As filed with the Securities and Exchange Commission on ______ __, 2023

Registration No. 333-_____

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________

FORM S‑8

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

_____________________________________________

ARROW FINANCIAL CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | 250 Glen Street | | |

| | Glens Falls, New York 12801 | | |

| NEW YORK | | Telephone: (518) 745-1000 | | 22-2448962 |

| (State or other jurisdiction of incorporation or organization) | | (Address of Principal Executive Offices) | | (I.R.S. Employer |

| | | | |

ARROW FINANCIAL CORPORATION 2023 EMPLOYEE STOCK PURCHASE PLAN

(Full title of the plan)

DAVID S. DEMARCO

PRESIDENT AND CHIEF EXECUTIVE OFFICER

ARROW FINANCIAL CORPORATION

250 GLEN STREET

GLENS FALLS, NEW YORK 12801

Telephone: (518) 415-4526

(Name, address and telephone numbers,

including area code, of agent for service)

Copy to:

Michele C. Kloeppel, ESQ.

Thompson Coburn LLP

One US Bank Plaza

St. Louis, Missouri 63101

Telephone: (314) 552-6170

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ☐ Accelerated filer ☑

Non-accelerated filer ☐ Smaller reporting company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY NOTE

Arrow Financial Corporation (the “Registrant,” the “Company” or “Arrow”) hereby files this Registration Statement on Form S-8 relating to three hundred thousand (300,000) shares of the Registrant’s Common Stock, $1.00 par value, issuable to participants under the Arrow Financial Corporation 2023 Employee Stock Purchase Plan (the “Plan”).

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The document(s) containing the information specified in this Part I will be sent or given to participants in the Plan as specified by Rule 428(b)(1) under the Securities Act of 1933, as amended (the “Securities Act”). Such documents need not be filed with the Commission either as part of this registration statement or as prospectuses or prospectus supplements pursuant to Rule 424 under the Securities Act. These documents and the documents incorporated by reference in the registration statement pursuant to Item 3 of Part II of this Form, taken together, constitute a prospectus that meets the requirements of Section 10(a) of the Securities Act.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents filed with the Securities and Exchange Commission (the “Commission”) by the Registrant are incorporated herein by reference:

(a) The Registrant’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022,

filed July 18, 2023;

(b) The Registrant’s Quarterly Reports on Form 10-Q for the quarters ended March 31, 2023, filed July 27, 2023, and June 30, 2023, filed August 8, 2023 and September 30, 2023, filed November 9, 2023;

(c) The Registrant’s Current Reports on Form 8-K (specifically excluding the information furnished under Items 2.02 and 7.01 and any exhibits furnished thereto), filed January 30, 2023, February 6, 2023, February 23, 2023, April 5, 2023, May 3, 2023, May 15, 2023, June 5, 2023, July 21, 2023, July 24, 2023, July 27, 2023, July 28, 2023, July 31, 2023, August 8, 2023 and August 31, 2023, October 24, 2023, October 25, 2023, October 26, 2023, October 27, 2023 and December 4, 2023; and

(d) The description of the Registrant’s common stock which is contained in the Registration Statement on Form 8-A filed by the Registrant under Section 12 of the Exchange Act, including any amendments or reports filed for the purpose of updating such description.

We specifically note that the December 4, 2023 Form 8-K referenced above disclosed a two-part balance sheet repositioning strategy as follows:

"During the week of November 27, 2023, Arrow sold all 27,771 shares of Visa Class B common shares it previously held (the “Visa Sale”) for a pre-tax gain of approximately $9.3 million.

Concurrently, the Company also executed a balance sheet repositioning of its available-for-sale securities portfolio (the “Repositioning”). The Company sold approximately $100 million of lower-yielding securities, resulting in an approximate pre-tax loss of $9.2 million. The proceeds were reinvested in higher yielding available for sale securities and federal funds.

On an annualized basis, the positive spread differential of about 3% between the sold securities and the new investments is expected to generate approximately $3 million in pre-tax earnings.

The combined impact of the gain generated from the Visa Sale and the loss generated from the Repositioning is expected to have a positive impact on consolidated shareholders’ equity and book value per share equal to the after-tax impact of the gain realized on the Visa Sale.

Regulatory Risk-Based-Capital ratios will improve as the new investments carry a lower risk weighting than the securities that were sold. Non-risk-based capital ratios are not materially impacted by these transactions.

Arrow expects the above transactions to be accretive to earnings, net interest margin and return on assets in future periods."

All documents filed by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, after the date of this Registration Statement and prior to the filing of a post-effective amendment which indicates that all securities offered hereby have been sold or which deregisters all securities remaining unsold, shall be deemed to be incorporated by reference in this Registration Statement and to be made a part hereof from the date of filing of such documents. Any statements contained herein or in a document incorporated herein by reference shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained in a subsequently filed document incorporated herein by reference modifies or supersedes such document. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

Where any document or part thereof is incorporated by reference in this Registration Statement, the Registrant will provide without charge to each person to whom a prospectus with respect to the Plan is delivered, upon written or oral request of such person, a copy of any and all of the information incorporated by reference in this Registration Statement, excluding exhibits unless such exhibits are specifically incorporated by reference.

Item 4. Description of Securities.

The class of securities to be offered is registered under Section 12 of the Exchange Act.

Item 5. Interests of Named Experts and Counsel.

Not applicable.

Item 6. Indemnification of Directors and Officers.

Sections 721-726 of the New York Business Corporation Law generally provide for or permit a corporation to indemnify the directors and officers against liabilities they may incur in such capacities provided certain standards are met, including good faith and the reasonable belief that the particular action was in, or not opposed to, the best interests of the corporation.

The Registrant’s Certificate of Incorporation provides that directors and officers of the Registrant shall be indemnified, to the fullest extent permitted by the Business Corporation Law, against judgments, fines, amounts paid in settlement and reasonable expenses (including attorneys’ fees) incurred by them in connection with actions to which they are, or are threatened to be made, parties. If a director or officer is not successful in the defense of an action, he or she is entitled to indemnification, under the Registrant’s Certificate of Incorporation and the relevant provisions of law, if ordered by a court or if the Board of Directors, acting by a majority vote of a quorum of disinterested directors or upon the written opinion of independent legal counsel, determines that the director or officer acted in good faith for a purpose which he or she reasonably believed to be in the best interests of the Registrant, and, in criminal actions, had no reasonable cause to believe his or her conduct was unlawful. In connection with actions by or in the right of the Registrant (derivative suits) as to which the director or officer is not successful, indemnification is permitted for expenses and amounts paid in settlement only if and to the extent that a court of competent jurisdiction deems proper, and indemnification for adverse judgments is not permitted.

Under the Registrant’s Certificate of Incorporation and applicable provisions of law, the Board of Directors or the Registrant may advance expenses to a director or officer before final disposition of an action or proceeding upon receipt of an undertaking by the director or officer to repay the amount advanced if he is ultimately found not to be entitled to indemnification with respect thereto.

The Registrant’s Certificate of Incorporation also provides that to the fullest extent permitted by law, subject only to the express prohibitions on limitation of liability set forth in Section 402(b) of the Business Corporation Law, a director of the Registrant shall not be liable to the Registrant or its shareholders for monetary damages for any breach of duty as a director.

Pursuant to policies of directors’ and officers’ liability insurance, the directors and officers of the Registrant and its subsidiary banks are insured, subject to the limits, exceptions and other terms and conditions of such policy, against liability for claims made against them for any actual or alleged error or misstatement or misleading statement or act or omission or neglect or breach of duty while acting in their individual or collective capacities as directors or officers of such entities.

Item 7. Exemption From Registration Claimed.

Not applicable.

Item 8. Exhibits.

The following exhibits are filed as part of this Registration Statement.

EXHIBIT INDEX | | | | | |

| Exhibit No. | |

| 3.1 | |

| 3.2 | |

| 4.1 | |

| 4.2 | |

| 4.3 | |

| 4.4 | |

| 4.5 | Amended and Restated Trust Agreement among the Registrant, as Depositor, Wilmington Trust Company, as Property Trustee, Wilmington Trust Company, as Delaware trustee, and certain Administrators named therein, dated as of December 28, 2004, relating to Arrow Capital Statutory Trust III, incorporated herein by reference from the Registrant’s Annual Report on Form 10-K for the year ended December 31, 2004, Exhibit 4.6 |

| 4.6 | |

| 4.7 | |

| 4.8 | |

| 4.9* | |

| 5.1* | |

| 15* | |

| 23.1* | |

| 23.2 | |

| 24.1 | |

| 107* | |

Item 9. Undertakings.

(a) The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers and sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement

Provided, however, that paragraphs (a)(1)(i) and (a)(1)(ii) of this section do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Securities and Exchange Commission by the Company pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(b) The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission

such indemnification is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act of 1933 and will be governed by the final adjudication of such issue.

SIGNATURES

The Registrant. Pursuant to the requirements of the Securities Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Glens Falls, State of New York, on December 7, 2023

ARROW FINANCIAL CORPORATION

By: /s/ David S. DeMarco

David S. DeMarco,

President and Chief Executive Officer

POWER OF ATTORNEY

We, the undersigned officers and directors of Arrow Financial Corporation, hereby severally and individually constitute and appoint David S. DeMarco and Penko K. Ivanov, and each of them, the true and lawful attorneys and agents of each of us to execute in the name, place and stead of each of us (individually and in any capacity stated below) any and all amendments (including post-effective amendments) to this Registration Statement on Form S-8 and all instruments necessary or advisable in connection therewith and to file the same with the Securities and Exchange Commission, each of said attorneys and agents to have the power to act with or without the other and to have full power and authority to do and perform in the name and on behalf of each of the undersigned every act whatsoever necessary or advisable to be done in the premises as fully and to all intents and purposes as any of the undersigned might or could do in person, and we hereby ratify and confirm our signatures as they may be signed by our said attorneys and agents and each of them to any and all such amendments and instruments.

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities and on the dates indicated.

| | | | | | | | |

| Name | Title | Date |

/s/ David S. DeMarco David S. DeMarco | President, Chief Executive Officer and Director (Principal Executive Officer) | December 7, 2023 |

/s/ Penko K. Ivanov Penko K. Ivanov | Senior Executive Vice President, Chief Financial Officer, Treasurer and Chief Accounting Officer (Principal Financial Officer and Principal Accounting Officer) | December 7, 2023 |

/s/ William L. Owens William L. Owens | Chairman and Director | December 7, 2023 |

/s/ Mark L. Behan

Mark L. Behan | Director | December 7, 2023 |

/s/ Tenée R. Casaccio Tenée R. Casaccio | Director | December 7, 2023 |

/s/ Gregory J. Champion Gregory J. Champion | Director | December 7, 2023 |

/s/ Gary C. Dake Gary C. Dake | Director | December 7, 2023 |

/s/ David G. Kruczlnicki David G. Kruczlnicki | Director | December 7, 2023 |

/s/ Elizabeth A. Miller Elizabeth A. Miller | Director | December 7, 2023 |

/s/ Raymond F. O’Conor Raymond F. O’Conor | Director | December 7, 2023 |

/s/ Colin L. Read, Ph.D. Colin L. Read, Ph.D. | Director | December 7, 2023 |

Ex. 107 Security Type Security Class Title Fee Calculati on Rule Amount Registered Proposed Maximum Offering Price Per Unit Maximum Aggregate Offering Price Fee Rate $0.00014760 ($147.60/ Equity million dollars (3) registered) 7,920,000.00$ 1,168.99$ $ - (4) 1,168.99$ (4) See “Table 2: Fee Offset Claims and Sources” to this Exhibit 107 for information related to the fee offset. Registrant or Filer Name Form or Type of Filing File Number Initial Filing Date Filing Date Fee Offset Claimed Security Title Associat ed with Fee Offset Claimed Unsold Securities Associated with Fee Offset Claimed Unsold Aggregate Offering Amount Associate d with Fee Offset Claimed Fee Paid with Fee Offset Source Fee Offset Claims Fee Offset Sources Total Offering Amounts Total Fee Offsets Net Fee Due Rule 457(p) Table 1: Newly Registered Common stock, par value $1.00 per share 457(c) and 457(h) 300,000 (1) $26.40 (2) $ 7,920,000.00 $ 1,168.99 Amount of Registration Fee (3) Rounded up to the nearest cent. (1) Represents shares of common stock, par value $1.00 per share (the “Common Stock”), of Arrow Financial Corporation, a New York corporation (the “Registrant”), underlying the Arrow Financial Corporation 2023 Employee Stock Purchase Plan. Pursuant to Rule 416(a), the amount to be registered also includes an indeterminate number of additional securities that may be offered or issued in connection with any stock split, stock dividend or similar transaction. (2) Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) and Rule 457(h) promulgated under the Securities Act, using the average of the high and low prices as reported on as reported on the Nasdaq Global Select Market on December 4, 2023 and rounded up to the nearest cent. Security Type Associated with Fee Offset Claimed

Arrow Financial Corporation

2023 Employee Stock Purchase Plan

(adopted October 25, 2023)

1. Purpose.

a. The general purpose of the Arrow Financial Corporation 2023 Employee Stock Purchase Plan (the “Plan”) is to provide certain persons employed by or rendering services to Arrow Financial Corporation (the “Company”) or its direct or indirect subsidiaries (“Subsidiaries”) with an incentive to work for the continued success of the Company by encouraging them to acquire a proprietary interest in the Company in the form of the Company’s common stock, $1.00 par value (“Common Stock”). The Plan is also intended to help the Company and its Subsidiaries retain the services of such persons and attract additional qualified personnel. The Plan is a stock purchase plan that is intended to satisfy all requirements of Section 423 of the Internal Revenue Code of 1986, as amended (the “Code”).

b. The Plan shall become effective on January 1, 2024 (the “Effective Date”).

2. Number of Shares; Source of Shares.

a. The maximum number of shares of Common Stock that may be purchased under the Plan on behalf of participants (“Participants”) is three hundred thousand (300,000), provided that, if the Company shall at any time change the number of shares of Common Stock issued and outstanding without new consideration to the Company (such as by a stock dividend, stock split or corporate reorganization or recapitalization), the total remaining number of shares that may be purchased under the Plan at the time of such change shall be adjusted accordingly.

b. All shares purchased under the Plan shall be purchased from the Company, which may be authorized but unissued shares of Common Stock or shares of Common Stock held by the Company in the treasury. The Company has reserved three hundred thousand (300,000) shares of Common Stock, subject to adjustment from time to time in the event of certain changes in the number of outstanding shares of Common Stock as provided in Section 2(a), for issuance under the Plan.

3. Purchase Price.

a. The purchase price for shares of Common Stock purchased on behalf of Participants under the Plan (the “Purchase Price”) shall be 90% of the Current Market Price of the Common Stock or such greater or lower percentage as may from time to time be determined by resolution of the Compensation Committee of the Board of the Company (the “Compensation Committee”); provided, however, that such Purchase Price shall never by less than 85% of the Current Market Price of the Common Stock.

b. The “Current Market Price” of the Common Stock as of any date shall be the closing price for the Common Stock, as reported on the NASDAQ Global Select Market or such other national securities exchange or quotation system on which the Common Stock may be listed at such time (any such, a “National Securities Exchange”), for the last trading date prior to such date.

4. Administration.

a. The Compensation Committee will serve as administrator of the Plan (the “Administrator”). The principal duties of the Administrator are to interpret the Plan provisions, to oversee the operation of the Plan, and to make key determinations regarding the Plan, including eligibility to participate in the Plan. Subject to the express provisions of the Plan, the Administrator is authorized to approve such policies and procedures for the Plan and to issue such interpretations of the Plan as it deems appropriate and desirable to ensure the efficient operation of the Plan and achievement of the Plan’s purposes. All actions taken and all interpretations issued by the Administrator shall be conclusive and binding on the Company and all Participants and other persons affected thereby.

b. The Administrator may appoint and/or retain one or more qualified service providers or other agents (collectively, “Agents;” any such, an “Agent”), including the Company’s Subsidiary, Glens Falls National Bank and Trust Company, Glens Falls, New York, to assist in the oversight and operation of the Plan and may entrust to any such Agent specific ministerial duties under the Plan, including maintenance of separate accounts for individual Plan Participants (“Plan Accounts”), distribution of account statements to Plan Participants, and preparation and distribution of Plan materials and forms to Participants and persons eligible to participate.

c. The Administrator, with the consent of the Board, may designate a successor to serve as Administrator. All administrative costs of the Plan will be borne by the Company, except as may be expressly provided otherwise herein. The Administrator and any Agents appointed by the Administrator shall not be liable for any actions taken or determinations made by them in good faith with respect to the Plan.

5. Participation.

a. Persons eligible to participate in the Plan shall include those regular employees of the Company or its Subsidiaries who have been employed continuously by the Company or a Subsidiary for at least one (1) full month, provided he or she is considered employed for purposes of Section 423(b)(4) of the Code (an “Employee”); and provided, further that such Employee does not or is not deemed to own 5% or more of the total combined voting power or value of all classes of stock of the Company or any Subsidiary.

b. Any eligible person who elects to commence participation in the Plan may do so by completing the prescribed participation form, indicating thereon the initial level of participation by such Participant (which may not be zero) and returning such form to the Administrator or its Agent. Participation of a Participant electing to participate in the Plan will commence only as of the first day of a pay period for an Employee.

6. Participant Contributions.

a. Participants contribute to the Plan through regular contributions (“Contributions”) effected at regular intervals (generally, not less often than monthly), as determined from time to time by the Administrator and the Company. The methods by which Participants may make Contributions will be as determined from time to time by the Administrator in consultation with the Company, which methods may vary depending on the category of the Participant. In the case of participating Employees, Contributions typically will be made through regular payroll deductions. In appropriate circumstances, the Administrator in its absolute discretion may permit other methods of effecting Contributions under the Plan. Participants determine the level of their Contributions from time to time, within limitations established by the Compensation Committee (as further discussed in Section 7 below). Participants may increase or decrease their level of Contributions in accordance with Section 7, provided that Participants who are subject to Section 16 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), may not change the level of their Contributions to the Plan except in accordance with applicable law and Company policy.

b. No interest shall accrue on Contributions received from or on behalf of Participants under the Plan pending investment thereof in shares of Common Stock, as provided in Section 8 below. Any Contributions received and held pending investment by the Administrator or any Agent shall be held in one or more insured deposit accounts maintained by the Administrator or its Agent on behalf of Plan Participants as a group at one or more insured depository institutions selected by the Administrator in its sole discretion, which may include one or more of the Company’s subsidiary banks.

7. Limitations on Contributions.

a. The Compensation Committee may from time to time, at its discretion, establish limitations on the maximum amounts or levels and the minimum amounts or levels that may be contributed by individual Participants during a designated period (e.g., per month or per pay period) under the Plan, which limitations (the “Maximum Contribution” and the “Minimum Contribution,” respectively), may be expressed as absolute dollar amounts or by some other objective measurement (e.g., a designated percentage of salaries, fees, contract amounts or other regular payments due to the individual Participants). The Administrator may specify a single set or more than one set of such limitations (collectively, the “Contribution Limitations”) for Participants,

provided that all members of any similarly-situated category of Participant shall be subject to the same set of Contribution Limitations at any given time, and provided, further that any such limitations comply with Section 423(b)(5) of the Code.

b. The Contribution Limitations and the Maximum Contribution Eligible for Discount, as in effect for Participants or any category of Participants from time to time, may not be waived for any individual Participant and may only be changed by the Compensation Committee, in its discretion, and not by any Agent. Any change in the Contribution Limitations will become effective only after reasonable prior notice thereof has been provided to Participants affected by such change and, if and to the extent legally required or deemed appropriate by the Compensation Committee, such Participants have been given the opportunity to alter their level of participation in the Plan.

c. Subject to the foregoing limitations, Participants may select their individual desired level of participation in the Plan (i.e., their Contributions) with such frequency and at such intervals as may be established by the Administrator. Changes in levels of participation by Participants shall be effected on such forms as may be determined from time to time by the Administrator or its Agent; provided that Participants who are subject to Section 16 of the Exchange Act may not change the level of their Contributions to the Plan except in accordance with applicable law and Company policy.

d. Notwithstanding anything to the contrary herein, as specified by Section 423(b)(8) of the Code, an Employee may be granted purchase rights under the Plan only if such purchase rights, together with any other rights granted under all Employee Stock Purchase Plans of the Company and any Subsidiary, do not permit such Employee's rights to purchase stock of the Company or any Subsidiary to accrue at a rate which exceeds twenty five thousand dollars ($25,000) of fair market value of such stock (determined at the time such rights are granted) for each calendar year in which such rights are outstanding at any time.

8. Purchases of Shares Under the Plan.

a. The Administrator shall determine from time to time the regularly recurring dates (occurring not less often than monthly) on which Contributions from Participants will be invested in shares of Common Stock under the Plan. On each such date (an “Investment Date”), all Contributions received from or on behalf of Participants since the immediately preceding Investment Date will be collected and accumulated by the Administrator or its Agent and paid or forwarded to the Company. Such accumulated Contributions will be invested on behalf of the contributing Participants in shares of Common Stock of the Company at the Purchase Price or Prices for such shares determined as provided in Section 3 above. Shares thus purchased shall be deliverable by the Company to the Administrator or its Agent on the Investment Date or as soon as practicable thereafter.

b. All purchases of shares under the Plan on behalf of Participants will be reflected on account statements prepared and distributed to Participants by the Administrator or its Agent relating to the Plan Accounts maintained for Participants as specified in Section 9(a) below. The purchase of, and the cost basis for, shares purchased for any Participant on an Investment Date will be reflected separately on such Participant’s account statement.

c. All shares purchased under the Plan and delivered to and subsequently held by the Administrator or its Agent will be registered on the stock transfer books and credited in the name of the Administrator or its Agent, or the nominee of either of them, until such time as such shares are transferred by the Administrator or its Agent out of the Plan Accounts of the individual Participants or sold by the Administrator or its Agent on behalf of individual Participants, in accordance with and subject to the provisions of the Plan regarding withdrawals, distributions and sales of shares out of Plan Accounts.

d. Participants will be credited with the purchase of fractional shares of Common Stock up to three decimal places (e.g., .001 of a share), subject to such limitations as may be provided elsewhere in the Plan or as the Compensation Committee or Administrator may specify regarding withdrawals, distributions, sales or the cashing out of fractional shares held in Participants’ Plan Accounts.

9. Plan Accounts, Account Statements, Shareholder Rights of Participants.

a. The Administrator will ensure that a separate Plan Account is maintained for each Participant by it or its Agent. The Plan Account records will reflect all contributions by or on behalf of such Participant, all purchases of shares of Common Stock under the Plan on behalf of such Participant, all dividends and other amounts paid on shares held in such Plan Account, all sales of shares held in such Plan Account by the Administrator or its service provider or other Agent, and all withdrawals of shares or funds from such Plan Account.

b. Participants will receive monthly account statements from the Administrator or its Agent as well as all notices and proxy materials for meetings of Company shareholders and all other materials distributed to Company shareholders.

c. Each Participant will have the authority to direct the Administrator or its Agent in the manner of voting the shares of Common Stock held in such Participant’s Plan Account or regarding any other action that may be taken by shareholders of the Company with respect to shares of Common Stock owned by them.

10. Withdrawal of Shares from Plan Accounts.

A Participant may elect, without terminating his or her participation in the Plan, to receive a distribution of any or all whole shares of Common Stock held in such Participant’s Plan Account not more than twice in any calendar year, by written request directed to the Administrator or its Agent. Any shares thus withdrawn and distributed to a Participant will be evidenced by one or more stock certificates, as requested by the Participant, and registered on the books of the Company in the name of the Participant or such other person or persons as the Participant may request. If a name is not specified, the shares will be registered in the name of the Participant as it appears on the records of the Plan. Any such withdrawals will require at least five (5) business days’ prior written notice to the Administrator or its Agent on the prescribed form. On or as soon as practicable following the requested effective date of such withdrawal as specified in the notice, but in any event not later than 30 days after receipt of the written request in proper form, the Administrator or its Agent will send to the requesting Participant the stock certificate or certificates evidencing the withdrawn shares. Participants subject to Section 16 of the Exchange Act may not effect such withdrawals except in accordance with applicable law and Company policy. After the effective date of any such withdrawal of shares, all dividends and other distributions and materials made or provided with respect to the withdrawn shares will be mailed directly to the registered holder of such shares.

11. Dividends.

a. All cash dividends paid on shares of Common Stock held under the Plan in the name of the Administrator or its Agent or nominee will be paid to the Administrator or its Agent or nominee and credited to the Plan Accounts of the appropriate Participants. These dividends will then be reinvested automatically in additional shares of Common Stock of the Company under the Arrow Financial Corporation Automatic Dividend Reinvestment Plan (the “DRIP”) on the next dividend reinvestment date under the DRIP, which will not necessarily coincide with the next Investment Date under the Plan. All additional shares of Common Stock thus purchased with reinvested dividends will be credited to the Plan Accounts of the respective Participants. Participants will not receive separate accounts under the DRIP solely as a result of the reinvestment through the DRIP of cash dividends paid from time to time on the shares held in their Plan Accounts, and those Participants who maintain separate DRIP accounts without regard to their participation in the Plan will not be entitled to have the additional shares of Common Stock acquired on their behalf through the DRIP with reinvested cash dividends paid on the shares in the Plan Accounts credited to their separate DRIP accounts. Otherwise, shares purchased through the DRIP with reinvested cash dividends paid on shares held in Plan Accounts will be purchased in the same manner as all other shares purchased through the DRIP. Specifically, the purchase price for all such additional shares will be the same purchase price paid for other shares of Common Stock acquired from time to time through the DRIP on behalf of other DRIP participants, which purchase price (i) will not reflect any Discounted Price that may then apply to purchases of shares for Participants under the Plan and (ii) may not be identical to the Current Market Price of the Common Stock then determined under the Plan. In addition, any such cash dividends paid on shares held in Plan Accounts and automatically reinvested through the DRIP in additional shares on behalf of Participants will not be treated as Contributions to the Plan by such

Participants for purposes of evaluating their compliance with the Contribution Limitations or the Maximum Contribution Eligible for Discount then in effect with respect to their participation in the Plan. If so requested, the Administrator or its Agent will provide to Participants free of charge a brochure and/or prospectus relating to the DRIP describing in more detail how the DRIP operates. Notwithstanding the foregoing, if the DRIP has been terminated or suspended, then all cash dividends paid on shares of Common Stock held under the Plan in the name of the Administrator or its Agent or nominee will be paid (i) to the Administrator or its Agent or nominee and credited to the Plan Accounts of the appropriate Participants or (ii) the Participant, at the option of the Company.

b. All stock dividends and stock splits paid on shares of Common Stock held in Plan Accounts of Participants will be paid to the Administrator or its Agent or nominee, as the record owner of such shares, and immediately credited to the Plan Accounts of such Participants.

12. Administrator Sale of Shares for Participants.

Any Participant (other than a Participant subject to Section 16 of the Exchange Act) may elect, not more than twice in any calendar year, to have the Administrator or its Agent, acting through such other agents or brokers as the foregoing may choose in its sole discretion, to sell some or all of the whole shares of Common Stock held in the Plan Account of such Participant, with the net proceeds of such sale, after the deduction of brokerage commissions and any transfer taxes, to be remitted by the Administrator or its Agent to the Participant. Such election shall be on such form and subject to such procedures as may be prescribed by the Administrator or its Agent. A Participant subject to Section 16 of the Exchange Act wishing to direct the Administrator or its Agent to sell shares of Common Stock held in such Participant’s Plan Account must comply with special procedures established by the Administrator or its Agent from time to time regarding such sales, and if such sales are suspended or prohibited at the time under these procedures, may not effect such sales until the suspension or prohibition is lifted.

13. Termination of Participation.

a. A Participant may voluntarily terminate his or her participation in the Plan at any time by submitting notice of such termination on a form prescribed by the Administrator or its Agent. The effective date of any such termination shall be the date specified by the Participant in the notice, which may not be earlier than the fifth business day following the date on which the notice is delivered or mailed to the Administrator or its Agent. Any election by a Participant to reduce his or her Contributions under the Plan to zero (0) will constitute a notice of termination by the Participant, effective on the fifth business day following delivery of such election to the Administrator or its Agent, unless a later effective date is specified by the Participant in the election.

b. Participation in the Plan by any Participant terminates automatically upon the death of such Participant.

c. On and after the effective date of any termination of participation, voluntary or automatic, no additional contributions to the Plan will be accepted from or on behalf of the terminating Participant. Any person whose participation in the Plan has terminated may resume participation on or after such date only if such person is then eligible to participate by virtue of then qualifying to participate under Section 5 hereof as an Employee of the Company and/or one or more of its Subsidiaries.

d. Upon termination of a Participant’s participation in the Plan, the Plan Account of the Participant typically will be terminated and the assets in the Plan Account will be distributed to the Participant. Any such distribution will be effected in one of three methods identified below, as selected in writing by the Participant, or in the event of the death of the Participant, by his or her successor, heir or the administrator of his or her estate, as the case may be (any such, the “personal representative” of the Participant), on an account distribution form obtained from the Administrator or its Agent. Terminating Participants who fail to properly select a distribution method will have the assets in their Plan Account distributed in accordance with the third method set forth below in subparagraph (iii). The three options are as follows:

i. Distribution of Shares. The Administrator or its Agent will (a) issue to the Participant or the Participant’s personal representative one or more stock certificates for all of the whole shares of Common Stock in the Plan Account, and (b) sell any fractional shares in the Plan Account and remit the net proceeds to the Participant or the Participant’s personal representative.

ii. Sale of Shares and Distribution of Proceeds. The Administrator or its Agent will sell on the Participant’s behalf all of the whole shares and any fractional shares in the Plan Account and remit the net proceeds to the Participant or the Participant’s personal representative.

iii. Transfer of Account to the DRIP. The Administrator will transfer all of the whole shares and any fractional shares in the Plan Account to an account in the DRIP in the name of the Participant. If a DRIP account already exists in the name of the Participant, the shares will be transferred to that account; otherwise, a new account under the DRIP will be opened in the Participant’s name.

e. If, in connection with any termination and distribution of a Participant’s Plan Account pursuant to Section (d) above, the Administrator or its Agent sells any whole or fractional shares in the Plan Account, the sale will occur in connection with the next regularly scheduled sale of shares for Participants by the Administrator or its Agent, in accordance with procedures established from time to time by the Administrator for such sales.

f. In connection with any termination or distribution of a Participant’s Plan Account pursuant to Section (d) above, any cash held in the Plan Account, including cash awaiting investment, will be remitted by the Administrator or its Agents to the Participant or the Participant’s personal representative.

g. Notwithstanding Sections 13(d) and (e) above, if the Compensation Committee so determines from time to time in its sole discretion, Participants terminating their participation in the Plan who meet certain requirements established by the Compensation Committee may be permitted, if they so elect, to retain their Plan Accounts following such termination, for such period of time and subject to such conditions as the Compensation Committee may determine. During any such period of continuing account holding on behalf of terminated Participants, the account holders shall have such rights with respect to the shares held on their behalf in their Plan Accounts as the Compensation Committee may determine, provided that the ability of such account holders to resume participation in the Plan by resumption of cash Contributions to the Plan by them or on their behalf shall be subject to the express provisions of the Plan regarding such resumption including eligibility.

h. Notwithstanding Sections 13(d) and (e) above, Participants who are subject to Section 16 of the Exchange Act at the time of termination and distribution of their Plan Accounts may be subject to special restrictions and procedures with regard to their obtaining the shares and other assets held in their Plan Accounts, as such restrictions and procedures may be established by the Compensation Committee or Administrator from time to time in light of applicable laws and regulations pertinent to such individuals and their transactions in the Common Stock and Company policy.

14. Bifurcation of Plan.

It is the intent of the Company that the purchase and sale of shares of Common Stock under the Plan by or on behalf of Participants who are or may be subject to Section 16 of the Exchange Act (“Insiders”) will be structured and conducted so as to render such purchases and sales exempt, to the extent possible, from the reporting obligations of Insiders under Section 16(a) of the Exchange Act and any liability of the Insiders under Section 16(b) of the Exchange Act. In furtherance of this goal, the Compensation Committee is authorized, in its discretion, to adopt such additional procedures and to establish such additional terms and conditions relevant to participation by Insiders in the Plan generally so as to qualify such Insiders’ transactions as exempt under the rules and regulations promulgated by the Securities and Exchange Commission under said Section 16, specifically including Rule 16b-3. Included, without limitation, in the measures that the Compensation Committee is authorized to take in order to achieve such purpose are the following:

i.the establishment of additional limits on Insiders’ ability to purchase and sell shares under the Plan, including prohibitions or suspensions of certain sales and purchases;

ii.prohibiting certain Insiders from participating altogether in the Plan (e.g., Insiders who are or become 5% shareholders);

iii.limiting the ability of Insiders to purchase shares under the Plan for certain periods of time at a Discounted Price or at a Purchase Price lower than a defined “target price;” and

iv.segregating the participation of Insiders under the Plan from the participation of non-Insiders, in whole or in part, by establishment of separate sub-plans or the bifurcation of the general Plan into two or more plans, operating independently of one another to the extent necessary to exempt Insiders’ transactions from Sections 16(a) and 16(b).

Any such measures adopted by the Compensation Committee will be structured to the extent possible so as to provide Insider Participants with benefits similar to, but not materially greater than, benefits then available to non-Insider Participants.

15. Miscellaneous.

a. Expiration, Termination, Amendments. The Plan shall continue in effect until all of the shares of Common Stock reserved under the Plan (as adjusted pursuant to Section 2) have been purchased, unless otherwise terminated earlier as contemplated below. The Board in its sole discretion may amend or terminate the Plan at any time, provided that any such amendment or termination may not adversely affect the rights or interests of any Participant with respect to the shares of Common Stock or other assets then held in such Participant’s Plan Account without the express consent of such Participant, and provided further that any such amendment requiring the approval of shareholders of the Company under any applicable law or regulation, including the rules and regulations of the Securities and Exchange Commission and National Securities Exchange, will not become effective unless and until such shareholder approval shall have been obtained.

The Plan is subject to approval by the holders of a majority of the shares present in person or by proxy and voting at a meeting at which the Plan is considered within twelve (12) months after its adoption by the Board. In the event such approval is not obtained at the meeting at which the Plan is considered, or in the event no meeting shall occur at which the Plan is considered within such twelve (12) month period: (i) the Plan shall immediately terminate; (ii) all amounts contributed to the Plan which have not be used to purchase Common Stock will be returned to the Participants as soon as practicable; and (iii) purchases under the Plan as in effect from the Plan’s inception to the date of termination of the Plan shall not be treated as purchased pursuant to an employee stock purchase plan that satisfies Code Section 423.

b. No Right to Continued Service. An individual Participant’s right, if any, to continue to serve the Company or any Subsidiary in any capacity, including as an Employee or Director shall not be enhanced or otherwise affected by such individual’s participation in the Plan.

c. Rules of Construction; Governing Law. The terms and provisions of this Plan shall be construed according to the principles, and in the priority, as follows: first, in accordance with the meaning under, and which will bring the Plan into conformity with, Code Section 423, and secondly, in accordance with the laws of the State of New York without reference to applicable conflict of laws provisions, except insofar as such provisions may be expressly made subject to the laws of any other state or federal law.

d. Successors. All obligations of the Company in connection with the Plan shall be binding on any successor to the Company.

e. Beneficiaries. No right or benefit under the Plan may be transferred by any Participant to any other party, except upon such Participant’s death and then only pursuant to the terms of a will or other binding instrument governing the transfer of Participant’s assets upon death or the laws of descent and intestacy. All rights and benefits of participation may be exercised only by the Participant during his or her lifetime. In accordance with the procedures determined by the Administrator, if any, a Participant may file with the Administrator or its Agent a written designation

of a beneficiary who is to receive any shares and/or cash, if any, from the Participant's Plan Account upon such Participant's death.

* * *

Exhibit 5.1

December 7, 2023

Arrow Financial Corporation

250 Glen Street,

Glen Falls, New York 12801

Re: Registration Statement on Form S-8 for three hundred thousand (300,000) shares of Arrow Financial Corporation Common Stock, par value $1.00 per share, for issuance to participants under the Arrow Financial Corporation 2023 Employee Stock Purchase Plan

Ladies and Gentlemen:

We have served as counsel to Arrow Financial Corporation, Glens Falls, New York (the “Company”), in connection with the preparation and filing of a registration statement on Form S-8 (the “Registration Statement”) under the Securities Act of 1933, as amended, and the Rules and Regulations promulgated thereunder (the “Securities Act”), registering the offer and sale by the Company of up to three hundred thousand (300,000) shares of common stock of the Company, par value $1.00 per share (the “Shares”), through the Arrow Financial Corporation 2023 Employee Stock Purchase Plan (the “Plan”).

We have examined such corporate records of the Company, such laws and such other information as we have deemed relevant, including the Company’s Certificate of Incorporation and all amendments thereto, By-laws and all amendments thereto and statements we have received from officers and representatives of the Company. In delivering this opinion, we have assumed the genuineness of all signatures, the authenticity of all documents submitted to us as originals, the conformity to the originals of all documents submitted to us as certified, photostatic or conformed copies, the authenticity of originals of all such latter documents, and the correctness of statements submitted to us by officers and representatives of the Company. Except to the extent expressly set forth herein, we have not undertaken any independent investigation to determine the existence or absence of such facts and no inference as to our knowledge of the existence or absence of such facts should be drawn from our representation of the Company.

Based solely on the foregoing, we are of the opinion that the Shares to be issued by the Company have been duly authorized and, when issued and sold by the Company in accordance with the Plan, will be legally issued, fully paid and non-assessable.

We hereby consent to the filing of this opinion as an Exhibit to the Registration Statement.

Our opinions set forth above are limited to the Federal laws of the United States of America and the laws of the State of New York.

This opinion may only be used, quoted or relied upon for the purpose of complying with the Securities Act in connection with the filing of the Registration Statement and may not be furnished to, quoted to or relied upon by any other person or entity for any purpose, without our prior written consent. Please note that we are opining only as to the matters expressly set forth herein and no opinion should be inferred as to any other matters. No opinion is expressed herein with respect to the qualification of the Shares under the securities or blue sky laws of any state or any foreign jurisdiction.

Very truly yours,

/s/ THOMPSON COBURN LLP

Exhibit 15

December 7, 2023

Arrow Financial Corporation

Glens Falls, New York

Re: Registration Statement on Form S-8 related to the Arrow Financial Corporation 2023 Employee Stock Purchase Plan

With respect to the subject registration statement, we acknowledge our awareness of the use therein of our report dated November 9, 2023 related to our review of interim financial information.

Pursuant to Rule 436 under the Securities Act of 1933 (the Act), such report is not considered part of a registration statement prepared or certified by an independent registered public accounting firm, or a report prepared or certified by an independent registered public accounting firm within the meaning of Sections 7 and 11 of the Act.

/s/ KPMG LLP

Albany, New York

Exhibit 23.1

Consent of Independent Registered Public Accounting Firm

The Board of Directors

Arrow Financial Corporation:

We consent to the use of our report dated July 17, 2023, with respect to the consolidated financial statements of Arrow Financial Corporation, and the effectiveness of internal control over financial reporting, incorporated herein by reference.

/s/ KPMG LLP

Albany, New York

December 7, 2023

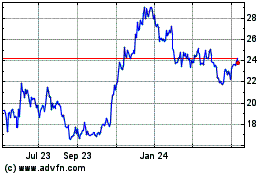

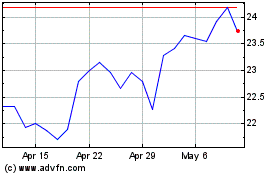

Arrow Financial (NASDAQ:AROW)

Historical Stock Chart

From Apr 2024 to May 2024

Arrow Financial (NASDAQ:AROW)

Historical Stock Chart

From May 2023 to May 2024