0000917520false00009175202023-12-122023-12-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 12, 2023

INTEGRA LIFESCIENCES HOLDINGS CORPORATION

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | |

| Delaware | 0-26224 | 51-0317849 |

| (State or Other Jurisdiction of Incorporation or Organization) | (Commission File Number) | (IRS Employer Identification No.) |

1100 Campus Road

Princeton, NJ 08540

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code: (609) 275-0500

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425).

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12).

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)).

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)).

Securities Registered Pursuant to Section12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol | Name of Exchange on Which Registered |

| Common Stock, Par Value $.01 Per Share | IART | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

On December 12, 2023, Integra LifeSciences Holdings Corporation, a Delaware corporation (the “Company”), entered into a stock purchase agreement (the “Purchase Agreement”) between the Company, Integra LifeSciences Israel Ltd., a private company organized under the laws of the State of Israel and a wholly-owned subsidiary of the Company (“Buyer Israeli Sub”), and Ethicon, Inc., a New Jersey corporation (“Seller”), pursuant to which the Company agreed to acquire all of the outstanding common shares (the “Transferred Shares”) of Acclarent, Inc., a Delaware corporation and wholly-owned subsidiary of Seller (“Acclarent”) for $275.0 million in cash, subject to customary purchase price adjustments, and a cash payment of $5.0 million upon the achievement of a regulatory milestone. In connection with the purchase and sale of the Transferred Shares, and pursuant to the terms of the Purchase Agreement, Buyer Israeli Sub also agreed to acquire from Biosense Webster (Israel) Ltd., a private company organized under the laws of the State of Israel (“BWI”) and a wholly-owned subsidiary of Seller, certain assets related to Acclarent’s business (the “Transferred Assets”) and assume certain liabilities (the “Assumed Liabilities”) related to such assets (in each case, as described in the Purchase Agreement). The purchase and sale of the Transferred Shares and the Transferred Assets and the assumption of the Assumed Liabilities are referred to herein as the “Transaction”. Seller is a wholly-owned subsidiary of Johnson & Johnson. The Transaction is expected to close by the second quarter of 2024.

The consummation of the Transaction is subject to customary closing conditions, including the expiration or early termination of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, approval by the Israel Innovation Authority (“IIA”) of an in-license agreement by and between BWI, as licensor, and Acclarent, as licensee (as described below), the absence of any injunction or law preventing or prohibiting the closing, the absence of any material adverse effect on Acclarent or its business, the delivery of certain closing deliverables, the accuracy of each party’s respective representations and warranties contained in the Purchase Agreement (subject, with specified exceptions, to materiality or “Material Adverse Effect” standards) and each party’s performance of its respective covenants and agreements in the Purchase Agreement in all material respects. Under the terms of the Purchase Agreement, the Company is required to use reasonable best efforts to: (i) promptly obtain all authorizations, consents, orders, waivers and approvals of all Governmental Entities (as defined in the Purchase Agreement) that may be or become necessary or advisable under the Purchase Agreement; and (ii) enable the parties to close the Transaction as promptly as practicable, and in any event prior to the Outside Date (as defined below), including agreeing to divestitures, operational restrictions and the termination of existing relationships or arrangements as necessary or advisable to avoid litigation or proceedings that would otherwise delay or prevent the consummation of the Transaction.

The Purchase Agreement contains customary representations, warranties and covenants of each of the Company and Seller, respectively, including covenants by Seller relating to the operation of the business of Acclarent prior to the closing of the Transaction. The representations and warranties of the Company and Seller will generally not survive the closing, subject to certain limited exceptions. In connection with the Transaction, the Company has purchased a buyer-side representations and warranties insurance policy, which will generally be its sole recourse with respect to breaches of the Seller’s representations and warranties contained in the Purchase Agreement. Each of the Company and Seller has agreed to indemnify the other for certain losses arising out of breaches of covenants and for certain other losses, subject to certain limitations.

The Purchase Agreement contains certain customary termination rights for the Company and Seller, including the right to terminate the Purchase Agreement if the Transaction is not consummated by December 12, 2024 (the “Outside Date”).

In connection with the Transaction, the Company and Seller, or their respective affiliates, will enter into certain ancillary agreements, including a transition services agreement and a transition manufacturing agreement, pursuant to which Seller or its affiliates will provide certain migration and transition services to facilitate an orderly transition of the business and operations of Acclarent to the Company following consummation of the Transaction, and an in-license agreement with BWI, pursuant to which, as of the closing of the Transaction, Acclarent will have an exclusive, fully-paid, royalty-free worldwide license to certain intellectual property to exploit certain products (including the TruDi® Navigation System) in the ENT field.

The foregoing description of the Purchase Agreement is not complete and is qualified in its entirety by reference to the Purchase Agreement, which will be filed as an exhibit to the Company’s Annual Report on Form 10-K for the year ended December 31, 2023. The representations, warranties and covenants set forth in the Purchase Agreement

have been made only for the purposes of the Purchase Agreement and as of specific dates, and are solely for the benefit of the parties thereto, and may be subject to limitations agreed upon by the contracting parties, including being qualified by confidential disclosures made for the purposes of allocating contractual risk between the parties to the Purchase Agreement instead of establishing these matters as facts. In addition, information regarding the subject matter of the representations and warranties made in the Purchase Agreement may change after the date of the Purchase Agreement. Accordingly, the description of the Purchase Agreement is included with this Current Report on Form 8-K only to provide investors with information regarding its terms and not to provide investors with any other factual information regarding the Company, Seller, their subsidiaries, their affiliates or their businesses as of the date of the Purchase Agreement or as of any other date.

Item 7.01 Regulation FD Disclosure

On December 13, 2023, the Company issued a Press Release announcing, among other things, the signing of the Purchase Agreement, which is attached as Exhibit 99.1, and incorporated into this Item 7.01 by reference. The Company also prepared an investor presentation, a copy of which is attached hereto as Exhibit 99.2 and is incorporated herein by reference. The information contained herein, including the attached press release and investor presentation, is furnished pursuant to Item 7.01 of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934 except as may be expressly set forth by specific reference in such filing.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. You can identify forward-looking statements by words such as “anticipate,” “believe,” “commitment,” “could,” “design,” “estimate,” “expect,” “forecast,” “goal,” “guidance,” “imply,” “intend,” “may,” “objective,” “opportunity,” “outlook,” “plan,” “policy,” “position,” “potential,” “predict,” “priority,” “project,” “proposition,” “prospective,” “pursue,” “seek,” “should,” “strategy,” “target,” “will,” “would” or other similar expressions that convey the uncertainty of future events or outcomes. These forward-looking statements are based on our beliefs, assumptions and estimates using information available to us at the time and are not intended to be guarantees of future events or performance. These forward-looking statements include, among other things, statements regarding: the closing of the Transaction on anticipated terms and timing, or at all, including obtaining regulatory approvals that may be required under the terms of the Purchase Agreement; and future capital expenditures, revenues, expenses, earnings, synergies, economic performance, financial condition, future prospects, business and management strategies for the management, and the expansion and growth of the Company following the close of the Transaction, including the possibility that any of the anticipated benefits of the Transaction will not be realized or will not be realized within the expected time period. Such forward-looking statements involve risks and uncertainties that could cause actual results to differ from predicted results. These risks and uncertainties include: successful closing of the Transaction; the ability to obtain required regulatory approvals for the Transaction (including the approval of antitrust authorities and the IIA necessary to complete the Transaction), the timing of obtaining such approvals and the risk that such approvals may result in the imposition of conditions, including with respect to divestitures required by antitrust authorities, that could materially adversely affect the Company and the expected benefits of the Transaction; the risk that a condition to closing of the Transaction may not be satisfied on a timely basis or at all, the failure of the Transaction to close for any other reason and the risk of liability to the Company in connection therewith; the Company’s ability to successfully integrate Acclarent and other acquired businesses; the State of Israel's on-going war against Hamas, and the potential for the continuation or escalation of such conflict to disrupt the operations and employees of Acclarent’s business located in the State of Israel and make it more difficult for the Company to both integrate Acclarent and realize the expected benefits of the Transaction; global macroeconomic and political conditions, including acts of terrorism or outbreak of war, hostilities, civil unrest, and other political or security disturbances, including the State of Israel’s ongoing war against Hamas and any escalations of that conflict; the difficulty of predicting the timing or outcome of product development efforts and regulatory agency approvals or actions, if any; physicians’ willingness to adopt and third-party payers’ willingness to provide reimbursement for the Company’s and Acclarent's existing, recently launched and planned products; difficulties or delays in manufacturing; the availability and pricing of third party sourced products and materials; and other factors beyond the Company's control; and the economic, competitive, governmental, technological and other factors identified under the heading "Risk Factors" included in item 1A of the Company’s Annual Report on Form 10-K for the year ended December

31, 2022, and information contained in subsequent filings with the Securities and Exchange Commission, including Item 8.01 of this Current Report on Form 8-K. These forward-looking statements are made only as the date thereof, and the Company undertakes no obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

Item 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

104 Cover Page Interactive Data File (embedded within the inline XRBL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| INTEGRA LIFESCIENCES HOLDINGS CORPORATION |

| | |

| Date: December 13, 2023 | By: | /s/ Eric I. Schwartz |

| | Eric I. Schwartz |

| Title: | Executive Vice President, Chief Legal Officer and |

| | Secretary |

| | |

| | |

| | |

1 Privileged and Confidential Integra LifeSciences Announces Definitive Agreement to Acquire Acclarent® • The acquisition will become part of Integra’s Codman Specialty Surgical (CSS) division. The ear, nose and throat (ENT) category is a key area of strategic interest and highly complementary to the neurosurgery segment. • Provides a unique opportunity to build scale and capture a leadership position in the attractive ENT device segment with Acclarent’s established commercial scale, strong brand recognition, differentiated portfolio, and robust innovation pipeline. • Generates shareholder value; transaction expected to be accretive to Integra’s long-range plan. Princeton, New Jersey, December 12, 2023 -- Integra LifeSciences Holdings Corporation (Nasdaq: IART), a global leader in medical technology, today announced that it has entered into a definitive agreement to acquire Acclarent, Inc. from Ethicon, Inc., a Johnson & Johnson MedTech company for $275 million in cash at closing, subject to customary purchase price adjustments, and an additional $5 million upon the achievement of certain regulatory milestones. Acclarent is an innovator and market leader in ENT procedures and upon closing, Integra will be one of the leading providers of ENT products and technologies. “This acquisition presents Integra with a rare opportunity to become a key player in the ENT segment. Acclarent’s culture of pioneering technologies aligns with Integra’s legacy of innovation to transform care and restore patients’ lives,” said Jan De Witte, president and chief executive officer of Integra LifeSciences. “We are looking forward to welcoming the Acclarent employees to the Integra team. Together, we can make a profound impact on the future of ENT and neurosurgery.” The U.S. ENT specialty devices market is growing at 5-6% and will add approximately $1 billion to the CSS global total addressable market. The Acclarent portfolio includes its groundbreaking balloon technologies for sinus dilation and eustachian tube dilation as well as surgical navigation systems. Acclarent is headquartered in Irvine, California, and derives its revenues from U.S. product sales, which generated about $110 million in 2022 and gross margins in line with Integra’s company average. The company maintains R&D facilities in Irvine and Haifa, Israel, and uses third-party manufacturers. “The ENT segment is an anatomical adjacency to neurosurgery. For example, this acquisition will provide opportunities for ENT and neurosurgeons to closely collaborate on tumor care using skull base approaches,” said Mike McBreen, president of the CSS division. “Acclarent’s strong commercial capabilities, R&D expertise, advanced portfolio and deep clinical knowledge will be important assets to Integra, allowing us to deliver future innovation not only within ENT, but also across our other CSS technology platforms.” Integra currently participates in the ENT category with its MicroFrance® line of ENT instruments. Expected Financial Impact of the Transaction Integra expects to provide detailed guidance regarding the financial impacts of this transaction upon closing. The transaction, subject to customary closing conditions and regulatory approvals, is expected to close by the second quarter of 2024. Following the close, transition services, including transition manufacturing services, will be provided for up to four years. Exhibit 99.1

2 Privileged and Confidential Advisors Goldman, Sachs & Co. is serving as exclusive financial advisor and Morgan, Lewis & Bockius LLP is acting as legal advisor to Integra. Conference Call Integra will discuss the acquisition of Acclarent at a conference call on December 13, 2023, at 8:30 a.m. EST Management will also reference a presentation, which will be available on the Investor Relations section of Integra’s Website at www.integralife.com, under events & presentations. This call will contain forward- looking statements and other material information. A live webcast will be available on the Investors section of the Company’s website at investor.integralife.com. For those planning to participate on the call, register here to receive dial-in details and an individual pin. While not required, it is recommended to join 10 minutes prior to the event’s start. A webcast replay of the conference call will be available on the Investors section of the Company’s website following the call. About Integra At Integra LifeSciences, we are driven by our purpose of restoring patients’ lives. We innovate treatment pathways to advance patient outcomes and set new standards of surgical, neurologic, and regenerative care. We offer a comprehensive portfolio of high quality, leadership brands that include AmnioExcel®, Aurora®, Bactiseal®, BioD™, CerebroFlo®, CereLink® Certas® Plus, Codman®, CUSA®, Cytal®, DuraGen®, DuraSeal®, DuraSorb®, Gentrix®, ICP Express®, Integra®, Licox®, MAYFIELD®, MediHoney®, MicroFrance®, MicroMatrix®, NeuraGen®, NeuraWrap™, PriMatrix®, SurgiMend®, TCC-EZ® and VersaTru®. For the latest news and information about Integra and its products, please visit www.integralife.com. Forward Looking Statements This news release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties and reflect the Company's judgment as of the date of this release. All statements, other than statements of historical fact, are statements that could be deemed forward-looking statements. Some of these forward-looking statements may contain words like “will,” “believe,” “may,” “could,” “would,” “might,” “possible,” “should,” “expect,” “intend,” "forecast," "guidance," “plan,” “anticipate,” "target," or “continue,” the negative of these words, other terms of similar meaning or they may use future dates. Forward-looking statements contained in this news release include, but are not limited to, statements concerning the closing of the transaction on anticipated terms and timing, or at all, including obtaining regulatory approvals that may be required under the terms of the purchase agreement between the parties, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, financial condition, prospects, business and management strategies for the management, and the expansion and growth of the Company following the close of the transaction, including the possibility that any of the anticipated benefits of the transaction will not be realized or will not be realized within the expected time period. It is important to note that the Company’s goals and expectations are not predictions of actual performance. Such forward-looking statements involve risks and

3 Privileged and Confidential uncertainties that could cause actual results to differ materially from predicted or expected results. Such risks and uncertainties include, but are not limited, to the following: the successful closing of the transaction; the ability to obtain required regulatory approvals for the transaction, the timing of obtaining such approvals and the risk that such approvals may result in the imposition of conditions, including with respect to divestitures required by antitrust authorities, that could materially adversely affect the Company and the expected benefits of the transaction; the risk that a condition to closing of the transaction may not be satisfied on a timely basis or at all; the failure of the transaction to close for any other reason and the risk of liability to the Company in connection therewith; the Company’s ability to successfully integrate Acclarent and other acquired businesses; the State of Israel's on-going war against Hamas, and the potential for the continuation or escalation of such conflict to disrupt the operations and employees of Acclarent’s business located in the State of Israel and make it more difficult for the Company to both integrate Acclarent and realize the expected benefits of the transaction; global macroeconomic and political conditions, including acts of terrorism or outbreak of war, hostilities, civil unrest, and other political or security disturbances, including the State of Israel’s ongoing war against Hamas and any escalations of that conflict; the difficulty of predicting the timing or outcome of product development efforts and regulatory agency approvals or actions, if any; physicians’ willingness to adopt and third-party payers’ willingness to provide reimbursement for the Company’s and Acclarent's existing, recently launched and planned products; difficulties or delays in manufacturing; the availability and pricing of third party sourced products and materials; and the economic, competitive, governmental, technological and other risk factors and uncertainties identified under the heading “Risk Factors” included in Item 1A of Integra's Annual Report on Form 10-K for the year ended December 31, 2022 and information contained in subsequent filings with the Securities and Exchange Commission. These forward-looking statements are made only as of the date hereof, and the Company undertakes no obligation to update or revise the forward-looking statements, whether as a result of new information, future events, or otherwise. CONTACT: Integra LifeSciences Holdings Corporation Investors Chris Ward (609) 772-7736 chris.ward@integralife.com Media Laurene Isip (609) 208-8121 laurene.isip@integralife.com

ACQUISTION OF ACCLARENT, A LEADER IN ENT SURGICAL INTERVENTIONS DECEMBER 13, 2023 Exhibit 99.2

Legal Information 2 Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties and reflect the Company's judgment as of the date of this presentation. All statements, other than statements of historical fact, are statements that could be deemed forward-looking statements. Some of these forward-looking statements may contain words like “will,” “believe,” “may,” “can,” “could,” “would,” “might,” “project,” “possible,” “should,” “expect,” “intend,” “plan,” “anticipate,” “target,” or “continue,” the negative of these words, other terms of similar meaning or they may use future dates. Forward-looking statements contained in this presentation include, but are not limited to, statements regarding the planned completion of the Company's proposed acquisition of Acclarent, Inc. ("Acclarent"), the expected strategic and financial benefits of the proposed acquisition, including future financial performance and operating results, Integra’s business’s plans, objectives, expectations and intentions and the expected timing of completion of the proposed acquisition. Statements of past performance, efforts, or results about which assumptions or inferences may be made can also be forward-looking statements and are not indicative of future performance or results. Such forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from predicted or expected results. Such risks and uncertainties include, but are not limited to, the following: the successful closing of the proposed acquisition; the ability to obtain required regulatory approvals for the proposed acquisition (including the approval of antitrust authorities and the Israel Innovation Authority necessary to complete the proposed acquisition), the timing of obtaining such approvals and the risk that such approvals may result in the imposition of conditions, including with respect to divestitures required by antitrust authorities, that could materially adversely affect Integra, the Acclarent ear, nose and throat ("ENT") business and the expected benefits of the proposed acquisition; the risk that a condition to closing of the proposed acquisition may not be satisfied on a timely basis or at all; the State of Israel's on-going war against Hamas, and the potential for the continuation or escalation of such conflict to disrupt the operations and employees of Acclarent located in the State of Israel and make it more difficult for the Company to realize the intended benefits of the acquisition; the effects of disruption caused by the proposed acquisition making it more difficult for Integra to execute its operating plan effectively or to maintain relationships with employees, vendors and other business partners; Integra’s ability to successfully integrate the Acclarent ENT business and other acquired businesses; the difficulty of predicting the timing or outcome of product development efforts and regulatory agency approvals or actions, if any; physicians’ willingness to adopt and third-party payers’ willingness to provide reimbursement for Integra’s and Acclarent ENT business’s existing, recently launched and planned products; difficulties or delays in manufacturing; the Company's ability to remediate quality systems violations; the availability and pricing of third party sourced products and materials; macroeconomic conditions, including inflation, disruptions to the global supply chain, fluctuations in currency exchange rates, weakness in general economic conditions and recessions; global macroeconomic and political conditions, including acts of terrorism or outbreak of war, hostilities, civil unrest and other political or security disturbances, including the war in Ukraine and the State of Israel's on-going war against Hamas and any escalations of that conflict; the Company's ability to increase product sales and gross margins, and control non-product costs; the Company’s ability to achieve anticipated growth rates, margins and scale and execute its strategy generally; the amount and timing of divestiture, acquisition and integration-related costs; the geographic distribution of where the Company generates its taxable income; new U.S. and foreign government laws and regulations, and changes in existing laws, regulations and enforcement guidance, which affect areas of our operations including, but not limited to, those affecting the health care industry, including the EU Medical Devices Regulation; and the economic, competitive, governmental, technological, and other risk factors and uncertainties identified under the heading “Risk Factors” included in Item 1A of Integra's Annual Report on Form 10-K for the year ended December 31, 2022 and information contained in subsequent filings with the Securities and Exchange Commission. These forward-looking statements are made only as of the date hereof, and the Company undertakes no obligation to update or revise the forward-looking statements, whether as a result of new information, future events, or otherwise. Industry and Market Data This presentation has been prepared by the Company and includes market data and other statistical information from third-party sources. Although the Company believes these third-party sources are reliable as of their respective dates, none of the Company or any of its respective representatives make any representation or warranty with respect to the accuracy of such information. Use of Projections This presentation contains certain financial forecast information including revenues, earnings per share, and return on invested capital. Such financial forecast information constitutes forward-looking information and is for informational purposes only and should not be relied upon as necessarily being indicative of future results. The assumptions and estimates underlying such financial forecast information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties. Actual results may differ materially from the results contemplated by the financial forecast information contained in this presentation, and inclusion of such information in this presentation should not be regarded as a representation by any person that the results reflected in such forecasts will be achieved. The Company’s independent auditors have not audited, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this presentation, and, accordingly, they have not expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this presentation.

International Portfolio and Channel Higher Revenue Growth, Higher Margin Growth Breadth/Depth in Care Pathway Adjacencies S T R AT E G I C F I LT E R S F I N A N C I A L F I LT E R S Accretive to Growth and/or Earnings ≥10% ROIC by Year 5 TBD Strategic and Accretive Approach to M&A Acclarent acquisition provides a unique opportunity to build scale and capture a leadership position in the complementary ENT device segment while delivering value to shareholders 3

Acquisition Overview & Strategic Rationale Strategic Rationale Acclarent Business Description 2022 revenue ~$110 million, HSD Growth; gross margin in line with company average; U.S. sales only • Pioneered balloon sinus dilation to treat patients suffering from chronic sinus disease; developed first dilation system to address persistent eustachian tube dysfunction; leadership position in each category • Developed advanced surgical navigation platform for sinus and skull base surgery, including electromagnetic instrument tracking; robust R&D capabilities in hardware/software design, digital/AI applications development • US-based direct sales force with deep clinical knowledge, strong KOL relationships, professional education focus • Primary headquarters in Irvine, CA. R&D in Irvine, CA and in Haifa, Israel. Outsourced product manufacturing Key Deal Terms Purchase price $275M at closing and an additional $5 million upon the achievement of certain regulatory milestones Adj. EPS expected to be neutral in 2024; accretive in the first full year (2025) ROIC to exceed 10% by year 5 (2028) • Acquisition structured as a stock purchase agreement • Subject to the satisfaction of customary conditions; transaction expected to close by the second quarter of 2024 • Transition Service Agreement and Transition Manufacturing Agreement for up to 4 years ENT specialty device category is a natural adjacency for CSS • Attractive category; >$1B U.S. opportunity, 5-6% CAGR1 • Anatomical adjacency to neurosurgery, including access to brain tumors through skull base approaches • Opportunity to accelerate Integra’s current MicroFrance® ENT instruments (~$20M US, MSD CAGR2), with a focused channel Enables Integra to successfully access the ENT device segment with immediate relevant scale and accretive growth • Expanded footprint enables Integra to reach all ENT sites of care (hospital, ASC, office/clinic) via direct ENT sales channel • Enables internal development of ENT products using Integra technology and follow-on M&A 1Triangulated from third-party and internal reports 42MSD CAGR 2019-2023E 4

5 1 MAYFIELD is a registered trademark of SM USA, Inc. and is used by Integra under license; ENT: Ear, Nose, and Throat Transformative leader in Neuro -access, -surgery, -monitoring Leading provider of specialty instruments solutions DuraGen®/DuraSeal® | CUSA® | MAYFIELD1 | Certas® Plus BACTISEAL® | CereLink® | ISOCOOL® | Integra® Duo | MicroFrance® Codman Specialty Surgical Outcomes leader in complex wound reconstruction Leading innovator in surgical/breast reconstruction Tissue Technologies Support Segments and Private Label Regenerative Technologies Integra Dermal Matrices | NeuraGen® | NeuraWrap™ PriMatrix® | MicroMatrix® UBM | SurgiMend® Macroporous TCC-EZ® Total Contact Cast System Announcing the acquisition of the Acclarent ENT business to be integrated into Integra’s Codman Specialty Surgical division Integra Overview (NASDAQ: IART) Restoring Patient Lives through Technologies that Transform Surgical, Neurologic & Regenerative Care

HAWK 6 Codman Specialty Surgical Overview Acclarent acquisition propels Integra to a leadership position in ENT 3% – 5% Market CAGR INSTRUMENTS Neuro and Specialty Instrumentation 2% – 3% Market CAGR Expansion to >$6B TAM1 • 3% – 5% Market CAGR • >$1B Revenue2 $0.2B2 Jarit® • Surgical Lighting Systems Dural Access & Repair $0.3B2 DuraGen Dural Graft DuraSeal Dural Sealant Hydrocephalus $0.2B2 Certas Plus Programmable Valves • BACTISEAL® Catheters Neuro Monitoring $0.1B2 CereLink ICP Monitor and Sensors Advanced Energy $0.2B2 CUSA Tissue Ablation Aurora® Surgiscope ENT $0.1B3 TruDi® • RELIEVA SPINPLUS® NAV • Acclarent AERA®•MicroFrance® NEUROSURGERY and ENT Brain Lesion Surgery with MIS Expansion Traumatic Brain Injury (TBI) Hydrocephalus ENT Note: Market size and growth from third party market reports and internal estimates; 1 TAM for ENT is US only; 2 TTM revenue as of 9/30/23; 3TTM revenue as of 12/31/22; MIS: Minimally Invasive Surgery; ICP: Intracranial Pressure

7 ENT is a natural & complementary adjacency to Neurosurgery & Instruments Entering a higher growth segment where focused innovation and channels win NEURO- SURGERY INSTRUMENTSENT • Highly specialized market where focus wins • Disease states driven by patient demographics and advancements in diagnostics and imaging • Surgeons influence buying decisions • Stable market with consistent demand • Portfolio breadth including specialty instruments enables scale and drives broad customer relationships • Focused segment with high degree of specialization and surgeon preference • Disease states with high prevalence and unmet clinical needs • Neurosurgery & ENT anatomically adjacent in skull base procedures • Expands R&D capabilities, fuels innovation • Pull-through of existing Integra MicroFrance ENT instrumentation portfolio KEY ADJACENCIES

8 1Triangulated from third-party and internal reports, numbers may not add up due to rounding 2 2022-2025 ENT Market growth CAGR 3 Other segments include Energy, RF, Cryoablation, Endoscopy / Video, and Nasal Stents Note: HSD = High single digit growth; MSD = Mid-single-digit growth; LSD = Low single-digit growth Attractive ENT market Disease states with high prevalence and unmet clinical needs (e.g. chronic rhinosinusitis, nasal airway obstruction, eustachian tube dysfunction, and skull base tumors) Focused category with high degree of specialization and surgeon preference Increasing adoption of navigation technologies and shift towards minimally invasive, navigated procedures Continued expansion of new indications and payor coverage Why Integra & Acclarent will win in ENT Strong brand equity from creating the ENT balloon category Heritage in sinus balloon technology with strong innovation pipeline and expanding clinical areas such as eustachian tube Expansion within higher growth segments such as navigation and navigated instruments with differentiated product offering Best-in-class ENT sales channel – expands footprint into outpatient, ASC, and office sites of care Pull-through of existing MicroFrance ENT offerings Synergistic R&D and portfolio capabilities to fuel innovation US 2022 $1B Market Size and MSD CAGR Immediate relevant scale in attractive and complementary ENT market Acclarent is positioned to accelerate penetration in higher growth segments $0.2 LSD Sinus Balloons $0.1 MSD Eustachian Tube & Airway Balloons $0.3 MSD Shavers & Drills $0.2 HSD Navigation Systems $0.1 MSD Instruments $0.4 Other Segments3 ~$1.1B1 5-6%2 Expanding Presence MSD / HSD Growth, Current Share <5% Acclarent Legacy Leadership Position Higher Growth Segments

Differentiated recent NPIs and complete suite of navigation products Positioned for continued portfolio expansion in higher growth segments 9 TruDi® Navigation System is designed to provide consistent accuracy, a simple workflow, and advanced software functionality.1,2 1. ACCLARENT® ENT Navigation System Instructions for Use. UG-2000-00 02A 11.2018. 2. Acclarent, Inc. IOM005058 Rev. B, 02/12/2019 Fast Anatomical Mapping (FAM) Real-time imaging tool that documents surgical changes to the anatomy TruSeg™ TruDi® uses artificial intelligence to apply automatic segmentation to pre-defined anatomical structures TruPath™ Calculates and presents the shortest, valid path between 2 points specified by the physician TruDi® enables the use of a full suite of differentiated, navigated disposables for sinus and skull base surgical procedures (balloons, shavers, and other instruments) RELIEVA SPINPLUS® NAV Balloon Sinuplasty System Disposable Patient Tracker TruDi® Shaver Blade TruDi® Probe Navigation Instrument

Building upon heritage and leading position in balloon technology Driving category growth by creating new standards of care; supported by clinical evidence and expanding market access 10 The Acclarent AERA® Eustachian Tube Dilation (ETD) System is the first device specifically designed to dilate the Eustachian tube for patients with persistent tube dysfunction Clinical evidence demonstrating safety and efficacy and expanding market access Acclarent AERA® is backed by a prospective, multicenter, randomized clinical trial to demonstrate:1 1. Poe D, Anand V, Dean M, et al. (2017). Balloon dilation of the Eustachian tube for dilatory dysfunction: A randomized controlled trial.Laryngoscope. Sep 20. doi: 10.1002/lary.26827.Laryngoscope. Sep 20. doi: 10.1002/lary.26827.2010;120(7):1411-1416 99.7% technical success in dilating the Eustachian tube 51.8% vs. 13.9% higher rate of tympanogram normalization compared to control subjects treated with medical management alone 56.1% vs. 8.5% improvement in the quality-of-life measure from the Eustachian Tube Dysfunction Questionnaire (ETDQ-7) A) Balloon Catheter Insertion B) Balloon Inflation Eustachian Tube Balloon Dilation

Strong business foundation to support sustainable growth 11 Expanding Portfolio & Strong Innovation Pipeline TruDi enhancements: including augmented reality and AI capabilities New products to invigorate core platforms such as navigated accessories AREA® Eustachian Tube – potential for indication expansion Advanced Innovation Capabilities & Culture Established R&D capabilities spanning core technologies and advancing digital solutions Strong culture and history of breakthrough innovation Established Commercial Footprint & Presence Proficient and complementary sales channel Strong brand equity and category leadership Fueling Organic & Inorganic Opportunities Scale enables future opportunities to extend and complement ENT market presence and/or supplement portfolio with differentiated technologies

Acclarent acquisition propels Integra to a leadership position in ENT & Neurosurgery ENT provides a natural and complementary adjacency to Neurosurgery 12 1 Highly complementary with neuro commercial, portfolio and R&D capabilities • Anatomical adjacency to neurosurgery, including access to brain tumors with skull base approaches • Foundational commercial capabilities and scale for future organic and inorganic growth • Pull-through of existing Integra MicroFrance ENT portfolio • Expands R&D capabilities to fuel innovation across CSS technology platforms 2 Attractive growth and value profile • Adds $1B to CSS TAM growing MSD • HSD sales CAGR and accretive to LRP growth rate • 2022 revenue ~$110M; gross margin in line with company average • Transaction expected to be neutral to adj. EPS in 2024; accretive to adj. EPS in 2025; ROIC > 10% by Year 5 • Close expected by the second quarter of 2024 3 Enables Integra’s CSS division to effectively address the attractive ENT device segment with established commercial scale, strong brand recognition, differentiated portfolio, and robust innovation pipeline

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

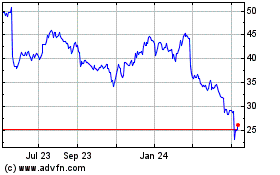

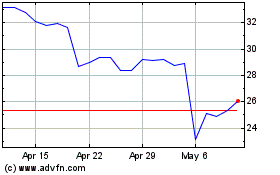

Integra LifeSciences (NASDAQ:IART)

Historical Stock Chart

From Apr 2024 to May 2024

Integra LifeSciences (NASDAQ:IART)

Historical Stock Chart

From May 2023 to May 2024