false

0001861522

0001861522

2023-12-06

2023-12-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): December 6, 2023

Kidpik

Corp.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-41032 |

|

81-3640708 |

(State

or other jurisdiction

of

incorporation or organization) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

Number) |

200

Park Avenue South, 3rd Floor

New

York, New York |

|

10003 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (212) 399-2323

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.001 par value per share |

|

PIK |

|

The

NASDAQ Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

(d)

Appointment of New Director

Effective

on December 6, 2023, the Board of Directors of Kidpik Corp., a Delaware corporation (the “Company”), appointed Mr.

Louis G. Schott as a member of the Board of Directors of the Company, to fill the vacancy on the Board of Directors created by the resignation

of David Oddi, which as previously disclosed, was effective on November 27, 2023. Mr. Schott was appointed to the Board of Directors

pursuant to the power provided to the Board of Directors by the Company’s Bylaws. Mr. Schott was appointed as a Class I director.

As a Class I director, Mr. Schott is expected to stand for election by the Company’s stockholders at the 2025 Annual Meeting of

Stockholders.

The

Board of Directors determined that Mr. Schott was “independent” pursuant to the rules of the NASDAQ Capital Market and pursuant

to Rule 10A-3(b)(1) under the Securities Exchange Act of 1934, as amended.

Mr.

Schott is not party to any material plan, contract or arrangement (whether or not written) with the Company and there are no arrangements

or understandings between Mr. Schott and any other person pursuant to which Mr. Schott was selected to serve as a director of the Company,

nor is Mr. Schott a participant in any related party transaction required to be reported pursuant to Item 404(a) of Regulation S-K.

The

Company contemplates entering into an Indemnification Agreement with Mr. Schott. The Indemnification Agreement will provide for indemnification

of, and advancement of litigation and other expenses to, Mr. Schott to the fullest extent permitted by law for claims relating to his

service to the Company, subject to the terms and conditions contained in the form of Indemnification Agreement incorporated by reference

hereto as Exhibit 99.1. The Indemnification Agreement will be identical in all material respects to the indemnification agreements

entered into with other Company directors.

There

are no family relationships between any director or executive officer of the Company, including Mr. Schott, except that Ezra Dabah, the

Company’s Chairman and Chief Executive Officer, is the father of Moshe Dabah, the Company’s Vice President, Chief Operating

Officer and Chief Technology Officer.

Mr.

Schott was appointed as a member of, and as Chairperson of, the Company’s Audit Committee upon his appointment to the Board of

Directors, and as a result, the Company now has an Audit Committee consisting of three independent directors. Mr. Schott was also appointed

as a member of the Company’s recently formed Strategy and Alternatives Committee.

The

Company has no formal director compensation policy; however, Mr. Schott was granted 60,270 shares of fully-vested common stock of the

Company upon his appointment to the Board, valued at $25,000. The shares will be issued

under the Company’s First Amended and Restated 2021 Equity Incentive Plan. Moving forward, it is expected that Mr. Schott will

receive equity consideration for his services on the Board of Directors, issuable in the discretion of the Board of Directors, provided

that the Company has no current plans to award any additional equity compensation to Mr. Schott.

Biographical

information for Mr. Schott is provided below:

Louis

G. Schott, age 57

Mr.

Schott has over 25 years of legal and business experience, including a strong background in restructuring, mergers and acquisitions,

public company regulations and requirements, title, energy finance, business development, general negotiations and land. Mr. Schott’s

recent restructuring experience includes restructurings within and outside of bankruptcy and both public, traded on the TSX and NYSE

American, and private entities.

Mr.

Schott has served as Principal of Fides Energy, LLC, an oil and gas, real estate, green energy solutions, insurance, annuities and settlement

company, since January 2017. Since January 2020, Mr. Schott has served as a Co-Principal of Insurance Securities and Union Title Guarantee

Company, a company in the oil and gas and real estate investment industry. From May 2018 to December 2020, Mr. Schott served as Interim

Chief Executive Officer of Camber Energy, Inc. (NYSE American:CEI), an oil and gas exploration company, after serving as a consultant

to Camber Energy, Inc., from June 2017 to June 2018.

Prior

to that, Mr. Schott was the Interim Chief Executive Officer of EnerJex Resources, Inc. (NYSE American:ENRJ)(“EnerJex”),

a position which he held from February 2017 to March 2018. As CEO, he led restructuring efforts, cost reductions and the successful completion

of a merger between EnerJex and a privately held company (AgEagle Aerial Systems, Inc.).

Mr.

Schott was previously General Counsel and Treasurer of TexOak Petro Holdings LLC (“TexOak”) and its subsidiaries including

Equal Energy (“Equal”), from 2009 through August 2016, where he actively performed all legal functions, including

corporate structure and governance, negotiation of oil and gas acquisitions and divestitures, drafting review and certification of all

corporate and financial documents, legal and land due diligence, corporate finance, litigation management, risk management, insurance,

corporate policies, and human resource management. At TexOak, Mr. Schott successfully managed two mergers including the merger with Equal,

a Canadian public company dually listed on the New York Stock Exchange and the Toronto Stock Exchange and Equal’s subsequent privatization

and redomestication. Mr. Schott was also instrumental in working with the CEO and the Board in guiding Petroflow’s predecessor

through restructuring and bankruptcy, emerging as a private company with no debt and capital to grow.

Prior

to joining TexOak’s subsidiary, Petroflow, in 2005, Mr. Schott served in various senior roles with TDC Energy (“TDC”)

from 1996 through 2005. Prior to TDC, Mr. Schott was an oil and gas attorney with Liskow & Lewis in New Orleans.

Mr.

Schott is a graduate of Tulane University with a BBA in Management, an MBA, and a Juris Doctorate. Mr. Schott is also a non-practicing

unlicensed Certified Public Accountant.

We

have concluded that Mr. Schott is well qualified to serve on our Board of Directors based upon his legal and business experience, including

his background in restructuring, mergers and acquisitions.

Item

9.01 Financial Statements and Exhibits.

*

Furnished herewith.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Dated:

December 8, 2023

| |

Kidpik

Corp. |

| |

|

|

| |

By: |

/s/

Ezra Dabah |

| |

Name: |

Ezra

Dabah |

| |

Title: |

Chief

Executive Officer |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

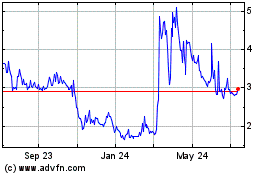

Kidpik (NASDAQ:PIK)

Historical Stock Chart

From Apr 2024 to May 2024

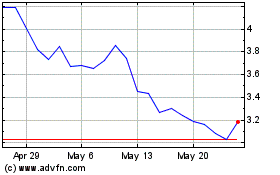

Kidpik (NASDAQ:PIK)

Historical Stock Chart

From May 2023 to May 2024