda, MAAB Global, and MSW Projects is 6745 Century Avenue, Mississauga, Ontario, L5N 7K2. The principal business

address of Mr. Bent is 320 West Main Street Lewisville, Texas 75057. |

| (c) | The principal business of Mint Capital is investing in securities. The principal business of each of Esmerelda,

MAAB Global, and MSW Projects is investing in securities. The principal occupation of Mr. Bent is serving as Vice President of Matthews

Southwest Holdings Inc. |

| (d) | During the last five years, none of the Reporting Persons have been convicted in a criminal proceeding

(excluding traffic violations or similar misdemeanors). |

| (e) | During the last five years, none of the Reporting Persons have been a party to a civil proceeding of a

judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or

final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding

any violation with respect to such laws. |

| (f) | Mint Capital is a limited company organized in the Bahamas. Each of Esmerelda, MAAB Global, and MSW Projects

are corporations incorporated under the laws of Ontario, Canada. Mr. Bent is a citizen of Canada. |

| Item 3. | Source and Amount of Funds or Other Consideration. |

The securities of the Company

owned by Mint Capital, Esmerelda, MAAB Global, and MSW Projects were purchased with working capital. The securities of the Company owned

by Mr. Bent were purchased with personal funds.

The 1,040,000 shares of Common

Stock and 1,040,000 Common Warrants (defined below) beneficially owned by Mint Capital were purchased as Units (defined below) through

a public offering by the Issuer on October 19, 2021, for an aggregate purchase price of $4,940,000. Each Unit consists of one share of

Common Stock and one warrant to purchase one share of Common Stock (the “Common Warrants”). The Common Warrants issued in

the offering were then-immediately exercisable and entitle the holder to purchase one share of Common Stock at an exercise price equal

to $5.00 and expire on the fifth anniversary of the issuance date.

The aggregate purchase price

of the 10,000 shares of Common Stock beneficially owned by Esmerelda is approximately $50,150, not including brokerage commissions. The

aggregate purchase price of the 226,960 shares of Common Stock beneficially owned by MAAB Global is approximately $733,081, not including

brokerage commissions. The aggregate purchase price of the 91,000 shares of Common Stock beneficially owned by MSW Projects is approximately

$422,690, not including brokerage commissions. The aggregate purchase price of the 223,000 shares of Common Stock beneficially owned by

Mr. Bent is approximately $1,076,301, not including brokerage commissions.

| Item 4. | Purpose of Transaction. |

The Reporting Persons purchased

the shares of Common Stock based on the Reporting Persons’ belief that the shares of Common Stock, when purchased, were undervalued

and represented an attractive investment opportunity. Depending upon overall market conditions, other investment opportunities available

to the Reporting Persons, and the availability of the shares of Common Stock at prices that would make the purchase or sale of shares

of Common Stock desirable, the Reporting Persons may endeavor to increase or decrease their position in the Issuer through, among other

things, the purchase or sale of shares of Common Stock on the open market or in private transactions or otherwise, on such terms and at

such times as the Reporting Persons may deem advisable.

On October 2, 2023, Mr. Bent

delivered a letter to the Issuer nominating Paul Abramowitz and Daniel Brauser (the “Nominees”) for election to the Board

at the Issuer’s 2023 annual meeting of stockholders (the “Annual Meeting”).

No Reporting Person has any

present plan or proposal which would relate to or result in any of the matters set forth in subparagraphs (a) - (j) of Item 4 of Schedule

13D except as set forth herein or such as would occur upon or in connection with completion of, or following, any of the actions discussed

herein. The Reporting Persons intend to review their investment in the Issuer on a continuing basis. Depending on various factors including,

without limitation, the Issuer’s financial position and investment strategy, the price levels of the shares of Common Stock, conditions

in the securities markets and general economic and industry conditions, the Reporting Persons may in the future take such actions with

respect to their investment in the Issuer as they deem appropriate including, without limitation, engaging in communications with management

and the Board, engaging in discussions with stockholders of the Issuer or other third parties about the Issuer and the Reporting Persons’

investment, including potential business combinations or dispositions involving the Issuer or certain of its businesses, making recommendations

or proposals to the Issuer concerning changes to the capitalization, ownership structure, Board structure (including Board composition),

potential business combinations or dispositions involving the Issuer or certain of its businesses, or suggestions for improving the Issuer’s

financial and/or operational performance, purchasing additional shares of Common Stock, selling some or all of their shares of Common

Stock, engaging in short selling of or any hedging or similar transaction with respect to the shares of Common Stock, including swaps

and other derivative instruments, or changing their intention with respect to any and all matters referred to in Item 4.

| Item 5. | Interest in Securities of the Issuer. |

The aggregate percentage

of shares of Common Stock reported owned by each person named herein is based upon 14,651,883 shares of Common Stock outstanding as of

August 7, 2023, as reported in the Issuer’s quarterly report on Form 10-Q filed with the SEC on August 14, 2023.

| (a) | As of the date hereof, Mint Capital directly owned 2,080,000 shares of Common Stock, including 1,040,000

shares of Common Stock issuable upon the exercise of the Common Warrants. |

Percentage: Approximately

13.3%

| (b) | 1. Sole power to vote or direct vote: 2,080,000

2. Shared power to vote or direct vote: 0

3. Sole power to dispose or direct the disposition: 2,080,000

4. Shared power to dispose or direct the disposition: 0 |

| (a) | As of the date hereof, Esmeralda directly owned 10,000 shares of Common Stock. |

Percentage: Less than 1%

| (b) | 1. Sole power to vote or direct vote: 10,000

2. Shared power to vote or direct vote: 0

3. Sole power to dispose or direct the disposition: 10,000

4. Shared power to dispose or direct the disposition: 0 |

| (a) | As of the date hereof, MAAB Global directly owned 226,960 shares of Common Stock. |

Percentage: Approximately

1.5%

| (b) | 1. Sole power to vote or direct vote: 226,960

2. Shared power to vote or direct vote: 0

3. Sole power to dispose or direct the disposition: 226,960

4. Shared power to dispose or direct the disposition: 0 |

| (a) | As of the date hereof, MSW Projects directly owned 91,000 shares of Common Stock. |

Percentage: Less than 1%

| (b) | 1. Sole power to vote or direct vote: 91,000

2. Shared power to vote or direct vote: 0

3. Sole power to dispose or direct the disposition: 91,000

4. Shared power to dispose or direct the disposition: 0 |

| (a) | As of the date hereof, Mr. Bent directly beneficially owned 223,000 shares of Common Stock. Mr. Bent,

as sole director and shareholder of each of Esmerelda, MAAB Global and MSW Projects, may be deemed to beneficially own: the (i) 10,000

shares of Common Stock owned by Esmerelda; (ii) the 226,960 shares of Common Stock owned by MAAB Global; and (iii) the 91,000 shares of

Common Stock owned by MSW Projects. |

Percentage: Approximately

3.8%

| (b) | 1. Sole power to vote or direct vote: 550,960

2. Shared power to vote or direct vote: 0

3. Sole power to dispose or direct the disposition: 550,960

4. Shared power to dispose or direct the disposition: 0 |

The filing of this Schedule

13D shall not be deemed an admission that the Reporting Persons are, for purposes of Section 13(d) of the Securities Exchange Act of 1934,

as amended, the beneficial owners of any securities of the Issuer that he or it does not directly own. Each of the Reporting Persons specifically

disclaims beneficial ownership of the securities reported herein that he or it does not directly own.

(c) The

Reporting Persons have not transacted in the securities of the Issuer during the past sixty days.

(d) No

person other than the Reporting Persons is known to have the right to receive, or the power to direct the receipt of dividends from, or

proceeds from the sale of, the shares of Common Stock.

(e) Not

applicable.

| Item 6. | Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer. |

As described above in Item

3, Mint Capital beneficially owns 1,040,000 shares of Common Stock that are issuable upon the exercise of the Common Warrants. Each Common

Warrant is currently exercisable into one share of Common Stock at a price of $5.00 per share.

On October 2, 2023, the Reporting

Persons and the Nominees (collectively, the “Group”) entered into a Joint Filing and Solicitation Agreement (the “Joint

Filing and Solicitation Agreement”) pursuant to which the Group agreed, among other things, (a) to the extent required by applicable

law, to the joint filing on behalf of each of them of statements on Schedule 13D with respect to the securities of the Company, (b) to

solicit proxies for the election of the Nominees at the Annual Meeting, (c) not to transact in securities of the Company without the prior

written consent of Mint Capital, subject to certain exceptions, (d) that any SEC filing, press release, public shareholder communication

or Company communication proposed to be made or issued by the Group or any member of the Group in connection with the Group’s activities

shall be mutually agreeable to Mint Capital, and (e) Mint Capital agrees to pay directly all such pre-approved expenses.

Mr. Bent and the Nominees

have granted Eric Strachan, Director of Mint Capital, a power of attorney to execute certain SEC filings and other documents in connection

with the solicitation of proxies from the Company’s stockholders in connection with the Annual Meeting and any other related transactions.

Other than as described herein,

there are no contracts, arrangements, understandings or relationships among the Reporting Persons, or between the Reporting Persons and

any other person, with respect to the securities of the Issuer.

| Item 7. | Material to be Filed as Exhibits. |

| Exhibit 99.1 | Joint Filing and Solicitation Agreement, dated October 2, 2023. |

| Exhibit 99.2 | Form of Power of Attorney. |

SIGNATURES

After reasonable inquiry

and to the best of our knowledge and belief, the undersigned certify that the information set forth in this statement is true, complete,

and correct.

Dated: October 6, 2023

| |

Mint Capital Advisors Ltd. |

| |

|

| |

By: |

/s/ Eric Strachan |

| |

|

Name: |

Eric Strachan |

| |

|

Title: |

CEO and Director |

| |

/s/ Eric Strachan |

| |

Eric Strachan, as attorney-in-fact for Bruce Bent |

Exhibit 99.1

JOINT FILING AND SOLICITATION AGREEMENT

WHEREAS, certain of the

undersigned are stockholders, direct or beneficial, of LM Funding America, Inc., a Delaware corporation (the “Company”);

and

WHEREAS, Mint

Capital Advisors Ltd., Esmerelda, Inc., MAAB Global Limited, MSW Projects Limited, Bruce Bent, Daniel Brauser and Paul Abramowitz

wish to form a group for the purpose of (i) seeking representation on the Board of Directors of the Company (the “Board”)

at the 2023 annual meeting of stockholders of the Company (including any other meeting of stockholders held in lieu thereof, and any adjournments,

postponements, reschedulings or continuations thereof, the “Annual Meeting”), (ii) soliciting proxies for the election

of certain persons nominated for election to the Board at the Annual Meeting (including those nominated by Mr. Bent), (iii) taking all

other action necessary to achieve the foregoing and (iv) taking any other actions the Group (as defined below) determines to undertake

in connection with their respective investment in the Company (collectively, the “Purposes”).

NOW, IT IS AGREED, this

2nd day of October 2023 by the parties hereto:

1. In

accordance with Rule 13d-1(k)(1)(iii) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), each

of the undersigned (collectively, the “Group”) agrees to the joint filing on behalf of each of them of statements on

Schedule 13D, and any amendments thereto, with respect to the securities of the Company to the extent required by applicable law. Each

member of the Group shall be responsible for the accuracy and completeness of its own disclosure therein, and is not responsible for the

accuracy and completeness of the information concerning the other members, unless such member knows or has reason to know that such information

is inaccurate.

2. So

long as this agreement is in effect, each of the undersigned shall provide written notice to Olshan Frome Wolosky LLP (“Olshan”)

of (i) any of their purchases or sales of securities of the Company or (ii) any securities of the Company over which they acquire or dispose

of beneficial ownership. Notice shall be given no later than four (4) hours after each such transaction. For purposes of this agreement,

the term “beneficial ownership” shall have the meaning of such term set forth in Rule 13d-3 under the Exchange Act.

3. Each

of the undersigned agrees to form the Group for the Purposes as set forth above.

4. Mint

Capital Advisors Ltd. shall have the right to pre-approve all expenses incurred in connection with the Group’s activities and agrees

to pay directly all such pre-approved expenses.

5. Each

of the undersigned agrees that any filing with the Securities and Exchange Commission, press release, Company communication or stockholder

communication proposed to be made or issued by the Group or any member of the Group in connection with the Group’s activities set

forth in Section 3 shall be as directed by Mint Capital Advisors Ltd.

6. The

relationship of the parties hereto shall be limited to carrying on the business of the Group in accordance with the terms of this agreement.

Such relationship shall be construed and deemed to be for the sole and limited purpose of carrying on such business as described herein.

Nothing herein shall be construed to authorize any party to act as an agent for any other party, or to create a joint venture or partnership,

or to constitute an indemnification. Nothing herein shall restrict any party’s right to purchase or sell securities of the Company,

as it deems appropriate, in its sole discretion, provided that all such purchases and sales are made in compliance with all applicable

securities laws and the provisions of this agreement.

7. This

agreement may be executed in counterparts, each of which shall be deemed an original and all of which, taken together, shall constitute

but one and the same instrument, which may be sufficiently evidenced by one counterpart.

8. This

agreement is governed by and will be construed in accordance with the laws of the State of New York. In the event of any dispute arising

out of the provisions of this agreement or their investment in the Company, the parties hereto consent and submit to the exclusive jurisdiction

of the United States District Court for the Southern District of New York located in the Borough of Manhattan or the courts of the State

of New York located in the County of New York.

9. The

parties’ rights and obligations under this agreement (other than the rights and obligations set forth in Section 4 and Section 8,

which shall survive any termination of this agreement) shall terminate upon the earlier to occur of (i) the conclusion of the Annual Meeting

or (ii) Mint Capital Advisors Ltd. providing written notice of termination to the other parties.

10. Each party hereby

waives the application of any law, regulation, holding, or rule of construction providing that ambiguities in an agreement or other document

will be construed against the party drafting such agreement or document.

11. Each

party acknowledges that Olshan shall act as counsel for both the Group and Mint Capital Advisors

Ltd. relating to their investment in the Company.

12. Each

party hereby agrees that this agreement shall be filed as an exhibit to a Schedule 13D pursuant to Rule 13d-1(k)(1)(iii) under the Exchange

Act that may in the future be required to be filed under applicable law.

IN WITNESS WHEREOF, the parties hereto have

caused this agreement to be executed as of the day and year first above written.

| |

Mint Capital Advisors Ltd. |

| |

|

| |

By: |

/s/ Eric Strachan |

| |

|

Name: |

Eric Strachan |

| |

|

Title: |

President and Director |

| |

Esmerelda, Inc. |

| |

|

| |

By: |

/s/ Bruce Bent |

| |

|

Name: |

Bruce Bent |

| |

|

Title: |

Director |

| |

MAAB Global Limited |

| |

|

| |

By: |

/s/ Bruce Bent |

| |

|

Name: |

Bruce Bent |

| |

|

Title: |

Director |

| |

MSW Projects Limited |

| |

|

| |

By: |

/s/ Bruce Bent |

| |

|

Name: |

Bruce Bent |

| |

|

Title: |

Director |

| |

/s/ Daniel Brauser |

| |

Daniel Brauser |

| |

/s/ Paul Abramowitz |

| |

Paul Abramowitz |

Exhibit

99.2

POWER OF ATTORNEY

Know all by these presents,

that the undersigned hereby constitutes and appoints Eric Strachan and Mint Capital Advisors Ltd. as the undersigned’s true and

lawful attorney-in-fact to take any and all action in connection with (i) the undersigned’s beneficial ownership of, or participation

in a group with respect to, securities of LM Funding America, Inc., a Delaware corporation (the “Company”), directly

or indirectly beneficially owned by Mint Capital Advisors Ltd. or any of its affiliates or members of its Schedule 13D group (collectively,

the “Group”) and (ii) any potential proxy solicitation that may be pursued by the Group to elect a slate of director

nominees to the board of directors of the Company at the 2023 annual meeting of stockholders of the Company, including any adjournments

or postponements thereof (the “Solicitation”). Such action shall include, but not be limited to:

1.

executing for and on behalf of the undersigned all Group Agreements, Joint Filing and Solicitation

Agreements or similar documents pursuant to which the undersigned shall agree to be a member of the Group;

2.

if applicable, executing for and on behalf of the undersigned any Schedule 13D, and amendments thereto,

filed by the Group that are required to be filed under Section 13(d) of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), and the rules thereunder in connection with the undersigned’s beneficial ownership of, or participation in a group

with respect to, securities of the Company or the Solicitation;

3.

if applicable, executing for and on behalf of the undersigned all Forms 3, 4 and 5 required to be

filed under Section 16(a) of the Exchange Act in connection with the undersigned’s beneficial ownership of, or participation in

a group with respect to, securities of the Company or the Solicitation;

4.

performing any and all acts for and on behalf of the undersigned that may be necessary or desirable

to complete and execute any such document, complete and execute any amendment or amendments thereto, and timely file such form with the

United States Securities and Exchange Commission and any stock exchange or similar authority; and

5.

taking any other action of any type whatsoever in connection with the Solicitation, including entering

into any settlement agreement, that in the opinion of such attorney-in-fact, may be of benefit to, in the best interest of, or legally

required by, the undersigned, it being understood that the documents executed by such attorney-in-fact on behalf of the undersigned pursuant

to this Power of Attorney shall be in such form and shall contain such terms and conditions as such attorney-in-fact may approve in such

attorney-in-fact’s discretion.

The undersigned hereby

grants to such attorney-in-fact full power and authority to do and perform any and every act and thing whatsoever requisite, necessary,

or proper to be done in the exercise of any of the rights and powers herein granted, as fully to all intents and purposes as the undersigned

might or could do if personally present, with full power of substitution or revocation, hereby ratifying and confirming all that such

attorney-in-fact, or such attorney-in-fact’s substitutes, shall lawfully do or cause to be done by virtue of this Power of Attorney

and the rights and powers herein granted. The undersigned acknowledges that the foregoing attorney-in-fact, in serving in such capacity

at the request of the undersigned, is not assuming any of the undersigned's responsibilities to comply with Section 13(d), Section 16

or Section 14 of the Exchange Act.

This Power of Attorney

shall remain in full force and effect until the undersigned is no longer a member of the Group unless earlier revoked by the undersigned

in a signed writing delivered to the foregoing attorney-in-fact.

IN WITNESS WHEREOF, the

undersigned has caused this Power of Attorney to be executed as of this __ day of October 2023.

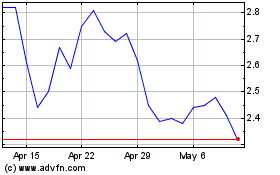

LM Funding America (NASDAQ:LMFA)

Historical Stock Chart

From Mar 2024 to Apr 2024

LM Funding America (NASDAQ:LMFA)

Historical Stock Chart

From Apr 2023 to Apr 2024