Filed Pursuant to Rule 424(b)(5)

Registration No. 333-220395

The information in this preliminary prospectus is not complete and

may be changed. These securities may not be sold until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an

offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion

PRELIMINARY PROSPECTUS SUPPLEMENT DATED SEPTEMBER 8, 2017

TO PROSPECTUS DATED SEPTEMBER 8, 2017

130,434,600 Class B Ordinary Shares, including

Class B Ordinary Shares represented by American Depositary Shares

Grupo Financiero Galicia S.A.

We, Grupo Financiero

Galicia S.A., a

sociedad anónima

organized under the laws of the Republic of Argentina, are offering 130,434,600 Class B ordinary shares, par value Ps.1.00 per share, including Class B ordinary shares represented by American

depositary shares (“ADSs”), each representing 10 of our Class B ordinary shares.

We are offering ADSs and Class B ordinary shares

in a global offering, which consists of an international offering of ADSs in the United States and other countries outside Argentina, a concurrent offering of Class B ordinary shares in Argentina, and an offering of Class B ordinary shares in

Argentina pursuant to preferential rights of our existing shareholders, as described below. The international offering of the ADSs in the United States and other countries outside Argentina is being underwritten by the underwriters named in this

prospectus supplement. In the Argentine offering, Class B ordinary shares are being offered to investors in Argentina through the Argentine placement agent named in this prospectus supplement. The closings of the international offering and the

Argentine offering are conditioned upon each other. This prospectus supplement is not complete without, and may not be utilized except in connection with, the accompanying prospectus, including any amendments or supplements thereto.

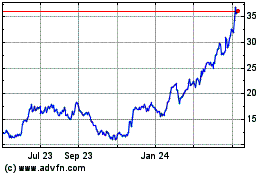

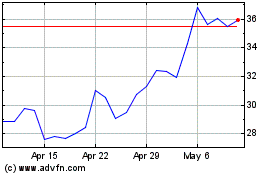

The ADSs are listed on the Nasdaq Capital Market (the “NASDAQ”) under the symbol “GGAL.” On September 7, 2017, the last

reported sale price of the ADSs was US$47.60 per ADS on the NASDAQ. In addition, our Class B ordinary shares are listed on the

Bolsas y Mercados Argentinos S.A.

(the “BYMA”) and on

the Mercado Abierto Electrónico S.A.

(the “MAE”) under the symbol “GGAL.” On September 6, 2017, the last reported sale price of our Class B ordinary shares was Ps.82.05 per share on the BYMA.

Our existing shareholders have preferential rights, including preemptive rights and accretion rights, to subscribe to our capital increase

resulting from the global offering. The preferential subscription period will expire on or about September 26, 2017. The offering pursuant to the preferential rights has not been and will not be registered under the U.S. Securities Act of 1933,

as amended (the “Securities Act”), and, accordingly, the preferential rights may not be offered to our shareholders in the United States and will not be made available to ADS holders. EBA Holding S.A., which owns 100% of our outstanding

Class A shares, representing 21.6% of our capital stock, has transferred its preferential rights to our affiliate Galicia Valores S.A. (“Galicia Valores”) and, in order to facilitate the international offering, Galicia Valores, at the

discretion of the underwriters, will exercise these rights to purchase Class B ordinary shares, including Class B ordinary shares represented by ADSs, to be sold in the international offering. In addition, the underwriters will be able to acquire

from us Class B ordinary shares, if any, including Class B ordinary shares represented by ADSs, relating to preferential rights that are not exercised. See “Underwriting” in this prospectus supplement.

Investing in the ADSs or our Class B ordinary shares involves significant risks. You should carefully read “Item 3.D. Risk

Factors” in our 2016 Form 20-F (as defined below), which is incorporated herein by reference as well as the information set forth under the caption “

Risk Factors

” beginning on page S-17 of this

prospectus supplement, for more information.

|

|

|

|

|

|

|

|

|

|

|

|

|

Per ADS

|

|

|

Total

|

|

|

Public offering price

|

|

US$

|

|

|

|

US$

|

|

|

|

Underwriting discount

(1)

|

|

US$

|

|

|

|

US$

|

|

|

|

Proceeds, before expenses, to us

|

|

US$

|

|

|

|

US$

|

|

|

|

(1)

|

See “Underwriting” in this prospectus supplement.

|

The underwriters may also exercise

their option to purchase up to an additional 19,565,190 Class B ordinary shares, including Class B ordinary shares represented by ADSs, from us, at the public offering price within 30 days after the date of the underwriting agreement. All of our

existing shareholders will have preferential rights with respect to the Class B ordinary shares, including Class B ordinary shares represented by ADSs, offered pursuant to the underwriters’ option to purchase additional Class B ordinary shares,

including Class B ordinary shares represented by ADSs; provided, however, that such preferential rights may not be offered to our shareholders in the United States and are not being made available to ADS holders. New shareholders will not have

preferential rights with respect to the Class B ordinary shares, including Class B ordinary shares represented by ADSs, offered pursuant to the underwriters’ option to purchase additional Class B ordinary shares.

The offering of our Class B ordinary shares in Argentina has been approved by the Argentine securities regulator (

Comisión Nacional de

Valores

, or the “CNV”). Neither the U.S. Securities and Exchange Commission (the “SEC”) nor any state securities regulators have approved or disapproved these securities, or determined if this prospectus supplement or the

accompanying prospectus are truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to

deliver the ADSs against payment in New York, New York on , 2017.

Joint Book-Running

Managers

|

|

|

|

|

BofA Merrill Lynch

|

|

UBS Investment Bank

|

The date of this prospectus supplement is , 2017.

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

S-i

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement is a supplement to the accompanying prospectus. This prospectus supplement and the accompanying prospectus are

parts of a registration statement that we filed with the SEC using a shelf registration process. Under this shelf registration process, we may sell from time to time an unspecified amount of any combination of securities described in the

accompanying prospectus in one or more offers such as this offering. The accompanying prospectus provides you with a general description of the securities we may offer. This prospectus supplement provides you with specific information about the ADSs

and the underlying Class B ordinary shares we are offering in the international offering. Both this prospectus supplement and the accompanying prospectus include important information about us and other information you should know before investing.

Generally, when we refer only to the “prospectus,” we are referring to both parts combined, and when we refer to the “accompanying prospectus” we are referring to the accompanying prospectus.

This prospectus supplement also adds to, updates and changes information contained in the accompanying prospectus. To the extent the

information in this prospectus supplement is different from that in the accompanying prospectus, you should rely on the information in this prospectus supplement. You should read both this prospectus supplement and the accompanying prospectus,

together with the additional information described under the caption “Incorporation of Certain Information by Reference” in this prospectus supplement and the accompanying prospectus, before investing in the ADSs.

GENERAL INFORMATION

Grupo Financiero Galicia S.A. is a financial services holding company incorporated in Argentina as a sociedad anónima (stock

corporation). As used in this prospectus supplement, references to “we,” “our,” “us” and “Grupo Galicia” are to Grupo Financiero Galicia S.A. and its consolidated subsidiaries, except where otherwise noted or

the context otherwise requires. We maintain our financial books and records and publish our financial statements in pesos. In this prospectus supplement, references to “pesos” and “Ps.” are to Argentine pesos, and references to

“U.S. dollars” and “US$” are to United States dollars and references to the “Central Bank” and the “BCRA” are to

Banco Central de la República Argentina

(the Argentine Central Bank).

This prospectus supplement contains conversions of certain peso amounts into U.S. dollars at specified exchange rates solely for the

convenience of the reader. These conversions should not be construed as representations that the peso amounts actually represent such U.S. dollar amounts or could be converted into U.S. dollars at the exchange rate indicated. Unless otherwise

indicated, U.S. dollar amounts that have been converted from pesos have been converted at an exchange rate of Ps.16.5985 per U.S. dollar, the exchange rate in effect on June 30, 2017, as published by the Argentine Central Bank.

The average balances of assets, including the related interest that is due, average shareholder’s equity and average loans, each as

presented in this prospectus supplement are calculated on a daily basis for Banco de Galicia y Buenos Aires S.A., as well as for Tarjetas Regionales S.A. consolidated with its operating subsidiaries, and on a monthly basis for Grupo Galicia and its

non-banking subsidiaries.

We are responsible for the information contained in this prospectus supplement, the accompanying prospectus and

the documents incorporated by reference herein and therein. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We have not authorized any other person to provide you

with different information. We are not making an offer to sell our Class B ordinary shares or ADSs in any jurisdiction where the offer or sale is not permitted. The information appearing in this prospectus supplement, the accompanying prospectus and

the documents incorporated by reference herein and therein may only be accurate as of their respective dates. Our business, financial condition, results of operations and prospects may have changed since such dates. The information in the

accompanying prospectus is supplemented by, and to the extent inconsistent therewith replaced and superseded by, the information in this prospectus supplement.

S-ii

Our principal executive offices are located at Tte. Gral. Juan D. Perón 430, 25th floor,

City of Buenos Aires, Argentina, and our telephone number is +54 11-4343-7528. We maintain an internet site at www.gfgsa.com and our website is available in Spanish and English. Information contained on our website is not incorporated by reference

in, and shall not be considered a part of, this prospectus supplement.

S-iii

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference” the information we submit to it, which means that we can disclose important

information to you by referring you to those documents that are considered part of this prospectus supplement and the accompanying prospectus. Information contained in this prospectus supplement and the accompanying prospectus and information that

we submit to the SEC in the future and incorporate by reference will automatically update and supersede the previously submitted information. We incorporate herein by reference the document listed below that we have furnished to the SEC:

|

|

•

|

|

our annual report on Form 20-F for the fiscal year ended December 31, 2016 filed with the SEC on May 1, 2017 (our “2016 Form 20-F”); and

|

|

|

•

|

|

our report on Form 6-K furnished to the SEC on September 6, 2017 containing our unaudited interim consolidated financial statements as of June 30, 2017 and for the six months ended June 30, 2017 and 2016

and a reconciliation to U.S. generally accepted accounting principles (“GAAP”) of certain financial information as of June 30, 2017 and for the six months ended June 30, 2017 and 2016.

|

As you read the above documents or other documents incorporated by reference, you may find inconsistencies in information from one document to

another. If you find inconsistencies, you should rely on the statements made in this prospectus supplement or in the most recent document incorporated by reference herein.

To obtain copies of documents incorporated by reference herein or in the accompanying prospectus, see “Where You Can Find More

Information” in the accompanying prospectus. In addition, upon written or oral request, we will provide to any person, at no cost to such person, including any beneficial owner to whom a copy of this prospectus supplement is delivered, a copy

of any or all of the information that has been incorporated by reference in this prospectus supplement or the accompanying prospectus. You may make such a request by writing or telephoning us at the following address or telephone number:

Grupo Financiero Galicia S.A.

Tte. Gral. Juan D. Perón 430, 25th floor

Buenos Aires, Argentina

Tel: +54

11-4343-7528

S-iv

FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus and the documents incorporated herein and therein by reference, contain

forward-looking statements within the meaning of Section 27A of the Securities Act, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended, that involve substantial risks and uncertainties. All statements other than

statements of historical facts contained in this prospectus (including any statements regarding our future financial performance, business strategy, budgets, projected costs and macroeconomic or financial sector forecasts) are forward-looking

statements. In addition, forward-looking statements generally can be identified by the use of such words as “may,” “will,” “aim,” “expect,” “intend,” “estimate,” “anticipate,”

“believe,” “continue” or other similar terminology. Although we believe that the expectations reflected in these forward-looking statements are reasonable, no assurance can be provided with respect to these statements. Because

these statements are subject to risks and uncertainties, actual results may differ materially and adversely from those expressed or implied by such forward-looking statements. Factors that could cause actual results to differ materially and

adversely from those contemplated in such forward-looking statements include but are not limited to:

|

|

•

|

|

changes in Argentine government regulations applicable to financial institutions, including tax regulations and changes in or failures to comply with banking or other regulations;

|

|

|

•

|

|

changes in general political, legal, social or other conditions in Argentina, Latin America or abroad;

|

|

|

•

|

|

changes in the macroeconomic situation at the regional, national or international levels, and the influence of these changes on the microeconomic conditions of the financial markets in Argentina;

|

|

|

•

|

|

fluctuations in the Argentine rate of inflation;

|

|

|

•

|

|

volatility of the peso and the exchange rates between the peso and foreign currencies;

|

|

|

•

|

|

changes in capital markets in general that may affect policies or attitudes toward lending to Argentina or Argentine companies, including expected or unexpected turbulence or volatility in domestic or international

financial markets;

|

|

|

•

|

|

increased competition in the banking, financial services, credit card services, insurance, asset management, mutual funds and related industries, from both traditional players as well as financial technology (fintech)

companies;

|

|

|

•

|

|

changes in interest rates which may, among other things, adversely affect margins;

|

|

|

•

|

|

the inability of any of Grupo Galicia’s businesses to sustain or improve their performance, or a loss of market share by any of Grupo Galicia’s businesses;

|

|

|

•

|

|

a change in the credit cycle, increased borrower defaults and/or a decrease in the fees charged to clients;

|

|

|

•

|

|

changes in the saving and consumption habits of its customers and other structural changes in the general demand for financial products;

|

|

|

•

|

|

the ability of any of Grupo Galicia’s businesses to obtain additional debt or equity financing on attractive conditions or at all, which may limit their ability to fund existing operations and to finance new

activities;

|

|

|

•

|

|

technological changes and difficulties in any of Grupo Galicia’s businesses’ ability to implement new technologies; and

|

|

|

•

|

|

other factors discussed under “Item 3.D. Risk Factors” in our 2016 Form 20-F, which is incorporated herein by reference.

|

S-v

You should not place undue reliance on forward-looking statements, which speak only as of the

date that they were made. Moreover, you should consider these cautionary statements in connection with any written or oral forward-looking statements that we may issue in the future. We do not undertake any obligation to release publicly any

revisions to forward-looking statements after completion of this prospectus supplement to reflect later events or circumstances or to reflect the occurrence of unanticipated events. In light of the risks and uncertainties described above, the

forward-looking events and circumstances discussed in this prospectus supplement and the documents incorporated by reference might not occur, and are not guarantees of future performance.

S-vi

PROSPECTUS SUPPLEMENT SUMMARY

The following summary highlights information contained elsewhere in this prospectus supplement or the documents incorporated by reference

herein. This summary is not complete and does not contain all of the information you should consider before investing in our securities. You should read the entire prospectus supplement and the accompanying prospectus, including each of the

documents incorporated by reference herein or therein, carefully, including the “Risk Factors” and “Forward-Looking Information” sections of this prospectus supplement, and “Item 3.D. Risk Factors” in our 2016 Form 20-F

which is incorporated herein by reference.

Overview

Our Business

We are one of

Argentina’s largest financial services groups with consolidated assets of Ps.253,173 million (US$15,252.7 million) as of June 30, 2017. As a holding company, we do not have operations of our own and conduct our business through our

subsidiaries. Banco de Galicia y Buenos Aires S.A. (“Banco Galicia” or the “Bank”) is our main subsidiary and one of Argentina’s largest full-service banks. In addition, through Banco Galicia’s subsidiary Tarjetas

Regionales S.A. (“Tarjetas Regionales”), we provide proprietary brand credit cards mainly outside the Buenos Aires region, and through our other subsidiaries we provide consumer finance services and insurance products throughout Argentina.

Banco Galicia is a leading provider of financial services in Argentina. According to information published by the Argentine Central Bank,

as of May 31, 2017, Banco Galicia ranked second in terms of assets, deposits and loan portfolio within private-sector banks in Argentina. The Bank’s market share of private sector deposits and of loans to the private sector was 9.51% and

10.38%, respectively, as of June 30, 2017. As of June 30, 2017, Banco Galicia and its subsidiaries on a consolidated basis had total assets of Ps.250,395 million (US$15,085.3 million), total loans of Ps.159,923 million (US$9,634.7 million),

total deposits of Ps.158,211 million (US$9,531.6 million), and its shareholders’ equity amounted to Ps.22,049 million (US$1,328.3 million).

Banco Galicia provides a full range of financial services through one of the most extensive and diversified distribution platforms among

private-sector banks in Argentina. This distribution platform, as of June 30, 2017, was comprised of 279 full service banking branches and 1,870 ATMs and self-service terminals located throughout the country, as well as phone banking and

internet banking platforms. Banco Galicia’s customer base was comprised of approximately 3.7 million customers, which were mostly individuals but also included more than 97,500 companies. Banco Galicia has a strong competitive position in

retail banking, both with respect to individuals and small- and medium-sized companies. It also has a solid market position in providing service to large corporations and institutional investors.

The Bank’s Wholesale Banking Division provides products and services to medium and large businesses (i.e., those businesses with annual

revenues above Ps.100 million) in the Corporate Banking, Mid-Sized Companies, Agricultural and Livestock sectors. This Division also provides foreign trade, capital markets and investment banking services. Within the Wholesale Banking Division, the

Bank provides services targeted to the needs of these clients, including a Galicia Rural credit card for its clients in the agricultural and livestock sector and underwriting and placement agent services through its capital markets department.

Through its Retail Banking Division, Banco Galicia provides products and services to individuals from across most income brackets, micro and small businesses (i.e., those businesses with annual revenues below Ps.100 million) and small retailers and

professionals.

The companies devoted to the issuance of regional credit cards are subsidiaries of Banco Galicia through Tarjetas

Regionales, which include Tarjeta Naranja S.A. and Tarjetas Cuyanas S.A. Tarjetas Regionales has a

S-1

distinctive business model that we believe is well-suited to developing economies in Latin America and to the cultural background of its clients. Its business model of credit card issuance and

related credit services focuses on the specific needs of lower- and lower-middle-income clients through personalized and attentive services using its extensive network of branches. Tarjetas Regionales’ client base is primarily located outside

the Buenos Aires area, where its brands have a leading presence.

Tarjetas Regionales is the largest non-bank credit card issuer in

Argentina and one of the largest in Latin America, in each case, based on the number of credit cards issued as of June 30, 2017. It is also one of the two largest merchant acquirers in Argentina and one of the largest credit card processors in

Argentina. As of June 30, 2017, Tarjetas Regionales had more than 3.5 million active accounts, 9.5 million credit cards issued and approximately 250,000 affiliated merchants. Based on numbers from “

ATACyC Cámara de

Tarjetas de Créditos y Compra

”, an Argentine industry group, we estimate that, as of the same date, Tarjetas Regionales’ market share of issued credit cards in Argentina was approximately 17.9%. As the credit card processor for

all of its credit card operations, Tarjetas Regionales processed approximately 163 million transactions during 2016.

Our goal is to

consolidate our position as one of Argentina’s leading comprehensive financial services providers while continuing to strengthen Banco Galicia’s position as one of Argentina’s leading banks. We seek to broaden and complement the

operations and businesses of Banco Galicia, through holdings in companies and undertakings whose objectives are related to and/or can produce synergies with financial activities. Our non-banking subsidiaries operate in financial and related

activities in which Banco Galicia either cannot participate or in which it can participate only on a limited basis due to restrictive banking regulations.

S-2

The following table shows certain of Grupo Galicia’s key financial and operational

statistics as of and for the periods indicated.

|

|

|

|

|

|

|

|

|

|

|

|

|

As of and for the

Six Months Ended

June 30,

|

|

|

|

|

2017

|

|

|

2016

|

|

|

|

|

(in millions of pesos,

except percentages

and share data)

|

|

|

For the Fiscal Period

|

|

|

|

|

|

|

|

|

|

Net Income

|

|

|

3,436

|

|

|

|

2,723

|

|

|

Average Shares Outstanding (in millions)

|

|

|

1,300

|

|

|

|

1,300

|

|

|

Earnings per Share

|

|

|

2.64

|

|

|

|

2.09

|

|

|

At Period-End

|

|

|

|

|

|

|

|

|

|

Assets

|

|

|

253,173

|

|

|

|

199,850

|

|

|

Loans, Net

|

|

|

159,873

|

|

|

|

109,334

|

|

|

Deposits

|

|

|

158,152

|

|

|

|

118,114

|

|

|

Shareholders’ Equity

|

|

|

23,549

|

|

|

|

17,058

|

|

|

Shares Outstanding (in millions)

|

|

|

1,300

|

|

|

|

1,300

|

|

|

Book Value per Share

|

|

|

18.11

|

|

|

|

13.12

|

|

|

Selected Ratios (%)

|

|

|

|

|

|

|

|

|

|

Return on Average Shareholders’ Equity

(1)

|

|

|

31.35

|

|

|

|

34.60

|

|

|

Return on Average Assets

(2)

|

|

|

3.09

|

|

|

|

3.38

|

|

|

Financial Margin

(3)

|

|

|

12.79

|

|

|

|

11.36

|

|

|

Shareholders’ Equity to Total Assets

|

|

|

9.30

|

|

|

|

8.54

|

|

|

Market Share (%)

(4)

|

|

|

|

|

|

|

|

|

|

Deposits from Private Sector

|

|

|

9.51

|

|

|

|

9.60

|

|

|

Loans to the Private Sector

|

|

|

10.38

|

|

|

|

9.53

|

|

|

Exchange Rate

(4

)

|

|

|

|

|

|

|

|

|

|

Pesos per U.S. dollar

|

|

|

16.5985

|

|

|

|

14.9200

|

|

|

(1)

|

Net income as a percentage of average shareholders’ equity.

|

|

(2)

|

Net Income plus Minority Interests, divided by average Total Assets.

|

|

(3)

|

Net Financial Income divided by average interest-earning assets.

|

|

(4)

|

Source: Argentine Central Bank.

|

Our Competitive Strengths

We believe that the following characteristics enable us to maintain our competitiveness in the Argentine financial institutions sector and to

continue to achieve our strategic objectives:

Nationwide Presence and Strong Brand Recognition

. Grupo Galicia has a nationwide

reach through a network, as of June 2017, of 581 branches strategically located in all of Argentina’s 23 provinces and in the Autonomous City of Buenos Aires, serving a consolidated total of 9,225,000 clients. This network is one of the most

extensive and diversified networks in the financial system in Argentina and it allows Grupo Galicia to provide targeted customer service to various retail and corporate segments throughout the country. Our subsidiary Banco Galicia has operated as a

bank in Argentina for over 110 years and as such has a long and established history as a leading private-banking institution in Argentina, and a well-established and highly-regarded reputation in the Argentine market. The Bank is particularly

strongly represented among individual clients, the agricultural and small and medium enterprise segments, which are three of the sectors that we believe are well positioned for economic growth. Using the Net Promoter Score (“NPS”)

management tool, an index

S-3

generated by an external consultant in which several banks participate, Banco Galicia is able to measure its customers’ satisfaction and likelihood of being recommended by its customers to

friends or colleagues. In 2016 using the NPS, Banco Galicia was ranked first in micro-and small-sized companies, with an 18% and a 14% NPS Index, respectively. In the micro-sized companies category, Banco Galicia was five percentage points above the

second place company, and in the small-sized companies category it was two percentage points above the second place company.

We also

believe that Tarjetas Regionales’ business has a leading position in the Argentine credit card market. Tarjetas Regionales has a nationwide reach through a network of 262 branches, customer service centers and other points of sale strategically

located in most major Argentine cities. This extensive network allows Tarjetas Regionales to provide targeted customer service and form close relationships with its clients and the local merchants that accept its credit cards. We believe that

Tarjetas Regionales’ extensive network and the close attention it pays to the needs of its clients in each particular location have allowed it to rank first in “top of mind” recognition (as determined by an external consultant) in

every province in which it operates, except Buenos Aires.

Innovative, Specialized and Comprehensive Product Offerings

. We offer

our clients a broad range of financial services and solutions through our different subsidiaries. Banco Galicia offers a wide variety of innovative, specialized and comprehensive products both with respect to transactional banking and online

banking. For example, with respect to transactional banking, Banco Galicia offers its clients a wide variety of products including deposit accounts, credit cards, debit cards and personal loans. With respect to online banking, the Bank’s

website allows for customers to request both customary and specialized products, such as the payment of balances, obtaining information about credit cards with the assistance of an interactive advisor, obtaining information on promotions in an

innovative benefits catalogue and obtaining information about products and services offered by the Bank. In addition, the Bank’s Galicia Servicios Móviles (mobile) business provides cell phone services that allow the Bank’s

customers to inquire about their accounts, pay balances, subscribe for alerts and obtain information regarding their credit cards from their cell phones. The Bank continues to focus its efforts on developing its online banking and mobile

capabilities so as to ensure a better experience for its customers.

At the same time, Tarjetas Regionales offers its clients a wide

variety of innovative, specialized and comprehensive products, including the Tarjeta Naranja Clásica credit card, a Tarjeta Naranja credit card targeted at teenagers whose parents hold a Tarjeta Naranja credit card, the Tarjeta Naranja Visa,

the Tarjeta Naranja MasterCard and the Tarjeta Naranja American Express credit cards, as well as the Tarjeta Nevada credit cards. Tarjetas Regionales additionally provides other products and services to its clients, including an e-commerce platform

or Tienda Naranja, insurance policies, magazine subscriptions and mobile services. We believe these other products and services help us to develop and maintain customer contacts and brand recognition, which supports the distribution of our financial

services. It also offers its clients various payment plans and discounts that are tailored for its particular customer base and the characteristics of each significant market in which Tarjetas Regionales operates. In addition, the sales force of

Tarjetas Regionales adapts its marketing strategies based on the relative maturity of each market in order to offer products which best target the position of Tarjetas Regionales in the applicable market.

Conservative and Robust Credit Review Procedures at Banco Galicia

. We have a thorough and conservative approach to overall credit risk

which, as of June 30, 2017, resulted in only 1.7% of Banco Galicia’s private sector loans being classified as non-performing. On a consolidated basis (including Tarjetas Regionales), this ratio was 3.3% as of June 30, 2017. The Bank

has created committees for each division and department which meet periodically to review and discuss credit procedures related to their applicable area. Due to the Bank’s strict credit review procedures, almost 72% of Banco Galicia’s

portfolio is rated as low risk, while 22% is rated as medium low risk in the Bank’s own internal system. This internal system is divided into large company’s ratings, small and medium companies’ scorings, and individual scorings.

Large companies’ ratings are based on

S-4

the analysis of their financial statements, relating financial ratios with observed defaults through statistical analysis. Small and medium companies’ scorings are behavioral scorings based

on the use of bank’s products by the company. Payments delays, intensity of use, average amounts and quantity of movements are some of the variables used to build these statistical models. Individual scorings are behavioral scorings based on

the use of the bank’s products by the individual clients. Payments delays, use of credit cards, loans’ aging and quantity of movements are some of the variables used to build these statistical models. Furthermore, the Bank’s exposure

to any single customer’s credit risk is limited with the Bank’s top ten loan accounts by an amount outstanding representing less than 8% of its total loan portfolio as of June 30, 2017.

Highly Trained, Motivated and Effective Work Force

. Banco Galicia prides itself on its highly trained, motivated and effective work

force and its overall positive work place culture. On average, its employees remain with the Bank for more than ten years, which demonstrates a low turn-over rate and the loyalty of its employees. Banco Galicia has implemented a corporate culture

that is premised on providing the very best customer service to its clients in a motivated, positive and cooperative manner. This culture and work force have allowed the Bank to successfully interact with a wide variety of diverse clients and to

tailor its products and solutions to address each customer segment’s needs.

Tarjetas Regionales has implemented a corporate culture

that is premised on providing the very best service to the client. It has repeatedly been ranked as one of the best places to work in Argentina by the Argentine Great Place to Work Institute. Tarjetas Regionales interacts with both clients and

merchants in a positive and cooperative manner and creates solutions to address each group’s needs. For example, Tarjetas Regionales, as an essential part of its distribution network, often sets up points of sale physically located in stores.

Such arrangements have proven to be very effective in both marketing to existing and future clients and strengthening the relationships between Tarjetas Regionales and its merchant base.

Experienced Management Team

. Banco Galicia’s senior management team has approximately 25 years of aggregate financial experience

on average, while Tarjetas Regionales senior management team also has more than 25 years of aggregate financial, marketing and credit card industry experience. The diverse experience of both companies’ senior management has contributed

significantly to their success in the recent past and is expected to play a significant role in their future.

Our Strategy

We are one of the leading companies offering comprehensive financial services in Argentina. Our principal objective is to create value for our

shareholders, while also establishing sustainable management practices and considering our impact on the environment and society. To achieve this objective, we intend to continue to develop our presence in a range of financial services businesses

and sectors, while at the same time continuing to consolidate Banco Galicia’s position as one of the principal banks in Argentina. Our strategy includes:

|

|

•

|

|

Leveraging our established platform to provide aggregate value to our shareholders and clients

. Through the creation of autonomous businesses, we have established a platform which we believe will allow us to

leverage the experience and market knowledge of our different companies. We believe our platform provides us significant flexibility that we can use to react to market trends, respond rapidly to our client’s changing needs and facilitate our

entry into new markets, products and distribution channels.

|

|

|

•

|

|

Obtain high participation levels in certain high growth businesses and take advantage of cross-selling

opportunities

. The Argentine Central Bank limits the capacity of financial entities to carry out investments in subsidiaries that perform activities which are considered “non-complementary”

|

S-5

|

|

to the banking activity, such as insurance. Grupo Galicia, however, is not limited to investments in complementary businesses, and therefore is well positioned to take advantage of future growth

potential in Argentina. Grupo Galicia has established, and in the future intends to establish, controlling participations in businesses that can cross-sell services to the clients of Banco Galicia and other companies.

|

|

|

•

|

|

Maintain a favorable corporate structure

. We intend to keep a favorable corporate structure that supports our different business lines. Our separate subsidiary structure helps us to distribute capital in an

effective way, allowing us to minimize required capital investment in specific businesses, thereby freeing capital for investment and growth in other business lines. We also believe our corporate structure allows us to effectively assess sources of

income and costs, facilitating analysis of our businesses’ patterns, and provides commercial effectiveness and efficiency in the use of resources.

|

S-6

Organizational Structure

The following table illustrates our organizational structure as of June 30, 2017. Percentages indicate the ownership interests held. See

“Recent Developments” below for pending and potential changes to the organizational structure.

S-7

Recent Developments

Compañía Financiera Argentina

On January 12, 2017, Grupo Galicia together with its main subsidiary, Banco Galicia, accepted an offer by Mr. Julio A. Fraomeni

and Galeno Capital S.A.U. to sell 100% of Banco Galicia’s shares of Compañía Financiera Argentina S.A. (“CFA”) and Cobranzas y Servicios S.A. The closing of the transaction is subject to the fulfillment of the conditions

contained in the offer, including the prior approval of the Argentine Central Bank, which are still pending as of the date of this prospectus supplement. Banco Galicia believes that the transaction will not have a material adverse consequence for

its shareholders.

We believe the transaction will be beneficial for Banco Galicia because we expect it will: (i) improve Banco

Galicia’s regulatory capital base by increasing the amount of ordinary capital Level 1, as calculated according to the BCRA’s regulatory framework, (ii) reallocate capital in order to provide credit support to priority segments, such as

the commercial and investment portfolio, in line with the overall growth of the Argentine economy, and (iii) rebalance the credit exposure of Banco Galicia as between companies and individuals in accordance with acceptable risk levels, as determined

by Banco Galicia’s board of directors.

Tarjetas Regionales

On August 9, 2017, Grupo Galicia accepted an irrevocable offer to sell shares of Tarjetas Regionales made by Mr. Juan Carlos Angulo,

Mr. Miguel Angel Innocenti and Mr. José Luis Innocenti (the “Tarjetas Regionales Minority Purchase”). Each seller individually holds 5,658,315 Class A common shares, with five votes per share, and 10,508,299 Class B

common shares, with one vote per share. The shares in the aggregate represent a total of 4.5% of the issued and outstanding share capital of Tarjetas Regionales. The total purchase price for the shares is US$36.8 million. We expect the purchase to

close on or before January 5, 2018.

On August 10, 2017, the Boards of Directors of our subsidiaries Tarjeta Naranja and

Tarjetas Cuyanas resolved to initiate the steps leading to a merger of both companies, by which Tarjetas Cuyanas would be absorbed into Tarjeta Naranja. On September 5, 2017, Tarjetas Naranja, as the absorbing company and Tarjetas Cuyanas, as the

absorbed company, have signed a supplemental agreement to the merger.

On August 14, 2017, Grupo Galicia accepted an irrevocable

offer to sell shares of Tarjetas Regionales made by Mr. Alejandro Pedro Angulo. The seller holds 5,658,315 Class A common shares, with five votes per share, and 10,508,299 Class B common shares, with one vote per share. The shares in the

aggregate represent a total of 1.5% of the issued and outstanding share capital of Tarjetas Regionales. The total purchase price for the shares is US$12.25 million. We expect the purchase to close on or before January 5, 2018. This transaction

complements that of August 10, 2017, and, taken together, the irrevocable offers to sell accepted by Grupo Galicia amount to a total of 6% of the issued and outstanding share capital of Tarjetas Regionales.

Net Investment S.A.

Net

Investment S.A. was established in February 2000 as a holding company (87.5% owned by Grupo Galicia and 12.5% owned by Banco Galicia) whose purpose was to invest in and develop businesses related to technology, communications, internet connectivity

and web contents. On May 16, 2017, Net Investment S.A. shareholders, Grupo Galicia and Banco Galicia, agreed to dissolve and liquidate the company.

S-8

SUMMARY FINANCIAL INFORMATION

The historical financial information set forth below as of and for the years ended December 31, 2016, 2015 and 2014, as of June 30,

2017 and for the six months ended June 30, 2017 and 2016 has been derived from, and should be read together with, our consolidated financial statements incorporated herein by reference. For information concerning the preparation and

presentation of our consolidated financial statements, see “Presentation of Financial Information” in our 2016 Form 20-F.

Our

consolidated financial statements, from which the below information has been derived, are prepared in conformity with Central Bank rules, which differ in certain respects from U.S. GAAP. For a reconciliation of certain of our financial information

to U.S. GAAP, see “Item 5.A. U.S. GAAP to Argentine Banking GAAP Reconciliation” in our 2016 Form 20-F and our Form 6-K furnished on September 6, 2017, each of which is incorporated herein by reference. See “Presentation of

Financial Information” in our 2016 Form 20-F for a definition of Argentine Banking GAAP.

For the periods presented below, inflation

adjustments have not been applied to our consolidated financial statements under Central Bank rules. In reviewing our financial information, investors should consider that, in recent years, there have been significant changes in the prevailing

prices of certain inputs and economic indicators, such as salary cost, interest and exchange rates, however, local regulations have not required the application of inflation adjustments to our consolidated financial statements. For more information

on inflation, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Inflation” in this prospectus supplement.

As a result of Central Bank requirements, we expect to prepare our consolidated financial statements in accordance with International

Financial Reporting Standards (“IFRS”), with certain criteria of measurement and exposure specifically established by the Central Bank, commencing on January 1, 2018. Following our adoption of IFRS, our results of operation may differ

significantly from previous amounts reported under Central Bank rules. For a reconciliation of certain of our financial information as of June 30, 2017 from Argentine Banking GAAP to IFRS, see Note 1.16 to our unaudited interim consolidated

financial statements as of June 30, 2017 and for the six months ended June 30, 2017 and 2016, which are incorporated herein by reference to our Form 6-K furnished on September 6, 2017.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of and for the Six

Months Ended

June 30,

|

|

|

As of and for the

Year Ended December 31,

|

|

|

|

|

2017

|

|

|

2016

|

|

|

2016

|

|

|

2015

|

|

|

2014

|

|

|

|

|

(in millions of pesos, except as noted)

|

|

|

Consolidated Income Statement in Accordance with Argentine Banking GAAP

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial Income

|

|

|

20,713

|

|

|

|

17,890

|

|

|

|

36,608

|

|

|

|

25,844

|

|

|

|

19,860

|

|

|

Financial Expenses

|

|

|

9,894

|

|

|

|

10,538

|

|

|

|

20,239

|

|

|

|

13,402

|

|

|

|

10,321

|

|

|

Net Financial Income

(1)

|

|

|

10,819

|

|

|

|

7,352

|

|

|

|

16,369

|

|

|

|

12,442

|

|

|

|

9,539

|

|

|

Provision for Losses on Loans and Other Receivables

|

|

|

2,606

|

|

|

|

1,341

|

|

|

|

3,533

|

|

|

|

2,214

|

|

|

|

2,411

|

|

|

Income before Taxes

|

|

|

5,501

|

|

|

|

4,244

|

|

|

|

9,371

|

|

|

|

7,139

|

|

|

|

5,330

|

|

|

Income Tax

|

|

|

(2,065

|

)

|

|

|

(1,521

|

)

|

|

|

(3,353

|

)

|

|

|

(2,801

|

)

|

|

|

(1,992

|

)

|

|

Net Income

|

|

|

3,436

|

|

|

|

2,723

|

|

|

|

6,018

|

|

|

|

4,338

|

|

|

|

3,338

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic Earnings per Share (in pesos)

|

|

|

2.64

|

|

|

|

2.09

|

|

|

|

4.63

|

|

|

|

3.34

|

|

|

|

2.57

|

|

|

Diluted Earnings per Share (in pesos)

|

|

|

2.64

|

|

|

|

2.09

|

|

|

|

4.63

|

|

|

|

3.34

|

|

|

|

2.57

|

|

|

Cash Dividends per Share (in pesos)

|

|

|

—

|

|

|

|

—

|

|

|

|

0.18

|

|

|

|

0.12

|

|

|

|

0.08

|

|

|

Book Value per Share (in pesos)

|

|

|

18.11

|

|

|

|

13.12

|

|

|

|

15.66

|

|

|

|

11.14

|

|

|

|

7.88

|

|

|

Amounts in Accordance with U.S. GAAP

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income

|

|

|

3,627

|

|

|

|

3,336

|

|

|

|

6,037

|

|

|

|

4,336

|

|

|

|

3,504

|

|

S-9

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of and for the Six

Months Ended

June 30,

|

|

|

As of and for the

Year Ended December 31,

|

|

|

|

|

2017

|

|

|

2016

|

|

|

2016

|

|

|

2015

|

|

|

2014

|

|

|

|

|

(in millions of pesos, except as noted)

|

|

|

Basic and Diluted Earnings per Share (in pesos)

|

|

|

2.79

|

|

|

|

2.57

|

|

|

|

4.64

|

|

|

|

3.33

|

|

|

|

2.70

|

|

|

Book Value per Share (in pesos)

|

|

|

17.91

|

|

|

|

13.27

|

|

|

|

15.45

|

|

|

|

11.06

|

|

|

|

7.88

|

|

|

Financial Income

|

|

|

19,382

|

|

|

|

17,241

|

|

|

|

34,549

|

|

|

|

24,252

|

|

|

|

18,166

|

|

|

Financial Expenses

|

|

|

9,374

|

|

|

|

10,207

|

|

|

|

19,410

|

|

|

|

12,826

|

|

|

|

9,663

|

|

|

Net Financial Income

|

|

|

10,008

|

|

|

|

7,034

|

|

|

|

15,139

|

|

|

|

11,426

|

|

|

|

8,503

|

|

|

Provision for Losses on Loans and Other Receivables

|

|

|

2,298

|

|

|

|

810

|

|

|

|

3,192

|

|

|

|

1,985

|

|

|

|

1,992

|

|

|

Income Tax

|

|

|

1,971

|

|

|

|

1,602

|

|

|

|

3,195

|

|

|

|

2,644

|

|

|

|

1,890

|

|

|

Consolidated Balance Sheet in Accordance with Argentine Banking GAAP

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and Due from Banks

|

|

|

33,334

|

|

|

|

28,439

|

|

|

|

61,166

|

|

|

|

30,835

|

|

|

|

16,959

|

|

|

Government Securities, Net

|

|

|

29,717

|

|

|

|

29,804

|

|

|

|

13,701

|

|

|

|

15,525

|

|

|

|

10,010

|

|

|

Loans, Net

|

|

|

159,873

|

|

|

|

109,334

|

|

|

|

137,452

|

|

|

|

98,345

|

|

|

|

66,608

|

|

|

Total Assets

|

|

|

253,173

|

|

|

|

199,850

|

|

|

|

242,251

|

|

|

|

161,748

|

|

|

|

107,314

|

|

|

Deposits

|

|

|

158,152

|

|

|

|

118,114

|

|

|

|

151,688

|

|

|

|

100,039

|

|

|

|

64,666

|

|

|

Other Funds

(2)

|

|

|

71,472

|

|

|

|

64,678

|

|

|

|

70,210

|

|

|

|

47,224

|

|

|

|

32,402

|

|

|

Total Shareholders’ Equity

|

|

|

23,549

|

|

|

|

17,058

|

|

|

|

20,353

|

|

|

|

14,485

|

|

|

|

10,246

|

|

|

Average Total Assets

(3)

|

|

|

240,193

|

|

|

|

170,794

|

|

|

|

184,395

|

|

|

|

122,684

|

|

|

|

92,510

|

|

|

Percentage of Period-end Balance Sheet Items Denominated in U.S. dollars:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans, Net of Allowances

|

|

|

19.93

|

|

|

|

10.69

|

|

|

|

12.77

|

|

|

|

3.26

|

|

|

|

4.20

|

|

|

Total Assets

|

|

|

23.43

|

|

|

|

16.85

|

|

|

|

27.56

|

|

|

|

16.88

|

|

|

|

12.11

|

|

|

Deposits

|

|

|

30.38

|

|

|

|

17.91

|

|

|

|

33.63

|

|

|

|

14.37

|

|

|

|

7.46

|

|

|

Total Liabilities

|

|

|

25.91

|

|

|

|

18.86

|

|

|

|

30.82

|

|

|

|

18.86

|

|

|

|

13.61

|

|

|

Amounts in Accordance with U.S. GAAP

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trading Securities

|

|

|

31,076

|

|

|

|

31,482

|

|

|

|

17,196

|

|

|

|

16,148

|

|

|

|

10,199

|

|

|

Available-for-Sale Securities

|

|

|

4,514

|

|

|

|

3,548

|

|

|

|

5,423

|

|

|

|

4,385

|

|

|

|

4,627

|

|

|

Total Assets

|

|

|

276,354

|

|

|

|

218,213

|

|

|

|

260,403

|

|

|

|

180,142

|

|

|

|

120,393

|

|

|

Total Liabilities

|

|

|

253,069

|

|

|

|

200,956

|

|

|

|

240,316

|

|

|

|

165,759

|

|

|

|

110,150

|

|

|

Shareholders’ Equity

|

|

|

23,285

|

|

|

|

17,257

|

|

|

|

20,087

|

|

|

|

14,383

|

|

|

|

10,243

|

|

S-10

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of and for the

Six Months Ended

June 30,

|

|

|

As of and for the

Year Ended December 31,

|

|

|

|

|

2017

|

|

|

2016

|

|

|

2016

|

|

|

2015

|

|

|

2014

|

|

|

|

|

(in millions of pesos, except as noted)

|

|

|

Selected Ratios in Accordance with Argentine Banking GAAP

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profitability and in Efficiency

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Yield on Interest Earning Assets

(4)

|

|

|

14.02

|

%

|

|

|

12.45

|

%

|

|

|

13.26

|

%

|

|

|

14.18

|

%

|

|

|

14.42

|

%

|

|

Financial Margin

(5)

|

|

|

12.79

|

|

|

|

11.36

|

|

|

|

12.10

|

|

|

|

13.12

|

|

|

|

13.56

|

|

|

Return on Average Assets

(6)

|

|

|

3.09

|

|

|

|

3.38

|

|

|

|

3.48

|

|

|

|

3.83

|

|

|

|

3.85

|

|

|

Return on Average Shareholders’ Equity

(7)

|

|

|

31.35

|

|

|

|

34.60

|

|

|

|

35.03

|

|

|

|

35.54

|

|

|

|

39.07

|

|

|

Net Income from Services as a Percentage of Operating Income

(8)

|

|

|

39.47

|

|

|

|

38.71

|

|

|

|

39.63

|

|

|

|

38.65

|

|

|

|

37.40

|

|

|

Efficiency ratio

(9)

|

|

|

60.79

|

|

|

|

66.79

|

|

|

|

64.98

|

|

|

|

63.64

|

|

|

|

60.51

|

|

|

Capital

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders’ Equity as a Percentage of Total Assets

|

|

|

9.30

|

%

|

|

|

8.54

|

%

|

|

|

8.40

|

%

|

|

|

8.96

|

%

|

|

|

9.55

|

%

|

|

Total Liabilities as a Multiple of Shareholders’ Equity

|

|

|

9.75

|

x

|

|

|

10.72

|

x

|

|

|

10.90

|

x

|

|

|

10.17

|

x

|

|

|

9.47

|

x

|

|

Total Capital Ratio

|

|

|

11.80

|

%

|

|

|

10.98

|

%

|

|

|

15.04

|

%

|

|

|

13.38

|

%

|

|

|

15.91

|

%

|

|

Liquidity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and Due from Banks as a Percentage of Total Deposits

|

|

|

21.08

|

%

|

|

|

24.08

|

%

|

|

|

40.32

|

%

|

|

|

30.82

|

%

|

|

|

26.23

|

%

|

|

Loans, Net as a Percentage of Total Assets

|

|

|

63.15

|

|

|

|

54.71

|

|

|

|

56.74

|

|

|

|

60.80

|

|

|

|

62.07

|

|

|

Credit Quality

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Past Due Loans

(10)

as a Percentage of

Total Loans

|

|

|

2.61

|

%

|

|

|

2.66

|

%

|

|

|

2.43

|

%

|

|

|

2.46

|

%

|

|

|

2.61

|

%

|

|

Non-Accrual Loans

(11)

as a Percentage

of Total Loans

|

|

|

3.59

|

|

|

|

3.44

|

|

|

|

3.31

|

|

|

|

3.11

|

|

|

|

3.57

|

|

|

Allowance for Loan Losses as a Percentage of Non-accrual Loans

(12)

|

|

|

100.02

|

|

|

|

103.26

|

|

|

|

100.06

|

|

|

|

112.41

|

|

|

|

105.78

|

|

|

Net Charge-Offs

(12)

as a Percentage of

Average Loans

|

|

|

1.58

|

|

|

|

1.40

|

|

|

|

1.67

|

|

|

|

1.26

|

|

|

|

2.81

|

|

|

Ratios in Accordance with U.S. GAAP

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders’ Equity (deficit) as a Percentage of Total Assets

|

|

|

8.43

|

|

|

|

7.91

|

|

|

|

7.71

|

|

|

|

7.98

|

|

|

|

8.51

|

|

|

Total Liabilities as a Multiple of Total Shareholders’ Equity

|

|

|

10.87

|

|

|

|

11.64

|

|

|

|

11.96x

|

|

|

|

11.52x

|

|

|

|

10.75x

|

|

|

Liquidity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans, Net as a Percentage of Total Assets

|

|

|

57.79

|

|

|

|

50.31

|

|

|

|

52.76

|

%

|

|

|

54.55

|

%

|

|

|

55.29

|

%

|

|

Credit Quality

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Allowance for Loan Losses as a Percentage of Non-Accrual Loans

|

|

|

125.95

|

|

|

|

110.20

|

|

|

|

128.53

|

|

|

|

135.35

|

|

|

|

129.78

|

|

|

Inflation and Exchange Rate

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wholesale Inflation

(13)

|

|

|

7.62

|

%

|

|

|

26.81

|

%

|

|

|

34.59

|

%

|

|

|

12.65

|

%

|

|

|

28.27

|

%

|

|

Consumer Inflation

(14)

|

|

|

11.85

|

%

|

|

|

29.22

|

%

|

|

|

41.05

|

%

|

|

|

26.90

|

%

|

|

|

23.91

|

%

|

|

Exchange Rate Variation

(15)

(%)

|

|

|

4.72

|

|

|

|

14.73

|

|

|

|

21.88

|

|

|

|

52.07

|

|

|

|

31.21

|

|

|

CER

(16)

|

|

|

11.98

|

|

|

|

21.03

|

|

|

|

35.79

|

|

|

|

15.05

|

|

|

|

24.34

|

|

The ratios disclosed above are considered significant by the management of Grupo Galicia despite of the fact

that they are not a specific requirement of any GAAP.

|

(1)

|

Net financial income primarily represents income from interest on loans and other receivables resulting from

financial brokerage plus net income from government and corporate debt securities, including gains

|

S-11

|

|

and losses, minus interest on deposits and other liabilities from financial intermediation. It also includes the CER adjustment.

|

|

(2)

|

Primarily includes debt with merchants and liabilities with other banks and international entities.

|

|

(3)

|

The average balances of assets, including the related interest that is due, are calculated on a daily basis for Banco Galicia, as well as for Tarjetas Regionales, and on a monthly basis for Grupo Financiero Galicia and

its non-banking subsidiaries.

|

|

(4)

|

Net interest earned divided by average interest-earning assets. For a description of net interest earned, see Item 4. “Information on the Company- Selected Statistical Information-Interest-Earning Assets-Net

Yield on Interest-Earning Assets” in our 2016 Form 20-F, incorporated herein by reference.

|

|

(5)

|

Financial margin represents net financial income divided by average interest-earning assets.

|

|

(6)

|

Net income plus minority interest, divided by average total assets.

|

|

(7)

|

Net income as a percentage of average shareholders’ equity.

|

|

(8)

|

Operating income is defined as net financial income plus net income from services.

|

|

(9)

|

Administrative expenses as a percentage of operating income as defined above.

|

|

(10)

|

Past-due loans are defined as the aggregate principal amount of a loan plus any accrued interest that is due and payable for which either the principal or any interest payment is 91 days or more past due.

|

|

(11)

|

Non-Accrual loans are defined as those loans in the categories of: (a) Consumer portfolio: “Medium Risk,” “High Risk,” “Uncollectible,” and “Uncollectible Due to Technical

Reasons,” and (b) Commercial portfolio: “With problems,” Risk of Insolvency,” “Uncollectible,” and “Uncollectible Due to Technical Reasons.”

|

|

(12)

|

Charge-offs minus bad debts recovered.

|

|

(13)

|

As of December 31, 2015 as measured by the interannual change between October 2014 and October 2015 Wholesale Price Index (“WPI”), published by INDEC (as defined herein), because the measurement of this

index was discontinued. In 2016 the measure was normalized.

|

|

(14)

|

In 2015, annual variation of the Consumer Price Index (“CPI”) was calculated using the Consumer Price Index of the City of Buenos Aires, an alternative measure of inflation proposed by INDEC after it suspended

its index.

|

|

(15)

|

Change in the end-of-period exchange rate expressed in pesos per U.S. dollar.

|

|

(16)

|

The “CER” is the “Coeficiente de Estabilización de Referencia,” an adjustment coefficient based on changes in the CPI.

|

S-12

THE OFFERING

|

Issuer

|

Grupo Financiero Galicia S.A.

|

|

Global Offering

|

The global offering of 130,434,600 Class B ordinary shares, par value Ps.1.00 per share, including Class B ordinary shares represented by ADSs, consists of the international offering, the concurrent Argentine offering, and the preferential

offering to our existing shareholders in Argentina.

|

|

|

Class B ordinary shares in the international offering will be represented by ADSs and are being offered through the underwriters in the United

States and in other countries outside the United States and Argentina. Concurrently with the international offering, Class B ordinary shares in the Argentine offering are being

offered through the Argentine placement agent to investors in Argentina. The Class B ordinary shares being offered in the global offering may be reallocated between the international offering and the concurrent Argentine offering depending upon

demand and related factors in the Argentine and international markets. The closings of the international offering and the Argentine offering are conditioned upon each other. The Company has included in the prospectus for the Argentine offering an

indicative price range for the Class B ordinary shares to be sold in such offering of US$3.90 to US$5.60 per share (or Ps.67.14 to Ps.96.41 per share). Such range is non-binding and subject to change without notice.

|

|

|

The Class B ordinary shares offered in the international offering, including Class B ordinary shares that may be offered pursuant to the underwriters’ option to purchase additional Class B ordinary shares, are

(i) Class B ordinary shares that became available as a result of the decision of one of our shareholders not to exercise its preemptive and accretion rights to subscribe to our capital increase underlying the global offering and the transfer of

such rights to Galicia Valores and (ii) additional Class B ordinary shares, if any, that the underwriters may acquire from us relating to preemptive and accretion rights not exercised by our other existing shareholders.

|

|

|

The total amount of Class B ordinary shares to be sold in the international offering will depend on the amount of Class B ordinary shares that are subscribed by our shareholders through their exercise of preemptive and

accretion rights. See “—Preferential Rights.” Class B ordinary shares subscribed for by our existing shareholders in the preferential rights offering will reduce the amount of Class B ordinary shares that may be offered in the

international offering.

|

|

ADSs

|

Each ADS represents 10 Class B ordinary shares. The ADSs will be issued from time to time under the amended and restated deposit agreement, dated as of July 12, 2011, among us, The Bank of New York Mellon, as depositary (the

“Depositary”), and all owners and holders from time to time of American Depositary Shares issued thereunder (the “Deposit Agreement”).

|

S-13

|

Preferential Rights

|

Our existing shareholders have preemptive rights to subscribe for any capital increase by us, including in connection with the international offering and the concurrent Argentine offering, in a number sufficient to maintain their proportionate

holdings in our total capital. In addition, our existing shareholders have accretion rights, which will permit them to subscribe for Class B ordinary shares that are not subscribed by other existing shareholders in the preemptive rights offering in

proportion to the percentage of shares for which such subscribing existing shareholders have exercised their preemptive rights.

|

|

|

The preferential rights have not been and will not be registered under the Securities Act and, accordingly the preferential rights may not be offered to our shareholders in the United States and will not be made

available to holders of the ADSs. In order to facilitate the global offering, EBA Holding S.A., which owns 100% of our outstanding Class A shares representing 21.6% of our capital stock, has transferred its preferential rights to subscribe

for Class B ordinary shares with respect to the capital increase to our affiliate Galicia Valores and, in order to facilitate the international offering, Galicia Valores, at the discretion of the underwriters, will exercise these rights to purchase