1/18/20240000776901false00007769012024-01-182024-01-180000776901dei:MailingAddressMember2024-01-182024-01-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report Pursuant to Section 13 or 15 (d) of

The Securities and Exchange Act of 1934

DATE OF REPORT:

January 18, 2024

(Date of Earliest Event Reported)

Massachusetts

(State or Other Jurisdiction of Incorporation)

| | | | | | | | |

| 1-9047 | | 04-2870273 |

| (Commission File Number) | | (I.R.S. Employer identification No.) |

| | | | | | | | | | | | | | |

| INDEPENDENT BANK CORP. |

| Office Address: | 2036 Washington Street, | Hanover, | Massachusetts | 02339 |

| Mailing Address: | 288 Union Street, | Rockland, | Massachusetts | 02370 |

| (Address of principal executive offices, including zip code) |

NOT APPLICABLE

(Former Address of Principal Executive Offices)

(781)-878-6100

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each Class | Trading Symbol | Name of each exchange on which registered |

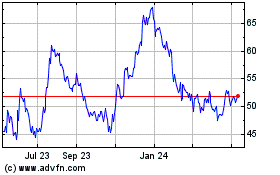

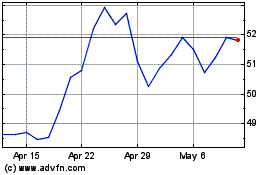

| Common Stock, $.01 par value per share | INDB | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act (17CFR 230.405)) or Rule 12b-2 of the Exchange Act (17CFR 240.12b-2).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

| | | | | |

| ITEM 2.02 | RESULTS OF OPERATIONS AND FINANCIAL CONDITION |

On January 18, 2024, Independent Bank Corp. (the "Company") announced by press release its earnings for the quarter ended December 31, 2023. A copy of the press release is attached hereto as Exhibit 99.1.

The information in this Item 2.02 (including Exhibit 99.1) is being furnished pursuant to Item 2.02 and shall not be deemed to be "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section.

| | | | | |

| ITEM 7.01 | REGULATION FD DISCLOSURE |

The Company is furnishing presentation materials to be discussed during its earnings conference call which are included as Exhibit 99.2 to this report pursuant to Item 7.01.

The information in this Item 7.01 (including Exhibit 99.2) shall not be deemed to be "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section.

| | | | | |

ITEM 9.01 | FINANCIAL STATEMENTS AND EXHIBITS |

d. The following exhibits are included with this Report:

| | | | | |

| Exhibit Index | |

| |

| Exhibit # | Exhibit Description |

| 99.1 | |

| 99.2 | |

| 101 | The instance document does not appear in the interactive data file because its XBRL tags are embedded within the inline XBRL document |

| 104 | Cover page interactive data file (formatted as inline XBRL and contained in Exhibit 101) |

SIGNATURE

Pursuant to the requirements of the Securities and Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned and hereunto duly authorized.

| | | | | | | | | | | |

| | | INDEPENDENT BANK CORP. |

| | | |

| Date: | January 18, 2024 | By: | /s/Mark J. Ruggiero |

| | | MARK J. RUGGIERO |

| | | CHIEF FINANCIAL OFFICER |

Exhibit 99.1

Shareholder Relations NEWS RELEASE

288 Union Street

Rockland, Ma. 02370

INDEPENDENT BANK CORP. REPORTS FOURTH QUARTER NET INCOME OF $54.8 MILLION

Completes solid performance in 2023

Rockland, Massachusetts (January 18, 2024) - Independent Bank Corp. (Nasdaq Global Select Market: INDB), parent of Rockland Trust Company, today announced 2023 fourth quarter net income of $54.8 million, or $1.26 per diluted share, a decrease of $6.0 million, or 9.9%, compared to the prior quarter. Full year net income was $239.5 million, or $5.42 on a diluted earnings per share basis, a decrease of $24.3 million, or 9.2%, as compared to the prior year. In 2023, full year operating net income was also $239.5 million, or $5.42 on a diluted earnings per share basis, as no adjustments were recognized. In 2022, full year operating net income was $268.9 million, or $5.80 on a diluted earnings per share basis, which excluded non-core adjustments associated with the Company's fourth quarter 2021 acquisition of Meridian Bancorp, Inc. ("Meridian") and its subsidiary, East Boston Savings Bank. Please refer to "Reconciliation of Net Income (GAAP) to Operating Net Income (Non-GAAP)" below for a reconciliation of net income to operating net income.

The Company generated a return on average assets and a return on average common equity of 1.13% and 7.51%, respectively, for the fourth quarter of 2023, as compared to 1.25% and 8.35%, respectively, for the prior quarter. For the full year 2023, the Company generated a return on average assets and return on average common equity of 1.24% and 8.31%, respectively, as compared to 1.33% and 9.05%, respectively, for 2022, or 1.24% and 8.31%, respectively, on an operating basis for 2023, compared to 1.35% and 9.22%, respectively, on an operating basis for 2022.

“The dedication of my colleagues and their unrelenting focus on each relationship, day in and day out, paved the way for the solid financial results we achieved throughout this past year,” said Jeffrey Tengel, the Chief Executive Officer of Independent Bank Corp. and Rockland Trust Company. “I am confident that our core fundamentals position us well for continued success heading into 2024 and beyond.”

BALANCE SHEET

Total assets of $19.3 billion at December 31, 2023 remained relatively consistent with the prior quarter and increased by $53.2 million, or 0.3%, as compared to December 31, 2022.

Total loans at December 31, 2023 of $14.3 billion increased by $53.8 million, or 0.4% (1.5% annualized), compared to the prior quarter level. The increase was driven primarily by consumer real estate, which increased $88.7 million, or 2.6% (10.3% annualized) for the quarter, largely attributable to adjustable-rate residential mortgages retained on the balance sheet. Total commercial loans decreased by $37.0 million, or 0.3% (1.4% annualized), compared to the prior quarter, primarily reflecting disciplined new origination activity, offset by commercial and industrial payoffs and decreased line utilization. The small business portfolio continued its steady growth and has risen by 15.0% since December 31, 2022.

Deposit balances of $14.9 billion at December 31, 2023 decreased by $194.0 million, or 1.3%, from September 30, 2023, driven primarily by seasonal business cash flows. Though some level of product remixing persists, total noninterest bearing demand deposits comprised a healthy 30.7% of total deposits at December 31, 2023. Core deposits, inclusive of reciprocal money market deposits, represented 84.6% of total deposits at December 31, 2023 as compared to 86.0% at September 30, 2023. The total cost of deposits for the fourth quarter increased 24 basis points to 1.31% compared to the prior quarter, reflective of ongoing customer preference for higher yielding accounts.

In conjunction with the decline in deposit balances, the Company's Federal Home Loan Bank borrowings increased by $218.0 million, or 21.8%, during the fourth quarter of 2023 to serve as a funding source for stock buyback activity and net loan growth during the quarter.

The securities portfolio decreased by $43.1 million, or 1.4%, compared to September 30, 2023, driven primarily by paydowns, calls, and maturities which were partially offset by unrealized gains of $45.2 million in the available for sale portfolio. Total securities represented 15.1% of total assets at December 31, 2023, as compared to 15.4% at September 30, 2023.

During the fourth quarter of 2023, the Company executed on its previously announced $100 million stock repurchase plan, buying back 1.3 million shares of common stock for $69.0 million at an average price per share of $53.73. Stockholders' equity at December 31, 2023 remained generally consistent when compared to September 30, 2023, as the impact of the share repurchase program was offset by strong earnings retention and unrealized gains on the available for sale investment securities portfolio included in other comprehensive income. The Company's ratio of common equity to assets of 14.96% at December 31, 2023 represented an increase of 6 basis points, or 0.4%, from September 30, 2023 and was consistent with the level at December 31, 2022. The Company's book value per share increased by $2.16, or 3.3%, to $67.53 at December 31, 2023 as compared to the prior quarter. The Company's tangible book value per share at December 31, 2023 rose by $1.53, or 3.6%, from the prior quarter to $44.13, and represented an increase of 7.3% from the year ago period. The Company's ratio of tangible common equity to tangible assets of 10.31% at December 31, 2023 represented an increase of 7 basis points from the prior quarter and an increase of 5 basis points from the year ago period. Please refer to Appendix A for a detailed reconciliation of Non-GAAP balance sheet metrics.

NET INTEREST INCOME

Net interest income for the fourth quarter of 2023 decreased 3.2% to $145.1 million compared to $149.9 million for the prior quarter, as rising deposit costs continued to counter the benefit of repriced assets resulting in a reduction in net interest margin of 9 basis points to 3.38% for the quarter. The core margin (excluding purchase accounting and other non-core items) was 3.35% for the fourth quarter, representing a reduction of 12 basis points as compared to the prior quarter. Please refer to Appendix C for additional details regarding the net interest margin and Non-GAAP reconciliation of core margin.

NONINTEREST INCOME

Noninterest income of $32.1 million for the fourth quarter of 2023 represented a decrease of $1.5 million, or 4.4%, as compared to the prior quarter. Significant changes in noninterest income for the fourth quarter of 2023 compared to the prior quarter included the following:

•Investment management income decreased by $428,000, or 4.2%, primarily driven by lower insurance commissions. However, total assets under administration increased by $417.4 million, or 6.8%, to a record level of $6.5 billion at December 31, 2023, driving higher managed fee income quarter over quarter.

•The Company received proceeds on life insurance policies resulting in gains of $180,000 for the fourth quarter, as compared to gains of $1.9 million in the prior quarter.

•Other noninterest income increased by $738,000, or 10.4%, primarily due to unrealized gains on equity securities and discounted purchases of tax credits, as well as outsized loan fees recognized during the third quarter of 2023.

NONINTEREST EXPENSE

Noninterest expense of $100.7 million for the fourth quarter of 2023 represented an increase of $3.0 million, or 3.0%, as compared to the prior quarter. Significant changes in noninterest expense for the fourth quarter compared to the prior quarter included the following:

•Salaries and employee benefits increased by $1.6 million, or 2.9%, due primarily to timing of incentive compensation.

•Occupancy and equipment expenses increased by $733,000, or 5.9%, due primarily to one-time termination costs associated with two leased locations related to the 2021 Meridian acquisition.

•FDIC assessment increased $1.2 million, or 44.6%, from the prior quarter, and includes a one-time $1.1 million special assessment implemented by the FDIC to recover losses incurred by the Deposit Insurance Fund in 2023.

•Other noninterest expense decreased by $593,000, or 2.3%, due primarily to decreases in consultant fees, unrealized losses on equity securities, and card issuance costs, partially offset by increases in check fraud losses, software maintenance and legal costs.

The Company’s tax rate for the fourth quarter of 2023 decreased to 22.72%, compared to 24.12% for the prior quarter. The fourth quarter decline was due to the recognition of discrete items in the quarter associated with low income housing tax investments and the release of certain tax reserves in conjunction with the final 2022 tax return filing.

ASSET QUALITY

The fourth quarter provision for credit losses was consistent with the prior quarter at $5.5 million. Net charge-offs declined to $3.8 million for the fourth quarter of 2023 compared to $5.6 million in the prior quarter and were largely attributable to one partial charge-off of a commercial real estate loan and general overdraft loan charge-offs. Nonperforming loans increased to $54.4 million, or 0.38% of total loans at December 31, 2023, as compared to $39.2 million, or 0.28% of total loans at September 30, 2023, driven primarily by the migration of two commercial loans totaling $25.9 million, offset by paydowns during the quarter. Delinquency as a percentage of total loans increased 22 basis points from the prior quarter to 0.44% at December 31, 2023.

The allowance for credit losses on total loans increased slightly to $142.2 million at December 31, 2023 compared to $140.6 million at September 30, 2023, or 1.00% and 0.99% of total loans, at December 31, 2023 and September 30, 2023, respectively.

CONFERENCE CALL INFORMATION

Jeffrey Tengel, Chief Executive Officer, and Mark Ruggiero, Chief Financial Officer and Executive Vice President of Consumer Lending, will host a conference call to discuss fourth quarter earnings at 10:00 a.m. Eastern Time on Friday, January 19, 2024. Internet access to the call is available on the Company’s website at https://INDB.RocklandTrust.com or via telephonic access by dial-in at 1-888-336-7153 reference: INDB. A replay of the call will be available by calling 1-877-344-7529, Replay Conference Number: 9516407 and will be available through January 26, 2024. Additionally, a webcast replay will be available on the Company's website until January 19, 2025.

ABOUT INDEPENDENT BANK CORP.

Independent Bank Corp. (NASDAQ Global Select Market: INDB) is the holding company for Rockland Trust Company, a full-service commercial bank headquartered in Massachusetts. With retail branches in Eastern Massachusetts and Worcester County as well as commercial banking and investment management offices in Massachusetts and Rhode Island, Rockland Trust offers a wide range of banking, investment, and insurance services to individuals, families, and businesses. The Bank also offers a full suite of mobile, online, and telephone banking services. Rockland Trust was named to The Boston Globe's "Top Places to Work" 2023 list, an honor earned for the 15th consecutive year. Rockland Trust has a longstanding commitment to equity and inclusion. This commitment is underscored by initiatives such as Diversity and Inclusion leadership training, a colleague Allyship mentoring program, and numerous Employee Resource Groups focused on providing colleague support and education, reinforcing a culture of mutual respect and advancing professional development, and Rockland Trust's sponsorship of diverse community organizations through charitable giving and employee-based volunteerism. In addition, Rockland Trust is deeply committed to the communities it serves, as reflected in the overall "Outstanding" rating in its most recent Community Reinvestment Act performance evaluation. Rockland Trust is an FDIC member and an Equal Housing Lender.

This press release contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to the financial condition, results of operations and business of the Company. These statements may be identified by such forward-looking terminology as “expect,” “achieve,” “plan,” “believe,” “future,” “positioned,” “continued,” “will,” “would,” “potential,” or similar statements or variations of such terms. Actual results may differ from those contemplated by these forward-looking statements.

Factors that may cause actual results to differ materially from those contemplated by such forward-looking statements include, but are not limited to:

•further weakening in the United States economy in general and the regional and local economies within the New England region and the Company’s market area;

•the effects to the Company or its customers of inflationary pressures, labor market shortages and supply chain issues;

•the instability or volatility in financial markets and unfavorable general economic or business conditions, globally, nationally or regionally, whether caused by geopolitical concerns, including the Russia/Ukraine conflict, the conflict in Israel and surrounding areas and the possible expansion of such conflicts, recent disruptions in the banking industry, or other factors, and the potential impact of unfavorable economic conditions on the Company and its customers, including the potential for decreases in deposits and loan demand, unanticipated loan delinquencies, loss of collateral and decreased service revenues;

•unanticipated loan delinquencies, loss of collateral, decreased service revenues, and other potential negative effects on our business caused by severe weather, pandemics or other external events;

•adverse changes or volatility in the local real estate market;

•rising interest rates and any resultant adverse changes in asset quality, increased credit risks, decreased loan demand, and/or refinancing challenges, which in turn could further lead to unanticipated credit deterioration in the Company's loan portfolio, including with respect to one or more large commercial relationships;

•acquisitions may not produce results at levels or within time frames originally anticipated and may result in unforeseen integration issues or impairment of goodwill and/or other intangibles;

•additional regulatory oversight and related compliance costs;

•changes in trade, monetary and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System;

•higher than expected tax expense, including as a result of failure to comply with general tax laws and changes in tax laws;

•changes in market interest rates for interest earning assets and/or interest bearing liabilities;

•increased competition in the Company’s market areas, including competition that could impact deposit gathering, retention of deposits and the cost of deposits, increased competition due to the demand for innovative products and service offerings, and competition from non-depository institutions which may be subject to fewer regulatory constraints and lower cost structures;

•adverse weather, changes in climate, natural disasters, including the risk of floods and fire; the emergence of widespread health emergencies or pandemics, any further resurgences or variants of the "COVID-19 virus", actions

taken by governmental authorities in response thereto, other public health crises or man-made events, and their impact on the Company's local economies or the Company's operations;

•a deterioration in the conditions of the securities markets;

•a deterioration of the credit rating for U.S. long-term sovereign debt or uncertainties surrounding the federal budget;

•inability to adapt to changes in information technology, including changes to industry accepted delivery models driven by a migration to the internet as a means of service delivery;

•electronic or other fraudulent activity within the financial services industry, especially in the commercial banking sector;

•adverse changes in consumer spending and savings habits;

•the effect of laws and regulations regarding the financial services industry, including the need to invest in technology to meet heightened regulatory expectations or introduction of new requirements or expectations resulting in increased costs of compliance or required adjustments to strategy;

•changes in laws and regulations (including laws and regulations concerning taxes, banking, securities and insurance) generally applicable to the Company’s business, including any such changes in laws and regulations as a result of recent disruptions in the banking industry, and the associated costs of such changes;

•the Company's potential judgments, claims, damages, penalties, fines and reputational damage resulting from pending or future litigation and regulatory and government actions;

•changes in accounting policies, practices and standards, as may be adopted by the regulatory agencies as well as the Public Company Accounting Oversight Board, the Financial Accounting Standards Board, and other accounting standard setters;

•operational risks related to cyber threats, attacks, intrusions, and fraud which could lead to interruptions or disruptions of the Company's operating systems, including systems that are customer facing, and adversely impact the Company's business; and

•other unexpected material adverse changes in the Company's operations or earnings.

The Company wishes to caution readers not to place undue reliance on any forward-looking statements as the Company’s business and its forward-looking statements involve substantial known and unknown risks and uncertainties described in the Company’s Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q ("Risk Factors"). Except as required by law, the Company disclaims any intent or obligation to update publicly any such forward-looking statements, whether in response to new information, future events or otherwise. Any public statements or disclosures by the Company following this release which modify or impact any of the forward-looking statements contained in this release will be deemed to modify or supersede such statements in this release. In addition to the information set forth in this press release, you should carefully consider the Risk Factors.

This press release and the appendices attached to it contain financial information determined by methods other than in accordance with accounting principles generally accepted in the United States of America ("GAAP"). This information may include operating net income and operating earnings per share ("EPS"), operating return on average assets, operating return on average common equity, operating return on average tangible common equity, core net interest margin ("core margin"), tangible book value per share and the tangible common equity ratio.

Operating net income, operating EPS, operating return on average assets and operating return on average common equity, exclude items that management believes are unrelated to the Company's core banking business such as merger and acquisition expenses, and other items, if applicable. Management uses operating net income and related ratios and operating EPS to measure the strength of the Company’s core banking business and to identify trends that may to some extent be obscured by such items. Management reviews its core margin to determine any items that may impact the net interest margin that may be one-time in nature or not reflective of its core operating environment, such as significant purchase accounting adjustments or other adjustments such as nonaccrual interest reversals/recoveries and prepayment penalties. Management believes that adjusting for these items to arrive at a core margin provides additional insight into the operating environment and how management decisions impact the net interest margin.

Management also supplements its evaluation of financial performance with analysis of tangible book value per share (which is computed by dividing stockholders' equity less goodwill and identifiable intangible assets, or "tangible common equity", by common shares outstanding), the tangible common equity ratio (which is computed by dividing tangible common equity by "tangible assets", defined as total assets less goodwill and other

intangibles), and return on average tangible common equity (which is computed by dividing net income by average tangible common equity). The Company has included information on tangible book value per share, the tangible common equity ratio and return on average tangible common equity because management believes that investors may find it useful to have access to the same analytical tools used by management. As a result of merger and acquisition activity, the Company has recognized goodwill and other intangible assets in conjunction with business combination accounting principles. Excluding the impact of goodwill and other intangibles in measuring asset and capital values for the ratios provided, along with other bank standard capital ratios, provides a framework to compare the capital adequacy of the Company to other companies in the financial services industry.

These non-GAAP measures should not be viewed as a substitute for operating results and other financial measures determined in accordance with GAAP. An item which management excludes when computing these non-GAAP measures can be of substantial importance to the Company’s results for any particular quarter or year. The Company’s non-GAAP performance measures, including operating net income, operating EPS, operating return on average assets, operating return on average common equity, core margin, tangible book value per share and the tangible common equity ratio, are not necessarily comparable to non-GAAP performance measures which may be presented by other companies.

Contacts:

Jeffrey Tengel

President and Chief Executive Officer

(781) 982-6144

Mark J. Ruggiero

Chief Financial Officer and

Executive Vice President of Consumer Lending

(781) 982-6281

Category: Earnings Releases

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| INDEPENDENT BANK CORP. FINANCIAL SUMMARY | | | | | | |

| CONSOLIDATED BALANCE SHEETS | | | | |

| (Unaudited, dollars in thousands) | | | | | | | % Change | | % Change |

| December 31

2023 | | September 30

2023 | | December 31

2022 | | Dec 2023 vs. | | Dec 2023 vs. |

| | | | Sept 2023 | | Dec 2022 |

| Assets | | | | | | | | | |

| Cash and due from banks | $ | 178,861 | | | $ | 176,930 | | | $ | 175,843 | | | 1.09 | % | | 1.72 | % |

| Interest-earning deposits with banks | 45,469 | | | 43,198 | | | 177,090 | | | 5.26 | % | | (74.32) | % |

| Securities | | | | | | | | | |

| Trading | 4,987 | | | 4,476 | | | 3,888 | | | 11.42 | % | | 28.27 | % |

| Equities | 22,510 | | | 21,475 | | | 21,119 | | | 4.82 | % | | 6.59 | % |

| Available for sale | 1,334,256 | | | 1,353,744 | | | 1,399,154 | | | (1.44) | % | | (4.64) | % |

| Held to maturity | 1,569,107 | | | 1,594,279 | | | 1,705,120 | | | (1.58) | % | | (7.98) | % |

| Total securities | 2,930,860 | | | 2,973,974 | | | 3,129,281 | | | (1.45) | % | | (6.34) | % |

| Loans held for sale | 6,368 | | | 3,998 | | | 2,803 | | | 59.28 | % | | 127.19 | % |

| Loans | | | | | | | | | |

| Commercial and industrial | 1,579,986 | | | 1,653,003 | | | 1,635,103 | | | (4.42) | % | | (3.37) | % |

| Commercial real estate | 8,041,508 | | | 7,896,230 | | | 7,760,230 | | | 1.84 | % | | 3.62 | % |

| Commercial construction | 849,586 | | | 965,442 | | | 1,154,413 | | | (12.00) | % | | (26.41) | % |

| Small business | 251,956 | | | 245,335 | | | 219,102 | | | 2.70 | % | | 14.99 | % |

| Total commercial | 10,723,036 | | | 10,760,010 | | | 10,768,848 | | | (0.34) | % | | (0.43) | % |

| Residential real estate | 2,424,754 | | | 2,338,102 | | | 2,035,524 | | | 3.71 | % | | 19.12 | % |

| Home equity - first position | 518,706 | | | 529,938 | | | 566,166 | | | (2.12) | % | | (8.38) | % |

| Home equity - subordinate positions | 578,920 | | | 565,617 | | | 522,584 | | | 2.35 | % | | 10.78 | % |

| Total consumer real estate | 3,522,380 | | | 3,433,657 | | | 3,124,274 | | | 2.58 | % | | 12.74 | % |

| Other consumer | 32,654 | | | 30,568 | | | 35,553 | | | 6.82 | % | | (8.15) | % |

| Total loans | 14,278,070 | | | 14,224,235 | | | 13,928,675 | | | 0.38 | % | | 2.51 | % |

| Less: allowance for credit losses | (142,222) | | | (140,569) | | | (152,419) | | | 1.18 | % | | (6.69) | % |

| Net loans | 14,135,848 | | | 14,083,666 | | | 13,776,256 | | | 0.37 | % | | 2.61 | % |

| Federal Home Loan Bank stock | 43,557 | | | 43,878 | | | 5,218 | | | (0.73) | % | | 734.75 | % |

| Bank premises and equipment, net | 193,049 | | | 191,560 | | | 196,504 | | | 0.78 | % | | (1.76) | % |

| Goodwill | 985,072 | | | 985,072 | | | 985,072 | | | — | % | | — | % |

| Other intangible assets | 18,190 | | | 19,825 | | | 25,068 | | | (8.25) | % | | (27.44) | % |

| Cash surrender value of life insurance policies | 297,387 | | | 295,670 | | | 293,323 | | | 0.58 | % | | 1.39 | % |

| | | | | | | | | |

| Other assets | 512,712 | | | 550,338 | | | 527,716 | | | (6.84) | % | | (2.84) | % |

| Total assets | $ | 19,347,373 | | | $ | 19,368,109 | | | $ | 19,294,174 | | | (0.11) | % | | 0.28 | % |

| Liabilities and Stockholders' Equity | | | | | | | | | |

| Deposits | | | | | | | | | |

| Noninterest-bearing demand deposits | $ | 4,567,083 | | | $ | 4,796,148 | | | $ | 5,441,584 | | | (4.78) | % | | (16.07) | % |

| Savings and interest checking accounts | 5,298,913 | | | 5,398,322 | | | 5,898,009 | | | (1.84) | % | | (10.16) | % |

| Money market | 2,818,072 | | | 2,852,293 | | | 3,343,673 | | | (1.20) | % | | (15.72) | % |

| Time certificates of deposit | 2,181,479 | | | 2,012,763 | | | 1,195,741 | | | 8.38 | % | | 82.44 | % |

| Total deposits | 14,865,547 | | | 15,059,526 | | | 15,879,007 | | | (1.29) | % | | (6.38) | % |

| Borrowings | | | | | | | | | |

| Federal Home Loan Bank borrowings | 1,105,541 | | | 887,548 | | | 637 | | | 24.56 | % | | nm |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Junior subordinated debentures, net | 62,858 | | | 62,857 | | | 62,855 | | | — | % | | — | % |

| Subordinated debentures, net | 49,980 | | | 49,957 | | | 49,885 | | | 0.05 | % | | 0.19 | % |

| Total borrowings | 1,218,379 | | | 1,000,362 | | | 113,377 | | | 21.79 | % | | 974.63 | % |

| Total deposits and borrowings | 16,083,926 | | | 16,059,888 | | | 15,992,384 | | | 0.15 | % | | 0.57 | % |

| Other liabilities | 368,196 | | | 422,813 | | | 415,089 | | | (12.92) | % | | (11.30) | % |

| Total liabilities | 16,452,122 | | | 16,482,701 | | | 16,407,473 | | | (0.19) | % | | 0.27 | % |

| Stockholders' equity | | | | | | | | | |

| Common stock | 427 | | | 440 | | | 455 | | | (2.95) | % | | (6.15) | % |

| Additional paid in capital | 1,932,163 | | | 1,999,448 | | | 2,114,888 | | | (3.37) | % | | (8.64) | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Retained earnings | 1,077,488 | | | 1,046,266 | | | 934,442 | | | 2.98 | % | | 15.31 | % |

| Accumulated other comprehensive loss, net of tax | (114,827) | | | (160,746) | | | (163,084) | | | (28.57) | % | | (29.59) | % |

| Total stockholders' equity | 2,895,251 | | | 2,885,408 | | | 2,886,701 | | | 0.34 | % | | 0.30 | % |

| Total liabilities and stockholders' equity | $ | 19,347,373 | | | $ | 19,368,109 | | | $ | 19,294,174 | | | (0.11) | % | | 0.28 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| CONSOLIDATED STATEMENTS OF INCOME | | | | | |

| (Unaudited, dollars in thousands, except per share data) | | | | | |

| Three Months Ended | | | | |

| | | | | | | % Change | | % Change |

| December 31

2023 | | September 30

2023 | | December 31

2022 | | Dec 2023 vs. | | Dec 2023 vs. |

| | | | Sept 2023 | | Dec 2022 |

| Interest income | | | | | | | | | |

| Interest on federal funds sold and short-term investments | $ | 304 | | | $ | 905 | | | $ | 4,163 | | | (66.41) | % | | (92.70) | % |

| Interest and dividends on securities | 14,631 | | | 14,818 | | | 15,789 | | | (1.26) | % | | (7.33) | % |

| Interest and fees on loans | 192,178 | | | 187,145 | | | 164,153 | | | 2.69 | % | | 17.07 | % |

| Interest on loans held for sale | 57 | | | 60 | | | 22 | | | (5.00) | % | | 159.09 | % |

| Total interest income | 207,170 | | | 202,928 | | | 184,127 | | | 2.09 | % | | 12.51 | % |

| Interest expense | | | | | | | | | |

| Interest on deposits | 49,456 | | | 40,713 | | | 14,325 | | | 21.47 | % | | 245.24 | % |

| Interest on borrowings | 12,618 | | | 12,335 | | | 1,447 | | | 2.29 | % | | 772.01 | % |

| Total interest expense | 62,074 | | | 53,048 | | | 15,772 | | | 17.01 | % | | 293.57 | % |

| Net interest income | 145,096 | | | 149,880 | | | 168,355 | | | (3.19) | % | | (13.82) | % |

| Provision for credit losses | 5,500 | | | 5,500 | | | 5,500 | | | — | % | | — | % |

| Net interest income after provision for credit losses | 139,596 | | | 144,380 | | | 162,855 | | | (3.31) | % | | (14.28) | % |

| Noninterest income | | | | | | | | | |

| Deposit account fees | 6,126 | | | 5,936 | | | 5,788 | | | 3.20 | % | | 5.84 | % |

| Interchange and ATM fees | 4,638 | | | 4,808 | | | 4,282 | | | (3.54) | % | | 8.31 | % |

| Investment management | 9,818 | | | 10,246 | | | 10,394 | | | (4.18) | % | | (5.54) | % |

| Mortgage banking income | 609 | | | 739 | | | 526 | | | (17.59) | % | | 15.78 | % |

| Increase in cash surrender value of life insurance policies | 2,091 | | | 1,983 | | | 2,136 | | | 5.45 | % | | (2.11) | % |

| Gain on life insurance benefits | 180 | | | 1,924 | | | 691 | | | (90.64) | % | | (73.95) | % |

| | | | | | | | | |

| | | | | | | | | |

| Loan level derivative income | 802 | | | 842 | | | 1,421 | | | (4.75) | % | | (43.56) | % |

| Other noninterest income | 7,803 | | | 7,065 | | | 7,064 | | | 10.45 | % | | 10.46 | % |

| Total noninterest income | 32,067 | | | 33,543 | | | 32,302 | | | (4.40) | % | | (0.73) | % |

| Noninterest expenses | | | | | | | | | |

| Salaries and employee benefits | 56,388 | | | 54,797 | | | 53,754 | | | 2.90 | % | | 4.90 | % |

| Occupancy and equipment expenses | 13,054 | | | 12,321 | | | 12,586 | | | 5.95 | % | | 3.72 | % |

| Data processing and facilities management | 2,423 | | | 2,404 | | | 2,442 | | | 0.79 | % | | (0.78) | % |

| FDIC assessment | 3,942 | | | 2,727 | | | 1,726 | | | 44.55 | % | | 128.39 | % |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Other noninterest expenses | 24,940 | | | 25,533 | | | 24,364 | | | (2.32) | % | | 2.36 | % |

| Total noninterest expenses | 100,747 | | | 97,782 | | | 94,872 | | | 3.03 | % | | 6.19 | % |

| Income before income taxes | 70,916 | | | 80,141 | | | 100,285 | | | (11.51) | % | | (29.29) | % |

| Provision for income taxes | 16,113 | | | 19,333 | | | 23,242 | | | (16.66) | % | | (30.67) | % |

| Net Income | $ | 54,803 | | | $ | 60,808 | | | $ | 77,043 | | | (9.88) | % | | (28.87) | % |

| | | | | | | | | |

| Weighted average common shares (basic) | 43,474,734 | | | 44,135,487 | | | 45,641,605 | | | | | |

| Common share equivalents | 9,474 | | | 11,417 | | | 20,090 | | | | | |

| Weighted average common shares (diluted) | 43,484,208 | | | 44,146,904 | | | 45,661,695 | | | | | |

| | | | | | | | | |

| Basic earnings per share | $ | 1.26 | | | $ | 1.38 | | | $ | 1.69 | | | (8.70) | % | | (25.44) | % |

| Diluted earnings per share | $ | 1.26 | | | $ | 1.38 | | | $ | 1.69 | | | (8.70) | % | | (25.44) | % |

| | | | | | | | | |

| | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

|

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Performance ratios | | | | | | | | | |

| Net interest margin (FTE) | 3.38 | % | | 3.47 | % | | 3.85 | % | | | | |

| Return on average assets (calculated by dividing net income by average assets) | 1.13 | % | | 1.25 | % | | 1.56 | % | | | | |

| | | | | | | | | |

| Return on average common equity (calculated by dividing net income by average common equity) (GAAP) | 7.51 | % | | 8.35 | % | | 10.70 | % | | | | |

| | | | | | | | | |

| Return on average tangible common equity (Non-GAAP) (calculated by dividing net income by average tangible common equity) | 11.50 | % | | 12.81 | % | | 16.57 | % | | | | |

| | | | | | | | | |

| Noninterest income as a % of total revenue (calculated by dividing total noninterest income by net interest income plus total noninterest income) | 18.10 | % | | 18.29 | % | | 16.10 | % | | | | |

| | | | | | | | | |

| Efficiency ratio (calculated by dividing total noninterest expense by total revenue) | 56.87 | % | | 53.31 | % | | 47.28 | % | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| CONSOLIDATED STATEMENTS OF INCOME | | | | | |

| (Unaudited, dollars in thousands, except per share data) | | | | |

| | Years Ended | | |

| | | | | | % Change |

| | December 31

2023 | | December 31

2022 | | Dec 2023 vs. |

| | | | Dec 2022 |

| | | | | | |

| Interest income | | | | | | |

| Interest on federal funds sold and short-term investments | | $ | 5,186 | | | $ | 14,385 | | | (63.95) | % |

| Interest and dividends on securities | | 60,342 | | | 50,360 | | | 19.82 | % |

| Interest and fees on loans | | 730,008 | | | 577,923 | | | 26.32 | % |

| Interest on loans held for sale | | 190 | | | 172 | | | 10.47 | % |

| Total interest income | | 795,726 | | | 642,840 | | | 23.78 | % |

| Interest expense | | | | | | |

| Interest on deposits | | 144,752 | | | 24,652 | | | 487.18 | % |

| Interest on borrowings | | 44,453 | | | 4,939 | | | 800.04 | % |

| Total interest expense | | 189,205 | | | 29,591 | | | 539.40 | % |

| Net interest income | | 606,521 | | | 613,249 | | | (1.10) | % |

| Provision for credit losses | | 23,250 | | | 6,500 | | | 257.69 | % |

| Net interest income after provision for credit losses | | 583,271 | | | 606,749 | | | (3.87) | % |

| Noninterest income | | | | | | |

| Deposit account fees | | 23,486 | | | 23,370 | | | 0.50 | % |

| Interchange and ATM fees | | 18,108 | | | 16,249 | | | 11.44 | % |

| Investment management | | 40,191 | | | 36,832 | | | 9.12 | % |

| Mortgage banking income | | 2,326 | | | 3,515 | | | (33.83) | % |

| Increase in cash surrender value of life insurance policies | | 7,868 | | | 7,685 | | | 2.38 | % |

| Gain on life insurance benefits | | 2,291 | | | 1,291 | | | 77.46 | % |

| | | | | | |

| | | | | | |

| Loan level derivative income | | 3,327 | | | 2,932 | | | 13.47 | % |

| Other noninterest income | | 27,012 | | | 22,793 | | | 18.51 | % |

| Total noninterest income | | 124,609 | | | 114,667 | | | 8.67 | % |

| Noninterest expenses | | | | | | |

| Salaries and employee benefits | | 222,135 | | | 204,711 | | | 8.51 | % |

| Occupancy and equipment expenses | | 50,582 | | | 49,841 | | | 1.49 | % |

| Data processing and facilities management | | 9,884 | | | 9,320 | | | 6.05 | % |

| FDIC assessment | | 11,953 | | | 6,951 | | | 71.96 | % |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Merger and acquisition expense | | — | | | 7,100 | | | (100.00) | % |

| Other noninterest expenses | | 98,192 | | | 95,739 | | | 2.56 | % |

| Total noninterest expenses | | 392,746 | | | 373,662 | | | 5.11 | % |

| Income before income taxes | | 315,134 | | | 347,754 | | | (9.38) | % |

| Provision for income taxes | | 75,632 | | | 83,941 | | | (9.90) | % |

| Net Income | | $ | 239,502 | | | $ | 263,813 | | | (9.22) | % |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Weighted average common shares (basic) | | 44,181,540 | | | 46,372,051 | | | |

| Common share equivalents | | 12,007 | | | 17,938 | | | |

| Weighted average common shares (diluted) | | 44,193,547 | | | 46,389,989 | | | |

| | | | | | |

| Basic earnings per share | | $ | 5.42 | | | $ | 5.69 | | | (4.75) | % |

| Diluted earnings per share | | $ | 5.42 | | | $ | 5.69 | | | (4.75) | % |

| | | | | | |

| Reconciliation of Net Income (GAAP) to Operating Net Income (Non-GAAP): | | | | | | |

| Net Income | | $ | 239,502 | | | $ | 263,813 | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Noninterest expense components | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Add - merger and acquisition expenses | | — | | | 7,100 | | | |

| Noncore increases to income before taxes | | — | | | 7,100 | | | |

| Net tax benefit associated with noncore items (1) | | — | | | (1,995) | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Noncore increases to net income | | $ | — | | | $ | 5,105 | | | |

| Operating net income (Non-GAAP) | | $ | 239,502 | | | $ | 268,918 | | | (10.94) | % |

| | | | | | |

| Diluted earnings per share, on an operating basis | | $ | 5.42 | | | $ | 5.80 | | | (6.55) | % |

| | | | | | |

| (1) The net tax benefit associated with noncore items is determined by assessing whether each noncore item is included or excluded from net taxable income and applying the Company's combined marginal tax rate to only those items included in net taxable income. |

| | | | | | |

| Performance ratios | | | | | | |

| Net interest margin (FTE) | | 3.54 | % | | 3.46 | % | | |

| Return on average assets (GAAP) (calculated by dividing net income by average assets) | | 1.24 | % | | 1.33 | % | | |

| Return on average assets on an operating basis (Non-GAAP) (calculated by dividing net operating net income by average assets) | | 1.24 | % | | 1.35 | % | | |

| Return on average common equity (GAAP) (calculated by dividing net income by average common equity) | | 8.31 | % | | 9.05 | % | | |

| Return on average common equity on an operating basis (Non-GAAP) (calculated by dividing net operating net income by average common equity) | | 8.31 | % | | 9.22 | % | | |

| Return on average tangible common equity (GAAP) (calculated by dividing net income by average tangible common equity) | | 12.78 | % | | 13.87 | % | | |

| Return on average tangible common equity on an operating basis (Non-GAAP) (calculated by dividing net operating net income by average tangible common equity) | | 12.78 | % | | 14.14 | % | | |

| Noninterest income as a % of total revenue (calculated by dividing total noninterest income by net interest income plus total noninterest income) | | 17.04 | % | | 15.75 | % | | |

| Noninterest income as a % of total revenue on an operating basis (Non-GAAP) (calculated by dividing total noninterest income on an operating basis by net interest income plus total noninterest income) | | 17.04 | % | | 15.75 | % | | |

| Efficiency ratio (GAAP) (calculated by dividing total noninterest expense by total revenue) | | 53.72 | % | | 51.33 | % | | |

| Efficiency ratio on an operating basis (Non-GAAP) (calculated by dividing total noninterest expense on an operating basis by total revenue) | | 53.72 | % | | 50.36 | % | | |

| | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| ASSET QUALITY | | |

| (Unaudited, dollars in thousands) | | Nonperforming Assets At |

| | December 31

2023 | | September 30

2023 | | December 31

2022 |

| Nonperforming loans | | | | | | |

| Commercial & industrial loans | | $ | 20,188 | | | $ | 2,953 | | | $ | 26,693 | |

| Commercial real estate loans | | 22,952 | | | 23,867 | | | 15,730 | |

| Small business loans | | 398 | | | 372 | | | 104 | |

| Residential real estate loans | | 7,634 | | | 8,493 | | | 8,479 | |

| Home equity | | 3,171 | | | 3,411 | | | 3,400 | |

| Other consumer | | 40 | | | 75 | | | 475 | |

| Total nonperforming loans | | 54,383 | | | 39,171 | | | 54,881 | |

| | | | | | |

| | | | | | |

| Other real estate owned | | 110 | | | 110 | | | — | |

| Total nonperforming assets | | $ | 54,493 | | | $ | 39,281 | | | $ | 54,881 | |

| | | | | | |

| Nonperforming loans/gross loans | | 0.38 | % | | 0.28 | % | | 0.39 | % |

| Nonperforming assets/total assets | | 0.28 | % | | 0.20 | % | | 0.28 | % |

| Allowance for credit losses/nonperforming loans | | 261.52 | % | | 358.86 | % | | 277.73 | % |

| Allowance for credit losses/total loans | | 1.00 | % | | 0.99 | % | | 1.09 | % |

| Delinquent loans/total loans | | 0.44 | % | | 0.22 | % | | 0.30 | % |

| | | | | | |

| | Nonperforming Assets Reconciliation for the Three Months Ended |

| | December 31

2023 | | September 30

2023 | | December 31

2022 |

| | | | | | |

| Nonperforming assets beginning balance | | $ | 39,281 | | | $ | 45,812 | | | $ | 56,017 | |

| New to nonperforming | | 31,823 | | | 3,455 | | | 5,734 | |

| | | | | | |

| Loans charged-off | | (4,182) | | | (6,018) | | | (660) | |

| Loans paid-off | | (10,905) | | | (2,915) | | | (2,448) | |

| | | | | | |

| Loans restored to performing status | | (1,534) | | | (1,428) | | | (3,846) | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Other | | 10 | | | 375 | | | 84 | |

| Nonperforming assets ending balance | | $ | 54,493 | | | $ | 39,281 | | | $ | 54,881 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Net Charge-Offs (Recoveries) |

| | Three Months Ended | | Years Ended |

| | December 31

2023 | | September 30

2023 | | December 31

2022 | | December 31

2023 | | December 31

2022 |

| Net charge-offs (recoveries) | | | | | | | | | | |

| Commercial and industrial loans | | $ | 80 | | | $ | (111) | | | $ | (5) | | | $ | 23,419 | | | $ | (49) | |

| Commercial real estate loans | | 2,783 | | | 5,072 | | | — | | | 7,855 | | | (271) | |

| Small business loans | | 267 | | | 77 | | | 135 | | | 392 | | | 47 | |

| | | | | | | | | | |

| Home equity | | 23 | | | (12) | | | (16) | | | (15) | | | 1 | |

| Other consumer | | 694 | | | 552 | | | 280 | | | 1,796 | | | 1,275 | |

| Total net charge-offs (recoveries) | | $ | 3,847 | | | $ | 5,578 | | | $ | 394 | | | $ | 33,447 | | | $ | 1,003 | |

| | | | | | | | | | |

| Net charge-offs (recoveries) to average loans (annualized) | | 0.11 | % | | 0.16 | % | | 0.01 | % | | 0.24 | % | | 0.01 | % |

nm = not meaningful

| | | | | | | | | | | | | | | | | | | | |

| | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| BALANCE SHEET AND CAPITAL RATIOS | | | | | | |

| | December 31

2023 | | September 30

2023 | | December 31

2022 |

| Gross loans/total deposits | | 96.05 | % | | 94.45 | % | | 87.72 | % |

| Common equity tier 1 capital ratio (1) | | 14.19 | % | | 14.42 | % | | 14.33 | % |

| Tier 1 leverage capital ratio (1) | | 10.97 | % | | 11.12 | % | | 10.99 | % |

| Common equity to assets ratio GAAP | | 14.96 | % | | 14.90 | % | | 14.96 | % |

| Tangible common equity to tangible assets ratio (2) | | 10.31 | % | | 10.24 | % | | 10.26 | % |

| Book value per share GAAP | | $ | 67.53 | | | $ | 65.37 | | | $ | 63.25 | |

| Tangible book value per share (2) | | $ | 44.13 | | | $ | 42.60 | | | $ | 41.12 | |

(1) Estimated number for December 31, 2023.

(2) See Appendix A for detailed reconciliation from GAAP to Non-GAAP ratios.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| INDEPENDENT BANK CORP. SUPPLEMENTAL FINANCIAL INFORMATION |

| | | | | | | | | | | | | | | | | | |

| (Unaudited, dollars in thousands) | | Three Months Ended |

| | December 31, 2023 | | September 30, 2023 | | December 31, 2022 |

| | | | Interest | | | | | Interest | | | | | Interest | | |

| | Average | | Earned/ | Yield/ | | Average | | Earned/ | Yield/ | | Average | | Earned/ | | Yield/ |

| | Balance | | Paid (1) | | Rate | | Balance | | Paid (1) | | Rate | | Balance | | Paid (1) | | Rate |

| Interest-earning assets | | | | | | | | | | | | | | | | | | |

| Interest-earning deposits with banks, federal funds sold, and short term investments | | $ | 42,391 | | | $ | 304 | | | 2.85 | % | | $ | 89,449 | | | $ | 905 | | | 4.01 | % | | $ | 466,691 | | | $ | 4,163 | | | 3.54 | % |

| Securities | | | | | | | | | | | | | | | | | | |

| Securities - trading | | 4,509 | | | — | | | — | % | | 4,546 | | | — | | | — | % | | 3,732 | | | — | | | — | % |

| Securities - taxable investments | | 2,923,983 | | | 14,629 | | | 1.98 | % | | 3,000,736 | | | 14,817 | | | 1.96 | % | | 3,147,635 | | | 15,787 | | | 1.99 | % |

| Securities - nontaxable investments (1) | | 186 | | | 2 | | | 4.27 | % | | 188 | | | 1 | | | 2.11 | % | | 189 | | | 2 | | | 4.20 | % |

| Total securities | | $ | 2,928,678 | | | $ | 14,631 | | | 1.98 | % | | $ | 3,005,470 | | | $ | 14,818 | | | 1.96 | % | | $ | 3,151,556 | | | $ | 15,789 | | | 1.99 | % |

| Loans held for sale | | 3,614 | | | 57 | | | 6.26 | % | | 4,072 | | | 60 | | | 5.85 | % | | 1,607 | | | 22 | | | 5.43 | % |

| Loans | | | | | | | | | | | | | | | | | | |

| Commercial and industrial (1) | | 1,600,886 | | | 28,990 | | | 7.18 | % | | 1,682,000 | | | 30,739 | | | 7.25 | % | | 1,560,885 | | | 23,258 | | | 5.91 | % |

| Commercial real estate (1) | | 7,956,103 | | | 100,331 | | | 5.00 | % | | 7,823,525 | | | 94,861 | | | 4.81 | % | | 7,732,925 | | | 88,508 | | | 4.54 | % |

| Commercial construction | | 895,313 | | | 15,932 | | | 7.06 | % | | 1,007,814 | | | 16,829 | | | 6.62 | % | | 1,223,695 | | | 17,205 | | | 5.58 | % |

| Small business | | 246,411 | | | 3,956 | | | 6.37 | % | | 240,782 | | | 3,752 | | | 6.18 | % | | 213,384 | | | 2,995 | | | 5.57 | % |

| Total commercial | | 10,698,713 | | | 149,209 | | | 5.53 | % | | 10,754,121 | | | 146,181 | | | 5.39 | % | | 10,730,889 | | | 131,966 | | | 4.88 | % |

| Residential real estate | | 2,380,706 | | | 24,712 | | | 4.12 | % | | 2,276,882 | | | 23,197 | | | 4.04 | % | | 2,001,042 | | | 18,334 | | | 3.64 | % |

| Home equity | | 1,097,233 | | | 18,747 | | | 6.78 | % | | 1,093,479 | | | 18,313 | | | 6.64 | % | | 1,088,846 | | | 14,339 | | | 5.22 | % |

| Total consumer real estate | | 3,477,939 | | | 43,459 | | | 4.96 | % | | 3,370,361 | | | 41,510 | | | 4.89 | % | | 3,089,888 | | | 32,673 | | | 4.20 | % |

| Other consumer | | 32,141 | | | 667 | | | 8.23 | % | | 30,775 | | | 608 | | | 7.84 | % | | 34,638 | | | 595 | | | 6.82 | % |

| Total loans | | $ | 14,208,793 | | | $ | 193,335 | | | 5.40 | % | | $ | 14,155,257 | | | $ | 188,299 | | | 5.28 | % | | $ | 13,855,415 | | | $ | 165,234 | | | 4.73 | % |

| Total interest-earning assets | | $ | 17,183,476 | | | $ | 208,327 | | | 4.81 | % | | $ | 17,254,248 | | | $ | 204,082 | | | 4.69 | % | | $ | 17,475,269 | | | $ | 185,208 | | | 4.20 | % |

| Cash and due from banks | | 178,100 | | | | | | | 184,003 | | | | | | | 184,985 | | | | | |

| Federal Home Loan Bank stock | | 37,054 | | | | | | | 38,252 | | | | | | | 5,218 | | | | | |

| Other assets | | 1,883,317 | | | | | | | 1,859,099 | | | | | | | 1,871,241 | | | | | |

| Total assets | | $ | 19,281,947 | | | | | | | $ | 19,335,602 | | | | | | | $ | 19,536,713 | | | | | |

| Interest-bearing liabilities | | | | | | | | | | | | | | | | | | |

| Deposits | | | | | | | | | | | | | | | | | | |

| Savings and interest checking accounts | | $ | 5,323,667 | | | $ | 14,315 | | | 1.07 | % | | $ | 5,393,209 | | | $ | 11,860 | | | 0.87 | % | | $ | 5,966,326 | | | $ | 4,921 | | | 0.33 | % |

| Money market | | 2,851,343 | | | 15,197 | | | 2.11 | % | | 2,945,450 | | | 13,709 | | | 1.85 | % | | 3,408,441 | | | 7,492 | | | 0.87 | % |

| Time deposits | | 2,103,666 | | | 19,944 | | | 3.76 | % | | 1,860,440 | | | 15,144 | | | 3.23 | % | | 1,175,667 | | | 1,912 | | | 0.65 | % |

| Total interest-bearing deposits | | $ | 10,278,676 | | | $ | 49,456 | | | 1.91 | % | | $ | 10,199,099 | | | $ | 40,713 | | | 1.58 | % | | $ | 10,550,434 | | | $ | 14,325 | | | 0.54 | % |

| Borrowings | | | | | | | | | | | | | | | | | | |

| Federal Home Loan Bank borrowings | | 884,441 | | | 10,836 | | | 4.86 | % | | 869,646 | | | 10,568 | | | 4.82 | % | | 639 | | | 2 | | | 1.24 | % |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Junior subordinated debentures | | 62,857 | | | 1,164 | | | 7.35 | % | | 62,857 | | | 1,150 | | | 7.26 | % | | 62,855 | | | 827 | | | 5.22 | % |

| Subordinated debentures | | 49,968 | | | 618 | | | 4.91 | % | | 49,944 | | | 617 | | | 4.90 | % | | 49,873 | | | 618 | | | 4.92 | % |

| Total borrowings | | $ | 997,266 | | | $ | 12,618 | | | 5.02 | % | | $ | 982,447 | | | $ | 12,335 | | | 4.98 | % | | $ | 113,367 | | | $ | 1,447 | | | 5.06 | % |

| Total interest-bearing liabilities | | $ | 11,275,942 | | | $ | 62,074 | | | 2.18 | % | | $ | 11,181,546 | | | $ | 53,048 | | | 1.88 | % | | $ | 10,663,801 | | | $ | 15,772 | | | 0.59 | % |

| Noninterest-bearing demand deposits | | 4,704,888 | | | | | | | 4,883,009 | | | | | | | 5,606,055 | | | | | |

| Other liabilities | | 406,029 | | | | | | | 381,483 | | | | | | | 410,679 | | | | | |

| Total liabilities | | $ | 16,386,859 | | | | | | | $ | 16,446,038 | | | | | | | $ | 16,680,535 | | | | | |

| Stockholders' equity | | 2,895,088 | | | | | | | 2,889,564 | | | | | | | 2,856,178 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total liabilities and stockholders' equity | | $ | 19,281,947 | | | | | | | $ | 19,335,602 | | | | | | | $ | 19,536,713 | | | | | |

| | | | | | | | | | | | | | | | | | |

| Net interest income | | | | $ | 146,253 | | | | | | | $ | 151,034 | | | | | | | $ | 169,436 | | | |

| | | | | | | | | | | | | | | | | | |

| Interest rate spread (2) | | | | | | 2.63 | % | | | | | | 2.81 | % | | | | | | 3.61 | % |

| | | | | | | | | | | | | | | | | | |

| Net interest margin (3) | | | | | | 3.38 | % | | | | | | 3.47 | % | | | | | | 3.85 | % |

| | | | | | | | | | | | | | | | | | |

| Supplemental Information | | | | | | | | | | | | | | | | | | |

| Total deposits, including demand deposits | | $ | 14,983,564 | | | $ | 49,456 | | | | | $ | 15,082,108 | | | $ | 40,713 | | | | | $ | 16,156,489 | | | $ | 14,325 | | | |

| Cost of total deposits | | | | | | 1.31 | % | | | | | | 1.07 | % | | | | | | 0.35 | % |

| Total funding liabilities, including demand deposits | | $ | 15,980,830 | | | $ | 62,074 | | | | | $ | 16,064,555 | | | $ | 53,048 | | | | | $ | 16,269,856 | | | $ | 15,772 | | | |

| Cost of total funding liabilities | | | | | | 1.54 | % | | | | | | 1.31 | % | | | | | | 0.38 | % |

(1) The total amount of adjustment to present interest income and yield on a fully tax-equivalent basis is $1.2 million, $1.2 million, and $1.1 million for the three months ended December 31, 2023, September 30, 2023, and December 31, 2022, respectively, determined by applying the Company's marginal tax rates in effect during each respective quarter.

(2) Interest rate spread represents the difference between weighted average yield on interest-earning assets and the weighted average cost of interest-bearing liabilities.

(3) Net interest margin represents annualized net interest income as a percentage of average interest-earning assets.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Years Ended |

| | December 31, 2023 | | December 31, 2022 |

| | | | Interest | | | | | | Interest | | |

| | Average | | Earned/ | | Yield/ | | Average | | Earned/ | | Yield/ |

| | Balance | | Paid | | Rate | | Balance | | Paid | | Rate |

| Interest-earning assets | | | | | | | | | | | | |

| Interest earning deposits with banks, federal funds sold, and short term investments | | $ | 118,806 | | | $ | 5,186 | | | 4.37 | % | | $ | 1,222,434 | | | $ | 14,385 | | | 1.18 | % |

| Securities | | | | | | | | | | | | |

| Securities - trading | | 4,411 | | | — | | | — | % | | 3,764 | | | — | | | — | % |

| Securities - taxable investments | | 3,027,769 | | | 60,336 | | | 1.99 | % | | 2,948,358 | | | 50,354 | | | 1.71 | % |

| Securities - nontaxable investments (1) | | 190 | | | 7 | | | 3.68 | % | | 196 | | | 7 | | | 3.57 | % |

| Total securities | | $ | 3,032,370 | | | $ | 60,343 | | | 1.99 | % | | $ | 2,952,318 | | | $ | 50,361 | | | 1.71 | % |

| Loans held for sale | | 3,289 | | | 190 | | | 5.78 | % | | 4,774 | | | 172 | | | 3.60 | % |

| Loans | | | | | | | | | | | | |

| Commercial and industrial (1) | | 1,646,939 | | | 115,752 | | | 7.03 | % | | 1,538,848 | | | 77,074 | | | 5.01 | % |

| Commercial real estate (1) | | 7,839,476 | | | 376,586 | | | 4.80 | % | | 7,807,427 | | | 326,593 | | | 4.18 | % |

| Commercial construction | | 1,019,871 | | | 66,440 | | | 6.51 | % | | 1,191,394 | | | 57,804 | | | 4.85 | % |

| Small business | | 235,108 | | | 14,428 | | | 6.14 | % | | 204,982 | | | 10,886 | | | 5.31 | % |

| Total commercial | | 10,741,394 | | | 573,206 | | | 5.34 | % | | 10,742,651 | | | 472,357 | | | 4.40 | % |

| Residential real estate | | 2,217,971 | | | 88,210 | | | 3.98 | % | | 1,831,493 | | | 63,443 | | | 3.46 | % |

| Home equity | | 1,093,546 | | | 70,698 | | | 6.47 | % | | 1,061,228 | | | 44,048 | | | 4.15 | % |

| Total consumer real estate | | 3,311,517 | | | 158,908 | | | 4.80 | % | | 2,892,721 | | | 107,491 | | | 3.72 | % |

| Other consumer | | 31,202 | | | 2,418 | | | 7.75 | % | | 31,986 | | | 2,114 | | | 6.61 | % |

| Total loans | | $ | 14,084,113 | | | $ | 734,532 | | | 5.22 | % | | $ | 13,667,358 | | | $ | 581,962 | | | 4.26 | % |

| Total interest-earning assets | | $ | 17,238,578 | | | $ | 800,251 | | | 4.64 | % | | $ | 17,846,884 | | | $ | 646,880 | | | 3.62 | % |

| Cash and due from banks | | 180,553 | | | | | | | 184,812 | | | | | |

| Federal Home Loan Bank stock | | 33,734 | | | | | | | 7,134 | | | | | |

| Other assets | | 1,853,585 | | | | | | | 1,858,210 | | | | | |

| Total assets | | $ | 19,306,450 | | | | | | | $ | 19,897,040 | | | | | |

| Interest-bearing liabilities | | | | | | | | | | | | |

| Deposits | | | | | | | | | | | | |

| Savings and interest checking accounts | | $ | 5,489,923 | | | $ | 43,073 | | | 0.78 | % | | $ | 6,159,289 | | | $ | 8,339 | | | 0.14 | % |

| Money market | | 3,022,322 | | | 51,630 | | | 1.71 | % | | 3,489,981 | | | 11,683 | | | 0.33 | % |

| Time deposits | | 1,724,625 | | | 50,050 | | | 2.90 | % | | 1,310,442 | | | 4,630 | | | 0.35 | % |

| Total interest-bearing deposits | | $ | 10,236,870 | | | $ | 144,753 | | | 1.41 | % | | $ | 10,959,712 | | | $ | 24,652 | | | 0.22 | % |

| Borrowings | | | | | | | | | | | | |

| Federal Home Loan Bank borrowings | | 782,121 | | | 37,624 | | | 4.81 | % | | 16,138 | | | 313 | | | 1.94 | % |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Long-term borrowings | | — | | | — | | | — | % | | 2,235 | | | 31 | | | 1.39 | % |

| Junior subordinated debentures | | 62,857 | | | 4,359 | | | 6.93 | % | | 62,854 | | | 2,125 | | | 3.38 | % |

| Subordinated debentures | | 49,933 | | | 2,470 | | | 4.95 | % | | 49,837 | | | 2,470 | | | 4.96 | % |

| Total borrowings | | $ | 894,911 | | | $ | 44,453 | | | 4.97 | % | | $ | 131,064 | | | $ | 4,939 | | | 3.77 | % |

| Total interest-bearing liabilities | | $ | 11,131,781 | | | $ | 189,206 | | | 1.70 | % | | $ | 11,090,776 | | | $ | 29,591 | | | 0.27 | % |

| Noninterest-bearing demand deposits | | 4,918,787 | | | | | | | 5,559,997 | | | | | |

| Other liabilities | | 374,585 | | | | | | | 330,371 | | | | | |

| Total liabilities | | $ | 16,425,153 | | | | | | | $ | 16,981,144 | | | | | |

| Stockholders' equity | | 2,881,297 | | | | | | | 2,915,896 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total liabilities and stockholders' equity | | $ | 19,306,450 | | | | | | | $ | 19,897,040 | | | | | |

| | | | | | | | | | | | |

| Net interest income | | | | $ | 611,045 | | | | | | | $ | 617,289 | | | |

| | | | | | | | | | | | |

| Interest rate spread (2) | | | | | | 2.94 | % | | | | | | 3.35 | % |

| | | | | | | | | | | | |

| Net interest margin (3) | | | | | | 3.54 | % | | | | | | 3.46 | % |

| | | | | | | | | | | | |

| Supplemental Information | | | | | | | | | | | | |

| Total deposits, including demand deposits | | $ | 15,155,657 | | | $ | 144,753 | | | | | $ | 16,519,709 | | | $ | 24,652 | | | |

| Cost of total deposits | | | | | | 0.96 | % | | | | | | 0.15 | % |

| Total funding liabilities, including demand deposits | | $ | 16,050,568 | | | $ | 189,206 | | | | | $ | 16,650,773 | | | $ | 29,591 | | | |

| Cost of total funding liabilities | | | | | | 1.18 | % | | | | | | 0.18 | % |

(1) The total amount of adjustment to present interest income and yield on a fully tax-equivalent basis is $4.5 million and $4.0 million for the years ended months ended December 31, 2023 and 2022, respectively.

(2) Interest rate spread represents the difference between weighted average yield on interest-earning assets and the weighted average cost of interest-bearing liabilities.

(3) Net interest margin represents annualized net interest income as a percentage of average interest-earning assets.

Certain amounts in prior year financial statements have been reclassified to conform to the current year's presentation.

APPENDIX A: NON-GAAP Reconciliation of Balance Sheet Metrics

(Unaudited, dollars in thousands, except per share data)

The following table summarizes the calculation of the Company's tangible common equity to tangible assets ratio and tangible book value per share, at the dates indicated:

| | | | | | | | | | | | | | | | | | | | | | | |

| | December 31

2023 | | September 30

2023 | | December 31

2022 | |

| Tangible common equity | | (Dollars in thousands, except per share data) | |

| Stockholders' equity (GAAP) | | $ | 2,895,251 | | | $ | 2,885,408 | | | $ | 2,886,701 | | (a) |

| Less: Goodwill and other intangibles | | 1,003,262 | | | 1,004,897 | | | 1,010,140 | | |

| Tangible common equity (Non-GAAP) | | $ | 1,891,989 | | | $ | 1,880,511 | | | $ | 1,876,561 | | (b) |

| Tangible assets | | | | | | | |

| Assets (GAAP) | | $ | 19,347,373 | | | $ | 19,368,109 | | | $ | 19,294,174 | | (c) |

| Less: Goodwill and other intangibles | | 1,003,262 | | | 1,004,897 | | | 1,010,140 | | |

| Tangible assets (Non-GAAP) | | $ | 18,344,111 | | | $ | 18,363,212 | | | $ | 18,284,034 | | (d) |

| | | | | | | |

| Common Shares | | 42,873,187 | | | 44,141,973 | | | 45,641,238 | | (e) |

| | | | | | | |

| Common equity to assets ratio (GAAP) | | 14.96 | % | | 14.90 | % | | 14.96 | % | (a/c) |

| Tangible common equity to tangible assets ratio (Non-GAAP) | | 10.31 | % | | 10.24 | % | | 10.26 | % | (b/d) |

| Book value per share (GAAP) | | $ | 67.53 | | | $ | 65.37 | | | $ | 63.25 | | (a/e) |

| Tangible book value per share (Non-GAAP) | | $ | 44.13 | | | $ | 42.60 | | | $ | 41.12 | | (b/e) |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

APPENDIX B: Non-GAAP Reconciliation of Earnings Metrics

(Unaudited, dollars in thousands)

The following table summarizes the impact of noncore items on the Company's calculation of noninterest income and noninterest expense, the impact of noncore items on noninterest income as a percentage of total revenue and the efficiency ratio, as well as the average tangible common equity used to calculate return on average tangible common equity and operating return on tangible common equity for the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Years Ended | |

| December 31

2023 | | September 30

2023 | | December 31

2022 | | December 31

2023 | | December 31

2022 | |

| Net interest income (GAAP) | $ | 145,096 | | | $ | 149,880 | | | $ | 168,355 | | | $ | 606,521 | | | $ | 613,249 | | |

| | | | | | | | | | |

| Noninterest income (GAAP) | $ | 32,067 | | | $ | 33,543 | | | $ | 32,302 | | | $ | 124,609 | | | $ | 114,667 | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Noninterest income on an operating basis (Non-GAAP) | $ | 32,067 | | | $ | 33,543 | | | $ | 32,302 | | | $ | 124,609 | | | $ | 114,667 | | |

| | | | | | | | | | |

| Noninterest expense (GAAP) | 100,747 | | | $ | 97,782 | | | $ | 94,872 | | | $ | 392,746 | | | $ | 373,662 | | |

| Less: | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Merger and acquisition expense | — | | | — | | | — | | | — | | | 7,100 | | |

| | | | | | | | | | |

| Noninterest expense on an operating basis (Non-GAAP) | $ | 100,747 | | | $ | 97,782 | | | $ | 94,872 | | | $ | 392,746 | | | $ | 366,562 | | |

| | | | | | | | | | |

| Total revenue (GAAP) | $ | 177,163 | | | $ | 183,423 | | | $ | 200,657 | | | $ | 731,130 | | | $ | 727,916 | | |

| Total operating revenue (Non-GAAP) | $ | 177,163 | | | $ | 183,423 | | | $ | 200,657 | | | $ | 731,130 | | | $ | 727,916 | | |

| | | | | | | | | | |

| Net income (GAAP) | $ | 54,803 | | | $ | 60,808 | | | $ | 77,043 | | | $ | 239,502 | | | $ | 263,813 | | |

| Operating net income (Non-GAAP) (See income statement for reconciliation of GAAP to Non-GAAP) | $ | 54,803 | | | $ | 60,808 | | | $ | 77,043 | | | $ | 239,502 | | | $ | 268,918 | | |

| | | | | | | | | | |

| Average common equity (GAAP) | $ | 2,895,088 | | | $ | 2,889,564 | | | $ | 2,856,178 | | | $ | 2,881,297 | | | $ | 2,915,896 | | |

| Less: Average goodwill and other intangibles | 1,004,081 | | | 1,005,778 | | | 1,011,091 | | | 1,006,658 | | | 1,014,045 | | |

| Tangible average tangible common equity (Non-GAAP) | $ | 1,891,007 | | | $ | 1,883,786 | | | $ | 1,845,087 | | | $ | 1,874,639 | | | $ | 1,901,851 | | |

| | | | | | | | | | |

| Ratios | | | | | | | | | | |

| Noninterest income as a % of total revenue (GAAP) (calculated by dividing total noninterest income by total revenue) | 18.10 | % | | 18.29 | % | | 16.10 | % | | 17.04 | % | | 15.75 | % | |

| Noninterest income as a % of total revenue on an operating basis (Non-GAAP) (calculated by dividing total noninterest income on an operating basis by total revenue) | 18.10 | % | | 18.29 | % | | 16.10 | % | | 17.04 | % | | 15.75 | % | |

| Efficiency ratio (GAAP) (calculated by dividing total noninterest expense by total revenue) | 56.87 | % | | 53.31 | % | | 47.28 | % | | 53.72 | % | | 51.33 | % | |

| Efficiency ratio on an operating basis (Non-GAAP) (calculated by dividing total noninterest expense on an operating basis by total revenue) | 56.87 | % | | 53.31 | % | | 47.28 | % | | 53.72 | % | | 50.36 | % | |

| Return on average tangible common equity (Non-GAAP) (calculated by dividing annualized net income by average tangible common equity) | 11.50 | % | | 12.81 | % | | 16.57 | % | | 12.78 | % | | 13.87 | % | |

| Return on average tangible common equity on an operating basis (Non-GAAP) (calculated by dividing annualized net operating net income by average tangible common equity) | 11.50 | % | | 12.81 | % | | 16.57 | % | | 12.78 | % | | 14.14 | % | |

APPENDIX C: Net Interest Margin Analysis & Non-GAAP Reconciliation of Core Margin

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| December 31, 2023 | | September 30, 2023 |

| Volume | Interest | Margin Impact | | Volume | Interest | Margin Impact |

| (Dollars in thousands) |

| Reported total interest earning assets | $ | 17,183,476 | | $ | 146,253 | | 3.38 | % | | $ | 17,254,248 | | $ | 151,034 | | 3.47 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Acquisition fair value marks: | | | | | | | |

| Loan accretion | | (1,156) | | | | | (330) | | |

| CD amortization | | 11 | | | | | 11 | | |

| | (1,145) | | (0.03) | % | | | (319) | | — | % |

| | | | | | | |

| Nonaccrual interest, net | | 549 | | 0.01 | % | | | 67 | | — | % |

| | | | | | | |

| Other noncore adjustments | (4,913) | | (574) | | (0.01) | % | | (5,448) | | (77) | | — | % |

| | | | | | | |

| Core margin (Non-GAAP) | $ | 17,178,563 | | $ | 145,083 | | 3.35 | % | | $ | 17,248,800 | | $ | 150,705 | | 3.47 | % |

| | | | | | | |

| | | | | | | |

Exhibit 99.2 Independent Bank Corp. (INDB) (parent of Rockland Trust Company) Q4 2023 Earnings Presentation January 19, 2024

2 Company Overview Safe & Sound Customer Centric • Strong balance sheet • Prudent interest rate and liquidity risk management • Significant capital buffer • Diversified, low-cost deposit base • Experienced commercial lender with conservative credit culture • Proven operator and acquiror • Full suite of retail and commercial banking product offerings • Relationship-oriented commercial lending with strong local market knowledge • Exceptional brand awareness and reputations Attractive Market • Top performing MA-based bank with scale and density • Supported by strong economic growth and vitality in key markets served • Depth of market offers opportunities for continued growth Strong, Resilient Franchise; Well Positioned for Growth High Performing • Consistent, strong profitability • Focused on maintaining good margins • Fee income contribution from scalable wealth franchise • Efficient cost structure focused on operating leverage • History of organic capital generation

$ 54.8M Net Income $ 1.26 Diluted EPS 1.13% ROAA 7.51% ROAE 11.50% ROATCE 3 Q4 2023 Financial Highlights • Disciplined loan growth • Seasonal business deposit impact, stable consumer balances • Core NIM at 3.35% • Nonperforming asset increase; minimal charge-offs/ loss exposure • Solid fee income • Expense increase includes non-recurring and timing items • Tangible book value per share growth $1.53 • $69 million of shares repurchased Key Metrics Highlights

4 ($ in millions) Period Ended $ Increase % Increase Deposit Product Type 12/31/2023 9/30/2023 (Decrease) (Decrease) Noninterest-bearing demand deposits $ 4,567 $ 4,796 $ (229) (4.8) % Savings and interest checking deposits 5,299 5,398 (99) (1.8) % Money market deposits 2,818 2,852 (34) (1.2) % Time certificates of deposit 2,182 2,013 169 8.4 % $ 14,866 $ 15,059 $ (193) (1.3) % Average Deposit Balances $ 14,984 $ 15,082 $ (98) (0.6) % Deposit Balances $ in b ill io ns Average Balances and Cost of Deposits $15.5 $15.1 $15.1 $15.0 0.59% 0.85% 1.07% 1.31% Deposits Cost of deposits Q1 2023 Q2 2023 Q3 2023 Q4 2023 $0.0 $5.0 $10.0 $15.0 0.00% 0.50% 1.00% 1.50% Primarily business customer usage

5 Liquidity Additional Borrowing Capacity ($ in millions) Period Ended Off Balance Sheet Liquidity 12/31/2023 9/30/2023 Federal Home Loan Bank ("FHLB") $ 1,578 $ 1,789 Federal Reserve 3,078 3,074 Unpledged securites 1,188 1,188 Lines of credit 85 85 Total borrowing capacity $ 5,929 $ 6,136 Estimated uninsured $ 4,598 $ 4,730 Borrowing capacity / estimated uninsured 129% 130% Estimated uninsured less collateralized deposits $ 3,878 $ 4,030 Borrowing capacity / estimated uninsured less collateralized deposits 153% 152%

6 Securities Portfolio Available for Sale (AFS) Held to Maturity (HTM) Portfolio Composition at December 31, 2023 Book Value Fair Value Unrealized Gain/(Loss) Book Value Fair Value Unrealized Gain/(Loss) ($ in millions) U.S. government agency securities $ 230 $ 207 $ (23) $ 30 $ 29 $ (1) U.S. treasury securities 825 769 (56) 101 92 (9) Agency mortgage-backed securities 314 277 (37) 829 763 (66) Agency collateralized mortgage obligations 36 33 (3) 478 408 (70) Other 55 48 (7) 131 126 (6) Total securities $ 1,460 $ 1,334 $ (126) $ 1,569 $ 1,418 $ (152) Duration of portfolio 3.3 Years 4.8 Years Capital Impact $ % of Tangible Assets ($ in millions) Tangible capital (Non-GAAP) $ 1,892 10.31 % Less: HTM unrealized loss, net of tax (109) Tangible capital adjusted for HTM $ 1,783 9.80 % ($ in m ill io ns ) Projected Cash Flows $373 $349 $593 2024 2025 2026 $0 $500 Securities as a % of Total Assets 16.2% 16.0% 15.6% 15.4% 15.1% 13.2% Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q4 2024 Proforma 12.5% 15.0% 17.5%

7 Loan Balances ($ in millions) Period Ended $ Increase % Increase Loan Category 12/31/2023 9/30/2023 (Decrease) (Decrease) Commercial and industrial $ 1,580 $ 1,653 $ (73) (4.4) % Commercial real estate 8,041 7,896 145 1.8 % Commercial construction 850 965 (115) (11.9) % Small business 252 245 7 2.9 % Total commercial 10,723 10,759 (36) (0.3) % Residential real estate 2,424 2,338 86 3.7 % Home equity - first position 519 530 (11) (2.1) % Home equity - subordinate positions 579 566 13 2.3 % Total consumer real estate 3,522 3,434 88 2.6 % Other consumer 33 31 2 6.5 % Total loans $ 14,278 $ 14,224 $ 54 0.4 %

8 Loan Portfolios 95% CRE & Construction Portfolio $8.9 billion Residential - Related - 34.0% Strip Malls / Retail - 19.5% Mixed Use, Primarily Office - 2.5% Office Buildings - 13.9% Industrial Warehouse - 12.6% Hotels/Motels - 8.1% Healthcare - 2.7% All Other - 6.7% C&I Portfolio $1.6 billion Retail Trade - 22.1% Real Estate/ Rental and Leasing - 15.7% Wholesale Trade - 8.8% Construction - 8.1% Administrative Support/Waste Mgmt/ Remediation Services - 7.4% Manufacturing - 5.8% Finance and Insurance - 5.3% Educational Services - 4.5% All Other (11 Sectors) - 22.3% Consumer Portfolio $3.6 billion Residential real estate - 68.2% Home equity - first position - 14.6% Home equity - subordinate positions - 16.3% Other consumer - 0.9% $8.9 $8.8 $8.9 $8.9 316% 319% 321% 319% CRE NOO CRE/Capital * Q1 2023 Q2 2023 Q3 2023 Q4 2023 $0.0 $2.5 $5.0 $7.5 $10.0 310% 320% 330% 340% 350% * Rockland Trust Bank only; Non-owner occupied commercial real estate divided by total capital. Ratio for Q4 2023 is an estimated number. ($Bil)

9 Focal Point: Non-Owner Occupied CRE Office (inclusive of construction) 95% CRE Office - Total Portfolio ($ in millions) December 31, 2023 September 30, 2023 CRE - Mixed use, primarily office* $ 219 $ 219 CRE - Office: owner occupied 193 200 CRE - Office: non-owner occupied 1,045 1,060 *CRE - Mixed use, primarily office category includes loans with revenues from office space greater than 50%. Focus Point: Non-owner Occupied CRE Office Asset Quality As of 12/31/2023 Criticized Classified Total Avg. Loan Size $ % $ % ($ in millions) Class A $ 481 $ 12.7 $ 75.0 7.2 % $ 38.5 3.7 % Class B/C 441 2.9 10.0 1.0 % 2.4 0.2 % Medical Office 123 4.7 — — % — — % $ 1,045 $ 4.9 $ 85.0 8.2 % $ 40.9 3.9 % Key Portfolio Characteristics • Primarily Massachusetts based • "Barbell" portfolio ◦ Top 20 loans: Avg balance = $25.8M ◦ All others (193 loans): Avg balance = $2.8M Maturity Schedule Review of Top 20 Loans • $516.1M, or 49.4% of portfolio ◦ $55.3M criticized ◦ $18.5M classified • $305.1M in Class A Category • In general, ~80% occupancy • Loans are actively managed - direct communication with borrowers 2024 2025 2026 2027 2028+ Total ($) 12% 20% 8% 13% 47% $1.045B