UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

Amendment No. 1

TENDER OFFER STATEMENT UNDER SECTION 14(d)(1)

OR 13(e)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934

INTERCEPT PHARMACEUTICALS, INC.

(Name of Subject Company (Issuer))

INTERSTELLAR ACQUISITION INC.

a wholly owned subsidiary of

ALFASIGMA S.P.A.

(Name of Filing Person (Offerors))

Common Stock, par value $0.001 per share

(Title of Class of Securities)

45845P108

(CUSIP Number of Class of Securities)

Michele A. Cera

Corporate General Counsel

Alfasigma S.p.A.

Via Ragazzi del ’99, 5

40133 Bologna, Italy

+39 051 648 9521

(Name, Address and Telephone Number of Person Authorized

to Receive Notices and Communications on Behalf of Filing Persons)

Copy to:

Matthew G. Hurd

Oderisio de Vito Piscicelli

Sullivan & Cromwell LLP

125 Broad Street

New York, NY 10004

| ¨ |

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to designate any transactions to

which the statement relates:

| x |

Third-party offer subject to Rule 14d-1. |

| ¨ |

Issuer tender offer subject to Rule 13e-4. |

| ¨ |

Going-private transaction subject to Rule 13e-3. |

| ¨ |

Amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing is a final amendment reporting

the results of the tender offer: ¨

If applicable, check the appropriate box(es) below to designate the

appropriate rule provision(s) relied upon:

| ¨ |

Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| ¨ |

Rule 14d-1(d) (Cross-Border Third Party Tender Offer) |

This Amendment No. 1 (this “Amendment”) amends and

supplements the Tender Offer Statement on Schedule TO filed with the Securities and Exchange Commission on October 11, 2023 (as it may

be amended and supplemented from time to time, the “Schedule TO”) by Interstellar Acquisition Inc. (the “Purchaser”),

a Delaware corporation and a wholly owned subsidiary of Alfasigma S.p.A., an Italian società per azioni (joint stock company)

(“Alfasigma”). The Schedule TO relates to the offer by the Purchaser to purchase all of the outstanding shares of common stock,

par value $0.001 per share (the “Shares”), of Intercept Pharmaceuticals, Inc., a Delaware corporation (“Intercept”),

at a price of $19.00 per Share, net to the seller in cash, without interest and subject to any applicable withholding taxes, upon the

terms and subject to the conditions described in the offer to purchase, dated October 11, 2023 (the “Offer to Purchase”),

and in the related letter of transmittal (the “Letter of Transmittal”), copies of which are attached to the Schedule TO as

Exhibits (a)(1)(i) and (a)(1)(ii), respectively, which Offer to Purchase and Letter of Transmittal collectively constitute the “Offer.”

Except as otherwise set forth in this Amendment, the information

set forth in the Schedule TO remains unchanged. Capitalized terms used but not defined herein have the meaning ascribed to them in

the Schedule TO.

| Item 11. |

Additional Information. |

Section 17 — “Certain Legal Matters;

Regulatory Approvals” of the Offer to Purchase is hereby amended and supplemented by adding the following paragraphs immediately

after the last subsection “Stockholder Approval Not Required” under a new subsection “Legal Proceedings:”

“As of October 17, 2023, three complaints

have been filed in federal court, each relating to the Offer and the transactions contemplated by the Merger Agreement. On October 13,

2023, a purported stockholder of Intercept filed a lawsuit in the United States District Court for the District of Delaware against Intercept

and its directors, captioned Walsh v. Intercept Pharmaceuticals, Inc., et al., Case No. 23-cv-01153 (which we refer to as the “Walsh

Complaint”). Also on October 13, 2023, a purported stockholder of Intercept filed a lawsuit in the United States District Court

for the Southern District of New York against Intercept and its directors, captioned O’Dell v. Intercept Pharmaceuticals, Inc.,

et al., Case No. 23-cv-09052 (which we refer to as the “O’Dell Complaint”). On October 17, 2023, a purported

stockholder of Intercept filed a lawsuit in the United States District Court for the Southern District of New York against Intercept and

its directors, captioned Dickerson v. Intercept Pharmaceuticals, Inc., et al., Case No. 23-cv-09121 (which we refer to as the “Dickerson

Complaint”).

The Walsh Complaint, the O’Dell

Complaint and the Dickerson Complaint allege that the Solicitation/Recommendation Statement issued on Schedule 14D-9 in connection

with the Offer and the transactions contemplated by the Merger Agreement omits material information or contains misleading

disclosures and that, as a result, the defendants violated Sections 14(d), 14(e), and 20(a) of the Exchange Act.

The complaints seek, among other things, (i) injunctive

relief preventing the consummation of the transactions contemplated by the Merger Agreement; (ii) rescission or rescissory damages in

the event the transactions contemplated by the Merger Agreement have been implemented; (iii) dissemination of a Solicitation/Recommendation

Statement that does not omit material information or contain any misleading disclosures; (iv) an award of damages that plaintiff suffered

as a result of the defendant’s purported wrongdoings; and (v) an award of plaintiff’s expenses, including attorneys’

and experts’ fees.

Intercept has stated that it believes the claims

asserted in each of the complaints are without merit.

Additional lawsuits may be filed against Intercept,

the Board of Directors of Intercept, Alfasigma, Alfasigma Board and/or the Purchaser in connection with the Offer and the transactions

contemplated by the Merger Agreement, this Schedule TO and the Schedule 14D-9. If additional similar complaints are filed, absent

new or different allegations that are material, we will not necessarily announce such additional filings.”

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify

that the information set forth in this statement is true, complete and correct.

| Dated: October 18, 2023 |

ALFASIGMA S.P.A. |

| |

|

|

| |

By: |

/s/ Francesco Balestrieri |

| |

|

Name: Francesco Balestrieri |

| |

|

Title: Chief Executive Officer |

| |

|

| |

INTERSTELLAR ACQUISITION INC. |

| |

|

|

| |

By: |

/s/ Francesco Balestrieri |

| |

|

Name: Francesco Balestrieri |

| |

|

Title: President |

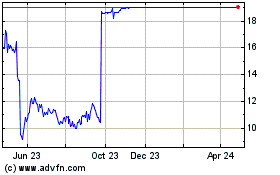

Intercept Pharmaceuticals (NASDAQ:ICPT)

Historical Stock Chart

From Apr 2024 to May 2024

Intercept Pharmaceuticals (NASDAQ:ICPT)

Historical Stock Chart

From May 2023 to May 2024