false

0001158324

DC

0001158324

2024-01-03

2024-01-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

January 3, 2024

Cogent Communications Holdings, Inc.

(Exact name of registrant as specified in

its charter)

| Delaware |

|

000-51829 |

|

46-5706863 |

(State or other

jurisdiction of

incorporation) |

|

(Commission File

Number) |

|

(IRS Employer

Identification No.) |

2450 N St. NW,

Washington, D.C. |

|

20037 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: 202-295-4200

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of

the Act:

| Title of Each Class |

Trading Symbol |

Name of Each Exchange on which Registered |

| Common Stock, par value $0.001 per share |

CCOI |

NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02 Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On January 3, 2024, Cogent Communications

Holdings, Inc. (the “Company”), the Company’s US operating subsidiary and the Company’s Chief Executive Officer,

David Schaeffer, entered into an amendment to Mr. Schaeffer’s employment agreement, which, among other things, extended the

term through December 31, 2026, set the parameters of his long-term equity compensation awards through 2026, and amended the criteria

for Mr. Schaeffer’s annual cash incentive (hereafter “Amendment 9”).

Per Amendment 9, Mr. Schaeffer’s

annual cash incentive award will be based on the Company’s Annualized Wavelength Revenue achievement compared to a target amount

(the “AWR Target”), which shall be set by the Compensation Committee of the Company’s Board of Directors (the “Board”)

in the prior year. The annual bonus shall be determined by dividing $500,000 by the AWR Target and multiplying the result by Annualized

Wavelength Revenue, provided, that the annual bonus shall not exceed $667,000. If Annualized Wavelength Revenue is zero, the

annual bonus shall be zero.

With respect to the restricted stock awards granted to Mr. Schaeffer

in the years 2020 through 2023 (the “Outstanding Awards”), due to the impossibility of obtaining the information necessary

to perform the applicable calculations with respect to the Performance-Vesting Shares (as defined in the applicable agreements for the

Outstanding Awards), the applicable performance measures were amended as described in Amendment 9.

Lastly, per the terms of Amendment 9, provided

Mr. Schaeffer is employed by the Company on January 1 of such year, the Board shall grant Mr. Schaeffer an award of 180,000

shares of restricted stock in each of 2024, 2025 and 2026. A portion of the grant, 84,000 shares, will vest in 12 monthly increments of

7,000 shares starting on January 1 of the third year following the year of the grant, subject to Mr. Schaeffer’s continued

employment with the Company through each applicable vesting date (except in the case of certain qualifying terminations of employment).

The remaining portion of the grant, 96,000 shares of performance-vesting restricted stock, will be eligible to vest following a three-year

performance period, subject to Mr. Schaeffer’s continued employment with the Company through the applicable vesting date (except

in the case of certain qualifying terminations of employment) and based on the achievement of certain EBITDA and total shareholder return

targets as described in Amendment 9.

This description of Amendment 9 does not purport

to be complete and is subject to and qualified in its entirety by reference to the full text of Amendment 9, which is attached as Exhibit 10.1

to this Current Report on Form 8-K and is incorporated herein by reference.

On January 3, 2024, the Board granted

a restricted stock award to Mr. Schaeffer consistent with the terms above. The form of Restricted Stock Award to Mr. Schaeffer

is attached hereto as Exhibit 10.2 and incorporated herein by reference.

Also on January 3, 2024, in addition

to the customary annual grants to the named executive officers, the following retention awards were made:

Thaddeus G. Weed, Chief Financial Officer

– 30,000 shares of restricted stock

John B.Chang, Chief Legal Officer –

30,000 shares of restricted stock

James Bubeck, Chief Revenue Officer –

10,000 shares of restricted stock

Henry W. Kilmer, Vice President of Network

Strategy – 5,000 shares of restricted stock

The retention awards will vest on January 3,

2027, subject to the recipients’ continued employment with the Company on such date.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Cogent Communications Holdings, Inc. |

| |

|

| January 5, 2024 |

By: |

/s/ David Schaeffer |

| |

|

Name: David Schaeffer |

| |

|

Title: President and Chief Executive Officer |

Exhibit 10.1

Amendment No. 9

to

Employment Agreement of David Schaeffer

This amendment is made by and among Cogent Communications Holdings, Inc.

(“Holdings”), Cogent Communications, Inc. (the “Company”) and David Schaeffer (“Executive”).

This amendment amends the employment agreement between the Company and Executive dated February 7, 2000 as amended.

| 1. | The second and third sentences of Section 2 are replaced with the following: |

The term of employment under this Agreement (the “Term”)

shall be for the period beginning on the Effective Date and ending on December 31, 2026, unless earlier terminated as provided in

Section 6.

| 2. | Section 5(b) (“Bonus”) is replaced with the following: |

With respect to each calendar year during the Term, Executive

shall be eligible for an annual bonus based on Annualized Wavelength Revenue achievement of Holdings compared to a target amount (the

“AWR Target”), which shall be set by the Compensation Committee (the “Committee”) of Holdings’ Board of

Directors in the prior year. Annualized Wavelength Revenue shall be calculated by multiplying Holdings’ wavelength revenue for the

quarter ending December 31st of the applicable year (as reported in Holdings’ earnings release for such quarter)

by 4 (four). The annual bonus shall be determined by dividing $500,000 by the AWR Target and multiplying the result by Annualized Wavelength

Revenue, provided, that the annual bonus shall not exceed $667,000. If Annualized Wavelength Revenue is zero, the annual bonus shall be

zero. The annual bonus for each year, if any, shall be calculated and paid in February of the following year in connection with the

filing of Holdings’ Annual Report on Form 10-K (e.g. the annual bonus, if any, to be paid in February 2025 is based on

reported results for the quarter/year ending December 31, 2024), subject to Executive’s continued employment through December 31

of the applicable year.

| 3. | A new Section 5(g) (“Equity Awards”) is added, as follows: |

(i) Notwithstanding

anything to the contrary in those certain Restricted Stock Award Agreements dated February 14, 2020, February 24, 2021, January 3,

2022 and January 3, 2023, by and between Executive and Holdings (the “Outstanding Award Agreements”), due to the impossibility

of obtaining the information necessary to perform the applicable calculations with respect to the Performance-Vesting Shares (as defined

in the applicable Outstanding Award Agreements), (i) the sentence “Revenue Growth Rate for the Company and the NTI shall be

calculated using organic growth only, excluding any impact of any merger, acquisition or business combination.” shall be deemed

deleted from Section 2(a) of each Outstanding Award Agreement; and (ii) the sentence “Cash Flow Growth Rate for the

Company and the NTI shall be calculated using organic growth only, excluding any impact of any merger, acquisition or business combination.”

shall be deemed deleted from Section 2(b) of each Outstanding Award Agreement, and Executive and Holdings agree that the Outstanding

Award Agreements shall be deemed amended accordingly.

(ii) With

respect to 2024, 2025 and 2026, provided Executive is employed by the Company on January 1 of such year, each year Holdings shall

grant to Executive 84,000 (eighty-four thousand) shares of time-based Restricted Stock (“New Award Time Vesting Shares”) and

96,000 (ninety six thousand) shares of performance-vesting Restricted Stock (the “New Award Performance Vesting Shares,” and

together with the New Award Time Vesting Shares, the “Restricted Shares”), subject to the vesting requirements described below.

New Award Time Vesting Shares will vest in 12 equal monthly

installments beginning on January 1 of the third year following the year of grant (e.g., a grant in January 2024 shall begin

vesting on January 1, 2027), subject to Executive’s continued employment with the Company through each applicable vesting date.

New Award Performance Vesting Shares will be eligible to

vest following a three-year performance period (a “Performance Period”) (e.g., a grant in January 2024 shall relate to

performance during the period beginning on January 1, 2024 and ending on December 31, 2026), subject to Executive’s continued

employment with the Company through the applicable vesting date, and based upon Executive’s achievements during the applicable Performance

Period relative to the following performance targets to be determined and/or amended by the Committee in the year prior to the applicable

grant date:

| (a) | up to 48,000 of the Performance Vesting Shares shall vest only if the Company’s compound annual growth rate in EBITDA as set

forth in the Company’s earnings press releases, (“EBITDA CAGR”) for the last year of the applicable Performance Period

compared to the EBITDA CAGR for the year immediately prior to the applicable Performance Period is positive. If Company’s EBITDA

CAGR for the applicable Performance Period is positive, then the number of Performance Vesting Shares that will be vested is determined

by dividing (i) the Company’s actual EBIDTA CAGR, by (ii) a target percent to be set by the Committee, and then multiplying

the resulting fraction by 48,000, provided, however that the number of Performance Vesting Shares that will vest in accordance with this

clause (a) shall not exceed 48,000 Shares. If the Company’s EBITDA CAGR for the applicable Performance Period is less than

zero then no Performance Vesting Shares subject to this clause (a) will vest. Any Performance Vesting Shares subject to this clause

(a) which do not vest on the applicable vesting date will be forfeited and cancelled; and |

| | (b) | up to 48,000 of the Performance Vesting Shares shall vest only

if the Company’s total shareholder return (“TSR”) for the applicable Performance Period is positive. If Company’s

TSR for the applicable Performance Period is positive, then the number of Performance Vesting Shares that will be vested is determined

by dividing the Company’s TSR by the TSR of the Nasdaq Telecommunications Index (“NTI”) for the applicable Performance

Period and multiplying that percentage by 48,000; provided, however that the number of Performance Vesting Shares that will vest in accordance

with this clause (b) shall not exceed 48,000 Shares. If the Company’s TSR for the applicable Performance Period is zero or

negative then no Performance Vesting Shares subject to this clause (b) will vest. Any Performance Vesting Shares subject to this

clause (b) which do not vest on the applicable vesting date will be forfeited and cancelled. TSR is calculated by comparing an amount

invested in the Company to the same amount invested in the NTI at the beginning of the applicable Performance Period with all dividends

reinvested during such Performance Period. In calculating the TSR the average price of the Company’s stock and of the NTI in the

20 trading days prior to the measurement dates shall be used. |

Each grant of Restricted Shares will be issued pursuant

to the Amended and Restated Cogent Communications 2017 Incentive Award Plan (as it may be amended or restated from time to time, the “Plan”)

of Holdings and shall be subject to the Plan, the applicable award agreement and such other terms and conditions set by the Committee.

Except as herein amended the Employment Agreement shall remain in full

force and effect.

Accepted and Agreed to:

| |

|

As to Sections 1 and 2: Cogent Communications, Inc.

As to Section 3: Cogent Communications Holdings, Inc. |

| |

|

|

|

| |

|

|

|

| /s/ David Schaeffer |

|

by: |

/s/ John Chang |

| David Schaeffer |

|

|

John Chang |

| In his individual capacity |

|

|

Chief Legal Officer and VP |

| |

|

|

Cogent Communications, Inc. and Cogent |

| |

|

|

Communications Holdings, Inc. on behalf of the |

| |

|

|

board of directors |

| |

|

|

|

| Date: January 3, 2024 |

|

|

Date: January 3, 2024 |

Exhibit 10.2

RESTRICTED STOCK AWARD

| Name: Dave Schaeffer |

Cogent Communications Holdings, Inc. |

| Grant Date: [_____________] |

2017 Incentive Award Plan (the “Plan”) |

1. Grant:

Effective as of the Grant Date specified above you have been granted [_____________] ([_____________]) Shares (“Time

Vesting Shares”) and up to [_____________] ([_____________]) performance-vesting Shares of (the “Performance

Vesting Shares” and along with the Time Vesting Shares the “Restricted Shares”) of Cogent Communications Holdings, Inc.

(the “Company”) subject to the vesting requirements described below. Defined terms used but not otherwise defined herein will

have the meaning set forth in the Plan.

2. Normal

Vesting: You will become vested in [_____________] of the Time Vesting Shares on [_____________]

and in an additional [_____________] of the Time Vesting Shares on the first day of each month thereafter, with full vesting

of [_____________] Time Vesting Shares completed on [_____________], subject to your continued employment with the Company

through each applicable vesting date. The Performance Vesting Shares shall vest on [_____________] (the “Performance Share

Vesting Date”), based on performance from [_____________] through [_____________] (the “Performance Period”),

and subject to your continued employment through the Performance Share Vesting Date, as follows:

(a) up to [_____________] of the Performance

Vesting Shares shall vest only if the Company’s compound annual growth rate in EBITDA as set forth in the Company’s earnings

press releases, (“EBITDA CAGR”) for the year ending [_____________] compared to EBITDA CAGR for the year ending [_____________]

is positive. If Company’s EBITDA CAGR is positive, then the number of Performance Vesting Shares that will be vested is determined

by dividing (i) the Company’s actual EBIDTA CAGR, by (ii) [_____________], and then multiplying the resulting fraction

by [_____________], provided, however that the number of Performance Vesting Shares that will vest in accordance with this clause

(a) shall not exceed [_____________] Shares. If the Company’s EBITDA CAGR is less than zero then no Performance Vesting

Shares subject to this clause (a) will vest. Any Performance Vesting Shares subject to this clause (a) which do not vest on

the Performance Share Vesting Date will be automatically forfeited and cancelled; and

(b) up to [_____________] of the Performance

Vesting Shares shall vest only if the Company’s total shareholder return (“TSR”) for the Performance Period is positive.

If Company’s TSR for the Performance Period is positive, then the number of Performance Vesting Shares that will be vested is determined

by dividing the Company’s TSR by the TSR of the Nasdaq Telecommunications Index (“NTI”) for the Performance Period and

multiplying that percentage by [_____________]; provided, however that the number of Performance Vesting Shares that will vest

in accordance with this clause (b) shall not exceed [_____________] Shares. If the Company’s TSR for the Performance

Period is zero or negative then no Performance Vesting Shares subject to this clause (b) will vest. Any Performance Vesting Shares

subject to this clause (b) which do not vest on the Performance Share Vesting Date will be automatically forfeited and cancelled.

TSR is calculated by comparing an amount invested in the Company to the same amount invested in the NTI at the beginning of the Performance

Period with all dividends reinvested during the performance. In calculating the TSR the average price of the Company’s stock and

of the NTI in the 20 trading days prior to the measurement dates shall be used.

3. Accelerated

Vesting: Notwithstanding Section 2, vesting in the Restricted Shares upon the following

events will be treated as follows:

(a) Upon

the termination of your employment by reason of death or disability you will fully vest in all unvested Time Vesting Shares and Performance

Vesting Shares. Upon termination of your employment due your retirement (for the avoidance of doubt, the determination that a termination

constitutes a retirement for this purpose is made in the sole and absolute discretion of the Committee), you will fully vest in all Time

Vesting Shares and upon expiration of the Performance Period you will vest in any Performance Vesting Shares in accordance with Section 2

based on actual performance through and at the end of the Performance Period.

(b) If

your employment is terminated entitling you to severance under the terms of your employment agreement either prior to a Change in Control

or more than six months after a Change in Control, then you will vest in (i) the number of Time Vested Shares you would have vested

in had you remained employed during the one-year severance period and (ii) on the Performance Share Vesting Date you will vest in

the number of Performance Vesting Shares that vest in accordance with Section 2 above, based on actual performance through and at

the end of the Performance Period, but pro-rated based on the number of days elapsed from the beginning of the Performance Period through

the last day of your severance period.

(c) Immediately

prior to a Change in Control the Performance Period will end and the number of Performance Vesting Shares in which you will be eligible

to vest in will be determined based on EBITDA CAGR through the most recent publicly reported fiscal quarter ending prior to the Change

in Control (if the most recently publicly reported fiscal quarter ending prior to the Change in Control is not at the year end, then EBITDA

CAGR for such year should be calculated using the most recently reported EBITDA for a quarter and multiplying such amount by 4 (four))

and TSR through the date of the Change in Control provided you remain employed through [_____________]; provided, however, you

will be fully vested in such number of Performance Vesting Shares and fully vested in your unvested Time Vested Shares (i) if during

the six months following the Change of Control the Company terminates your employment without cause (as defined in your employment agreement

with the Company) or you terminate your employment for Good Reason (as defined in your employment agreement with the Company) or (ii) as

otherwise provided in Section 3(a) above treating the Performance Vesting Shares which vest under the provisions of this Section 3(c) as

Time Vesting Shares for such purposes.

4. Nontransferable:

The Restricted Shares or any interest or right therein or part thereof may not be disposed of by transfer, alienation, anticipation, pledge,

hypothecation, encumbrance, assignment or any other means, whether such disposition be voluntary or involuntary or by operation of law

by judgment, levy, attachment, garnishment or any other legal or equitable proceedings (including bankruptcy), until vested, and any attempted

disposition prior thereto shall be null and void and of no effect. The foregoing notwithstanding, transfers of the Restricted Shares may

be permitted for estate planning purposes with the prior written consent of the Committee and subject in each case to the provisions of

the Plan and the same restrictions and forfeiture provisions under this Restricted Stock Award Agreement (“Agreement”) that

the Restricted Shares had in your hands.

5. Dividends/Voting:

You will be entitled to vote the Restricted Shares. However, you will only be entitled to receive any dividends that are paid on shares

of the Restricted Shares once they are vested. Any dividends paid on unvested Restricted Shares shall be held by the Company, without

interest thereon and paid to you at the time the Restricted Shares on which such dividends were paid vest.

6. Certificates:

The Company shall cause the Restricted Shares to be issued and a stock certificate or certificates representing the Restricted Shares

to be registered in your name or held in book entry form, but if a stock certificate or certificates are issued, they shall be delivered

to, and held in custody by the Company until the shares of Restricted Shares vest. You agree to give to the Company a stock power, except

for voting rights, for all unvested Restricted Shares. If issued, each such certificate will bear such legends as the Company may determine.

7. No

Other Rights: The grant of Restricted Shares under the Plan is a one-time benefit and does not

create any contractual or other right to receive an award of Restricted Shares or benefits in lieu of Restricted Shares in the future.

Future awards of Restricted Shares, if any, will be at the sole discretion of the Company, including, but not limited to, the timing of

the award, the number of shares and vesting provisions. The grant of Restricted Shares under the Plan does not entitle you to any rights

to remain employed with the Company, nor does it constitute a contract of employment.

8. Miscellaneous:

The shares of Restricted Shares are granted under and governed by the terms and conditions of

the Plan, as may be amended from time to time. Defined terms used herein shall have the meaning set forth in the Plan, unless otherwise

defined herein.

9. 280G:

Notwithstanding anything in this Agreement to the contrary, if the acceleration of vesting and

any other payments to be made you (a “Payment”) would (i) constitute a “parachute payment” under Section 280G

of the Code and (ii) but for this Section 9 be subject to the excise tax imposed by Section 4999 of the Code (the “Excise

Tax”), then either (A) such Payments shall be reduced to the maximum amount that could be paid to you without any portion of

the Payment (after reduction) being subject to the Excise Tax, or (B) the entire Payment, shall be paid if after taking into account

all applicable federal, state and local taxes and the Excise Tax would provide a more favorable net after tax benefit to you (i.e., because

the after tax proceeds to you of the reduced Payments and other benefits under this Agreement would exceed the after tax proceeds to you

of Payments in the absence of any reduction, taking into account the Excise Tax applicable to such Payments). If a reduction in a Payment

is to be made under clause (ii)(A), then the reduction will be made as determined by the Company in a manner that results in your retaining

the largest amounts of Payments which are payable in cash or equity at or as close to the event giving rise to the change in control as

possible, such as by first reducing your rights to any Payments that are contingent upon the occurrence of later events (such as severance).

Any determination of whether any portion of the Payments constitutes a “parachute payment” within the meaning of Section 280G(b) of

the Code, shall be made by a nationally recognized accounting firm selected by the Company, which may make reasonable assumptions and

approximations concerning applicable taxes and may rely on reasonable good faith interpretations concerning the application of Sections

280G and 4999 of the Code. In no event will the Company or any stockholder be liable to Executive for any amounts not paid as a result

of the operation of this Section 9.

10. Claw-Back

Provisions: The Restricted Shares (including any proceeds, gains or other economic benefit actually

or constructively received by you upon receipt or exercise of this Award or upon the receipt or resale of any Shares underlying the Award)

shall be subject to reduction, cancellation, forfeiture and/or recoupment to the extent necessary to comply with any clawback, forfeiture

or other similar policy adopted by the Company, including, without limitation, the Policy for Recovery of Erroneously Awarded Compensation

adopted by the Company, effective October 2, 2023.

Cogent Communications Holdings, Inc.

| | |

|

| By: | |

|

| John Chang on behalf of the Board of Directors and the Compensation Committee |

|

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

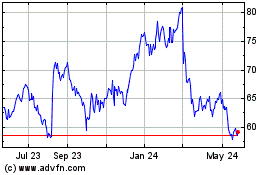

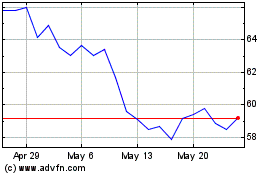

Cogent Communications (NASDAQ:CCOI)

Historical Stock Chart

From Apr 2024 to May 2024

Cogent Communications (NASDAQ:CCOI)

Historical Stock Chart

From May 2023 to May 2024