0001445499false00014454992023-09-282023-09-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 28, 2023

IMPEL PHARMACEUTICALS INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware |

|

001-40353 |

|

26-3058238 |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

201 Elliott Avenue West, Suite 260 Seattle, WA |

98119 |

(Address of principal executive offices) |

(Zip Code) |

(206) 568-1466

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading symbol(s) |

Name of each exchange on which registered |

Common Stock, $0.001 Par Value Per Share |

IMPL |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01 Entry into a Material Definitive Agreement.

Amended Credit Agreement

On October 2, 2023, Impel Pharmaceuticals Inc. (the “Company”) entered into the Third Amendment to Credit Agreement and Guaranty (the “Amended Credit Agreement”) with Oaktree Fund Administration, LLC as administrative agent, and the existing lenders party thereto (collectively, the “Secured Parties”), which amends the Company’s Credit Agreement and Guaranty dated March 17, 2022, as amended on August 21, 2023 and September 5, 2023 (the “Original Agreement”). The Amended Credit Agreement and related agreements described in this Form 8-K were approved by a special committee of independent directors of the Board of Directors (the “Board”).

Pursuant to the Amended Credit Agreement, the requisite lenders waived certain defaults of the Company under the Original Agreement. Under the Amended Credit Agreement, terms of the tranche B term loans funding were modified, and the Company drew an additional $2,500,000 of tranche B term loans, at signing of the Amended Credit Agreement (of which 75% was funded on October 2, 2023 and 25% is expected to be funded by October 5, 2023). The Company continues to have the right to draw up to an additional $10,000,000 in tranche B term loans over the course of 2023, subject to the Company’s achievement of certain strategic milestones, satisfaction of minimum net revenue and product units sold covenants and satisfaction of certain other covenants and conditions as further amended in the Amended Credit Agreement.

The Amended Credit Agreement further provides that the Company shall use best efforts, subject to applicable law and fiduciary duties, to consummate an equity financing prior to October 31, 2023, and that to the extent proceeds from such financing exceed $5,000,000, the Company will apply 50% of such excess proceeds to repay the tranche B term loans.

The Amended Credit Agreement further provides that the Company will, no later than October 16, 2023, appoint one additional independent director (the “Designee”) to the Board, subject to approval by the administrative agent and required lenders, who shall (i) be entitled to reasonable and customary compensation and indemnification arrangements at the expense of the Company and (ii) be available to serve on any committees or subcommittees, including any committees overseeing, coordinating or implementing matters relating to the Company’s capital structure, any restructuring, any equity raise and any sale or business combination transaction. The Amended Credit Agreement further provides that if the Designee is unable or unwilling to serve and ceases to be a director, resigns as a director or is removed as a director, or for any other reason fails to serve or is not serving as a director, the Company agrees to cause the appointment to the Board of a new independent director in substantially the same manner as the Company, the administrative agent and the requisite lenders agreed upon the selection of such Designee.

The foregoing summary of the Amended Credit Agreement does not purport to be complete and is qualified in its entirety by reference to the Amended Credit Agreement, which is attached as Exhibit 10.1, and are incorporated by reference in its entirety.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth in Item 1.01 of this Current Report on Form 8-K with respect to the Amended Credit Agreement is hereby incorporated by reference into this Item 2.03.

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On September 28, 2023, the Company received notice (the “Notice”) from the Listing Qualifications staff of the Nasdaq Stock Market LLC (“Nasdaq”) that, because the closing bid price for the Company’s common stock has fallen below $1.00 per share for 30 consecutive business days, the Company no longer complies with the minimum bid price requirement for continued listing on The Nasdaq Global Market under Nasdaq Listing Rule 5450(a)(1). The Notice has no immediate effect on the listing of the Company’s common stock on the Nasdaq Global Select Market.

Pursuant to Nasdaq Listing Rule 5810(c)(3)(A), the Company has been provided an initial compliance period of 180 calendar days, or until March 26, 2024, to regain compliance with the minimum bid price requirement. To regain compliance, the closing bid price of the Company’s common stock must meet or exceed $1.00 per share for a minimum of 10 consecutive business days prior to March 26, 2024.

If the Company does not regain compliance by March 26, 2024, the Company may be eligible for an additional 180-calendar day grace period if it applies to transfer the listing of its common stock to The Nasdaq Capital Market. To qualify, the Company would be required to meet the continued listing requirement for the market value of its publicly held shares and all other initial listing standards for The Nasdaq Capital Market, with the exception of the minimum bid price requirement, and provide written notice of its intention to cure the minimum bid price deficiency during the second compliance period by effecting a reverse stock split, if necessary. If the Nasdaq staff determines that the Company will not be able to cure the deficiency, or if the Company is otherwise not eligible for such additional compliance period, Nasdaq will provide notice that the Company’s common stock will be subject to delisting. The

2

Company would have the right to appeal a determination to delist its common stock, and the common stock would remain listed on the Nasdaq Global Select Market until the completion of the appeal process.

The Company is considering actions that it may take in response to the Notice in order to regain compliance with the continued listing requirements, but no decision about a response has been made at this time. There can be no assurance that the Company will be able to regain compliance with the minimum bid price requirement or will otherwise be in compliance with other Nasdaq listing criteria.

Item 3.02 Unregistered Sale of Equity Securities.

Pursuant to the Original Agreement, the Company also agreed to issue to the tranche B lenders and certain of their affiliates warrants (each, a “Warrant” and, collectively, the “Warrants”) to purchase, in aggregate of 4,749,800 shares of Common Stock. A total of 1,781,175 Warrants were issued on September 5, 2023, with the remaining 2,968,625 Warrants to be issued on a pro rata basis in connection with each subsequent draw by the Company of the tranche B term loans. In connection with the Company's draw of an additional $2,500,000 of tranche B term loans at signing of the Amended Credit Agreement, 445,293 Warrants were issued by the Company on October 2, 2023 and 148,431 Warrants are expected to be issued by the Company on October 5, 2023.

The terms of the Warrant were previously reported in a Current Report on Form 8-K filed by the Company with the Securities and Exchange Commission on September 7, 2023, and all of such disclosure is incorporated herein by reference.

The Company issued the Warrants and offered the shares of Common Stock underlying the Warrants in reliance on Section 4(a)(2) of the Securities Act of 1933, as amended.

Cautionary Statement Regarding Forward-Looking Statements

This filing contains “forward-looking” statements within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995, including, but not limited to, the Company’s ability to maintain compliance with the Amended Credit

Agreement and access additional funds thereunder, and to maintain listing on Nasdaq. Forward-looking statements can be identified by words such as: “believe,” “may,” “will,” “potentially,” “estimate,” “continue,” “anticipate,” “intend,” “could,” “would,” “project,” “plan,” “expect” or the negative or plural of these words or similar expressions. These statements are subject to numerous risks and uncertainties that could cause actual results and events to differ materially from those anticipated by the forward-looking statements. Important factors that may cause actual results to differ materially from those in the forward-looking statements include, but are not limited to, risk factors described in the Company’s filings with the SEC, the Company’s ability to explore strategic alternatives, and the risk of the initiation of bankruptcy proceedings under Chapter 11 of the U.S. Bankruptcy Code by the Company. The Company disclaims and does not undertake any obligation to update or revise any forward-looking statement in this report, except as required by applicable law or regulation.

3

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

^ The Registrant has omitted schedules and exhibits pursuant to Item 601(b)(2) of Regulation S-K. The Registrant agrees to furnish supplementally a copy of the omitted schedules and exhibits to the SEC upon request.

† The Registrant has omitted portions of the exhibit as permitted under Item 601(b)(10) of Regulation S-K.

4

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

IMPEL PHARMACEUTICALS INC. |

|

|

|

|

|

|

|

Date: October 4, 2023 |

|

|

|

By: |

|

/s/ Adrian Adams |

|

|

|

|

|

|

Adrian Adams |

|

|

|

|

|

|

Chief Executive Officer |

5

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT, MARKED BY [***], HAS BEEN OMITTED BECAUSE IT IS NOT MATERIAL AND IS THE TYPE THAT THE REGISTRANT TREATS AS PRIVATE AND CONFIDENTIAL.

EXHIBIT 10.1

THIRD AMENDMENT TO Credit agreement AND guaranty

This Third Amendment to Credit Agreement and Guaranty (this “Amendment”) is made as of October 2, 2023, by and among IMPEL PHARMACEUTICALS INC., a Delaware corporation, as borrower (“Borrower”), the Lenders party to the Credit Agreement (as defined below) (the “Lenders”), OAKTREE FUND ADMINISTRATION, LLC, in its capacity as administrative agent for the Lenders (the “Administrative Agent”).

WHEREAS, the Borrower, the Administrative Agent and the Lenders party thereto previously entered into that certain Credit Agreement and Guaranty, dated as of March 17, 2022 (including the exhibits and other attachments thereto, as amended by that certain First Amendment, dated as of August 21, 2023, and that certain Second Amendment, dated as of September 5, 2023, the “Existing Credit Agreement”, and as further amended by this Amendment, the “Credit Agreement”);

WHEREAS, the Borrower has advised the Administrative Agent that certain Events of Default have occurred and are continuing under the Existing Credit Agreement due to: (i) the Borrower’s failure to deliver the materials required pursuant to Section 8.01(k) (Financial Statements and Other Information) with respect to the week ending September 15, 2023; (ii) the Borrower’s failure to timely satisfy the milestones on September 22, 2023 pursuant to Section 8.14 (Milestones); and (iii) the Borrower’s failure to comply with Section 10.02 (Minimum Net Revenue and Product Units Sold) for the three-week periods ended on September 15, 2023, September 22, 2023 and September 29, 2023 (the “Specified Defaults”);

WHEREAS, the Borrower has advised the Administrative Agent that the Borrower may fail to comply with Section 10.02 (Minimum Net Revenue and Product Units Sold) for the three-week period ended on October 6, 2023 and has requested that the Majority Lenders waive compliance with Section 10.02 for the three week period ended on October 6, 2023 (the “Additional Waiver”);

WHEREAS, upon an Event of Default the Majority Lenders may instruct the Administrative Agent to take certain remedies upon such Event of Default;

WHEREAS, the Borrower is requesting the Majority Lenders and Administrative Agent to waive the Specified Defaults and grant the Additional Waiver upon the terms and subject to the conditions of this Amendment;

WHEREAS, Majority Lenders and Administrative Agent have agreed to a limited waiver of the Specified Defaults and to grant the Additional Waiver on the terms and conditions set forth herein;

WHEREAS, the Borrower, the Administrative Agent and the Lenders have agreed to amend the Existing Credit Agreement on the terms and subject to the conditions set forth herein.

NOW, THEREFORE, for and in consideration of the above premises and other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged by the parties hereto, each of the Borrower, the Administrative Agent and the Lenders party hereto hereby covenants and agrees as follows:

1.Definitions. Capitalized terms used herein and not otherwise defined herein shall have the meanings assigned to such terms in the Existing Credit Agreement.

2.Amendments. Subject to the satisfaction of the conditions precedent set forth in Section 5 hereof, on the Third Amendment Effective Date the Existing Credit Agreement shall be amended as follows:

(a)Notwithstanding the Specified Defaults, each Lender holding a Tranche B Commitment shall fund its pro rata share of $2,500,000 in principal amount of Tranche B Term Loans in accordance with the Credit Agreement (i) in the case of the Oaktree Lenders, on the Third Amendment Effective Date and (ii) in the case of the other Lenders, on October 4, 2023; provided that notwithstanding anything to the contrary in the Existing Credit Agreement, advance delivery of the Borrowing Notice shall not be required for this $2,500,000 borrowing.

(b)Lenders holding Tranche B Commitments shall fund $2,500,000 in principal amount of Tranche B Term Loans upon satisfaction of the Milestone required to be completed by October 6, 2023 (subject to satisfaction of all other conditions precedent applicable to such borrowing under Section 6.02 of the Credit Agreement); provided that notwithstanding anything to the contrary in the Existing Credit Agreement, advance delivery of the Borrowing Notice shall not be required.

(c)Exhibit M of the Credit Agreement shall be amended and restated in its entirety to read as set forth on Exhibit A of this Amendment.

(d)Section 3.03 of the Existing Credit Agreement shall be amended to add the following sentence at the end of such section:

“Immediately upon receipt by any Obligor of any Prepayment Proceeds, the Borrower shall prepay the Tranche B Term Loans plus the Tranche B Return Shortfall in an amount equal to 100% of such Prepayment Proceeds until the outstanding Tranche B Term Loans and Tranche B Return Shortfall have been paid in full.”

(e)Section 3.04 of the Existing Credit Agreement shall be amended and restated in its entirety as follows:

“Section 3.04 Commitment Termination. The Tranche A Commitment shall terminate automatically without further action upon the making by the Lenders of the Tranche A Term Loans on the Second Amendment Effective Date. The Tranche B Commitment shall be automatically and permanently reduced on a dollar-for-dollar basis by (a) the amount of Tranche B Term Loans made from time to time, and (b) the amount of any Prepayment Proceeds in excess of amounts applied to mandatory prepayments pursuant to Section 3.03(b)(ii).”

2

(f)Section 8.20 of the Existing Credit Agreement shall be amended and restated in its entirety as follows:

“Section 8.20 Equity Financing. Subject to applicable Law and the fiduciary duties of the Borrower’s board of directors, including securities laws and disclosure requirements, the Borrower shall use best efforts to consummate primary equity financings for the sale of common stock on or prior to October 31, 2023, whether through at-the-market offerings, underwritten offerings or otherwise. In the event the Borrower receives aggregate net cash proceeds from one or more such equity financings after the Third Amendment Effective Date that exceed $5,000,000 (such excess proceeds, “Excess Equity Proceeds”), the Borrower shall apply fifty percent (50%) of such Excess Equity Proceeds (such fifty percent of the Excess Equity Proceeds, the “Prepayment Proceeds”) to repay Tranche B Term Loans in accordance with Section 3.03(b)(ii) and, to the extent such Prepayment Proceeds exceed the outstanding Tranche B Term Loans plus Tranche B Return Shortfall, the remaining Tranche B Commitments shall be automatically and permanently reduced on a dollar-for-dollar basis by the amount of such excess. In the event that the Borrower is unable to raise at least $5,000,000 in aggregate net cash proceeds through at-the-market offerings prior to October 31, 2023, or the Borrower and the Majority Lenders mutually agree, acting reasonably and in good faith, that the Borrower will not be able to raise such amount through at-the-market offerings by such time, the Borrower will use its best efforts to engage a financial advisor to assist the Borrower, subject to applicable Law and the fiduciary duties of the Borrower’s board of directors, with an underwritten equity offering or other common equity financing transaction on terms acceptable to the Majority Lenders; provided that the Borrower shall not be required to agree to any such engagement that would require the Borrower to pay material fees to such advisor that are not contingent upon the consummation of a successful equity raise.”

(g)Independent Director. The following new Section 8.21 shall be added to the Existing Credit Agreement:

“8.21 Independent Director. On or prior to October 16, 2023, the Borrower shall cause at least one individual approved by the Administrative Agent and Majority Lenders to be appointed to the board of directors of the Borrower and to remain on the board of directors at all times thereafter (the “Independent Director”). The Independent Director will be entitled to reasonable and customary compensation and indemnification arrangements at the sole expense of the Borrower. The Independent Director shall have the right to serve on all committees or subcommittees, including any committees overseeing, coordinating or implementing matters relating to the Borrower’s capital structure, any restructuring, any equity raise and any sale or business combination transaction. If any Independent Director resigns, is removed or is unable to continue service for any reason, the Borrower shall cause the prompt appointment of a replacement Independent Director acceptable to the Administrative Agent and Majority Lenders.”

3

(h)The following definition shall be inserted alphabetically into Section 1.01 of the Existing Credit Agreement:

““Independent Director” has the meaning set forth in Section 8.21.”

3.Limited Waiver. Effective as of the Third Amendment Effective Date, the Administrative Agent and the Majority Lenders hereby waive the Specified Defaults and grant the Additional Waiver. The waivers set forth in this Section 3 are specific as to content and time and are effective only for the purposes set forth herein and shall be limited precisely as written and shall not be deemed to (a) be a consent to any amendment, waiver or modification of any other term or condition of any Loan Document, (b) otherwise prejudice any right or remedy which the Lenders or Administrative Agent may now have or may have in the future under or in connection with any Loan Document or (c) constitute a waiver of any other current or future default or breach of any other terms in the Credit Agreement or any documents signed by any Obligor in favor of the Administrative Agent and/or the Lenders (including any future breach of the provisions underlying the Specified Defaults), in each case, other than the Additional Waiver.

4.Reaffirmation of Loan Documents. The Borrower, as Grantor under the Security Documents, hereby (i) agrees that each of the Loan Documents is, and shall continue to be, in full force and effect and is hereby in all respects ratified and confirmed on the Third Amendment Effective Date, except that, on and after the Third Amendment Effective Date, each reference to “Credit Agreement”, “this Agreement”, “thereunder”, “thereof” or words of like import shall, unless the context otherwise requires, mean and be a reference to the Existing Credit Agreement as amended by this Amendment and (ii) confirms that the Security Documents and all of the Collateral described therein do, and shall continue to, secure the payment in full and performance of all of the Secured Obligations.

5.Conditions Precedent to Effectiveness. This Amendment shall not be effective unless and until each of the following conditions precedent has been fulfilled to the satisfaction of the Administrative Agent and each of the Lenders party hereto (the date of such fulfillment, the “Third Amendment Effective Date”):

(a)This Amendment shall have been duly executed and delivered to the Administrative Agent by the Borrower and the Lenders, which constitute Majority Lenders;

(b)The conditions set forth in Section 6.02 with respect to the funding of the Tranche B Term Loans on the Third Amendment Effective Date shall have been satisfied (after giving effect to the waiver of the Specified Defaults).

(c)The Administrative Agent shall have received from each Obligor a certificate in form and substance reasonably satisfactory to the Administrative Agent, dated as of the Third Amendment Effective Date, duly executed and delivered by such Person’s Responsible Officer, as to resolutions of each such Person’s Board then in full force and effect authorizing the execution, delivery and performance of this Amendment.

4

6.Representations and Warranties. The Borrower hereby represents and warrants:

(a)The execution, delivery and performance by the Borrower of this Amendment and the documents, instruments and agreements executed in connection herewith (collectively, the “Amendment Documents”), the Borrower’s consummation of the transactions contemplated by the Amendment Documents and performance under the Amendment Documents do not and will not (i) conflict with any of its organizational, constitutional or constituent documents; (ii) contravene, conflict with, constitute a default under or violate any Law except as would not reasonably be expected to have a Material Adverse Effect; (iii) contravene, conflict or violate any applicable order, writ, judgment, injunction, decree, determination or award of any Governmental Authority by which it or any of its property or assets may be bound or affected except as would not reasonably be expected to have a Material Adverse Effect; (iv) require any action by, filing, registration, or qualification with, or approval of, any Governmental Authority (except such approval which has already been obtained and is in full force and effect, or the filing of any UCC financing statement) except where the failure to do so would not reasonably be expected to have a Material Adverse Effect; or (v) constitute a default under or conflict with any Material Agreement that, individually or in the aggregate, could reasonably be expected to result in a Material Adverse Effect.

(b)This Amendment and the other Amendment Documents have been duly authorized, executed and delivered by the Borrower and constitute legal, valid and binding agreements of the Borrower, enforceable in accordance with their terms (subject, as to enforcement, to (x) the effect of applicable bankruptcy, insolvency, examinership or similar laws affecting the enforcement or creditors’ rights and (y) general principles of equity).

(c)The execution, delivery and performance by the Borrower of the Amendment and the other Amendment Documents executed or to be executed by it is in each case within the Borrower’s powers.

(a)In consideration of this Amendment and agreements of the Administrative Agent, and the Lenders contained herein and for other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the Borrower (the “Releasing Party”), on behalf of itself and its successors, assigns and other legal representatives hereby absolutely, unconditionally and irrevocably releases, remises and forever discharges the Administrative Agent and the Lenders and their respective present and former shareholders, affiliates, subsidiaries, divisions, predecessors, directors, officers, attorneys, employees, agents and other representatives, in each case solely in their capacities relative to the Lenders and not in any other capacity such party may have relative to the Releasing Party (the Administrative Agent, each Lender and all such other Persons being hereinafter referred to collectively as the “Releasees” and individually as a “Releasee”), of and from all demands, actions, causes of action, suits, covenants, contracts, controversies, agreements, promises, sums of money, accounts, bills, reckonings,

5

damages and any and all other claims, counterclaims, defenses, rights of set-off, demands and liabilities whatsoever of every name and nature, known or unknown, suspected or unsuspected, both at law and in equity, which the Borrower or any of its successors, assigns or other legal representatives may now or hereafter own, hold, have or claim to have against the Releasees or any of them for, upon, or by reason of any circumstance, action, cause or thing whatsoever which arises at any time on or prior to the Third Amendment Effective Date, for or on account of, or in relation to, or in any way in connection with the Credit Agreement or any of the other Loan Documents or transactions thereunder (any of the foregoing, a “Claim” and collectively, the “Claims”). The Releasing Party expressly acknowledges and agrees, with respect to the Claims, that it waives, to the fullest extent permitted by applicable law, any and all provisions, rights and benefits conferred by any applicable U.S. federal or state law, or any principle of U.S. common law, that would otherwise limit a release or discharge of any unknown Claims pursuant to this Section 7. Furthermore, the Releasing Party hereby absolutely, unconditionally and irrevocably covenants and agrees with and in favor of each Releasee that it will not sue (at law, in equity, in any regulatory proceeding or otherwise) any Releasee on the basis of any Claim released and/or discharged by the Releasing Parties pursuant to this Section 7. The foregoing release, covenant and waivers of this Section 7 shall survive and remain in full force and effect regardless of the consummation of the transactions contemplated hereby, the repayment or prepayment of any of the Loans, or the termination of the Credit Agreement, this Amendment, any other Loan Document or any provision hereof or thereof.

(b)Each Releasing Party understands, acknowledges and agrees that its release set forth above may be pleaded as a full and complete defense and may be used as a basis for an injunction against any action, suit or other proceeding which may be instituted, prosecuted or attempted in breach of the provisions of such release.

(c)Each Releasing Party agrees that no fact, event, circumstance, evidence or transaction which could now be asserted or which may hereafter be discovered shall affect in any manner the final, absolute and unconditional nature of the release set forth above.

8.Fees and Expenses. The Borrower agrees to pay on demand all reasonable and documented out-of-pocket fees, costs and expenses of the Administrative Agent and the Lenders accrued prior to the Third Amendment Effective Date and all reasonable and documented out-of-pocket fees, costs and expenses of the Administrative Agent and the Lenders incurred in connection with the preparation, execution and delivery of (i) this Amendment, (ii) any Amendment Documents, other Loan Documents or other post-closing amendments, agreements, arrangements or documentation and (iii) any other instruments and documents to be delivered hereunder or thereunder, including, without limitation, (x) the fees and reasonable and documented out-of-pocket expenses of Sullivan & Cromwell LLP, as outside counsel to Administrative Agent and the Oaktree Lenders, with respect thereto and (y) the fees and reasonable and documented out-of-pocket expenses of Paul, Weiss, as outside counsel to certain other Lenders, with respect thereto; provided that the aggregate amount of such expenses obligated to be paid by the Borrower pursuant to this clause (y) (together with amounts paid previously) shall not exceed $150,000.

6

(a)Except as otherwise expressly provided herein, (i) all provisions of the Credit Agreement and the other Loan Documents remain in full force and effect and (ii) the execution, delivery and effectiveness of this Amendment shall not operate as a waiver of any right, power or remedy of the Administrative Agent or the Lenders, nor constitute a waiver of any provision of the Existing Credit Agreement or any of the Loan Documents. None of the Administrative Agent or any Lender is under any obligation to enter into this Amendment. The entering into of this Amendment by such parties shall not be deemed to limit or hinder any rights of any such party under the Loan Documents, nor shall it be deemed to create or infer a course of dealing between any such party, on the one hand, and the Borrower, on the other hand, with regard to any provision of the Loan Documents.

(b)This Amendment shall constitute a Loan Document.

(c)This Amendment may be executed in several counterparts and by each party on a separate counterpart, each of which when so executed and delivered shall be an original, and all of which together shall constitute one instrument. An executed facsimile or electronic copy of this Amendment shall be effective for all purposes as an original hereof. The words “execution,” “execute”, “signed,” “signature,” and words of like import in or related to any document to be signed in connection with this Amendment and the transactions contemplated hereby (including without limitation assignments, assumptions, amendments, waivers and consents) shall be deemed to include electronic signatures, the electronic matching of assignment terms and contract formations on electronic platforms approved by the Administrative Agent, or the keeping of records in electronic form, each of which shall be of the same legal effect, validity or enforceability as a manually executed signature or the use of a paper-based recordkeeping system, as the case may be, to the extent and as provided for in any applicable law, including the Federal Electronic Signatures in Global and National Commerce Act, the New York State Electronic Signatures and Records Act, or any other similar state laws based on the Uniform Electronic Transactions Act.

(d)This Amendment expresses the entire understanding of the parties with respect to the amendments contemplated hereby. No prior negotiations or discussions shall limit, modify, or otherwise affect the provisions hereof.

(e)This Amendment and the rights and obligations of the parties hereunder shall be governed by, and construed and enforced in accordance with, the law of the State of New York, excluding conflict of laws principles that would cause the application of laws of any other jurisdiction.

(f)Save to the extent expressly provided for in any Loan Document to the contrary, all judicial proceedings (to the extent that the reference requirement of Section 12(g) is not applicable) arising in or under or related to this Amendment may be brought in any state or federal court located in the State of New York. By execution and delivery of this Amendment, each party hereto generally and unconditionally: (a)

7

consents to nonexclusive personal jurisdiction in New York County, State of New York; (b) waives any objection as to jurisdiction or venue in New York County, State of New York; (c) agrees not to assert any defense based on lack of jurisdiction or venue in the aforesaid courts; and (d) irrevocably agrees to be bound by any judgment rendered thereby in connection with this Amendment. Service of process on any party hereto in any action arising out of or relating to this Amendment shall be effective if given in accordance with the requirements for notice set forth in Section 14.02 of the Credit Agreement, and shall be deemed effective and received as set forth in Section 14.02 of the Credit Agreement. Nothing herein shall affect the right to serve process in any other manner permitted by law or shall limit the right of either party to bring proceedings in the courts of any other jurisdiction.

(g)Because disputes arising in connection with complex financial transactions are most quickly and economically resolved by an experienced and expert Person and the parties wish applicable state and federal laws to apply (rather than arbitration rules), the parties desire that their disputes be resolved by a judge applying such applicable laws. EACH OF THE BORROWER, ADMINISTRATIVE AGENT AND LENDER SPECIFICALLY WAIVES ANY RIGHT IT MAY HAVE TO TRIAL BY JURY OF ANY CAUSE OF ACTION, CLAIM, CROSS-CLAIM, COUNTERCLAIM, THIRD PARTY CLAIM OR ANY OTHER CLAIM (COLLECTIVELY, “CLAIMS”) ASSERTED BY THE BORROWER AGAINST ADMINISTRATIVE AGENT, LENDER OR THEIR RESPECTIVE ASSIGNEE OR BY ADMINISTRATIVE AGENT, LENDER OR THEIR RESPECTIVE ASSIGNEE AGAINST THE BORROWER. This waiver extends to all such Claims, including Claims that involve Persons other than Administrative Agent, the Borrower and Lender; Claims that arise out of or are in any way connected to the relationship among the Borrower, Administrative Agent and Lender; and any Claims for damages, breach of contract, tort, specific performance, or any equitable or legal relief of any kind, arising out of this Agreement or any other Loan Document.

(h)This Amendment and its contents shall be subject to the indemnification and severability provisions of the Existing Credit Agreement, mutatis mutandis.

[SIGNATURE PAGES FOLLOW]

8

[Signature Page to Third Amendment]

|

|

|

BORROWER: IMPEL PHARMACEUTICALS INC. |

|

|

|

|

By: |

/s/ Adrian Adams |

|

Name: |

Adrian Adams |

|

Title: |

Chief Executive Officer |

[Signature Page to Third Amendment]

ADMINISTRATIVE AGENT:

OAKTREE FUND ADMINISTRATION, LLC

By: Oaktree Capital Management, L.P. Its: Managing Member

By: /s/ Matthew Stewart Name: Matthew Stewart

Title: Managing Director

By:/s/ Mary Gallegly Name: Mary Gallegly

Title: Managing Director

[Signature Page to Third Amendment]

LENDERS:

OAKTREE-TCDRS STRATEGIC CREDIT, LLC

By: Oaktree Capital Management, L.P.

Its: Manager

By: /s/ Matthew Stewart

Name: Matthew Stewart

Title: Managing Director

By: /s/ Mary Gallegly

Name: Mary Gallegly

Title: Managing Director

Address for Notices:

Oaktree Fund Administration, LLC 333 S. Grand Avenue, 28th Fl.

Los Angeles, CA 90071 Attn: Oaktree Agency

Email: Oaktreeagency@alterdomus.com

With a copy to:

Oaktree Capital Management, L.P. 333 S. Grand Avenue, 28th Fl.

Los Angeles, CA 90071 Attn: Aman Kumar

Email: AmKumar@oaktreecapital.com

With a copy to:

Sullivan & Cromwell LLP 125 Broad Street

New York, NY 10004 Attn: Ari B. Blaut

Email: blauta@sullcrom.com

[Signature Page to Third Amendment]

OAKTREE-FORREST MULTI-STRATEGY, LLC

By: Oaktree Capital Management, L.P.

Its: Manager

By: /s/ Matthew Stewart

Name: Matthew Stewart

Title: Managing Director

By: /s/ Mary Gallegly

Name: Mary Gallegly

Title: Managing Director

Address for Notices:

Oaktree Fund Administration, LLC 333 S. Grand Avenue, 28th Fl.

Los Angeles, CA 90071 Attn: Oaktree Agency

Email: Oaktreeagency@alterdomus.com

With a copy to:

Oaktree Capital Management, L.P. 333 S. Grand Avenue, 28th Fl.

Los Angeles, CA 90071 Attn: Aman Kumar

Email: AmKumar@oaktreecapital.com

With a copy to:

Sullivan & Cromwell LLP 125 Broad Street

New York, NY 10004 Attn: Ari B. Blaut

Email: blauta@sullcrom.com

[Signature Page to Third Amendment]

OAKTREE-TBMR STRATEGIC CREDIT FUND C, LLC

By: Oaktree Capital Management, L.P.

Its: Manager

By: /s/ Matthew Stewart

Name: Matthew Stewart

Title: Managing Director

By: /s/ Mary Gallegly

Name: Mary Gallegly

Title: Managing Director

Address for Notices:

Oaktree Fund Administration, LLC 333 S. Grand Avenue, 28th Fl.

Los Angeles, CA 90071 Attn: Oaktree Agency

Email: Oaktreeagency@alterdomus.com

With a copy to:

Oaktree Capital Management, L.P. 333 S. Grand Avenue, 28th Fl.

Los Angeles, CA 90071 Attn: Aman Kumar

Email: AmKumar@oaktreecapital.com

With a copy to:

Sullivan & Cromwell LLP 125 Broad Street

New York, NY 10004 Attn: Ari B. Blaut

Email: blauta@sullcrom.com

[Signature Page to Third Amendment]

OAKTREE-TBMR STRATEGIC CREDIT FUND F, LLC

By: Oaktree Capital Management, L.P.

Its: Manager

By: /s/ Matthew Stewart

Name: Matthew Stewart

Title: Managing Director

By: /s/ Mary Gallegly

Name: Mary Gallegly

Title: Managing Director

Address for Notices:

Oaktree Fund Administration, LLC 333 S. Grand Avenue, 28th Fl.

Los Angeles, CA 90071 Attn: Oaktree Agency

Email: Oaktreeagency@alterdomus.com

With a copy to:

Oaktree Capital Management, L.P. 333 S. Grand Avenue, 28th Fl.

Los Angeles, CA 90071 Attn: Aman Kumar

Email: AmKumar@oaktreecapital.com

With a copy to:

Sullivan & Cromwell LLP 125 Broad Street

New York, NY 10004 Attn: Ari B. Blaut

Email: blauta@sullcrom.com

[Signature Page to Third Amendment]

OAKTREE-TBMR STRATEGIC CREDIT FUND G, LLC

By: Oaktree Capital Management, L.P.

Its: Manager

By: /s/ Matthew Stewart

Name: Matthew Stewart

Title: Managing Director

By: /s/ Mary Gallegly

Name: Mary Gallegly

Title: Managing Director

Address for Notices:

Oaktree Fund Administration, LLC 333 S. Grand Avenue, 28th Fl.

Los Angeles, CA 90071 Attn: Oaktree Agency

Email: Oaktreeagency@alterdomus.com

With a copy to:

Oaktree Capital Management, L.P. 333 S. Grand Avenue, 28th Fl.

Los Angeles, CA 90071 Attn: Aman Kumar

Email: AmKumar@oaktreecapital.com

With a copy to:

Sullivan & Cromwell LLP 125 Broad Street

New York, NY 10004 Attn: Ari B. Blaut

Email: blauta@sullcrom.com

[Signature Page to Third Amendment]

OAKTREE-TSE 16 STRATEGIC CREDIT, LLC

By: Oaktree Capital Management, L.P.

Its: Manager

By: /s/ Matthew Stewart

Name: Matthew Stewart

Title: Managing Director

By: /s/ Mary Gallegly

Name: Mary Gallegly

Title: Managing Director

Address for Notices:

Oaktree Fund Administration, LLC 333 S. Grand Avenue, 28th Fl.

Los Angeles, CA 90071 Attn: Oaktree Agency

Email: Oaktreeagency@alterdomus.com

With a copy to:

Oaktree Capital Management, L.P. 333 S. Grand Avenue, 28th Fl.

Los Angeles, CA 90071 Attn: Aman Kumar

Email: AmKumar@oaktreecapital.com

With a copy to:

Sullivan & Cromwell LLP 125 Broad Street

New York, NY 10004 Attn: Ari B. Blaut

Email: blauta@sullcrom.com

[Signature Page to Third Amendment]

INPRS STRATEGIC CREDIT HOLDINGS, LLC

By: Oaktree Capital Management, L.P.

Its: Manager

By: /s/ Matthew Stewart

Name: Matthew Stewart

Title: Managing Director

By: /s/ Mary Gallegly

Name: Mary Gallegly

Title: Managing Director

Address for Notices:

Oaktree Fund Administration, LLC 333 S. Grand Avenue, 28th Fl.

Los Angeles, CA 90071 Attn: Oaktree Agency

Email: Oaktreeagency@alterdomus.com

With a copy to:

Oaktree Capital Management, L.P. 333 S. Grand Avenue, 28th Fl.

Los Angeles, CA 90071 Attn: Aman Kumar

Email: AmKumar@oaktreecapital.com

With a copy to:

Sullivan & Cromwell LLP 125 Broad Street

New York, NY 10004 Attn: Ari B. Blaut

Email: blauta@sullcrom.com

[Signature Page to Third Amendment]

OAKTREE GILEAD INVESTMENT FUND AIF (DELAWARE), L.P.

By: Oaktree Fund AIF Series, L.P. – Series T

Its: General Partner

By: Oaktree Fund GP AIF, LLC

Its: Managing Member

By: Oaktree Fund GP III, L.P.

Its: General Partner

By: /s/ Matthew Stewart

Name: Matthew Stewart

Title: Authorized Signatory

By: /s/ Mary Gallegly

Name: Mary Gallegly

Title: Authorized Signatory

Address for Notices:

Oaktree Fund Administration, LLC 333 S. Grand Avenue, 28th Fl.

Los Angeles, CA 90071 Attn: Oaktree Agency

Email: Oaktreeagency@alterdomus.com

With a copy to:

Oaktree Capital Management, L.P. 333 S. Grand Avenue, 28th Fl.

Los Angeles, CA 90071 Attn: Aman Kumar

Email: AmKumar@oaktreecapital.com

With a copy to:

Sullivan & Cromwell LLP 125 Broad Street

New York, NY 10004 Attn: Ari B. Blaut

Email: blauta@sullcrom.com

[Signature Page to Third Amendment]

OAKTREE SPECIALTY LENDING CORPORATION

By: Oaktree Fund Advisors, LLC

Its: Investment Adviser

By: /s/ Matthew Stewart

Name: Matthew Stewart

Title: Managing Director

By: /s/ Mary Gallegly

Name: Mary Gallegly

Title: Managing Director

Address for Notices:

Oaktree Fund Administration, LLC 333 S. Grand Avenue, 28th Fl.

Los Angeles, CA 90071 Attn: Oaktree Agency

Email: Oaktreeagency@alterdomus.com

With a copy to:

Oaktree Capital Management, L.P. 333 S. Grand Avenue, 28th Fl.

Los Angeles, CA 90071 Attn: Aman Kumar

Email: AmKumar@oaktreecapital.com

With a copy to:

Sullivan & Cromwell LLP 125 Broad Street

New York, NY 10004 Attn: Ari B. Blaut

Email: blauta@sullcrom.com

[Signature Page to Third Amendment]

OAKTREE STRATEGIC CREDIT FUND

By: Oaktree Fund Advisors, LLC

Its: Investment Advisor

By: /s/ Matthew Stewart

Name: Matthew Stewart

Title: Managing Director

By: /s/ Mary Gallegly

Name: Mary Gallegly

Title: Managing Director

Address for Notices:

Oaktree Fund Administration, LLC 333 S. Grand Avenue, 28th Fl.

Los Angeles, CA 90071 Attn: Oaktree Agency

Email: Oaktreeagency@alterdomus.com

With a copy to:

Oaktree Capital Management, L.P. 333 S. Grand Avenue, 28th Fl.

Los Angeles, CA 90071 Attn: Aman Kumar

Email: AmKumar@oaktreecapital.com

With a copy to:

Sullivan & Cromwell LLP 125 Broad Street

New York, NY 10004 Attn: Ari B. Blaut

Email: blauta@sullcrom.com

[Signature Page to Third Amendment]

OAKTREE GCP FUND DELAWARE HOLDINGS, L.P.

By: Oaktree Global Credit Plus Fund GP, L.P.

Its: General Partner

By: Oaktree Global Credit Plus Fund GP Ltd.

Its: General Partner

By: Oaktree Capital Management, L.P.

Its: Director

By: /s/ Matthew Stewart

Name: Matthew Stewart

Title: Managing Director

By: /s/ Mary Gallegly

Name: Mary Gallegly

Title: Managing Director

Address for Notices:

Oaktree Fund Administration, LLC 333 S. Grand Avenue, 28th Fl.

Los Angeles, CA 90071 Attn: Oaktree Agency

Email: Oaktreeagency@alterdomus.com

With a copy to:

Oaktree Capital Management, L.P. 333 S. Grand Avenue, 28th Fl.

Los Angeles, CA 90071 Attn: Aman Kumar

Email: AmKumar@oaktreecapital.com

With a copy to:

Sullivan & Cromwell LLP 125 Broad Street

New York, NY 10004 Attn: Ari B. Blaut

Email: blauta@sullcrom.com

[Signature Page to Third Amendment]

OAKTREE DIVERSIFIED INCOME FUND INC.

By: Oaktree Fund Advisors, LLC

Its: Investment Advisor

By: /s/ Matthew Stewart

Name: Matthew Stewart

Title: Managing Director

By: /s/ Mary Gallegly

Name: Mary Gallegly

Title: Managing Director

Address for Notices:

Oaktree Fund Administration, LLC 333 S. Grand Avenue, 28th Fl.

Los Angeles, CA 90071 Attn: Oaktree Agency

Email: Oaktreeagency@alterdomus.com

With a copy to:

Oaktree Capital Management, L.P. 333 S. Grand Avenue, 28th Fl.

Los Angeles, CA 90071 Attn: Aman Kumar

Email: AmKumar@oaktreecapital.com

With a copy to:

Sullivan & Cromwell LLP 125 Broad Street

New York, NY 10004 Attn: Ari B. Blaut

Email: blauta@sullcrom.com

[Signature Page to Third Amendment]

OAKTREE AZ STRATEGIC LENDING FUND, L.P.

By: Oaktree AZ Strategic Lending Fund GP, L.P.

Its: General Partner

By: Oaktree Fund GP IIA, LLC

Its: General Partner

By: Oaktree Fund GP II, L.P.

Its: Managing Member

By: /s/ Matthew Stewart

Name: Matthew Stewart

Title: Authorized Signatory

By: /s/ Mary Gallegly

Name: Mary Gallegly

Title: Authorized Signatory

Address for Notices:

Oaktree Fund Administration, LLC 333 S. Grand Avenue, 28th Fl.

Los Angeles, CA 90071 Attn: Oaktree Agency

Email: Oaktreeagency@alterdomus.com

With a copy to:

Oaktree Capital Management, L.P. 333 S. Grand Avenue, 28th Fl.

Los Angeles, CA 90071 Attn: Aman Kumar

Email: AmKumar@oaktreecapital.com

With a copy to:

Sullivan & Cromwell LLP 125 Broad Street

New York, NY 10004 Attn: Ari B. Blaut

Email: blauta@sullcrom.com

[Signature Page to Third Amendment]

OAKTREE LOAN ACQUISITION FUND, L.P.

By: Oaktree Fund GP IIA, LLC

Its: General Partner

By: Oaktree Fund GP II, L.P.

Its: Managing Member

By: /s/ Matthew Stewart

Name: Matthew Stewart

Title: Authorized Signatory

By: /s/ Mary Gallegly

Name: Mary Gallegly

Title: Authorized Signatory

Address for Notices:

Oaktree Fund Administration, LLC 333 S. Grand Avenue, 28th Fl.

Los Angeles, CA 90071 Attn: Oaktree Agency

Email: Oaktreeagency@alterdomus.com

With a copy to:

Oaktree Capital Management, L.P. 333 S. Grand Avenue, 28th Fl.

Los Angeles, CA 90071 Attn: Aman Kumar

Email: AmKumar@oaktreecapital.com

With a copy to:

Sullivan & Cromwell LLP 125 Broad Street

New York, NY 10004 Attn: Ari B. Blaut

Email: blauta@sullcrom.com

[Signature Page to Third Amendment]

OAKTREE LSL FUND HOLDINGS EURRC S.À R.L.

26A, boulevard Royal L-2449 Luxembourg, Grand Duchy of Luxembourg

R.C.S Luxembourg Number: B269245

By: /s/ Martin Eckel

Name: Martin Eckel

Title: Manager

By: /s/ Flora Verrecchia

Name: Flora Verrecchia

Title: Authorized Signatory

Address for Notices:

Oaktree Fund Administration, LLC 333 S. Grand Avenue, 28th Fl.

Los Angeles, CA 90071 Attn: Oaktree Agency

Email: Oaktreeagency@alterdomus.com

With a copy to:

Oaktree Capital Management, L.P. 333 S. Grand Avenue, 28th Fl.

Los Angeles, CA 90071 Attn: Aman Kumar

Email: AmKumar@oaktreecapital.com

With a copy to:

Sullivan & Cromwell LLP 125 Broad Street

New York, NY 10004 Attn: Ari B. Blaut

Email: blauta@sullcrom.com

[Signature Page to Third Amendment]

OAKTREE LSL FUND DELAWARE HOLDINGS EURRC, L.P.

By: Oaktree Life Sciences Lending Fund GP, L.P.

Its: General Partner

By: Oaktree Life Sciences Lending Fund GP Ltd.

Its: General Partner

By: /s/ Matthew Stewart

Name: Matthew Stewart

Title: Managing Director

By: /s/ Mary Gallegly

Name: Mary Gallegly

Title: Managing Director

Address for Notices:

Oaktree Fund Administration, LLC 333 S. Grand Avenue, 28th Fl.

Los Angeles, CA 90071 Attn: Oaktree Agency

Email: Oaktreeagency@alterdomus.com

With a copy to:

Oaktree Capital Management, L.P. 333 S. Grand Avenue, 28th Fl.

Los Angeles, CA 90071 Attn: Aman Kumar

Email: AmKumar@oaktreecapital.com

With a copy to:

Sullivan & Cromwell LLP 125 Broad Street

New York, NY 10004 Attn: Ari B. Blaut

Email: blauta@sullcrom.com

[Signature Page to Third Amendment]

OAKTREE PRE LIFE SCIENCES FUND, L.P.

By: Oaktree Pre Life Sciences Fund GP, L.P.

Its: General Partner

By: Oaktree Fund GP IIA, LLC

Its: General Partner

By: Oaktree Fund GP II, L.P.

Its: Managing Member

By: /s/ Matthew Stewart

Name: Matthew Stewart

Title: Authorized Signatory

By: /s/ Mary Gallegly

Name: Mary Gallegly

Title: Authorized Signatory

Address for Notices:

Oaktree Fund Administration, LLC 333 S. Grand Avenue, 28th Fl.

Los Angeles, CA 90071 Attn: Oaktree Agency

Email: Oaktreeagency@alterdomus.com

With a copy to:

Oaktree Capital Management, L.P. 333 S. Grand Avenue, 28th Fl.

Los Angeles, CA 90071 Attn: Aman Kumar

Email: AmKumar@oaktreecapital.com

With a copy to:

Sullivan & Cromwell LLP 125 Broad Street

New York, NY 10004 Attn: Ari B. Blaut

Email: blauta@sullcrom.com

[Signature Page to Third Amendment]

KKR HEALTH CARE STRATEGIC GROWTH FUND L.P.

By: KKR Associates HCSG L.P.,

Its: General Partner

By: KKR HCSG GP LLC,

Its: General Partner

By: /s/ Ali Satvat

Name: Ali Satvat

Title: Vice President

Address for Notices:

KKR

2800 Sand Hill Road

Suite 200

Menlo Park, California 94025

Attn: Ali Satvat

Email: Ali.Satvat@kkr.com

With a copy to:

Paul, Weiss, Rifkind Wharton & Garrison LLP

1285 6th Avenue

New York, NY 10019

Attn: Sung Pak

Email: spak@paulweiss.com

[Signature Page to Third Amendment]

KKR HCS GROWTH FUND ESC L.P.

By: KKR HCSG GP LLC,

Its: General Partner

By: /s/ Ali Satvat

Name: Ali Satvat

Title: Vice President

Address for Notices:

KKR

2800 Sand Hill Road

Suite 200

Menlo Park, California 94025

Attn: Ali Satvat

Email: Ali.Satvat@kkr.com

With a copy to:

Paul, Weiss, Rifkind Wharton & Garrison LLP

1285 6th Avenue

New York, NY 10019

Attn: Sung Pak

Email: spak@paulweiss.com

[Signature Page to Third Amendment]

KKR HCS GROWTH FUND SBS L.P.

By: KKR HCSG GP LLC,

Its: General Partner

By: /s/ Ali Satvat

Name: Ali Satvat

Title: Vice President

Address for Notices:

KKR

2800 Sand Hill Road

Suite 200

Menlo Park, California 94025

Attn: Ali Satvat

Email: Ali.Satvat@kkr.com

With a copy to:

Paul, Weiss, Rifkind Wharton & Garrison LLP

1285 6th Avenue

New York, NY 10019

Attn: Sung Pak

Email: spak@paulweiss.com

[Signature Page to Third Amendment]

EXHIBIT A

EXHIBIT M

MILESTONES

|

|

|

Milestone |

Milestone Deadline |

Aggregate Tranche B Availability |

[***] |

[***] |

[***] |

[***] |

[***] |

[***] |

[***] |

[***] |

[***] |

[***] |

[***] |

[***] |

[***] |

[***] |

[***] |

[***] |

[***] |

[***] |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

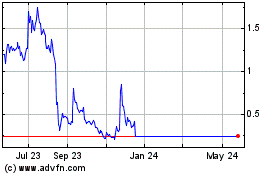

Impel Pharmaceuticals (NASDAQ:IMPL)

Historical Stock Chart

From Apr 2024 to May 2024

Impel Pharmaceuticals (NASDAQ:IMPL)

Historical Stock Chart

From May 2023 to May 2024