0001421517False00014215172024-01-162024-01-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

Current Report

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 31, 2024 (January 16, 2024)

ENERGY RECOVERY, INC.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-34112 | | 01-0616867 |

| (State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

1717 Doolittle Drive, San Leandro, California 94577

(Address of Principal Executive Offices) (Zip Code)

(510) 483-7370

(Registrant’s telephone number, including area code)

Not applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.001 par value | | ERII | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On January 22, 2024, Energy Recovery, Inc. (the “Company”) filed a Current Report on Form 8-K (the “Original Report”) to announce the appointment of Mr. David W. Moon as the Company’s President and Chief Executive Officer. At the time of the filing of the Original Report, Mr. Moon’s compensation as President and Chief Executive Officer had not yet been determined by the Company’s Compensation Committee. Pursuant to Item 5.02(e) of Current Report on Form 8-K, the Company is filing this Amendment No. 1 to the Original Report (the “Amendment”) solely for the purpose of disclosing a brief description of Mr. Moon’s compensation arrangements as President and Chief Executive Officer. The information contained in the Amendment should be read in conjunction with the information contained in the Original Report.

Mr. Moon’s compensation as President and Chief Executive Officer are set forth in that certain Offer of Employment dated January 25, 2024, by and between the Company and Mr. Moon (the “Employment Letter”). Pursuant to the terms of the Employment Letter, Mr. Moon will receive an annual salary of $570,000, be eligible for an annual bonus from 0% to 150% of his annual base salary, be eligible to receive additional equity awards under the Company’s Long Term Incentive Plan and other standard Company benefits, and a one-time relocation benefit in the amount of $100,000.

The foregoing description of the Employment Letter does not purport to be complete and is qualified in its entirety by reference to the Employment Letter, which is attached hereto as Exhibit 10.1 and is incorporated herein by reference into this Item 5.02.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | | | | |

| Exhibit Number | | Description | |

| | | |

| | | |

| | | |

| | | |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. | |

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | Energy Recovery, Inc. | |

| | | | |

| Date: | January 31, 2024 | By: | /s/ William Yeung | |

| | | William Yeung | |

| | | Chief Legal Officer | |

Exhibit 10.1

January 25, 2024

David W. Moon

1717 Doolittle Drive

San Leandro, CA 94577

Re: Offer of Employment with Energy Recovery, Inc., as President and Chief Executive Officer

Dear David;

On behalf of the Board of Directors of Energy Recovery, Inc (“ERII” or the “Company), I am pleased to confirm your appointment to the position of President and Chief Executive Officer of ERII, reporting to the Board of Directors, subject to the following terms and conditions.

Effective Date and Salary. Your appointment as President and Chief Executive Officer was effective January 16, 2024. In connection with your role, you will receive a bi-weekly salary of $21,923.08 per pay period (annualized $570,000.08), less deductions authorized or required by law, which will be paid bi-weekly in accordance with the Company’s standard payroll procedures. Since you are now a full-time employee, you will no longer receive any separate compensation for your role as a Director of ERII.

Annual Incentive Plan. You will be eligible to participate in the Company’s Annual Incentive Plan (“AIP”) pursuant to which you may receive from zero (0%) to one hundred fifty percent (150%) of your base salary as a bonus for achieving performance goals established by the Board of Directors each year.

Long Term Incentive Plan. Subject to the approval and discretion of the Company’s Board of Directors or its Compensation Committee, each year you may continue to be granted additional equity awards under the Company’s 2016 Incentive Plan. The awards will generally be in the form of options to purchase the Company’s common stock, restricted stock units (RSUs) or and performance stock units (PSUs) or some combination thereof. The exercise price per share of an option award or the value of the RSUs and PSUs will be equal to the closing price on NASDAQ of a share of the Company’s common stock on the day the Committee approves your grant, and all awards will be subject to the terms and conditions for the 2020 Incentive Plan or such other Plan the Board and shareholders may approve and any award agreement.

Change of Control. In connection with your appointment, you will be named as a Participant in the Company’s Change in Control Plan (“CCP”), as amended.

Termination for Convenience. In connection with your appointment, you will be named as a Participant in the Company’s Severance Plan, as amended.

Resignation from Board. In the event your employment as President and Chief Executive Officer is terminated for any reason or you otherwise becomes unaffiliated with the Company, you shall, and do hereby agree to, tender your written resignation from the Board of Directors and all other positions with any subsidiaries of the Company on the date of termination, resignation or non-affiliation. In the event you do not promptly provide your written resignation, this provision of the Agreement shall serve as your voluntary and irrevocable resignation from the Board of Directors and all other positions with any subsidiaries of the Company.

Benefits. As a full-time employee, you will be eligible to receive employee benefits including, paid-time-off under the company’s DTO “Discretionary Time Off” policy, medical, dental and vision insurance for you and your dependents; as well as long-term disability and life insurance. Your eligibility to participate in these programs will begin the first of the month following your date of hire. Please note that the benefits program may change from time to time at the Company’s discretion.

Employment Status. Although your status may change, your employment with the Company remains “at will”, meaning that either you or the Company will be entitled to terminate your employment at any time and for any reason, with or without cause. Any contrary representations which may have been made to you are superseded by this offer letter. In addition, although your job duties, compensation, benefits, as well as the Company’s personnel policies and procedures may change in the future, the “at will” nature of your employment may not be changed.

Relocation. The Company authorizes a one-time gross lump sum allowance in the amount of $100,000, plus a tax gross-up utilizing the marginal method as calculated by the Company’s relocation service provider. The lump sum payment will appear in your pay check in the near term. This sum shall constitute full and total reimbursement for costs associated with your relocation from Texas to California.

Thank you for signing and returning this offer letter to William Yeung, Chief Legal Officer and Secretary to the Board of Directors.

Sincerely,

/s/ Joan Chow

__________________________________

Joan Chow

Chair of the Compensation Committee

On behalf of the ERII Board of Directors

I hereby accept the foregoing offer of employment and acknowledge that no representations, offer, commitments, other than those contained herein, have been issued, given, or made to me whatsoever. I understand that this agreement does not constitute a guarantee of employment for a fixed period.

/s/ David W. Moon

__________________________________

David W Moon

Date

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

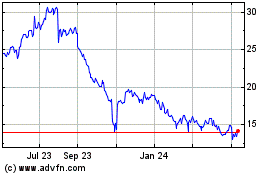

Energy Recovery (NASDAQ:ERII)

Historical Stock Chart

From Mar 2024 to Apr 2024

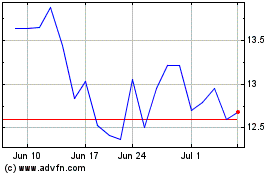

Energy Recovery (NASDAQ:ERII)

Historical Stock Chart

From Apr 2023 to Apr 2024