0001861522

false

0001861522

2023-09-18

2023-09-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): September 18, 2023

Kidpik

Corp.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-41032 |

|

81-3640708 |

(State

or other jurisdiction

of

incorporation or organization) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

Number) |

200

Park Avenue South, 3rd Floor

New

York, New York |

|

10003 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (212) 399-2323

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.001 par value per share |

|

PIK |

|

The

NASDAQ Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01. Entry into a Material Definitive Agreement.

Debt

Conversion Agreement

On

September 18, 2023, Kidpik Corp. (the “Company”) entered into a Debt Conversion Agreement (the “Debt Conversion

Agreement”) with Ezra Dabah, the Chief Executive Officer and Chairman of the Company (“Dabah”).

Pursuant

to the Debt Conversion Agreement the Company and Dabah agreed to convert an aggregate of $1,200,000 of principal owed by the Company

to Dabah under certain outstanding promissory notes dated (a) September 23, 2021 ($500,000); (b) October 8, 2021 ($500,000); and (c)

October 26, 2021 (of which $500,000 is outstanding, and of which $200,000 was subject to the Debt Conversion Agreement)(collectively,

such $1,200,000 of promissory notes, the “Converted Notes”), into an aggregate of 1,553,800 shares of restricted common

stock of the Company (the “Debt Conversion Shares”).

The

conversion price was equal to the greater of the closing consolidated bid price on the date the Conversion Agreement was entered into

(or the prior day’s closing consolidated bid price in the event that the agreement was entered into during market hours), and $0.7723

per share, provided that because $0.7723 was above the closing consolidated bid price, the conversion price was fixed at $0.7723 per

share.

Pursuant

to the Debt Conversion Agreement, which included customary representations and warranties of the parties, Dabah agreed that the shares

of common stock issuable in connection therewith were in full and complete satisfaction of amounts owed under the Converted Notes, including

all accrued and unpaid interest thereon, if any, which was forgiven by Dabah upon his entry into the Debt Conversion Agreement.

The

issuance of the Debt Conversion Shares increases Dabah’s beneficial ownership of the Company’s common stock (when including

shares subject to a voting agreement which Dabah is a party to and shares owned by his wife, which he is deemed to beneficially own)

to approximately 68.1% of the Company’s outstanding common stock, compared to approximately 61.7% of the Company’s outstanding

common stock prior to the issuance.

The

foregoing summary of the terms of the Debt Conversion Agreement is not complete and is qualified in its entirety by reference to the

full text of the Debt Conversion Agreement, which is filed as Exhibit 10.1 to this Current Report and is incorporated in this

Item 1.01 by reference.

Item

3.02. Unregistered Sales of Equity Securities.

The

information and disclosures set forth in Item 1.01 above are incorporated into this Item 3.02 by reference in their entirety.

The Company claims an exemption from registration pursuant to Section 4(a)(2) and/or Rule 506 of Regulation D of the Securities Act of

1933, as amended (the “Securities Act”), for the issuance of the Debt Conversion Shares, since the offer and sale

of such shares did not involve a public offering and the recipient was an “accredited investor”. The securities were

offered without any general solicitation by us or our representatives. No underwriters or agents were involved in the foregoing issuances

and we paid no underwriting discounts or commissions. The securities are subject to transfer restrictions, and the certificates evidencing

the securities will contain an appropriate legend stating that such securities have not been registered under the Securities Act and

may not be offered or sold absent registration or pursuant to an exemption therefrom. The securities were not registered under the Securities

Act and such securities may not be offered or sold in the United States absent registration or an exemption from registration under the

Securities Act and any applicable state securities laws.

Item

7.01. Regulation FD Disclosure.

On

September 18, 2023, the Company issued a press release announcing the entry into the Debt Conversion Agreement, which is attached as

Exhibit 99.1 hereto and incorporated by reference herein.

The

information contained in, or incorporated into, this Item 7.01 of this Current Report, is furnished under Item 7.01 of

Form 8-K and shall not be deemed “filed” for the purposes of Section 18 of the Exchange Act of 1934, as amended (the

“Exchange Act”) or otherwise subject to the liabilities of that section, and shall not be deemed to be incorporated

by reference into the filings of the Company under the Securities Act or the Exchange Act regardless of any general incorporation language

in such filings.

Item

8.01. Other Events.

As

a result of the transactions contemplated by the Debt Conversion Agreement, the stockholders’ equity of the Company as of September

18, 2023 is greater than $5 million (unaudited).

Item

9.01. Financial Statements and Exhibits

(d)

Exhibits

| * |

Filed

herewith. |

| ** |

Furnished herewith. |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Dated:

September 18, 2023

| |

Kidpik

Corp. |

| |

|

|

| |

By: |

/s/

Ezra Dabah |

| |

Name: |

Ezra

Dabah |

| |

Title: |

Chief

Executive Officer |

Exhibit 10.1

DEBT

CONVERSION AGREEMENT

This

Debt Conversion Agreement (this “Agreement”) dated and effective September 18, 2023 (the “Effective

Date”), is by and between, Kidpik Corp., a Delaware corporation (the “Company”), and Ezra Dabah,

an individual (the “Creditor”), each a “Party” and collectively the “Parties”.

W

I T N E S S E T H:

WHEREAS,

as of the date of this Agreement, the Company owes Creditor $2,000,000 in principal amount under those certain Promissory Notes effective

(a) September 23, 2021 ($500,000)(as amended from time to time, the “September 2021 Note”); (b) October 8,

2021 ($500,000)(as amended from time to time, the “First October 2021 Note”); (c) October 12, 2021 ($500,000)(as

amended from time to time, the “Second October 2021 Note”); and (d) October 26, 2021 ($500,000), which note

funds were provided by Creditor to the Company as working capital loans;

WHEREAS,

the Creditor is the Chief Executive Officer of the Company and the Chairman of the Board Directors;

WHEREAS,

the Creditor and the Company desire to convert $1,200,000 of principal owed under the September 2021 Note, First October 2021 Note and

Second October 2021 Note, and more specifically, all of the September 2021 Note, all of the First October 2021 Note, and $200,000 of

the principal owed under the Second October 2021 Note (collectively, the “Converted Notes”) into shares of

the Company’s restricted common stock, pursuant to the terms and conditions of this Agreement set forth below (the “Conversion”)

and for the Creditor to forgive any interest accrued under the Converted Notes (the “Forgiveness”); and

WHEREAS,

the Company and the Creditor desire to set forth in writing herein the terms and conditions of their agreement and understanding concerning

Conversion and Forgiveness.

NOW,

THEREFORE, in consideration of the premises and the mutual covenants, agreements, and considerations herein contained, the receipt

and sufficiency of which is hereby acknowledged by the Parties, the Parties hereto agree as follows:

1. Consideration.

(a)

Effective on the Effective Date, and in consideration and in full satisfaction of the forgiveness of the principal amount of, and all

accrued and unpaid interest on, the Converted Notes1, the Company shall issue the Creditor that number of restricted shares

of common stock of the Company as equals (i) the principal amount of the Converted Notes, divided by (ii) the Conversion Price (as defined

below), rounded down to the nearest whole share (the “Shares”).

1

For the sake of clarity and in an abundance of caution, the Parties agree that each reference herein to the Converted Notes refers

to all of the September 2021 Note, all of the First October 2021 Note, and the first $200,000 of principal owed under the Second October

2021 Note only.

$1,200,000 Promissory Note | Debt Conversion Agreement |

Kidpik Corp. and Ezra Dabah |

| Page 1 of 6 |

(b) The

Shares shall be issued in book-entry/non-certificated form.

(c) Creditor

represents that he is the sole owner of the Converted Notes and has good and marketable title to the Converted Notes, free and clear

of any liens, claims, charges, options, rights of tenants or other encumbrances. Creditor has sole managerial and dispositive authority

with respect to the Converted Notes.

(e) For

the purposes of this Agreement, “Conversion Price” means the greater of:

(A)

$0.7723; and

(B)(1)

if this Agreement is fully executed by all Parties (“Fully Executed”) hereto prior to 4:00 p.m. Eastern Time

on any day in which the Company’s common stock is traded on The Nasdaq Capital Market, (i) the consolidated closing bid price of

the common stock of the Company on the last trading day prior to the date this Agreement is Fully Executed; and (2) if this Agreement

is Fully Executed after 4:00 p.m. Eastern Time on any day in which the Company’s common stock is traded on The Nasdaq Capital Market

the consolidated closing bid price of the common stock of the Company on such trading day that this Agreement is Fully Executed.

2. Full

Satisfaction.

Creditor

agrees that he is accepting the Shares in full satisfaction of all amounts owed under, and in connection with, the Converted Notes, which

are being converted into the Shares as described above and that as such, Creditor will no longer have any rights of repayment against

the Company as to the amounts owed under the Converted Notes which are being converted into the Shares according to this Agreement. Creditor

further agrees that the Shares are being issued in full consideration of the amounts owed under the Converted Notes. Creditor further

agrees that all accrued interest owed on the Converted Notes as of the Effective Date, if any, shall be deemed forgiven by the Creditor

upon his entry into this Agreement.

$1,200,000 Promissory Note | Debt Conversion Agreement |

Kidpik Corp. and Ezra Dabah |

| Page 2 of 6 |

3.

Mutual Representations, Covenants and Warranties.

(a)

The Parties have all requisite power and authority, corporate or otherwise, to execute and deliver this Agreement and to consummate

the transactions contemplated hereby and thereby. The Parties have duly and validly executed and delivered this Agreement and,

assuming the due authorization, execution and delivery of this Agreement by the Parties hereto and thereto, this Agreement

constitutes, the legal, valid and binding obligation of the Parties enforceable against each Party in accordance with its terms,

except as such enforcement may be limited by applicable bankruptcy, insolvency, reorganization, moratorium or similar laws affecting

creditor’s rights generally and general equitable principles.

(b)

The execution and delivery by the Parties of this Agreement and the consummation of the transactions contemplated hereby and thereby

do not and shall not, by the lapse of time, the giving of notice or otherwise: (a) constitute a violation of any law; or (b)

constitute a breach or violation of any provision contained in the document(s) regarding organization and/or management of the

Parties, if applicable; or (c) constitute a breach of any provision contained in, or a default under, any governmental approval, any

writ, injunction, order, judgment or decree of any governmental authority or any contract to which either the Company or the

Creditor are a party or by which either the Company or the Creditor are bound or affected.

(c)

The Parties hereby covenant that they will, whenever and as reasonably requested by another Party hereto, at such acting

Party’s sole cost and expense, do, execute, acknowledge and deliver any and all such other and further acts, deeds,

assignments, transfers, conveyances, confirmations, powers of attorney and any instruments of further assurance, approvals and

consents as such Party may reasonably require in order to complete, insure and perfect the transactions contemplated

herein.

(d)

Any individual executing this Agreement on behalf of a Party has the authority to act on behalf of such Party and has been duly and

properly authorized to sign this Agreement on behalf of such Party.

4. Representations

of Creditor.

The

Creditor represents to the Company that:

(a) Creditor

is acquiring the Shares for his own account, for investment purposes only and not with a view to, or for sale in connection with, a distribution,

as that term is used in Section 2(11) of the Securities Act of 1933, as amended (the “Securities Act,” or the

“Act”) in a manner which would require registration under the Securities Act or any state securities laws.

Creditor can bear the economic risk of investment in the Shares, has knowledge and experience in financial business matters, is capable

of bearing and managing the risk of investment in the applicable Shares and is an “accredited investor” as

defined in Regulation D under the Securities Act. Creditor recognizes that the applicable Shares are not registered under the Securities

Act, nor under the securities laws of any state and, therefore, cannot be resold unless the resale of the applicable Shares is registered

under the Securities Act or unless an exemption from registration is available.

$1,200,000 Promissory Note | Debt Conversion Agreement |

Kidpik Corp. and Ezra Dabah |

| Page 3 of 6 |

(b) Creditor

understands and agrees that a legend has been or will be placed on any certificate(s) or other document(s) evidencing the Shares in substantially

the following form:

‘‘THE

SECURITIES REPRESENTED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED OR ANY STATE SECURITIES

ACT. THE SECURITIES HAVE BEEN ACQUIRED FOR INVESTMENT AND MAY NOT BE SOLD, TRANSFERRED, PLEDGED OR HYPOTHECATED UNLESS (I) THEY SHALL

HAVE BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED AND ANY APPLICABLE STATE SECURITIES ACT, OR (II) THE CORPORATION SHALL

HAVE BEEN FURNISHED WITH AN OPINION OF COUNSEL, SATISFACTORY TO COUNSEL FOR THE CORPORATION, THAT REGISTRATION IS NOT REQUIRED UNDER

ANY SUCH ACTS.’’

(c) Creditor

hereby covenants that he will, whenever and as reasonably requested by the Company and at Creditor’s sole cost and expense, do,

execute, acknowledge and deliver any and all such other and further acts, deeds, assignments, transfers, conveyances, confirmations,

powers of attorney and any instruments of further assurance, approvals and consents as the Company may reasonably require in order to

complete, insure and perfect the transactions contemplated herein.

5. Miscellaneous.

(a) Assignment.

All of the terms, provisions, and conditions of this Agreement shall be binding upon and shall inure to the benefit of and be enforceable

by the Parties hereto and their respective successors and permitted assigns.

(b) Applicable

Law. This Agreement shall be construed under and governed by the laws of the State of Delaware, excluding any provision which

would require the use of the laws of any other jurisdiction.

(c)

Entire Agreement, Amendments, and Waivers. This Agreement constitutes the entire agreement of the Parties regarding the

subject matter of the Agreement and expressly supersedes all prior and contemporaneous understandings and commitments, whether written

or oral, with respect to the subject matter hereof. No variations, modifications, changes or extensions of this Agreement or any other

terms hereof shall be binding upon any Party hereto unless set forth in a document duly executed by such Party or an authorized agent

of such Party.

$1,200,000 Promissory Note | Debt Conversion Agreement |

Kidpik Corp. and Ezra Dabah |

| Page 4 of 6 |

(d)

Headings; Gender. The paragraph headings contained in this Agreement are for convenience only, and shall in no manner be

construed as part of this Agreement. All references in this Agreement as to gender shall be interpreted in the applicable gender of the

Parties.

(e) Binding

Effect. This Agreement shall be binding on the Company and Creditor only upon execution of this Agreement by all Parties hereto.

Upon such execution by all Parties hereto, this Agreement shall be binding on and inure to the benefit of each of the Parties and their

respective heirs, successors, assigns, directors, officers, agents, employees, and personal representatives.

(f) Severability.

Should any clause, sentence, paragraph, subsection, Section or Article of this Agreement be judicially declared to be invalid, unenforceable

or void, such decision will not have the effect of invalidating or voiding the remainder of this Agreement, and the Parties agree that

the part or parts of this Agreement so held to be invalid, unenforceable or void will be deemed to have been stricken herefrom by the

Parties, and the remainder will have the same force and effectiveness as if such stricken part or parts had never been included herein.

(g) Arm’s

Length Negotiations. Each Party herein expressly represents and warrants to all other Parties hereto that (a) before executing

this Agreement, said Party has fully informed itself of the terms, contents, conditions, and effects of this Agreement; (b) said Party

has relied solely and completely upon its own judgment in executing this Agreement; (c) said Party has had the opportunity to seek and

has obtained the advice of its own legal, tax and business advisors before executing this Agreement; (d) said Party has acted voluntarily

and of its own free will in executing this Agreement; and (e) this Agreement is the result of arm’s length negotiations conducted

by and among the Parties and their respective counsel.

(h) Counterparts,

Effect of Facsimile, Emailed and Photocopied Signatures. This Agreement and any signed agreement or instrument entered into in

connection with this Agreement, and any amendments hereto or thereto, may be executed in one or more counterparts, all of which shall

constitute one and the same instrument. Any such counterpart, to the extent delivered by means of a facsimile machine or by .pdf, .tif,

..gif, .jpeg or similar attachment to electronic mail (any such delivery, an “Electronic Delivery”) shall be

treated in all manner and respects as an original executed counterpart and shall be considered to have the same binding legal effect

as if it were the original signed version thereof delivered in person. At the request of any Party, each other Party shall re-execute

the original form of this Agreement and deliver such form to all other Parties. No Party shall raise the use of Electronic Delivery to

deliver a signature or the fact that any signature or agreement or instrument was transmitted or communicated through the use of Electronic

Delivery as a defense to the formation of a contract, and each such Party forever waives any such defense, except to the extent such

defense relates to lack of authenticity.

[Remainder

of page left intentionally blank. Signature page follows.]

$1,200,000 Promissory Note | Debt Conversion Agreement |

Kidpik Corp. and Ezra Dabah |

| Page 5 of 6 |

IN

WITNESS WHEREOF, the Parties hereto have executed this Agreement as of the day and year first written above.

| |

“Company” |

| |

|

| |

Kidpik

Corp. |

| |

|

| |

/s/

Jill Pasechnick |

| |

Jill

Pasechnick |

| |

Chief

Accounting Officer |

| “Creditor” |

|

| |

|

| /s/

Erza Dabah |

|

| Erza

Dabah |

|

$1,200,000 Promissory Note | Debt Conversion Agreement |

Kidpik Corp. and Ezra Dabah |

| Page 6 of 6 |

Exhibit

99.1

KIDPIK

Enters Into Debt Exchange Agreement

NEW

YORK, September 18, 2023 / PRNewswire/—Kidpik Corp. (“KIDPIK” or the “Company”), an online

clothing subscription-based e-commerce company, is pleased to announce that it has entered into a debt exchange agreement with Ezra Dabah,

its Chief Executive Officer, Chairman and largest stockholder. Pursuant to the debt exchange agreement, Mr. Dabah agreed to exchange

$1.2 million of outstanding promissory notes, which were due on demand, for 1,553,800 shares of restricted common stock of the Company,

based on a conversion price of $0.7723 per share, which was 29.8% above the closing sales price of the Company’s common stock on

the Nasdaq Capital Market on September 15, 2023, the date that the agreement was entered into.

The

1,553,800 shares of restricted common stock represent approximately 19.9% of the Company’s outstanding common stock prior to the

conversion, and increased Mr. Dabah’s beneficial ownership of our outstanding shares of common stock from 61.7% to 68.1%.

The

debt conversion was undertaken in an effort to reduce the Company’s outstanding debt and for the Company to increase its stockholders’

equity above $5 million as of September 18, 2023, such that the Company would be eligible for an extension of the period of time that

the Company was provided by Nasdaq to regain compliance with Nasdaq’s $1.00 minimum bid price requirement, which extension the

Company expects Nasdaq to grant later this week.

About

Kidpik Corp.

Founded

in 2016, KIDPIK (NASDAQ:PIK) is an online clothing subscription box for kids, offering mix & match, expertly styled outfits that

are curated based on each member’s style preferences. KIDPIK delivers a surprise box monthly or seasonally, providing an effortless

shopping experience for parents and a fun discovery for kids. Each seasonal collection is designed in-house by a team with decades of

experience designing childrenswear. KIDPIK combines the expertise of fashion stylists with proprietary data and technology to translate

kids’ unique style preferences into surprise boxes of curated outfits. We also sell our branded clothing and footwear through our

e-commerce website, shop.kidpik.com. For more information, visit www.kidpik.com.

Forward-Looking

Statements

This

press release may contain statements that constitute “forward-looking statements” within the federal securities laws, including

The Private Securities Litigation Reform Act of 1995, which provide a safe-harbor for forward-looking statements. In particular, when

used in the preceding discussion, the words “may,” “could,” “expect,” “intend,” “plan,”

“seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,”

“continue,” “likely,” “will,” “would” and variations of these terms and similar expressions,

or the negative of these terms or similar expressions are intended to identify forward-looking statements within the meaning of such

laws, and are subject to the safe harbor created by such applicable laws. Any statements made in this news release other than those of

historical fact, about an action, event or development, are forward-looking statements. These statements involve known and unknown risks,

uncertainties and other factors, which may cause the results of KIDPIK to be materially different than those expressed or implied in

such statements. The forward-looking statements may include projections and estimates of KIDPIK’s corporate strategies, future

operations and plans, including the costs thereof. We have based these forward-looking statements on our current expectations and assumptions

and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected future developments,

as well as other factors we believe are appropriate under the circumstances. However, whether actual results and developments will conform

with our expectations and predictions is subject to a number of risks and uncertainties, including our actual stockholders’ equity

as of the date of this press release and as of the Company’s next fiscal quarter end; the willingness of Nasdaq to provide us an

extension to comply with Nasdaq’s minimum bid price requirement and our ability to comply with such requirement in the future;

our ability to obtain additional funding, the terms of such funding and potential dilution caused thereby; the continuing effect of rising

interest rates and inflation on our operations, sales, and market for our products; deterioration of the global economic environment;

rising interest rates and inflation and our ability to control our costs, including employee wages and benefits and other operating expenses;

our history of losses; our ability to achieve profitability; our ability to execute our growth strategy and scale our operations and

risks associated with such growth; our ability to maintain current members and customers and grow our members and customers; risks associated

with the effect of global pandemics, and governmental responses thereto on our operations, those of our vendors, our customers and members

and the economy in general; risks associated with our supply chain and third-party service providers, interruptions in the supply of

raw materials and merchandise; increased costs of raw materials, products and shipping costs due to inflation; disruptions at our warehouse

facility and/or of our data or information services, our ability to locate new warehouse and distribution facilities and the lease terms

of any such facility; issues affecting our shipping providers; disruptions to the internet; risks that effect our ability to successfully

market our products to key demographics; the effect of data security breaches, malicious code and/or hackers; increased competition and

our ability to maintain and strengthen our brand name; changes in consumer tastes and preferences and changing fashion trends; material

changes and/or terminations of our relationships with key vendors; significant product returns from customers, excess inventory and our

ability to manage our inventory; the effect of trade restrictions and tariffs, increased costs associated therewith and/or decreased

availability of products; our ability to innovate, expand our offerings and compete against competitors which may have greater resources;

certain anti-dilutive, drag-along and tag-along rights which may be deemed to be held by a former minority stockholder; our significant

reliance on related party transactions and loans; the fact that our Chief Executive Officer has majority voting control over the Company;

if the use of “cookie” tracking technologies is further restricted, regulated, or blocked, or if changes in technology cause

cookies to become less reliable or acceptable as a means of tracking consumer behavior; our ability to comply with the covenants of future

loan and lending agreements and covenants; our ability to prevent credit card and payment fraud; the risk of unauthorized access to confidential

information; our ability to protect our intellectual property and trade secrets, claims from third-parties that we have violated their

intellectual property or trade secrets and potential lawsuits in connection therewith; our ability to comply with changing regulations

and laws, penalties associated with any non-compliance (inadvertent or otherwise), the effect of new laws or regulations, and our ability

to comply with such new laws or regulations; changes in tax rates; our reliance and retention of our current management; the outcome

of future lawsuits, litigation, regulatory matters or claims; the fact that we have a limited operating history; the effect of future

acquisitions on our operations and expenses; our significant indebtedness; and others that are included from time to time in filings

made by KIDPIK with the Securities and Exchange Commission, many of which are beyond our control, including, but not limited to, in the

“Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” sections in its Form 10-Ks and Form

10-Qs and in its Form 8-Ks, which it has filed, and files from time to time, with the U.S. Securities and Exchange Commission, including,

but not limited to its Annual Report on Form 10-K for the year ended December 31, 2022 and its Quarterly Report on Form 10-Q for the

quarter ended July 1, 2023. These reports are available at www.sec.gov and on our website at https://investor.kidpik.com/sec-filings.

The Company cautions that the foregoing list of important factors is not complete. All subsequent written and oral forward-looking statements

attributable to the Company or any person acting on behalf of the Company are expressly qualified in their entirety by the cautionary

statements referenced above. Other unknown or unpredictable factors also could have material adverse effects on KIDPIK’s future

results and/or could cause our actual results and financial condition to differ materially from those indicated in the forward-looking

statements. The forward-looking statements included in this press release are made only as of the date hereof. KIDPIK cannot guarantee

future results, levels of activity, performance or achievements. Accordingly, you should not place undue reliance on these forward-looking

statements. We undertake no obligation to update publicly any of these forward-looking statements to reflect actual results, new information

or future events, changes in assumptions or changes in other factors affecting forward-looking statements, except to the extent required

by applicable laws and take no obligation to update or correct information prepared by third parties that is not paid for by the Company.

If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to

those or other forward-looking statements.

Contacts

Investor

Relations Contact:

ir@kidpik.com

Media:

press@kidpik.com

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

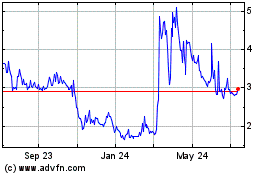

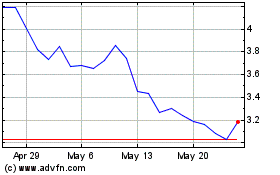

Kidpik (NASDAQ:PIK)

Historical Stock Chart

From Apr 2024 to May 2024

Kidpik (NASDAQ:PIK)

Historical Stock Chart

From May 2023 to May 2024