0000717538FALSE--12-3100007175382024-01-312024-01-3100007175382023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report: January 31, 2024

(Date of earliest event reported)

ARROW FINANCIAL CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| New York | 0-12507 | 22-2448962 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | | | | | | | | | | |

| 250 Glen Street | Glens Falls | New York | 12801 |

| (Address of principal executive offices) | (Zip Code) |

| | | | |

| Registrant’s telephone number, including area code: | 518 | | 745-1000 |

(Former name or former address, if changed since last report)

| | | | | |

| Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol | Name of each exchange on which registered |

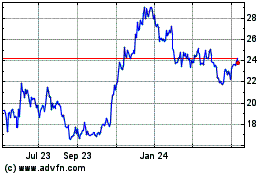

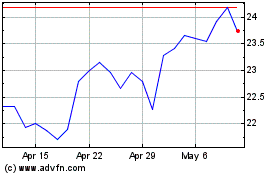

| Common Stock, Par Value $1.00 per share | AROW | NASDAQ Global Select Market |

| | | | | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). | |

| Emerging growth company | ☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act | ☐ |

Item 2.02. Results of Operations and Financial Condition.

On February 1, 2024, Arrow Financial Corporation (the "Company") issued a press release containing unaudited financial information and accompanying discussion for the year-to-date period ended December 31, 2023. A copy of this press release is furnished as Exhibit 99.1 to this report on Form 8-K.

Item 5.03 Amendment to Articles of Incorporation or ByLaws; Change in Fiscal Year.

On January 31, 2024, the Board approved and adopted an amendment and restatement of the Company’s bylaws (as amended and restated, the “Amended and Restated Bylaws”), effective as of that date. The amendments contained in the Amended and Restated Bylaws include, among other things:

a.employing the use of gender-neutral language throughout the By-laws;

b.amending Sections 2.1 and 3.9 to expressly allow for shareholder and board meetings to be conducted through means of remote communications pursuant to New York Business Corporation Law (“NYBCL”) Sections 602 and 708, respectively;

c.amending Section 2.1 to provide for requirements and procedures for the postponement of a meeting of the shareholders;

d.amending Section 2.2 to clarify that the adjournment, recess, or postponement of an annual meeting of the shareholders shall not provide a new period for a shareholder to provide notice of a proposal of business to be transacted at that meeting;

e.amending Section 2.5 to clarify the determination of the shareholders of record for an adjourned meeting;

f.amending Section 2.9 to clarify the policies and procedures for an adjourned meeting of the shareholders and the notice requirements related to such an adjournment;

g.amending Section 2.10 to clarify the scope of a proxy authorization;

h.amending Sections 2.12 and 2.13 to set forth a clear protocol for determining who shall lead a meeting of the shareholders in the absence of the Chairman of the Board and the methods of conducting such a meeting;

i.amending Section 3.4.2 to establish the requirements for submitting shareholder notice of a director nomination in compliance with stockholder proxy solicitations for director nominees;

j.amending Sections 3.18 and 4.2 to expressly allow for obtaining the written consent of Directors, including in their role as members of Board committees, through electronic means in accordance with NYBCL Section 708; and

k.amending Section 4.1 to clarify the voting power of the chair of the executive committee of the Board; and

l.incorporating other technical and conforming revisions and clarifications.

The foregoing is a summary of the Amended and Restated Bylaws only, and is qualified in its entirety by the full text of the Amended and Restated Bylaws, a copy of which is filed as Exhibit 3.1 to this current report on Form 8-K.

Item 7.01. Regulation FD Disclosure.

On February 1, 2024, the Company made available certain presentation material (the "Fourth Quarter 2023 Investor Presentation"), which includes among other things, a review of financial results and trends through the period ended December 31, 2023. The furnished Fourth Quarter 2023 Investor Presentation should be read in conjunction with our Earnings Release for the quarter ended December 31, 2023.

A copy of the presentation material is included as Exhibit 99.2 to this current report on Form 8-K and is incorporated herein by reference.

The information furnished under this Report, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or subject to the liabilities of that section. The information shall not be deemed incorporated by reference into any other filing with the Securities and Exchange Commission made by the Company, regardless of any general incorporation language in such filing.

Item 8.01. Other Events.

On January 31, 2024, the Board of Directors (the “Board”) of Arrow Financial Corporation (the “Company”) declared a quarterly cash dividend of $0.27 per share payable February 23, 2024 to shareholders of record on February 12, 2024.

A copy of the press release announcing the quarterly cash dividend is furnished as Exhibit 99.1 to this report on Form 8-K.

Item 9.01. Financial Statements and Exhibits.

Exhibit No. Description

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | ARROW FINANCIAL CORPORATION |

| | Registrant |

| | |

| Date: | February 1, 2024 | /s/ Penko Ivanov |

| | Penko Ivanov

Chief Financial Officer |

ARROW FINANCIAL CORPORATION (A New York corporation) BY-LAWS (Originally adopted 7/2/90, as amended through 1/31/24)

1 BY-LAWS ARROW FINANCIAL CORPORATION (A New York Corporation) ARTICLE I Definitions As used in these By-laws, unless the context otherwise requires, the term: 1.1 “Assistant Secretary” means an Assistant Secretary of the Corporation. 1.2 “Assistant Treasurer” means an Assistant Treasurer of the Corporation. 1.3 “Associated Person” of any stockholder or proposed nominee shall mean (i) any member of the immediate family of such stockholder or proposed nominee sharing the same household with such stockholder or proposed nominee; (ii) any person controlling, controlled by, or under common control with, such stockholder or proposed nominee; (iii) any person acting in concert or as part of a group (within the meaning of the Exchange Act and the regulations promulgated thereunder) with such stockholder or proposed nominee; or (iv) any beneficial owner of shares of stock of the corporation owned of record or beneficially by such stockholder or proposed nominee. 1.4 “Board” means the Board of Directors of the Corporation. 1.5 “Business Corporation Law” means the Business Corporation Law of the State of New York, as amended from time to time. 1.6 “By-laws” means the initial By-laws of the Corporation, as amended from time to time. 1.7 “Certificate of Incorporation” means the initial certificate of incorporation of the Corporation, as amended, supplemented or restated from time to time. 1.8 “Chair of the Board” means the Chair of the Board of the Corporation. 1.9 “Corporation” means Arrow Financial Corporation 1.10 “Directors” means directors of the Corporation 1.11 “Entire Board” means the total number of Directors which the Corporation would have if there were no vacancies. 1.12 “Exchange Act” means the Securities Exchange Act of 1934, as amended. 1.13 “Executive Committee” means the Executive Committee of the Board. 1.14 “Office of the Corporation” means the executive office of the Corporation, anything in Section 102(10) of the Business Corporation Law to the contrary notwithstanding. 1.15 “President” means the President of the Corporation.

2 1.16 “Secretary” means the Secretary of the Corporation. 1.17 “Treasurer” means the Treasurer of the Corporation. 1.18 “Vice President” means a Vice President of the Corporation. ARTICLE II Shareholders 2.1 Place of Meetings; Postponement. Every meeting of shareholders shall be held at the office of the Corporation or at such other place within or without the State of New York as shall be designated in the notice of such meeting or in the waiver of notice thereof. The Board may, in its sole discretion, determine that a meeting of the shareholders, including, without limitation, the annual meeting of the shareholders, may be held solely by means of electronic communication. If the Board, in its sole discretion, determines that a meeting be held solely by means of electronic communication, the platform or service of such meeting shall be the place of the meeting. Meetings of shareholder may be postponed by the Corporation to such time and place, if any, as is specified in the notice of postponement of such meeting. 2.2 Annual Meeting. A meeting of shareholders shall be held annually for the election of Directors and the transaction of other business at such hour and on such business day in April, May or June or such other month as may be determined by the Board and designated in the notice of meeting. This Section 2.2 shall govern the advance notice requirements for shareholder business other than the nomination of directors. Section 3.4.2 of these By-laws shall govern the advance notice requirements for the nomination of directors. No business may be transacted at an annual meeting of shareholders, other than business that is either (a) specified in the notice of meeting (or any supplement thereto) given by or at the direction of the Board, (b) otherwise properly brought before the annual meeting by or at the direction of the Board, or (c) otherwise properly brought before the annual meeting by any shareholder of the Corporation (i) who is a shareholder of record on the date of the giving of the notice provided for in Section 2.6 of these By-laws and on the record date for the determination of shareholders entitled to vote at such annual meeting and (ii) who complies with the notice procedures set forth in this Section 2.2. In addition to any other applicable requirements, for business to be properly brought before an annual meeting by a shareholder, such shareholder must have given timely notice thereof in proper written form to the Secretary. To be timely, a shareholder’s notice to the Secretary must: (i) for any proposals submitted for inclusion in the Corporation’s proxy statement and form of proxy pursuant to Rule 14a-8 under the Exchange Act meet the deadline and other procedural requirements for proposals submitted under such rule; and (ii) for all other matters, be delivered to or mailed and received at the principal executive offices of the Corporation not less than one hundred twenty (120) days prior to the anniversary date of the immediately preceding annual meeting of shareholders; provided, however, that in the event that the annual meeting is called for a date that is not within thirty (30) days before or after the anniversary date of the prior year’s annual meeting, notice by the shareholder in order to be timely must be so received not later than the close of business on the tenth (10th) day following the day on which notice of the date of the annual meeting is first mailed or public disclosure of the date of the annual meeting is first made, whichever first occurs. In no event shall any adjournment, recess, or postponement of an annual meeting or the announcement thereof commence a new time period for the giving of a shareholder’s notice as described above.

3 To be in proper written form, a shareholder’s notice to the Secretary must set forth as to each matter such shareholder proposes to bring before the annual meeting (i) a brief description of the business desired to be brought before the annual meeting and the reasons for conducting such business at the annual meeting, (ii) the name and record address of such shareholder, (iii) the class or series and number of shares of capital stock of the Corporation that are owned beneficially or of record by such shareholder, (iv) a description of all arrangements or understandings between such shareholder and any other person or persons (including their names) in connection with the proposal of such business by such shareholder and any material interest of such shareholder in such business and (v) a representation that such shareholder intends to appear in person or by proxy at the annual meeting to bring such business before the meeting. Without limiting the applicability of the foregoing provisions of this Section 2.2, a shareholder who seeks to have any proposal included in the Corporation’s proxy materials must provide notice as required by, and otherwise comply with, the applicable requirements of the rules and regulations under the Exchange Act in addition to this Section 2.2. Except for the immediately preceding sentence, nothing in this Section 2.2 shall be deemed to affect any rights of shareholders to request inclusion of proposals in the Corporation’s proxy statement pursuant to Rule 14a-8 under the Exchange Act. Subject to Rule 14a-8 under the Exchange Act, nothing in these Bylaws shall be construed to permit any shareholder, or give any shareholder the right, to include or have disseminated or described in the Corporation’s proxy statement any proposal. No business shall be conducted at the annual meeting of shareholders except business brought before the annual meeting in accordance with the procedures set forth in this Section 2.2, Section 2.6 and Section 3.4.2 of these By-laws; provided, however, that, once business has been properly brought before the annual meeting in accordance with such procedures, nothing in this Section 2.2 shall be deemed to preclude discussion by any shareholder of any such business. If the chair of an annual meeting determines that business was not properly brought before the annual meeting in accordance with the foregoing procedures of this Section 2.2, Section 2.6 and Section 3.4.2 of these By-laws, such chair shall declare to the meeting that the business was not properly brought before the meeting and such business shall not be transacted or discussed. 2.3 Special Meeting for Election of Directors, Etc. If the annual meeting of shareholders for the election of Directors and the transaction of other business is not held within the months specified in Section 2.2, the Board may call a special meeting of shareholders for the election of Directors and the transaction of other business at any time thereafter. 2.4 Special Meetings. A special meeting of shareholders, (other than a special meeting for the election of Directors), unless otherwise prescribed by statute, may be called at any time by the Board, the Chair of the Board or the Secretary. At any special meeting of shareholders, only such business may be transacted as is related to the purpose or purposes of such meeting set forth in the notice thereof given pursuant to Section 2.6 of the By-laws or in any waiver of notice thereof given pursuant to Section 2.7 of the By-laws. 2.5 Fixing Record Date. For the purpose of determining the shareholders entitled (i) to notice of or to vote at any meeting of shareholders or any adjournment thereof, (ii) to express consent to or dissent from any proposal without a meeting, (iii) for the purpose of determining shareholders entitled to receive payment of any dividend or the allotment of any rights, or (iv) for the purpose of any other action, the Board may fix, in advance, a date as the record date for any such determination of shareholders. Such date shall not be more than sixty nor less than ten (10) days before the date of such meeting, nor more than sixty (60) days prior to any other action. If no such record date is fixed: 2.5.1 The record date for the determination of shareholders entitled to notice of or to vote at a meeting of shareholders shall be at the close of business on the day next preceding the

4 day on which notice is given, or, if no notice is given, the day on which the meeting is held. When a determination of shareholders entitled to notice of or to vote at any meeting of shareholders has been made as provided in this Section 2.5.1, such determination shall apply to any adjournment thereof, unless the Board fixes a new record date for the adjourned meeting. 2.5.2 The record date for determining shareholders for any purpose other than that specified in Section 2.5.1 shall be at the close of business on the day on which the resolution of the Board relating hereto is adopted. When a determination of shareholders entitled to notice of or to vote at any meeting of shareholders has been made as provided in this Section 2.5.2, such determination shall apply to any adjournment thereof, unless the Board fixes a new record date for the adjourned meeting. A determination of shareholders of record entitled to notice of or to vote at a meeting of shareholders shall apply to any adjournment of the meeting; provided, however, that the Board of Directors may fix a new record date for the determination of shareholders entitled to vote at the adjourned meeting, and in such case shall also fix as the record date for shareholders entitled to notice of such adjourned meeting the same or an earlier date as that fixed for determination of shareholders entitled to vote in accordance herewith at the adjourned meeting. 2.6 Notice of Meetings of Shareholders. Except as otherwise provided in Section 2.5 and Section 2.7 of the By-laws, whenever under the Business Corporation Law or the Certificate of Incorporation or the By-laws, shareholders are required or permitted to take any action at a meeting, written or electronic notice shall be given stating the place, date and hour of the meeting, the means of electronic communications, if any, by which shareholders and proxyholders may participate in the proceedings of the meeting and vote or grant proxies at such meeting and, unless it is the annual meeting, indicating that it is being issued by or at the direction of the person or persons calling the meeting. Notice of a special meeting shall also state the purpose or purposes for which the meeting is called. If, at any meeting, action is proposed to be taken which would, if taken, entitle shareholders fulfilling the requirements of Section 623 of the Business Corporation Law to receive payment for their shares, the notice of such meeting shall include a statement of that purpose and to that effect. A copy of the notice of any meeting shall be given, personally or by mail, not less than ten (10) nor more than fifty (50) days before the date of the meeting, to each shareholder entitled to notice of or to vote at such meeting. If mailed, such notice shall be deemed to be given when deposited in the United States mail, with postage thereon prepaid, directed to the shareholder at their address as it appears on the record of shareholders, or if they shall have filed with the Secretary a written request that notices be mailed to some other address, then directed to them at such other address. An affidavit of the Secretary or other person giving the notice or of the transfer agent of the Corporation that the notice required by this section has been given shall, in the absence of fraud, be prima facie evidence of the facts therein stated. When a meeting is adjourned to another time or place, it shall not be necessary to give any notice of the adjourned meeting if the time and place to which the meeting is adjourned are announced at the meeting at which the adjournment is taken, and at the adjourned meeting any business may be transacted that might have been transacted at the meeting as originally called. However, if after the adjournment the Board fixes a new record date for the adjourned meeting, a notice of the adjourned meeting shall be given to each shareholder of record on the new record date who is entitled to notice. 2.7 Waivers of Notice. Notice of meeting need not be given to any shareholder who submits a signed waiver of notice in person or by proxy, whether before or after the meeting. The attendance of any shareholder at a meeting, in person or by proxy, without protesting prior to the conclusion of the meeting the lack of notice of such meeting, shall constitute a waiver of notice by them.

5 2.8 List of Shareholders at Meeting. A list of shareholders as of the record date, certified by the officer of the Corporation responsible for its preparation, or by a transfer agent, shall be produced at any meeting of shareholders upon the request thereat or prior thereto of any shareholder. If the right to vote at any meeting is challenged, the inspectors of election, or person presiding thereat, shall require such list of shareholders to be produced as evidence of the right of the persons challenged to vote at such meeting, and all persons who appear from such list to be shareholders entitled to vote thereat may vote at such meeting. 2.9 Quorum of Shareholders; Adjournment. The holders of one-third (1/3) of the shares entitled to vote at any meeting of shareholders, present in person or represented by proxy, shall constitute a quorum for the transaction of any business at any such meeting, provided that when a specified item of business is required to be voted on by a class or series (if the Corporation shall then have outstanding shares of more than one class or series), voting as a class, the holders of one-third (1/3) of the shares of such class or series shall constitute a quorum (as to such class or series) for the transaction of such item of business. When a quorum is once present to organize a meeting of shareholders, it is not broken by the subsequent withdrawal of any shareholders or their proxies. To the extent permitted by law, any meeting of shareholders may be adjourned by a majority of the Directors present, whether or not a quorum is present, for any reason from time to time to another date, time and place, whether or not a quorum is present at such meeting. When a meeting is for any reason adjourned to another time or place, notice need not be given of the adjourned meeting if the time and place thereof, and the means of remote communications, if any, by which shareholders and proxy holders may be deemed to be present in person and vote at such adjourned meeting are (a) announced at the meeting at which the adjournment is taken, (b) displayed, during the time scheduled for the meeting on the same electronic network used to enable shareholders and proxy holders to participate in the meeting by means of remote communication or (c) set forth in the notice of meeting given in accordance with Section 2.6. At the adjourned meeting, any business may be transacted which might have been transacted at the original meeting. If the adjournment is for more than thirty (30) days, or if after the adjournment a new record date is fixed for the adjourned meeting, a notice of the adjourned meeting shall be given to each shareholder of record entitled to vote at the meeting. 2.10 Voting; Proxies. Unless otherwise provided in the Certificate of Incorporation, every shareholder of record, as determined in accordance with Section 2.5 of the By-laws, shall be entitled to vote at every meeting of shareholders. The provisions of Section 612 of the Business Corporation Law shall apply in determining whether any shares may be voted and the persons, if any, entitled to vote such shares; but the Corporation shall be protected in treating the persons in whose names such shares stand on the record of shareholders as owners thereof for all purposes. The authorization of a proxy may be, but need not be, limited to specified action; provided, however, that if a proxy limits its authorization to a meeting or meetings of shareholders, unless otherwise specifically provided, such proxy shall entitle the holder thereof to vote at any adjourned or postponed session but shall not be valid after the final adjournment thereof. At any meeting of shareholders (at which a quorum was once present to organize the meeting), all matters, except as otherwise provided by law, or by the Certificate of Incorporation or by the By- laws, shall be decided by a majority of the votes cast at such meeting by the holders of shares present in person or represented by proxy and entitled to vote thereon, whether or not a quorum is present when the vote is taken. In voting on any questions on which a vote by ballot is required by law or is demanded by any shareholder entitled to vote, the voting shall be by ballot. Each ballot shall be signed by the shareholder voting or by their proxy, and shall state the number of shares voted. On all other questions, the voting may be viva voce. Every shareholder entitled to vote at a meeting of shareholders or to express consent or dissent without a meeting may authorize another person or persons to act for him by proxy. The validity and enforceability of any proxy shall be determined in accordance with Section 609 of the Business Corporation Law.

6 2.11 Selection and Duties of Inspectors at Meetings of Shareholders. The Board, in advance of any meeting of shareholders, may appoint one or more inspectors to act at the meeting or any adjournment thereof. If inspectors are not so appointed, the person presiding at such meeting may, and on the request of any shareholder entitled to vote thereat shall, appoint one or more inspectors. In case any person appointed fails to appear or act, the vacancy may be filled by appointment made by the Board in advance of the meeting or at the meeting by the person presiding thereat. Each inspector, before entering upon the discharge of their duties, shall take and sign an oath faithfully to execute the duties of inspector at such meeting with strict impartiality and according to the best of their ability. The inspector or inspectors represented at the meeting, shall determine the number of shares outstanding and the voting power of each, the shares represented at the meeting, the existence of a quorum, the validity and effect of proxies, and shall receive votes, ballots or consents, hear and determine all challenges and questions arising in connection with the right to vote, count and tabulate all votes, ballots or consents, determine the result, and shall do such acts as are proper to conduct the election or vote with fairness to all shareholders. On request of the person presiding at the meeting or any shareholder entitled to vote thereat, the inspector or inspectors shall make a report in writing of any challenge, question or matter determined by them and execute a certificate of any act found by them. Any report or certificate made by the inspector or inspectors shall be prima facie evidence of the facts stated and of the vote as certified by them. 2.12 Organization. At every meeting of shareholders, the Chair of the Board, or in the Chair of the Board’s absence, the vice-chair of the Board, or in the absence of such vice-chair, such person as the Board may designate as chair of the meeting, shall act as the chair of the meeting. The Secretary, or in their absence one of the Assistant Secretaries, shall act as secretary of the meeting. If neither the Secretary nor an Assistant Secretary is present, the chair of the meeting shall appoint a secretary of the meeting. 2.13 Order of Business; Conduct of Meeting. The order of business at all meetings of shareholders shall be as determined by the chair of the meeting, but the order of business to be followed at any meeting at which a quorum is present may be changed by a majority of the votes cast at such meeting by the holders of shares present in person or represented by proxy and entitled to vote at the meeting. The Chair of the Board, or in their absence, the person designated as chair under Section 2.12 above, shall be entitled to make such rules or regulations for the conduct of meetings of shareholders as they shall deem necessary, appropriate or convenient. Subject to such rules and regulations of the Board of Directors, if any, the chair of the meeting shall have the right and authority to prescribe such rules, regulations and procedures and to do all such acts as, in the judgment of such chair of the meeting, are necessary, appropriate or convenient for the proper conduct of the meeting. 2.14 Written Consent of Shareholders Without a Meeting. Whenever the shareholders are required or permitted to take any action by vote, such action may be taken without a meeting on written consent, setting forth the action so taken or to be taken, signed by the holders of all outstanding shares entitled to vote thereon. Such consent shall have the same effect as a unanimous vote of shareholders. ARTICLE III Directors 3.1 General Powers. Except as otherwise provided in the Certificate of Incorporation, the business of the Corporation shall be managed under the direction of its Board. The Board may adopt such rules and regulations, not inconsistent with the Certificate of Incorporation, the By-laws or

7 applicable laws, as it may deem proper for the conduct of its meetings and the management of the Corporation. In addition to the powers expressly conferred by the By-laws, the Board may exercise all powers and perform all acts which are not required, by the By-laws or the Certificate of Incorporation or by law, to be exercised and performed by the shareholders. 3.2 Number of Directors. The number of directors of the Corporation shall be as established from time to time (i) by the Board of Directors, by the affirmative vote of not less than seventy percent (70%) of the members of the entire Board, or (ii) by the shareholders of the Corporation. 3.3 Qualifications. Each Director shall, at the time of their election or appointment, be at least eighteen (18) years of age, but shall not have attained seventy-five (75) years of age (see also Section 3.20). 3.4 Election and Classification. 3.4.1 The entire Board of Directors shall be divided into three (3) classes of not less than three (3) members each, which classes are designated as Class A, Class B and Class C. The number of directors of Class A shall equal one-third (1/3) of the total number of directors as determined in the manner provided in the By-laws (with any fractional remainder to count as one); the number of directors of Class B shall equal one-third (1/3) of said total number of directors (or the nearest whole number thereto); and the number of directors of Class C shall equal said total number of directors minus the aggregate number of directors of Classes A and B. At the election of the first Board of Directors, the class of each of the members then elected shall be designated. The term of office of each member then designated as a Class A director shall expire at the annual meeting of shareholders next ensuing, that of each member then designated as a Class B director at the annual meeting of shareholders one year thereafter, and that of each member then designated as a Class C director at the annual meeting of shareholders two years thereafter. At each annual meeting of shareholders held after the election and classification of the first Board of Directors, directors to succeed those whose terms expire at such annual meeting shall be elected to hold office for a term expiring at the third succeeding annual meeting of shareholders and until their respective successors are elected and have qualified or until their respective earlier displacement from office by resignation, removal or otherwise. 3.4.2 Directors shall, except as otherwise required by law or by the Certificate of Incorporation, be elected by a plurality of the votes cast at a meeting of shareholders by the holders of shares entitled to vote in the election. Only persons who have been nominated in accordance with the following procedures shall be eligible for election as Directors of the Corporation. Nominations of persons for election to the Board may be made at any annual meeting of shareholders or special meeting of shareholders called and held for such express purpose (a) by or at the direction of the Board (or any duly authorized committee thereof) or (b) by any shareholder of the Corporation who (i) is a shareholder of record both on the date of the giving of the notice provided for in this Section 3.4.2 and on the record date for the determination of shareholders entitled to vote at such annual or special meeting, at the time of such meeting and at all times in between, and (ii) complies with the notice procedures set forth in this Section 3.4.2 and Regulation 14A of the Exchange Act, including, without limitation, Rule 14a-19. Such shareholder shall ensure that the proxy cards used by such shareholder to solicit proxies or votes in support of the nominees of such nomination are printed on a proxy card of any color but white, which such color shall be reserved for the exclusive use of the Board.

8 In addition to Regulation 14A of the Exchange Act, including, without limitation, Rule 14a-19 and any other applicable requirements, including those in these By- laws, for a nomination to be made by a shareholder in connection with an annual meeting of the shareholders, such shareholder must have given a timely notice of nomination in proper written form to the Secretary. To be timely given in the case of an annual meeting, a shareholder's notice of nomination to the Secretary must be delivered to or mailed and received at the principal executive offices of the Corporation not less than one hundred twenty (120) days prior to the anniversary date of the immediately preceding annual meeting of shareholders. To be timely given in the case of a special meeting called and held for such express purpose, a shareholder's notice of nomination to the Secretary must be delivered to or mailed and received at the principal executive offices of the Corporation not later than close of business on the tenth (10th) day following the date on which the notice of the special meeting was first mailed to shareholders or public disclosure of the date of the special meeting was made, whichever occurs first. In no event shall any adjournment, recess or postponement of an annual meeting or the announcement thereof commence a new time period for the giving of a shareholder’s notice as described above. To be in proper written form, a shareholder's notice of nomination to the Secretary must set forth (a) as to each person whom the shareholder proposes to nominate for election as a Director (i) the name, age, business address and residence address of such person, (ii) the principal occupation or employment of such person, (iii) the class or series and number of shares of capital stock of the Corporation which are owned beneficially or of record by such person, (iv) any other direct or indirect positions, agreements or understandings to which such person or any Associated Person of such person is a party (including hedged positions, short positions, options, derivatives, convertible securities and any other stock appreciation or voting interests) which provide the opportunity to profit or share in any profit derived from any increase or decrease in the value of the shares of the Corporation, (v) any voting commitments and a description of all arrangements, understandings or material relationships between the shareholder and each nominee and any other person or persons (naming such person or persons) pursuant to which the nominations are to be made by the shareholder or that otherwise affect the shares of the Corporation, and (vi) any other information relating to such person that may be required to be disclosed by the Corporation in connection with its solicitations of proxies for election of Directors pursuant to Section 14 of the Exchange Act and the rules and regulations promulgated thereunder, including, without limitation, Rule 14a-19, or as may be required in order to ascertain that the person meets any prerequisites contained in applicable law, the Corporation's Certificate of Incorporation or these By-laws for serving as a Director of the Corporation (such other information including, without limitation, such person’s consent, in writing and accompanying the notice, to being named in any applicable proxy statement as a nominee and to serving as a Director, if elected, and a completed questionnaire concerning such person’s business experience, beneficial ownership, relationships and transactions with the Corporation, independence and other matters typically contained in the Corporation’s questionnaire for Directors and officers); and (b) as to the shareholder giving such notice (i) the name and record address of such shareholder, (ii) the class or series and number of shares of capital stock of the Corporation which are owned beneficially or of record by such shareholder, (iii) a description of all arrangements or understandings between such shareholder and each proposed nominee and any other person or

9 persons (including their names) pursuant to which the nomination(s) are to be made by such shareholder, (iv) a representation that such shareholder (A) intends to solicit proxies from shareholders representing at least sixty-seven percent (67%) of the voting power of the shares entitled to vote on the election of Directors, in accordance with Rule 14a-19 under the Exchange Act, and shall include a statement to that effect on the proxy statement or the form of proxy of such shareholder; (B) shall otherwise comply with the requirements of Rule 14a- 19; (C) shall provide the Corporation, no later than five (5) business days prior to the applicable meeting of the shareholders, reasonable documentary evidence (as determined in good faith by the Corporation) that such shareholder has complied with such requirements of Rule 14a-19 under the Exchange Act; and (D) intends to appear in person or by proxy at the annual meeting to nominate the person or persons named in the notice of nomination, and (v) any other information relating to such shareholder that would be required to be disclosed by the Corporation in connection with its solicitations of proxies for election of Directors pursuant to Section 14 of the Exchange Act and the rules and regulations promulgated thereunder. No person shall be eligible for election as a Director of the Corporation unless nominated in accordance with the procedures set forth in this Section 3.4.2. If any of the foregoing information changes in any material respect from the date the notice is received through the date of the meeting, such shareholder shall promptly supplement such information to reflect such change by notice in writing and delivered to or mailed and received by the Secretary at the Corporation’s principal executive offices. For the avoidance of doubt, the obligation to update and supplement as set forth in this Section 3.4.2 or any other Section of these By- laws shall not limit the Corporation’s rights with respect to any deficiencies in any notice provided by a shareholder, extend any applicable deadlines hereunder or enable or be deemed to permit a shareholder who has previously submitted notice hereunder to amend or update any nomination or to submit any new nomination. In no event shall any adjournment or postponement of the related shareholder meeting or the announcement thereof commence a new time period for the giving of a shareholder’s notice as described above. If at any time such shareholder no longer intends to solicit proxies in accordance with the provisions of this Section 3.4.2 and Rule 14a-19 under the Exchange Act, including, without limitation, the requirement that such shareholder solicit proxies from shareholders representing at least sixty-seven percent (67%) of the voting power of the shares entitled to vote on the election of Directors, such shareholder shall notify the Corporation within three (3) business days of such change in intention. Subject to the rights of any holders of a class of preferred stock of the Corporation, no person shall be eligible for election as a Director unless nominated in accordance with the procedures set forth in this Section 3.4.2 and the requirements of Regulation 14A under the Exchange Act, including, without limitation, Rule 14a-19. Pursuant to Rule 14a-19 under the Exchange Act, a shareholder making such a nomination shall provide the Corporation, no later than three (3) business days prior to the applicable meeting of the shareholders, reasonable documentary evidence (as determined in good faith by the Corporation) that such shareholder has complied with such requirements of Rule 14a-19 under the Exchange Act. If the chair of the meeting properly determines in good faith that such a nomination was not made in accordance with the

10 procedures in this Section 3.4.2 and the requirements of Regulation 14A under the Exchange Act, including, without limitation, Rule 14a-19, the chair shall declare to the meeting that the nomination was defective and such defective nomination shall be disregarded. In the event that the Corporation receives votes or proxies for the nominees of such defective nomination, such votes or proxies shall be disregarded. 3.5 Newly Created Directorships and Vacancies. Newly created directorships resulting from an increase in the number of Directors and vacancies occurring in the Board for any reason, including the removal of Directors without cause, may be filled by vote of a majority of the Directors then in office, although less than a quorum, at any meeting of the Board, or may be elected by a plurality of the votes cast by the holders of shares entitled to vote in the election at a special meeting of shareholders called for that purpose. A Director elected to fill a vacancy shall hold office during the term to which their predecessor had been elected and until their successor shall have been elected and shall qualify, or until their earlier death, resignation or removal. 3.6 Resignations. Any Director may resign at any time by written notice to the Chair of the Board or the Secretary. Such resignation shall take effect at the time therein specified, and unless otherwise specified, the acceptance of such resignation shall not be necessary to make it effective. 3.7 Removal of Directors. The Entire Board, or less than the Entire Board, may be removed for cause by vote of the shareholders or by action of the Board. The Entire Board, or less than the Entire Board may be removed without cause only in the manner prescribed in the Certificate of Incorporation. 3.8 Compensation. Each Director, in consideration of their service as such, shall be entitled to receive from the Corporation such amount per annum or such fees for attendance at Directors' meetings, or both, as the Board may from time to time determine, together with reimbursement for the reasonable expenses incurred by them in connection with the performance of their duties. Each Director who shall serve as a member of any committee of the Board in consideration of their serving as such shall be entitled to such additional amount per annum or such fees for attendance at committee meetings, or both, as the Board may from time to time determine, together with reimbursement for the reasonable expenses incurred by them in the performance of their duties. Nothing in this Section contained shall preclude any Director from serving the Corporation or its subsidiaries in any other capacity and receiving proper compensation therefor. 3.9 Place and Time of Meetings of the Board. Meetings of the Board, regular or special, may be held at such times and places within or without the State of New York as the Board will by vote determine at its annual meeting, and may alter or amend from time to time. The times and places for holding meetings may be fixed from time to time by resolution of the Board or (unless contrary to resolution of the Board) in the notice of the meeting. The Board may, in its sole discretion, determine that meetings of the Board, regular or special, including, may be held solely by means of electronic communication. If, the Board, in its sole discretion, determines that a meeting be held solely by means of electronic communication, the platform or service of such meeting shall be the place of the meeting. 3.10 Annual Meetings. On the day when and at the place where the annual meeting of shareholders for the election of Directors is held, and as soon as practicable thereafter, the Board may hold its annual meeting, without notice of such meeting, for the purposes of organization, the election of officers and the transaction of other business. The annual meeting of the Board may be held at any other time and place specified in a notice given as provided in Section 3.12 of the By-laws for special meetings of the Board or in a waiver of notice thereof.

11 3.11 Regular Meetings. Regular meetings of the Board may be held at such times and places as may be fixed from time to time by the Board. Unless otherwise required by the Board, regular meetings of the Board may be held without notice. If any day fixed for a regular meeting of the Board shall be a Saturday or Sunday or a legal holiday at the place where such meeting is to be held, then such meeting shall be held at the same hour at the same place on the first business day thereafter which is not a Saturday, Sunday or legal holiday. 3.12 Special Meetings. Special meetings of the Board shall be held whenever called by the Chair of the Board, the Secretary or by any three (3) or more Directors. Notice of each special meeting of the Board shall, if mailed, be addressed to each Director at the address designated by them for that purpose or, if none is designated, at their last known address not later than twenty-four (24) hours before the date on which such meeting is to be held; or such notice shall be sent to each Director at such address by telegraph, Telex, TWX, cable, wireless, or similar means of communication, or be delivered to them personally, not later than the day before the date on which such meeting is to be held. Every such notice shall state the time and place of the meeting but need not state the purpose of the meeting, except to the extent required by law. If mailed, each notice shall be deemed given when deposited, with postage thereon prepaid, in the post office or official depository under the exclusive care and custody of the United States post office department. Such mailing shall be by first class mail. 3.13 Adjourned Meetings. A majority of the Directors present at any meeting of the Board, including an adjourned meeting, whether or not a quorum is present, may adjourn such meeting to another time and place. Notice of any adjourned meeting of the Board need not be given to any Director whether or not present at the time of the adjournment. Any business may be transacted at any adjourned meeting that might have been transacted at the meeting as originally called. 3.14 Waivers of Notice. Anything in these By-laws or in any resolution adopted by the Board to the contrary notwithstanding, notice of any meeting of the Board need not be given to any Director who submits a signed waiver of such notice, whether before or after such meeting, or who attends such meeting without protesting, prior thereto or at its commencement, the lack of notice to them. 3.15 Organization. At each meeting of the Board, the Chair of the Board, or a chair chosen by the majority of the Directors present, shall preside. The Secretary shall act as secretary at each meeting of the Board. In case the Secretary shall be absent from any meeting of the Board, an Assistant Secretary shall perform the duties of secretary at such meeting; and in the absence from any such meeting of the Secretary and Assistant Secretaries, the person presiding at the meeting may appoint any person to act as secretary of the meeting. 3.16 Quorum of Directors. A majority of the Directors shall constitute a quorum at any meeting of the Board. 3.17 Action by the Board. Except as otherwise provided in Section 3.18 of the By-laws, all corporate action taken by the Board shall be taken at a meeting of the Board. Except as otherwise provided herein, by the Certificate of Incorporation or by law, the vote of a majority of the Directors present at the time of the vote, if a quorum is present at such time, shall be the act of the Board. 3.18 Written Consent of Directors Without a Meeting. Any action required or permitted to be taken by the Board may be taken without a meeting if all members of the Board consent in writing to the adoption of a resolution authorizing the action. The written consent of a member of the Board may be made electronically through electronic mail, text, or any other secured platform for electronic communications, provided that the transmission provides sufficient information such it can be reasonably determined that the transmission was authorized by such member. The resolution and the written consents thereto by the members of the Board shall be filed with the minutes of the proceedings of the Board.

12 3.19 Participation in Meeting of Board by Means of Conference Telephone or Similar Communications Equipment. Any one or more members of the Board may participate in a meeting of the Board by means of a conference telephone or similar communications equipment allowing all persons participating in the meeting to hear each other at the same time. Participation by such means shall constitute presence in person at a meeting. 3.20 Retirement of Directors. Any Director who shall have attained the age of seventy-five (75) during their term of office shall retire from the Board at the first annual meeting of shareholders held after their birth date. ARTICLE IV Executive Committee and Other Committees 4.1 How Constituted and Powers. The Board shall, by resolution adopted by a majority of the Entire Board, designate from among its members an Executive Committee of three (3) or more members which shall have all the authority of the Board, except that it shall have no authority as to the following matters. 4.1.1 The submission to shareholders of any matter that needs shareholders' approval; 4.1.2 The filling of vacancies in the Board or in any committee; 4.1.3 The fixing of compensation of the Directors for serving on the Board or on any committee; 4.1.4 The amendment or repeal of the By-laws, or the adoption of new By-laws; 4.1.5 The amendment or repeal of any resolution of the Board which includes among its terms a provision that it is not so amendable or repealable. The Board, by resolution adopted by a majority of the Entire Board, may designate from among its members other committees, each consisting of three (3) or more Directors, which shall have the authority provided in such resolution. The vote of the chair of the Executive Committee shall be the deciding vote in the event that there is a tie in any vote held by the committees. 4.2 General. Any committee designated by the Board pursuant to Section 4.1 of the By-laws, and each of the members and alternate members thereof, shall serve at the pleasure of such committee, who may replace any absent member or members at any meeting of such committee. All corporate action taken by any committee designated by the Board pursuant to Section 4.1 of the By-laws shall be taken at a meeting of such committee except that any action required or permitted to be taken by any committee may be taken without a meeting if all members of the committee consent in writing to the adoption of a resolution authorizing the action. The written consent of a committee member may be made electronically through electronic mail, text, or any other secured platform for electronic communications, provided that the transmission provides sufficient information such it can be reasonably determined that the transmission was authorized by such member. The resolution and the written consents thereto by the members of the committee shall be filed with the minutes of the proceedings of the committee. Any one (1) or more members of any committee may participate in a meeting of such committee by means of conference telephone or similar communications equipment allowing all persons participating in the meeting to hear each other at the same time. Participation by such means shall constitute presence in person at a meeting. Any committee may adopt such rules and regulations, not

13 inconsistent with the Certificate of Incorporation, the By-laws, applicable laws or resolution of the Board designating such committee, as it may deem proper for the conduct of its meetings and the exercise by it of the authority of the Board conferred upon such committee by the resolution of the Board designating such committee. ARTICLE V Officers 5.1 Officers. The Board may elect or appoint a Chair of the Board, President, one (1) or more Vice Presidents, a Secretary and a Treasurer, and such other officers as it may determine. All officers shall be elected or appointed to hold offices until the meeting of the Board following the next annual meeting of shareholders. The Board may designate one (1) or more Vice Presidents as “Executive Vice Presidents,” and may use descriptive words or phrases to designate the standing, seniority or area of special competence of the Vice Presidents elected or appointed by it. Each officer shall hold office for the term for which they are elected or appointed, and until their successor shall have been elected or appointed and qualified or until their death, their resignation or their removal in the manner provided in Section 5.2 of the By-laws. Any two (2) or more offices may be held by the same person, except the offices of President and Secretary; provided, however, that if all of the issued and outstanding shares of the Corporation are owned by one person, such person may hold all or any combination of offices. The Board may require any officers to give a bond or other security for the faithful performance of their duties, in such amount and with such sureties as the Board may determine. All officers as between themselves and the Corporation shall have such authority and perform such duties in the management of the Corporation as may be provided in the By-laws or as the Board may from time to time determine. 5.2 Removal of Officers. Any officer elected or appointed by the Board may be removed by the Board with or without cause. The removal of an officer without cause shall be without prejudice to their contract rights, if any. The election or appointment of an officer shall not of itself create contract rights. 5.3 Resignations. Any officer may resign at any time by notifying the Board or the Chair of the Board or the Secretary in writing. Such resignation shall take effect at the date of receipt of such notice or at such later time as is therein specified, and, unless otherwise specified, the acceptance of such resignation shall not be necessary to make it effective. The resignation of an officer shall be without prejudice to the contract rights of the Corporation, if any. 5.4 Vacancies. A vacancy in any office because of death, resignation, removal, disqualification or any other cause may be filled for the unexpired portion of the term by the Board at any regular or special meeting of the Board. 5.5 Compensation. Salaries or other compensation of the officers may be fixed from time to time by the Board. No officer shall be prevented from receiving a salary or other compensation by reason of the fact that they are also a Director. 5.6 Chair of the Board. The Chair of the Board shall preside at all meetings of the shareholders and Directors, and shall have such other duties as may be assigned to him from time to time by the Board. Unless the Board otherwise determines, the Chair of the Board shall be the chief executive officer and head of the Corporation. Under the supervision of the Board and of the Executive Committee, the chief executive officer shall have the general control and management of its business and affairs, subject, however, to the right of the Board and of the executive committee to confer any specific power, except such as may be by statute exclusively conferred on the chief executive officer, upon any other officer or officers of the Corporation. The chief executive

14 officer shall perform and do all acts and things incident to the position of chief executive officer and such other duties as may be lawfully assigned from time to time by the Board or the Executive Committee. 5.7 President. The President shall perform such duties as may be assigned from time to time by the Board, by the executive committee or by the Chair of the Board. Unless the Board otherwise determines, the President shall be chief operating officer of the Corporation. They shall have such responsibilities as are assigned by the Board. In the event the President is designated as chief executive officer by the Board, the President shall have and possess all of the powers and discharge all of the duties of the chief executive officer, subject to the control of the Board and the executive committee. 5.8 Vice Presidents. At the request of the Chair of the Board, or in their absence, at the request of the President, or in their absence, at the request of the Board, a Vice President shall (in such order as may be designated by the Board) perform all of the duties of the President and, so acting, shall have all the powers of and be subject to all restrictions upon the President. Any Vice President may also, with the Secretary or the Treasurer or an Assistant Secretary or an Assistant Treasurer, sign certificates for shares of the Corporation; may sign and execute, in the name of the Corporation, deeds, mortgages, bonds, contracts or other instruments authorized by the Board, except in cases where the signing and execution thereof shall be expressly delegated by the Board or by the By-laws to some other officer or agent of the Corporation, or shall be required by law otherwise to be signed or executed; and shall perform such other duties as from time to time may be assigned by the Board or by the Chair of the Board, or in their absence, by the President. 5.9 Secretary. The Secretary, if present, shall act as secretary of all meetings of the shareholders and of the Board, and shall keep the minutes thereof in the proper book or books to be provided for that purpose; they shall see that all notices required to be given by the Corporation are duly given and served; they may, with the Chair of the Board, the President or a Vice President, sign certificates for shares of the Corporation; they shall be custodian of the seal of the Corporation and may seal with the seal of the Corporation or a facsimile thereof, all certificates for shares of the Corporation and all documents the execution of which on behalf of the Corporation under its corporate seal is authorized in accordance with the provisions of the By-laws; they shall have charge of the share records and also of the other books, records and papers of the Corporation relating to its organization and management as a Corporation, and shall see that the reports, statements and other documents required by law are properly kept and filed; and shall, in general perform all the duties incident to the office of Secretary and such other duties as from time to time may be assigned by the Board or by the Chair of the Board, or in their absence, by the President. 5.10 Treasurer. The Treasurer shall have charge and custody of, and be responsible for, all funds, securities and notes of the Corporation; receive and give receipts for monies due and payable to the Corporation from any sources whatsoever; deposit all such monies in the name of the Corporation in such banks, trust companies or other depositories as shall be selected in accordance with these By-laws; against proper vouchers, cause such funds to be disbursed by checks or drafts on the authorized depositories of the Corporation signed in such manner as shall be determined in accordance with any provisions of the by-laws, and be responsible for the accuracy of the amounts of all monies so disbursed; regularly enter or cause to be entered in books to be kept by them, under their direction, full and adequate account of all monies received or paid by the account of the Corporation; have the right to require, from time to time, reports or statements giving such information as they may desire with respect to any and all financial transactions of the Corporation from the officers or agents transacting the same; render to the Chair of the Board or the Board, whenever the Chair of the Board or the Board, respectively, shall require them so to do, an account of the financial condition of the Corporation and of all their transactions as Treasurer; exhibit at all reasonable times their books of account and other records

15 to any of the Directors upon application at the office of the Corporation where such books and records are kept; and, in general, perform all the duties incident to the office of Treasurer and such other duties as from time to time may be assigned by the Board or by the Chair of the Board, or in their absence, by the President; and they may sign with the Chair of the Board or the President or a Vice President certificates for shares of the Corporation. 5.11 Assistant Secretaries and Assistant Treasurers. Assistant Secretaries and Assistant Treasurers shall perform such duties as shall be assigned to them by the Secretary or by the Treasurer, respectively, or by the Board of by the Chair of the Board or in their absence, by the President. Assistant Secretaries and Assistant Treasurers may, with the Chair of the Board or President or a Vice President, sign certificates for shares of the Corporation. ARTICLE VI Contracts, Checks, Drafts, Bank Accounts, Etc. 6.1 Execution of Contracts. The Board may authorize any officer, employee or agent, in the name and on behalf of the Corporation, to enter into any contract or execute and satisfy any instrument, and any such authority may be general or confined to specific instances, or otherwise limited. 6.2 Loans. The Chair of the Board or any other officer, employee or agent authorized by the By-laws or by the Board may effect loans and advances at any time for the Corporation from any bank, trust company or other institution or from any firm, Corporation or individual and for such loans and advances may make, execute and deliver promissory notes, bonds or other certificates or evidences of indebtedness of the Corporation, and when authorized so to do may pledge and hypothecate or transfer any securities or other property of the Corporation as security for any such loans or advances. Such authority conferred by the Board may be general or confined to specific instances or otherwise limited. 6.3 Checks, Drafts, Etc. All checks, drafts and other orders for the payment of money out of the funds of the Corporation and all notes or other evidences of indebtedness of the Corporation shall be signed on behalf of the Corporation in such manner as shall from time to time be determined by resolution of the Board. 6.4 Deposits. The funds of the Corporation not otherwise employed shall be deposited from time to time to the order of the Corporation in such banks, trust companies or other depositories as the Board may select or as may be selected by an officer, employee or agent of the Corporation to whom such power may from time to time be delegated by the Board. ARTICLE VII Shares and Dividends 7.1 Certificates Representing Shares. The shares of the Corporation shall be represented by certificates in such form (consistent with the provisions of Section 508 of the Business Corporation Law) as shall be approved by the Board. Such certificates shall be signed by the Chair of the Board or the President or a Vice President and by the Secretary or an Assistant Secretary or the Treasurer or an Assistant Treasurer, and may be sealed with the seal of the Corporation or a facsimile thereof. The signatures of the officers upon a certificate may be facsimiles, if the certificate is countersigned by a transfer agent or registered by a registrar other than the Corporation itself or its employee. In case any officer who has signed or whose facsimile signature has been placed upon any certificate shall have ceased to be such officer before such

16 certificate is issued, such certificate may, unless otherwise ordered by the Board, be issued by the Corporation with the same effect as if such person were such officer at the date of issue. 7.2 Transfer of Shares. Transfers of shares shall be made only on the books of the Corporation by the holder thereof or by their duly authorized attorney appointed by a power of attorney duly executed and filed with the Secretary or a transfer agent of the Corporation, and on surrender of the certificate or certificates representing such shares properly endorsed for transfer and upon payment of all necessary transfer taxes. Every certificate exchanged, returned or surrendered to the Corporation shall be marked “Canceled”, with the date of cancellation, by the Secretary or an Assistant Secretary or the transfer agent of the Corporation. A person in whose name shares shall stand on the books of the Corporation shall be deemed the owner thereof to receive dividends, to vote as such owner and for all other purposes as respects the Corporation. No transfer of shares shall be valid as against the Corporation, its shareholders and creditors for any purpose, except to render the transferee liable for the debts of the Corporation to the extent provided by law, until such transfer shall have been entered on the books of the Corporation by an entry showing from and to whom transferred. 7.3 Transfer and Registry Agents. The Corporation may from time to time maintain one or more transfer offices or agents and registry offices or agents at such place or places as may be determined form time to time by the Board. 7.4 Lost, Destroyed, Stolen and Mutilated Certificates. The holder of any shares shall immediately notify the Corporation of any loss, destruction, theft or mutilation of the certificate representing such shares, and the Corporation may issue a new certificate to replace the certificate alleged to have been lost, destroyed, stolen or mutilated. The Board may, in its discretion, as a condition to the issue of any such new certificate, require the owner of the lost, destroyed, stolen or mutilated certificate, or their legal representatives, to advertise such fact in such manner as the Board may require, and to give the Corporation and its transfer agents and registrars, or such of them as the Board may require, a bond in such form, in such sums and with such surety or sureties as the board may direct, to indemnify the Corporation and its transfer agents and registrars against any claim that may be made against any of them on account of the continued existence of any such certificate so alleged to have been lost, destroyed, stolen or mutilated and against any expense in connection with such claim. 7.5 Regulations. The Board may make such rules and regulations as it may deem expedient, not inconsistent with the By-laws or with the Certificate of Incorporation, concerning the issue, transfer and registration of certificates representing shares. 7.6 Limitation on Transfers. If any two or more shareholders or subscribers for shares shall enter into any agreement whereby the rights of any one or more of them to sell, assign, transfer, mortgage, pledge, hypothecate, or transfer on the books of the Corporation, any or all of such shares held by them shall be abridged, limited or restricted, and if a copy of such agreement shall be filed with the Corporation and shall contain a provision that the certificates representing shares covered or affected by said agreement shall have such reference thereto endorsed thereon; and such shares shall not thereafter be transferred on the books of the Corporation except in accordance with the terms and provisions of such agreement. 7.7 Dividends, Surplus, Etc. Subject to the provisions of the Certificate of Incorporation and of law, the Board: 7.7.1 May declare and pay dividends or make other distributions on the outstanding shares in such amounts and at such time or times as, in its discretion, the condition of the affairs of the Corporation shall render advisable;

17 7.7.2 May use and apply, in its discretion, any of the surplus of the Corporation in purchasing or acquiring any shares of the Corporation, or purchase warrants therefor, in accordance with law, or any of its bonds, debentures, notes, scrip or other securities or evidences of indebtedness; 7.7.3 May set aside from time to time out of such surplus or net profits such sum or sums as, in its discretion, it may think proper, as a reserve fund to meet contingencies, or for equalizing dividends or for the purpose of maintaining or increasing the property or business of the Corporation, or for any other purpose it may think conducive to the best interests of the Corporation. ARTICLE VIII Indemnification 8.1 Indemnification of Others. The Board in its discretion shall have power on behalf of the Corporation to indemnify any person, other than a Director or officer, made a party to any action, suit or proceeding by reason of the fact that they, their testator or intestate, is or was an employee of the Corporation. 8.2 Insurance. The Board in its discretion shall have the power to purchase and maintain insurance in accordance with, and subject to, the provisions of Section 726 of the Business Corporation Law. ARTICLE IX Books and Records 9.1 Books and Records. The Corporation shall keep correct and complete books and records of account and shall keep minutes of the proceedings of the shareholders, Board and Executive Committee, if any. The Corporation shall keep at the office designated in the Certificate of Incorporation or at the office of the transfer agent or registrar of the Corporation in New York State, a record containing the names and addresses of all shareholders, the number and class of shares held by each and the dates when they respectively became the owners of record thereof. Any of the foregoing books, minutes or records may be in written form or in any other form capable of being converted into written form within a reasonable time. 9.2 Inspection of Books and Records. Except as otherwise provided by law, the Board shall determine from time to time whether, and, if allowed, when and under what conditions and regulations, the accounts, books, minutes and other records of the Corporation, or any of them, shall be open to the inspection of the shareholders. ARTICLE X Seal The Board may adopt a corporate seal which shall be in the form of a circle and shall bear the full name of the Corporation and the year of its incorporation.

18 ARTICLE XI Fiscal Year The fiscal year of the Corporation shall be determined, and may be changed, by resolution of the Board. ARTICLE XII Voting of Shares Held Unless otherwise provided in Section 3.17 hereof or by resolution of the Board, the Chair of the Board or in their absence the President may, from time to time, appoint one or more attorneys or agents of the Corporation, in the name and on behalf of the Corporation, to cast as a shareholder or otherwise in any other Corporation, any of whose shares or securities may be held by the Corporation, at meetings of the holders of the shares or other securities of such other Corporation, and to consent in writing to any action, by any such other Corporation, and may instruct the person or persons so appointed as to the manner of casting such votes or giving such consent, and may execute or cause to be executed on behalf of the Corporation and under its corporate seal, or otherwise, such written proxies, consents, waivers or other instruments as they may deem necessary and proper in the premises; or the Chair of the Board or in their absence, the President, may attend any meeting of the holders of the shares or other securities of any other such Corporation and thereat vote or exercise any or all other powers of the Corporation as the holder of such shares or other securities of such other Corporation. ARTICLE XIII Amendments The By-laws may be altered, amended, supplemented or repealed, or new By-laws may be adopted, by vote of the holders of a majority of the shares of the Corporation entitled to vote in the election of Directors or by vote of a majority of the Board; provided, however, that any alteration, amendment, supplement or repeal of (1) Section 3.4.1 of these By-laws may only be amended in the manner prescribed by the Certificate of Incorporation, (2) Section 3.4.2 of these By-laws or of this proviso to Article XIII of the By-laws, shall require the vote of not less than eighty percent (80%) of the shares entitled to vote in the election of Directors, or the vote of at least eighty percent (80%) of the Entire Board, for approval and (3) Section 3.2 or Section 4.1 of these By-laws shall require the vote of not less than seventy percent (70%) of the Entire Board for approval. If any By-law regulating an impending election of Directors is adopted, altered, amended, supplemented or repealed by the Board, such By-law shall be set forth in the notice of the next meeting of shareholders for election of Directors, together with a concise statement of the changes made. Any By-laws adopted, altered, amended, or supplemented by the Board may be altered, amended, supplemented or repealed by the shareholders entitled to vote thereon.

| | | | | |

| 250 Glen Street

Glens Falls, NY 12801 |

NASDAQ® Symbol: "AROW"

Website: arrowfinancial.com

Media Contact: Rachael Murray

Tel: (518) 415-4313

|

Arrow Reports 4th Quarter Net Income of $7.7 Million or $0.46 per Share and $30.1 Million or $1.77 per Share for 2023. Declares Cash Dividend of $0.27 per Share, its 43rd Consecutive Quarterly Dividend

GLENS FALLS, N.Y. (February 1, 2024) – Arrow Financial Corporation (NasdaqGS® – AROW) ("Arrow") reported net income of $7.7 million, and fully diluted earnings per share ("EPS") of $0.46 per share for the fourth quarter of 2023, versus $12.1 million and EPS of $0.71, for the same period in 2022. For the year ended 2023, net income totaled $30.1 million, with EPS of $1.77, versus $48.8 million, and EPS of $2.86, for the same period in 2022.

The Board of Directors of Arrow declared a quarterly cash dividend of $0.27 per share payable February 23, 2024 to shareholders of record as of February 12, 2024. This marks the 43rd consecutive quarterly cash dividend declared by Arrow.

This Earnings Release and related commentary should be read in conjunction with our February 1, 2024 Form 8-K and related Fourth Quarter 2023 Investor Presentation, which can also be found on our website: arrowfinancial.com/documents/investor-presentations.

Arrow President and CEO David S. DeMarco:

“As we reflect on a challenging year, I want to thank our employees who continued to diligently serve the needs of our customers, communities and shareholders. Arrow finished the year with robust loan growth, posting record high loan balances while maintaining strong credit, capital and liquidity positions. We also expanded our existing stock repurchase program by $5 million and reinstated our dividend reinvestment program. Our solid finish to the year is directly attributable to the hard work and dedication of our exceptional team."

Highlights and Key Metrics

•Loans reached a record of $3.2 billion, an increase of $224 million (7.5%) for the year and $68 million (9% annualized growth) during the fourth quarter1

•Fourth-quarter loan yields increased by 16bps from the prior quarter to 4.86%, while loan rates reached 5.01% at December 31, 2023

•Retail deposit balances of $3.5 billion, slightly ahead of year-end 2022

•Net interest margin was 2.53% for the quarter, and 2.65% for the full year (2.55% and 2.67% on a full tax equivalent basis, respectively)

•Sold all 27,771 of Visa Class B shares for a pre-tax gain of $9.3 million; Recognized a pre-tax loss of $9.2 million on repositioning of investment portfolio (sale of ~$110 million of securities); Reinvestment of proceeds resulted in annual interest income run-rate improvement of over $3 million

•Net charge-offs remained low at 0.05% for the quarter

•Tangible Book Value at year-end was $21.06, an increase from $19.37 from the prior year

•Nonperforming assets increased to $21.5 million or 0.51% of period-end assets, primarily due to one large loan relationship of approximately $15 million, which is well collateralized

1 Excludes $5.8 million Fair Value hedge adjustment

Please see below for further quarter- and year-end detail.

Income Statement

•Net Income: Net income for 2023 was $30.1 million, down from $48.8 million for 2022. The decrease from the prior year was primarily the result of a decrease in net interest income of $13.5 million and an increase of non-interest expense of $11.5 million, partially offset by a $1.4 million decrease in the provision for credit loss and a $6.7 million decrease in the provision for income taxes.

•Net Interest Income: Net interest income for the year ended December 31, 2023 was $104.8 million, a decrease of $13.5 million, or 11.4%, from the prior year, primarily due to an increase in interest expense. Interest and fees on loans were $142.0 million, an increase of 25.7% from the $113.0 million for the year ended December 31, 2022. The increase was primarily driven by loan growth and higher loan rates. Interest expense for the year ended December 31, 2023 was $57.7 million. This represents an increase of $46.4 million, or 410.5%, from the $11.3 million in expense for the prior-year period. The increase was driven primarily by higher deposit rates and changes in deposit composition.