Matthew P. Deines, President and CEO,

comments on financial results:

"The Company continues to manage through this historic interest

rate environment by remaining focused on deepening existing

relationships and acquiring new customers," said Matthew P. Deines,

President and CEO. "We are also maintaining our commitment to

reducing non-interest expense, which bore out in lower operating

expenses and an improved efficiency ratio this quarter compared to

the linked quarter. We celebrated our 100th anniversary in

style during the quarter at an event in Port Angeles, which

highlighted our history, strength and commitment to our

communities. We also enjoyed great music, culture and food with

friends and family."

The Board of Directors of First Northwest Bancorp declared a

quarterly cash dividend of $0.07 per common share. The

dividend will be payable on November 24, 2023, to shareholders of

record as of the close of business on November 10, 2023.

|

FINANCIAL HIGHLIGHTS |

|

3Q 23 |

|

|

2Q 23 |

|

|

3Q 22 |

|

|

YTD Highlights |

|

OPERATING RESULTS (in millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

● |

Deposit growth year-to-date of $93.5 million |

| Net income |

|

$ |

2.5 |

|

|

$ |

1.8 |

|

|

$ |

4.3 |

|

|

▪ |

Retail growth $57.8 million, or 4.0% |

| Pre-provision net interest

income |

|

|

15.0 |

|

|

|

16.0 |

|

|

|

18.2 |

|

|

▪ |

Brokered growth $35.7 million, or 26.7% |

| Noninterest expense |

|

|

14.4 |

|

|

|

15.2 |

|

|

|

15.4 |

|

|

|

|

| Total

revenue, net of interest expense* |

|

|

17.9 |

|

|

|

17.7 |

|

|

|

20.5 |

|

|

● |

Loan growth year-to-date of

$87.4 million, |

| PER SHARE

DATA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

or 6% |

| Basic and diluted

earnings |

|

$ |

0.28 |

|

|

$ |

0.20 |

|

|

$ |

0.47 |

|

|

|

|

| Book value |

|

|

16.20 |

|

|

|

16.56 |

|

|

|

15.69 |

|

|

● |

Deposit insurance coverage

update: |

|

Tangible book value * |

|

|

16.03 |

|

|

|

16.39 |

|

|

|

15.50 |

|

|

▪ |

Estimated uninsured business and |

| BALANCE SHEET (in

millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

consumer deposits totaling $257.3 million, |

| Total assets |

|

$ |

2,154 |

|

|

$ |

2,163 |

|

|

$ |

2,091 |

|

|

|

or approximately 16% of total deposits |

| Total loans |

|

|

1,635 |

|

|

|

1,638 |

|

|

|

1,537 |

|

|

|

40% of uninsured in urban areas |

| Total deposits |

|

|

1,658 |

|

|

|

1,653 |

|

|

|

1,605 |

|

|

|

60% of uninsured in rural areas |

| Total

shareholders' equity |

|

|

156 |

|

|

|

160 |

|

|

|

157 |

|

|

▪ |

Estimated uninsured public fund deposits |

| ASSET

QUALITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

to total deposits of 7% (fully collateralized) |

| Net charge-off ratio |

|

|

0.30 |

% |

|

|

0.10 |

% |

|

|

0.06 |

% |

|

▪ |

Estimated insured deposits to total |

| Nonperforming assets to total

assets |

|

|

0.11 |

|

|

|

0.12 |

|

|

|

0.17 |

|

|

|

deposits of 77% |

| Allowance for credit losses on

loans |

|

|

|

|

|

|

|

|

|

|

|

|

|

▪ |

Available borrowing capacity to |

|

to total loans |

|

|

1.04 |

|

|

|

1.06 |

|

|

|

1.06 |

|

|

|

uninsured deposits of 115% |

|

Nonperforming loan coverage ratio |

|

|

714 |

|

|

|

677 |

|

|

|

463 |

|

|

|

|

| SELECTED

RATIOS |

|

|

|

|

|

|

|

|

|

|

|

|

|

● |

Liquidity is closely monitored

with ample |

| Return on average assets |

|

|

0.46 |

% |

|

|

0.34 |

% |

|

|

0.85 |

% |

|

|

on and off balance sheet

liquidity with |

| Return on average equity |

|

|

6.17 |

|

|

|

4.41 |

|

|

|

10.12 |

|

|

|

coverage of uninsured deposits

at 1.3x. |

| Return on average tangible

equity * |

|

|

6.23 |

|

|

|

4.47 |

|

|

|

10.23 |

|

|

|

|

| Net interest margin |

|

|

2.97 |

|

|

|

3.25 |

|

|

|

3.88 |

|

|

● |

Asset quality: |

| Efficiency ratio |

|

|

80.52 |

|

|

|

86.01 |

|

|

|

74.86 |

|

|

|

Credit metrics remain stable.

Past due and |

| Bank common equity tier 1

(CETI) ratio |

|

|

13.43 |

|

|

|

13.10 |

|

|

|

13.13 |

|

|

|

nonperforming balances remain

low. |

| Bank

total risk-based capital ratio |

|

|

14.38 |

|

|

|

14.08 |

|

|

|

14.16 |

|

|

|

|

* See reconciliation of Non-GAAP Financial

Measures later in this release.

First Northwest Bancorp

(Nasdaq: FNWB) ("First Northwest" or

"Company") today reported quarterly net income of $2.5

million for the third quarter of 2023, compared

to $1.8 million for the second quarter of 2023,

and $4.3 million for the third quarter of 2022. Basic and

diluted earnings per share were $0.28 for the third

quarter of 2023, compared to $0.20 for the second quarter

of 2023, and $0.47 for the third quarter of 2022. In the

third quarter of 2023, the Company generated a return on average

assets ("ROAA") of 0.46%, a return on average equity ("ROAE")

of 6.17%, and a return on average tangible common equity* of

6.23%. Results in the third quarter of 2023 are reflective of

higher noninterest income and lower noninterest expense, partially

offset by higher funding costs. Income before provision for

income taxes was $3.1 million for the current quarter,

compared to $2.2 million for the preceding quarter, an

increase of $931,000, or 42.8% and decreased $1.3

million compared to $4.4 million for the third quarter of

2022.

Net Interest IncomeTotal interest

income increased $360,000 to $25.8 million for the third

quarter of 2023, compared to $25.5 million in the previous

quarter, and increased $5.0 million from $20.9 million in

the third quarter of 2022. Interest income increased in the current

quarter due to an increased volume of loans and higher yields

on investments and interest-earning deposits in banks. Interest and

fees on loans increased year-over-year, as the Company's

banking subsidiary, First Fed Bank ("First Fed" or "Bank"), grew

the loan portfolio through draws on new and existing lines of

credit, originations of multi-family real

estate loans and auto and manufactured home loan

purchases. Northpointe Mortgage Purchase Program ("Northpointe

MPP") participation also provided additional loan interest income.

Loan yields increased over the prior year due to higher rates on

new originations as well as the repricing of variable rate loans

tied to the Prime Rate or other indices.

Total interest expense was $10.9

million for the third quarter of 2023, compared to $9.5

million in the second quarter of 2023 and $2.7

million in the third quarter a year ago. Current quarter

interest expense was higher due to a 31 basis point

increase in the cost of deposits to 1.85% at September

30, 2023, from 1.54% at the prior quarter end. The

increase over the third quarter of 2022 was the result of

a 153 basis point increase in the cost of deposits

from 0.32% in the third quarter one year ago, along with

higher volumes and rates paid on short-term FHLB advances and

certificates of deposit ("CDs"). A shift in the deposit mix from

transaction and money market accounts to a higher volume of savings

accounts and CDs, primarily promotional, resulted in higher costs

of deposits. Measured reliance on brokered CDs also contributed to

additional deposit costs.

Net interest income before provision for

credit losses for the third quarter of

2023 decreased 6.5% to $15.0 million, compared

to $16.0 million for the preceding quarter, and

decreased 17.9% from the third quarter one year

ago.

The Company recorded a $371,000 provision for

credit losses in the third quarter of 2023, reflecting additional

charge-offs from the Splash unsecured consumer loan program,

partially offset by a provision recovery due to lower unfunded

commitments at quarter end. This compares to a credit loss

provision of $300,000 for the preceding quarter. A loan

loss provision of $750,000 was recorded for the third

quarter of 2022, which was estimated using the incurred loss method

based on historical loss trends combined with qualitative

adjustments.

The net interest margin decreased

to 2.97% for the third quarter of 2023, from

3.25% for the prior quarter, and decreased 91 basis

points compared to 3.88% for the third quarter of

2022. Decreases from both the prior quarter and the prior year are

due to higher funding costs for both deposits and borrowed funds.

While increases in the cost of funding are currently outpacing the

growth of the yield on interest-earning assets, the Company has

taken measures to combat interest rate compression. Organic

loan production is augmented with higher yielding purchased loans

through established relationships with loan originators. The Bank's

fair value hedging agreement has boosted interest income and new

loan originations are priced to account for the increasing cost of

funds.

The yield on average earning assets of 5.14% for the

third quarter of 2023 decreased 3 basis points compared

to the second quarter of 2023 and

increased 69 basis points from 4.45% for the

third quarter of 2022. Higher loan rates at origination and

increased yields on variable-rate loans were offset by a

reclassification from interest income to noninterest income of

funds recognized in the second quarter of 2023. The

year-over-year increase was primarily due to higher average loan

balances augmented by increases in yields, which were positively

impacted by the rising rate environment and overall improvements in

the mix of interest-earning assets.

The cost of average interest-bearing liabilities

increased to 2.60% for the third quarter of 2023,

compared to 2.33% for the second quarter of 2023, and

increased from 0.73% for the third quarter of

2022. Total cost of funds increased to 2.23% for

the third quarter of 2023 from 1.98% in the prior

quarter and increased from 0.59% for the third

quarter of 2022. Current quarter increases were due to higher costs

on interest-bearing deposits and advances in addition to increases

in average CD and savings balances.

The increase over the same quarter last year was

driven by higher rates paid on deposits and borrowings. The

Company attracted and retained funding through the use of

promotional products and a focus on outbound sales efforts. The mix

of retail deposit balances shifted from no or low-cost transaction

accounts towards higher cost term certificate and savings products.

Retail CDs represented 27.6%, 25.8% and 15.2% of retail

deposits at September 30, 2023, June 30, 2023 and September

30, 2022, respectively. Average interest-bearing deposit

balances increased $43.7 million, or 3.3%, to $1.38

billion for the third quarter of 2023 compared to $1.33

billion for the second quarter of 2023 and increased $153.1

million, or 12.5%, compared to $1.22 billion for the third

quarter of 2022.

|

Selected Yields |

|

3Q 23 |

|

|

2Q 23 |

|

|

1Q 23 |

|

|

4Q 22 |

|

|

3Q 22 |

|

|

Loan yield |

|

|

5.31 |

% |

|

|

5.38 |

% |

|

|

5.16 |

% |

|

|

5.22 |

% |

|

|

4.75 |

% |

| Investment securities

yield |

|

|

4.18 |

|

|

|

4.09 |

|

|

|

3.93 |

|

|

|

3.71 |

|

|

|

3.21 |

|

| Cost of interest-bearing

deposits |

|

|

2.22 |

|

|

|

1.87 |

|

|

|

1.37 |

|

|

|

0.78 |

|

|

|

0.41 |

|

| Cost of total deposits |

|

|

1.85 |

|

|

|

1.54 |

|

|

|

1.12 |

|

|

|

0.62 |

|

|

|

0.32 |

|

| Cost of borrowed funds |

|

|

4.45 |

|

|

|

4.36 |

|

|

|

3.92 |

|

|

|

3.30 |

|

|

|

2.50 |

|

| Net interest spread |

|

|

2.54 |

|

|

|

2.84 |

|

|

|

3.13 |

|

|

|

3.72 |

|

|

|

3.72 |

|

| Net interest margin |

|

|

2.97 |

|

|

|

3.25 |

|

|

|

3.46 |

|

|

|

3.96 |

|

|

|

3.88 |

|

Noninterest IncomeNoninterest income

increased 69.7% to $2.9 million for the third

quarter of 2023 from $1.7 million for the second quarter

of 2023, primarily due to a $750,000 reclassification of funds

recouped on Splash charge-offs and an increase in the valuation of

servicing rights on sold loans of $239,000. Noninterest income

increased 24.4% from $2.3 million the same quarter one

year ago, due to the Splash reclassification, offset

by decreases in the servicing rights valuation, gain on

sale of Small Business Administration ("SBA") loans and loan

fee income. Saleable mortgage loan production continues to be

hindered by reduced refinancing activity due to rising market rates

on mortgage loans compared to the prior year.

Noninterest income declined $10,000 to $6.95 million

for the nine months ended September 30, 2023, compared

to $6.96 million for the nine months ended September 30,

2022.

|

Noninterest Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| $ in

thousands |

|

3Q 23 |

|

|

2Q 23 |

|

|

1Q 23 |

|

|

4Q 22 |

|

|

3Q 22 |

|

| Loan and deposit service

fees |

|

$ |

1,068 |

|

|

$ |

1,064 |

|

|

$ |

1,141 |

|

|

|

1,163 |

|

|

$ |

1,302 |

|

| Sold loan servicing fees and

servicing rights mark-to-market |

|

|

98 |

|

|

|

(191 |

) |

|

|

493 |

|

|

|

202 |

|

|

|

206 |

|

| Net gain on sale of loans |

|

|

171 |

|

|

|

58 |

|

|

|

176 |

|

|

|

55 |

|

|

|

285 |

|

| Increase in cash surrender

value of bank-owned life insurance |

|

|

252 |

|

|

|

190 |

|

|

|

226 |

|

|

|

230 |

|

|

|

221 |

|

| Income from death benefit on

bank-owned life insurance, net |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,489 |

|

|

|

— |

|

| Other income |

|

|

1,315 |

|

|

|

590 |

|

|

|

298 |

|

|

|

229 |

|

|

|

320 |

|

|

Total noninterest income |

|

$ |

2,904 |

|

|

$ |

1,711 |

|

|

$ |

2,334 |

|

|

$ |

3,368 |

|

|

$ |

2,334 |

|

Noninterest ExpenseNoninterest expense

totaled $14.4 million for the third quarter of 2023, compared

to $15.2 million for the preceding quarter and $15.4

million for the third quarter a year ago. Decreases in

marketing, payroll tax, medical insurance, software

licensing and shareholder communications during the current

quarter were partially offset by losses due to fraud. The

decrease in expenses compared to the third quarter of

2022 reflects a $1.1 million reduction related to Quin

Ventures, Inc. ("Quin Ventures") compensation, advertising and

customer acquisition costs, and occupancy expenses, as well as

decreases in Bank incentive compensation paid

and non-recurring compensation expense, partially offset by

higher Bank professional fees and FDIC insurance premiums. The

Company continues to focus on managing expenses, with a

focus on controlling compensation expense, and reducing

advertising and other discretionary spending.

Noninterest expense decreased 5.7% to $44.5

million for the nine months ended September 30, 2023, compared

to $47.2 million for the nine months ended September 30, 2022.

Compensation expense decreased $3.8 million primarily due to

lower commissions, payroll taxes, and medical insurance expenses.

Quin Ventures expenses included for the nine months ended

September 30, 2023, totaled $320,000 compared to $3.9 million in

the nine months ended September 30, 2022.

|

Noninterest Expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| $ in

thousands |

|

3Q 23 |

|

|

2Q 23 |

|

|

1Q 23 |

|

|

4Q 22 |

|

|

3Q 22 |

|

| Compensation and benefits |

|

$ |

7,795 |

|

|

$ |

8,180 |

|

|

$ |

7,837 |

|

|

$ |

8,357 |

|

|

$ |

9,045 |

|

| Data processing |

|

|

1,945 |

|

|

|

2,080 |

|

|

|

2,038 |

|

|

|

2,119 |

|

|

|

1,778 |

|

| Occupancy and equipment |

|

|

1,173 |

|

|

|

1,214 |

|

|

|

1,209 |

|

|

|

1,300 |

|

|

|

1,499 |

|

| Supplies, postage, and

telephone |

|

|

292 |

|

|

|

435 |

|

|

|

355 |

|

|

|

333 |

|

|

|

322 |

|

| Regulatory assessments and

state taxes |

|

|

446 |

|

|

|

424 |

|

|

|

389 |

|

|

|

372 |

|

|

|

365 |

|

| Advertising |

|

|

501 |

|

|

|

929 |

|

|

|

1,041 |

|

|

|

486 |

|

|

|

645 |

|

| Professional fees |

|

|

929 |

|

|

|

884 |

|

|

|

806 |

|

|

|

762 |

|

|

|

695 |

|

| FDIC insurance premium |

|

|

369 |

|

|

|

313 |

|

|

|

257 |

|

|

|

235 |

|

|

|

219 |

|

| Other expense |

|

|

926 |

|

|

|

758 |

|

|

|

939 |

|

|

|

1,179 |

|

|

|

807 |

|

|

Total noninterest expense |

|

$ |

14,376 |

|

|

$ |

15,217 |

|

|

$ |

14,871 |

|

|

$ |

15,143 |

|

|

$ |

15,375 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Efficiency ratio |

|

|

80.52 |

% |

|

|

86.01 |

% |

|

|

79.78 |

% |

|

|

67.91 |

% |

|

|

74.86 |

% |

Investment SecuritiesInvestment securities

decreased $12.6 million, or 3.9%, to $309.3 million at

September 30, 2023, compared to $322.0 million three months

earlier, and decreased $20.1 million compared to $329.4

million at September 30, 2022. The market value of the portfolio

decreased $8.3 million during the third quarter of 2023,

primarily driven by an increase in long-term interest rates. At

September 30, 2023, municipal bonds totaled $94.0 million and

comprised the largest portion of the investment portfolio at 30.4%.

Non-agency issued mortgage-backed securities ("MBS non-agency")

were the second largest segment, totaling

$90.0 million, or 29.1%, of the portfolio at quarter end.

Included in MBS non-agency are $58.7 million of commercial

mortgaged-backed securities ("CMBS"), of which 85.6% are in "A"

tranches. The majority of the remaining 14.4% are in "B" tranches

with one investment in a "C" tranche. Our largest exposure is to

long-term care facilities, which makes up 53.9%, or $31.7

million, of our private label CMBS securities. All of the

CMBS bonds have credit enhancements that further reduce risk of

loss on these investments.

The estimated average life of the securities portfolio was

approximately 7.7 years, compared to 7.8 years in

the prior quarter and 8.4 years in the third quarter of

2022. The effective duration of the portfolio was approximately 4.9

years, compared to 5.2 years in the prior quarter and

5.1 years at the end of the third quarter of 2022.

|

Investment Securities Available for Sale, at Fair

Value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| $ in

thousands |

|

3Q 23 |

|

|

2Q 23 |

|

|

1Q 23 |

|

|

4Q 22 |

|

|

3Q 22 |

|

| Municipal bonds |

|

$ |

93,995 |

|

|

$ |

100,503 |

|

|

$ |

101,910 |

|

|

$ |

98,050 |

|

|

$ |

96,130 |

|

| U.S. Treasury notes |

|

|

2,377 |

|

|

|

2,364 |

|

|

|

2,390 |

|

|

|

2,364 |

|

|

|

2,355 |

|

| International agency issued

bonds (Agency bonds) |

|

|

1,703 |

|

|

|

1,717 |

|

|

|

1,745 |

|

|

|

1,702 |

|

|

|

1,683 |

|

| Corporate issued debt

securities (Corporate debt): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Senior positions |

|

|

16,975 |

|

|

|

16,934 |

|

|

|

17,025 |

|

|

|

16,828 |

|

|

|

16,571 |

|

|

Subordinated bank notes |

|

|

37,360 |

|

|

|

36,740 |

|

|

|

38,092 |

|

|

|

38,671 |

|

|

|

39,594 |

|

| Mortgage-backed

securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. government agency issued mortgage-backed securities (MBS

agency) |

|

|

66,946 |

|

|

|

71,565 |

|

|

|

74,946 |

|

|

|

75,648 |

|

|

|

78,231 |

|

|

Non-agency issued mortgage-backed securities (MBS non-agency) |

|

|

89,968 |

|

|

|

92,140 |

|

|

|

92,978 |

|

|

|

93,306 |

|

|

|

94,872 |

|

| Total securities available for

sale, at fair value |

|

$ |

309,324 |

|

|

$ |

321,963 |

|

|

$ |

329,086 |

|

|

$ |

326,569 |

|

|

$ |

329,436 |

|

Loans and Unfunded Loan CommitmentsNet loans,

excluding loans held for sale, decreased $2.8 million, or 0.2%, to

$1.62 billion at September 30, 2023, from $1.62 billion at

June 30, 2023, and increased $96.9 million, or 6.4%,

from $1.52 billion one year ago. Multi-family loans

increased $28.9 million during the current quarter. The

increase was the result of new originations totaling

$17.2 million and $13.0 million of construction loans

converting into permanent amortizing loans, partially offset by

scheduled payments. One-to-four family loans increased

$4.4 million during the current quarter as a result of

$14.9 million in residential construction loans that converted

to permanent amortizing loans, partially offset by payments

received. Commercial real estate increased

$5.5 million during the current quarter compared to

the previous quarter as originations exceeded payoffs and scheduled

payments. Home equity loans also increased $5.5 million over

the previous quarter due to draws on new and existing commitments.

Commercial business loans decreased $28.8 million, mainly from

a reduction in our Northpointe MPP participation from $23.9 million

three months prior to $162,000 at the current quarter end along

with repayment on existing lines of credit. Construction loans

decreased $13.6 million during the quarter, with

$25.4 million converting into fully amortizing loans,

partially offset by draws on new and existing loans. Auto and other

consumer loans decreased $5.2 million during the current quarter as

payoffs and scheduled payments exceeded originations.

The Company originated $8.3 million in residential

mortgages during the third quarter of 2023 and sold $9.7

million, with an average gross margin on sale of mortgage loans of

approximately 2.02%. This production compares to residential

mortgage originations of $10.7 million in the preceding

quarter with sales of $6.4 million, with an average gross margin of

2.00%. While single-family home inventory increased in the third

quarter of 2023, higher market rates on mortgage loans

continued to hinder saleable mortgage loan production. We have

expanded our secondary market outlets and changed our portfolio

pricing in an effort to improve saleable loan production. New

single-family residence construction loan commitments

totaled $6.5 million in the third quarter, compared

to $4.8 million in the preceding quarter.

|

Loans by Collateral and Unfunded Commitments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| $ in

thousands |

|

3Q 23 |

|

|

2Q 23 |

|

|

1Q 23 |

|

|

4Q 22 |

|

|

3Q 22 |

|

| One-to-four family

construction |

|

$ |

72,991 |

|

|

$ |

74,787 |

|

|

$ |

65,770 |

|

|

$ |

63,021 |

|

|

$ |

58,038 |

|

| All other construction and

land |

|

|

71,092 |

|

|

|

81,968 |

|

|

|

95,769 |

|

|

|

130,588 |

|

|

|

157,527 |

|

| One-to-four family first

mortgage |

|

|

409,207 |

|

|

|

428,879 |

|

|

|

394,595 |

|

|

|

384,255 |

|

|

|

374,309 |

|

| One-to-four family junior

liens |

|

|

12,859 |

|

|

|

11,956 |

|

|

|

9,140 |

|

|

|

8,219 |

|

|

|

7,244 |

|

| One-to-four family revolving

open-end |

|

|

38,413 |

|

|

|

33,658 |

|

|

|

30,473 |

|

|

|

29,909 |

|

|

|

27,496 |

|

| Commercial real estate, owner

occupied: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Health care |

|

|

22,677 |

|

|

|

23,157 |

|

|

|

23,311 |

|

|

|

23,463 |

|

|

|

23,909 |

|

|

Office |

|

|

18,599 |

|

|

|

18,797 |

|

|

|

22,246 |

|

|

|

22,583 |

|

|

|

23,002 |

|

|

Warehouse |

|

|

14,890 |

|

|

|

15,158 |

|

|

|

16,782 |

|

|

|

20,411 |

|

|

|

18,479 |

|

|

Other |

|

|

57,414 |

|

|

|

60,054 |

|

|

|

52,212 |

|

|

|

47,778 |

|

|

|

38,282 |

|

| Commercial real estate,

non-owner occupied: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Office |

|

|

53,879 |

|

|

|

54,926 |

|

|

|

58,711 |

|

|

|

59,216 |

|

|

|

60,655 |

|

|

Retail |

|

|

51,466 |

|

|

|

51,824 |

|

|

|

52,175 |

|

|

|

54,800 |

|

|

|

53,186 |

|

|

Hospitality |

|

|

61,339 |

|

|

|

53,416 |

|

|

|

45,978 |

|

|

|

46,349 |

|

|

|

44,359 |

|

|

Other |

|

|

96,083 |

|

|

|

90,870 |

|

|

|

93,207 |

|

|

|

89,047 |

|

|

|

98,386 |

|

| Multi-family residential |

|

|

325,338 |

|

|

|

296,398 |

|

|

|

284,699 |

|

|

|

252,765 |

|

|

|

242,509 |

|

| Commercial business loans |

|

|

75,068 |

|

|

|

80,079 |

|

|

|

80,825 |

|

|

|

73,963 |

|

|

|

69,626 |

|

| Commercial agriculture and

fishing loans |

|

|

4,437 |

|

|

|

7,844 |

|

|

|

1,829 |

|

|

|

1,847 |

|

|

|

938 |

|

| State and political

subdivision obligations |

|

|

439 |

|

|

|

439 |

|

|

|

439 |

|

|

|

439 |

|

|

|

472 |

|

| Consumer automobile loans |

|

|

134,695 |

|

|

|

137,860 |

|

|

|

136,540 |

|

|

|

136,213 |

|

|

|

134,221 |

|

| Consumer loans secured by

other assets |

|

|

113,685 |

|

|

|

115,646 |

|

|

|

114,343 |

|

|

|

102,333 |

|

|

|

104,272 |

|

| Consumer loans unsecured |

|

|

407 |

|

|

|

444 |

|

|

|

420 |

|

|

|

352 |

|

|

|

481 |

|

| Total loans |

|

$ |

1,634,978 |

|

|

$ |

1,638,160 |

|

|

$ |

1,579,464 |

|

|

$ |

1,547,551 |

|

|

$ |

1,537,391 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Unfunded loan commitments |

|

$ |

154,722 |

|

|

$ |

168,668 |

|

|

$ |

202,720 |

|

|

$ |

225,836 |

|

|

$ |

231,208 |

|

DepositsTotal deposits increased $4.6 million,

to $1.66 billion at September 30, 2023, compared to $1.65

billion at June 30, 2023, and increased $52.5 million, or 3.3%,

compared to $1.61 billion one year ago. Increases in

consumer CDs of $27.7 million, business money market

account balances of $12.1 million, business

CD balances of $4.0 million, and consumer savings

account balances of $2.1 million, were offset

by decreases in consumer money market account balances of

$13.7 million, brokered CDs of $10.0 million, business

savings account balances of $9.2 million, business demand

account balances of $7.3 million, public fund CDs of

$1.0 million, and consumer demand account balances

of $741,000 during the third quarter of 2023. Decreases in

certain categories were driven by customers seeking higher rates

and spending of excess savings accumulated in 2020 and 2021. The

current rate environment has contributed to greater competition for

deposits with additional deposit rate specials offered to attract

new funds.

The Company estimates that 23% of total deposit balances were

uninsured at September 30, 2023. Approximately 15% of total

deposits were uninsured business and consumer deposits with the

remaining 8% consisting of uninsured public fund balances

totaling $123.9 million. Uninsured public fund balances

are fully collateralized. The Bank holds an FHLB letter of

credit as part of our participation in the Washington Public

Deposit Protection Commission program which covers

$104.7 million of related deposit balances. The

remaining $19.2 million is fully covered through pledged

securities. Consumer deposits make up 61% of total deposits with an

average balance of approximately $24,000 per account.

|

Deposits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| $ in

thousands |

|

3Q 23 |

|

|

2Q 23 |

|

|

1Q 23 |

|

|

4Q 22 |

|

|

3Q 22 |

|

| Noninterest-bearing demand

deposits |

|

$ |

269,800 |

|

|

$ |

280,475 |

|

|

$ |

292,119 |

|

|

$ |

315,083 |

|

|

$ |

342,808 |

|

| Interest-bearing demand

deposits |

|

|

182,361 |

|

|

|

179,029 |

|

|

|

189,187 |

|

|

|

193,558 |

|

|

|

192,504 |

|

| Money market accounts |

|

|

372,706 |

|

|

|

374,269 |

|

|

|

402,760 |

|

|

|

473,009 |

|

|

|

519,018 |

|

| Savings accounts |

|

|

253,182 |

|

|

|

260,279 |

|

|

|

242,117 |

|

|

|

200,920 |

|

|

|

196,780 |

|

| Certificates of deposit,

retail |

|

|

410,136 |

|

|

|

379,484 |

|

|

|

333,510 |

|

|

|

247,824 |

|

|

|

224,574 |

|

| Certificates of deposit,

brokered |

|

|

169,577 |

|

|

|

179,586 |

|

|

|

134,515 |

|

|

|

133,861 |

|

|

|

129,551 |

|

| Total deposits |

|

$ |

1,657,762 |

|

|

$ |

1,653,122 |

|

|

$ |

1,594,208 |

|

|

$ |

1,564,255 |

|

|

$ |

1,605,235 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Public fund and tribal

deposits included in total deposits |

|

$ |

128,627 |

|

|

$ |

130,974 |

|

|

$ |

119,969 |

|

|

$ |

103,662 |

|

|

$ |

113,690 |

|

| Total loans to total

deposits |

|

|

99 |

% |

|

|

99 |

% |

|

|

99 |

% |

|

|

99 |

% |

|

|

96 |

% |

|

Deposit Mix |

|

3Q 23 |

|

|

2Q 23 |

|

|

1Q 23 |

|

|

4Q 22 |

|

|

3Q 22 |

|

|

Noninterest-bearing demand deposits |

|

|

16.3 |

% |

|

|

17.0 |

% |

|

|

18.3 |

% |

|

|

20.1 |

% |

|

|

21.4 |

% |

| Interest-bearing demand

deposits |

|

|

11.0 |

|

|

|

10.8 |

|

|

|

11.9 |

|

|

|

12.4 |

|

|

|

12.0 |

|

| Money market accounts |

|

|

22.5 |

|

|

|

22.6 |

|

|

|

25.3 |

|

|

|

30.3 |

|

|

|

32.2 |

|

| Savings accounts |

|

|

15.3 |

|

|

|

15.7 |

|

|

|

15.2 |

|

|

|

12.8 |

|

|

|

12.3 |

|

| Certificates of deposit,

retail |

|

|

24.7 |

|

|

|

23.0 |

|

|

|

20.9 |

|

|

|

15.8 |

|

|

|

14.0 |

|

| Certificates of deposit,

brokered |

|

|

10.2 |

|

|

|

10.9 |

|

|

|

8.4 |

|

|

|

8.6 |

|

|

|

8.1 |

|

|

Cost of Deposits for the Quarter Ended |

|

3Q 23 |

|

|

2Q 23 |

|

|

1Q 23 |

|

|

4Q 22 |

|

|

3Q 22 |

|

|

Interest-bearing demand deposits |

|

|

0.46 |

% |

|

|

0.45 |

% |

|

|

0.42 |

% |

|

|

0.17 |

% |

|

|

0.03 |

% |

| Money market accounts |

|

|

1.22 |

|

|

|

0.99 |

|

|

|

0.73 |

|

|

|

0.49 |

|

|

|

0.33 |

|

| Savings accounts |

|

|

1.42 |

|

|

|

1.22 |

|

|

|

0.70 |

|

|

|

0.17 |

|

|

|

0.05 |

|

| Certificates of deposit,

retail |

|

|

3.52 |

|

|

|

3.25 |

|

|

|

2.59 |

|

|

|

1.65 |

|

|

|

1.05 |

|

| Certificates of deposit,

brokered |

|

|

4.31 |

|

|

|

3.44 |

|

|

|

2.99 |

|

|

|

2.15 |

|

|

|

1.08 |

|

| Cost of total deposits |

|

|

1.85 |

|

|

|

1.54 |

|

|

|

1.12 |

|

|

|

0.62 |

|

|

|

0.32 |

|

Asset QualityNonperforming loans were $2.4

million at September 30, 2023, a decrease of $180,000

from June 30, 2023, related to decreased delinquencies in

Triad purchased manufactured home loans and home equity lines of

credit, partially offset by a newly delinquent single-family

residential loan and a Woodside auto loan. The percentage of the

allowance for credit losses on loans to nonperforming loans

increased to 714% at September 30, 2023,

from 677% at June 30, 2023, and from 463% at

September 30, 2022. Classified loans increased $245,000

to $23.0 million at September 30, 2023, due to the downgrades

of a $119,000 commercial business loan, a $110,00 home equity loan

and $196,000 in additional funds disbursed on a substandard

commercial construction loan during the third quarter.

The allowance for credit losses on loans as a percentage of

total loans was 1.04% at September 30, 2023, decreasing

from 1.06% at the prior quarter end and from 1.06%

reported one year earlier. The current quarter 2 basis point

decrease can be attributed to changes in the loan mix with a

shift in balances to amortizing loans, which carry lower reserve

estimates, and a decrease in the qualitative factor adjustment

applied to Woodside auto loans. The decrease in reserve calculation

for the allowance for credit losses on loans was offset by net

charge-offs.

| $ in

thousands |

|

3Q 23 |

|

|

2Q 23 |

|

|

1Q 23 |

|

|

4Q 22 |

|

|

3Q 22 |

|

|

Allowance for credit losses on loans to total loans |

|

|

1.04 |

% |

|

|

1.06 |

% |

|

|

1.10 |

% |

|

|

1.04 |

% |

|

|

1.06 |

% |

| Allowance for credit losses on

loans to nonperforming loans |

|

|

714 |

|

|

|

677 |

|

|

|

661 |

|

|

|

900 |

|

|

|

463 |

|

| Nonperforming loans to total

loans |

|

|

0.15 |

|

|

|

0.16 |

|

|

|

0.17 |

|

|

|

0.12 |

|

|

|

0.22 |

|

| Net charge-off ratio

(annualized) |

|

|

0.30 |

|

|

|

0.10 |

|

|

|

0.25 |

|

|

|

0.11 |

|

|

|

0.06 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total nonperforming loans |

|

$ |

2,374 |

|

|

$ |

2,554 |

|

|

$ |

2,633 |

|

|

$ |

1,790 |

|

|

$ |

3,517 |

|

| Reserve for unfunded

commitments |

|

$ |

828 |

|

|

$ |

1,336 |

|

|

$ |

1,336 |

|

|

$ |

325 |

|

|

$ |

331 |

|

CapitalTotal shareholders’ equity decreased to

$156.1 million at September 30, 2023, compared to $159.6

million three months earlier, due to a decrease in the

fair market value of the available-for-sale investment

securities portfolio, net of taxes, of $6.5 million,

dividends declared of $675,000 and share repurchases

totaling $12,000, partially offset by net income of

$2.5 million and a $727,000 increase in the fair market value

of derivatives, net of taxes. Bond values continue to be impacted

by the higher rate environment.

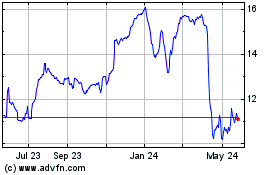

Tangible book value per common

share* was $16.03 at September 30, 2023, compared

to $16.39 at June 30, 2023, and $15.50 at

September 30, 2022. Book value per common

share was $16.20 at September 30, 2023, compared

to $16.56 at June 30, 2023, and $15.69 at

September 30, 2022.

Capital levels for both the Company and its operating bank,

First Fed, remain in excess of applicable regulatory requirements

and the Bank was categorized as "well-capitalized" at September 30,

2023. Common Equity Tier 1 and Total Risk-Based Capital Ratios at

September 30, 2023, were 13.4% and 14.4%,

respectively.

|

|

|

3Q 23 |

|

|

2Q 23 |

|

|

1Q 23 |

|

|

4Q 22 |

|

|

3Q 22 |

|

|

Equity to total assets |

|

|

7.25 |

% |

|

|

7.38 |

% |

|

|

7.38 |

% |

|

|

7.75 |

% |

|

|

7.49 |

% |

| Tangible common equity ratio

* |

|

|

7.17 |

|

|

|

7.31 |

|

|

|

7.30 |

|

|

|

7.67 |

|

|

|

7.40 |

|

| Capital ratios (First Fed

Bank): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tier 1 leverage |

|

|

10.12 |

|

|

|

10.16 |

|

|

|

10.41 |

|

|

|

10.41 |

|

|

|

10.50 |

|

|

Common equity Tier 1 capital |

|

|

13.43 |

|

|

|

13.10 |

|

|

|

13.34 |

|

|

|

13.40 |

|

|

|

13.13 |

|

|

Tier 1 risk-based |

|

|

13.43 |

|

|

|

13.10 |

|

|

|

13.34 |

|

|

|

13.40 |

|

|

|

13.13 |

|

|

Total risk-based |

|

|

14.38 |

|

|

|

14.08 |

|

|

|

14.35 |

|

|

|

14.42 |

|

|

|

14.16 |

|

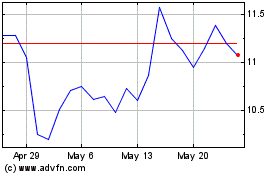

Share Repurchase Program and Cash DividendFirst

Northwest continued to return capital to our shareholders

through cash dividends and share repurchases during the third

quarter of 2023. We repurchased 1,073 shares of common stock

under the Company's October 2020 stock repurchase plan at an

average price of $11.10 per share for a total of $12,000

during the quarter ended September 30, 2023, leaving 226,337 shares

remaining under the plan. In addition, the Company paid cash

dividends totaling $671,000 in the third quarter of

2023.

__________________* See reconciliation of Non-GAAP

Financial Measures later in this release.

Awards/Recognition

The Company received several accolades as a leader in the

community in the last year.

In October 2023, the First Fed team was honored to bring home

the Gold for Best Bank in the Best of the Northwest survey hosted

by Bellingham Alive for the second year in a row.

In September 2023, the First Fed team was recognized in the 2023

Best of Olympic Peninsula surveys, winning Best Bank and Best

Financial Advisor in Clallam County. First Fed was also a finalist

for Best Bank in Jefferson County, Best Employer in Kitsap County,

and Best Bank and Best Financial Institution in

Bainbridge.

In June 2023, First Fed was named on the Puget Sound

Business Journal’s Best Workplaces list. First Fed has been

recognized as one the top 100 workplaces in Washington, as

voted for two years in row by each company’s own

employees.

In May 2023, First Fed was recognized as a Top Corporate Citizen

by the Puget Sound Business Journal. The Corporate Citizenship

Awards honors local corporate philanthropists and companies making

significant contributions in the region. The top 25 small, medium

and large-sized companies were recognized in addition to nine other

honorees last year. First Fed was ranked #1 in the

medium-sized company category in 2023 and was ranked #3 in the same

category in 2022.

In March 2023, First Fed won “Best Bank” in Cascadia Daily News

2023 Readers' Choice. It was the first year that First Fed had

participated in this Whatcom County poll.

First Fed has been rated a 5-star bank by Bauer Financial, a

leading independent bank and credit union rating and research firm.

This top rating indicates that First Fed is one of the strongest

banks in the nation based on capital, loan quality and other

detailed performance criteria.

About the Company

First Northwest Bancorp (Nasdaq: FNWB) is a financial holding

company engaged in investment activities including the business of

its subsidiary, First Fed Bank. First Fed is a Pacific

Northwest-based financial institution which has served its

customers and communities since 1923. Currently First Fed has 16

locations in Washington state including 12 full-service branches.

First Fed’s business and operating strategy is focused on building

sustainable earnings by delivering a full array of financial

products and services for individuals, small businesses, non-profit

organizations, and commercial customers. In 2022, First Northwest

made an investment in The Meriwether Group, LLC, a boutique

investment banking and accelerator firm. Additionally, First

Northwest focuses on strategic partnerships to provide modern

financial services such as digital payments and marketplace

lending. First Northwest Bancorp was incorporated in 2012 and

completed its initial public offering in 2015 under the ticker

symbol FNWB. The Company is headquartered in Port Angeles,

Washington.

Forward-Looking Statements

Certain matters discussed in this press release may contain

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. These forward-looking

statements relate to, among other things, expectations of the

business environment in which we operate, projections of future

performance, perceived opportunities in the market, potential

future credit experience, and statements regarding our mission and

vision. These forward-looking statements are based upon current

management expectations and may, therefore, involve risks and

uncertainties. Our actual results, performance, or achievements may

differ materially from those suggested, expressed, or implied by

forward-looking statements as a result of a wide variety of factors

including, but not limited to: increased competitive pressures;

changes in the interest rate environment; the credit risks of

lending activities; pressures on liquidity, including as a result

of withdrawals of deposits or declines in the value of our

investment portfolio; changes in general economic conditions

and conditions within the securities markets; legislative and

regulatory changes; and other factors described in the Company’s

latest Annual Report on Form 10-K and other filings with the

Securities and Exchange Commission ("SEC"),which are available on

our website at www.ourfirstfed.com and on the SEC’s website at

www.sec.gov.

Any of the forward-looking statements that we make in this Press

Release and in the other public statements we make may turn out to

be incorrect because of the inaccurate assumptions we might make,

because of the factors illustrated above or because of other

factors that we cannot foresee. Because of these and other

uncertainties, our actual future results may be materially

different from those expressed or implied in any forward-looking

statements made by or on our behalf and the Company's operating and

stock price performance may be negatively affected. Therefore,

these factors should be considered in evaluating the

forward-looking statements, and undue reliance should not be placed

on such statements. We do not undertake and specifically disclaim

any obligation to revise any forward-looking statements to reflect

the occurrence of anticipated or unanticipated events or

circumstances after the date of such statements. These risks could

cause our actual results for 2023 and beyond to differ

materially from those expressed in any forward-looking statements

by, or on behalf of, us and could negatively affect the Company’s

operations and stock price performance.

For More Information Contact:Matthew P. Deines,

President and Chief Executive OfficerGeri Bullard, EVP, Chief

Financial Officer and Chief Operating

OfficerIRGroup@ourfirstfed.com360-457-0461

FIRST NORTHWEST BANCORP AND

SUBSIDIARYCONSOLIDATED BALANCE SHEETS(Dollars in

thousands, except share data) (Unaudited)

| |

|

September 30, 2023 |

|

|

June 30, 2023 |

|

|

September 30, 2022 |

|

|

Three Month Change |

|

|

One Year Change |

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and due from banks |

|

$ |

20,609 |

|

|

$ |

19,294 |

|

|

$ |

22,784 |

|

|

|

6.8 |

% |

|

|

-9.5 |

% |

| Interest-earning deposits in

banks |

|

|

63,277 |

|

|

|

59,008 |

|

|

|

80,879 |

|

|

|

7.2 |

|

|

|

-21.8 |

|

| Investment securities

available for sale, at fair value |

|

|

309,324 |

|

|

|

321,963 |

|

|

|

329,436 |

|

|

|

-3.9 |

|

|

|

-6.1 |

|

| Loans held for sale |

|

|

689 |

|

|

|

2,049 |

|

|

|

263 |

|

|

|

-66.4 |

|

|

|

162.0 |

|

| Loans receivable (net of

allowance for credit losses on loans $16,945, $17,297,

and $16,273) |

|

|

1,618,033 |

|

|

|

1,620,863 |

|

|

|

1,521,118 |

|

|

|

-0.2 |

|

|

|

6.4 |

|

| Federal Home Loan Bank (FHLB)

stock, at cost |

|

|

12,621 |

|

|

|

12,621 |

|

|

|

11,961 |

|

|

|

0.0 |

|

|

|

5.5 |

|

| Accrued interest

receivable |

|

|

8,093 |

|

|

|

7,480 |

|

|

|

6,655 |

|

|

|

8.2 |

|

|

|

21.6 |

|

| Premises and equipment,

net |

|

|

17,954 |

|

|

|

18,140 |

|

|

|

20,841 |

|

|

|

-1.0 |

|

|

|

-13.9 |

|

| Servicing rights on sold

loans, at fair value |

|

|

3,729 |

|

|

|

3,825 |

|

|

|

3,872 |

|

|

|

-2.5 |

|

|

|

-3.7 |

|

| Bank-owned life insurance,

net |

|

|

40,318 |

|

|

|

40,066 |

|

|

|

40,003 |

|

|

|

0.6 |

|

|

|

0.8 |

|

| Equity and partnership

investments |

|

|

14,623 |

|

|

|

14,569 |

|

|

|

13,990 |

|

|

|

0.4 |

|

|

|

4.5 |

|

| Goodwill and other intangible

assets, net |

|

|

1,087 |

|

|

|

1,087 |

|

|

|

1,173 |

|

|

|

0.0 |

|

|

|

-7.3 |

|

| Deferred tax asset, net |

|

|

16,611 |

|

|

|

15,031 |

|

|

|

12,689 |

|

|

|

10.5 |

|

|

|

30.9 |

|

| Prepaid expenses and other

assets |

|

|

26,577 |

|

|

|

26,882 |

|

|

|

25,777 |

|

|

|

-1.1 |

|

|

|

3.1 |

|

|

Total assets |

|

$ |

2,153,545 |

|

|

$ |

2,162,878 |

|

|

$ |

2,091,441 |

|

|

|

-0.4 |

% |

|

|

3.0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND

SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Deposits |

|

$ |

1,657,762 |

|

|

$ |

1,653,122 |

|

|

$ |

1,605,235 |

|

|

|

0.3 |

% |

|

|

3.3 |

% |

| Borrowings |

|

|

300,416 |

|

|

|

303,397 |

|

|

|

292,338 |

|

|

|

-1.0 |

|

|

|

2.8 |

|

| Accrued interest payable |

|

|

2,276 |

|

|

|

1,367 |

|

|

|

105 |

|

|

|

66.5 |

|

|

|

2,067.6 |

|

| Accrued expenses and other

liabilities |

|

|

34,651 |

|

|

|

44,286 |

|

|

|

34,940 |

|

|

|

-21.8 |

|

|

|

-0.8 |

|

| Advances from borrowers for

taxes and insurance |

|

|

2,375 |

|

|

|

1,149 |

|

|

|

2,224 |

|

|

|

106.7 |

|

|

|

6.8 |

|

|

Total liabilities |

|

|

1,997,480 |

|

|

|

2,003,321 |

|

|

|

1,934,842 |

|

|

|

-0.3 |

|

|

|

3.2 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shareholders' Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred stock, $0.01 par value, authorized 5,000,000

shares, no shares issued or outstanding |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

n/a |

|

|

|

n/a |

|

|

Common stock, $0.01 par value, authorized 75,000,000

shares; issued and outstanding 9,630,735 at September

30, 2023; issued and outstanding 9,633,496 at June 30,

2023; and issued and outstanding 9,978,041 at

September 30, 2022 |

|

|

96 |

|

|

|

96 |

|

|

|

100 |

|

|

|

0.0 |

|

|

|

-4.0 |

|

|

Additional paid-in capital |

|

|

95,658 |

|

|

|

95,360 |

|

|

|

97,924 |

|

|

|

0.3 |

|

|

|

-2.3 |

|

|

Retained earnings |

|

|

113,579 |

|

|

|

111,750 |

|

|

|

110,107 |

|

|

|

1.6 |

|

|

|

3.2 |

|

|

Accumulated other comprehensive loss, net of tax |

|

|

(45,850 |

) |

|

|

(40,066 |

) |

|

|

(41,023 |

) |

|

|

-14.4 |

|

|

|

-11.8 |

|

|

Unearned employee stock ownership plan (ESOP) shares |

|

|

(7,418 |

) |

|

|

(7,583 |

) |

|

|

(8,077 |

) |

|

|

2.2 |

|

|

|

8.2 |

|

|

Total parent's shareholders' equity |

|

|

156,065 |

|

|

|

159,557 |

|

|

|

159,031 |

|

|

|

-2.2 |

|

|

|

-1.9 |

|

|

Noncontrolling interest in Quin Ventures, Inc. |

|

|

— |

|

|

|

— |

|

|

|

(2,432 |

) |

|

|

n/a |

|

|

|

100.0 |

|

|

Total shareholders' equity |

|

|

156,065 |

|

|

|

159,557 |

|

|

|

156,599 |

|

|

|

-2.2 |

|

|

|

-0.3 |

|

|

Total liabilities and shareholders' equity |

|

$ |

2,153,545 |

|

|

$ |

2,162,878 |

|

|

$ |

2,091,441 |

|

|

|

-0.4 |

% |

|

|

3.0 |

% |

FIRST NORTHWEST BANCORP AND

SUBSIDIARYCONSOLIDATED STATEMENTS OF INCOME(Dollars in

thousands, except per share data) (Unaudited)

| |

|

Quarter Ended |

|

|

|

|

|

|

|

|

|

| |

|

September 30, 2023 |

|

|

June 30, 2023 |

|

|

September 30, 2022 |

|

|

Three Month Change |

|

|

One Year Change |

|

|

INTEREST INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest and fees on loans receivable |

|

$ |

21,728 |

|

|

$ |

21,299 |

|

|

$ |

17,778 |

|

|

|

2.0 |

% |

|

|

22.2 |

% |

|

Interest on investment securities |

|

|

3,368 |

|

|

|

3,336 |

|

|

|

2,817 |

|

|

|

1.0 |

|

|

|

19.6 |

|

|

Interest on deposits in banks |

|

|

524 |

|

|

|

617 |

|

|

|

118 |

|

|

|

-15.1 |

|

|

|

344.1 |

|

|

FHLB dividends |

|

|

214 |

|

|

|

222 |

|

|

|

142 |

|

|

|

-3.6 |

|

|

|

50.7 |

|

|

Total interest income |

|

|

25,834 |

|

|

|

25,474 |

|

|

|

20,855 |

|

|

|

1.4 |

|

|

|

23.9 |

|

| INTEREST EXPENSE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits |

|

|

7,699 |

|

|

|

6,209 |

|

|

|

1,251 |

|

|

|

24.0 |

|

|

|

515.4 |

|

|

Borrowings |

|

|

3,185 |

|

|

|

3,283 |

|

|

|

1,400 |

|

|

|

-3.0 |

|

|

|

127.5 |

|

|

Total interest expense |

|

|

10,884 |

|

|

|

9,492 |

|

|

|

2,651 |

|

|

|

14.7 |

|

|

|

310.6 |

|

|

Net interest income |

|

|

14,950 |

|

|

|

15,982 |

|

|

|

18,204 |

|

|

|

-6.5 |

|

|

|

-17.9 |

|

|

Provision for credit losses |

|

|

371 |

|

|

|

300 |

|

|

|

750 |

|

|

|

23.7 |

|

|

|

-50.5 |

|

|

Net interest income after provision for credit

losses |

|

14,579 |

|

|

|

15,682 |

|

|

|

17,454 |

|

|

|

-7.0 |

|

|

|

-16.5 |

|

| NONINTEREST INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loan and deposit service fees |

|

|

1,068 |

|

|

|

1,064 |

|

|

|

1,302 |

|

|

|

0.4 |

|

|

|

-18.0 |

|

|

Sold loan servicing fees and servicing rights mark-to-market |

|

|

98 |

|

|

|

(191 |

) |

|

|

206 |

|

|

|

151.3 |

|

|

|

-52.4 |

|

|

Net gain on sale of loans |

|

|

171 |

|

|

|

58 |

|

|

|

285 |

|

|

|

194.8 |

|

|

|

-40.0 |

|

|

Increase in cash surrender value of bank-owned life insurance |

|

|

252 |

|

|

|

190 |

|

|

|

221 |

|

|

|

32.6 |

|

|

|

14.0 |

|

|

Other income |

|

|

1,315 |

|

|

|

590 |

|

|

|

320 |

|

|

|

122.9 |

|

|

|

310.9 |

|

|

Total noninterest income |

|

|

2,904 |

|

|

|

1,711 |

|

|

|

2,334 |

|

|

|

69.7 |

|

|

|

24.4 |

|

| NONINTEREST EXPENSE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensation and benefits |

|

|

7,795 |

|

|

|

8,180 |

|

|

|

9,045 |

|

|

|

-4.7 |

|

|

|

-13.8 |

|

|

Data processing |

|

|

1,945 |

|

|

|

2,080 |

|

|

|

1,778 |

|

|

|

-6.5 |

|

|

|

9.4 |

|

|

Occupancy and equipment |

|

|

1,173 |

|

|

|

1,214 |

|

|

|

1,499 |

|

|

|

-3.4 |

|

|

|

-21.7 |

|

|

Supplies, postage, and telephone |

|

|

292 |

|

|

|

435 |

|

|

|

322 |

|

|

|

-32.9 |

|

|

|

-9.3 |

|

|

Regulatory assessments and state taxes |

|

|

446 |

|

|

|

424 |

|

|

|

365 |

|

|

|

5.2 |

|

|

|

22.2 |

|

|

Advertising |

|

|

501 |

|

|

|

929 |

|

|

|

645 |

|

|

|

-46.1 |

|

|

|

-22.3 |

|

|

Professional fees |

|

|

929 |

|

|

|

884 |

|

|

|

695 |

|

|

|

5.1 |

|

|

|

33.7 |

|

|

FDIC insurance premium |

|

|

369 |

|

|

|

313 |

|

|

|

219 |

|

|

|

17.9 |

|

|

|

68.5 |

|

|

Other expense |

|

|

926 |

|

|

|

758 |

|

|

|

807 |

|

|

|

22.2 |

|

|

|

14.7 |

|

|

Total noninterest expense |

|

|

14,376 |

|

|

|

15,217 |

|

|

|

15,375 |

|

|

|

-5.5 |

|

|

|

-6.5 |

|

|

Income before provision for income taxes |

|

|

3,107 |

|

|

|

2,176 |

|

|

|

4,413 |

|

|

|

42.8 |

|

|

|

-29.6 |

|

| Provision for income

taxes |

|

|

603 |

|

|

|

475 |

|

|

|

818 |

|

|

|

26.9 |

|

|

|

-26.3 |

|

|

Net income |

|

|

2,504 |

|

|

|

1,701 |

|

|

|

3,595 |

|

|

|

47.2 |

|

|

|

-30.3 |

|

| Net loss attributable to

noncontrolling interest in Quin Ventures, Inc. |

|

|

— |

|

|

|

75 |

|

|

|

696 |

|

|

|

-100.0 |

|

|

|

-100.0 |

|

| Net income attributable to

parent |

|

$ |

2,504 |

|

|

$ |

1,776 |

|

|

$ |

4,291 |

|

|

|

41.0 |

% |

|

|

-41.6 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted earnings per

common share |

|

$ |

0.28 |

|

|

$ |

0.20 |

|

|

$ |

0.47 |

|

|

|

40.0 |

% |

|

|

-40.4 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FIRST NORTHWEST BANCORP AND