UNITED STATES SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the Month of July 2023

Commission File Number: 001-39131

LIMINAL BIOSCIENCES INC.

(Translation of registrant’s name into English)

440 Armand-Frappier Boulevard, Suite 300

Laval, Québec

H7V 4B4

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F Form 40-F

INCORPORATION BY REFERENCE

This Report on Form 6-K (the “Report”) and Exhibits 99.1, 99.2 and 99.3 to this Report are hereby expressly incorporated by reference into the registrant’s registration statements on Form F-3 (File nos. 333-251055, 333-245703 and 333-251065) filed with the Securities and Exchange Commission on December 1, 2020, December 2, 2020 and December 2, 2020, respectively, and the registration statement on Form S-8 (File no. 333-235692) filed with the Securities and Exchange Commission on December 23, 2019.

EXHIBIT LIST

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liminal BioSciences Inc. |

|

|

|

|

Date: July 12, 2023 |

|

|

|

By: |

|

/s/ Bruce Pritchard |

|

|

|

|

|

|

Name |

|

Bruce Pritchard |

|

|

|

|

|

|

Title: |

|

Chief Executive Officer |

Exhibit 99.1

Execution Version

ARRANGEMENT AGREEMENT

AMONG:

STRUCTURED ALPHA LP

– and –

LIMINAL BIOSCIENCES INC.

July 11, 2023

TABLE OF CONTENTS

|

|

|

Article 1 INTERPRETATION |

1 |

1.1 |

Definitions |

1 |

1.2 |

Certain Rules of Interpretation |

11 |

1.3 |

Schedules |

12 |

Article 2 THE ARRANGEMENT |

13 |

2.1 |

The Arrangement |

13 |

2.2 |

Court Proceedings and Materials |

13 |

2.3 |

Interim Order |

14 |

2.4 |

Company Circular |

15 |

2.5 |

The Company Meeting |

16 |

2.6 |

Final Order |

18 |

2.7 |

Articles of Arrangement and Effective Date |

18 |

2.8 |

Payment of Consideration |

18 |

2.9 |

Withholding Rights |

18 |

Article 3 REPRESENTATIONS AND WARRANTIES |

19 |

3.1 |

Representations and Warranties of the Company |

19 |

3.2 |

Representations and Warranties of the Purchaser |

19 |

Article 4 COVENANTS OF THE PARTIES |

20 |

4.1 |

Covenants of the Company Regarding the Conduct of Business |

20 |

4.2 |

Pre-Acquisition Reorganizations |

24 |

4.3 |

Covenants of the Company Relating to the Arrangement |

25 |

4.4 |

Covenants of the Purchaser Relating to the Arrangement |

27 |

4.5 |

Preparation of Filings |

29 |

4.6 |

Access to Information |

29 |

4.7 |

Insurance and Indemnification |

30 |

4.8 |

Exchange Delisting |

31 |

4.9 |

Post-Closing Employment Matters |

31 |

Article 5 ADDITIONAL AGREEMENTS |

32 |

5.1 |

Non-Solicitation |

32 |

5.2 |

Responding to a Superior Proposal and Right to Match |

34 |

5.3 |

Agreement as to Damages |

36 |

5.4 |

Liquidated Damages, Injunctive Relief and No Liability of Others |

37 |

Article 6 TERM, TERMINATION, AMENDMENT AND WAIVER |

37 |

6.1 |

Term |

37 |

6.2 |

Termination |

37 |

6.3 |

Notice and Cure Provisions |

39 |

6.4 |

Effect of Termination/Survival |

40 |

6.5 |

Amendment |

41 |

6.6 |

Waiver |

41 |

Article 7 CONDITIONS |

41 |

7.1 |

Mutual Condition Precedents |

41 |

7.2 |

Additional Conditions Precedent to the Obligations of the Purchaser |

42 |

7.3 |

Additional Conditions Precedent to the Obligations of the Company |

43 |

7.4 |

Satisfaction of Conditions |

43 |

i

( )

|

|

|

Article 8 GENERAL PROVISIONS |

44 |

8.1 |

Notices to Parties |

44 |

8.2 |

Governing Law |

45 |

8.3 |

Expenses |

45 |

8.4 |

Injunctive Relief |

45 |

8.5 |

Entire Agreement |

46 |

8.6 |

Assignment and Enurement |

46 |

8.7 |

Severability |

46 |

8.8 |

Waiver |

46 |

8.9 |

No Third Party Beneficiaries |

46 |

8.10 |

Counterparts |

47 |

Schedule A PLAN OF ARRANGEMENT |

1 |

Article 1 INTERPRETATION |

1 |

Article 2 The Arrangement |

5 |

Article 3 RIGHTS OF DISSENT |

7 |

Article 4 CERTIFICATES AND PAYMENTS |

8 |

Article 5 AMENDMENTS |

11 |

Article 6 FURTHER ASSURANCES |

11 |

SCHEDULE C REPRESENTATIONS AND WARRANTIES OF THE COMPANY |

1 |

SCHEDULE D REPRESENTATIONS AND WARRANTIES OF THE PURCHASER |

1 |

ii

( )

ARRANGEMENT AGREEMENT

THIS AGREEMENT is made as of July 11, 2023,

AMONG:

STRUCTURED ALPHA LP, a limited partnership existing under the laws of the Cayman Islands, by its general partner, THOMVEST ASSET MANAGEMENT LTD., a corporation existing under the laws of the Province of Ontario

(the “Purchaser”)

- and -

LIMINAL BIOSCIENCES INC., a corporation existing under the laws of Canada

(the “Company”)

NOW THEREFORE, in consideration of the covenants and agreements herein contained, the Parties agree as follows:

Article 1

INTERPRETATION

1.1 Definitions

In this Agreement, the following words, terms and expressions (and all grammatical variations thereof) shall have the following meanings:

- 2 -

“Acquisition Proposal” means, other than the transactions contemplated by this Agreement and other than any transactions involving only the Company and/or one or more of its wholly-owned subsidiaries, any inquiry, proposal or offer (written or oral) from any person or group of persons other than the Purchaser (or an affiliate of the Purchaser or any person acting jointly or in concert with the Purchaser) received by the Company before or after the date of this Agreement relating to, in each case whether in a single transaction or a series of transactions: (a) any direct or indirect sale, disposition or joint venture (or any lease, license or other arrangement having the same economic effect as a sale, disposition or joint venture) of assets (including securities of any subsidiary of the Company) representing 20% or more of the consolidated assets or contributing 20% or more of the consolidated revenue of the Company and its subsidiaries (based on the most recent publicly available consolidated financial statements of the Company); (b) any direct or indirect take-over bid, tender offer, exchange offer, treasury issuance or other transaction that, if consummated, would result in a person or group of persons beneficially owning 20% or more of any class of voting or equity securities of the Company or any of its subsidiaries (including securities convertible into or exercisable or exchangeable for voting or equity securities of the Company or any of its subsidiaries) then outstanding (assuming, if applicable, the conversion, exchange or exercise of such securities convertible into or exercisable or exchangeable for voting or equity securities); (c) any acquisition, disposition, plan of arrangement, merger, amalgamation, consolidation, share exchange, business combination, reorganization, recapitalization, liquidation, dissolution, winding up or other similar transaction involving the Company or any subsidiary whose assets represent 20% or more of the consolidated assets or contribute 20% or more of the consolidated revenue of the Company and its subsidiaries (based on the most recent publicly available consolidated financial statements of the Company); (d) any other transaction, the consummation of which could reasonably be expected to impede, interfere with, prevent or delay the transactions contemplated by this Agreement or the Arrangement; or (e) any public announcement of a proposal, plan or intention to do any of the foregoing or any agreement to engage in any of the foregoing.

“affiliate” has the meaning specified thereto in National Instrument 45-106 – Prospectus Exemptions.

“Agreement” “this Agreement”, “the Agreement”, “hereof”, “herein”, “hereto”, “hereby”, “hereunder” and similar expressions mean this arrangement agreement, including all schedules and exhibits and all instruments supplementing, amending, modifying, restating or otherwise confirming this Agreement, in each case in accordance with the terms hereof, and all references to “Articles”, “Sections”, “Schedules” and “Exhibits” mean and refer to the specified article, section, schedule or exhibit of this Agreement.

“Arrangement” means the arrangement involving the Company and the Purchaser under the provisions of Section 192 of the CBCA on the terms and subject to the conditions set forth in this Agreement and as more particularly described in the Plan of Arrangement, subject to any amendments or variations thereto made in accordance with this Agreement, the applicable provisions of the Plan of Arrangement or made at the direction of the Court in the Final Order with the prior written consent of the Purchaser and the Company, each acting reasonably.

“Arrangement Resolution” means the special resolution of the Company Shareholders to be considered by the Company Shareholders by the Required Vote at the Company Meeting, to be in substantially the form and content of SCHEDULE A hereto, with such changes as may be agreed to by the Purchaser and the Company, each acting reasonably.

“Articles of Arrangement” means the articles of arrangement of the Company in respect of the Arrangement required to be filed with the Director pursuant to Section 191(4) of the CBCA after the Final Order is made.

- 3 -

“Authorization” means with respect to any person, any order, grant, permit, approval, certificate, consent, waiver, licence, classification, registration or similar authorization of any Governmental Entity having jurisdiction over the person.

“Board” means the board of directors of the Company as constituted from time to time.

“Board Recommendation” has the meaning specified in Section 2.4(d).

“Business Day” means any day on which commercial banks are generally open for business in Toronto, Ontario, other than a Saturday, a Sunday or a day observed as a holiday in Toronto, Ontario and Montreal, Québec.

“CBCA” means the Canada Business Corporations Act, R.S.C. 1985, c. C-44.

“Certificate of Arrangement” means the certificate giving effect to the Arrangement issued pursuant to Section 192(7) of the CBCA in respect of the Articles of Arrangement.

“Change in Recommendation” has the meaning specified in Section 6.2(c)(i)(B).

“Closing” has the meaning specified in Section 2.7(b).

“Collective Agreements” means any collective bargaining agreements or union agreements applicable to the Company or any of its subsidiaries and all related letters or memoranda of understanding applicable to the Company or any of its subsidiaries which impose obligations upon the Company or any of its subsidiaries.

“Common Shares” means the common shares in the capital of the Company.

“Company Circular” means the notice of the Company Meeting and the accompanying management information circular, including all schedules, appendices and exhibits thereto, to be sent to the Company Shareholders in connection with the Company Meeting, as amended, supplemented or otherwise modified.

“Company Disclosure Letter” means the disclosure letter dated the date of this Agreement and all schedules, exhibits and appendices thereto, delivered by the Company to the Purchaser with this Agreement.

“Company Employees” means the officers and employees of the Company and its subsidiaries.

“Company Filings” means all forms, reports and documents publicly filed by or on behalf of the Company on SEDAR, or publicly filed with or furnished to the SEC on EDGAR, between January 1, 2021 and the date immediately preceding the date of this Agreement.

“Company Meeting” means the special meeting of the Company Shareholders, including any adjournment or postponement thereof in accordance with the terms of this Agreement, to be called and held in accordance with this Agreement and the Interim Order for the purpose of considering the Arrangement Resolution and for any other purpose as may be set out in the Company Circular.

“Company Options” means the outstanding options to purchase Common Shares issued pursuant the Company Stock Option Plan or the Omnibus Incentive Plan, as applicable.

“Company Shareholders” means holders of Common Shares.

- 4 -

“Company Stock Option Plan” means the amended and restated stock option plan of the Company effective as of and from August 10, 2010.

“Company Warrants” means the common share purchase warrants of the Company, including the 789,472 common share purchase warrants of the Company issued on November 3, 2020 and November 25, 2020 that expire on November 3, 2025.

“Confidentiality Agreement” means the agreement dated as of April 25, 2023 between Thomvest Asset Management Ltd. and the Company.

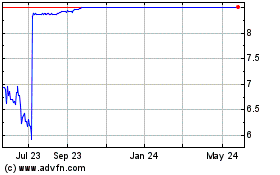

“Consideration” means US$8.50 in cash per Common Share.

“Constating Documents” means articles of incorporation, amalgamation, arrangement or continuation, as applicable, by-laws or other constating documents and all amendments thereto.

“Contract” means any written or oral agreement, commitment, engagement, contract, licence, lease, obligation or undertaking, in each case, together with any amendment, modification or supplement thereto, to which the Company or any of its subsidiaries is a party or by which the Company or any of its subsidiaries is bound or affected or to which any of their respective properties or assets is subject.

“Court” means the Ontario Superior Court of Justice (Commercial List).

“D&O Indemnification Expiry” has the meaning specified in Section 4.7(b).

“Depositary” means Computershare Investor Services Inc. or such other person as the Company may appoint to act as the depositary in relation to the Arrangement, with the approval of the Purchaser, acting reasonably.

“Director” means the Director appointed under section 260 of the CBCA.

“Dissent Rights” means the rights of dissent in respect of the Arrangement described in the Plan of Arrangement.

“EDGAR” means the Electronic Data Gathering, Analysis, and Retrieval system maintained for purposes of filings made under the United States Securities Act of 1933, the Exchange Act and other statutes.

“Effective Date” means the date shown on the Certificate of Arrangement giving effect to the Arrangement.

“Effective Time” has the meaning ascribed thereto in the Plan of Arrangement.

“Employee Plans” means all health, welfare, supplemental unemployment benefit, bonus, profit sharing, option, stock appreciation, savings, insurance, incentive, incentive compensation, deferred compensation, share purchase, share compensation, disability, pension or supplemental retirement plans and other employee or director compensation or benefit plans, policies, trusts, funds, agreements or arrangements for the benefit of directors or former directors of the Company or any of its subsidiaries, Company Employees or former employees of the Company or any of its subsidiaries (or their respective beneficiaries), whether or not in writing, in each case, which are maintained, funded or sponsored by the Company or any of its subsidiaries or in respect of which the Company or any of its subsidiaries has any liability, other than any statutory plans administered by a Governmental Entity, including the Canada Pension Plan and Québec Pension Plan and plans administered pursuant to applicable federal or provincial health, worker’s compensation or employment insurance legislation.

- 5 -

“Environmental Laws” means all Laws and agreements with Governmental Entities and all other statutory requirements relating to public health and safety, noise control, pollution, reclamation or the protection of the environment or to the generation, production, installation, use, storage, treatment, transportation, Release or threatened Release of Hazardous Substances, including civil responsibility for acts or omissions with respect to the environment, and all Authorizations issued pursuant to such Laws, agreements or other statutory requirements.

“Exchange Act” means the United States Securities Exchange Act of 1934.

“Final Order” means the final order of the Court under section 192 of the CBCA, in a form acceptable to the Company and the Purchaser, each acting reasonably, approving the Arrangement, as such order may be amended by the Court (with the consent of both the Company and the Purchaser, each acting reasonably) at any time prior to the Effective Time or, if appealed, then, unless such appeal is withdrawn or denied, as affirmed or as amended (provided that any such amendment is acceptable to both the Company and the Purchaser, each acting reasonably) on appeal.

“Financial Advisor Opinion” means the opinion of BMO Nesbitt Burns Inc. rendered on July 11, 2023 to the Special Committee to the effect that, as of the date of such opinion, and based on and subject to the various assumptions made, procedures followed, matters considered and limitations and qualifications on the review undertaken set forth therein, the Consideration to be received by the Public Shareholders pursuant to the Plan of Arrangement was fair, from a financial point of view, to the Public Shareholders.

“Financial Statements” means, collectively, (a) the Company’s audited consolidated financial statements as at and for the fiscal years ended December 31, 2022 and 2021 (including any notes or schedules thereto and the auditor’s report thereon), and (b) the Company’s interim condensed consolidated financial statements for the three-month periods ended March 31, 2023 and 2022 (including any notes or schedules thereto).

“Governmental Entity” means (a) any multinational, federal, provincial, state, regional, municipal, local or other government, governmental or public department, ministry, central bank, court, tribunal, arbitral body, commission, commissioner, board, bureau or agency, domestic or foreign, (b) any subdivision, agent or authority of any of the foregoing; (c) any quasi-governmental or private body, including any tribunal, commission, regulatory agency or self-regulatory organization, exercising any regulatory, expropriation or taxing authority under or for the account of any of the foregoing; or (d) any stock exchange, including Nasdaq.

“Hazardous Substances” means any element, waste or other substance, whether natural or artificial and whether consisting of gas, liquid, solid or vapour that is prohibited, listed, defined, judicially interpreted, designated or classified as dangerous, hazardous, radioactive, explosive or toxic or a pollutant or a contaminant under or pursuant to any applicable Environmental Laws, and specifically including petroleum and all derivatives thereof or synthetic substitutes therefor and asbestos or asbestos-containing materials or any substance which is deemed under Environmental Laws to be deleterious to natural resources or worker or public health and safety or having a significant adverse effect upon the environment or human life or health.

“IFRS” means generally accepted accounting principles as set out in the CPA Canada Handbook – Accounting for an entity that prepares its financial statements in accordance with International Financial Reporting Standards, at the relevant time, applied on a consistent basis.

“Indemnified D&Os” has the meaning specified in Section 4.7(b).

- 6 -

“Intellectual Property” means all intellectual property, industrial property, and intellectual property rights which may exist under the Laws of any jurisdiction of the world, including any of the following: (a) patents, applications for patents and reissues, divisionals, divisions, continuations, renewals, re-examinations, extensions and continuations-in-part of patents or patent applications; (b) trade names, business names, corporate names, common law (unregistered) trade-marks, trade-mark registrations, trade-mark applications, trade dress and logos, and the goodwill associated with any of the foregoing; (c) registered and unregistered copyrights, and applications for registration of copyrights; (d) designs, design registrations, design registration applications, industrial designs, industrial design registrations, industrial design registration applications, integrated circuit topographies, mask works, mask work registrations and applications for mask work registrations; (e) internet domain names, website names, world wide web addresses, social media handles and all goodwill associated therewith; (f) rights in and to Software, data, and databases; and (g) proprietary and non-public business information, including inventions (whether patentable or not), invention disclosures, improvements, discoveries, trade secrets, confidential information, know-how, methods, processes, designs, technology, technical data, schematics, formulae and customer lists, and documentation relating to any of the foregoing.

“Interim Order” means the interim order of the Court pursuant to section 192 of the CBCA, in a form acceptable to the Company and the Purchaser, each acting reasonably, providing for, among other things, the calling and holding of the Company Meeting, as such order may be amended by the Court (with the consent of both the Company and the Purchaser, each acting reasonably).

“IT Systems” means all computer hardware and operating systems, application software, database engines and processed data, technology infrastructure and other computer systems used in connection with the conduct of the business of the Company and its subsidiaries.

“Law” or “Laws” means all laws (including common law), by-laws, statutes, rules, regulations, principles of law and equity, orders, rulings, ordinances, judgments, injunctions, determinations, awards, decrees or other requirements, whether domestic or foreign, and the terms and conditions of any grant of approval, permission, authority or license of any Governmental Entity or self-regulatory authority (including Nasdaq), and the term “applicable” with respect to such Laws and in a context that refers to one or more Parties, means such Laws as are applicable to such Party or its business, undertaking, property or securities and emanate from a person having jurisdiction over the Party or Parties or its or their business, undertaking, property or securities.

“Leased Real Property” means all real property leased, subleased, licensed, or similarly occupied by the Company or any of its subsidiaries or which the Company or any of its subsidiaries otherwise has a right or option to use or occupy, together with all structures, facilities, fixtures, systems, improvements and items of property previously or hereafter located thereon, or attached or appurtenant thereto, and all easements, rights and appurtenances relating to the foregoing.

“Leases” means all written or oral leases, subleases, licenses, and similar occupancy agreements, including any third-party head lease or sublease to which the Company or any of its subsidiaries is subject to, and all amendments, extensions, assignments, waivers and variations thereof or guarantee, indemnity or security agreements therefor, of the Leased Real Property and “Lease” means any one of them.

“Liens” means any hypothecations, mortgages, liens, charges, security interests, pledges, claims, encumbrances and adverse rights or claims.

“Match Period” has the meaning specified in Section 5.2(a)(v).

- 7 -

“Material Adverse Effect” means any change, event, occurrence, effect, development, state of fact or circumstance that, individually or in the aggregate with any other changes, events, occurrences, effects, developments, states of facts or circumstances has or could reasonably be expected to be material and adverse to the business, operations, results of operations, assets, properties, capitalization, condition (financial or otherwise) or liabilities (contingent or otherwise) of the Company and its subsidiaries, taken as a whole, but excluding any change, event, occurrence, effect, development, state of fact or circumstance resulting from or arising, directly or indirectly, in connection with:

(a) any change, event, occurrence, effect, state of fact or circumstance generally affecting the industry in which the Company and its subsidiaries operate or carry on their business;

(b) any change or development in currency exchange, interest or inflationary rates or in general economic, business, regulatory, political or market conditions or in financial securities or capital markets in Canada, the United States or in global financial or capital markets;

(c) any change, event, occurrence, effect, state of fact or circumstance resulting from any act of terrorism or any outbreak of hostilities or declared or undeclared war, or any escalation or worsening of such acts of terrorism, hostilities or war;

(d) any adoption, proposal, implementation or change in Law or in any interpretation, application or non-application of any Laws by any Governmental Entity;

(e) any change in applicable generally accepted accounting principles, including IFRS;

(f) any hurricane, flood, tornado, earthquake, fire or other natural disaster or man-made disaster; or

(g) any epidemic, pandemic or outbreak of illness (including COVID-19) or other health crisis or public health event, or the worsening of any of the foregoing;

provided, however, if a change, event, occurrence, effect, development, state of fact or circumstance referred to in clauses (a) through to and including (g) above does not primarily relate to (or have the effect of primarily relating to) the Company and its subsidiaries, taken as a whole, or disproportionately adversely effects the Company and its subsidiaries, taken as a whole, relative to other companies and entities operating in the industries and businesses in which the Company and its subsidiaries operate, such change, event, occurrence, effect, development, state of fact or circumstance may be taken into account in determining whether a Material Adverse Effect has or could reasonably be expected to have occurred.

- 8 -

“Material Contract” means any Contract: (a) that if terminated or modified or if it ceased to be in effect, would reasonably be expected to have a Material Adverse Effect; (b) that is a shareholder agreement, partnership agreement, limited liability company agreement, joint venture agreement or similar agreement or arrangement, relating to the formation, creation or operation of any corporation, partnership, limited liability company or joint venture in which the Company or any of its subsidiaries is a shareholder, partner, member or joint venturer (or other participant) that is material to the Company and its subsidiaries, taken as a whole, but excluding any such partnership, limited liability company or joint venture which is a wholly-owned subsidiary of the Company; (c) relating to indebtedness for borrowed money that is or may become outstanding, or the guarantee or any similar commitment with respect to any liabilities, other than any such Contract between two or more wholly-owned subsidiaries of the Company or between the Company and one or more of its wholly-owned subsidiaries; (d) restricting the incurrence of indebtedness by the Company or any of its subsidiaries or the incurrence of any Liens on any properties or assets of the Company or any of its subsidiaries or restricting the payment of dividends by the Company or by any of its subsidiaries; (e) under which the Company or any of its subsidiaries is obligated to make or expects to receive payments in excess of $100,000 over the next twelve months; (f) providing for the purchase, sale or exchange of, or option to purchase, sell or exchange, any property or asset where the purchase or sale price or agreed value or fair market value of such property or asset exceeds $100,000; (g) that contains express exclusivity, right of first offer or refusal, or non-solicitation obligations of the Company or any of its subsidiaries; (h) with any person with whom the Company or any of its subsidiaries does not deal at arm’s length (within the meaning specified in the Tax Act); (i) relating to any litigation or settlement thereof which does or could have actual or contingent obligations or entitlements of the Company or any of its subsidiaries in excess of $100,000 and which have not been fully satisfied prior to the date of this Agreement; (j) which has been or would be required by Securities Laws to be filed by the Company with the Securities Authorities; (k) that expressly limits or restricts in any material respect (A) the ability of the Company or any subsidiary to engage in any line of business or carry on business in any geographic area or (B) the scope of persons to whom the Company or any of its subsidiaries may sell products; and (l) that is a Lease.

“material fact” has the meaning specified in the Securities Act as in effect as of the date of this Agreement.

“Material Subsidiaries” means, collectively, Liminal R&D BioSciences Inc., Liminal BioSciences Limited, Telesta Therapeutics Inc., Pathogen Removal and Diagnostic Technologies Inc. and Fairhaven Pharmaceuticals Inc.

“MI 61-101” means Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions.

“Misrepresentation” means an untrue statement of a material fact or an omission to state a material fact required or necessary to make the statements contained therein not misleading in light of the circumstances in which they are made.

“Nasdaq” means The Nasdaq Stock Market LLC.

“Omnibus Incentive Plan” means the omnibus incentive plan of the Company dated May 7, 2019.

“Ordinary Course” means, with respect to an action taken by the Company or its subsidiaries, that such action is, in all material respects, consistent with the past practices of the Company and its subsidiaries and is taken in the ordinary course of the normal day-to-day operations of the business of the Company and its subsidiaries.

“Outside Date” means December 31, 2023, or such later date as may be agreed to in writing by the Parties.

- 9 -

“Parties” means, together, the Purchaser and the Company, and “Party” means any one of them, as the context requires.

“Permitted Liens” means, in respect of the Company or any of its subsidiaries, any one or more of the following:

(a) Liens for Taxes which are not due or delinquent, or for which instalments have been paid based on reasonable estimates pending final assessments, or if due, the validity of which is being contested diligently and in good faith by appropriate proceedings and for which adequate provision for payment of the contested amount has been made in the Financial Statements;

(b) inchoate or statutory Liens of contractors, subcontractors, mechanics, workers, suppliers, materialmen, carriers and others in respect of the construction, maintenance, repair or operation of assets, in each case incurred in the Ordinary Course and provided that such Liens are related to obligations not due or delinquent, are not registered against title to any assets and in respect of which adequate holdbacks are being maintained as required by applicable Law;

(c) the right reserved to or vested in any Governmental Entity by any statutory provision or by the terms of any lease, license, franchise, grant or permit of the Company or any of its subsidiaries, to terminate any such lease, license, franchise, grant or permit, or to require annual or other payments as a condition of their continuance, provided that such statutory provisions or terms have been complied with and do not individually or in the aggregate materially and adversely impair the current use and operation thereof assuming its continued use in the manner in which it is currently used;

(d) easements, rights-of-way, encroachments, restrictions, covenants, conditions and other similar matters provided that they have been complied with and, individually or in the aggregate, do not materially and adversely impact the Company’s and its subsidiaries’ current or contemplated use, occupancy, utility or value of the Leased Real Property; and

(e) Liens listed and described in Section 1.1 of the Company Disclosure Letter.

“person” includes an individual, limited or general partnership, limited liability company, limited liability partnership, trust, joint venture, association, body corporate, unincorporated organization, trustee, executor, administrator, legal representative, government (including any Governmental Entity) or any other entity, whether or not having legal status.

“Personal Information” means any information about an identifiable individual, including information that, alone or in combination with other available information, may be used to identify an individual, including any information to which applicable Privacy Laws may apply.

“Plan of Arrangement” means the plan of arrangement substantially in the form of SCHEDULE A hereto and any amendments or variations thereto made in accordance with the provisions of this Agreement, the applicable provisions of the Plan of Arrangement or made at the direction of the Court in the Final Order with the consent of the Purchaser and the Company, each acting reasonably.

“Pre-Acquisition Reorganization” has the meaning specified in Section 4.2(a)(i).

“Preferred Shares” means the preferred shares in the capital of the Company.

“Privacy Laws” has the meaning specified in Schedule C.

- 10 -

“Public Shareholders” means the holders of the Common Shares (other than the Purchaser and its affiliates and any other person who holds Common Shares in respect of which votes are required to be excluded under section 8.1(2) of MI 61-101 for the purposes of determining minority approval for the Arrangement).

“Regulatory Approvals” means those sanctions, rulings, consents, orders, exemptions, permits and other approvals (including the waiver or lapse, without objection, of a prescribed time under a statute or regulation that states that a transaction may be implemented if a prescribed time lapses following the giving of notice without an objection being made) of Governmental Entities required in connection with the consummation of the Arrangement or any of the transactions contemplated by this Agreement.

“Release” has the meaning prescribed in any Environmental Law and includes any sudden, intermittent or gradual release, spill, leak, pumping, addition, pouring, emission, emptying, discharge, migration, injection, escape, leaching, disposal, dumping, deposit, spraying, burial, abandonment, incineration, seepage, placement or introduction of a Hazardous Substance, whether accidental or intentional, into the environment.

“Representatives” means, with respect to any person, any directors, officers, employees, investment bankers, attorneys, accountants and other advisors or representatives of such person or any of its subsidiaries.

“Required Vote” has the meaning specified in Section 2.3(b)(ii).

“RSUs” means the outstanding restricted share units issued under the Omnibus Incentive Plan.

“Sarbanes-Oxley Act” means the U.S. Sarbanes-Oxley Act of 2002.

“Schedule 13E-3” means the Rule 13e-3 transaction statement on Schedule 13E-3 under the Exchange Act to be filed in connection with this Agreement and the Plan of Arrangement, as amended, supplemented or otherwise modified.

“SEC” means the U.S. Securities and Exchange Commission.

“Securities Act” means the Securities Act (Ontario) and the rules, regulations and published policies made thereunder.

“Securities Authorities” means the applicable securities commissions and other securities regulatory authorities in Canada and the United States.

“Securities Laws” means the Securities Act, the Exchange Act and all other applicable Canadian provincial and United States federal and state securities laws, rules, regulations and published policies thereunder, including the rules, regulations, policies and orders of Nasdaq.

“Security Incident” means any act, omission, or event that has occurred or which the Company or its subsidiaries reasonably believe may have occurred, which: (a) compromises the confidentiality, integrity, or availability of any IT Systems; or (b) breaches or creates an imminent threat of breaching any of the Company’s or its subsidiaries’ confidentiality obligations and/or security controls.

“SEDAR” means the System for Electronic Document Analysis Retrieval maintained on behalf of the applicable Securities Authorities.

- 11 -

“Software” means software, firmware, middleware, and computer programs, including any and all software implementations of algorithms, models and methodologies, whether in source code, object code, executable or binary code, and all documentation and other materials related to the software, firmware, middleware, and computer programs.

“Special Committee” means the special committee of independent directors of the Company constituted to consider the transactions contemplated by this Agreement and to supervise the preparation of the Valuation.

“subsidiary” has the meaning specified in National Instrument 45-106 – Prospectus Exemptions as in effect on the date of this Agreement.

“Superior Proposal” means an unsolicited bona fide written Acquisition Proposal from a person or group of persons who is an arm’s length third party to the Company made after the date hereof: (a) to acquire not less than all of the outstanding Common Shares; (b) that complies with Securities Laws and is available to all Company Shareholders on the same terms and did not result from or involve a breach of Article 5; (c) that is not subject to any financing condition and in respect of which it has been demonstrated to the satisfaction of the Board, acting in good faith, after receiving the advice of its outside legal counsel and financial advisors, that adequate arrangements have been made in respect of any financing required to complete such Acquisition Proposal; (d) that is not subject to a due diligence and/or access condition; (e) that provides that the person making such Acquisition Proposal will advance or otherwise provide to the Company the cash required in order to pay the Termination Fee prior to the date on which such Termination Fee is to be paid and (f) in respect of which the Board and any relevant committee determines, in its good faith judgment, after receiving the advice of its outside legal counsel and financial advisors and after taking into account all of the terms and conditions of the Acquisition Proposal and the person or group of persons making such Acquisition Proposal, that it would, if consummated in accordance with its terms (but without assuming away any risk of non completion), result in a transaction which is more favourable, from a financial point of view, to the Company Shareholders than the Arrangement (including any adjustment to the terms and conditions of the Arrangement proposed by the Purchaser pursuant to Section 5.2(b)).

“Tax” or “Taxes” means (a) any and all taxes, duties, fees, excises, premiums, assessments, imposts, levies and other charges or assessments of any kind whatsoever imposed by any Governmental Entity, whether computed on a separate, consolidated, unitary, combined or other basis, including those levied on, or measured by, or described with respect to, income, gross receipts, profits, gains, capital, capital stock, recapture, transfer, land transfer, license, net worth, indebtedness, surplus, sales, goods and services, harmonized sales, use, value-added, excise, special assessment, withholding, business, franchising, real or personal property, employee health, payroll, workers’ compensation, employment or unemployment, severance, surtaxes, customs, import or export, and including all license and registration fees and all employment insurance, health insurance and government pension plan premiums or contributions; (b) all interest, penalties, fines, additions to tax or other additional amounts imposed by any Governmental Entity on or in respect of amounts of the type described in clause (a) above or this clause (b); (c) any liability for the payment of any amounts of the type described in clauses (a) or (b) as a result of being a member of an affiliated, consolidated, combined or unitary group for any period; and (d) any liability for the payment of any amounts of the type described in clauses (a) or (b) as a result of any express or implied obligation to indemnify any other person or as a result of being a transferee or successor in interest to any party.

“Tax Act” means the Income Tax Act (Canada).

“Tax Returns” means any and all information and tax returns, reports, declarations, elections, notices, forms, designations, filings, and statements (including estimated tax returns and reports, withholding tax returns and reports, information returns, reports and any amendments, schedules, attachments, supplements,

- 12 -

appendices and exhibits thereto) filed or required to be filed in respect of the determination, assessment, collection or payment of any Tax or in connection with the administration, implementation or enforcement of any legal requirements relating to any Taxes.

“Termination Fee” has the meaning specified in Section 5.3.

“Third Party Beneficiaries” has the meaning specified in Section 8.9.

“Valuation” means the formal valuation of the Common Shares dated July 11, 2023 prepared by BMO Nesbitt Burns Inc. in accordance with MI 61-101.

“Willful Breach” means a material breach of this Agreement by a Party that is a consequence of any act or omission by such Party with the actual knowledge, after due inquiry, that the taking of such act or failure to act, as applicable, would, or would be reasonably expected to, cause a breach of this Agreement.

1.2 Certain Rules of Interpretation

In this Agreement:

(a) Time. Time is of the essence in and of this Agreement.

(b) Calculation of Time. Unless otherwise specified, time periods within or following which any payment is to be made or act is to be done shall be calculated by excluding the day on which the period commences and including the day on which the period ends. Where the last day of any such time period is not a Business Day, such time period shall be extended to the next Business Day following the day on which it would otherwise end.

(c) Business Days. Whenever any action to be taken or payment to be made pursuant to this Agreement would otherwise be required to be made on a day that is not a Business Day, such action shall be taken or such payment shall be made on the first Business Day following such day.

(d) Currency. Unless otherwise specified, all references to amounts of money in this Agreement refer to the lawful currency of Canada.

(e) Headings. The descriptive headings preceding Articles and Sections of this Agreement are inserted solely for convenience of reference and are not intended as complete or accurate descriptions of the content of such Articles or Sections. The division of this Agreement into Articles and Sections and the insertion of a table of contents shall not affect the interpretation of this Agreement.

(f) Including. Where the word “including” or “includes” is used in this Agreement, it means “including without limitation” or “includes without limitation”.

(g) Plurals and Genders. The use of words in the singular or plural, or referring to a particular gender, shall not limit the scope or exclude the application of any provision of this Agreement to such persons or circumstances as the context otherwise permits.

- 13 -

(h) Statutory References. Any reference to a statute shall mean the statute in force as at the date of this Agreement (together with all regulations promulgated thereunder), as the same may be amended, re-enacted, consolidated or replaced from time to time, and any successor statute thereto, unless otherwise expressly provided. Any reference herein to the Tax Act shall also include a reference to any applicable and corresponding provision under the income tax Laws of a province or territory of Canada.

(i) Knowledge. Any reference to “the knowledge of the Company” means the actual knowledge, in their capacity as directors and/or officers of the Company and its subsidiaries and not in their personal capacity, of Bruce Pritchard, Patrick Sartore, Nicole Rusaw and Marie Iskra, after reasonable inquiry, and references to “the knowledge of the Purchaser” means the actual knowledge, in his capacity as a director and/or officer of the Purchaser, and not in his personal capacity, of Eugene Siklos, after reasonable inquiry.

1.3 Schedules

The following Schedules are annexed to this Agreement and are incorporated by reference into this Agreement and form a part hereof:

|

|

|

SCHEDULE A |

- |

Plan of Arrangement |

SCHEDULE B |

- |

Arrangement Resolution |

SCHEDULE C |

- |

Representations and Warranties of the Company |

SCHEDULE D |

- |

Representations and Warranties of the Purchaser |

Article 2

THE ARRANGEMENT

2.1 The Arrangement

The Company and the Purchaser agree that the Arrangement will be implemented in accordance with and subject to the terms and conditions contained in this Agreement and the Plan of Arrangement.

- 14 -

2.2 Court Proceedings and Materials

In connection with all Court proceedings relating to obtaining the Interim Order and the Final Order, the Company shall diligently pursue, and cooperate with the Purchaser in diligently pursuing, the Interim Order and the Final Order, and the Company will provide the Purchaser and its outside legal counsel with a reasonable opportunity to review and comment upon drafts of all materials to be filed with the Court in connection with the Arrangement, prior to the service and filing of such materials, and will accept the reasonable comments of the Purchaser and its outside legal counsel; provided, however, that the Company agrees that all information relating solely to the Purchaser included in all such materials must be in a form and content satisfactory to the Purchaser, acting reasonably. The Company will ensure that all material filed with the Court in connection with the Arrangement is consistent in all material respects with the terms of this Agreement and the Plan of Arrangement, and will not file any material with the Court in connection with the Arrangement or serve any such material, and will not agree to modify or amend any materials so filed or served, except as contemplated by this Agreement or with the Purchaser’s prior written consent (such consent not to be unreasonably withheld, conditioned or delayed); provided, however, that nothing in this Agreement shall require the Purchaser to agree or consent to any increase or variation in the form of the Consideration or other modification or amendment to such filed or served materials that expands or increases the Purchaser’s obligations, or diminishes or limits the Purchaser’s rights set forth in any such filed or served materials or under this Agreement or the Arrangement. In addition, the Company will not object to the outside legal counsel to the Purchaser making such submissions on the application for the Interim Order and the application for the Final Order as such counsel considers appropriate, acting reasonably, provided the Purchaser advises the Company of the nature of any such submissions prior to the hearing and such submissions are consistent in all material respects with the terms of this Agreement and the Plan of Arrangement. The Company will also provide the outside legal counsel to the Purchaser, on a timely basis, with copies of any notice, evidence or other documents served on the Company or its outside legal counsel in respect of the application for the Interim Order or the Final Order or any appeal from them, and any notice, written or oral, indicating the intention of any person to appeal, or oppose the granting of, the Interim Order or Final Order, and will oppose any proposal from any person that the Final Order contains any provision inconsistent with the Arrangement or this Agreement, and, if at any time after the issuance of the Final Order and prior to the Effective Date, the Company is required by the terms of the Final Order or by applicable Law to return to Court with respect to the Final Order, it will do so only after notice to, and in consultation and cooperation with, the Purchaser.

2.3 Interim Order

(a) Subject to the terms of this Agreement, as soon as reasonably practicable, but in any event in sufficient time to hold the Company Meeting in accordance with Section 2.5(a), the Company shall apply to the Court, pursuant to Section 192(3) of the CBCA, for the Interim Order in a manner and form reasonably acceptable to Purchaser, and thereafter in cooperation with the Purchaser, prepare, file and diligently pursue an application for the Interim Order.

(b) The application referred to in Section 2.3(a) shall request that the Interim Order provide, among other things:

(i) for the class of persons to whom notice is to be provided in respect of the Arrangement and the Company Meeting and for the manner in which such notice is to be provided;

- 15 -

(ii) that the requisite approval for the Arrangement Resolution shall be (A) 662/3% of the votes cast on the Arrangement Resolution by the Company Shareholders present in person or represented by proxy at the Company Meeting and (B) a simple majority of the votes cast on the Arrangement Resolution by the Public Shareholders present in person or represented by proxy at the Company Meeting (the “Required Vote”);

(iii) that in all other respects the terms, restrictions and conditions of the Constating Documents of the Company, including quorum requirements, shall apply in respect of the Company Meeting;

(iv) for the grant of the Dissent Rights to the Company Shareholders who are registered holders of Common Shares as of the record date for the purposes of determining the Company Shareholders entitled to receive notice of and to vote at the Company Meeting, as contemplated in the Plan of Arrangement;

(v) for the notice requirements with respect to the application to the Court for the Final Order;

(vi) that the Company Meeting may be adjourned or postponed from time to time by the Company in the circumstances contemplated by this Agreement or as otherwise agreed to by the Parties without the need for additional approval of the Court and without the necessity of first convening the Company Meeting or obtaining any vote of the Company Shareholders;

(vii) that the record date for the Company Shareholders entitled to receive notice of and to vote at the Company Meeting will not change in respect of any adjournment(s) or postponement(s) of the Company Meeting; and

(viii) for such other matters as the Company and the Purchaser may reasonably require, subject to obtaining the prior consent of the other Party, such consent not to be unreasonably withheld, conditioned or delayed.

2.4 Company Circular

(a) As promptly as reasonably practicable after the execution and delivery of this Agreement, the Company shall prepare, in consultation with the Purchaser, the Company Circular and Schedule 13E-3, together with any other documents required by applicable Laws in connection with the Company Meeting and the Arrangement, and will, as promptly as practicable after the issuance of the Interim Order, file the Schedule 13E-3 with the appropriate Securities Authorities. The Company will promptly inform the Purchaser of any requests or comments made by Securities Authorities in connection with the Schedule 13E-3 or Company Circular. Each of the Parties will use its respective commercially reasonable efforts to resolve all requests or comments made by Securities Authorities with respect to the Company Circular, the Schedule 13E-3 and any other required filings under applicable Securities Laws as promptly as practicable after receipt thereof. As promptly as reasonably practicable, but subject to the foregoing, the Company will file the final Company Circular and revised Schedule 13E-3 with the appropriate Securities Authorities, as required by applicable Laws.

- 16 -

(b) The Company shall provide the Purchaser and its Representatives with a reasonable opportunity to review and comment on the Company Circular, the Schedule 13E-3 and such other documents, including by providing on a timely basis a description of any information required to be supplied by the Purchaser for inclusion in the Company Circular or Schedule 13E-3 pursuant to Section 2.4(c), prior to any filing of the Company Circular and Schedule 13E-3 and mailing of the Company Circular and in accordance with this Agreement, the Interim Order and applicable Laws, and will accept all reasonable comments made by the Purchaser and its outside legal counsel.

(c) The Purchaser will, in a timely manner, furnish in writing the Company with all such information regarding the Purchaser as is reasonably required to be included in the Company Circular and Schedule 13E-3 and any other filings required to be made by the Company under applicable Laws or for the resolution of any comments from the SEC in connection with the transactions contemplated by this Agreement.

(d) As promptly as practicable after the issuance of the Interim Order, the Company will cause the Company Circular and such other documents to be sent to the Company Shareholders, as required by applicable Laws and the Interim Order, using commercially reasonable efforts so as to permit the Company Meeting to be held by the date specified in Section 2.5(a). The Company Circular shall include (i) a statement that the Special Committee has received the Financial Advisor Opinion and the Valuation (copies of which shall also be included in the Company Circular), (ii) subject to the terms of this Agreement, that the Board has received the unanimous recommendation of the Special Committee and that the Board (with any conflicted directors abstaining) and Special Committee have each unanimously determined (A) that the Arrangement is fair to the Public Shareholders, (B) that the Arrangement and the entering into of this Agreement is in the best interests of the Company and (C) that, after, among other things, receiving outside legal and financial advice in connection with evaluating the Arrangement, each of the Board (with any conflicted directors abstaining) and Special Committee unanimously recommends that the Company Shareholders vote in favour of the Arrangement Resolution (collectively, the “Board Recommendation”) and (iii) a statement that each of the directors and executive officers of the Company has entered into a voting agreement and, subject to the terms and conditions of such voting agreement, will vote all Common Shares beneficially owned by such person in favour of the Arrangement Resolution and against any resolution submitted by any other person that is inconsistent with the Arrangement.

(e) Each of the Parties shall promptly notify the other if at any time before the Effective Time it becomes aware that the Company Circular or Schedule 13E-3 contains a Misrepresentation, or that otherwise requires an amendment or supplement to the Company Circular or Schedule 13E-3, and the Parties shall co-operate in the preparation of any such amendment or supplement and, if required by applicable Law or by the Court, will cause the same to be distributed to the Company Shareholders and/or filed with the applicable Securities Authorities, as applicable.

- 17 -

(f) The Company shall ensure that the Company Circular complies with the Interim Order and that the Company Circular and Schedule 13E-3 comply with all applicable Laws and, without limiting the generality of the foregoing, that the Company Circular and Schedule 13E-3 do not, at the time of mailing, contain any Misrepresentation (other than with respect to any information relating to and provided by the Purchaser). The Purchaser shall ensure that the information provided by it for inclusion in the Company Circular and Schedule 13E-3 does not, at the time of the mailing, contain any Misrepresentation. Notwithstanding the foregoing and for the avoidance of doubt, no covenant is made by the Company with respect to any of the information supplied by the Purchaser specifically for inclusion or incorporation by reference in the Company Circular or in the Schedule 13E-3.

2.5 The Company Meeting

(a) The Company shall convene and hold the Company Meeting in accordance with the Interim Order and applicable Laws, as soon as reasonably practicable, but in any event no later than September 15, 2023, for the purpose of considering the Arrangement Resolution. Except with the prior written consent of the Purchaser, the Arrangement Resolution shall be the only matter of business transacted at the Company Meeting.

(b) Unless the Agreement shall have been terminated in accordance with its terms, the Company shall not adjourn, postpone or cancel (or propose the adjournment, postponement or cancellation of) the Company Meeting without the prior written consent of the Purchaser, except:

(i) in the case of an adjournment, as required for quorum purposes;

(ii) for adjournments or postponements for not more than 10 Business Days in the aggregate for the purposes of attempting to solicit proxies to obtain the requisite approval of the Arrangement Resolution;

(iii) as required by Law or by a Governmental Entity; or

(iv) as directed by the Purchaser in accordance with Section 5.2(c) or in the circumstances contemplated by Section 6.3(c).

(c) Subject to the terms of this Agreement, the Company shall use commercially reasonable efforts to solicit from the Public Shareholders proxies in favour of the approval of the Arrangement Resolution and against any resolution submitted by any Public Shareholder that is inconsistent with the Arrangement Resolution and the completion of any of the transactions contemplated by this Agreement, including, if so requested by the Purchaser and at the Purchaser’s own expense, using the services of dealers and proxy solicitation services to be selected by the Purchaser, subject to the consent of the Company (not to be unreasonably withheld, conditioned or delayed), to solicit proxies in favour of the approval of the Arrangement Resolution and against any resolution submitted by any Public Shareholder that is inconsistent with the Arrangement Resolution.

- 18 -

(d) The Company shall use commercially reasonable efforts (including any required disclosure in the Company Circular) to allow the Purchaser, directly or using the services of dealers and proxy solicitation services, at the Purchaser’s own expense, to solicit from the Public Shareholders proxies in favour of the Arrangement Resolution and against any resolution submitted by any other Public Shareholder. Without limiting the generality of the foregoing, the Company shall, upon reasonable request from time to time by the Purchaser, deliver to the Purchaser: (i) basic lists of all registered Company Shareholders and other security holders of the Company or any of its subsidiaries, showing the name and address of each holder and the number of Common Shares or other securities of the Company or such subsidiaries held by each such holder, all as shown on the records of the Company or such subsidiaries, as applicable, as of a date that is not more than three Business Days prior to the date of delivery of such list and, to the extent in the possession of the Company or as can be reasonably obtained by the Company using the procedure set forth under Securities Laws, a list of participants in book-based clearing systems, nominee registered Company Shareholders or other securities of the Company or any of its subsidiaries, as the case may be, and non-registered beneficial owners lists that are available to the Company, and securities positions and other information and assistance as the Purchaser may reasonably request in connection with the solicitation of proxies or the transactions contemplated hereby, and (ii) from time to time, at the reasonable request of the Purchaser, updated or supplemental lists setting out any changes from the list(s) referred to in clause (i) of this Section 2.5(d).

(e) The Company shall advise the Purchaser as the Purchaser may reasonably request, and on a daily basis on each of the last ten Business Days prior to the proxy cut-off date for the Company Meeting, as to the aggregate tally of the proxies received by the Company in respect of the Arrangement Resolution and any other matters to be considered at the Company Meeting.

(f) The Company shall (i) promptly advise the Purchaser of any communication (written or oral) received from Public Shareholders in opposition to the Arrangement and any notice of Dissent Rights exercised or purported to have been exercised by any Public Shareholder received by the Company or its representatives in relation to the Company Meeting or the Arrangement Resolution and any withdrawal of Dissent Rights received by the Company and, subject to applicable Laws, any written communications sent by or on behalf of the Company to any Public Shareholder exercising or purporting to exercise Dissent Rights in relation to the Arrangement Resolution and (ii) provide the Purchaser with an opportunity to review and comment on any written communication sent by or on behalf of the Company to any Public Shareholder exercising or purporting to exercise Dissent Rights, and to participate in any discussions, negotiations or proceedings with or including such persons.

(g) The Company shall not make any payment or settlement offer, or agree to any payment or settlement, prior to the Effective Time with respect to Dissent Rights without the prior written consent of the Purchaser.

(h) The Company shall not, without the prior written consent of the Purchaser, (i) change the record date for the Company Shareholders entitled to vote at the Company Meeting in connection with any adjournment or postponement thereof or (ii) waive the deadline for the submission of proxies by the Public Shareholders for the Company Meeting.

(i) The Company will give notice to the Purchaser of the Company Meeting and allow the Purchaser’s representatives and legal counsel to attend and speak at the Company Meeting.

- 19 -

2.6 Final Order

If the Interim Order is obtained and the Arrangement Resolution is approved at the Company Meeting, as soon as reasonably practicable after the Company Meeting, but in any event no later than five Business Days thereafter, the Company shall submit the Arrangement to the Court and diligently pursue an application for the Final Order pursuant to Section 192 of the CBCA, in a form and manner reasonably acceptable to the Purchaser and the Company, each acting reasonably.

2.7 Articles of Arrangement and Effective Date

(a) The Articles of Arrangement shall implement the Plan of Arrangement. The Articles of Arrangement shall include the Plan of Arrangement.

(b) Unless another time or date is agreed to in writing by the Parties, the completion of the Arrangement (the “Closing”) will take place remotely by exchange of documents and signatures (or their electronic counterparts) as soon as reasonably practicable (and in any event not later than five Business Days) after the satisfaction, or where not prohibited, the waiver by the applicable Party or Parties in whose favour the condition is, of the conditions set out in Article 7 (excluding conditions that, by their terms, are to be satisfied on the Effective Date, but subject to the satisfaction, or where not prohibited, the waiver by the applicable Party or Parties in whose favour the condition is, of those conditions as of the Effective Date). The Company shall file the Articles of Arrangement together with such other documents as may be required under the CBCA to give effect to the Arrangement, and will implement the Plan of Arrangement on the day of Closing.

2.8 Payment of Consideration

The Purchaser shall, following receipt of the Final Order by the Company and at least one Business Day prior to the filing by the Company of the Articles of Arrangement in accordance with Section 2.7(b), (i) provide the Depositary with sufficient funds to be held in escrow (the terms and conditions of such escrow to be satisfactory to the Company and the Purchaser, each acting reasonably) to satisfy the aggregate Consideration payable to the Public Shareholders pursuant to Section 2.3(e) of the Plan of Arrangement, as provided in the Plan of Arrangement, and (ii) provide the Company, by way of loan, an amount equal to the consideration that the holders of Company Options, Company Warrants and RSUs are entitled to receive pursuant to Sections 2.3(a), 2.3(b) and 2.3(c) of the Plan of Arrangement, as provided in the Plan of Arrangement.

- 20 -

2.9 Withholding Rights

The Purchaser, the Company, the Depositary or any other person making a payment to any person under this Agreement, as applicable, shall be entitled to deduct or withhold from any amount otherwise payable or deliverable to any person under this Agreement such amounts as the Purchaser, the Company, the Depositary or any other person making such payment, as applicable, is required to deduct or withhold, or reasonably believe to be required to deduct or withhold, from such amount otherwise payable or deliverable under any provision of any Laws in respect of Taxes. Any such amounts will be deducted or withheld and remitted from the amount otherwise payable or deliverable pursuant to this Agreement to the appropriate Governmental Entity and shall be treated for all purposes under this Agreement as having been paid to the person in respect of which such deduction or withholding was made; provided that such deducted or withheld amounts are actually timely remitted to the appropriate Governmental Entity. On the date hereof, the Purchaser does not intend to withhold any amounts in respect of the Consideration payable to the Company Shareholders for the Common Shares. The Purchaser acknowledges and agrees that the Purchaser, the Company or any other person that makes a payment to a holder of Company Options that is resident in Canada or is employed in Canada for purposes of the Tax Act in connection with the surrender or cancellation of the Company Options as described herein or in the Plan of Arrangement will forego any deduction under the Tax Act with respect to such payment and will comply with the requirements described in subsection 110(1.1) of the Tax Act.

Article 3

REPRESENTATIONS AND WARRANTIES

3.1 Representations and Warranties of the Company

(a) Except as set forth in the correspondingly numbered section, subsection, paragraph or subparagraph of the Company Disclosure Letter (it being expressly understood and agreed that the disclosure of any fact or item in any section of the Company Disclosure Letter shall be deemed to be an exception to (or, as applicable, disclosure for the purposes of) SCHEDULE C to the extent that its relevance to SCHEDULE C is reasonably apparent on its face) the Company represents and warrants to the Purchaser as set forth in SCHEDULE C and acknowledges and agrees that the Purchaser is relying upon such representations and warranties in connection with the entering into of this Agreement.

(b) Except for the representations and warranties set forth in this Agreement, neither the Company nor any other person has made or makes, and the Purchaser has not relied upon, any other express or implied representation and warranty, either written or oral, on behalf of the Company.

(c) The representations and warranties of the Company contained in this Agreement shall not survive the completion of the Arrangement and shall expire and be terminated on the earlier of the Effective Time and the date on which this Agreement is terminated in accordance with its terms.

3.2 Representations and Warranties of the Purchaser

(a) The Purchaser represents and warrants to the Company as set forth in SCHEDULE D and acknowledges and agrees that the Company is relying upon such representations and warranties in connection with the entering into of this Agreement.

- 21 -

(b) Except for the representations and warranties set forth in this Agreement, neither the Purchaser nor any other person has made or makes, and the Company has not relied upon, any other express or implied representation and warranty, either written or oral, on behalf of the Purchaser.

(c) The representations and warranties of the Purchaser contained in this Agreement shall not survive the completion of the Arrangement and shall expire and be terminated on the earlier of the Effective Time and the date on which this Agreement is terminated in accordance with its terms.

Article 4

COVENANTS OF THE PARTIES

4.1 Covenants of the Company Regarding the Conduct of Business

(a) The Company covenants and agrees that, during the period from the date of this Agreement until the earlier of the Effective Time and the time that this Agreement is terminated in accordance with its terms, except: (i) with the prior written consent of the Purchaser (such consent not to be unreasonably withheld, conditioned or delayed); (ii) as required or expressly permitted by this Agreement, (iii) as required by applicable Law or by a Governmental Entity, (iv) as required by any Pre-Acquisition Reorganization; or (v) with respect to clauses 4.1(b)(vi), 4.1(b)(xvii), 4.1(b)(xxiv) and 4.1(b)(xxx) below as expressly contemplated by the Company’s current budget approved by the Board on December 12, 2022, a copy of which is set forth in Section 4.1 of the Company Disclosure Letter, the Company shall, and shall cause each of its subsidiaries, to conduct its business in the Ordinary Course, and the Company shall maintain and preserve in all material respects its and its subsidiaries’ business organization, liquidity, assets, properties, employees, goodwill and business relationships it currently maintains with customers, suppliers, partners and other persons with which the Company or any of its subsidiaries has material business relations.

(b) Without limiting the generality of Section 4.1(a), the Company covenants and agrees that, during the period from the date of this Agreement until the earlier of the Effective Time and the time that this Agreement is terminated in accordance with its terms, except: (i) with the prior written consent of the Purchaser (such consent not to be unreasonably withheld, conditioned or delayed); (ii) as required or expressly permitted by this Agreement, (iii) as required by applicable Law or by a Governmental Entity, (iv) as required by any Pre-Acquisition Reorganization; or (v) with respect to clauses 4.1(b)(vi), 4.1(b)(xvii), 4.1(b)(xxiv) and 4.1(b)(xxx) below as expressly contemplated by the Company’s current budget approved by the Board on December 12, 2022, a copy of which is set forth in Section 4.1 of the Company Disclosure Letter, the Company shall not, and shall not permit any of its subsidiaries to, directly or indirectly:

(i) amend or otherwise modify its Constating Documents;

- 22 -

(ii) reduce the stated capital, adjust, split, divide, consolidate, combine or reclassify any shares of the Company or of any subsidiary, set aside or pay any dividend or other distribution or make any payment (whether in cash, shares or property or any combination thereof), in respect of the Common Shares owned by any person or the securities of any subsidiary, other than, in the case of any wholly-owned subsidiary of the Company, any dividends, distributions or payments payable to the Company or any other wholly-owned subsidiary of the Company;

(iii) redeem, repurchase, or otherwise acquire or offer to redeem, repurchase or otherwise acquire any shares of the Company or any of its subsidiaries or securities convertible into or exchangeable or exercisable for shares or other securities of the Company or any of its subsidiaries, except for: (A) the acquisition of shares of any subsidiary of the Company by the Company or by any other wholly-owned subsidiary of the Company; or (B) pursuant to the forfeiture or withholding of Taxes with respect to Company Options or RSUs;

(iv) issue, grant, deliver, sell, pledge or otherwise encumber (other than Permitted Liens), or authorize any such issuance, grant, delivery, sale, pledge or other encumbrance of, any shares or any options, units, warrants or similar rights exercisable or exchangeable for or convertible into shares of the Company or any of its subsidiaries, or any stock appreciation rights, phantom stock awards or other rights that are linked to the price or the value of the Common Shares, except for: (A) the issuance of Common Shares issuable upon the exercise of the currently outstanding Company Options or the delivery of Common Shares upon the settlement of the currently outstanding RSUs; and (B) the issuance of any shares of any wholly-owned subsidiary of the Company to the Company or any other wholly-owned subsidiary of the Company;

(v) acquire (by merger, consolidation, acquisition of shares or assets or otherwise), directly or indirectly, in one transaction or in a series of related transactions, any assets, securities, properties, interests or businesses having a cost, on a per transaction basis, in excess of $100,000 and subject to a maximum of $250,000 for all such transactions, other than, current assets acquired in the Ordinary Course;

(vi) other than inventory sold in the Ordinary Course, sell, lease, transfer or otherwise dispose of, directly or indirectly, in one transaction or in a series of related transactions, any of the Company’s or its subsidiaries assets;

(vii) reorganize, recapitalize, restructure, amalgamate or merge the Company or its subsidiaries;

(viii) grant a Lien (other than Permitted Liens) against any asset or properties of the Company or its subsidiaries;

(ix) adopt a plan of liquidation or resolution providing for the winding-up, liquidation or dissolution of the Company or any of its subsidiaries;

- 23 -

(x) make, rescind or amend any Tax election, information schedule, designation or Tax Return, except in each case in the Ordinary Course, settle or compromise any material Tax claim, assessment, reassessment or liability, change any of its methods of reporting income, deductions or accounting for income Tax purposes, change any annual Tax accounting period, surrender any right to claim a material Tax abatement, reduction, deduction, exemption, credit or refund, or consent to the extension or waiver of the limitation period applicable to any material Tax matter;

(xi) make a request for a Tax ruling or voluntary disclosure or enter into any agreement with any Governmental Entity or consent to any extension or waiver of any limitation period with respect to Taxes;

(xii) enter into any Tax sharing, Tax advance pricing, Tax allocation, Tax indemnification or similar agreement (other than customary Tax indemnification provisions in commercial contracts not primarily relating to Taxes);

(xiii) materially reduce the amount of any of its individual categories of Tax attributes;

(xiv) create, incur, assume or otherwise become liable, in one transaction or in a series of related transactions, with respect to any indebtedness for borrowed money or guarantees thereof, any equity commitment or otherwise become liable with respect to the liabilities of any person in an amount, on a per transaction or series of related transactions basis, in excess of $100,000 other than indebtedness owing by one wholly-owned subsidiary of the Company to the Company or another wholly-owned subsidiary of the Company or by the Company to another wholly-owned subsidiary of the Company;

(xv) make any changes in the Company’s accounting methods, policies, principles, practices or procedures, except as required by concurrent changes in IFRS;

(xvi) hire any Company Employee or, except in the Ordinary Course for misconduct or other serious reasons, terminate the employment of any Company Employee;

(xvii) other than increases made in the Ordinary Course, grant any increase in the rate of wages, salaries, bonuses or other remuneration of Company Employees (including, for greater certainty, making any bonus or profit sharing distribution or similar payment of any kind);

(xviii) grant, amend or enter into any Contract with respect to change of control, severance, retention or termination payments with Company Employees or grant any increase of benefits payable under the Company’s and its subsidiaries’ current change of control, severance, retention or termination pay arrangements, plans, policies or Contracts, other than with respect to termination of Company Employees in the Ordinary Course earning a base salary of less than $100,000 annually;

(xix) adopt any new Employee Plan or terminate, amend or modify an existing Employee Plan (or commit to do so);

- 24 -