0001730773

false

0001730773

2023-06-16

2023-06-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): June 16, 2023

BLUE

STAR FOODS CORP.

(Exact

name of registrant as specified in charter)

| Delaware |

|

001-40991 |

|

82-4270040 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

3000

NW 109th Avenue

Miami,

Florida |

|

33172 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (305) 836-6858

| N/A |

| (Former

name or former address, if changed since last report) |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4 (c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.0001 par value |

|

BSFC |

|

The

Nasdaq Stock Market LLC

(Nasdaq

Capital Market) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item

1.01 |

Entry

into a Material Definitive Agreement. |

On

July 6, 2023, Blue Star Foods Corp., a Delaware corporation (the “Company”), Taste of BC Aquafarms Inc., a corporation formed

under the Province of British Columbia, Canada (“TOBC”) and Steve Atkinson and Janet Atkinson (each a “Seller”

and collectively, the “Sellers”), entered into an agreement to waive a requirement in the First Amendment to Stock Purchase

Agreement (the “Amendment”), entered into as of June 24, 2021, between the same parties, that an aggregate of 17,247 shares

(after taking into account the Company’s 1:20 reverse stock split effective June 21, 2023) of common stock of the Company (“Additional

Shares”) be held in escrow and be released from escrow and delivered to the Sellers, if at June 24, 2023, the twenty-four month

anniversary of the closing of the acquisition of TOBC by the Company, TOBC had cumulative revenues of at least CAD$1,300,000, or if TOBC’s

cumulative revenue has not reached CAD$1,300,000, the Sellers would be entitled to a prorated number of Additional Shares. Accordingly,

on July 6, 2026, the Board of Directors of the Company authorized its escrow agent, to instruct the Company’s transfer agent to

deliver 8,451 Additional Shares to Steve Atkinson and 8,796 Additional Shares to Janet Atkinson.

| Item 1.02 |

Termination of a Material Definitive Agreement |

On

June 16, 2023, the Company terminated the loan and security agreement, dated March 31, 2021 (the “Loan Agreement”), between

Lighthouse Financial Corp., a North Carolina corporation (“Lighthouse”) and the Company’s wholly-owned subsidiary,

John Keeler & Co., Inc., d/b/a Blue Star Foods, a Florida corporation (“Keeler & Co.”) and its wholly-owned subsidiary,

Coastal Pride Seafood, LLC, a Florida limited liability company (“Coastal Pride”) and paid a total of approximately $108,471

to Lighthouse which included, as of June 16, 2023, an outstanding principal balance of approximately $93,490, accrued interest of approximately

$9,988, and other fees incurred in connection with the line of credit of approximately $4,991. Upon the repayment of the total outstanding

indebtedness owing to Lighthouse, the Loan Agreement and all other related financing agreements and documents entered into in connection

with the Loan Agreement were deemed terminated.

As

previously reported, pursuant to the terms of the Loan Agreement, Lighthouse made available to Keeler & Co. and Coastal Pride (together,

the “Borrowers”) a $5,000,000 revolving line of credit for a term of thirty-six months, renewable annually for one-year periods.

Amounts due under the line of credit were represented by a revolving credit note issued to Lighthouse by the Borrowers. The line of credit

was secured by a first priority security interest on all the assets of each Borrower. Pursuant to the terms of a guaranty agreement,

the Company guaranteed the obligations of the Borrowers under the note and John Keeler, Executive Chairman and Chief Executive Officer

of the Company, provided a personal guaranty of up to $1,000,000 to Lighthouse.

| Item

3.02 |

Unregistered

Sales of Equity Securities. |

Reference

is made to the disclosure set forth under Item 1.01 above, which disclosure is incorporated herein by reference.

The

issuances of the Additional Shares are exempt from registration under Section 4(a)(2) of Securities Act of 1933, as amended, as transactions

by an issuer not involving any public offering.

| Item 9.01 |

Financial Statements and Exhibits. |

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

| Date:

July 11, 2023 |

BLUE

STAR FOODS CORP. |

| |

|

| |

By: |

/s/

John Keeler |

| |

|

John

Keeler

Executive

Chairman and Chief Executive Officer |

Exhibit

10.1

Blue

Star Foods Corp.

3000

NW 109th Avenue

Miami,

FL 33172

July

6, 2023

Taste

of BC Aquafarms Inc.

2930

Jameson Road

Nanaimo,

British Columbia

Canada

V9R 6W8

Steve

Atkinson

2904

Jameson Road

Nanaimo,

British Columbia

Canada

V9R 6W8

Janet

Atkinson

2904

Jameson Road

Nanaimo,

British Columbia

Canada

V9R 6W8

Ladies

and Gentlemen:

Reference

is made to Section 2(d) of the First Amendment to Stock Purchase Agreement (the “Amendment”), entered into as of June 24,

2021 by and among Blue Star Foods Corp., a Delaware corporation (the “Company”), Taste of BC Aquafarms Inc., a corporation

formed under the Province of British Columbia, Canada (“TOBC”) and Steve Atkinson and Janet Atkinson (each a “Seller”

and collectively, the “Sellers”), which among other things, amends Section 2.2 of the stock purchase agreement, dated April

27, 2021 (“SPA”) of which the Company, TOBC and the Sellers are parties, to provide among other things, that, after taking

into account the Company’s 1:20 reverse stock split effective June 21, 2023, 17,247 shares of common stock of the Company (“Additional

Shares”) being held by The Crone Group, P.C. as escrow agent (“CLG”), be released from escrow and delivered to the

Sellers, if at June 24, 2023, the twenty-four month anniversary of the closing of the acquisition of TOBC by the Company, (i)TOBC had

cumulative revenues of at least CAD$1,300,000, with each Seller receiving a pro rata portion of such shares based upon the total number

of shares of TOBC held by such Seller at April 27, 2021 or (ii) if TOBC’s cumulative revenue has not reached CAD$1,300,000, the

Sellers would be entitled to a prorated number of Additional Shares, based on the actual cumulative revenue of the Company as of such

date.

As

an accommodation to the Sellers, the Company hereby agrees to (i) waive the revenue requirements set forth in Section 2(d) of the Amendment

and (ii) authorizes and directs CLG, as escrow agent, to instruct the transfer agent for the Company to deliver the Additional Shares

to the Sellers as follows:

| (i) | 8,451

Additional Shares to Steve Atkinson (49% original ownership); and |

| (ii) | 8,796

Additional Shares to Janet Atkinson (51% original ownership). |

The

parties hereto hereby indemnify and hold harmless CLG and its employees, agents and affiliates from any claim, loss, expense or liability

of any kind, including reasonable attorney’s fees and expenses arising out of or connected in any way with this Agreement or the

acting as escrow agent or holding the Additional Shares.

The

Sellers acknowledge that the Additional Shares will not be registered pursuant to the Securities Act of 1933, as amended (the “Securities

Act”) or any applicable state securities laws, and will be deemed “restricted securities” and cannot be sold or otherwise

disposed of without registration under the Securities Act or an exemption therefrom.

Each

Seller is acquiring the Additional Shares for their own account as principal, not as a nominee or agent, for investment purposes only,

and not with a view to, or for, resale, distribution or fractionalization thereof in whole or in part in any transactions that would

be in violation of the Securities Act or any state securities or “blue-sky” laws. No other person or entity has a direct

or indirect beneficial interest in, and such Seller does not have any contract, undertaking, agreement or arrangement with any person

or entity to sell, transfer or grant participations to such person or entity or to any third party, with respect to, the Additional Shares

or any part thereof that would be in violation of the Securities Act or any state securities laws or other applicable law.

Each

Seller understands that the Company is under no obligation to register the Additional Shares under the Securities Act, or to assist such

Seller in complying with the Securities Act or the securities laws of any state of the United States or of any foreign jurisdiction.

Except

as expressly provided herein, nothing contained in this letter shall constitute a waiver of any other right, power or remedy, or constitute

a waiver of any other provision of the SPA or Amendment, or any other document, instrument and/or agreement executed of delivered in

connection therewith.

This

letter agreement may be executed in counterparts, and execution may be evidenced by facsimile or other electronic transmission of a signed

signature page, and all such counterparts together shall constitute one and the same document.

Please

indicate your acknowledgment of and agreement to the foregoing by signing where indicated below and returning to a copy to us.

| |

Sincerely, |

| |

|

|

| |

BLUE STAR FOODS CORP. |

| |

|

|

| |

By: |

/s/

John Keeler |

| |

|

John

Keeler, Chief Executive Officer |

Accepted

and agreed to this July 6, 2023

| TASTE OF BC AQUAFARMS INC. |

|

| |

|

|

| By: |

/s/

Ben Atkinson |

|

| Name:

|

Ben

Atkinson |

|

| Title:

|

President |

|

| /s/Steve

Atkinson |

|

| Steve

Atkinson |

|

| |

|

| /s/

Janet Atkinson |

|

| Janet

Atkinson |

|

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

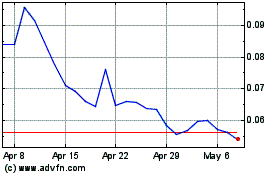

Blue Star Foods (NASDAQ:BSFC)

Historical Stock Chart

From Apr 2024 to May 2024

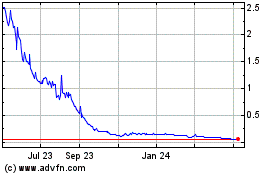

Blue Star Foods (NASDAQ:BSFC)

Historical Stock Chart

From May 2023 to May 2024