Comera Life Sciences Holdings, Inc. (Nasdaq: CMRA), a life sciences

company developing a new generation of bio-innovative biologic

medicines to improve patient access, safety, and convenience, today

reported financial results for the second quarter ended June 30,

2023, and provided a business update.

“We made substantial progress across our

business, strengthening our partnerships, platform and pipeline.

Recent key accomplishments include advancing our ongoing

collaboration with Regeneron, bolstering our intellectual property

to further protect our SQore platform, and strengthening our cash

position,” said Jeffrey Hackman, Chairman and Chief Executive

Officer of Comera. “We remain focused on creating value for

shareholders and executing on our mission to reduce healthcare

costs and improve patient quality of life by leveraging our SQore

platform to transform the delivery of biologics from intravenous to

self-administered subcutaneous forms.”

Recent Business Highlights

- Advanced to final stage of

technical evaluation as part of an ongoing research collaboration

with Regeneron, a leading U.S. biotechnology company. The

partnership includes an option to negotiate a license after the

technical evaluation is complete.

- On August 8, 2023, received formal

notice that Nasdaq granted Comera’s request for the continued

listing of its common stock, subject to Comera’s satisfaction of

certain conditions. These conditions include satisfaction of

specified interim milestones and demonstrated compliance with all

applicable criteria for continued listing on Nasdaq by no later

than November 14, 2023. Comera is taking definitive steps to comply

with these conditions; however, there can be no assurance that it

will be able to do so.

- In August 2023, announced the

execution of a definitive agreement to complete a $4.1 million

private placement of shares of its common stock, and accompanying

warrants to purchase shares of its common stock, to existing

stockholders at a purchase price of $0.51125 per share. At the

initial closing on July 31, 2023, Comera sold and issued a total of

4,399,016 shares of its common stock and accompanying warrants to

purchase up to 10,997,550 shares of common stock, resulting in

gross proceeds of approximately $2.25 million to Comera. Comera

expects to sell and issue an additional 3,561,851 shares of its

common stock and accompanying warrants to purchase up to an

additional 8,904,641 shares of common stock in a second closing,

resulting in additional gross proceeds of approximately $1.82

million, conditioned upon receipt of stockholder approval under the

applicable Nasdaq listing standards.

- In August 2023, received a Notice

of Intention to Grant a European patent by the European Patent

Office, which would represent the first granted patent in Europe

for Comera’s SQore platform technology.

- In August 2023, announced the

significant expansion of its SQore technology patent portfolio with

the issuance of four new patents and two new notices of allowance.

The six new patents, three issued in the United States and three

covering Canada, Korea and India, expand the number of proprietary

viscosity reducing excipients in Comera’s SQore platform and

significantly broaden claims covered by previously issued

patents.

- In July 2023, announced

collaboration with Quality Chemical Laboratories to manufacture one

of Comera’s lead SQore excipients, as part of a broader strategy to

secure the GMP manufacturing and supply chain of key proprietary

technology owned by the Company. Ownership of proprietary sourcing

for lead SQore excipients allows for full control over supply

chain, manufacturing within the United States, and greater

flexibility to support product development needs.

- In April 2023, announced the

issuance of one new patent granted in South Korea and two Notices

of Allowance in the United States and Japan covering expansion of

claims, geographic coverage, and exclusive rights pertaining to

certain excipients in its proprietary SQore platform.

Second Quarter 2023 Financial Results

Comera reported revenues of $315 thousand for

the three months ended June 30, 2023, compared to $147 thousand for

the same period in 2022, with the increase primarily related to the

expansion of its ongoing research collaborations.

Cost of revenue totaled $56 thousand for the

three months ended June 30, 2023, compared to $55 thousand for the

same period in 2022. The costs are relatively consistent across

periods despite higher revenues in the three months ended

June 30, 2023, primarily related to an increase in research

activities performed under customer contracts, which had more

favorable margins compared with the prior period.

R&D expense totaled $236 thousand for the

three months ended June 30, 2023, compared to $369 thousand for the

same period in 2022. The overall decrease of approximately $133

thousand is primarily related to both a reduction in employee

compensation expense and lower lab supply expenses in the three

months ended June 30, 2023.

General and administrative expenses totaled $1.5

million for the three months ended June 30, 2023, compared to $3.7

million for the same period in 2022. The overall decrease of

approximately $2.2 million is primarily related to expenses in

connection with the Company’s transition to a public company in the

three months ended June 30, 2022, and an overall reduction in

general and administrative spending.

Comera reported a net loss of $1.5 million, or

$0.08 loss per share for the three months ended June 30, 2023,

compared to a net loss of $9.3 million, or $1.14 loss per share,

for the same period in 2022. The decrease was primarily due to

higher non-operating expense in the prior year, primarily related

to the reverse recapitalization in 2022.

Comera had approximately $0.8 million in cash

and accounts receivables, at June 30, 2023. Subsequent to the end

of the second quarter, as mentioned above, the Company announced

the execution of a definitive agreement for a $4.1 million private

placement of shares of its common stock, and accompanying warrants

to purchase shares of its common stock, to new and existing

stockholders, as described above.

About Comera Life Sciences

Leading a compassionate new era in medicine,

Comera Life Sciences is applying a deep knowledge of formulation

science and technology to transform essential biologic medicines

from intravenous (IV) to subcutaneous (SQ) forms. The goal of this

approach is to provide patients with the freedom of self-injectable

care, reduce institutional dependency and to put patients at the

center of their treatment regimen.

To learn more about the Comera Life Sciences

mission, as well as the proprietary SQore™ platform, visit

https://comeralifesciences.com/.

Forward-Looking Statements

This press release includes “forward-looking

statements” within the meaning of the federal securities laws.

These forward-looking statements generally are identified by the

words “believe,” “project,” “expect,” “anticipate,” “estimate,”

“intend,” “strategy,” “future,” “opportunity,” “plan,” “may,”

“should,” “will,” “would,” “will be,” “will continue,” “will likely

result,” and similar expressions. Forward-looking statements are

predictions, projections and other statements about future events

(including statements related to the second closing of the private

placement, our ability to regain and maintain compliance with

Nasdaq listing standards and our SQore platform) that are based on

current expectations and assumptions and, as a result, are subject

to risks and uncertainties. Many factors could cause actual future

events to differ materially from the forward-looking statements in

this document, including, but not limited to: the Company’s ability

to maintain the listing of its securities on the Nasdaq Capital

Market; the price of the Company’s securities may be volatile due

to a variety of factors, including changes in the competitive and

highly regulated industries in which the Company plans to operate,

variations in performance across competitors, changes in laws and

regulations affecting the Company’s business and changes in the

capital structure; the Company’s ability to execute on its business

plans, forecasts, and other expectations and identify and realize

additional opportunities; the risk of economic downturns and the

possibility of rapid change in the highly competitive industry in

which the Company operates; the risk that the Company and its

current and future collaborators are unable to successfully develop

and commercialize the Company’s products or services, or experience

significant delays in doing so; the risk that we will be unable to

continue to attract and retain third-party collaborators, including

collaboration partners and licensors; the risk that the Company may

never achieve or sustain profitability; the risk that the Company

will need to raise additional capital to execute its business plan,

which may not be available on acceptable terms or at all; the risk

that the Company experiences difficulties in managing its growth

and expanding operations; the risk that third-party suppliers and

manufacturers are not able to fully and timely meet their

obligations; the risk that the Company is unable to secure or

protect its intellectual property; the risk that the Company is

unable to secure regulatory approval for its product candidates;

the effect of any resurgence of the COVID-19 pandemic or other

public health emergencies on the Company’s business; general

economic conditions; and other risks and uncertainties described in

Item 1A of Part I of the Company’s Annual Report on Form 10-K filed

with the SEC on March 17, 2023 under “Risk Factors” and in other

filings that have been made or will be made with the SEC. The

foregoing list of factors is not exhaustive. Forward-looking

statements speak only as of the date they are made. Readers are

cautioned not to put undue reliance on forward-looking statements,

and Comera assumes no obligation and does not intend to update or

revise these forward-looking statements, whether as a result of new

information, future events, or otherwise. Comera can give no

assurance that it will achieve its expectations.

Contacts

Comera Investor

John Woolford ICR Westwicke John.Woolford@westwicke.com

Comera Press

Jon Yu ICR WestwickeComeraPR@westwicke.com

| |

| |

| COMERA LIFE

SCIENCES HOLDINGS, INC. |

| CONSOLIDATED

BALANCE SHEETS |

|

(unaudited) |

|

|

|

|

|

June 30, |

|

December

31, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

Assets |

|

|

|

|

| Current

assets: |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

476,302 |

|

|

$ |

446,607 |

|

|

Restricted cash - current |

|

|

— |

|

|

|

1,505,625 |

|

|

Accounts receivable |

|

|

250,000 |

|

|

|

34,320 |

|

|

Deferred issuance costs |

|

|

25,013 |

|

|

|

90,047 |

|

|

Prepaid expenses and other current assets |

|

|

1,072,719 |

|

|

|

986,499 |

|

|

Total current assets |

|

|

1,824,034 |

|

|

|

3,063,098 |

|

| Restricted

cash - non-current |

|

|

50,000 |

|

|

|

50,000 |

|

| Property and

equipment, net |

|

|

209,732 |

|

|

|

257,186 |

|

| Right-of-use

asset |

|

|

213,206 |

|

|

|

313,629 |

|

| Security

deposit |

|

|

43,200 |

|

|

|

43,200 |

|

|

Total assets |

|

$ |

2,340,172 |

|

|

$ |

3,727,113 |

|

|

Liabilities, Convertible Preferred Stock and Stockholders’

Deficit |

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

Accounts payable |

|

$ |

2,150,774 |

|

|

$ |

1,458,267 |

|

|

Accrued expenses and other current liabilities |

|

|

959,773 |

|

|

|

1,295,764 |

|

|

Insurance premium financing |

|

|

584,809 |

|

|

|

455,562 |

|

|

Deposit liability |

|

|

— |

|

|

|

1,505,625 |

|

|

Deferred revenue |

|

|

36,310 |

|

|

|

144,280 |

|

|

Lease liability - current |

|

|

221,879 |

|

|

|

199,184 |

|

|

Total current liabilities |

|

|

3,953,545 |

|

|

|

5,058,682 |

|

| Derivative

warrant liabilities |

|

|

46,591 |

|

|

|

277,507 |

|

| Lease

liability - noncurrent |

|

|

— |

|

|

|

120,302 |

|

|

Total liabilities |

|

|

4,000,136 |

|

|

|

5,456,491 |

|

| Commitments

and contingencies (Note 15) |

|

|

|

|

| Preferred

stock, $0.0001 par value; 1,000,000 shares authorized; 4,305 shares

designated Series A convertible preferred stock; 4,305 shares

issued and outstanding at June 30, 2023 and December 31, 2022 |

|

|

4,690,398 |

|

|

|

4,517,710 |

|

|

Stockholders’ equity (deficit): |

|

|

|

|

|

Common stock, $0.0001 par value; 150,000,000 shares authorized;

19,155,138 and 16,709,221 shares issued and outstanding at June 30,

2023 and December 31, 2022, respectively |

|

|

1,915 |

|

|

|

1,671 |

|

|

Additional paid-in capital |

|

|

32,444,578 |

|

|

|

28,655,164 |

|

|

Accumulated deficit |

|

|

(38,796,855 |

) |

|

|

(34,903,923 |

) |

|

Total stockholders’ deficit |

|

|

(6,350,362 |

) |

|

|

(6,247,088 |

) |

|

Total liabilities, convertible preferred stock and stockholders’

deficit |

|

$ |

2,340,172 |

|

|

$ |

3,727,113 |

|

| |

|

|

|

|

| COMERA LIFE

SCIENCES HOLDINGS, INC. |

| CONSOLIDATED

STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS |

|

(unaudited) |

| |

|

|

|

Three Months Ended June 30, |

|

Six months ended June 30, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Revenue |

|

$ |

315,055 |

|

|

$ |

146,726 |

|

|

$ |

707,970 |

|

|

$ |

242,060 |

|

| Cost of

revenue |

|

|

56,040 |

|

|

|

54,543 |

|

|

|

172,559 |

|

|

|

99,067 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

Research and development |

|

|

235,696 |

|

|

|

368,553 |

|

|

|

579,401 |

|

|

|

855,770 |

|

|

General and administrative |

|

|

1,503,553 |

|

|

|

3,696,517 |

|

|

|

3,936,700 |

|

|

|

5,712,762 |

|

|

Total operating expenses |

|

|

1,739,249 |

|

|

|

4,065,070 |

|

|

|

4,516,101 |

|

|

|

6,568,532 |

|

| Loss from

operations |

|

|

(1,480,234 |

) |

|

|

(3,972,887 |

) |

|

|

(3,980,690 |

) |

|

|

(6,425,539 |

) |

| Other income

(expense), net: |

|

|

|

|

|

|

|

|

|

Change in fair value of derivative warrant liabilities |

|

|

72,591 |

|

|

|

1,454,440 |

|

|

|

99,353 |

|

|

|

1,454,440 |

|

|

Reverse recapitalization issuance costs in excess of gross

proceeds |

|

|

— |

|

|

|

(6,566,821 |

) |

|

|

— |

|

|

|

(6,566,821 |

) |

|

Interest expense |

|

|

(3,977 |

) |

|

|

— |

|

|

|

(11,595 |

) |

|

|

(77 |

) |

|

Other expense, net |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(426,666 |

) |

|

Total other income (expense), net |

|

|

68,614 |

|

|

|

(5,112,381 |

) |

|

|

87,758 |

|

|

|

(5,539,124 |

) |

| Net loss and

comprehensive loss |

|

|

(1,411,620 |

) |

|

|

(9,085,268 |

) |

|

|

(3,892,932 |

) |

|

|

(11,964,663 |

) |

| Less:

accretion of convertible preferred stock to redemption value |

|

|

(85,872 |

) |

|

|

(201,168 |

) |

|

|

(172,688 |

) |

|

|

(201,168 |

) |

| Net loss

attributable to common stockholders |

|

$ |

(1,497,492 |

) |

$ |

(9,286,436 |

) |

$ |

(4,065,620 |

) |

$ |

(12,165,831 |

) |

| Net loss per

share attributable to common stockholders — basic and diluted |

|

$ |

(0.08 |

) |

|

$ |

(1.14 |

) |

|

$ |

(0.21 |

) |

|

$ |

(2.75 |

) |

|

Weighted-average number of common shares used in computing net loss

per share attributable to common stockholders — basic and

diluted |

|

|

19,154,681 |

|

|

|

8,142,383 |

|

|

|

19,094,394 |

|

|

|

4,430,401 |

|

| |

|

|

|

|

|

|

|

|

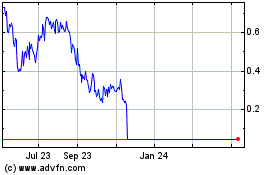

Comera Life Sciences (NASDAQ:CMRA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Comera Life Sciences (NASDAQ:CMRA)

Historical Stock Chart

From Apr 2023 to Apr 2024