The information in

this preliminary prospectus supplement is not complete and may be changed. This preliminary prospectus supplement and the accompanying

prospectus are not an offer to sell these securities and are not soliciting an offer to buy these securities in any jurisdiction where

the offer or sale is not permitted.

Filed pursuant to Rule 424(b)(3)

Registration No. 333- 268397

Subject to completion,

dated September 7, 2023

Preliminary Prospectus Supplement

(to Prospectus dated November 28, 2022)

Shares

Offered by the Selling Stockholders

Karat Packaging Inc.

Common Stock

The Selling Stockholders identified

in this prospectus supplement (the “Selling Stockholders”) are offering shares (the “Selling Stockholder Shares”)

of common stock, par value $0.001 per share (the “Common Stock”), of Karat Packaging Inc., a Delaware corporation (the “Company”).

We are not selling any shares in this offering and we will not receive any proceeds from the sale of the Selling Stockholder Shares.

The Selling Stockholders have

granted the underwriter a 30-day option to purchase up to additional shares of Common Stock at the public offering price, less underwriting

discounts and commissions. See “Underwriting” on page S-14.

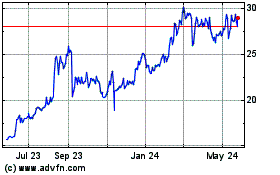

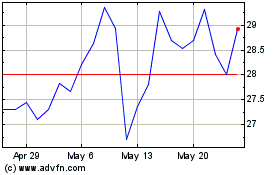

Our Common Stock is listed on The Nasdaq Capital Market under the ticker

symbol “KRT”. On September 6, 2023, the closing sale price of our Common Stock as reported by The Nasdaq Capital Market was

$ 25.46 per share.

_________________

Investing in our Common Stock involves risks.

See “Risk Factors” beginning on page S-11 of this prospectus supplement and the risk factors described in the accompanying

prospectus and in the documents incorporated by reference in this prospectus supplement and the accompanying prospectus to read about

factors you should consider before buying shares of our Common Stock.

Neither the Securities and Exchange Commission (“SEC”)

nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus

supplement. Any representation to the contrary is a criminal offense.

_________________

| | |

| Per

share | | |

| Total | |

| Public Offering Price | |

$ | | | |

$ | | |

| Underwriting discount(1) | |

$ | | | |

$ | | |

| Proceeds, before expenses, to the Selling Stockholders | |

$ | | | |

$ | | |

| (1) |

We refer to

“Underwriting” beginning on page S-14 of this prospectus supplement for additional information regarding underwriter

compensation. |

We expect that delivery

of the shares of Common Stock will be made to investors in book-entry form through The Depository Trust Company on or about ,

2023.

Sole Book-Running Manager

Lake Street

Prospectus Supplement dated ,

2023

TABLE OF CONTENTS

Prospectus Supplement

PROSPECTUS

ABOUT THIS PROSPECTUS SUPPLEMENT

This document contains two

parts. The first part is this prospectus supplement, which describes the terms of this offering of Common Stock and also adds to and updates

information contained in the accompanying prospectus and the documents incorporated by reference into this prospectus supplement and the

accompanying prospectus. The second part, the accompanying prospectus dated November 28, 2022 including the documents incorporated by

reference therein, provides more general information. Generally, when we refer to this “prospectus”, we are referring to both

parts of this document combined. To the extent there is a conflict between the information contained in this prospectus supplement, on

the one hand, and the information contained in the accompanying prospectus or in any document incorporated by reference that was filed

with the SEC before the date of this prospectus supplement, on the other hand, you should rely on the information in this prospectus supplement.

If any statement in one of these documents is inconsistent with a statement in another document having a later date — for

example, a document incorporated by reference in the accompanying prospectus — the statement in the document having

the later date modifies or supersedes the earlier statement.

This prospectus supplement

and the accompanying prospectus relate to part of a registration statement that we filed with the SEC, using a shelf registration process.

Both this prospectus supplement and the accompanying prospectus include or incorporate by reference important information about us and

other information you should know before investing in the Common Stock. The rules of the SEC allow us to incorporate information

by reference into this prospectus supplement. This information incorporated by reference is considered to be part of this prospectus supplement,

and information that we file later with the SEC will automatically update and supersede this information. See “Incorporation of

Certain Documents by Reference.” You should read both this prospectus supplement and the accompanying prospectus together with additional

information described under “Where You Can Find Additional Information.”

The Selling Stockholders are

offering to sell, and seeking offers to buy, shares of our Common Stock only in jurisdictions where offers and sales are permitted. For

investors outside the United States, the underwriter in this offering, we and the Selling Stockholders have not done anything that would

permit this offering or possession or distribution of this prospectus supplement, the accompanying prospectus and in any free writing

prospectus that we have authorized for use in connection with this offering in any jurisdiction where action for that purpose is required,

other than in the United States. Persons outside the United States who come into possession of this prospectus supplement, the accompanying

prospectus and any free writing prospectus that we have authorized for use in connection with this offering must inform themselves about,

and observe any restrictions relating to, the offering of the shares of Common Stock and the distribution of this prospectus supplement,

the accompanying prospectus and any free writing prospectus that we have authorized for use in connection with this offering outside the

United States.

We have not, and the Selling

Stockholders and the underwriter have not, authorized anyone to provide you with information different from, or in addition to, that contained

or incorporated by reference in this prospectus supplement, the accompanying prospectus or any related free writing prospectus that we

prepare or distribute. We, the Selling Stockholders and the underwriter take no responsibility for, and can provide no assurances as to

the reliability of, any other information that others may give you. This prospectus supplement and the accompanying prospectus do not

constitute an offer to sell, or a solicitation of an offer to purchase, the securities offered by this prospectus supplement and the accompanying

prospectus in any jurisdiction in which it is unlawful to make such offer or solicitation. The information contained or incorporated by

reference in this prospectus supplement, the accompanying prospectus or any free writing prospectus prepared by us is only accurate as

of the date of the document containing such information, regardless of the time of delivery of this prospectus and any sale of shares

of our Common Stock.

When used in this prospectus

supplement, the terms “we”, “us”, “our”, “Karat”, “the Company” or “our

Company” refer to Karat Packaging Inc., a Delaware corporation, and, unless the context requires otherwise, our operating subsidiaries.

References to “Lollicup” refer to Lollicup USA Inc., a California corporation, our wholly-owned subsidiary.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement,

including the documents that we incorporate by reference, includes forward-looking statements within the meaning of Section 27A of

the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as

amended (the “Exchange Act”), that relate to future events or to our future operations or financial performance. Any forward-looking

statement involves known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance

or achievements to differ materially from any future results, levels of activity, performance or achievements expressed or implied by

such forward-looking statement. Forward-looking statements include statements, other than statements of historical fact, about:

| ● | our

future development priorities; |

| ● | our

estimates regarding the size of our potential target markets; |

| ● | our

expectations about the impact of new accounting standards; |

| ● | our

future operations, financial position, revenues, costs, expenses, uses of cash, capital requirements, our need for additional financing

or the period for which our existing cash resources will be sufficient to meet our operating requirements; and |

| ● | our

strategies, prospects, plans, expectations, forecasts or objectives. |

Words such as, but not limited

to, “believe,” “expect,” “anticipate,” “estimate,” “forecast,” “intend,”

“may,” “plan,” “potential,” “predict,” “project,” “targets,” “likely,”

“will,” “would,” “could,” “should,” “continue,” “scheduled” and

similar expressions or phrases, or the negative of those expressions or phrases, are intended to identify forward-looking statements,

although not all forward-looking statements contain these identifying words. Although we believe that we have a reasonable basis for each

forward-looking statement contained in this registration statement, we caution you that these statements are based on our estimates or

projections of the future that are subject to known and unknown risks and uncertainties and other important factors that may cause our

actual results, level of activity, performance, experience or achievements to differ materially from those expressed or implied by any

forward-looking statement. Actual results, level of activity, performance, experience or achievements may differ materially from those

expressed or implied by any forward-looking statement as a result of various important factors, including our critical accounting policies

and risks and uncertainties relating, to:

| ● | our

ability to obtain additional financing on reasonable terms, or at all; |

| ● | our

ability to repay our indebtedness; |

| ● | the

accuracy of our estimates regarding expenses, costs, future revenues, uses of cash and capital requirements; |

| ● | the

impact of earthquakes, fire, power outages, floods, pandemics and other catastrophic events, as well as the impact of any interruption

by problems such as terrorism, cyberattacks, or failure of key information technology systems; |

| ● | our

ability to generate significant revenues and achieve profitability; |

| ● | fluctuations

in the demand for our products in light of changes in laws and regulations applicable to food and beverages and changes in consumer preferences; |

| ● | supply

chain disruptions that could interrupt product manufacturing and increase product costs; |

| ● | our

ability to source raw materials and navigate a shortage of available materials; |

| ● | our

ability to accurately forecast demand for our products or our results of operations; |

| ● | the

impact of problems relating to delays or disruptions in the shipment of our goods through operational ports; |

| ● | our

ability to expand into additional foodservice and geographic markets; |

| ● | our

ability to successfully design and develop new products; |

| ● | fluctuations

in freight carrier costs related to the shipment of our products could have a material adverse impact on our results of operations; |

| ● | the

effects of COVID-19 or other public health crises; and |

| ● | our

ability to attract and retain skilled personnel and senior management. |

Consider these factors

carefully in evaluating the forward-looking statements. Additional factors that may cause results to differ materially from those

described in the forward-looking statements are set forth in the in the sections titled “Risk Factors” in this

prospectus supplement on page S-11, and under “Risk Factors” discussed under the caption “Item 1A. Risk

Factors” in Part I of our most recent Annual Report on Form 10-K or any updates discussed under the caption “Item 1A.

Risk Factors” in Part II of our quarterly reports on Form 10-Q, together with all of the other information appearing in or

incorporated by reference into this prospectus supplement. You should read this prospectus supplement completely and with the

understanding that our actual future results may be materially different from what we expect. We qualify all of the forward-looking

statements in this prospectus supplement by these cautionary statements. We undertake no obligation to publicly update any

forward-looking statement, whether as a result of new information, future events or otherwise, except as may be required under the

securities laws of the United States. You are advised, however, to consult any additional disclosures we make in our reports filed

with the SEC.

PROSPECTUS SUPPLEMENT SUMMARY

The following summary highlights

information contained in or incorporated by reference into this prospectus supplement and the accompanying prospectus. This summary does

not contain all of the information you should consider before investing in our common stock. You should carefully read

this entire prospectus supplement, as well as the accompanying prospectus and the documents incorporated by reference herein that are

described under “Where You Can Find Additional Information” and “Incorporation of Certain Documents by Reference.”

Overview

We

are a rapidly-growing specialty distributor and select manufacturer of environmentally-friendly disposable foodservice products and related

items. We are a nimble supplier of a wide range of products for the foodservice industry, including food and take-out containers, bags,

tableware, cups, lids, cutlery, straws, specialty beverage ingredients, equipment, gloves and other products. Our products are available

in plastic, paper, biopolymer-based and other compostable forms. Our Karat Earth® line provides environmentally friendly options to

our customers, who are increasingly focused on sustainability. We offer customized solutions to our customers, including new product development,

design, printing and logistics services.

While

a majority of our revenue is generated from the distribution of our vendors’ products, we have select manufacturing

capabilities in the U.S., which allows us to provide customers with broad product choices and customized offerings with short lead

times. For the year ended December 31, 2022 and the six months ended June 30, 2023, distribution accounted for approximately 74% and

79%, respectively, of our net sales, while manufacturing accounted for approximately 26% and 21%, respectively, of our net sales. We

expect manufacturing to remain a relatively small portion of our sales mix in fiscal year 2023, but believe it provides us with the

flexibility to provide customized products with short lead times to complement our global sourcing capabilities. To that end, we

operate our business strategically and with broad flexibility to provide both our large and small customers with the wide spectrum

of products they need to successfully run and grow their businesses. We believe our ability to source products quickly on a

cost-effective basis via a global supplier network, complemented by our own manufacturing capabilities for select products, has

established us as a differentiated provider of high-quality products relative to our competitors.

Our

customers include a wide variety of national and regional distributors, restaurant chains, retail establishments and online customers.

Our products are well suited to address our customers’ increased focus on take-out and delivery capabilities. Our diverse and growing

blue chip customer base includes well-known fast casual chains such as Applebee’s Neighborhood Grill + Bar, Chili’s Grill

& Bar, PF Chang’s, Texas Roadhouse, Chipotle Mexican Grill, Corner Bakery Cafe and TGI Fridays, as well as fast food chains

including The Coffee Bean & Tea Leaf, El Pollo Loco, In-N-Out Burger, Jack in The Box, Popeyes, Panda Express, Raising Cane’s

Chicken Fingers and Torchy’s Tacos. As our capabilities, product offering and footprint expand, we are also beginning to supply

products to national and regional supermarket chains, airlines, sports and entertainment venues and other non-restaurant customers. Our

strong brand recognition in the foodservice industry, nimble operations and rapidly increasing size and scope of our distribution and

logistics network provide us with a significant advantage that enables us to acquire new customers as well as increase our business with

existing customers. For the years ended December 31, 2022 and December 31, 2021, no single customer represented more than 10% of our revenue.

We

are an omni-channel provider and have recently made significant investments in e-commerce, technology, supply chain, distribution center

layout remodels, and customer initiatives, such as online ordering and same day pickup. We operate our e-commerce channel through our

company website, www.lollicupstore.com, and also through third-party storefronts such as Amazon and Walmart. Our e-commerce channel offers

the entire range of our products for online procurement, and we believe it will continue to be a key growth driver for our business going

forward. Additionally, the e-commerce channel enables us to cross market other products to our customers.

We

classify our customers into four categories: distributors, national and regional chains, retail and online.

| ● | Distributors: national and regional distributors

across the U.S. that purchase our products and provide a channel to offer our products to restaurants, offices, schools, government entities

and other end users. |

| ● | National and regional chains: typically fast

casual and fast food restaurants with locations across multiple states to which we supply specified products. We enter into sales contracts

with a subset of our national and regional chains customers, providing visibility into future revenue. |

| ● | Retail: primarily regional bubble tea shops,

boutique coffee shops and frozen yogurt shops that often purchase our specialty beverage ingredients and related items. |

| ● | Online: small businesses, often with less than

two locations, such as small restaurants, bubble tea shops, coffee shops, juice bars, smoothie shops and some customers who purchase

for personal use. |

In

addition to product sales, we also generate revenue from logistics services which is the transportation and delivery of shipping containers

from ports to customers, primarily to retail customers. The diversity of our customer types provides us with the ability to source products

efficiently while maintaining a broad product offering, as we are able to sell many products across multiple customer segments. We expect

a large proportion of our growth to come from national and regional chains and our higher margin online customers.

We

have generated significant growth through the continued expansion of our customer base and increasing penetration into existing customers

across all channels. In addition, we have been able to grow our wallet share with many customers, in particular our national and regional

chains, by supplying them a broader range of our foodservice disposables and related products.

With

the growing trend towards at-home dining and mobility-oriented e-commerce, food delivery and take-out dining are currently experiencing

rapid growth. As consumer preferences have evolved, foodservice establishments have realized that the at-home dining experience is closely

linked to the quality of the packaging utilized. Data from the National Restaurant Association and Technomic shows that operators are

increasingly acknowledging the importance of off-premises dining and making it a strategic priority. Based on data from a Global Industry

Analysis, dated March 2022, the global market for foodservice disposables was estimated at $58.4 billion in 2022 and is projected to reach

$74.8 billion by 2026, and the U.S. foodservice disposables market is estimated at $15.5 billion in 2022. Additionally, based on data

from Statista in 2021, the online delivery market is expected to grow to $96.4 billion by 2026. This growth is driven in large part by

e-commerce companies such as Grubhub, Uber Eats, DoorDash and others. We believe the market opportunity will continue to expand for years

to come. In order to benefit from this growing market trend, foodservice establishments are actively trying to provide a high quality

at-home dining customer experience that is comparable to the in-restaurant experience. Central to this effort is food quality and overall

presentation where take-out containers and related products play a critical role. Restaurants are seeking to develop high quality, customized

disposables that not only provide the freshest and best possible food experience, but also provide a premium, branded at-home dining experience.

We

currently operate manufacturing facilities and distribution and fulfillment centers in Chino, California, Rockwall, Texas and Kapolei,

Hawaii. In addition, we operate other distribution centers located in Rockwall, Texas, Branchburg, New Jersey, Sumner, Washington, Summerville,

South Carolina, Kapolei, Hawaii and City of Industry, California. The distribution and fulfillment centers are strategically located in

proximity to major population centers, including the Los Angeles, New York, Chicago, Houston Seattle, Atlanta and Honolulu metro areas.

Competitive Strengths

We

believe the following strengths fundamentally differentiate us from our competitors and drive our success:

One-stop shop with

a diverse product offering for the foodservice market and highly nimble sourcing capabilities

We

leverage our diversified global supplier network and offer customers a wide selection of single-use disposable foodservice products, with

over 8,600 SKUs across a broad range of product categories. We have significantly grown our inventory sourcing network from only a handful

of vendors initially to over 70 active vendors by the end of 2022. Key offerings include food and take-out containers, bags, tableware,

cups, lids, cutlery and straws primarily sourced through our diverse supplier base. Our strong relationships with our suppliers allow

us to offer customers products that both preserve the highest possible food quality and meet the unique needs of their business. Furthermore,

these supplier relationships allow us to offer custom-branded and custom-designed products with fast turnaround times and at competitive

prices. With increasing regulations around single use plastics, our Karat Earth® line provides environmentally friendly options that

include food and take-out containers, bags, tableware, cups, lids, cutlery and straws. This special catalog of sustainable products are

made from renewable resources that are ethically sourced. We intend to invest further in research and development for our Karat Earth®

line to significantly expand our product offering to meet the needs of our customers and the evolving regulatory landscape.

We

often are a key supply chain partner integral to the daily operations of our customers. Our ability to quickly provide premium products

at competitive prices has typically allowed us to become a trusted supplier to our customers. Through an ongoing feedback loop, as customer

demand varies and new needs emerge, we are able to act nimbly and qualify new suppliers quickly to augment our product offering. These

capabilities make us a key partner to our customers.

Focus on distribution

and advanced logistics network, complemented by flexible manufacturing capabilities

We

consider our increasingly sophisticated distribution capabilities and related strength in logistics to be an important core competency

and key differentiator from our competitors. We own a fleet of 31 trucks, 41 trailers, 9 bobtails, one yard goat and 24 chassis, and as

of December 31, 2022, employ 43 drivers in our logistics division.

This

model has resulted in more efficient distribution to customers, reducing the need for reliance on third-party logistics providers such

as FedEx and United Parcel Service. Our strategically located facilities give us a strong national footprint, which positions us well

to serve regions across the U.S. in a timely fashion. We intend to continue to add to our capabilities via further distribution center

openings and expansions, the purchase of additional vehicles, the hiring of additional drivers and additional logistics service offerings.

Our

California, Texas and Hawaii facilities have a portion of operational capacity dedicated to manufacturing capabilities. For the year ended

December 31, 2022, approximately 26% of our revenues were generated from the sale of products manufactured in-house. We view distribution

as our primary focus and growth driver while utilizing our manufacturing capabilities as a complement to the base distribution business.

This approach allows us to procure products at competitive prices by being able to compare procurement costs versus domestic manufacturing

costs to help determine whether it is more efficient to produce ourselves versus relying on suppliers.

Diverse and growing

blue-chip customer base

We

sell and distribute a broad portfolio of single-use disposable foodservice products to customers nationwide including leading chain restaurants,

distributors, convenience stores, retail establishments and online customers. Our blue-chip customers include leading fast casual chains

such as Chili’s Grill & Bar and Chipotle Mexican Grill, as well as fast food chains such as In-N-Out Burger, El Pollo Loco and

Panda Express, among others. We intend to further expand our customer base by selling our products to non-traditional foodservice customers,

including regional and national supermarket chains, airlines, sports and entertainment venues and other non-restaurant customers. Plans

for such expansion are already underway and beginning to yield positive results and a diversification of our customer base.

Leader in eco-friendly

products to address sustainability

We are committed to pursuing environmental sustainability and this

is exhibited in every aspect of our business. We are amongst the leading companies in the supply of eco-friendly disposal foodservice

products in the United States. Since our inception, we have made the conscious choice to never use Styrofoam in any of our products. In

2008, we established Karat Earth® as an eco-friendly line of foodservice products, including food and takeout containers, bags, tableware,

cups, lids, cutlery and straws. We have consistently grown eco-friendly products as a percentage of our total product sales, and continued

to invest in research and development to expand our eco-friendly product line to meet the needs of our customers and the evolving regulatory

landscape. For the year ended December 31, 2022 and the quarter ended June 30, 2023, our eco-friendly products grew 47% and 21%, respectively,

as compared to the year ended December 31, 2021 and the quarter ended June 30, 2022, respectively. Additionally, our eco-friendly products

represented 32% of total sales in the second quarter of 2023 as compared to 25% in the second quarter of 2022.

Customized solutions

offering new product development, design, printing and logistics services

In

recent years, we are seeing a growing trend towards takeout and at-home dining, and as a result the restaurant industry is becoming increasingly

focused on receiving a customized, value-add, and customer oriented-experience when it comes to the packaging of their products. In order

to promote brand familiarity and loyalty, we collaborate closely with our customers to develop and deliver custom products that meet the

unique branding, color and schematics requirements of their businesses. Our in house domestic printing capability allows for fast turnaround

times at competitive costs.

Experienced and

growth-oriented management team

We have assembled a strong executive management team to lead our company

in its next phase of growth, supported by a deep bench of functional area leads across the organization. Our co-founders Alan Yu and Marvin

Cheng have worked together over the last 20 years to aggressively drive growth across the business. Our Chief Financial Officer, Jian

Guo, joined us in 2022, bringing years of public company experience to further bolster our finance and accounting functions. Our Chief

Revenue Officer, Daniel Quire, has been with us since 2018 and brings more than a decade of sales management experience in the foodservice

sector.

Implications of Being an Emerging Growth Company

We are an “emerging

growth company” as defined in the Jumpstart Our Business Startups Act of 2012, as amended, or the JOBS Act. We will remain an emerging

growth company until the earlier of (1) December 31, 2026, (2) the last day of the fiscal year in which we have total annual gross revenue

of at least $1.235 billion, (3) the last day of the fiscal year in which we are deemed to be a “large accelerated filer” as

defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, or the Exchange Act, which would occur if the market value

of our common stock held by non-affiliates exceeded $700.0 million as of the last business day of the second fiscal quarter of such fiscal

year or (4) the date on which we have issued more than $1.0 billion in non-convertible debt securities during the prior three-year period.

An emerging growth company may take advantage of specified reduced reporting requirements and is relieved of certain other significant

requirements that are otherwise generally applicable to public companies. As an emerging growth company, we may present only two years

of audited financial statements, plus unaudited condensed financial statements for any interim period, and related management’s

discussion and analysis of financial condition and results of operations in this prospectus; we may avail ourselves of the exemption from

the requirement to obtain an attestation and report from our auditors on the assessment of our internal control over financial reporting

pursuant to the Sarbanes-Oxley Act of 2002, or Sarbanes-Oxley; we may provide reduced disclosure about our executive compensation arrangements;

and we may not require stockholder non-binding advisory votes on executive compensation or golden parachute arrangements.

In addition, under the JOBS

Act, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to

private companies. We have elected to avail ourselves of this extended transition period, and, as a result, we will adopt new or revised

accounting standards on the relevant dates on which adoption of such standards is required for other public companies.

We are also a “smaller

reporting company” as defined in Rule 12b-2 of the Exchange Act and have elected to take advantage of certain of the scaled disclosure

available to smaller reporting companies.

Corporate History

We were founded in 2000 by

Alan Yu and Marvin Cheng in San Gabriel, California as Lollicup USA Inc., a California corporation. Initially our business was focused

on the establishment, franchising and licensing of bubble tea stores nationwide. Considered a pioneer for the bubble tea business in North

America, our business grew rapidly from a single Lollicup Tea Café store in 2000 to more than 60 stores in 2006. In order to ensure

consistency across our stores, we expanded our focus in 2004 to include the distribution of supplies for the bubble tea industry. In 2013,

we sold the retail bubble tea business to certain of Lollicup’s shareholders. In 2014, as a result of a growing demand across the

foodservice industry for our packaging goods, we began distributing and manufacturing products under our Karat brand in our California

facility.

In September 2018, we incorporated

Karat Packaging Inc. in Delaware, and the Company, Lollicup, and Messrs. Yu and Cheng and the other shareholders of Lollicup (together,

the “Lollicup Shareholders”) entered into a share exchange agreement and plan of reorganization whereby the Lollicup Shareholders

exchanged their shares of common stock in Lollicup for an equal number of shares of common stock of the Company, resulting in Lollicup

becoming a wholly-owned subsidiary of the Company. Our principal executive and administrative offices are located at 6185 Kimball Avenue,

Chino, CA 91708, and our telephone number is (626) 965-8882. Our website address is www.karatpackaging.com. For additional historical

information about us, see Note 1 — Nature of Operations in the Notes to the Consolidated Financial Statements included in Part II,

Item 8 of our most recent Annual Report on Form 10-K.

Corporate Information

Our principal executive offices

are located at 6185 Kimball Avenue, Chino, California 91708 and our telephone number is (626) 965-8882. We maintain a website at www.karatpackaging.com,

to which we regularly post copies of our press releases as well as additional information about us. Our filings with the Securities and

Exchange Commission, or SEC, will be available free of charge through the website as soon as reasonably practicable after being electronically

filed with or furnished to the SEC. Information contained on, or accessible through, our website does not constitute a part of this prospectus

or our other filings with the SEC, and you should not consider any information contained on, or that can be accessed through, our website

as part of this prospectus or in deciding whether to purchase shares of our common stock.

All brand names or trademarks

appearing in this prospectus are the property of their respective holders. Use or display by us of other parties’ trademarks, trade

dress, or products in this prospectus is not intended to, and does not, imply a relationship with, or endorsements or sponsorship of,

us by the trademark or trade dress owners.

THE OFFERING

| Common Stock offered by the Selling Stockholders: |

|

shares of Common Stock

The shares are offered and sold by the

Selling Stockholders identified in this prospectus supplement. See “Selling Stockholders” on page S-13 of this

prospectus supplement. We will not be selling any shares of Common Stock in this offering, therefore the offering will not result in

any dilution of equity ownership to our existing stockholders. |

| |

|

|

|

Option to purchase additional shares of Common

Stock

|

|

The Selling Stockholders have granted the underwriter an option for a period of 30 days from the date of this prospectus supplement to purchase up to an additional shares of their Common Stock. |

| |

|

|

| Total number of shares outstanding before and after the offering: |

|

19,893,846

shares of Common Stock as of September 7, 2023. The number of shares of Common Stock outstanding will not change as a result of this

offering. |

| |

|

| Use of proceeds: |

|

The Selling Stockholders will receive all of the net proceeds from this offering and we will not receive any proceeds from the sale of our Common Stock by the Selling Stockholders pursuant to this prospectus supplement. See “Use of Proceeds” and “Selling Stockholders.” |

| |

|

| Nasdaq symbol: |

|

“KRT” |

| |

|

|

|

Risk factors: |

|

Investing in our Common Stock involves a high degree of risk. See “Risk Factors” in this prospectus supplement and the sections captioned “Risk Factors” contained in our filings that are included or incorporated by reference in this prospectus supplement and the accompanying prospectus. |

The number of shares of Common Stock outstanding before and after the

offering is based on 19,893,846 shares of our Common Stock outstanding as of September 7, 2023, but excluding the following as of

such date:

| ● |

75,929 shares of common stock issuable upon vesting of outstanding restricted stock units; |

| ● |

407,534 shares of common stock issuable upon the exercise of outstanding stock options; and |

| ● |

1,330,675 shares of common stock reserved for future issuance under our equity incentive plans. |

RISK FACTORS

Investing in our securities

involves a high degree of risk. Before deciding whether to invest in our securities, you should carefully consider the risks and uncertainties

described the section titled “Risk Factors” in the applicable prospectus supplement, the accompanying prospectus and any related

free writing prospectus, and discussed in the sections titled “Item 1A. Risk Factors” in our most recent Annual Report on

Form 10-K and in any subsequent filings we have made with the SEC that are incorporated by reference into this prospectus, together with

other information in this prospectus supplement, the documents incorporated by reference, the accompanying prospectus or any free writing

prospectus that we may authorize for use in connection with this offering. See “Where You Can Find Additional Information”

for more information. The risks described these documents are not the only ones we face. Additional risks and uncertainties that we are

unaware of, or that we currently believe are not material, may also become important factors that adversely affect our business. Past

financial performance may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results

or trends in future periods. If any of these risks actually occurs, our business, reputation, financial condition, results of operations,

revenue, and future prospects could be seriously harmed. This could cause the trading price of our securities to decline, resulting in

a loss of all or part of your investment. Please also read carefully the section titled “Cautionary Statement Regarding Forward-Looking

Statements.”

Risks Related to the Common Shares Offered

by the Selling Stockholders

Future issuances or sales, or the perception

of future issuances or sales, of our Common Stock by us or the Selling Stockholders in the public market following this offering could

be dilutive or cause the market price for our common stock to decline.

After this offering,

the issuance by us or the sale by us or the Selling Stockholders of a substantial number of shares of our Common Stock in the public market,

or the perception that such issuances or sales could occur, could harm the prevailing market price of shares of our Common Stock. These

issuances or sales, or the possibility that the issuances or sales may occur, also might make it more difficult for us to sell shares

of our Common Stock in the future at a time and at a price that we deem appropriate.

Upon the completion of this offering and assuming no exercise by the

underwriter of its option to purchase additional shares of Common Stock from the Selling Stockholders, 14,135,750 shares of our outstanding

common stock beneficially owned by our executive officers and directors will be subject to lock-up agreements with the underwriter of

this offering that restrict the sale of shares of our Common Stock by those parties for a period of 120 days after the date of this prospectus

supplement in the case of the Selling Stockholders and 60 days after the date of this prospectus supplement in the case of the other persons.

However, all of the shares sold in this offering and the remaining shares of our Common Stock outstanding prior to this offering will

not be subject to lock-up agreements with the underwriter and, except to the extent such shares are held by our affiliates, will be freely

tradable without restriction under the Securities Act. The registration statement we filed, of which this prospectus supplement and accompanying

prospectus dated November 28, 2022 form a part registered the issuance of sale of up to 2,000,000 shares of Common Stock by the Selling

Stockholders, as well as $150 million of additional primary securities issuable by our company, the remainder of which after deducting

the shares of common stock issued and sold in this offering will be available to be issued and sold by us from time to time in the future.

If these shares are sold, or if it is perceived that they may be sold, in the public market, the trading price of our common stock could

decline.

The proceeds from the sale of our Common

Stock by the Selling Stockholders in this offering will not be available to us.

We will not receive any proceeds

from the sale of Common Stock by the Selling Stockholders in this offering. The Selling Stockholders will receive all proceeds from the

sale of such shares. Consequently, none of the proceeds from such sale by the Selling Stockholders will be available to us for our use.

USE OF PROCEEDS

We are not selling any securities under this prospectus supplement

and we will not receive any proceeds from the sale of the shares covered hereby by the Selling Stockholders. The net proceeds from the

sale of the shares offered by the Selling Stockholders pursuant to this prospectus supplement will be received by the Selling Stockholders.

We will, however, bear the costs associated with the sale of shares by the Selling Stockholders, other than any underwriting discounts

and commissions, which will be borne by the Selling Stockholders. See “Selling Stockholders.”

SELLING STOCKHOLDERS

The following table sets forth the name of each Selling Stockholder,

the number of shares of our Common Stock and the percentage of our Common Stock beneficially owned by each Selling Stockholder prior to

this offering, the number of shares that may be offered under this prospectus supplement by the Selling Stockholder, and the number of

shares of our Common Stock and the percentage of our Common Stock to be beneficially owned by each Selling Stockholder after completion

of this offering, without exercise of the underwriter’s option to purchase additional shares, in each case based

on 19,893,846 shares of common stock outstanding as of September 7, 2023 and assuming that the shares offered hereunder are sold as contemplated

herein. We will not receive any proceeds from any sale of shares by a Selling Stockholder under this prospectus and any prospectus supplement.

We will bear the costs associated with the sale of shares by the Selling Stockholders, other than underwriting discounts and commissions,

which will be borne by the Selling Stockholders.

None of the Selling Stockholders

are known to us to be a registered broker-dealer or an affiliate of a registered broker-dealer. Each of the Selling Stockholders has acquired

his, her or its shares solely for investment and not with a view to or for resale or distribution of such securities. Beneficial ownership

is determined in accordance with SEC rules and includes voting or investment power with respect to the securities.

The information set forth in the table below is based upon written

representations from the Selling Stockholders. Beneficial ownership of the Selling Stockholders is determined in accordance with Rule

13d-3(d) under the Exchange Act. The following table sets forth (i) the names of each Selling Stockholder, (ii) the number of shares of

our Common Stock beneficially owned by each Selling Stockholder before the offering, (iii) the number of shares that may be offered under

this prospectus, (iv) the number of shares of our Common Stock beneficially owned by each such Selling Stockholder assuming all of the

shares covered hereby are sold and (v) the percentage of shares beneficially owned before and after the offering, which is based on approximately

19,893,846 shares of our Common Stock outstanding as of September 7, 2023. Except as indicated by the footnotes below, we believe, based

on the information furnished to us, that the Selling Stockholders have sole voting and investment power with respect to all shares of

Common Stock that they beneficially own, subject to applicable community property laws.

Except as set forth in the

footnotes below, to our knowledge, the Selling Stockholders listed in the table below do not have, and during the three years prior to

the date of this prospectus supplement have not had, any position, office, or other material relationships with us or any of our affiliates

other than as a stockholder.

| | |

Shares of Common Stock Owned

Prior to | | |

Shares of Common Stock

to be | | |

Shares of Common Stock Owned After | | |

Percentage of Common Stock Owned After | |

| Selling Stockholder | |

the Offering | | |

Sold | | |

the Offering | | |

the Offering | |

| | |

| | |

| | |

| | |

| |

| Alan Yu(1) | |

| 7,362,498 | | |

| [ ] | | |

| [ ] | | |

| [ ] | % |

| | |

| | | |

| | | |

| | | |

| | |

| Marvin Cheng(2) | |

| 6,748,727 | | |

| [ ] | | |

| [ ] | | |

| [ ] | % |

| | |

| | | |

| | | |

| | | |

| | |

| Total | |

| 14,111,225 | | |

| [ ] | | |

| [ ] | | |

| [ ] | % |

| (1) |

Mr. Yu, the Company’s Chairman and Chief Executive Officer, exercises sole voting and dispositive power over the 7,362,498 shares of common stock. |

| (2) |

Mr. Cheng, the Company’s Vice-President – Manufacturing and Secretary, exercises sole voting and dispositive power over the 6,748,727 shares of common stock. |

UNDERWRITING

The Selling Stockholders are

offering the shares of common stock described in this prospectus supplement and the accompanying prospectus through the underwriter listed

below. Lake Street Capital Markets, LLC is acting as the managing underwriter of this offering. The underwriter named below has agreed

to buy, subject to the terms of the underwriting agreement, the number of shares of common stock listed opposite its name below from the

Selling Stockholders. The underwriter is committed to purchase and pay for all of the shares if any are purchased, other than those shares

covered by the over-allotment option described below.

| Underwriter |

|

Number of

Shares |

|

| Lake Street Capital Markets, LLC |

|

|

|

|

| Total |

|

|

|

|

The underwriter has advised

us that it proposes to offer the shares of common stock to the public at a price of $

per share. The underwriter proposes to offer the shares of common stock to certain dealers at the same price, less a concession of not

more than $ per share. After the offering, these figures may be changed by

the underwriter.

The shares sold in this offering

are expected to be ready for delivery on or about ,

2023, against payment in immediately available funds. The underwriter may reject all or part of any order.

The Selling Stockholders have

granted to the underwriter an option to purchase up to an additional shares of Common Stock from the Selling Stockholders at the same

price to the public, and with the same underwriting discount, as set forth in the table below. The underwriter may exercise this option

at any time and from time to time during the 30-day period after the date of this prospectus supplement, but only to cover over-allotments,

if any. To the extent the underwriter exercises the option, the underwriter will become obligated, subject to certain conditions, to purchase

the shares for which it exercises the option from the Selling Stockholders.

The table below summarizes

the underwriting discounts that the Selling Stockholders will pay to the underwriter. These amounts are shown assuming both no exercise

and full exercise of the over-allotment option.

We have agreed to pay up to

$100,000 of the fees and expenses of the underwriter, which may include the fees and expenses of counsel to the underwriter.

Except as disclosed in this

prospectus supplement, the underwriter has not received and will not receive from us or the Selling Stockholders any other item of compensation

or expense in connection with this offering considered by FINRA to be underwriting compensation under FINRA Rule 5110. The underwriting

discount and reimbursable expenses the underwriter will receive were determined through arms’ length negotiations between us, the

Selling Stockholders and the underwriter.

| | |

| Per

Share | | |

| Total

with no

Over-

Allotment | | |

| Total

with

Over-

Allotment | |

| Underwriting discount to be paid by the Selling Stockholders | |

$ | | | |

$ | | | |

$ | | |

We estimate that our total

expenses of this offering will be approximately $ .

This includes $100,000 of fees and expenses of the underwriter in respect of this offering. These expenses are payable by us.

We and the Selling Stockholders

also have agreed to indemnify the underwriter against certain liabilities, including civil liabilities under the Securities Act, or to

contribute to payments that the underwriter may be required to make in respect of those liabilities.

No Sales of Similar Securities

Each of our directors and

officers have agreed not to offer, sell, agree to sell, directly or indirectly, or otherwise dispose of any shares of Common Stock or

any securities convertible into or exchangeable for shares of Common Stock without the prior written consent of the underwriter for a

period of 120 days after the date of this prospectus supplement in the case of the officers who are Selling Stockholders and 60 days after

the date of this prospectus supplement in the case of our remaining officers and our directors. These lock-up agreements provide limited

exceptions and their restrictions may be waived at any time by the underwriter.

Pursuant to the terms of the

underwriting agreement, we have agreed not to offer, sell, agree to sell, directly or indirectly, or otherwise dispose of any shares of

Common Stock or any securities convertible into or exchangeable for shares of Common Stock without the prior written consent of the underwriter

for a period of 120 days after the date of this prospectus supplement, subject to limited exceptions and such restrictions may be waived

at any time by the underwriter.

Price Stabilization, Short Positions, and Penalty

Bids

To facilitate this offering,

the underwriter may engage in transactions that stabilize, maintain, or otherwise affect the price of our Common Stock during and after

the offering. Specifically, the underwriter may over-allot or otherwise create a short position in our Common Stock for its own account

by selling more shares of Common Stock than the Selling Stockholders have sold to the underwriter. The underwriter may close out any short

position by either exercising its option to purchase additional shares or purchasing shares in the open market.

In addition, the underwriter

may stabilize or maintain the price of our Common Stock by bidding for or purchasing shares in the open market and may impose penalty

bids. If penalty bids are imposed, selling concessions allowed to broker-dealers participating in this offering are reclaimed if shares

previously distributed in this offering are repurchased, whether in connection with stabilization transactions or otherwise. The effect

of these transactions may be to stabilize or maintain the market price of our Common Stock at a level above that which might otherwise

prevail in the open market. The imposition of a penalty bid may also affect the price of our Common Stock to the extent that it discourages

resales of our Common Stock. The magnitude or effect of any stabilization or other transactions is uncertain. These transactions may be

effected on the Nasdaq Global Select Market or otherwise and, if commenced, may be discontinued at any time.

In connection with this offering,

the underwriter and selling group members may also engage in passive market-making transactions in our Common Stock on the Nasdaq Global

Select Market. Passive market-making consists of displaying bids on the Nasdaq Global Select Market limited by the prices of independent

market makers and effecting purchases limited by those prices in response to order flow. Rule 103 of Regulation M promulgated

by the SEC limits the amount of net purchases that each passive market maker may make and the displayed size of each bid. Passive market-making

may stabilize the market price of our Common Stock at a level above that which might otherwise prevail in the open market and, if commenced,

may be discontinued at any time.

None of we, the Selling Stockholders

nor the underwriter make any representation or prediction as to the direction or magnitude of any effect that the transactions described

above may have on the price of our Common Stock. In addition, none of we, the Selling Stockholders nor the underwriter make any representation

that the underwriter will engage in these transactions or that any transaction, if commenced, will not be discontinued without notice.

Affiliations

The underwriter and its affiliates

are full service financial institutions engaged in various activities, which may include securities trading, commercial and investment

banking, financial advisory, investment management, investment research, principal investment, hedging, financing, and brokerage activities.

The underwriter may in the future engage in investment banking and other commercial dealings in the ordinary course of business with us

or our affiliates. The underwriter may in the future receive customary fees and commissions for these transactions.

In the ordinary course of

their various business activities, the underwriter and its affiliates may make or hold a broad array of investments and actively trade

debt and equity securities (or related derivative securities) and financial instruments (including bank loans) for their own account and

for the accounts of their customers, and such investment and securities activities may involve securities and/or instruments of the issuer.

The underwriter and its affiliates may also make investment recommendations and/or publish or express independent research views in respect

of such securities or instruments and may at any time hold, or recommend to clients that they acquire, long and/or short positions in

such securities and instruments.

Electronic Offer, Sale, and Distribution

In connection with this offering,

the underwriter or certain of the securities dealers may distribute prospectuses by electronic means, such as e-mail. In addition, the

underwriter may facilitate Internet distribution for this offering to certain of its Internet subscription customers. The underwriter

may allocate a limited number of securities for sale to its online brokerage customers. An electronic prospectus supplement and accompanying

prospectus is available on the Internet websites maintained by any such underwriter. Other than the prospectus supplement and accompanying

prospectus in electronic format, the information on the websites of the underwriter is not part of this prospectus supplement or the accompanying

prospectus.

Listing

Our Common Stock is listed

on the Nasdaq Global Select Market under the symbol “KRT.”

Transfer Agent and Registrar

The transfer agent and registrar

for our Common Stock is VStock Transfer, LLC.

Selling Restrictions

Other than in the United States,

no action has been taken by us or the underwriter that would permit a public offering of the securities offered by this prospectus supplement

in any jurisdiction where action for that purpose is required. The shares offered by this prospectus supplement may not be offered or

sold, directly or indirectly, nor may this prospectus supplement or any other offering material or advertisements in connection with the

offer and sale of any such shares be distributed or published in any jurisdiction, except under circumstances that will result in compliance

with the applicable rules and regulations of that jurisdiction. Persons into whose possession this prospectus supplement comes are advised

to inform themselves about and to observe any restrictions relating to the offering and the distribution of this prospectus supplement.

This prospectus supplement does not constitute an offer to sell or a solicitation of an offer to buy any securities offered by this prospectus

supplement in any jurisdiction in which such an offer or a solicitation is unlawful.

European Economic Area

In relation to each Member

State of the European Economic Area, each, a Relevant State, no securities have been offered or will be offered pursuant to this offering

to the public in that Relevant State prior to the publication of a prospectus in relation to the securities which has been approved by

the competent authority in that Relevant State or, where appropriate, approved in another Relevant State and notified to the competent

authority in that Relevant State, all in accordance with the Prospectus Regulation, except that offers of securities may be made to the

public in that Relevant State at any time under the following exemptions under the Prospectus Regulation:

| (a) | to any legal entity which is a qualified investor as defined

under the Prospectus Regulation; |

| (b) | to fewer than 150 natural or legal persons (other than qualified

investors as defined under the Prospectus Regulation), subject to obtaining the prior consent of the underwriter; or |

| (c) | in any other circumstances falling within Article 1(4) of

the Prospectus Regulation, |

provided that no such offer of the securities

shall require us or the underwriter to publish a prospectus pursuant to Article 3 of the Prospectus Regulation or supplement a prospectus

pursuant to Article 23 of the Prospectus Regulation and each person who initially acquires any securities or to whom any offer is made

will be deemed to have represented, acknowledged and agreed to and with the underwriter and the Company that it is a “qualified

investor” within the meaning of Article 2(e) of the Prospectus Regulation. In the case of any securities being offered to a financial

intermediary as that term is used in the Prospectus Regulation, each such financial intermediary will be deemed to have represented, acknowledged

and agreed that the securities acquired by it in the offer have not been acquired on a nondiscretionary basis on behalf of, nor have they

been acquired with a view to their offer or resale to, persons in circumstances which may give rise to an offer of any securities to the

public other than their offer or resale in a Relevant State to qualified investors as so defined or in circumstances in which the prior

consent of the underwriter has been obtained to each such proposed offer or resale.

For the purposes of this provision,

the expression an “offer to the public” in relation to securities in any Relevant State means the communication in any form

and by any means of sufficient information on the terms of the offer and any securities to be offered so as to enable an investor to decide

to purchase or subscribe for any securities, and the expression “Prospectus Regulation” means Regulation (EU) 2017/1129.

We have not authorized and

do not authorize the making of any offer of the securities through any financial intermediary on their behalf, other than offers made

by the underwriter with a view to the final placement of the securities in this document. Accordingly, no purchaser of the securities,

other than the underwriter, is authorized to make any further offer of the securities on behalf of us or the underwriter.

United Kingdom

In relation to the United

Kingdom, no securities have been offered or will be offered pursuant to this offering to the public in the United Kingdom prior to the

publication of a prospectus in relation to the securities that has been approved by the Financial Conduct Authority, except that offers

of securities may be made to the public in the United Kingdom at any time under the following exemptions under the UK Prospectus Regulation:

| (a) | to any legal entity which is a qualified investor as defined

in Article 2 of the UK Prospectus Regulation; |

| (b) | to fewer than 150 natural or legal persons (other than qualified

investors as defined in Article 2 of the UK Prospectus Regulation), subject to obtaining the prior consent of the underwriter; or |

| (c) | in any other circumstances falling within section 86 of the

Financial Services and Markets Act 2000, or FSMA, |

provided that no such offer of securities shall

require us or any representatives to publish a prospectus pursuant to 85 of the FSMA or supplement a prospectus pursuant to Article 23

of the UK Prospectus Regulation.

Each person in the United

Kingdom who initially acquires any securities or to whom any offer is made will be deemed to have represented, acknowledged and agreed

to and with us and the representatives that it is a qualified investor within the meaning of Article 2 of the UK Prospectus Regulation.

In the case of any securities

being offered to a financial intermediary as that term is used in Article 1(4) of the U.K. Prospectus Regulation, each financial intermediary

will also be deemed to have represented, acknowledged and agreed that the securities acquired by it in the offer have not been acquired

on a non-discretionary basis on behalf of, nor have they been acquired with a view to their offer or resale to, persons in circumstances

which may give rise to an offer of any securities to the public, other than their offer or resale in the United Kingdom to qualified investors

as so defined or in circumstances in which the prior consent of the representatives has been obtained to each such proposed offer or resale.

For the purposes of this provision,

the expression an “offer to the public” in relation to any securities in any relevant state means the communication in any

form and by any means of sufficient information on the terms of the offer and any securities to be offered so as to enable an investor

to decide to purchase or subscribe for any securities, and the expression “UK Prospectus Regulation” means Regulation (EU)

2017/1129 as it forms part of domestic law by virtue of the European Union (Withdrawal) Act 2018.

Australia

No placement document, prospectus,

product disclosure statement or other disclosure document has been lodged with the Australian Securities and Investments Commission in

relation to this offering. This prospectus supplement does not constitute a prospectus, product disclosure statement or other disclosure

document under the Corporations Act 2001, or the Corporations Act, and does not purport to include the information required for a prospectus,

product disclosure statement or other disclosure document under the Corporations Act.

Any offer in Australia of

the securities may only be made to persons, or the Exempt Investors, who are “sophisticated investors” (within the meaning

of section 708(8) of the Corporations Act), “professional investors” (within the meaning of section 708(11) of the Corporations

Act) or otherwise pursuant to one or more exemptions contained in section 708 of the Corporations Act so that it is lawful to offer the

securities without disclosure to investors under Chapter 6D of the Corporations Act.

The securities applied for

by Exempt Investors in Australia must not be offered for sale in Australia in the period of 12 months after the date of allotment under

this offering, except in circumstances where disclosure to investors under Chapter 6D of the Corporations Act would not be required pursuant

to an exemption under section 708 of the Corporations Act or otherwise or where the offer is pursuant to a disclosure document which complies

with Chapter 6D of the Corporations Act. Any person acquiring securities must observe such Australian on-sale restrictions.

This prospectus supplement

contains general information only and does not take account of the investment objectives, financial situation or particular needs of any

particular person. It does not contain any securities recommendations or financial product advice. Before making an investment decision,

investors need to consider whether the information in this prospectus supplement is appropriate to their needs, objectives and circumstances,

and, if necessary, seek expert advice on those matters.

Canada

The securities may be sold

only to purchasers purchasing as principal that are both “accredited investors” as defined in National Instrument 45-106 Prospectus

and Registration Exemptions and “permitted clients” as defined in National Instrument 31-103 Registration Requirements, Exemptions

and Ongoing Registrant Obligations. Any resale of our securities must be made in accordance with an exemption from the prospectus requirements

and in compliance with the registration requirements of applicable securities laws.

France

This prospectus (including

any amendment, supplement or replacement thereto) is not being distributed in the context of a public offering in France within the meaning

of Article L. 411-1 of the French Monetary and Financial Code (Code monétaire et financier).

This prospectus has not been

and will not be submitted to the French Autorité des marchés financiers, or the AMF, for approval in France and accordingly

may not and will not be distributed to the public in France.

Pursuant to Article 211-3 of the AMF General Regulation,

French residents are hereby informed that:

| (a) | the transaction does not require a prospectus to be submitted

for approval to the AMF; |

| (b) | persons or entities referred to in Point 2°, Section

II of Article L.411-2 of the Monetary and Financial Code may take part in the transaction solely for their own account, as provided in

Articles D. 411-1, D. 734-1, D. 744-1, D. 754-1 and D. 764-1 of the Monetary and Financial Code; and |

| (c) | the financial instruments thus acquired cannot be distributed

directly or indirectly to the public otherwise than in accordance with Articles L. 411-1, L. 411-2, L. 412-1 and L. 621-8 to L. 621-8-3

of the Monetary and Financial Code. |

This prospectus is not to

be further distributed or reproduced (in whole or in part) in France by the recipients of this prospectus. This prospectus has been distributed

on the understanding that such recipients will only participate in the issue or sale of our securities for their own account and undertake

not to transfer, directly or indirectly, our securities to the public in France, other than in compliance with all applicable laws and

regulations and in particular with Articles L. 411-1 and L. 411-2 of the French Monetary and Financial Code.

Germany

Each person who is in possession

of this prospectus is aware of the fact that no German securities prospectus (wertpapierprospekt) within the meaning of the German Securities

Prospectus Act (Wertpapier-prospektgesetz, or the Act) of the Federal Republic of Germany has been or will be published with respect to

the securities. In particular, the underwriter has represented that it has not engaged and has agreed that it will not engage in a public

offering in the Federal Republic of Germany within the meaning of the Act with respect to any of the securities otherwise than in accordance

with the Act and all other applicable legal and regulatory requirements.

Hong Kong

The securities may not be

offered or sold in Hong Kong by means of any document other than (i) in circumstances which do not constitute an offer to the public within

the meaning of the Companies Ordinance (Cap. 32, Laws of Hong Kong), or (ii) to “professional investors” within the meaning

of the Securities and Futures Ordinance (Cap. 571, Laws of Hong Kong) and any rules made thereunder, or (iii) in other circumstances which

do not result in the document being a “prospectus” within the meaning of the Companies Ordinance (Cap. 32, Laws of Hong Kong)

and no advertisement, invitation or document relating to the securities may be issued or may be in the possession of any person for the

purpose of issue (in each case whether in Hong Kong or elsewhere), which is directed at, or the contents of which are likely to be accessed

or read by, the public in Hong Kong (except if permitted to do so under the laws of Hong Kong) other than with respect to securities which

are or are intended to be disposed of only to persons outside Hong Kong or only to “professional investors” within the meaning

of the Securities and Futures Ordinance (Cap. 571, Laws of Hong Kong) and any rules made thereunder.

Israel

This document does not constitute

a prospectus under the Israeli Securities Law, 5728-1968 (the Securities Law) and has not been filed with or approved by the Israel Securities

Authority. In Israel, this prospectus is being distributed only to, and is directed only at, and any offer of the securities is directed

only at, (i) a limited number of persons in accordance with the Israeli Securities Law and (ii) investors listed in the first addendum

(the Addendum), to the Israeli Securities Law, consisting primarily of joint investment in trust funds, provident funds, insurance companies,

banks, portfolio managers, investment advisors, members of the Tel Aviv Stock Exchange, underwriters, venture capital funds, entities

with equity in excess of NIS 50 million and “qualified individuals,” each as defined in the Addendum (as it may be amended

from time to time), collectively referred to as qualified investors (in each case, purchasing for their own account or, where permitted

under the Addendum, for the accounts of their clients who are investors listed in the Addendum). Qualified investors are required to submit

written confirmation that they fall within the scope of the Addendum, are aware of the meaning of same and agree to it.

Singapore

This prospectus supplement

has not been registered as a prospectus with the Monetary Authority of Singapore. Accordingly, the securities were not offered or sold

or caused to be made the subject of an invitation for subscription or purchase and will not be offered or sold or caused to be made the

subject of an invitation for subscription or purchase, and this prospectus or any other document or material in connection with the offer

or sale, or invitation for subscription or purchase, of the securities, has not been circulated or distributed, nor will it be circulated

or distributed, whether directly or indirectly, to any person in Singapore other than (i) to an institutional investor (as defined in

Section 4A of the Securities and Futures Act (Chapter 289) of Singapore, as modified or amended from time to time, or the SFA,) pursuant

to Section 274 of the SFA, (ii) to a relevant person (as defined in Section 275(2) of the SFA) pursuant to Section 275(1) of the SFA,

or any person pursuant to Section 275(1A) of the SFA, and in accordance with the conditions specified in Section 275 of the SFA, or (iii)

otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA.

Where the securities are subscribed or purchased

under Section 275 of the SFA by a relevant person which is:

| (a) | a corporation (which is not an accredited investor (as defined

in Section 4A of the SFA)) the sole business of which is to hold investments and the entire share capital of which is owned by one or

more individuals, each of whom is an accredited investor; or |

| (b) | a trust (where the trustee is not an accredited investor)

whose sole purpose is to hold investments and each beneficiary of the trust is an individual who is an accredited investor, securities

(as defined in Section 239(1) of the SFA) of that corporation or the beneficiaries’ rights and interest (howsoever described) in

that trust shall not be transferred within six months after that corporation or that trust has acquired the securities pursuant to an

offer made under Section 275 of the SFA except: |

| 1. | to an institutional investor or to a relevant person defined

in Section 275(2) of the SFA, or to any person arising from an offer referred to in Section 275(1A) or Section 276(4)(i)(B) of the SFA; |

| 2. | where no consideration is or will be given for the transfer; |

| 3. | where the transfer is by operation of law; |

| 4. | as specified in Section 276(7) of the SFA; or |

| 5. | as specified in Regulation 32 of the Securities and Futures

(Offers of Investment) (Shares and Debentures) Regulations 2005. |

Singapore Securities and Futures Act Product

Classification

Solely for the purposes of

our obligations pursuant to sections 309B(1)(a) and 309B(1)(c) of the SFA, we have determined, and hereby notify all relevant persons

(as defined in Section 309A of the SFA), that the securities are “prescribed capital markets products” (as defined in the

Securities and Futures (Capital Markets Products) Regulations 2018) and Excluded Investment Products (as defined in MAS Notice SFA 04-N12:

Notice on the Sale of Investment Products and MAS Notice FAA-N16: Notice on Recommendations on Investment Products).

Japan

The securities have not been

and will not be registered under the Financial Instruments and Exchange Law of Japan (Law No. 25 of 1948, as amended) and, accordingly,

will not be offered or sold, directly or indirectly, in Japan, or for the benefit of any Japanese Person or to others for re-offering

or resale, directly or indirectly, in Japan or to any Japanese Person, except in compliance with all applicable laws, regulations and

ministerial guidelines promulgated by relevant Japanese governmental or regulatory authorities in effect at the relevant time. For the

purposes of this paragraph, “Japanese Person” shall mean any person resident in Japan, including any corporation or other

entity organized under the laws of Japan.

Switzerland

The securities may not be

publicly offered in Switzerland and will not be listed on the SIX Swiss Exchange, or the SIX, or on any other stock exchange or regulated

trading facility in Switzerland. This document has been prepared without regard to the disclosure standards for issuance prospectuses

under art. 652a or art. 1156 of the Swiss Code of Obligations or the disclosure standards for listing prospectuses under art. 27 ff. of

the SIX Listing Rules or the listing rules of any other stock exchange or regulated trading facility in Switzerland. Neither this document

nor any other offering or marketing material relating to the securities or this offering may be publicly distributed or otherwise made

publicly available in Switzerland.

Neither this document nor

any other offering or marketing material relating to this offering, our company or the securities have been or will be filed with or approved

by any Swiss regulatory authority. In particular, this document will not be filed with, and the offer of securities will not be supervised

by, the Swiss Financial Market Supervisory Authority FINMA (FINMA), and the offer of securities has not been and will not be authorized