Caribou Biosciences, Inc. (Nasdaq: CRBU), a leading clinical-stage

CRISPR genome-editing biopharmaceutical company, today reported

financial results for the third quarter of 2023 and reviewed recent

business updates.

“In 2023, we have advanced our programs to build

value across the pipeline and position Caribou as a leader in the

allogeneic CAR-T cell therapy space,” said Rachel Haurwitz, PhD,

Caribou’s president and chief executive officer. “We plan to meet

with the FDA to discuss a potential pivotal trial in second-line

LBCL patients for our lead program, CB-010, and we intend to share

the agency’s feedback by the end of this year. Patient enrollment

is ongoing in the ANTLER trial, and we expect to report initial

dose expansion data in the first half of 2024. Additionally, we are

enrolling patients in our CaMMouflage trial for CB-011 and plan to

initiate enrollment in the AMpLify Phase 1 clinical trial for

CB-012 by mid-2024. With two years of cash and continued financial

discipline, we are well positioned to execute on our current

programs and continue Caribou’s momentum.”

Accomplishments and highlights

Pipeline and technology

- CB-010: Caribou

continues to enroll second-line LBCL patients in the dose expansion

portion of the ongoing ANTLER Phase 1 clinical trial based on

positive data from the dose escalation portion of the trial. CB-010

is an allogeneic anti-CD19 CAR-T cell therapy in development for

relapsed or refractory B cell non-Hodgkin lymphoma (r/r B-NHL). The

dose expansion data will be used to determine the recommended Phase

2 dose (RP2D).

- CB-011: Caribou

continues to enroll patients at dose level 2 (150x106 CAR-T cells)

in the dose escalation portion of the ongoing CaMMouflage Phase 1

trial of CB-011, an allogeneic anti-BCMA CAR-T cell therapy, for

relapsed or refractory multiple myeloma (r/r MM). Caribou has

concluded dose level 1 (50x106 CAR-T cells, N=3) without any

dose-limiting toxicities (DLTs) and received Study Steering

Committee clearance to proceed with dosing patients at dose level

2.

- CB-012: Caribou

recently announced clearance of the company’s investigational new

drug (IND) application from the U.S. Food and Drug Administration

(FDA) for CB-012, an allogeneic anti-CLL-1 CAR-T cell therapy, for

relapsed or refractory acute myeloid leukemia (r/r AML). Clinical

site activation is underway for the AMpLify Phase 1 clinical trial

and Caribou plans to initiate patient enrollment by mid-2024 to

evaluate CB-012 at ascending dose levels starting at dose level 1

(25x106 CAR-T cells).

Anticipated milestones

- CB-010: Caribou plans to meet with the FDA to

discuss a potential pivotal clinical trial in second-line LBCL

patients and plans to share FDA feedback by year-end 2023. The

Company also plans to report initial dose expansion data in

second-line LBCL patients from the ongoing ANTLER trial in H1

2024.

- CB-011: Caribou plans to provide updates on

dose escalation as the CaMMouflage Phase 1 clinical trial in r/r MM

advances.

- CB-012: Caribou plans

to initiate patient enrollment in the AMpLify Phase 1 clinical

trial in r/r AML by mid-2024.

Corporate updates

- Appointed two multiple myeloma experts to Caribou’s

scientific advisory board: Caribou appointed two experts

in multiple myeloma drug development to its scientific advisory

board in the third quarter of 2023.

- Sundar Jagannath, MD, director of the Center of Excellence for

Multiple Myeloma and professor of medicine at the Tisch Cancer

Institute of Mount Sinai.

- Sriram Krishnaswami, PhD, vice president and development head

for multiple myeloma at Pfizer Oncology’s Global Product

Development division.

- Appointed chief people officer: In September

2023, Caribou appointed Reigin Zawadzki to the newly created

position of chief people officer. Ms. Zawadzki brings over 20 years

of experience leading human resources in the biotechnology industry

and will lead Caribou’s people strategy.

- Completed successful $134.4 million follow-on

financing: In the third quarter of 2023, Caribou completed

an underwritten public offering of 22,115,384 shares of its common

stock, which included the full exercise of the underwriters’ option

to purchase additional shares. The net proceeds to Caribou were

$134.4 million.

- Received $25.0 million Pfizer investment: In

July 2023, Caribou announced that Pfizer invested $25.0 million in

Caribou common shares on June 30, 2023. Caribou will use the

proceeds from this investment to advance CB-011. Caribou maintains

full ownership and control of CB-011 and its other allogeneic CAR-T

and CAR-NK cell therapies.

Third quarter 2023 financial results

Cash, cash equivalents, and marketable

securities: Caribou had $396.7 million in cash, cash

equivalents, and marketable securities as of September 30, 2023,

compared to $317.0 million as of December 31, 2022. This amount

includes the approximately $134.4 million in net proceeds from the

Company’s underwritten public offering and the $25.0 million equity

investment from Pfizer. Caribou expects its cash, cash equivalents,

and marketable securities will be sufficient to fund its current

operating plan into Q4 2025.

Licensing and collaboration revenue: Revenue

from Caribou’s licensing and collaboration agreements was $23.7

million for the three months ended September 30, 2023, compared to

$3.3 million for the same period in 2022. The increase was

primarily due to $21.5 million in revenue recognized under the

AbbVie Collaboration and License Agreement, including $20.8 million

of revenue recognized upon termination of this agreement as

previously disclosed, which was the remaining deferred revenue

balance from AbbVie’s $30 million upfront payment in February

2021.

R&D expenses: Research and development

expenses were $28.6 million for the three months ended September

30, 2023, compared to $20.0 million for the same period in 2022.

The increase was primarily due to costs to advance pipeline

programs, including the CB-010 ANTLER and CB-011 CaMMouflage Phase

1 clinical trials; personnel-related expenses, including

stock-based compensation, due to headcount increases; and

facilities and other allocated expenses.

G&A expenses: General and

administrative expenses were $9.7 million for the three months

ended September 30, 2023, compared to $9.8 million for the same

period in 2022. The decrease was primarily due to lower patent

prosecution and maintenance costs, and lower insurance, accounting,

and other service-related expenses. This decrease was partially

offset by an increase in personnel-related expenses, including

stock-based compensation, due to headcount increases.

Net loss: Caribou reported a net loss of $10.0

million for the three months ended September 30, 2023, compared to

$26.6 million for the same period in 2022.

About CB-010CB-010 is the lead product

candidate from Caribou’s allogeneic CAR-T cell therapy platform and

is being evaluated in patients with relapsed or refractory B cell

non-Hodgkin lymphoma (r/r B-NHL). In the ongoing ANTLER Phase 1

trial, Caribou is enrolling second-line patients with large B cell

lymphoma (LBCL) comprised of different subtypes of aggressive r/r

B-NHL (DLBCL NOS, PMBCL, HGBL, tFL, and tMZL). CB-010 is an

allogeneic anti-CD19 CAR-T cell therapy engineered using Cas9

CRISPR hybrid RNA-DNA (chRDNA) genome-editing technology. To

Caribou’s knowledge, CB-010 is the first allogeneic CAR-T cell

therapy in the clinic with a PD-1 knockout, a genome-editing

strategy designed to improve antitumor activity by limiting

premature CAR-T cell exhaustion. To Caribou’s knowledge, CB-010 is

the first anti-CD19 allogeneic CAR-T cell therapy to be evaluated

in the second-line LBCL setting and it has been granted

Regenerative Medicine Advanced Therapy (RMAT), Fast Track, and

Orphan Drug designations by the FDA. Additional information on the

ANTLER trial (NCT04637763) can be found at clinicaltrials.gov.

About CB-011CB-011 is a product candidate from

Caribou’s allogeneic CAR-T cell therapy platform and is being

evaluated in patients with relapsed or refractory multiple myeloma

(r/r MM) in the CaMMouflage Phase 1 trial. CB-011 is an allogeneic

anti-BCMA CAR-T cell therapy engineered using Cas12a chRDNA

genome-editing technology. To Caribou’s knowledge, CB-011 is the

first allogeneic CAR-T cell therapy in the clinic that is

engineered to improve antitumor activity through an immune cloaking

strategy with a B2M knockout and insertion of a B2M–HLA-E fusion

protein to blunt immune-mediated rejection. CB-011 has been granted

Fast Track designation by the FDA. Additional information on the

CaMMouflage trial (NCT05722418) can be found at

clinicaltrials.gov.

About CB-012CB-012 is a product candidate from

Caribou’s allogeneic CAR-T cell therapy platform and will be

evaluated in the AMpLify Phase 1 clinical trial in patients with

relapsed or refractory acute myeloid leukemia (r/r AML). CB-012 is

an anti-CLL-1 CAR-T cell therapy engineered with five genome edits,

enabled by Caribou’s patented next-generation CRISPR technology

platform, which uses Cas12a chRDNA genome editing to significantly

improve the specificity of genome edits. To Caribou’s knowledge,

CB-012 is the first allogeneic CAR-T cell therapy with both

checkpoint disruption, through a PD-1 knockout, and immune

cloaking, through a B2M knockout and B2M–HLA-E fusion protein

insertion; both armoring strategies are designed to improve

antitumor activity.

About Caribou’s novel next-generation CRISPR

platform CRISPR genome editing uses easily designed,

modular biological tools to make DNA changes in living cells. There

are two basic components of Class 2 CRISPR systems: the nuclease

protein that cuts DNA and the RNA molecule(s) that guide the

nuclease to generate a site-specific, double-stranded break,

leading to an edit at the targeted genomic site. CRISPR systems are

capable of editing unintended genomic sites, known as off-target

editing, which may lead to harmful effects on cellular function and

phenotype. In response to this challenge, Caribou has developed

CRISPR hybrid RNA-DNA guides (chRDNAs; pronounced “chardonnays”)

that direct substantially more precise genome editing compared to

all-RNA guides. Caribou is deploying the power of its Cas12a chRDNA

technology to carry out high efficiency multiple edits, including

multiplex gene insertions, to develop CRISPR-edited therapies.

About Caribou Biosciences, Inc.Caribou

Biosciences is a clinical-stage CRISPR genome-editing

biopharmaceutical company dedicated to developing transformative

therapies for patients with devastating diseases. The company’s

genome-editing platform, including its Cas12a chRDNA technology,

enables superior precision to develop cell therapies that are

armored to potentially improve antitumor activity. Caribou is

advancing a pipeline of off-the-shelf cell therapies from its CAR-T

and CAR-NK platforms as readily available treatments for patients

with hematologic malignancies and solid tumors. Follow us

@CaribouBio and visit www.cariboubio.com.

Forward-looking statements This press release

contains forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. These

forward-looking statements include, without limitation, statements

related to Caribou’s strategy, plans, and objectives, and

expectations regarding its clinical and preclinical development

programs, including its expectations relating to the timing of

updates from its ANTLER Phase 1 clinical trial for CB-010 as well

as the status and updates from its CaMMouflage Phase 1 clinical

trial for CB-011, plans for meeting with the FDA to discuss a

potential pivotal clinical trial of CB-010 in second-line LBCL

patients and plans for sharing feedback from such meeting,

expectations about product developments, and expectations regarding

the timing of initiating patient enrollment in the AMpLify Phase 1

clinical trial for CB-012, and Caribou’s expected cash runway.

Management believes that these forward-looking statements are

reasonable as and when made. However, such forward-looking

statements are subject to risks and uncertainties, and actual

results may differ materially from any future results expressed or

implied by the forward-looking statements. Risks and uncertainties

include, without limitation, risks inherent in the development of

cell therapy products; uncertainties related to the initiation,

cost, timing, progress, and results of Caribou’s current and future

research and development programs, preclinical studies, and

clinical trials; and the risk that initial, preliminary, or interim

clinical trial data will not ultimately be predictive of the safety

and efficacy of Caribou’s product candidates or that clinical

outcomes may differ as patient enrollment continues and as more

patient data becomes available; the risk that preclinical study

results observed will not be borne out in human patients or

different conclusions or considerations are reached once additional

data have been received and fully evaluated; as well as other risk

factors described from time to time in Caribou’s filings with the

Securities and Exchange Commission, including its Annual Report on

Form 10-K for the year ended December 31, 2022 and subsequent

filings. In light of the significant uncertainties in these

forward-looking statements, you should not rely upon

forward-looking statements as predictions of future events. Except

as required by law, Caribou undertakes no obligation to update

publicly any forward-looking statements for any reason.

| Caribou Biosciences,

Inc.Condensed Consolidated Balance Sheet Data(in thousands)

(unaudited) |

| |

|

|

|

|

|

September 30, 2023 |

|

December 31, 2022 |

|

Cash, cash equivalents, and marketable securities |

$ |

396,707 |

|

|

$ |

317,036 |

|

| Total

assets |

|

457,521 |

|

|

|

373,765 |

|

| Total

liabilities |

|

59,253 |

|

|

|

72,894 |

|

| Total

stockholders' equity |

|

398,268 |

|

|

|

300,871 |

|

| Total

liabilities and stockholders' equity |

$ |

457,521 |

|

|

$ |

373,765 |

|

| Caribou Biosciences,

Inc.Condensed Consolidated Statement of Operations(in thousands,

except share and per share data)(unaudited) |

| |

|

|

|

|

|

|

|

|

|

Three Months Ended, September 30, |

|

Nine Months Ended, September 30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Licensing

and collaboration revenue |

$ |

23,662 |

|

|

$ |

3,303 |

|

|

$ |

30,919 |

|

|

$ |

10,159 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

Research and development |

|

28,584 |

|

|

|

19,991 |

|

|

|

80,796 |

|

|

|

56,494 |

|

|

General and administrative |

|

9,711 |

|

|

|

9,849 |

|

|

|

28,740 |

|

|

|

29,486 |

|

|

Total operating expenses |

|

38,295 |

|

|

|

29,840 |

|

|

|

109,536 |

|

|

|

85,980 |

|

| Loss from

operations |

|

(14,633 |

) |

|

|

(26,537 |

) |

|

|

(78,617 |

) |

|

|

(75,821 |

) |

| Other income

(expense): |

|

|

|

|

|

|

|

|

Change in fair value of equity securities |

|

(4 |

) |

|

|

31 |

|

|

|

3 |

|

|

|

(73 |

) |

|

Change in fair value of the MSKCC success payments liability |

|

(139 |

) |

|

|

(1,607 |

) |

|

|

395 |

|

|

|

1,041 |

|

|

Other income, net |

|

4,774 |

|

|

|

1,466 |

|

|

|

10,654 |

|

|

|

2,421 |

|

|

Total other income (expense) |

|

4,631 |

|

|

|

(110 |

) |

|

|

11,052 |

|

|

|

3,389 |

|

| Net

loss |

$ |

(10,002 |

) |

|

$ |

(26,647 |

) |

|

$ |

(67,565 |

) |

|

$ |

(72,432 |

) |

| Other

comprehensive income (loss): |

|

|

|

|

|

|

|

|

Net unrealized gain (loss) on available-for-sale marketable

securities, net of tax |

|

155 |

|

|

|

(454 |

) |

|

|

537 |

|

|

|

(1,900 |

) |

| Net

comprehensive loss |

$ |

(9,847 |

) |

|

$ |

(27,101 |

) |

|

$ |

(67,028 |

) |

|

$ |

(74,332 |

) |

| Net loss per

share, basic and diluted |

$ |

(0.12 |

) |

|

$ |

(0.44 |

) |

|

$ |

(0.98 |

) |

|

$ |

(1.19 |

) |

|

Weighted-average common shares outstanding, basic and diluted |

|

83,783,992 |

|

|

|

60,886,921 |

|

|

|

68,878,921 |

|

|

|

60,731,520 |

|

| |

|

|

|

|

|

|

|

Caribou Biosciences, Inc.

contacts:Investors:Amy Figueroa,

CFAinvestor.relations@cariboubio.com

Media:Peggy Vorwald,

PhDmedia@cariboubio.com

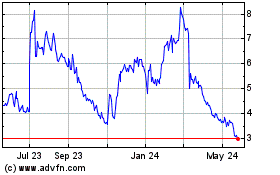

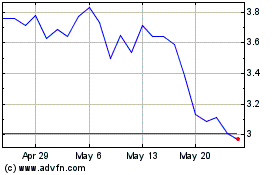

Caribou Biosciences (NASDAQ:CRBU)

Historical Stock Chart

From Apr 2024 to May 2024

Caribou Biosciences (NASDAQ:CRBU)

Historical Stock Chart

From May 2023 to May 2024