0001746109

false

0001746109

2023-08-29

2023-08-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 OR 15(d) of the Securities Exchange Act of 1934

| Date of Report (Date of earliest event reported) |

August

29, 2023 |

Bank First Corporation

(Exact name of registrant

as specified in its charter)

| Wisconsin |

001-38676 |

39-1435359 |

| (State or other jurisdiction |

(Commission |

(IRS Employer |

| of incorporation) |

File Number) |

Identification No.) |

| 402 North 8th Street, Manitowoc, WI |

54220 |

| (Address of principal executive offices) |

(Zip Code) |

| Registrant’s telephone number, including area code |

(920) 652-3100 |

N/A

(Former name or former

address, if changed since last report.)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered

pursuant to Section 12(b) of the Act:

| Title of each class |

Ticker symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

BFC |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for company with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 7.01 |

Regulation FD Disclosure |

On August 29, 2023, Bank

First Corporation issued its quarterly shareholder newsletter. A copy of the newsletter is attached as Exhibit 99.1 to this Report on

Form 8-K and is incorporated herein by reference.

Pursuant to General Instruction B.2 of Form 8-K,

the information in this Item 7.01 and Exhibit 99.1 is being furnished to the Securities and Exchange Commission and shall not be deemed

to be filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise

subject to the liabilities under that Section. Furthermore, the information in this Item 7.01 and Exhibit 99.1 shall not be deemed to

be incorporated by reference into the filings of the Registrant under the Securities Act of 1933, as amended, or the Exchange Act.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

BANK FIRST CORPORATION |

| |

|

|

| |

|

|

| Date: August 29, 2023 |

By: |

/s/ Kevin M. LeMahieu |

|

| |

Kevin M. LeMahieu |

| |

Chief Financial Officer |

Exhibit 99.1

means spending my free time barefoot waterskiing and boating . Not only is it revitalizing, but it also pushes me outside my comfort zone and challenges me mentally, reinforcing the significance of pursuing personal interests beyond the office . We strive to ensure our team has the flexibility and opportunity to pursue their interests outside the office as well, as work - life balance promotes increased productivity, reduced turnover, and improved mental and physical health . This summer, I visited all our branches and enjoyed sharing stories with employees while also meeting scores of customers . As I reflected on those visits, the conversations I had with our employees inevitably turned into discussions about family vacations, athletic events, and community activities . I enjoyed hearing about upcoming family reunions, weddings, softball tournaments, parades, children’s dance performances, camps, and other events . It was great to see our team pursuing their unique interests and spending time with family and friends . While visiting our Shawano office earlier this summer, I met a customer who is a member of the Shawano Ski Sharks Water Ski Show team, a local ski team that Bank First supports as a sponsor . While chatting about our mutual love for waterskiing, I was invited to attend and participate in one of their shows . On August 2 , my dream of performing in a waterski show became a reality when I got to kick off the Shawano Ski Sharks show with a barefoot waterski run . It was an incredible experience and again made me reflect on the ways we can pursue our interests while getting involved in our local community . Ski teams are unique organizations, featuring a diverse group of skiers and support personnel of all ages, backgrounds, skillsets, and capabilities . For many of the participants, it is a family affair, with entire families either performing or supporting the show . The hundreds of spectators in attendance were comprised of families throughout the Shawano community and the many visitors who enjoy the area in the summer . Not only do ski teams provide a wonderful form of entertainment for the community, but they also teach our youth essential values such as teamwork, hard work, and perseverance . Wisconsin is blessed to have more water ski shows than any other state in the country . If you would like to check out a water ski show in your area, please go to www . travelwisconsin . com and search for “water ski shows” . Our support of the Ski Sharks is just one example of our focus on community . Our commitment extends to local athletic teams, youth groups, and other nonprofit organizations that contribute to the growth and vibrancy of our communities as well as the holistic development of children . We take pride in supporting organizations that are near and dear to our team . Summer is a special time in Wisconsin, and we are fortunate to have the opportunity to enjoy and give back to the various community events the state has to offer . I hope you had a chance to make it a memorable summer . MESSAGE FROM THE CEO To our Shareholders, I trust this letter finds you well as we approach the final weeks of summer . I hope you were able to enjoy the outdoors with friends and family . Wisconsin is a wonderful place to live, and spending time outside enjoying our state’s waterways with family and dear friends holds a special place in my heart . At Bank First, we encourage our team of bankers to maintain a healthy work - life balance, ensuring everyone has an opportunity to grow personally and professionally at work while also dedicating time to their family, friends, and passions . For me personally, that Michael B. Molepske CEO - (920) 652 - 3202 Ticker: BFC www.bankfirst.com SHAREHOLDER NE WS CORPORATION AUGUST 2023 MIKE MOLEPSKE Bank First announces retirement of board member Robert Holmes and appointment of new board member Timothy McFarlane Robert W . Holmes has retired from the Board of Directors . Holmes joined the Bank First Corporation and Bank First Board of Directors in 2020 following the Bank’s acquisition of Tomah Bancshares, Inc . , where he served as Executive Chairman of the Board . “Robert has provided invaluable insights into acquisition structuring, regulatory guidance and strategic and corporate planning, adding strength and depth to the board,” stated Mike Molepske, Chief Executive Officer of Bank First Corporation . Timothy J . McFarlane has been elected to the Board of Directors . In addition to joining the board, McFarlane has joined Bank First serving as President of the Bank and the Corporation . As President of Bank First, Tim is responsible for the Bank’s retail and business banking operations, in addition to overseeing the Marketing, Human Resources, Credit Administration, and Deposit and Loan Operations functions . He plays a key role in determining the overall strategy of Bank First and ensuring the mission and core values of the organization are upheld . His extensive knowledge of the banking industry, strong leadership skills, and strategic vision make him an exceptional addition to Bank First’s Board of Directors .

SECOND QU A R TER KEVIN LEMAHIEU Chief Financial Officer (920) 652 - 3362 Total assets for the Company were $ 4 . 09 billion at June 30 , 2023 , up from $ 2 . 96 billion at June 30 , 2022 . Loans were $ 3 . 31 billion, growing $ 925 . 2 million on a year - over - year basis . Deposits were $ 3 . 41 billion, growing $ 804 . 3 million over that same time frame . Year - over - year comparisons were significantly impacted by the Company’s acquisitions of Denmark Bancshares, Inc . (“Denmark”) during the third quarter of 2022 and Hometown Bancorp, Ltd . (“Hometown”) during the first quarter of 2023 . These transactions included $ 457 . 1 million and $ 395 . 8 million in loans, $ 604 . 8 million and $ 532 . 4 million in deposits, and $ 685 . 8 million and $ 615 . 1 million in total assets, respectively . Earnings per share for the six months ended June 30 , 2023 , was $ 2 . 46 , down from $ 2 . 89 for the first half of 2022 . One - time costs during the first half of 2023 , primarily relating to the acquisition of Hometown, reduced earnings per share by $ 0 . 46 . Similar one - time costs from the acquisition of Denmark reduced earnings per share during the first half of 2022 by $0.10. Net interest income before provision for loan losses for the first half of 2023 totaled $ 65 . 5 million, an increase of $ 20 . 7 million over the first half of 2022 . The added scale from the acquisitions of Denmark and Hometown was the primary driver of this increase . Provisions for credit losses totaled $ 4 . 2 million for the first half of 2023 , up from $ 1 . 7 million for the same period during 2022 . Due to accounting rules associated with Quarterly Common Stock Cash Dividend Bank First’s Board of Directors approved a quarterly cash dividend of $ 0 . 30 per common share, payable on October 4 , 2023 , to shareholders of record as of September 20 , 2023 . This dividend represents a 20 . 0 % increase over the dividend declared one year earlier . During one of the numerous summer shows, a Bank First - branded boat proudly tows the Shawano Ski Sharks team as they form a striking triple ski pyramid . Bank First is honored to support the Ski Sharks, along with several other ski teams across the state . These teams bring value and vibrancy to our communities during the summer months . Moreover, our commitment to the community extends beyond the lakes . Throughout the year, Bank First champions a myriad of community events through diverse sponsorships . Our community support resonates with our mission of being a “relationship - based bank focused on providing innovative solutions that are value - driven to the communities we serve . ” acquired loan portfolios, the Hometown transaction required a provision for credit losses of $3.6 million. Continued strong asset quality metrics exhibited within the Company’s loan portfolio allowed for a reduced provision from the prior - year first quarter, net of the impact from the Hometown transaction. Non - interest income totaled $9.9 million for the six months ended June 30, 2023, down from $10.8 million during the first half of 2022. Most areas of non - interest income saw increases during the first half of 2023 compared to the first half of 2022. Counteracting those increases, however, was a decline in gains on sales of mortgage loans, from $1.1 million for the first half of 2022 to $0.4 million for the first half of 2023, and smaller positive valuation adjustments to the mortgage servicing rights asset on the Company’s balance sheet, totaling $2.0 million through the first half of 2022 compared to $0.2 million through the same period of 2023 . Non - interest expense increased by $ 13 . 2 million, or 50 . 8 % , from the first half of 2022 to $ 39 . 1 million for the first half of 2023 . Transaction expenses related to the acquisition of Hometown totaled $ 1 . 5 million during the first half of 2023 . The added scale resulting from the acquisitions of Denmark and Hometown, which combined to increase assets of the Company by approximately 40 % , and inflationary pressure also caused significant increases in nearly every category of non - interest expense . Total shareholders’ equity increased by $ 256 . 7 million to $ 570 . 9 million at June 30 , 2023 , compared to $ 314 . 2 million at June 30 , 2022 .

Net Income $ 24,812 $ 21,837 Earnings Per Share: Basic $ 2.46 $ 2.89 Earnings Per Share: Diluted $ 2.46 $ 2.89 Total Liabilities $ 3,521,199 $ 2,646,865 Total Shareholder Equity 570,872 314,162 Total Liabilities and Shareholder Equity $ 4,092,071 $ 2,961,027 Key Financial Metrics 6/30/2023 6/30/2022 Return on Average Assets (YTD) 1.25% 1.38% Return on Average Equity (YTD) 9.20% 13.75% Full - Time Equivalent Employee (FTE) - period end 398 285 Average Assets per Average FTE $ 10,805 $ 11,445 Dividend Payout Ratio 22% 15% Dividends Per Share (YTD) $ 0.55 $ 0.44 Net Interest Margin (YTD) 3.76% 3.13% Shares Outstanding - period end 10,389,240 7,470,255 Consolidated Statements of Financial Condition 6/30/2023 ASSETS (In Tho 6/30/2022 usands) Cash, Cash Equivalent s an d Fed Funds Sold $ 111,326 $ 43,985 Investmen t Securities 269,011 326,293 Othe r Investment s a t Cost 21,521 19,564 Loans, Net 3,271,072 2,364,919 Premises an d Equipmen t 66,958 50,608 Othe r Assets 352,183 155,658 Total Assets $ 4,092,071 $ 2,961,027 LIABILITIES Deposit s $ 3,405,736 $ 2,601,477 Securitie s Sol d Under Repurchase Agreements 23,802 16,125 Borrowe d Funds 70,269 19,235 Othe r Liabilities 21,392 10,028 6/30/2023 6/30/2022 (In Thousands, Except Per Share Data) Total Interest Income $ 86,831 $ 50,040 Total Interest Expense 20,325 4,270 Net Interest Income 66,506 45,770 Provision for Loan Losses 4,182 1,700 Net Interest Income After Provision for Loan Losses 62,324 44,070 Total Other Income 9,914 10,785 Total Operating Expenses 39,121 25,950 Income Before Provision for Income Taxes 33,117 28,905 Provision for Income Taxes 8,305 7,068 FINANCIAL PERFORMANCE Consolidated Statements of Income

Let’s stay in touch. Follow us! Bank First announces new hires and promotions KELSEY BEAVER recently rejoined the Bank as a Retail Banking Officer at its Eighth Street office in Manitowoc . Previously, Kelsey was a key member of Bank First’s loan operations team and served as a retail lender at the Bank’s Cedarburg office . In her new role, Kelsey is responsible for developing new and enhancing existing retail banking relationships in Manitowoc and the surrounding area . Involved in the community, Kelsey serves as a board member of the Manitowoc – Two Rivers YMCA, as well as a committee member for the Manitowoc Board of Realtors and the Manitowoc Chamber of Commerce . She is also actively involved in the Manitowoc County Homebuilders Association and the 100 + Women Who Care . KATHRYN SCHMITZ has been promoted to Vice President – Retail Market Manager . Kathryn joined the bank in 2016 and has almost 20 years of experience in mortgage lending . In her new role, Kathryn oversees the retail lending function in the Bank’s Manitowoc County market, providing mentorship, driving business growth, and supporting the county’s retail bankers . She is a graduate of UW – Green Bay where she received her bachelor’s degree in business administration . JODY HEUS , Assistant Vice President – Retail Banker, joined Bank First’s Plymouth team through its merger with Hometown Bank in February 2023 . The Bank is pleased to announce the expansion of Jody’s role, where she serves customers and leads Bank First’s sales efforts in both the Kiel and Plymouth markets . Jody has over 33 years of experience in banking and will leverage her knowledge and expertise to enhance the customer experience and grow the Bank’s retail banking presence in these two markets . Jody earned a bachelor’s degree from UW – Oshkosh . ALYSSA SCHWERMA has been promoted to Retail Banker at the Bank First office in Two Rivers . Alyssa has over eight years of banking experience, including three years at Bank First where she has served as a loan processer and most recently as Assistant Branch Manager at the Bank’s Custer Street office . In her new role, Alyssa is responsible for developing new and enhancing existing retail banking relationships in Two Rivers and the surrounding area . In addition, she provides leadership and support to the local team of bankers and assists with their efforts to deliver an exceptional customer experience . She earned an associate’s degree in marketing from Northeast Wisconsin Technical College . SALLY SPANGLER has been promoted to Compliance / Enterprise Risk Officer . Sally joined Bank First in 2020 through its merger with Timberwood Bank in Tomah and has over 23 years of experience in the banking industry, most recently specializing in enterprise risk, BSA, and compliance support . Sally is a knowledgeable compliance resource to Bank employees and will continue to manage the Bank’s secondary market loan quality control review processes, assist with the maintenance of its vendor management system, and conduct compliance monitoring reviews . Sally obtained multiple certifications from the Wisconsin Bankers Association for loans, real estate mortgages, and deposit compliance, as well as training in consumer, mortgage, and commercial lending . MIKE GINTNER has recently joined the Bank as Vice President – Agricultural Banking with 18 years of experience in the agricultural industry . Mike is based in Eau Claire and is responsible for expanding Bank First’s presence in northwest Wisconsin, as well as growing its agricultural relationships throughout the state . Mike was previously a Financial Officer at Compeer Financial for 15 years, where he develope d customized lending solutions for farms and agribusinesses of all sizes . From 2005 to 2008 , he worked as a Farm Store Representative for Cargill Animal Nutrition, assisting retail feed stores and large equine barns in attaining the nutritional goals for their animals . Mike earned a Bachelor of Science in Agricultural Industries and Marketing from the University of Minnesota – Twin Cities . CRYSTAL has been Corporate HEINZEN promoted to Training and Development Officer. Crystal joined the Bank in March 2023 with over 25 years of retail management experience. Durin g her short time at Bank First, she has shown exceptional dedication and leadership with a strong commitment to the success of the Bank and its employees . In her role, Crystal will continue to be responsible for the design, implementation, an d evaluation of programs that facilitate the onboarding of new team members, professional development , culture, and continuous learning of employees and leaders . She will also continue to lead the evolution of career paths, manage the Bank’s training programs, and implement leadership development initiatives . CARYN LANGOLF recently joined the Bank as Vice President – Compliance / BSA Officer, bringing extensive experience in various compliance related bank functions . Her impressive background includes 12 years at JPMorgan Chase and three years at Silicon Valley Bank, where she held key roles in fraud risk management, Bank Security Act (BSA) and Anti - Money Laundering (AML) investigations and compliance, card compliance, and compliance training . In her new role at Bank First, Caryn manages the Bank’s BSA and regulatory compliance programs . Her primary focus ensures adherence to all Federal, State, and local laws and regulations, safeguarding Bank First from potential risks . Caryn earned a Master of Education in Teaching from the University of Arizona in Tucson, Arizona as well as a Bachelor of Science in Finance from Elmhurst University in Elmhurst, Illinois . SCHWERMA SCHMITZ HEUS BEAVER SPANGLER LANGOLF GINTNER HEINZEN

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

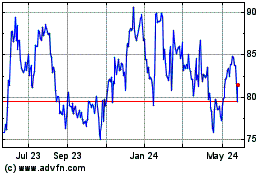

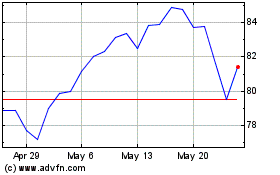

Bank First (NASDAQ:BFC)

Historical Stock Chart

From Apr 2024 to May 2024

Bank First (NASDAQ:BFC)

Historical Stock Chart

From May 2023 to May 2024