0001327607FALSE00013276072023-10-192023-10-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 19, 2023

FIRST WESTERN FINANCIAL, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Colorado | 001-38595 | 37-1442266 |

(State or other jurisdiction of

incorporation or organization) | (Commission

File Number) | (I.R.S. Employer

Identification No.) |

| | |

1900 16th Street, Suite 1200 Denver, Colorado | | 80202 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: 303.531.8100

Former name or former address, if changed since last report: Not Applicable

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| | | | | |

| x | Emerging growth company |

| |

| x | If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, no par value | MYFW | NASDAQ Stock Market LLC |

Item 2.02 Results of Operations and Financial Condition.

On October 19, 2023, First Western Financial, Inc. (the “Company”) issued a press release announcing its financial results for the third quarter ended September 30, 2023. A copy of the press release is furnished as Exhibit 99.1 and is incorporated by reference herein.

The information in this Item 2.02, including Exhibit 99.1, is being furnished pursuant to Item 2.02 of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liabilities of that section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, unless specifically identified therein as being incorporated therein by reference.

Item 7.01 Regulation FD Disclosure.

The Company intends to hold an investor call and webcast to discuss its financial results for the third quarter ended September 30, 2023 on Friday, October 20, 2023, at 10:00 a.m. Mountain Time. The Company’s presentation to analysts and investors contains additional information about the Company’s financial results for the third quarter ended September 30, 2023 and is furnished as Exhibit 99.2 and is incorporated by reference herein.

The information in this Item 7.01, including Exhibit 99.2, is being furnished pursuant to Item 7.01 of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to liabilities of that section, nor shall it be deemed incorporated by reference into any filing under the Securities Act or the Exchange Act, unless specifically identified therein as being incorporated therein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit

Number | | Description |

| | |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (the cover page XBRL tags are embedded in the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| | FIRST WESTERN FINANCIAL, INC. |

| | |

| | |

| Date: October 19, 2023 | | By: /s/ Scott C. Wylie |

| | Scott C. Wylie |

| | |

| | Chairman, Chief Executive Officer and President |

Exhibit 99.1

First Western Reports Third Quarter 2023 Financial Results

Third Quarter 2023 Summary

•Net revenue increased $2.0 million, or 9.6%, to $22.5 million in Q3 2023, compared to $20.6 million in Q2 2023

•Net income available to common shareholders of $3.1 million in Q3 2023, compared to $1.5 million in Q2 2023 and $6.2 million in Q3 2022

•Diluted EPS of $0.32 in Q3 2023, compared to $0.16 in Q2 2023 and $0.64 in Q3 2022

•Book value per common share increased to $25.76, or 1.5%, from $25.38 as of Q2 2023, and was up 4.1% from $24.74 as of Q3 2022

•Total deposits increased to $2.42 billion, or 1.9%, from $2.38 billion as of Q2 2023, and were up 11.7% from $2.17 billion as of Q3 2022

Denver, Colo., October 19, 2023 – First Western Financial, Inc. (“First Western” or the “Company”) (NASDAQ: MYFW), today reported financial results for the third quarter ended September 30, 2023.

Net income available to common shareholders was $3.1 million, or $0.32 per diluted share, for the third quarter of 2023. This compares to $1.5 million, or $0.16 per diluted share, for the second quarter of 2023, and $6.2 million, or $0.64 per diluted share, for the third quarter of 2022.

Scott C. Wylie, CEO of First Western, commented, "We delivered another quarter of strong financial performance and generated $4.6 million in pre-tax, pre-provision income, an increase of 17% from the prior quarter, while continuing to operate with a conservative approach, prioritizing prudent risk management, and maintaining high levels of liquidity, capital and reserves. While remaining disciplined in our underwriting and pricing criteria, we had our largest quarter of new loan production so far this year, which reflects the strength of the clients that we work with and the attractive lending opportunities that we are seeing throughout our markets. Importantly, we continue to see good results from our focus on deposit gathering, and our deposit growth outpaced our loan growth during the third quarter.

"We believe that our success in executing well on those areas that we can control, such as balance sheet management, attracting new clients, providing exceptional service to existing clients, and tightly managing expenses, will help us to continue to offset the impact from the challenging macro environment and deliver strong financial results for our shareholders in the near term. Over the long term, we believe we are very well positioned to consistently add new clients, realize more operating leverage as we increase our scale, generate profitable growth, and create additional value for shareholders," said Mr. Wylie.

| | | | | | | | | | | | | | | | | |

| For the Three Months Ended |

| September 30, | | June 30, | | September 30, |

| (Dollars in thousands, except per share data) | 2023 | | 2023 | | 2022 |

| Earnings Summary | | | | | |

| Net interest income | $ | 16,766 | | | $ | 18,435 | | | $ | 23,062 | |

Provision for credit losses(1) | 329 | | | 1,843 | | | 1,756 | |

| Total non-interest income | 6,099 | | | 3,962 | | | 6,189 | |

| Total non-interest expense | 18,314 | | | 18,519 | | | 19,260 | |

| Income before income taxes | 4,222 | | | 2,035 | | | 8,235 | |

| Income tax expense | 1,104 | | | 529 | | | 2,014 | |

| Net income available to common shareholders | 3,118 | | | 1,506 | | | 6,221 | |

Adjusted net income available to common shareholders(2) | 3,140 | | | 2,440 | | | 6,337 | |

| Basic earnings per common share | 0.33 | | | 0.16 | | | 0.66 | |

Adjusted basic earnings per common share(2) | 0.33 | | | 0.25 | | | 0.67 | |

| Diluted earnings per common share | 0.32 | | | 0.16 | | | 0.64 | |

Adjusted diluted earnings per common share(2) | 0.32 | | | 0.25 | | | 0.66 | |

| | | | | |

| Return on average assets (annualized) | 0.44 | % | | 0.21 | % | | 0.97 | % |

Adjusted return on average assets (annualized)(2) | 0.45 | | | 0.35 | | | 0.99 | |

| Return on average shareholders' equity (annualized) | 5.08 | | | 2.49 | | | 10.70 | |

Adjusted return on average shareholders' equity (annualized)(2) | 5.12 | | | 4.04 | | | 10.90 | |

Return on tangible common equity (annualized)(2) | 5.82 | | | 2.86 | | | 12.28 | |

Adjusted return on tangible common equity (annualized)(2) | 5.86 | | | 4.64 | | | 12.51 | |

| Net interest margin | 2.46 | | | 2.73 | | | 3.74 | |

Efficiency ratio(2) | 78.76 | | | 74.42 | | | 64.94 | |

____________________(1) Provision for credit loss amounts for periods prior to the ASC 326 adoption date of January 1, 2023 are reported in accordance with previously applicable GAAP.

(2) Represents a Non-GAAP financial measure. See “Reconciliations of Non-GAAP Measures” for a reconciliation of our Non-GAAP measures to the most directly comparable GAAP financial measure.

Operating Results for the Third Quarter 2023

Revenue

Total income before non-interest expense was $22.5 million for the third quarter of 2023, an increase of 9.6%, compared to $20.6 million for the second quarter of 2023. Gross revenue(1) was $23.1 million for the third quarter of 2023, a decrease of 6.6%, from $24.8 million for the second quarter of 2023. The decrease was primarily driven by a decrease in net interest income as a result of higher interest expense primarily due to higher deposit costs, offset partially by higher interest income. Relative to the third quarter of 2022, Total income before non-interest expense decreased 18.0% from $27.5 million. Relative to the third quarter of 2022, gross revenue decreased 21.0% from $29.3 million. The decrease was driven by a decrease in net interest income as a result of higher interest expense due to higher deposit costs, offset partially by higher interest income.

(1) Represents a Non-GAAP financial measure. See “Reconciliations of Non-GAAP Measures” for a reconciliation of our Non-GAAP measures to the most directly comparable GAAP financial measure.

Net Interest Income

Net interest income for the third quarter of 2023 was $16.8 million, a decrease of 9.1% from $18.4 million in the second quarter of 2023. Relative to the third quarter of 2022, net interest income decreased 27.3% from $23.1 million. The decreases were due to higher interest expense driven primarily by higher deposit costs, offset partially by higher interest income.

Net Interest Margin

Net interest margin for the third quarter of 2023 decreased 27 basis points to 2.46% from 2.73% reported in the second quarter of 2023. During the third quarter of 2023, net interest margin was negatively impacted by the addition of $45.9 million of non-performing assets, resulting in a 20 basis point decrease. Average cost of deposits increased 26 basis points in the third quarter of 2023 compared to the second quarter of 2023 driven by a rising rate environment and a highly competitive deposit market.

The yield on interest-earning assets decreased 3 basis points to 5.35% in the third quarter of 2023 from 5.38% in the second quarter of 2023 and the cost of interest-bearing deposits increased 31 basis points to 3.75% in the third quarter of 2023 from 3.44% in the second quarter of 2023.

Relative to the third quarter of 2022, net interest margin decreased from 3.74%, primarily due to a 244 basis point increase in average cost of deposits, offset partially by a 94 basis point increase in loan yields.

Non-interest Income

Non-interest income for the third quarter of 2023 was $6.1 million, an increase of 53.9%, from $4.0 million in the second quarter of 2023. The increase was partially driven by growth in Trust and advisory fees during the third quarter of 2023, as well as a $1.2 million impairment to the carrying value of contingent consideration assets recorded in the second quarter of 2023, not recurring in the third quarter of 2023. The increase in non-interest income was further driven by losses of $1.1 million recorded on loans accounted for under the fair value option during the second quarter of 2023, compared to $0.3 million of losses recorded during the third quarter of 2023.

Relative to the third quarter of 2022, non-interest income decreased 1.5% from $6.2 million. The decrease was primarily due to a decrease in bank fees and losses on loans accounted for under the fair value option, partially offset by an increase in Trust and investment management fees.

Non-interest Expense

Non-interest expense for the third quarter of 2023 decreased 1.1% to $18.3 million, from $18.5 million in the second quarter of 2023, driven primarily by lower salaries and employee benefits related to staffing reductions to better align with lower revenue. Relative to the third quarter of 2022, non-interest expense decreased 4.9% from $19.3 million, driven primarily by lower salaries and employee benefits related to staffing reductions to better align with lower revenue, as well as a decrease in Professional services.

The Company’s efficiency ratio(1) was 78.8% in the third quarter of 2023, compared with 74.4% in the second quarter of 2023 and 64.9% in the third quarter of 2022.

(1) Represents a Non-GAAP financial measure. See “Reconciliations of Non-GAAP Measures” for a reconciliation of our Non-GAAP measures to the most directly comparable GAAP financial measure.

Income Taxes

The Company recorded income tax expense of $1.1 million for the third quarter of 2023, representing an effective tax rate of 26.1%, compared to 26.0% for the second quarter of 2023 and 24.5% for the third quarter of 2022.

Loans

Total loans held for investment were $2.54 billion as of September 30, 2023, an increase of 1.4% from $2.50 billion as of June 30, 2023, due to loan growth primarily in our construction and development, residential mortgage, and commercial and industrial portfolios. Relative to the third quarter of 2022, total loans held for investment increased 7.7% from $2.35 billion as of September 30, 2022, attributable to loan growth primarily in our construction and development and residential mortgage portfolios. The growth in our construction and development portfolio was driven by draws on existing commitments, partially offset by payoffs.

Deposits

Total deposits were $2.42 billion as of September 30, 2023, an increase of 1.9% from $2.38 billion as of June 30, 2023, as a result of new and expanded deposit relationships. Relative to the third quarter of 2022, total deposits increased 11.7% from $2.17 billion as of September 30, 2022, driven primarily by new and expanded deposit relationships.

Borrowings

Federal Home Loan Bank (“FHLB”) and Federal Reserve borrowings were $259.9 million as of September 30, 2023, a decrease of $52.7 million from $312.6 million as of June 30, 2023, driven primarily by a net pay down on the Company's FHLB line of credit during the third quarter of 2023. Relative to the third quarter of 2022, borrowings decreased $13.3 million from $273.2 million as of September 30, 2022, driven by a year-over-year net pay down on the Company's FHLB line of credit, partially offset by an increase in term advances.

Subordinated notes were $52.3 million as of September 30, 2023, an increase of $0.1 million from $52.2 million as of June 30, 2023. Subordinated notes increased $19.7 million from $32.6 million as of September 30, 2022.

Assets Under Management

Assets Under Management ("AUM") decreased by $108.2 million during the third quarter to $6.40 billion as of September 30, 2023, compared to $6.50 billion as of June 30, 2023. This decrease was primarily attributable to a decrease in market values throughout the third quarter 2023, resulting in a decrease in the value of AUM balances. Total AUM increased by $477.4 million compared to September 30, 2022 from $5.92 billion, which was primarily attributable to improving market conditions year-over-year resulting in an increase in the value of AUM.

Credit Quality

Non-performing assets totaled $56.1 million, or 1.87% of total assets, as of September 30, 2023, compared to $10.3 million, or 0.36% of total assets, as of June 30, 2023. The increase was primarily attributable to four additional loans, under one relationship, moving to non-accrual during the third quarter of 2023, totaling $42.2 million. As of September 30, 2022, non-performing assets totaled $3.9 million, or 0.14% of total assets. Relative to the third quarter of 2022, the increase in non-performing assets was driven primarily by the addition of $42.2 million in loans, under one relationship, during the third quarter of 2023, and $8.9 million in loans at the end of the fourth quarter of 2022.

During the third quarter of 2023, the Company recorded a provision expense of $0.3 million, compared to a provision expense of $1.8 million in the second quarter of 2023 and a $1.8 million provision expense in the third quarter of 2022. The provision recorded in the third quarter of 2023 reflects a $2.0 million allowance on individually analyzed loans, partially offset by the impact of improved economic forecasts and a favorable change in loan mix.

Capital

As of September 30, 2023, First Western (“Consolidated”) and First Western Trust Bank (“Bank”) exceeded the minimum capital levels required by their respective regulators. As of September 30, 2023, the Bank was classified as “well capitalized,” as summarized in the following table:

| | | | | |

| September 30, |

| 2023 |

| Consolidated Capital | |

| Tier 1 capital to risk-weighted assets | 9.32 | % |

| Common Equity Tier 1 ("CET1") to risk-weighted assets | 9.32 | |

| Total capital to risk-weighted assets | 12.45 | |

| Tier 1 capital to average assets | 7.96 | |

| |

| Bank Capital | |

| Tier 1 capital to risk-weighted assets | 10.42 | |

| CET1 to risk-weighted assets | 10.42 | |

| Total capital to risk-weighted assets | 11.31 | |

| Tier 1 capital to average assets | 8.88 | |

Book value per common share increased 1.5% from $25.38 as of June 30, 2023 to $25.76 as of September 30, 2023. Book value per common share was up 4.1% from $24.74 as of September 30, 2022. The adoption of CECL on January 1, 2023 resulted in a $0.56 reduction of book value per common share.

Tangible book value per common share(1) increased 1.8% from $22.03 as of June 30, 2023, to $22.42 as of September 30, 2023. Tangible book value per common share was up 5.0% from $21.35 as of September 30, 2022. The adoption of CECL on January 1, 2023 resulted in a $0.56 reduction of tangible book value per common share.

(1) Represents a Non-GAAP financial measure. See “Reconciliations of Non-GAAP Measures” for a reconciliation of our Non-GAAP measures to the most directly comparable GAAP financial measure.

Conference Call, Webcast and Slide Presentation

The Company will host a conference call and webcast at 10:00 a.m. MT/ 12:00 p.m. ET on Friday, October 20, 2023. Telephone access: https://register.vevent.com/register/BI2dd97974afa54016910a3d47035cf03b

A slide presentation relating to the third quarter 2023 results will be accessible prior to the scheduled conference call. The slide presentation and webcast of the conference call can be accessed on the Events and Presentations page of the Company’s investor relations website at https://myfw.gcs-web.com.

About First Western

First Western is a financial services holding company headquartered in Denver, Colorado, with operations in Colorado, Arizona, Wyoming, California, and Montana. First Western and its subsidiaries provide a fully integrated suite of wealth management services on a private trust bank platform, which includes a comprehensive selection of deposit, loan, trust, wealth planning and investment management products and services. First Western’s common stock is traded on the Nasdaq Global Select Market under the symbol “MYFW.” For more information, please visit www.myfw.com.

Non-GAAP Financial Measures

Some of the financial measures included in this press release are not measures of financial performance recognized in accordance with generally accepted accounting principles in the United States (“GAAP”). These non-GAAP financial measures include “Tangible Common Equity,” “Tangible Common Book Value per Share,” “Return on Tangible Common Equity,” “Efficiency Ratio,” “Gross Revenue,” “Allowance for Credit Losses to Adjusted Loans,” “Adjusted Net Income Available to Common Shareholders,” “Adjusted Basic Earnings Per Share,” “Adjusted Diluted Earnings Per Share,” “Adjusted Return on Average Assets,” “Adjusted Return on Average Shareholders’ Equity,” and “Adjusted Return on Tangible Common Equity”. The Company believes these non-GAAP financial measures provide both management and investors a more complete understanding of the Company’s financial position and performance. These non-GAAP financial measures are supplemental and are not a substitute for any analysis based on GAAP financial measures. Not all companies use the same calculation of these measures; therefore, this presentation may not be comparable to other similarly titled measures as presented by other companies. Reconciliation of non-GAAP financial measures, to GAAP financial measures are provided at the end of this press release.

Forward-Looking Statements

Statements in this news release regarding our expectations and beliefs about our future financial performance and financial condition, as well as trends in our business and markets are “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements often include words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “project,” “position,” “outlook,” or words of similar meaning, or future or conditional verbs such as “will,” “would,” “should,” “opportunity,” “could,” or “may.” The forward-looking statements in this news release are based on current information and on assumptions that we make about future events and circumstances that are subject to a number of risks and uncertainties that are often difficult to predict and beyond our control. As a result of those risks and uncertainties, our actual financial results in the future could differ, possibly materially, from those expressed in or implied by the forward-looking statements contained in this news release and could cause us to make changes to our future plans. Those risks and uncertainties include, without limitation, the lack of soundness of other financial institutions or financial market utilities may adversely affect the Company; the Company’s ability to engage in routine funding and other transactions could be adversely affected by the actions and commercial soundness of other financial institutions; financial institutions are interrelated because of trading, clearing, counterparty or other relationships; defaults by, or even rumors or questions about, one or more financial institutions or financial market utilities, or the financial services industry generally, may lead to market-wide liquidity problems and losses of client, creditor and counterparty confidence and could lead to losses or defaults by other financial institutions, or the Company; integration risks and projected cost savings in connection with acquisitions; the risk of geographic concentration in Colorado, Arizona, Wyoming, California, and Montana; the risk of changes in the economy affecting real estate values and liquidity; the risk in our ability to continue to originate residential real estate loans and sell such loans; risks specific to commercial loans and borrowers; the risk of claims and litigation pertaining to our fiduciary responsibilities; the risk of competition for investment managers and professionals; the risk of fluctuation in the value of our investment securities; the risk of changes in interest rates; and the risk of the adequacy of our allowance for credit losses and the risk in our ability to maintain a strong core deposit base or other low-cost funding sources. Additional information regarding these and other risks and uncertainties to which our business and future financial performance are subject is contained in our Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission (“SEC”) on March 15, 2023 (“Form 10-K”), and other documents we file with the SEC from time to time. We urge readers of this news release to review the “Risk Factors” section our Form 10-K and any updates to those risk factors set forth in our subsequent Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and our other filings with the SEC. Also, our actual financial results in the future may differ from those currently expected due to additional risks and uncertainties of which we are not currently aware or which we do not currently view as, but in the future may become, material to our business or operating results. Due to these and other possible uncertainties and risks, readers are cautioned not to place undue reliance on the forward-looking statements contained in this news release, which speak only as of today’s date, or to make predictions based solely on historical financial performance. Any forward-looking statement speaks only as of the date on which it is made, and we do not undertake any obligation to update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law.

Contacts:

Financial Profiles, Inc.

Tony Rossi

310-622-8221

MYFW@finprofiles.com

IR@myfw.com

First Western Financial, Inc.

Consolidated Financial Summary (unaudited)

| | | | | | | | | | | | | | | | | |

| Three Months Ended |

| September 30, | | June 30, | | September 30, |

| (Dollars in thousands, except per share amounts) | 2023 | | 2023 | | 2022 |

| Interest and dividend income: | | | | | |

| Loans, including fees | $ | 34,141 | | | $ | 33,583 | | | $ | 24,988 | |

| Loans accounted for under the fair value option | 300 | | | 351 | | | 513 | |

| Investment securities | 607 | | | 627 | | | 653 | |

| Interest-bearing deposits in other financial institutions | 1,292 | | | 1,666 | | | 533 | |

| Dividends, restricted stock | 141 | | | 145 | | | 108 | |

| Total interest and dividend income | 36,481 | | | 36,372 | | | 26,795 | |

| | | | | |

| Interest expense: | | | | | |

| Deposits | 17,467 | | | 15,864 | | | 2,706 | |

| Other borrowed funds | 2,248 | | | 2,073 | | | 1,027 | |

| Total interest expense | 19,715 | | | 17,937 | | | 3,733 | |

| Net interest income | 16,766 | | | 18,435 | | | 23,062 | |

Less: provision for credit losses(1) | 329 | | | 1,843 | | | 1,756 | |

Net interest income, after provision for credit losses(1) | 16,437 | | | 16,592 | | | 21,306 | |

| | | | | |

| Non-interest income: | | | | | |

| Trust and investment management fees | 4,846 | | | 4,602 | | | 4,639 | |

| Net gain on mortgage loans | 654 | | | 774 | | | 728 | |

| | | | | |

| Bank fees | 427 | | | 591 | | | 587 | |

| Risk management and insurance fees | 145 | | | 103 | | | 115 | |

| Income on company-owned life insurance | 96 | | | 91 | | | 88 | |

| Net loss on loans accounted for under the fair value option | (252) | | | (1,124) | | | (134) | |

| Unrealized (loss)/gain recognized on equity securities | (19) | | | (11) | | | 75 | |

| Net gain on equity interests | — | | | — | | | 6 | |

| Other | 202 | | | (1,064) | | | 85 | |

| Total non-interest income | 6,099 | | | 3,962 | | | 6,189 | |

| Total income before non-interest expense | 22,536 | | | 20,554 | | | 27,495 | |

| | | | | |

| Non-interest expense: | | | | | |

| Salaries and employee benefits | 10,968 | | | 11,148 | | | 11,566 | |

| Occupancy and equipment | 1,807 | | | 1,939 | | | 1,836 | |

| Professional services | 1,867 | | | 1,858 | | | 2,316 | |

| Technology and information systems | 906 | | | 831 | | | 1,172 | |

| Data processing | 1,159 | | | 1,052 | | | 888 | |

| Marketing | 355 | | | 379 | | | 403 | |

| Amortization of other intangible assets | 62 | | | 62 | | | 77 | |

| Net gain on assets held for sale | — | | | — | | | (1) | |

| Net gain on sale of other real estate owned | — | | | — | | | (41) | |

| Other | 1,190 | | | 1,250 | | | 1,044 | |

| Total non-interest expense | 18,314 | | | 18,519 | | | 19,260 | |

| Income before income taxes | 4,222 | | | 2,035 | | | 8,235 | |

| Income tax expense | 1,104 | | | 529 | | | 2,014 | |

| Net income available to common shareholders | $ | 3,118 | | | $ | 1,506 | | | $ | 6,221 | |

| Earnings per common share: | | | | | |

| Basic | $ | 0.33 | | | $ | 0.16 | | | $ | 0.66 | |

| Diluted | 0.32 | | | 0.16 | | | 0.64 | |

(1) Provision for credit loss amounts for periods prior to the ASC 326 adoption date of January 1, 2023 are reported in accordance with previously applicable GAAP.

First Western Financial, Inc.

Consolidated Financial Summary (unaudited)

| | | | | | | | | | | | | | | | | |

| September 30, | | June 30, | September 30, |

| (Dollars in thousands) | 2023 | | 2023 | 2022 |

| Assets | | | | | |

| Cash and cash equivalents: | | | | | |

| Cash and due from banks | $ | 6,439 | | | $ | 6,285 | | | $ | 8,308 | |

| | | | | |

| Interest-bearing deposits in other financial institutions | 265,045 | | | 291,283 | | | 156,940 | |

| Total cash and cash equivalents | 271,484 | | | 297,568 | | | 165,248 | |

| | | | | |

| Held-to-maturity securities, at amortized cost (fair value of $66,487, $69,551 and $78,624, respectively), net of allowance for credit losses | 75,539 | | | 77,469 | | | 84,257 | |

| Correspondent bank stock, at cost | 11,305 | | | 13,518 | | | 12,783 | |

| Mortgage loans held for sale, at fair value | 12,105 | | | 19,746 | | | 12,743 | |

| | | | | |

| Loans (includes $15,464, $17,523, and $22,871 measured at fair value, respectively) | 2,530,459 | | | 2,495,582 | | | 2,351,322 | |

Allowance for credit losses(1) | (23,175) | | | (22,044) | | | (16,081) | |

| Loans, net | 2,507,284 | | | 2,473,538 | | | 2,335,241 | |

| Premises and equipment, net | 25,410 | | | 25,473 | | | 24,668 | |

| Accrued interest receivable | 11,633 | | | 11,135 | | | 8,451 | |

| Accounts receivable | 5,292 | | | 5,116 | | | 5,947 | |

| Other receivables | 3,052 | | | 3,331 | | | 2,868 | |

| Other real estate owned, net | — | | | — | | | 187 | |

| Goodwill and other intangible assets, net | 31,916 | | | 31,977 | | | 32,181 | |

| Deferred tax assets, net | 6,624 | | | 7,202 | | | 6,849 | |

| Company-owned life insurance | 16,429 | | | 16,333 | | | 16,064 | |

| Other assets | 24,680 | | | 23,240 | | | 21,212 | |

| | | | | |

| Total assets | $ | 3,002,753 | | | $ | 3,005,646 | | | $ | 2,728,699 | |

| | | | | |

| Liabilities | | | | | |

| Deposits: | | | | | |

| Noninterest-bearing | $ | 476,308 | | | $ | 514,241 | | | $ | 662,055 | |

| Interest-bearing | 1,943,688 | | | 1,861,153 | | | 1,505,392 | |

| Total deposits | 2,419,996 | | | 2,375,394 | | | 2,167,447 | |

| Borrowings: | | | | | |

| Federal Home Loan Bank and Federal Reserve borrowings | 259,930 | | | 312,600 | | | 273,225 | |

| Subordinated notes | 52,279 | | | 52,223 | | | 32,584 | |

| Accrued interest payable | 3,203 | | | 1,788 | | | 664 | |

| Other liabilities | 21,089 | | | 21,399 | | | 19,917 | |

| Total liabilities | 2,756,497 | | | 2,763,404 | | | 2,493,837 | |

| | | | | |

| Shareholders’ Equity | | | | | |

| Total shareholders’ equity | 246,256 | | | 242,242 | | | 234,862 | |

| Total liabilities and shareholders’ equity | $ | 3,002,753 | | | $ | 3,005,646 | | | $ | 2,728,699 | |

(1) Allowance for credit loss amounts for periods prior to the ASC 326 adoption date of January 1, 2023 are reported in accordance with previously applicable GAAP.

First Western Financial, Inc.

Consolidated Financial Summary (unaudited)

| | | | | | | | | | | | | | | | | |

| September 30, | | June 30, | | September 30, |

| (Dollars in thousands) | 2023 | | 2023 | 2022 |

| Loan Portfolio | | | | | |

Cash, Securities, and Other(1) | $ | 148,669 | | | $ | 150,679 | | | $ | 154,748 | |

| Consumer and Other | 23,975 | | | 21,866 | | | 27,781 | |

| Construction and Development | 349,436 | | | 313,227 | | | 228,060 | |

| 1-4 Family Residential | 913,085 | | | 878,670 | | | 822,796 | |

| Non-Owner Occupied CRE | 527,377 | | | 561,880 | | | 527,836 | |

| Owner Occupied CRE | 208,341 | | | 218,651 | | | 220,075 | |

| Commercial and Industrial | 349,515 | | | 338,679 | | | 350,954 | |

| Total | 2,520,398 | | | 2,483,652 | | | 2,332,250 | |

| Loans accounted for under the fair value option | 16,105 | | | 18,274 | | | 22,648 | |

| Total loans held for investment | 2,536,503 | | | 2,501,926 | | | 2,354,898 | |

Deferred (fees) costs and unamortized premiums/(unaccreted discounts), net(2) | (6,044) | | | (6,344) | | | (3,576) | |

| Loans (includes $15,464, $17,523, and $22,871 measured at fair value, respectively) | $ | 2,530,459 | | | $ | 2,495,582 | | | $ | 2,351,322 | |

| Mortgage loans held for sale | 12,105 | | | 19,746 | | | 12,743 | |

| | | | | |

| | | | | |

| Deposit Portfolio | | | | | |

| Money market deposit accounts | $ | 1,388,726 | | | $ | 1,297,732 | | | $ | 1,010,846 | |

| Time deposits | 373,459 | | | 376,147 | | | 186,680 | |

| Negotiable order of withdrawal accounts | 164,000 | | | 168,537 | | | 277,225 | |

| Savings accounts | 17,503 | | | 18,737 | | | 30,641 | |

| Total interest-bearing deposits | 1,943,688 | | | 1,861,153 | | | 1,505,392 | |

| Noninterest-bearing accounts | 476,308 | | | 514,241 | | | 662,055 | |

| Total deposits | $ | 2,419,996 | | | $ | 2,375,394 | | | $ | 2,167,447 | |

____________________

(1) Includes PPP loans of $4.9 million as of September 30, 2023, $5.6 million as of June 30, 2023, and $7.7 million as of September 30, 2022.

(2) Includes fair value adjustments on loans held for investment accounted for under the fair value option.

First Western Financial, Inc.

Consolidated Financial Summary (unaudited) (continued)

| | | | | | | | | | | | | | | | | |

| As of or for the Three Months Ended |

| September 30, | | June 30, | | September 30, |

| (Dollars in thousands) | 2023 | | 2023 | | 2022 |

| Average Balance Sheets | | | | | |

| Assets | | | | | |

| Interest-earning assets: | | | | | |

| Interest-bearing deposits in other financial institutions | $ | 102,510 | | | $ | 135,757 | | | $ | 101,564 | |

| Federal funds sold | — | | | — | | | 260 | |

| Investment securities | 78,057 | | | 80,106 | | | 87,340 | |

| Correspondent bank stock | 7,162 | | | 8,844 | | | 4,924 | |

| Loans | 2,502,419 | | | 2,471,587 | | | 2,241,343 | |

| Interest-earning assets | 2,690,148 | | | 2,696,294 | | | 2,435,431 | |

| Mortgage loans held for sale | 12,680 | | | 15,841 | | | 11,535 | |

| Total interest-earning assets, plus mortgage loans held for sale | 2,702,828 | | | 2,712,135 | | | 2,446,966 | |

Allowance for credit losses(1) | (22,122) | | | (20,077) | | | (14,981) | |

| Noninterest-earning assets | 125,774 | | | 124,561 | | | 126,457 | |

| Total assets | $ | 2,806,480 | | | $ | 2,816,619 | | | $ | 2,558,442 | |

| | | | | |

| Liabilities and Shareholders’ Equity | | | | | |

| Interest-bearing liabilities: | | | | | |

| Interest-bearing deposits | $ | 1,846,318 | | | $ | 1,847,788 | | | $ | 1,480,288 | |

| FHLB and Federal Reserve borrowings | 125,250 | | | 123,578 | | | 119,025 | |

| Subordinated notes | 52,242 | | | 52,186 | | | 32,564 | |

| Total interest-bearing liabilities | 2,023,810 | | | 2,023,552 | | | 1,631,877 | |

| Noninterest-bearing liabilities: | | | | | |

| Noninterest-bearing deposits | 512,956 | | | 527,562 | | | 673,949 | |

| Other liabilities | 24,228 | | | 23,850 | | | 20,103 | |

| Total noninterest-bearing liabilities | 537,184 | | | 551,412 | | | 694,052 | |

| Total shareholders’ equity | 245,486 | | | 241,655 | | | 232,513 | |

| Total liabilities and shareholders’ equity | $ | 2,806,480 | | | $ | 2,816,619 | | | $ | 2,558,442 | |

| | | | | |

| Yields/Cost of funds (annualized) | | | | | |

| Interest-bearing deposits in other financial institutions | 5.00 | % | | 4.92 | % | | 2.06 | % |

| Investment securities | 3.09 | | | 3.14 | | | 2.97 | |

| Correspondent bank stock | 7.81 | | | 6.58 | | | 8.70 | |

| Loans | 5.43 | | | 5.47 | | | 4.49 | |

| Mortgage loans held for sale | 6.70 | | | 5.82 | | | 5.40 | |

| Total interest-earning assets | 5.35 | | | 5.38 | | | 4.34 | |

| Interest-bearing deposits | 3.75 | | | 3.44 | | | 0.73 | |

| Cost of deposits | 2.94 | | | 2.68 | | | 0.50 | |

| FHLB and Federal Reserve borrowings | 4.58 | | | 4.42 | | | 2.22 | |

| Subordinated notes | 6.08 | | | 5.47 | | | 4.41 | |

| Total interest-bearing liabilities | 3.86 | | | 3.56 | | | 0.91 | |

| Net interest margin | 2.46 | | | 2.73 | | | 3.74 | |

| Net interest rate spread | 1.49 | | | 1.82 | | | 3.44 | |

(1) Allowance for credit loss amounts for periods prior to the ASC 326 adoption date of January 1, 2023 are reported in accordance with previously applicable GAAP.

First Western Financial, Inc.

Consolidated Financial Summary (unaudited) (continued)

| | | | | | | | | | | | | | | | | |

| As of or for the Three Months Ended |

| September 30, | | June 30, | | September 30, |

| (Dollars in thousands, except share and per share amounts) | 2023 | | 2023 | | 2022 |

| Asset Quality | | | | | |

| Non-performing loans | $ | 56,146 | | | $ | 10,273 | | | $ | 3,744 | |

| Non-performing assets | 56,146 | | | 10,273 | | | 3,931 | |

| Net charge-offs | 190 | | | 8 | | | 32 | |

| Non-performing loans to total loans | 2.21 | % | | 0.41 | % | | 0.16 | % |

| Non-performing assets to total assets | 1.87 | | | 0.36 | | | 0.14 | |

Allowance for credit losses to non-performing loans(3) | 41.28 | | | 214.58 | | | 429.51 | |

Allowance for credit losses to total loans(3) | 0.92 | | | 0.89 | | | 0.69 | |

Allowance for credit losses to adjusted loans(1)(3) | 0.92 | | | 0.89 | | | 0.77 | |

Net charge-offs to average loans(2) | 0.01 | | | * | | * |

| | | | | |

| Assets Under Management | $ | 6,395,786 | | | $ | 6,503,964 | | | $ | 5,918,403 | |

| | | | | |

| Market Data | | | | | |

| Book value per share at period end | 25.76 | | | 25.38 | | | 24.74 | |

Tangible book value per common share(1) | 22.42 | | | 22.03 | | | 21.35 | |

| Weighted average outstanding shares, basic | 9,553,331 | | 9,532,397 | | 9,481,311 |

| Weighted average outstanding shares, diluted | 9,743,270 | | 9,686,401 | | 9,673,078 |

| Shares outstanding at period end | 9,560,209 | | 9,545,071 | | 9,492,006 |

| | | | | |

| Consolidated Capital | | | | | |

| Tier 1 capital to risk-weighted assets | 9.32 | % | | 9.26 | % | | 9.54 | % |

| CET1 to risk-weighted assets | 9.32 | | | 9.26 | | | 9.54 | |

| Total capital to risk-weighted assets | 12.45 | | | 12.41 | | | 11.84 | |

| Tier 1 capital to average assets | 7.96 | | | 7.80 | | | 8.18 | |

| | | | | |

| Bank Capital | | | | | |

| Tier 1 capital to risk-weighted assets | 10.42 | | | 10.34 | | | 10.32 | |

| CET1 to risk-weighted assets | 10.42 | | | 10.34 | | | 10.32 | |

| Total capital to risk-weighted assets | 11.31 | | | 11.23 | | | 11.09 | |

| Tier 1 capital to average assets | 8.88 | | | 8.70 | | | 8.84 | |

____________________

(1) Represents a Non-GAAP financial measure. See “Reconciliation of Non-GAAP Measures” for a reconciliation of our Non-GAAP measures to the most directly comparable GAAP financial measure.

(2) Value results in an immaterial amount.

(3) Allowance for credit loss amounts for periods prior to the ASC 326 adoption date of January 1, 2023 are reported in accordance with previously applicable GAAP. Total loans does not include loans accounted for under the fair value option.

First Western Financial, Inc.

Consolidated Financial Summary (unaudited) (continued)

Reconciliations of Non-GAAP Financial Measures

| | | | | | | | | | | | | | | | | |

| As of or for the Three Months Ended |

| September 30, | | June 30, | | September 30, |

| (Dollars in thousands, except share and per share amounts) | 2023 | | 2023 | | 2022 |

| Tangible Common | | | | | |

| Total shareholders' equity | $ | 246,256 | | | $ | 242,242 | | | $ | 234,862 | |

| Less: goodwill and other intangibles, net | 31,916 | | | 31,977 | | | 32,181 | |

| Tangible common equity | $ | 214,340 | | | $ | 210,265 | | | $ | 202,681 | |

| | | | | |

| Common shares outstanding, end of period | 9,560,209 | | 9,545,071 | | 9,492,006 |

| Tangible common book value per share | $ | 22.42 | | | $ | 22.03 | | | $ | 21.35 | |

| Net income available to common shareholders | 3,118 | | 1,506 | | 6,221 |

| Return on tangible common equity (annualized) | 5.82 | % | | 2.86 | % | | 12.28 | % |

| | | | | |

| Efficiency | | | | | |

| Non-interest expense | $ | 18,314 | | | $ | 18,519 | | | $ | 19,260 | |

| Less: amortization | 62 | | | 62 | | | 77 | |

| Less: acquisition related expenses | 30 | | | 14 | | | 154 | |

| Adjusted non-interest expense | $ | 18,222 | | | $ | 18,443 | | | $ | 19,029 | |

| | | | | |

| Total income before non-interest expense | $ | 22,536 | | | $ | 20,554 | | | $ | 27,495 | |

| Less: unrealized (loss)/gain recognized on equity securities | (19) | | | (11) | | | 75 | |

| Less: net loss on loans accounted for under the fair value option | (252) | | | (1,124) | | | (134) | |

| Less: net gain on equity interests | — | | | — | | | 6 | |

| Less: impairment of contingent consideration assets | — | | | (1,249) | | | — | |

| | | | | |

| | | | | |

Plus: provision for credit losses(1) | 329 | | | 1,843 | | | 1,756 | |

| Gross revenue | $ | 23,136 | | | $ | 24,781 | | | $ | 29,304 | |

| Efficiency ratio | 78.76 | % | | 74.42 | % | | 64.94 | % |

| | | | | |

| Allowance for Credit Loss to Adjusted Loans | | | | | |

| Total loans held for investment | 2,536,503 | | | 2,501,926 | | | 2,354,898 | |

Less: loans acquired(2) | — | | | — | | | 248,573 | |

Less: PPP loans(3) | 4,876 | | | 5,558 | | | 6,905 | |

| Less: loans accounted for under fair value | 16,105 | | | 18,274 | | | 22,648 | |

| Adjusted loans | $ | 2,515,522 | | | $ | 2,478,094 | | | $ | 2,076,772 | |

| | | | | |

Allowance for credit losses(1) | $ | 23,175 | | | $ | 22,044 | | | $ | 16,081 | |

Allowance for credit losses to adjusted loans(1) | 0.92 | % | | 0.89 | % | | 0.77 | % |

___________________(1) Provision and allowance for credit loss amounts for periods prior to the ASC 326 adoption date of January 1, 2023 are reported in accordance with previously applicable GAAP.

(2)As of September 30, 2023 and June 30, 2023, acquired loans totaling $216.1 million and $225.4 million, respectively, are included in the allowance for credit loss calculation and are therefore not removed in calculating adjusted total loans.

(3)As of September 30, 2023 and June 30, 2023, the adjustment for PPP loans includes acquired PPP loans as acquired loans are included in total loans held for investment as a result of the adoption of ASC 326. As of September 30, 2022, the adjustment for PPP loans did not include acquired PPP loans, as those were already included in the loans acquired adjustment.

First Western Financial, Inc.

Consolidated Financial Summary (unaudited) (continued)

| | | | | | | | | | | | | | | | | |

| As of or for the Three Months Ended |

| September 30, | | June 30, | | September 30, |

| (Dollars in thousands, except share and per share data) | 2023 | | 2023 | | 2022 |

| Adjusted Net Income Available to Common Shareholders | | | | | |

| Net income available to common shareholders | $ | 3,118 | | | $ | 1,506 | | | $ | 6,221 | |

| Plus: impairment of contingent consideration assets | — | | | 1,249 | | | — | |

| | | | | |

| Plus: acquisition related expenses | 30 | | | 14 | | | 154 | |

| Less: income tax impact from impairment of contingent consideration assets | — | | | 325 | | | — | |

| | | | | |

| Less: income tax impact from acquisition related expenses | 8 | | | 4 | | | 38 | |

| Adjusted net income available to shareholders | $ | 3,140 | | | $ | 2,440 | | | $ | 6,337 | |

| | | | | |

| Pre-Tax, Pre-Provision Net Income | | | | | |

| Income before income taxes | $ | 4,222 | | | $ | 2,035 | | | $ | 8,235 | |

| Plus: provision for credit losses | 329 | | | 1,843 | | | 1,756 | |

| Pre-tax, pre-provision net income | $ | 4,551 | | | $ | 3,878 | | | $ | 9,991 | |

| | | | | |

| Adjusted Basic Earnings Per Share | | | | | |

| Basic earnings per share | $ | 0.33 | | | $ | 0.16 | | | $ | 0.66 | |

| Plus: impairment of contingent consideration assets net of income tax impact | — | | | 0.09 | | | — | |

| | | | | |

| Plus: acquisition related expenses net of income tax impact | * | | * | | 0.01 | |

| Adjusted basic earnings per share | $ | 0.33 | | | $ | 0.25 | | | $ | 0.67 | |

| | | | | |

| Adjusted Diluted Earnings Per Share | | | | | |

| Diluted earnings per share | $ | 0.32 | | | $ | 0.16 | | | $ | 0.64 | |

| Plus: impairment of contingent consideration assets net of income tax impact | — | | | 0.09 | | | — | |

| | | | | |

| Plus: acquisition related expenses net of income tax impact | * | | * | | 0.02 | |

| Adjusted diluted earnings per share | $ | 0.32 | | | $ | 0.25 | | | $ | 0.66 | |

| | | | | |

| Adjusted Return on Average Assets (annualized) | | | | | |

| Return on average assets | 0.44 | % | | 0.21 | % | | 0.97 | % |

| Plus: impairment of contingent consideration assets net of income tax impact | — | | | 0.13 | | | — | |

| | | | | |

| Plus: acquisition related expenses net of income tax impact | 0.01 | | | 0.01 | | | 0.02 | |

| Adjusted return on average assets | 0.45 | % | | 0.35 | % | | 0.99 | % |

| | | | | |

| Adjusted Return on Average Shareholders' Equity (annualized) | | | | | |

| Return on average shareholders' equity | 5.08 | % | | 2.49 | % | | 10.70 | % |

| Plus: impairment of contingent consideration assets net of income tax impact | — | | | 1.53 | | | — | |

| | | | | |

| Plus: acquisition related expenses net of income tax impact | 0.04 | | | 0.02 | | | 0.20 | |

| Adjusted return on average shareholders' equity | 5.12 | % | | 4.04 | % | | 10.90 | % |

| | | | | |

| Adjusted Return on Tangible Common Equity (annualized) | | | | | |

| Return on tangible common equity | 5.82 | % | | 2.86 | % | | 12.28 | % |

| Plus: impairment of contingent consideration assets net of income tax impact | — | | | 1.76 | | | — | |

| | | | | |

| Plus: acquisition related expenses net of income tax impact | 0.04 | | | 0.02 | | | 0.23 | |

| Adjusted return on tangible common equity | 5.86 | % | | 4.64 | % | | 12.51 | % |

* Represents an immaterial impact to adjusted earnings per share.

Safe Harbor 2 This presentation contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements reflect the current views of First Western Financial, Inc.’s (“First Western”) management with respect to, among other things, future events and First Western’s financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “position,” “project,” “future” “forecast,” “goal,” “target,” “would” and “outlook,” or the negative variations of those words or other comparable words of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about First Western’s industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond First Western’s control. Accordingly, First Western cautions you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although First Western believes that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. The following risks and uncertainties, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward- looking statements: integration risks in connection with acquisitions; the risk of geographic concentration in Colorado, Arizona, Wyoming, California, and Montana; the risk of changes in the economy affecting real estate values and liquidity; the risk in our ability to continue to originate residential real estate loans and sell such loans; risks specific to commercial loans and borrowers; the risk of claims and litigation pertaining to our fiduciary responsibilities; the risk of competition for investment managers and professionals; the risk of fluctuation in the value of our investment securities; the risk of changes in interest rates; and the risk of the adequacy of our allowance for credit losses and the risk in our ability to maintain a strong core deposit base or other low-cost funding sources. Additional information regarding these and other risks and uncertainties to which our business and future financial performance are subject is contained in our Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission (“SEC”) on March 15, 2023 and other documents we file with the SEC from time to time. All subsequent written and oral forward- looking statements attributable to First Western or persons acting on First Western’s behalf are expressly qualified in their entirety by this paragraph. Forward-looking statements speak only as of the date of this presentation. First Western undertakes no obligation to publicly update or otherwise revise any forward-looking statements, whether as a result of new information, future events or otherwise (except as required by law). Certain of the information contained herein may be derived from information provided by industry sources. The Company believes that such information is accurate and the sources from which it has been obtained are reliable; however, the Company cannot guaranty the accuracy of such information and has not independently verified such information. This presentation contains certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. Reconciliations of non-GAAP financial measures to GAAP financial measures are provided at the end of this presentation. Numbers in the presentation may not sum due to rounding. Our common stock is not a deposit or savings account. Our common stock is not insured by the Federal Deposit Insurance Corporation or any governmental agency or instrumentality. This presentation is not an offer to sell any securities and it is not soliciting an offer to buy any securities in any state or jurisdiction where the offer or sale is not permitted. Neither the SEC nor any state securities commission has approved or disapproved of the securities of the Company or passed upon the accuracy or adequacy of this presentation. Any representation to the contrary is a criminal offense. Except as otherwise indicated, this presentation speaks as of the date hereof. The delivery of this presentation shall not, under any circumstances, create any implication that there has been no change in the affairs of the Company after the date hereof.

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato(regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions Overview of 3Q23 3Q23 Earnings • Net revenue increased $2.0 million, or 9.6%, to $22.5 million in Q3 2023, compared to $20.6 million in Q2 2023 • Net income available to common shareholders of $3.1 million, or $0.32 per diluted share • Pre-tax, pre-provision net income of $4.6 million(1), an increase of 17% from $3.9 million(1) in the prior quarter • Strong earnings and disciplined balance sheet management resulted in further increase in tangible book value per share and increase in all capital ratios Prudent Balance Sheet Growth • Deposit growth exceeded loan growth in the third quarter • 7.5% annualized deposit growth • 5.6% annualized loan growth while maintaining conservative underwriting criteria and disciplined pricing Strong Execution on Key Priorities • Disciplined expense control resulted in operating expenses coming in at low end of targeted range • Increased focus on deposit gathering reduced loan-to-deposit ratio • Conservative underwriting and proactive portfolio management continues to result in immaterial credit losses • Increase in NPAs driven by one relationship consisting of $42 million in loans that are collateralized with minimal loss exposure (1) See Non-GAAP reconciliation 3

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato(regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 4 Net Income Available to Common Shareholders and Earnings per Share • Net income of $3.1 million, or $0.32 diluted earnings per share, in 3Q23 • Profitability and prudent balance sheet management resulted in book value and tangible book value per share(1) increasing by 4.1% and 5.0%, respectively, from 3Q22 Net Income Available to Common Shareholders Diluted Earnings per Share (1) See Non-GAAP reconciliation $6,337 $5,617 $3,847 $2,440 $3,140 $6,221 $5,471 $3,820 $1,506 $3,118 Net Income Adjustments to Net Income Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 $— $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 $0.66 $0.58 $0.39 $0.25 $0.32 $0.64 $0.56 $0.39 $0.16 $0.32 Net Income Adjustments to Net Income Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 $— $0.25 $0.50 $0.75(1) (1) (1) (1) (1) (1) (1) (1) (1) (1)

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 5 Loan Portfolio • Total loans held for investment increased $34.6 million from prior quarter • Growth driven by commercial and industrial loans, residential mortgage loans, and draws on existing construction lines, partially offset by a decrease in CRE loans due to an increase in payoffs • New loan production of more than $100 million represents largest quarter of new loan production of the year • Average rate on new loan production increased 51 bps to 7.92% compared to prior quarter 3Q 2022 2Q 2023 3Q 2023 Cash, Securities and Other $ 154,748 $ 150,679 $ 148,669 Consumer and Other 27,781 21,866 23,975 Construction and Development 228,060 313,227 349,436 1-4 Family Residential 822,796 878,670 913,085 Non-Owner Occupied CRE 527,836 561,880 527,377 Owner Occupied CRE 220,075 218,651 208,341 Commercial and Industrial 350,954 338,679 349,515 Total $ 2,332,250 $ 2,483,652 $ 2,520,398 Loans accounted for at fair value(2) 22,648 18,274 16,105 Total Loans HFI $ 2,354,898 $ 2,501,926 $ 2,536,503 Loans held-for-sale (HFS) 12,743 19,746 12,105 Total Loans $ 2,367,641 $ 2,521,672 $ 2,548,608 (1) Represents unpaid principal balance. Excludes deferred (fees) costs, and amortized premium/ (unaccreted discount). (2) Excludes fair value adjustments on loans accounted for under the fair value option. ($ in thousands, as of quarter end) Loan Portfolio Composition(1) Loan Portfolio Details Loan Production & Loan Payoffs Total Loans(1) $2,253 $2,445 $2,487 $2,487 2,515 $2,522 $2,549 3Q22 4Q22 1Q23 2Q23 3Q23 2Q23 3Q23 $— $400 $800 $1,200 $1,600 $2,000 $2,400 $2,800 $3,200 Average Period End

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 6 Total Deposits • Total deposits increased by $44.6 million in 3Q23 • Success in new business development, with $26 million in new deposit relationships added in 3Q23 • Continued migration of noninterest-bearing deposits into interest-bearing categories as clients seek higher rates for their excess liquidity 3Q 2022 2Q 2023 3Q 2023 Money market deposit accounts $ 1,010,846 $ 1,297,732 $ 1,388,726 Time deposits 186,680 376,147 373,459 NOW 277,225 168,537 164,000 Savings accounts 30,641 18,737 17,503 Noninterest-bearing accounts 662,055 514,241 476,308 Total Deposits $ 2,167,447 $ 2,375,394 $ 2,419,996 Deposit Portfolio Composition Total Deposits $2,154 $2,242 $2,352 $2,375 $2,359 $2,375 $2,420 3Q22 4Q22 1Q23 2Q23 3Q23 2Q23 3Q23 $— $500 $1,000 $1,500 $2,000 $2,500 $3,000 Average Period End

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 7 Trust and Investment Management • Total assets under management decreased $108.2 million from June 30, 2023 to $6.40 billion as of September 30, 2023 • Primarily attributable to a decrease in market values throughout the quarter resulting in a decrease in the value of assets under management balances (in millions, as of quarter end) Total Assets Under Management $5,918 $6,107 $6,382 $6,504 $6,396 Investment Agency Managed Trust 401(k)/Retirement Directed Trust Custody Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 $— $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 $8,000

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions (1) See Non-GAAP reconciliation Gross Revenue 3Q23 Gross Revenue(1) Gross Revenue(1) 8 $29.3 $29.0 $26.1 $24.8 $23.1 Wealth Management Mortgage Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 $— $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 • Gross revenue(1) declined 6.6% from prior quarter • Decline in net interest income, partially offset by an increase in noninterest income • Non-interest income mix increased to 26.7% from 17.7% in prior quarter

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 9 Net Interest Income and Net Interest Margin • Net interest income decreased to $16.8 million, or 9.1%, from $18.4 million in 2Q23 • Net interest income decreased from 2Q23 due to an increase in average cost of deposits • Net interest margin decreased 27 bps to 2.46%, driven by the increase in interest bearing deposit costs ◦ 20 bps of the 27 bps quarterly change directly impacted by the addition of $45.9 million of non- performing assets • Pressure on net interest margin expected to moderate in 4Q23 (in thousands) (1) See Non-GAAP reconciliation Net Interest Income Net Interest Margin $23,062 $21,842 $19,560 $18,435 $16,766 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 $— $5,000 $10,000 $15,000 $20,000 $25,000

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 10 Non-Interest Income • Non-interest income increased 54% from prior quarter, primarily due to impacts in 2Q23: ◦ $1.2 million impairment to carrying value of contingent consideration assets in 2Q23 ◦ $1.1 million of losses on loans accounted for under fair value option in 2Q23 vs. $0.3 million of losses in 3Q23 • Trust and investment management fees increased 5.3% from prior quarter due to an increase in fee structure implemented during 3Q23 • Net gain on mortgage loans decreased slightly to $0.7 million as higher rates continue to impact loan demand (in thousands) Total Non-Interest Income Trust and Investment Management Fees $6,189 $6,561 $5,819 $3,962 $6,099 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 $(2,000) $— $2,000 $4,000 $6,000 $8,000 $4,639 $4,358 $4,635 $4,602 $4,846 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 $— $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 (in thousands)

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 11 Non-Interest Expense and Efficiency Ratio • Non-interest expense decreased 1.1% from 2Q23 • Disciplined expense management resulted in non-interest expense coming in at low end of targeted range • Non-interest expense expected within the range of $18.5 million to $19.0 million for the remainder of 2023 (1) (1) See Non-GAAP reconciliation Total Non-Interest Expense Operating Efficiency Ratio(1) (in thousands) (1) (1) (1) (1) $19,260 $19,905 $20,528 $18,519 $18,314 $231 $272 $101 $76 $92 Non-Interest Expense Adjustments to Non-Interest Expense Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 $— $5,000 $10,000 $15,000 $20,000 $25,000 64.94% 67.66% 78.29% 74.42% 78.76% Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 —% 20.00% 40.00% 60.00% 80.00% 100.00% (1) (1) (1) (1) (1)

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 12 Asset Quality • NPAs increased $45.9 million primarily due to four additional loans, under one relationship, moving to non-accrual during 3Q23 • New additions to NPAs are primarily collateralized with real estate assets in attractive markets and did not require an allowance on individually analyzed loans • $0.3 million provision for credit losses • ACL/Adjusted Total Loans(1) increased to 0.92% in 3Q23 from 0.89% in 2Q23 • Continue to experience immaterial amount of credit losses Non-Performing Assets/Total Assets Net Charge-Offs/Average Loans (1) Adjusted Total Loans – Total Loans minus PPP loans and loans accounted for under fair value option; see non-GAAP reconciliation 0.14% 0.43% 0.42% 0.36% 1.87% Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 —% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 1.60% 1.80% 2.00% Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 —% 0.20% 0.40% 0.60% 0.80% 1.00%

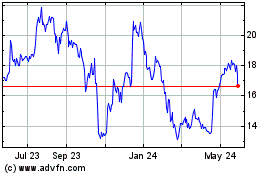

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 13 Consistent Value Creation TBV/Share(1) Up 144% Since July 2018 IPO Consistent increases in tangible book value per share driven by: • Organic growth that has increased operating leverage • Accretive acquisitions that have been well priced and smoothly integrated to realize all projected cost savings • Conservative underwriting criteria that has resulted in extremely low level of losses in the portfolio throughout the history of the company • Prudent asset/liability management including not investing excess liquidity accumulated during the pandemic in low-yielding bonds

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato(regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 14 Near-Term Outlook • Prudent risk management will remain top priority while economic uncertainty remains, which will impact level of profitability in short term • Continued focus on executing well on the areas that we can control • Balance sheet management • Attracting new clients with particular focus on core deposit relationships and Trust and Investment Management assets • Providing exceptional service to existing clients • Tightly managing expenses • While maintaining a conservative approach to operating in the current environment, investments continue to be made in areas that will further enhance business development capabilities including first full office in Bozeman market • By balancing near-term conservative approach with continued long-term investments, First Western is well positioned to continue capitalizing on our attractive markets to consistently add new clients, realize more operating leverage as we increase scale, generate profitable growth, and further enhance the value of our franchise

Appendix 15

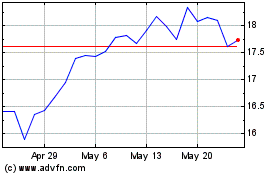

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 16 Capital and Liquidity Overview Liquidity Funding Sources (as of 9/30/23) (1) See Non-GAAP reconciliation (2) Based on internal policy guidelines Consolidated Capital Ratios (as of 9/30/23) Tangible Common Equity / TBV per Share(1) (in thousands) Liquidity Reserves: Total Available Cash $269,805 Unpledged Investment Securities 21,264 Borrowed Funds: Secured: FHLB Available 624,762 FRB Available 14,873 Other: Brokered Remaining Capacity 152,841(2) Unsecured: Credit Lines 29,000 Total Liquidity Funding Sources $1,112,545 Loan to Deposit Ratio 104.6 % 9.32% 9.32% 12.45% 7.96% Tier 1 Capital to Risk- Weighted Assets CET1 to Risk- Weighted Assets Total Capital to Risk- Weighted Assets Tier 1 Capital to Average Assets —% 5.00% 10.00% 15.00%

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 17 Non-GAAP Reconciliation Consolidated Tangible Common Book Value Per Share As of, (Dollars in thousands) Dec. 31, 2018 Dec. 31, 2019 Dec. 31, 2020 Dec. 31, 2021 Sept. 30, 2022 Dec. 31, 2022 Sept. 30, 2023 Total shareholders' equity $116,875 $127,678 $154,962 $219,041 $234,862 $240,864 $246,256 Less: Goodwill and other intangibles, net 25,213 19,714 24,258 31,902 32,181 32,104 31,916 Intangibles held for sale(1) - 3,553 - - - - - Tangible common equity 91,662 104,411 $130,704 187,139 202,681 208,760 214,340 Common shares outstanding, end of period 7,968,420 7,940,168 7,951,773 9,419,271 9,492,006 9,495,440 9,560,209 Tangible common book value per share $11.50 $13.15 $16.44 $19.87 $21.35 $21.99 $22.42 Net income available to common shareholders $3,118 Return on tangible common equity (annualized) 5.82% (1) Represents the intangible portion of assets held for sale Consolidated Efficiency Ratio (Dollars in thousands) September 30, 2022 December 31, 2022 March 31, 2023 June 30, 2023 September 30, 2023 Non-interest expense $19,260 $19,905 $20,528 $18,519 $18,314 Less: amortization 77 77 64 62 62 Less: acquisition related expenses 154 195 37 14 30 Adjusted non-interest expense $19,029 $19,633 $20,427 $18,443 $18,222 Net interest income $ 23,062 $21,842 $19,560 $18,435 $16,766 Non-interest income 6,189 6,561 5,819 3,962 6,099 Less: unrealized gains/(losses) recognized on equity securities 75 - 10 (11) (19) Less: impairment of contingent consideration assets - - - (1,249) - Less: net gain/(loss) on loans accounted for under the fair value option (134) (602) (543) (1,124) (252) Less: net gain on equity interests 6 - - - - Less: net (loss)/gain on loans held for sale at fair value - (12) (178) - - Adjusted non-interest income 6,242 7,175 6,530 6,346 6,370 Total income $29,304 $29,017 $26,090 $24,781 $23,136 Efficiency ratio 64.94% 67.66% 78.29% 74.42% 78.76%

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 18 Non-GAAP Reconciliation Wealth Management Gross Revenue For the Three Months Ended, (Dollars in thousands) September 30, 2022 December 31, 2022 March 31, 2023 June 30, 2023 September 30, 2023 Total income before non-interest expense $26,482 $26,623 $24,543 $19,529 $21,647 Less: unrealized gains/(losses) recognized on equity securities 75 - 10 (11) (19) Less: impairment of contingent consideration assets - - - (1,249) - Less: net gain/(loss) on loans accounted for under the fair value option (134) (602) (543) (1,124) (252) Less: net gain on equity interests 6 - - - - Less: net (loss)/gain on loans held for sale at fair value - (12) (178) - - Plus: provision for credit loss 1,756 1,197 (310) 1,843 329 Gross revenue $28,291 $28,434 $24,944 $23,756 $22,247 Mortgage Gross Revenue For the Three Months Ended, (Dollars in thousands) September 30, 2022 December 31, 2022 March 31, 2023 June 30, 2023 September 30, 2023 Total income before non-interest expense $1,013 $583 $1,146 $1,025 $889 Plus: provision for credit loss - - - - - Gross revenue $1,013 $583 $1,146 $1,025 $889 Consolidated Gross Revenue For the Three Months Ended, (Dollars in thousands) September 30, 2022 December 31, 2022 March 30, 2023 June 30, 2023 September 30, 2023 Total income before non-interest expense $27,495 $27,206 $25,689 $20,554 $22,536 Less: unrealized gains/(losses) recognized on equity securities 75 - 10 (11) (19) Less: impairment of contingent consideration assets - - - (1,249) - Less: net gain/(loss) on loans accounted for under the fair value option (134) (602) (543) (1,124) (252) Less: net gain on equity interests 6 - - - - Less: net (loss)/gain on loans held for sale at fair value - (12) (178) - - Plus: provision for credit loss 1,756 1,197 (310) 1,843 329 Gross revenue $29,304 $29,017 $26,090 $24,781 $23,136 Gross Revenue excluding net gain on mortgage loans For the Three Months Ended, (Dollars in thousands) December 31, 2021 December 31, 2022 September 30, 2023 Gross revenue $23,440 $29,017 $23,136 Less: net gain on mortgage loans 2,470 775 654 Gross revenue excluding net gain on mortgage loans $20,970 $28,242 $22,482