East West Bank Acquires the Banking Operations of Seattle, Washington-Based Washington First International Bank

June 11 2010 - 8:15PM

Business Wire

East West Bancorp, Inc. (Nasdaq:EWBC), parent company of East

West Bank, announced today that it has acquired the banking

operations of Seattle, Washington-based Washington First

International Bank (WFIB) in a transaction with the Federal Deposit

Insurance Corporation (FDIC). Under the terms of the transaction,

East West will receive approximately $504 million in assets,

including $403 million in loans, and assume approximately $478

million in liabilities, including $415 million in deposits. The

FDIC and East West have entered into a loss sharing agreement

covering the acquired loans.

East West Bank is the largest bank in the nation focused on

serving the Asian American community and this strategically

attractive transaction expands East West’s operations in

Washington's Puget Sound area. With today’s transaction, East West

adds four branches to its Seattle area branch presence for a

combined total of 6 branches in the Puget Sound area. East West is

now the largest Asian-American bank in Washington.

“The acquisition of Washington First International Bank reflects

our commitment to the Asian-American community in the Seattle

region,” said Dominic Ng, Chairman and Chief Executive Officer of

East West. “We look forward to providing the customers of

Washington First International Bank with our expanded array of

deposit and loan products and services immediately, and access to

our nationwide branch network after integration is complete. This

acquisition further strengthens our vision to be recognized as the

premier bridge between East and West and our position as the

largest bank in the U.S. focused on serving the Asian-American

community,” continued Ng.

All WFIB branches will reopen as branches of East West Bank

under normal business hours – on Saturday for the International

District branch, and on Monday for the branches that operate Monday

through Friday. Depositors can continue to access their money by

writing checks or using ATM or debit cards. All outstanding checks

will be processed as usual, and customers can continue using their

WFIB checks. Loan customers should continue to make their payments

as they always have.

“We welcome WFIB’s customers and employees to the East West Bank

family,” said Ng. “All customers can rest assured that all of their

deposits are safe and accessible, continue to be covered under the

FDIC insurance program, and are now backed by the security and

strength of East West Bank,” Ng concluded.

About East West

East West Bancorp is a publicly owned company with over $20

billion in assets and is traded on the Nasdaq Global Select Market

under the symbol “EWBC”. The Company’s wholly owned subsidiary,

East West Bank, is one of the largest independent commercial banks

headquartered in California with over 130 locations worldwide,

including the U.S. markets of California, New York, Georgia,

Massachusetts, Texas and Washington. In Greater China, East West’s

presence includes a full service branch in Hong Kong and

representative offices in Beijing, Shanghai, Shenzhen and Taipei.

Through a wholly-owned subsidiary bank, East West’s presence in

Greater China also includes full service branches in Shanghai and

Shantou and representative offices in Beijing and Guangzhou. For

more information on East West Bancorp, visit the Company's website

at www.eastwestbank.com.

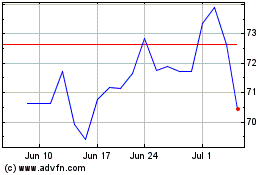

East West Bancorp (NASDAQ:EWBC)

Historical Stock Chart

From May 2024 to Jun 2024

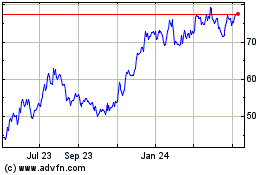

East West Bancorp (NASDAQ:EWBC)

Historical Stock Chart

From Jun 2023 to Jun 2024