UPDATE: Apollo Group Pulls 2011 Views; Roils Education Sector

October 13 2010 - 6:35PM

Dow Jones News

Apollo Group Inc. (APOL) Wednesday evening made investors in

for-profit education stocks wish they hadn't gone back to school

this fall. It withdrew its fiscal-2011 guidance and predicted that

regulatory scrutiny and falling new enrollments at its University

of Phoenix will crimp results.

Its fiscal-fourth-quarter results slightly beat its guidance and

analysts' expectations, and included a $175.9 million write-down of

goodwill and other intangible assets at its BPP subsidiary thanks

to the recession in the U.K. The withdrawn guidance and the

potential for weakened future results sent a shudder through the

education sector, sending Apollo shares down sharply in late

Wednesday trading and giving a back-to-school haircut to the stocks

of at least seven of its peers.

Apollo said "challenges" the industry faces, including

"regulatory and other scrutiny" and "heightened media attention,

much of which has portrayed the sector in an unflattering light,"

will "adversely impact its operating metrics and financial

results." Management later called the recent media coverage

"incredibly negative."

It said it expects the decline in new degreed enrollment it saw

in the fourth quarter at its University of Phoenix to accelerate in

the first quarter, "resulting in a significant year-over-year

decline." For the first quarter, that drop in new degreed

enrollment could top 40%, and executives said growth may not return

until 2012.

The stock fell to a four-year low in August after the University

of Phoenix was featured in an undercover investigation by the U.S.

Government Accountability Office exposing questionable practices in

15 for-profit schools' student recruitment offices. The sector also

faces proposed new rules from the U.S. Department of Education that

would penalize individual programs for graduating students with

high debt loads.

The company has reported lower earnings in the previous two

quarters on litigation and other charges. It also has warned its

bottom line will be hurt as it expands an orientation program

expected to improve retention and loan-repayment rates as

unprepared prospective students are weeded out before enrolling.

The program, which had been in a pilot phase since last fall, will

be required starting Nov. 1 for all students entering with less

than a full year of credit beginning in the current quarter.

In a late Wednesday conference call to discuss its results,

Apollo said any final rules instituted by regulators look to come

after the November mid-term elections, and as such can't be

quantified today. Management said its goals are "aligned" with

those of regulators, and it is pleased regulators are taking the

time to consider "potential unintended consequences" of any such

new rules. A spokesman said executives wouldn't be available after

the call to further discuss the results.

Apollo also said it expects to double its capital expenditures

this fiscal year compared with fiscal 2010.

Not all the news was bleak. It said on the call that it repaid

$400 million, or nearly 70%, of its $584.4 million in debt

subsequent to the fiscal year's end. It also paid about $100

million to buy back about 2 million shares during the previous

quarter, paying an average price about where Apollo traded before

late Wednesday's announcement.

For the quarter ended Aug. 31, Apollo reported a profit of $41

million, or 28 cents a share, down from $91.5 million, or 59 cents

a share, a year earlier. The latest results included the BPP

intangibles write-down while last year's quarter included $95.4

million in charges. Excluding such items, earnings from continuing

operations rose to $1.31 a share from $1.10 and topped its and

analysts estimates by a penny. Revenue grew 17% to $1.26

billion.

Apollo was off 14.7% in after-hours trading at $42.22, putting

it 45% below the high it touched last October. The losses only

mounted as Apollo provided more details about its future on its

conference call.

Among other education stocks, Corinthian Colleges Inc. (COCO)

was down 5.8%, Career Education Corp. (CECO) was down 6.9%, ITT

Educational Services Inc. (ESI) was off 8.1%, DeVry Inc. (DV) was

off 5.1% and Strayer Education Inc. (STRA) was down 6.4%.

Bridgepoint Education Inc. (BPI) and Capella Education Co. (CPLA)

were off during most of late trading but the most recent trades

brought both back to unchanged from Wednesday's close, according to

Nasdaq.com.

Like many other for-profit educators, Apollo expanded quickly as

the recession put people out of jobs and back into classrooms, both

real and virtual. Degreed enrollment rose 6.3% in the most recent

period, but new enrollment declined almost 10% and it blamed the

decline in part on the delay in enrollment caused by its new, free

orientation program that's now required for new students lacking 24

transfer credits. Total degree enrollment stood at 470,800 at the

end of the quarter, as it added bachelors and doctoral candidates

at degreed enrollment, but saw fewer seek associates and masters

degrees.

-By Maxwell Murphy, Dow Jones Newswires; 212-416-2171;

maxwell.murphy@dowjones.com

(Kathy Shwiff contributed to this article.)

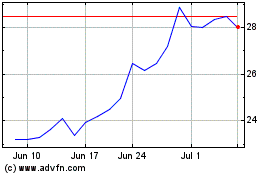

CECO Environmental (NASDAQ:CECO)

Historical Stock Chart

From May 2024 to Jun 2024

CECO Environmental (NASDAQ:CECO)

Historical Stock Chart

From Jun 2023 to Jun 2024