MORNING UPDATE: Man Securities Issues Alerts for EBAY, AA, CAT, CHKP, and KGC

May 11 2004 - 10:18AM

PR Newswire (US)

MORNING UPDATE: Man Securities Issues Alerts for EBAY, AA, CAT,

CHKP, and KGC CHICAGO, May 11 /PRNewswire/ -- Man Securities issues

the following Morning Update at 8:30 AM EDT with new PriceWatch

Alerts for key stocks. (Logo:

http://www.newscom.com/cgi-bin/prnh/20020214/MANSECLOGO ) Before

the open... PriceWatch Alerts for EBAY, AA, CAT, CHKP, and KGC,

Market Overview, Today's Economic Calendar, and the Quote Of The

Day. QUOTE OF THE DAY "We've got very strong fundamentals.

Corporate earnings are going up, up and away." -- Alfred Goldman,

chief market strategist, A.G. Edwards & Sons New PriceWatch

Alerts for EBAY, AA, CAT, CHKP, and KGC... PRICEWATCH ALERTS - HIGH

RETURN COVERED CALL OPTIONS ----------- -- eBay Inc. (NASDAQ:EBAY)

Last Price 77.53 - JUL 75.00 CALL OPTION@ $6.10 -> 5 % Return

assigned* -- Alcoa Inc. (NYSE:AA) Last Price 29.46 - JUL 27.50 CALL

OPTION@ $3.10 -> 4.3 % Return assigned* -- Caterpillar Inc.

(NYSE:CAT) Last Price 72.88 - AUG 70.00 CALL OPTION@ $5.90 ->

4.5 % Return assigned* -- Check Point Software Technologies Ltd.

(NASDAQ:CHKP) Last Price 22.56 - JUN 22.50 CALL OPTION@ $1.20 ->

5.3 % Return assigned* -- Kinross Gold Corp. (NYSE:KGC) Last Price

5.14 - AUG 5.00 CALL OPTION@ $0.60 -> 10.1 % Return assigned* *

To learn more about how to use these alerts and for our FREE

report, "The 18 Warning Signs That Tell You When To Dump A Stock ",

go to: http://www.investorsobserver.com/mu18 (Note: You may need to

copy the link above into your browser then press the [ENTER] key)

** For the FREE report, "The Secrets of Smart Election Year

Investing - Insights, Stocks, And Strategies." go to:

http://www.investorsobserver.com/FREEelection NOTE: All stocks and

options shown are examples only. These are not recommendations to

buy or sell any security. MARKET OVERVIEW Overseas markets are

refreshingly positive this morning with all 15 of our selected

group in agreement to the upside. The cumulative average return on

the collective stands at a positive 0.679 percent. Japan's index of

leading economic indicators stood at 80.0 in March, in line with

expectations and well ahead of the boom-bust demarcation level of

50. The pair of weekly reports on the health of the retail sector

pretty well represents today's economic calendar. On the previous

week the ICSC-UBS Store Sales Index rose by 1.5 percent, while the

Redbook Retail Sales for the same period jumped by a hefty 5.0

percent. The important monthly retail and sales report will be

released on Thursday. That is the report which will hold investor

attention. A key earnings report which many think will be the

salvation of the tech-sector won't be released until after today's

market close, at which time Cisco Systems offers up its third

quarter numbers. Analysts currently agree that the company will

report 18-cents per share. That report could well set the mood for

Wednesday's trade. Be prepared for the investing week ahead with

Bernie Schaeffer's FREE Monday Morning Outlook. For more details

and to sign up, go to: http://www.investorsobserver.com/freemo

DYNAMIC MARKET OPPORTUNITIES As crude oil prices drive relentlessly

past $40 a barrel, the global markets ran for their lives

yesterday. Morgan Stanley's Asia-Pacific Index slid 5.5%, as

Japan's Nikkei extended its losing streak to six days with a

554-point plunge (4.8%). Hong Kong fared little better, sinking 425

points (3.5%). South Korea's index shed 48 points (5.7%), while

Taiwan's exchange lost 215 points (3.5%), and India's BSE 30

slipped 113 points (2%). The International Energy Agency says a $10

jump in prices, if sustained over a year, could slice 0.8% from the

region's GDP. That's because several economies depend on oil

imports to drive growth. But the fast-growing Indian economy could

suffer most, since it imports 70% of its oil. Contrastingly, Asia's

oil exporting countries like Malaysia and Indonesia could benefit

from higher prices. Elsewhere, the Lundberg Survey says the average

nationwide price for U.S. gasoline rose 10 cents last week to $1.96

per gallon - the biggest weekly increase since August 2003. British

Airways also warned it may implement a fuel surcharge, as it

expects to pay an additional 100 million pounds sterling on fuel

costs this year. Even the oil-rich Saudis - OPEC's largest producer

- say $40 oil is a "major concern" and proposed the cartel raise

supplies by 1.5 million barrels per day to prevent a GDP slowdown.

They have the backing of No. 2 producer Iran, plus Kuwait and the

UAE. The move could be ratified at OPEC's June 3 meeting. Christian

DeHaemer and Ian Cooper, investment experts at Taipan's Extreme

Volatility Speculator group (EVS), are profiting from oil's surge.

After buying June Puts on Energy Select Sector on March 9, they

sold at the bottom on March 24, giving their investors as much as

150% gains. The EVS team is up an average of 14% per recommendation

in 2004 - simply by trading on company/industry speculation and

"selling the news" when it hits the mainstream media. To find out

more about the EVS group simply follow this link:

http://www.investorsobserver.com/agora8 TODAY'S ECONOMIC CALENDAR

7:45 a.m.: ICSC-UBS Store Sales Index for the week ending May 8

(last plus 1.5 percent). 8:55 a.m.: Redbook Retail Sales for the

week ending May 8 (last plus 5.0 percent). 10:00 a.m.: April

Richmond Fed Manufacturing Index (last plus 30). 2:30 p.m.:

Philadelphia Federal Reserve President Santomero speaks on economic

outlook, policy in New York. 6:30 p.m.: ABC/Money Magazine Consumer

Confidence Index for the week ending May 9 (last minus 11). Man

Financial Inc is one of the world's major futures and options

brokers and has been recognized as a leading option order execution

firm for individuals and institutions. Member CBOE/NASD/SIPC

(CRD#6731). For more information and a free CD with educational

tools to help you invest smarter, see

http://www.investorsobserver.com/mancd This Morning Update was

prepared with data and information provided by:

InvestorsObserver.com - Better Strategies for Making Money ->

For Investors With a Sense of Humor. Only $1 for your first month

plus seven free bonuses worth over $420, see:

http://www.investorsobserver.com/must 247profits.com: You'll get

exclusive financial commentary, access to a global network of

experts and undiscovered stock alerts. Register NOW for the FREE

247profits e-Dispatch. Go to:

http://www.investorsobserver.com/agora Schaeffer's Investment

Research - Sign up for your FREE e-weekly, Monday Morning Outlook,

Bernie Schaeffer's look ahead at the markets. Sign Up Now

http://www.investorsobserver.com/freemo PowerOptionsPlus - The Best

Way To Find, Compare, Analyze, and Make Money On Options

Investments. For a 14-Day FREE trial and 5 FREE bonuses go to:

http://www.poweroptionsplus.com/ All stocks and options shown are

examples only. These are not recommendations to buy or sell any

security and they do not represent in any way a positive or

negative outlook for any security. Potential returns do not take

into account your trade size, brokerage commissions or taxes which

will affect actual investment returns. Stocks and options involve

risk and are not suitable for all investors and investing in

options carries substantial risk. Prior to buying or selling

options, a person must receive a copy of Characteristics and Risks

of Standardized Options available from Sharon at 800-837-6212 or at

http://www.cboe.com/Resources/Intro.asp. Privacy policy available

upon request.

http://www.newscom.com/cgi-bin/prnh/20020214/MANSECLOGO

http://photoarchive.ap.org/ DATASOURCE: Man Securities CONTACT:

Michael Lavelle of Man Securities, +1-800-837-6212 Web site:

http://www.mansecurities.com/mu.html

Copyright

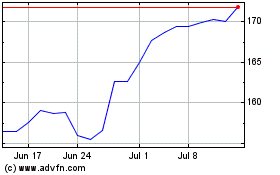

Check Point Software Tec... (NASDAQ:CHKP)

Historical Stock Chart

From Jul 2024 to Aug 2024

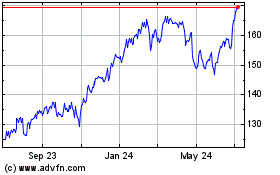

Check Point Software Tec... (NASDAQ:CHKP)

Historical Stock Chart

From Aug 2023 to Aug 2024