false

0001530249

0001530249

2023-10-25

2023-10-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 25, 2023

FS BANCORP, INC.

(Exact name of registrant as specified in its charter)

|

Washington

|

001-35589

|

45-4585178

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(I.R.S. Employer

Identification No.)

|

|

6920 220th Street SW

Mountlake Terrace, Washington

|

98043

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (425) 771-5299

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions.

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $.01 per share

|

|

FSBW

|

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On October 25, 2023, FS Bancorp, Inc., the parent corporation of 1st Security Bank of Washington, issued its earnings release for the quarter ended September 30, 2023. A copy of the press release is furnished with this Form 8-K as Exhibit 99.1 and is incorporated herein by reference.

Item 8.01 Other Events

On October 25, 2023, FS Bancorp announced its Board of Directors declared a regular quarterly cash dividend on FS Bancorp common stock of $0.25 per share, payable on November 22, 2023 to stockholders of record as of the close of business on November 9, 2023.

Item 9.01 Exhibits

| |

99.1

|

|

| |

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: October 25, 2023

|

FS BANCORP, INC.

|

|

|

|

|

|

/s/Matthew D. Mullet

|

|

|

Matthew D. Mullet

|

|

|

Chief Financial Officer

|

|

|

(Principal Financial and Accounting Officer)

|

Exhibit 99.1

FS Bancorp, Inc. Reports Third Quarter Net Income of $9.0 Million or $1.13 Per Diluted Share and the Forty-Third Consecutive Quarterly Dividend

MOUNTLAKE TERRACE, WA – October 25, 2023 – FS Bancorp, Inc. (NASDAQ: FSBW) (the “Company”), the holding company for 1st Security Bank of Washington (the “Bank” or “1st Security Bank”) today reported 2023 third quarter net income of $9.0 million, or $1.13 per diluted share, compared to $8.5 million, or $1.08 per diluted share, for the comparable quarter one year ago. For the nine months ended September 30, 2023, net income was $26.3 million, or $3.33 per diluted share, compared to net income of $22.0 million, or $2.73 per diluted share, for the comparable nine-month period in 2022.

“We were honored to be recently named the ‘Number One Best Place to Work’ in the extra-large company category by the Puget Sound Business Journal,” stated Joe Adams, CEO. “We are also pleased that our Board of Directors approved our forty-third consecutive quarterly cash dividend of $0.25 per share, demonstrating our continued commitment to returning value to shareholders. The cash dividend will be paid on November 22, 2023, to shareholders of record as of November 9, 2023,” concluded Adams.

2023 Third Quarter Highlights

| |

●

|

Net income was $9.0 million for the third quarter of 2023, compared to $9.1 million in the previous quarter, and $8.5 million for the comparable quarter one year ago;

|

| |

●

|

Net interest margin (“NIM”) compressed to 4.34%, compared to 4.66% for the previous quarter, and 4.54% for the comparable quarter one year ago;

|

| |

●

|

Total deposits increased $89.1 million, or 3.8%, to $2.45 billion at September 30, 2023 compared to $2.37 billion at June 30, 2023 and increased $371.1 million, or 17.8%, from $2.08 billion at September 30, 2022, with noninterest-bearing deposit totals of $670.2 million at September 30, 2023, $675.2 million at June 30, 2023, and $581.6 million at September 30, 2022;

|

| |

●

|

Loans receivable, net increased $33.1 million, or 1.4%, to $2.38 billion at September 30, 2023, compared to $2.34 billion at June 30, 2023, and increased $291.6 million, or 14.0%, from $2.08 billion at September 30, 2022;

|

| |

●

|

Consumer loans, of which 87.9% are home improvement loans, increased $6.2 million, or 1.0%, to $640.1 million at September 30, 2023, compared to $633.9 million in the previous quarter, and increased $121.5 million, or 23.4%, from $518.6 million in the comparable quarter one year ago. During the three months ended September 30, 2023, consumer loan originations included 82.4% of home improvement loans originated with a Fair Isaac and Company, Incorporated (“FICO”) score above 720 and 95.5% of home improvement loans with a UCC-2 security filing;

|

| |

●

|

Segment reporting in the third quarter of 2023 reflected net income of $8.8 million for the Commercial and Consumer Banking segment and $166,000 for the Home Lending segment, compared to net income of $9.1 million and $55,000 in the prior quarter, and net income of $9.3 million and net loss of $794,000 in the third quarter of 2022, respectively;

|

| |

●

|

The ratio of available unencumbered cash and secured borrowing capacity at the Federal Home Loan Bank (“FHLB”) and the Federal Reserve Bank to uninsured deposits was 216% at September 30, 2023, compared to 209% in the prior quarter. The average deposit size per FDIC-insured account at the Bank was $33,000 for both September 30, 2023 and June 30, 2023; and

|

| |

●

|

Regulatory capital ratios at the Bank were 13.1% for total risk-based capital and 10.3% for Tier 1 leverage capital at September 30, 2023, compared to 12.9% for total risk-based capital and 10.3% for Tier 1 leverage capital at June 30, 2023.

|

Page 2

Segment Reporting

The Company reports two segments: Commercial and Consumer Banking and Home Lending. The Commercial and Consumer Banking segment provides diversified financial products and services to our commercial and consumer customers. These products and services include deposit products; residential, consumer, business and commercial real estate lending portfolios and cash management services. This segment is also responsible for the management of the investment portfolio and other assets of the Bank. The Home Lending segment originates one-to-four-family residential mortgage loans primarily for sale in the secondary markets as well as loans held for investment.

The tables below provide a summary of segment reporting at or for the three and nine months ended September 30, 2023 and 2022 (dollars in thousands):

| |

|

At or For the Three Months Ended September 30, 2023

|

|

|

Condensed income statement:

|

|

Commercial and Consumer Banking

|

|

|

Home Lending

|

|

|

Total

|

|

|

Net interest income (1)

|

|

$ |

27,563 |

|

|

$ |

3,071 |

|

|

$ |

30,634 |

|

|

Provision for credit losses

|

|

|

(437 |

) |

|

|

(111 |

) |

|

|

(548 |

) |

|

Noninterest income (2)

|

|

|

2,680 |

|

|

|

2,302 |

|

|

|

4,982 |

|

|

Noninterest expense (3)

|

|

|

(18,539 |

) |

|

|

(5,047 |

) |

|

|

(23,586 |

) |

|

Income before provision for income taxes

|

|

|

11,267 |

|

|

|

215 |

|

|

|

11,482 |

|

|

Provision for income taxes

|

|

|

(2,480 |

) |

|

|

(49 |

) |

|

|

(2,529 |

) |

|

Net income

|

|

$ |

8,787 |

|

|

$ |

166 |

|

|

$ |

8,953 |

|

|

Total average assets for period ended

|

|

$ |

2,361,014 |

|

|

$ |

540,372 |

|

|

$ |

2,901,386 |

|

|

Full-time employees ("FTEs")

|

|

|

434 |

|

|

|

128 |

|

|

|

562 |

|

| |

|

At or For the Three Months Ended September 30, 2022

|

|

|

Condensed income statement:

|

|

Commercial and Consumer Banking

|

|

|

Home Lending

|

|

|

Total

|

|

|

Net interest income (1)

|

|

$ |

24,620 |

|

|

$ |

2,907 |

|

|

$ |

27,527 |

|

|

(Provision) recovery for credit losses

|

|

|

(1,811 |

) |

|

|

93 |

|

|

|

(1,718 |

) |

|

Noninterest income (2)

|

|

|

3,314 |

|

|

|

867 |

|

|

|

4,181 |

|

|

Noninterest expense (3)

|

|

|

(14,471 |

) |

|

|

(4,867 |

) |

|

|

(19,338 |

) |

|

Income (loss) before (provision) benefit for income taxes

|

|

|

11,652 |

|

|

|

(1,000 |

) |

|

|

10,652 |

|

|

(Provision) benefit for income taxes

|

|

|

(2,400 |

) |

|

|

206 |

|

|

|

(2,194 |

) |

|

Net income (loss)

|

|

$ |

9,252 |

|

|

$ |

(794 |

) |

|

$ |

8,458 |

|

|

Total average assets for period ended

|

|

$ |

2,072,614 |

|

|

$ |

427,368 |

|

|

$ |

2,499,982 |

|

|

FTEs

|

|

|

389 |

|

|

|

140 |

|

|

|

529 |

|

| |

|

At or For the Nine Months Ended September 30, 2023

|

|

|

Condensed income statement:

|

|

Commercial and Consumer Banking

|

|

|

Home Lending

|

|

|

Total

|

|

|

Net interest income (1)

|

|

$ |

83,332 |

|

|

$ |

9,516 |

|

|

$ |

92,848 |

|

|

Provision for credit losses

|

|

|

(2,555 |

) |

|

|

(817 |

) |

|

|

(3,372 |

) |

|

Noninterest income (2)

|

|

|

7,766 |

|

|

|

7,268 |

|

|

|

15,034 |

|

|

Noninterest expense (3)

|

|

|

(56,099 |

) |

|

|

(15,215 |

) |

|

|

(71,314 |

) |

|

Income before provision for income taxes

|

|

|

32,444 |

|

|

|

752 |

|

|

|

33,196 |

|

|

Provision for income taxes

|

|

|

(6,758 |

) |

|

|

(157 |

) |

|

|

(6,915 |

) |

|

Net income

|

|

$ |

25,686 |

|

|

$ |

595 |

|

|

$ |

26,281 |

|

|

Total average assets for period ended

|

|

$ |

2,288,996 |

|

|

$ |

520,513 |

|

|

$ |

2,809,509 |

|

|

FTEs

|

|

|

434 |

|

|

|

128 |

|

|

|

562 |

|

Page 3

| |

|

At or For the Nine Months Ended September 30, 2022

|

|

|

Condensed income statement:

|

|

Commercial and Consumer Banking

|

|

|

Home Lending

|

|

|

Total

|

|

|

Net interest income (1)

|

|

$ |

66,983 |

|

|

$ |

7,995 |

|

|

$ |

74,978 |

|

|

Provision for credit losses

|

|

|

(3,727 |

) |

|

|

(905 |

) |

|

|

(4,632 |

) |

|

Noninterest income (2)

|

|

|

7,944 |

|

|

|

6,468 |

|

|

|

14,412 |

|

|

Noninterest expense (3)

|

|

|

(42,878 |

) |

|

|

(14,456 |

) |

|

|

(57,334 |

) |

|

Income (loss) before (provision) benefit for income taxes

|

|

|

28,322 |

|

|

|

(898 |

) |

|

|

27,424 |

|

|

(Provision) benefit for income taxes

|

|

|

(5,583 |

) |

|

|

186 |

|

|

|

(5,397 |

) |

|

Net income (loss)

|

|

$ |

22,739 |

|

|

$ |

(712 |

) |

|

$ |

22,027 |

|

|

Total average assets for period ended

|

|

$ |

1,972,376 |

|

|

$ |

403,990 |

|

|

$ |

2,376,366 |

|

|

FTEs

|

|

|

389 |

|

|

|

140 |

|

|

|

529 |

|

|

(1)

|

Net interest income is the difference between interest earned on assets and the cost of liabilities to fund those assets. Interest earned includes actual interest earned on segment assets and, if the segment has excess liabilities, interest credits for providing funding to the other segment. The cost of liabilities includes interest expense on segment liabilities and, if the segment does not have enough liabilities to fund its assets, a funding charge based on the cost of assigned liabilities to fund segment assets.

|

|

(2)

|

Noninterest income includes activity from certain residential mortgage loans that were initially originated for sale and measured at fair value, and subsequently transferred to loans held for investment. Gains and losses from changes in fair value for these loans are reported in earnings as a component of noninterest income. For the three and nine months ended September 30, 2023, the Company recorded a net decrease in fair value of $343,000 and $285,000, as compared to a net decrease in fair value of $816,000 and $1.8 million for the three and nine months ended September 30, 2022, respectively. As of September 30, 2023 and 2022, there were $15.2 million and $14.2 million, respectively, in residential mortgage loans recorded at fair value as they were previously transferred from loans held for sale to loans held for investment.

|

|

(3)

|

Noninterest expense includes allocated overhead expense from general corporate activities. Allocation is determined based on a combination of segment assets and FTEs. For the three and nine months ended September 30, 2023 and 2022, the Home Lending segment included allocated overhead expenses of $1.5 million and $4.7 million, respectively.

|

Asset Summary

Total assets increased $14.5 million, or 0.5%, to $2.92 billion at September 30, 2023, compared to $2.91 billion at June 30, 2023, and increased $267.9 million, or 10.1%, from $2.65 billion at September 30, 2022. The increase in total assets at September 30, 2023, compared to the June 30, 2023, was primarily due to increases in loans receivable, net of $33.1 million and securities available-for-sale of $26.0 million, partially offset by a decrease in total cash and cash equivalents of $51.4 million. The increase in total assets at September 30, 2023, compared to September 30, 2022, was primarily due to increases in loans receivable, net of $291.6 million, primarily due to organic loan growth funded through deposits received from the purchase of seven retail branches from Columbia State Bank completed on February 24, 2023 (“Branch Acquisition”) and assets purchased in the Branch Acquisition. The increase in total assets at September 30, 2023, compared to September 30, 2022, also included securities available-for-sale of $24.0 million, core deposit intangible (“CDI”), net of $14.8 million and interest-earning deposits at other financial institutions of $12.7 million. These increases were partially offset by decreases in total cash and cash equivalents of $79.1 million, FHLB stock of $9.9 million and loans held for sale (“HFS”) of $4.8 million.

Page 4

|

LOAN PORTFOLIO

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Dollars in thousands)

|

|

September 30, 2023

|

|

|

June 30, 2023

|

|

|

September 30, 2022

|

|

| |

|

Amount

|

|

|

Percent

|

|

|

Amount

|

|

|

Percent

|

|

|

Amount

|

|

|

Percent

|

|

|

REAL ESTATE LOANS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial

|

|

$ |

364,673 |

|

|

|

15.2 |

%

|

|

$ |

343,008 |

|

|

|

14.4 |

%

|

|

$ |

310,923 |

|

|

|

14.7 |

%

|

|

Construction and development

|

|

|

289,873 |

|

|

|

12.0 |

|

|

|

312,093 |

|

|

|

13.2 |

|

|

|

335,177 |

|

|

|

15.9 |

|

|

Home equity

|

|

|

67,103 |

|

|

|

2.8 |

|

|

|

62,304 |

|

|

|

2.6 |

|

|

|

53,681 |

|

|

|

2.6 |

|

|

One-to-four-family (excludes HFS)

|

|

|

540,670 |

|

|

|

22.5 |

|

|

|

521,734 |

|

|

|

22.0 |

|

|

|

429,196 |

|

|

|

20.3 |

|

|

Multi-family

|

|

|

243,661 |

|

|

|

10.1 |

|

|

|

231,675 |

|

|

|

9.8 |

|

|

|

223,712 |

|

|

|

10.6 |

|

|

Total real estate loans

|

|

|

1,505,980 |

|

|

|

62.6 |

|

|

|

1,470,814 |

|

|

|

62.0 |

|

|

|

1,352,689 |

|

|

|

64.1 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONSUMER LOANS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Indirect home improvement

|

|

|

562,650 |

|

|

|

23.4 |

|

|

|

557,818 |

|

|

|

23.5 |

|

|

|

447,462 |

|

|

|

21.2 |

|

|

Marine

|

|

|

73,887 |

|

|

|

3.1 |

|

|

|

72,484 |

|

|

|

3.0 |

|

|

|

68,106 |

|

|

|

3.2 |

|

|

Other consumer

|

|

|

3,547 |

|

|

|

0.1 |

|

|

|

3,606 |

|

|

|

0.2 |

|

|

|

2,987 |

|

|

|

0.2 |

|

|

Total consumer loans

|

|

|

640,084 |

|

|

|

26.6 |

|

|

|

633,908 |

|

|

|

26.7 |

|

|

|

518,555 |

|

|

|

24.6 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMMERCIAL BUSINESS LOANS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial and industrial

|

|

|

236,520 |

|

|

|

9.8 |

|

|

|

237,403 |

|

|

|

10.0 |

|

|

|

211,009 |

|

|

|

10.0 |

|

|

Warehouse lending

|

|

|

23,489 |

|

|

|

1.0 |

|

|

|

30,649 |

|

|

|

1.3 |

|

|

|

28,102 |

|

|

|

1.3 |

|

|

Total commercial business loans

|

|

|

260,009 |

|

|

|

10.8 |

|

|

|

268,052 |

|

|

|

11.3 |

|

|

|

239,111 |

|

|

|

11.3 |

|

|

Total loans receivable, gross

|

|

|

2,406,073 |

|

|

|

100.0 |

%

|

|

|

2,372,774 |

|

|

|

100.0 |

%

|

|

|

2,110,355 |

|

|

|

100.0 |

%

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Allowance for credit losses on loans

|

|

|

(30,501 |

) |

|

|

|

|

|

|

(30,350 |

) |

|

|

|

|

|

|

(26,426 |

) |

|

|

|

|

|

Total loans receivable, net

|

|

$ |

2,375,572 |

|

|

|

|

|

|

$ |

2,342,424 |

|

|

|

|

|

|

$ |

2,083,929 |

|

|

|

|

|

Loans receivable, net increased $33.1 million to $2.38 billion at September 30, 2023, from $2.34 billion at June 30, 2023, and increased $291.6 million from $2.08 billion at September 30, 2022. The increase in total real estate loans at September 30, 2023, compared to the prior quarter reflects increases in commercial real estate loans of $21.7 million, one-to-four-family loans (excluding loans HFS) of $18.9 million, multi-family loans of $12.0 million, home equity loans of $4.8 million, and consumer loans, primarily indirect home improvement loans of $6.2 million. These increases were partially offset by an $8.0 million decrease in commercial business loans, primarily as a result of a $7.2 million decrease in warehouse lending.

Originations of one-to-four-family loans to purchase and refinance a home for the periods indicated were as follows:

|

(Dollars in thousands)

|

|

For the Three Months Ended

|

|

|

For the Three Months Ended

|

|

|

|

|

|

|

|

|

|

| |

|

September 30, 2023

|

|

|

June 30, 2023

|

|

|

|

|

|

|

|

|

|

| |

|

Amount

|

|

|

Percent

|

|

|

Amount

|

|

|

Percent

|

|

|

$ Change

|

|

|

% Change

|

|

|

Purchase

|

|

$ |

139,345 |

|

|

|

92.1 |

%

|

|

$ |

145,377 |

|

|

|

91.2 |

%

|

|

$ |

(6,032 |

) |

|

|

(4.1 |

)%

|

|

Refinance

|

|

|

12,001 |

|

|

|

7.9 |

|

|

|

14,099 |

|

|

|

8.8 |

|

|

|

(2,098 |

) |

|

|

(14.8 |

) |

|

Total

|

|

$ |

151,346 |

|

|

|

100.0 |

%

|

|

$ |

159,476 |

|

|

|

100.0 |

%

|

|

$ |

(8,130 |

) |

|

|

(5.0 |

)%

|

Page 5

|

(Dollars in thousands)

|

|

For the Three Months Ended September 30,

|

|

|

|

|

|

|

|

|

|

| |

|

2023

|

|

|

2022

|

|

|

|

|

|

|

|

|

|

| |

|

Amount

|

|

|

Percent

|

|

|

Amount

|

|

|

Percent

|

|

|

$ Change

|

|

|

% Change

|

|

|

Purchase

|

|

$ |

139,345 |

|

|

|

92.1 |

%

|

|

$ |

172,639 |

|

|

|

89.1 |

%

|

|

$ |

(33,294 |

) |

|

|

(19.3 |

)%

|

|

Refinance

|

|

|

12,001 |

|

|

|

7.9 |

|

|

|

21,096 |

|

|

|

10.9 |

|

|

|

(9,095 |

) |

|

|

(43.1 |

) |

|

Total

|

|

$ |

151,346 |

|

|

|

100.0 |

%

|

|

$ |

193,735 |

|

|

|

100.0 |

%

|

|

$ |

(42,389 |

) |

|

|

(21.9 |

)%

|

|

(Dollars in thousands)

|

|

For the Nine Months Ended September 30,

|

|

|

|

|

|

|

|

|

|

| |

|

2023

|

|

|

2022

|

|

|

|

|

|

|

|

|

|

| |

|

Amount

|

|

|

Percent

|

|

|

Amount

|

|

|

Percent

|

|

|

$ Change

|

|

|

% Change

|

|

|

Purchase

|

|

$ |

387,211 |

|

|

|

91.8 |

%

|

|

$ |

549,259 |

|

|

|

78.7 |

%

|

|

$ |

(162,048 |

) |

|

|

(29.5 |

)%

|

|

Refinance

|

|

|

34,635 |

|

|

|

8.2 |

|

|

|

148,335 |

|

|

|

21.3 |

|

|

|

(113,700 |

) |

|

|

(76.7 |

) |

|

Total

|

|

$ |

421,846 |

|

|

|

100.0 |

%

|

|

$ |

697,594 |

|

|

|

100.0 |

%

|

|

$ |

(275,748 |

) |

|

|

(39.5 |

)%

|

The decrease in loan purchase and refinance activity, as well as slower sales activity, compared to the comparable period in 2022 reflects the impact of rising market interest rates and low available housing inventory in our market areas.

During the quarter ended September 30, 2023, the Company sold $117.6 million of one-to-four-family loans compared to $127.0 million during the previous quarter and $142.3 million during the same quarter one year ago. Gross margins on home loan sales increased to 3.08% for the quarter ended September 30, 2023, compared to 3.07% in the previous quarter and increased from 2.85% in the same quarter one year ago. Gross margins are defined as the margin on loans sold (cash sales) without the impact of deferred costs.

Liabilities and Equity Summary

Changes in deposits at the dates indicated were as follows:

|

(Dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

September 30, 2023

|

|

|

June 30, 2023

|

|

|

|

|

|

|

|

|

|

|

Transactional deposits:

|

|

Amount

|

|

|

Percent

|

|

|

Amount

|

|

|

Percent

|

|

|

$ Change

|

|

|

% Change

|

|

|

Noninterest-bearing checking

|

|

$ |

643,670 |

|

|

|

26.2 |

%

|

|

$ |

658,440 |

|

|

|

27.9 |

%

|

|

$ |

(14,770 |

) |

|

|

(2.2 |

)%

|

|

Interest-bearing checking (1)

|

|

|

219,468 |

|

|

|

8.9 |

|

|

|

183,012 |

|

|

|

7.7 |

|

|

|

36,456 |

|

|

|

19.9 |

|

|

Escrow accounts related to mortgages serviced (2)

|

|

|

26,489 |

|

|

|

1.1 |

|

|

|

16,772 |

|

|

|

0.7 |

|

|

|

9,717 |

|

|

|

57.9 |

|

|

Subtotal

|

|

|

889,627 |

|

|

|

36.2 |

|

|

|

858,224 |

|

|

|

36.3 |

|

|

|

31,403 |

|

|

|

3.7 |

|

|

Savings

|

|

|

157,901 |

|

|

|

6.4 |

|

|

|

169,013 |

|

|

|

7.2 |

|

|

|

(11,112 |

) |

|

|

(6.6 |

) |

|

Money market (3)

|

|

|

389,962 |

|

|

|

15.9 |

|

|

|

419,308 |

|

|

|

17.7 |

|

|

|

(29,346 |

) |

|

|

(7.0 |

) |

|

Subtotal

|

|

|

547,863 |

|

|

|

22.3 |

|

|

|

588,321 |

|

|

|

24.9 |

|

|

|

(40,458 |

) |

|

|

(6.9 |

) |

|

Certificates of deposit less than $100,000 (4)

|

|

|

527,032 |

|

|

|

21.5 |

|

|

|

473,026 |

|

|

|

20.0 |

|

|

|

54,006 |

|

|

|

11.4 |

|

|

Certificates of deposit of $100,000 through $250,000

|

|

|

406,545 |

|

|

|

16.6 |

|

|

|

358,238 |

|

|

|

15.1 |

|

|

|

48,307 |

|

|

|

13.5 |

|

|

Certificates of deposit of $250,000 and over

|

|

|

83,377 |

|

|

|

3.4 |

|

|

|

87,499 |

|

|

|

3.7 |

|

|

|

(4,122 |

) |

|

|

(4.7 |

) |

|

Subtotal

|

|

|

1,016,954 |

|

|

|

41.5 |

|

|

|

918,763 |

|

|

|

38.8 |

|

|

|

98,191 |

|

|

|

10.7 |

|

|

Total

|

|

$ |

2,454,444 |

|

|

|

100.0 |

%

|

|

$ |

2,365,308 |

|

|

|

100.0 |

%

|

|

$ |

89,136 |

|

|

|

3.8 |

%

|

Page 6

|

(Dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

September 30, 2023

|

|

|

September 30, 2022

|

|

|

|

|

|

|

|

|

|

|

Transactional deposits:

|

|

Amount

|

|

|

Percent

|

|

|

Amount

|

|

|

Percent

|

|

|

$ Change

|

|

|

% Change

|

|

|

Noninterest-bearing checking

|

|

$ |

643,670 |

|

|

|

26.2 |

%

|

|

$ |

555,753 |

|

|

|

26.7 |

%

|

|

$ |

87,917 |

|

|

|

15.8 |

%

|

|

Interest-bearing checking (1)

|

|

|

219,468 |

|

|

|

8.9 |

|

|

|

147,968 |

|

|

|

7.1 |

|

|

|

71,500 |

|

|

|

48.3 |

|

|

Escrow accounts related to mortgages serviced (2)

|

|

|

26,489 |

|

|

|

1.1 |

|

|

|

25,859 |

|

|

|

1.2 |

|

|

|

630 |

|

|

|

2.4 |

|

|

Subtotal

|

|

|

889,627 |

|

|

|

36.2 |

|

|

|

729,580 |

|

|

|

35.0 |

|

|

|

160,047 |

|

|

|

21.9 |

|

|

Savings

|

|

|

157,901 |

|

|

|

6.4 |

|

|

|

143,612 |

|

|

|

6.9 |

|

|

|

14,289 |

|

|

|

9.9 |

|

|

Money market (3)

|

|

|

389,962 |

|

|

|

15.9 |

|

|

|

659,861 |

|

|

|

31.7 |

|

|

|

(269,899 |

) |

|

|

(40.9 |

) |

|

Subtotal

|

|

|

547,863 |

|

|

|

22.3 |

|

|

|

803,473 |

|

|

|

38.6 |

|

|

|

(255,610 |

) |

|

|

(31.8 |

) |

|

Certificates of deposit less than $100,000 (4)

|

|

|

527,032 |

|

|

|

21.5 |

|

|

|

345,227 |

|

|

|

16.6 |

|

|

|

181,805 |

|

|

|

52.7 |

|

|

Certificates of deposit of $100,000 through $250,000

|

|

|

406,545 |

|

|

|

16.6 |

|

|

|

133,429 |

|

|

|

6.4 |

|

|

|

273,116 |

|

|

|

204.7 |

|

|

Certificates of deposit of $250,000 and over

|

|

|

83,377 |

|

|

|

3.4 |

|

|

|

71,629 |

|

|

|

3.4 |

|

|

|

11,748 |

|

|

|

16.4 |

|

|

Subtotal

|

|

|

1,016,954 |

|

|

|

41.5 |

|

|

|

550,285 |

|

|

|

26.4 |

|

|

|

466,669 |

|

|

|

84.8 |

|

|

Total

|

|

$ |

2,454,444 |

|

|

|

100.0 |

%

|

|

$ |

2,083,338 |

|

|

|

100.0 |

%

|

|

$ |

371,106 |

|

|

|

17.8 |

%

|

|

(2)

|

Noninterest-bearing accounts.

|

At September 30, 2023, CDs, which include retail and nonretail CDs, totaled $1.02 billion, compared to $918.8 million at June 30, 2023 and $550.3 million at September 30, 2022, with nonretail CDs representing 33.2%, 33.7% and 51.7% of total CDs at such dates, respectively. At September 30, 2023, nonretail CDs, which include brokered CDs, online CDs and public funds CDs, increased $27.2 million to $337.2 million, compared to $310.0 million at June 30, 2023, primarily due to an increase of $27.6 million in brokered CDs. Nonretail CDs totaled $337.2 million at September 30, 2023, compared to $284.4 million at September 30, 2022.

At September 30, 2023, the Bank had uninsured deposits of approximately $591.6 million, compared to approximately $587.6 million at June 30, 2023, and $600.4 million at September 30, 2022. The uninsured amounts are estimates based on the methodologies and assumptions used for the Bank's regulatory reporting requirements.

At September 30, 2023, borrowings totaled $121.9 million and were comprised of advances from the Federal Reserve Bank's Term Funding Program of $90.0 million, overnight borrowings of $28.0 million, and FHLB fixed-rate advances of $3.9 million. Borrowings decreased $78.0 million to $121.9 million at September 30, 2023, from $199.9 million at June 30, 2023, and decreased $138.9 million at from $260.8 million at September 30, 2022. The decrease was partially attributable to a shift in funding mix to brokered CDs.

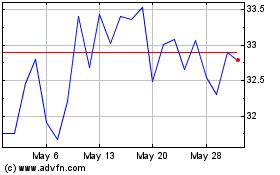

Total stockholders’ equity increased $732,000 to $250.7 million at September 30, 2023, from $249.9 million at June 30, 2023, and increased $30.1 million, from $220.5 million at September 30, 2022. The increase in stockholders’ equity at September 30, 2023, compared to June 30, 2023, reflects net income of $9.0 million, partially offset by dividends paid of $1.9 million. In addition, stockholders’ equity was negatively impacted by unrealized net losses in securities available for sale of $9.2 million, net of tax, partially offset by unrealized net gains on fair value and cash flow hedges of $2.3 million, net of tax, reflecting changes in market interest rates during the quarter, resulting in a $7.0 million increase in accumulated other comprehensive loss. Book value per common share was $32.58 at September 30, 2023, compared to $32.71 at June 30, 2023, and $29.07 at September 30, 2022.

Page 7

The Bank is considered well capitalized under the capital requirements established by the Federal Deposit Insurance Corporation (“FDIC”) with a total risk-based capital ratio of 13.1%, a Tier 1 leverage capital ratio of 10.3%, and a common equity Tier 1 (“CET1”) capital ratio of 11.8% at September 30, 2023.

The Company exceeded all regulatory capital requirements with a total risk-based capital ratio of 13.4%, a Tier 1 leverage capital ratio of 8.9%, and a CET1 ratio of 10.2% at September 30, 2023.

Credit Quality

The allowance for credit losses on loans (“ACLL”) totaled to $30.5 million, or 1.27% of gross loans receivable (excluding loans HFS) at September 30, 2023, compared to $30.4 million, or 1.28% of gross loans receivable (excluding loans HFS), at June 30, 2023, and $26.4 million, or 1.25% of gross loans receivable (excluding loans HFS), at September 30, 2022. The $151,000 increase in the ACLL at September 30, 2023, compared to the prior quarter was primarily due to an increase in loans. The $4.1 million increase in the ACLL at September 30, 2023, compared to the prior year was primarily due to organic loan growth and the addition of loans acquired in the Branch Acquisition. The allowance for credit losses on unfunded loan commitments decreased $149,000 to $1.8 million at September 30, 2023, compared to $1.9 million at June 30, 2023, and decreased $1.3 million from $3.1 million at September 30, 2022. The decreases were attributable to a decline in unfunded construction loan commitments at September 30, 2023.

Nonperforming loans decreased $3.7 million to $5.6 million at September 30, 2023, compared to $9.3 million at June 30, 2023, and decreased $2.6 million from $8.2 million at September 30, 2022. The decrease in nonperforming loans at September 30, 2023, from the prior quarter was primarily due to decreases in nonperforming commercial business loans of $3.5 million and indirect home improvement loans of $165,000. The decrease in nonperforming loans compared to the prior year was primarily due to decreases in commercial business loans of $4.3 million and one-to-four-family loans of $535,000, partially offset by increases in commercial real estate loans of $1.1 million, indirect home improvement loans of $1.0 million, and marine loans of $225,000. The decrease in the nonperforming commercial business loans between the periods was primarily attributable to a $3.5 million loan being upgraded to performing from nonperforming status.

Loans classified as substandard increased $2.8 million to $19.2 million at September 30, 2023, compared to $16.4 million at June 30, 2023, and increased $2.5 million from $16.6 million at September 30, 2022. The increase in substandard loans at September 30, 2023 compared to the prior quarter was primarily attributable to increases of $1.7 million in commercial real estate loans and $956,000 in one-to-four-family loans and compared to the prior year was primarily due to increases of $2.2 million in one-to-four-family loans, $1.0 million in indirect home improvement loans, and $225,000 in marine loans, partially offset by a decrease of $928,000 in commercial business loans. There was one other real estate owned property (“OREO”) in the amount of $570,000 (a closed branch in Centralia, Washington) at both September 30, 2023 and June 30, 2023, compared to one OREO in the amount of $145,000 at September 30, 2022.

Page 8

Operating Results

Net interest income increased $3.1 million to $30.6 million for the three months ended September 30, 2023, from $27.5 million for the three months ended September 30, 2022, primarily as a result of an increase in interest income on loans. Total interest income for the three months ended September 30, 2023, increased $12.0 million compared to the same period last year, primarily due to an increase of $10.3 million in interest income on loans receivable, including fees, impacted primarily as a result of new loans being originated at higher rates and variable rate loans repricing higher following recent increases in market interest rates. Total interest expense for the three months ended September 30, 2023, increased $8.9 million compared to the same period last year, primarily as a result of higher market interest rates, higher utilization of borrowings and a shift in deposit mix from transactional accounts to higher cost CDs.

For the nine months ended September 30, 2023, net interest income increased $17.9 million to $92.8 million, from $75.0 million for the nine months ended September 30, 2022, for the same reasons described above for the three-month comparison, with an increase in interest income of $39.9 million and an increase in interest expense of $22.0 million.

NIM (annualized) decreased 20 basis points to 4.34% for the three months ended September 30, 2023, from 4.54% for the same period in the prior year and increased 17 basis points to 4.56% for the nine months ended September 30, 2023, from 4.39% for the nine months ended September 30, 2022. The changes in NIM for the three and nine months ended September 30, 2023 compared to the same period in 2022, reflects new loan originations at higher market interest rates and variable rate interest-earning assets repricing higher following recent increases in market interest rates, offset by the rising cost of deposits and borrowings. The benefit from higher rates and interest earning assets were partially offset by rising deposit and borrowing costs. Increases in average balances of higher costing CDs and borrowings placed additional pressure on the NIM, which resulted in a decrease for the three months ended September 30, 2023, compared to the same period in 2022.

The average total cost of funds, including noninterest-bearing checking, increased 124 basis points to 1.92% for the three months ended September 30, 2023, from 0.68% for the three months ended September 30, 2022. This increase was predominantly due to the rise in cost for market rates for deposits. The average cost of funds increased 108 basis points to 1.58% for the nine months ended September 30, 2023, from 0.50% for the nine months ended September 30, 2022, also reflecting increases in market interest rates over last year. Management remains focused on matching deposit/liability duration with the duration of loans/assets where appropriate.

For the three and nine months ended September 30, 2023, the provision for credit losses on loans was $683,000 and $4.1 million, respectively, compared to $2.0 million and $4.5 million for the three and nine months ended September 30, 2022. The provision for credit losses on loans reflects an increase in total loans receivable and net charge-offs in indirect home improvement and marine loans.

During the three months ended September 30, 2023, net charge-offs totaled $531,000, compared to $563,000 for the same period last year, primarily due to decreased net charge-offs of $388,000 in deposit overdrafts and $35,000 in marine loans, partially offset by net increases of $387,000 in indirect home improvement loans and $3,000 in other loans. Net charge-offs totaled $1.6 million during the nine months ended September 30, 2023, compared to $843,000 during the nine months ended September 30, 2022. This increase was primarily due to net charge-off increases of $972,000 in indirect home improvement loans, $164,000 in marine loans, $10,000 in home equity loans, and $2,000 in other loans, partially offset by a net decrease of $400,000 in deposit overdrafts charge-offs. Management attributes the increase in net charge-offs over the year primarily to volatile economic conditions.

Noninterest income increased $801,000 to $5.0 million for the three months ended September 30, 2023, from $4.2 million for the three months ended September 30, 2022. The increase reflects a $1.4 million increase in service charges and fee income, primarily as a result of less amortization of mortgage servicing rights reflecting increased market interest rates and increased servicing fees from non-portfolio serviced loans, and an increase of $473,000 in gain on sale of loans, partially offset by a $1.1 million decrease in other noninterest income. Noninterest income increased $622,000, to $15.0 million, for the nine months ended September 30, 2023, from $14.4 million for the nine months ended September 30, 2022. This increase was primarily the result of a $4.1 million increase in service charges and fee income, partially offset by decreases of $2.0 million in gain on sale of loans and $1.4 million in other noninterest income.

Page 9

Noninterest expense increased $4.2 million to $23.6 million for the three months ended September 30, 2023, from $19.3 million for the three months ended September 30, 2022. The increase in noninterest expense was primarily a result of a $2.1 million increase in salaries and benefits largely due to the Branch Acquisition and growth in FTEs. Other increases included $829,000 in amortization of CDI, $597,000 in operations expense, $293,000 in data processing, $244,000 in occupancy expense, and $232,000 in marketing and advertising, offset by a decrease of $182,000 in loan costs. Noninterest expense increased $14.0 million to $71.3 million for the nine months ended September 30, 2023, from $57.3 million for the nine months ended September 30, 2022 primarily for the same reasons stated above. Increases during the nine-month period ended September 30, 2023 as compared to the same period last year included $5.8 million in salaries and benefits, $2.1 million in operations, $2.0 million in amortization of CDI, $1.6 million in acquisition costs, $928,000 in FDIC insurance, $845,000 in occupancy, $729,000 in data processing, and $420,000 in marketing and advertising, offset by a decrease of $386,000 in professional and board fees.

About FS Bancorp

FS Bancorp, Inc., a Washington corporation, is the holding company for 1st Security Bank. The Bank provides loan and deposit services to customers who are predominantly small- and middle-market businesses and individuals in Washington and Oregon through its 27 Bank branches, one headquarters office that produces loans and accepts deposits, and loan production offices in various suburban communities in the greater Puget Sound area, the Kennewick-Pasco-Richland metropolitan area of Washington, also known as the Tri-Cities, and in Vancouver, Washington. The Bank services home mortgage customers throughout the Northwest predominantly in Washington State including the Puget Sound, Tri-Cities and Vancouver home lending markets.

Forward-Looking Statements

When used in this press release and in other documents filed with or furnished to the Securities and Exchange Commission (the “SEC”), in press releases or other public stockholder communications, or in oral statements made with the approval of an authorized executive officer, the words or phrases “believe,” “will,” “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimate,” “project,” “plans,” or similar expressions are intended to identify “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward‑looking statements are not historical facts but instead represent management's current expectations and forecasts regarding future events, many of which are inherently uncertain and outside of our control. Actual results may differ, possibly materially from those currently expected or projected in these forward-looking statements. Factors that could cause the Company’s actual results to differ materially from those described in the forward-looking statements, include but are not limited to, the following: potential adverse impacts to economic conditions in the Company’s local market areas, other markets where the Company has lending relationships, or other aspects of the Company’s business operations or financial markets, including, without limitation, as a result of employment levels; labor shortages, the effects of inflation, a potential recession or slowed economic growth; changes in the interest rate environment, including the recent increases in the Federal Reserve benchmark rate and duration at which such increased interest rate levels are maintained, which could adversely affect our revenues and expenses, the values of our assets and obligations, and the availability and cost of capital and liquidity; the impact of continuing high inflation and the current and future monetary policies of the Federal Reserve in response thereto; the effects of any federal government shutdown; increased competitive pressures, changes in the interest rate environment, adverse changes in the securities markets, the Company’s ability to successfully realize the anticipated benefits of the Branch Acquisition, including customer acquisition and retention; the Company’s ability to execute its plans to grow its residential construction lending, mortgage banking, and warehouse lending operations, and the geographic expansion of its indirect home improvement lending; challenges arising from expanding into new geographic markets, products, or services; secondary market conditions for loans and the Company’s ability to originate loans for sale and sell loans in the secondary market; fluctuations in deposits; liquidity issues, including our ability to borrow funds or raise additional capital, if necessary; the impact of bank failures or adverse developments at other banks and related negative press about the banking industry in general on investor and depositor sentiment; legislative and regulatory changes, including changes in banking, securities and tax law, in regulatory policies and principles, or the interpretation of regulatory capital or other rules; disruptions, security breaches, or other adverse events, failures or interruptions in, or attacks on, our information technology systems or on the third-party vendors who perform critical processing functions for us; the effects of climate change, severe weather events, natural disasters, pandemics, epidemics and other public health crises, acts of war or terrorism, and other external events on our business; and other factors described in the Company’s latest Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and other reports filed with and furnished to the SEC which are available on its website at www.fsbwa.com and on the SEC's website at www.sec.gov. Any of the forward-looking statements that the Company makes in this press release and in the other public statements are based upon management's beliefs and assumptions at the time they are made and may turn out to be incorrect because of the inaccurate assumptions the Company might make, because of the factors illustrated above or because of other factors that cannot be foreseen by the Company. Therefore, these factors should be considered in evaluating the forward‑looking statements, and undue reliance should not be placed on such statements. The Company does not undertake and specifically disclaims any obligation to revise any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements. These risks could cause the Company’s actual results for 2023 and beyond to differ materially from those expressed in any forward-looking statements made by, or on behalf of the Company and could negatively affect its operating and stock performance.

Page 10

FS BANCORP, INC. AND SUBSIDIARY

CONSOLIDATED BALANCE SHEETS

(Dollars in thousands, except share amounts) (Unaudited)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Linked

|

|

|

Year

|

|

| |

|

September 30,

|

|

|

June 30,

|

|

|

September 30,

|

|

|

Quarter

|

|

|

Over Year

|

|

| |

|

2023

|

|

|

2023

|

|

|

2022

|

|

|

% Change

|

|

|

% Change

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and due from banks

|

|

$ |

18,137 |

|

|

$ |

17,573 |

|

|

$ |

11,541 |

|

|

|

3 |

|

|

|

57 |

|

|

Interest-bearing deposits at other financial institutions

|

|

|

62,536 |

|

|

|

114,526 |

|

|

|

148,256 |

|

|

|

(45 |

) |

|

|

(58 |

) |

|

Total cash and cash equivalents

|

|

|

80,673 |

|

|

|

132,099 |

|

|

|

159,797 |

|

|

|

(39 |

) |

|

|

(50 |

) |

|

Certificates of deposit at other financial institutions

|

|

|

17,636 |

|

|

|

14,747 |

|

|

|

4,960 |

|

|

|

20 |

|

|

|

256 |

|

|

Securities available-for-sale, at fair value

|

|

|

251,917 |

|

|

|

225,869 |

|

|

|

227,942 |

|

|

|

12 |

|

|

|

11 |

|

|

Securities held-to-maturity, net

|

|

|

8,455 |

|

|

|

8,469 |

|

|

|

8,469 |

|

|

|

— |

|

|

|

— |

|

|

Loans held for sale, at fair value

|

|

|

18,636 |

|

|

|

16,714 |

|

|

|

23,447 |

|

|

|

11 |

|

|

|

(21 |

) |

|

Loans receivable, net

|

|

|

2,375,572 |

|

|

|

2,342,424 |

|

|

|

2,083,929 |

|

|

|

1 |

|

|

|

14 |

|

|

Accrued interest receivable

|

|

|

13,925 |

|

|

|

12,244 |

|

|

|

10,407 |

|

|

|

14 |

|

|

|

34 |

|

|

Premises and equipment, net

|

|

|

30,926 |

|

|

|

31,293 |

|

|

|

25,438 |

|

|

|

(1 |

) |

|

|

22 |

|

|

Operating lease right-of-use

|

|

|

7,042 |

|

|

|

7,458 |

|

|

|

6,607 |

|

|

|

(6 |

) |

|

|

7 |

|

|

Federal Home Loan Bank stock, at cost

|

|

|

3,696 |

|

|

|

6,555 |

|

|

|

13,591 |

|

|

|

(44 |

) |

|

|

(73 |

) |

|

Other real estate owned

|

|

|

570 |

|

|

|

570 |

|

|

|

145 |

|

|

|

— |

|

|

|

293 |

|

|

Deferred tax asset, net

|

|

|

7,424 |

|

|

|

5,784 |

|

|

|

6,571 |

|

|

|

28 |

|

|

|

13 |

|

|

Bank owned life insurance (“BOLI”), net

|

|

|

37,480 |

|

|

|

37,247 |

|

|

|

36,578 |

|

|

|

1 |

|

|

|

2 |

|

|

Servicing rights, held at the lower of cost or fair value

|

|

|

17,657 |

|

|

|

17,627 |

|

|

|

18,470 |

|

|

|

— |

|

|

|

(4 |

) |

|

Goodwill

|

|

|

3,592 |

|

|

|

3,592 |

|

|

|

2,312 |

|

|

|

— |

|

|

|

55 |

|

|

Core deposit intangible, net

|

|

|

18,323 |

|

|

|

19,325 |

|

|

|

3,542 |

|

|

|

(5 |

) |

|

|

417 |

|

|

Other assets

|

|

|

26,548 |

|

|

|

23,604 |

|

|

|

19,933 |

|

|

|

12 |

|

|

|

33 |

|

|

TOTAL ASSETS

|

|

$ |

2,920,072 |

|

|

$ |

2,905,621 |

|

|

$ |

2,652,138 |

|

|

|

— |

|

|

|

10 |

|

|

LIABILITIES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest-bearing accounts

|

|

$ |

670,158 |

|

|

$ |

675,211 |

|

|

$ |

581,612 |

|

|

|

(1 |

) |

|

|

15 |

|

|

Interest-bearing accounts

|

|

|

1,784,286 |

|

|

|

1,690,097 |

|

|

|

1,501,726 |

|

|

|

6 |

|

|

|

19 |

|

|

Total deposits

|

|

|

2,454,444 |

|

|

|

2,365,308 |

|

|

|

2,083,338 |

|

|

|

4 |

|

|

|

18 |

|

|

Borrowings

|

|

|

121,895 |

|

|

|

199,896 |

|

|

|

260,828 |

|

|

|

(39 |

) |

|

|

(53 |

) |

|

Subordinated notes:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Principal amount

|

|

|

50,000 |

|

|

|

50,000 |

|

|

|

50,000 |

|

|

|

— |

|

|

|

— |

|

|

Unamortized debt issuance costs

|

|

|

(489 |

) |

|

|

(506 |

) |

|

|

(556 |

) |

|

|

(3 |

) |

|

|

(12 |

) |

|

Total subordinated notes less unamortized debt issuance costs

|

|

|

49,511 |

|

|

|

49,494 |

|

|

|

49,444 |

|

|

|

— |

|

|

|

— |

|

|

Operating lease liability

|

|

|

7,269 |

|

|

|

7,690 |

|

|

|

6,836 |

|

|

|

(5 |

) |

|

|

6 |

|

|

Other liabilities

|

|

|

36,288 |

|

|

|

33,300 |

|

|

|

31,145 |

|

|

|

9 |

|

|

|

17 |

|

|

Total liabilities

|

|

|

2,669,407 |

|

|

|

2,655,688 |

|

|

|

2,431,591 |

|

|

|

1 |

|

|

|

10 |

|

|

COMMITMENTS AND CONTINGENCIES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred stock, $.01 par value; 5,000,000 shares authorized; none issued or outstanding

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Common stock, $.01 par value; 45,000,000 shares authorized; 7,796,095 shares issued and outstanding at September 30, 2023, 7,753,607 at June 30, 2023, and 7,704,373 at September 30, 2022

|

|

|

78 |

|

|

|

77 |

|

|

|

77 |

|

|

|

1 |

|

|

|

1 |

|

|

Additional paid-in capital

|

|

|

57,464 |

|

|

|

56,781 |

|

|

|

53,769 |

|

|

|

1 |

|

|

|

7 |

|

|

Retained earnings

|

|

|

222,532 |

|

|

|

215,519 |

|

|

|

195,986 |

|

|

|

3 |

|

|

|

14 |

|

|

Accumulated other comprehensive loss, net of tax

|

|

|

(29,409 |

) |

|

|

(22,444 |

) |

|

|

(29,285 |

) |

|

|

31 |

|

|

|

— |

|

|

Total stockholders’ equity

|

|

|

250,665 |

|

|

|

249,933 |

|

|

|

220,547 |

|

|

|

— |

|

|

|

14 |

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

$ |

2,920,072 |

|

|

$ |

2,905,621 |

|

|

$ |

2,652,138 |

|

|

|

— |

|

|

|

10 |

|

Page 11

FS BANCORP, INC. AND SUBSIDIARY

CONSOLIDATED STATEMENTS OF INCOME

(Dollars in thousands, except per share amounts) (Unaudited)

| |

|

Three Months Ended

|

|

|

Qtr

|

|

|

Year

|

|

| |

|

September 30,

|

|

|

June 30,

|

|

|

September 30,

|

|

|

Over Qtr

|

|

|

Over Year

|

|

| |

|

2023

|

|

|

2023

|

|

|

2022

|

|

|

% Change

|

|

|

% Change

|

|

|

INTEREST INCOME

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans receivable, including fees

|

|

$ |

39,874 |

|

|

$ |

38,216 |

|

|

$ |

29,563 |

|

|

|

4 |

|

|

|

35 |

|

|

Interest and dividends on investment securities, cash and cash equivalents, and certificates of deposit at other financial institutions

|

|

|

3,396 |

|

|

|

2,651 |

|

|

|

1,741 |

|

|

|

28 |

|

|

|

95 |

|

|

Total interest and dividend income

|

|

|

43,270 |

|

|

|

40,867 |

|

|

|

31,304 |

|

|

|

6 |

|

|

|

38 |

|

|

INTEREST EXPENSE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits

|

|

|

10,462 |

|

|

|

7,610 |

|

|

|

2,596 |

|

|

|

37 |

|

|

|

303 |

|

|

Borrowings

|

|

|

1,689 |

|

|

|

1,219 |

|

|

|

696 |

|

|

|

39 |

|

|

|

143 |

|

|

Subordinated notes

|

|

|

485 |

|

|

|

486 |

|

|

|

485 |

|

|

|

— |

|

|

|

— |

|

|

Total interest expense

|

|

|

12,636 |

|

|

|

9,315 |

|

|

|

3,777 |

|

|

|

36 |

|

|

|

235 |

|

|

NET INTEREST INCOME

|

|

|

30,634 |

|

|

|

31,552 |

|

|

|

27,527 |

|

|

|

(3 |

) |

|

|

11 |

|

|

PROVISION FOR CREDIT LOSSES

|

|

|

548 |

|

|

|

716 |

|

|

|

1,718 |

|

|

|

(23 |

) |

|

|

(68 |

) |

|

NET INTEREST INCOME AFTER PROVISION FOR CREDIT LOSSES

|

|

|

30,086 |

|

|

|

30,836 |

|

|

|

25,809 |

|

|

|

(2 |

) |

|

|

17 |

|

|

NONINTEREST INCOME

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Service charges and fee income

|

|

|

2,882 |

|

|

|

2,862 |

|

|

|

1,511 |

|

|

|

1 |

|

|

|

91 |

|

|

Gain on sale of loans

|

|

|

1,875 |

|

|

|

1,947 |

|

|

|

1,402 |

|

|

|

(4 |

) |

|

|

34 |

|

|

Earnings on cash surrender value of BOLI

|

|

|

233 |

|

|

|

227 |

|

|

|

221 |

|

|

|

3 |

|

|

|

5 |

|

|

Other noninterest income

|

|

|

(8 |

) |

|

|

(203 |

) |

|

|

1,047 |

|

|

|

(96 |

) |

|

|

(101 |

) |

|

Total noninterest income

|

|

|

4,982 |

|

|

|

4,833 |

|

|

|

4,181 |

|

|

|

3 |

|

|

|

19 |

|

|

NONINTEREST EXPENSE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Salaries and benefits

|

|

|

13,503 |

|

|

|

13,513 |

|

|

|

11,402 |

|

|

|

— |

|

|

|

18 |

|

|

Operations

|

|

|

3,409 |

|

|

|

3,643 |

|

|

|

2,812 |

|

|

|

(6 |

) |

|

|

21 |

|

|

Occupancy

|

|

|

1,588 |

|

|

|

1,562 |

|

|

|

1,344 |

|

|

|

2 |

|

|

|

18 |

|

|

Data processing

|

|

|

1,841 |

|

|

|

1,683 |

|

|

|

1,548 |

|

|

|

9 |

|

|

|

19 |

|

|

Loan costs

|

|

|

564 |

|

|

|

1,043 |

|

|

|

746 |

|

|

|

(46 |

) |

|

|

(24 |

) |

|

Professional and board fees

|

|

|

666 |

|

|

|

657 |

|

|

|

631 |

|

|

|

1 |

|

|

|

6 |

|

|

Federal Deposit Insurance Corporation (“FDIC”) insurance

|

|

|

561 |

|

|

|

591 |

|

|

|

462 |

|

|

|

(5 |

) |

|

|

21 |

|

|

Marketing and advertising

|

|

|

452 |

|

|

|

430 |

|

|

|

220 |

|

|

|

5 |

|

|

|

105 |

|

|

Acquisition costs

|

|

|

— |

|

|

|

61 |

|

|

|

— |

|

|

|

NM |

|

|

|

— |

|

|

Amortization of core deposit intangible

|

|

|

1,002 |

|

|

|

1,023 |

|

|

|

173 |

|

|

|

(2 |

) |

|

|

479 |

|

|

Recovery of servicing rights

|

|

|

— |

|

|

|

(2 |

) |

|

|

— |

|