false000003478200000347822023-07-202023-07-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July 20, 2023

1st Source Corporation

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Indiana | 0-6233 | 35-1068133 |

| (State or other jurisdiction of incorporation) | (Commission File No.) | (I.R.S. Employer Identification No.) |

100 North Michigan Street, South Bend, Indiana 46601

(Address of principal executive offices) (Zip Code)

574-235-2000

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock - without par value | | SRCE | | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

ITEM 2.02 Results of Operations and Financial Condition.

On July 20, 2023, 1st Source Corporation issued a press release that announced its second quarter earnings for 2023. A copy of the press release is attached hereto as Exhibit 99.1 and incorporated by reference herein.

ITEM 9.01 Financial Statements and Exhibits.

Exhibit 99.1: Press release dated July 20, 2023, with respect to 1st Source Corporation’s financial results for the second quarter ended June 30, 2023.

101 Pursuant to Rule 406 of Regulation S-T, the cover page is formatted in Inline XBRL (Inline eXtensible Business reporting Language).

104 Cover Page Interactive Data File (embedded within the Inline XBRL document and included in Exhibit 101).

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | 1st SOURCE CORPORATION |

| | (Registrant) |

| | |

| | |

| Date: July 20, 2023 | | /s/ BRETT A. BAUER |

| | Brett A. Bauer |

| | Treasurer and Chief Financial Officer |

| | Principal Accounting Officer |

Exhibit 99.1 | | | | | | | | | | | |

|

| For: | Immediate Release | Contact: | Brett Bauer |

| July 20, 2023 | | 574-235-2000 |

1st Source Corporation Reports Strong Second Quarter Results,

Cash Dividend Declared

QUARTERLY HIGHLIGHTS

•Net income was $32.44 million for the quarter, up $3.12 million or 10.65% from the second quarter of 2022. Diluted net income per common share was $1.30, up $0.12 or 10.17% from the prior year’s second quarter of $1.18.

•Cash dividend of $0.32 per common share was approved, equal to the cash dividend declared a year ago.

•Average loans and leases grew $104.95 million in the second quarter, up 1.74% (6.96% annualized growth) from the previous quarter and $673.35 million, up 12.31% from the second quarter of 2022.

•Average deposits grew $70.08 million in the second quarter, up 1.02% from the previous quarter and $143.29 million, up 2.11% from the second quarter of 2022.

•Tax-equivalent net interest income was $68.70 million, down $1.10 million or 1.57% from first quarter 2023 and up $5.11 million, or 8.04% from the second quarter a year ago. Tax-equivalent net interest margin was 3.48%, down 12 basis points from the previous quarter and up 16 basis points from the second quarter a year ago.

South Bend, IN - 1st Source Corporation (NASDAQ: SRCE), parent company of 1st Source Bank, today reported quarterly net income of $32.44 million for the second quarter of 2023, up 10.65% from the $29.31 million reported in the second quarter a year ago, bringing the 2023 year-to-date net income to $63.56 million compared to $56.70 million in 2022. Diluted net income per common share for the second quarter of 2023 was $1.30, up 10.17% versus $1.18 in the second quarter of 2022. Diluted net income per common share for the first half of 2023 was $2.55 compared to $2.28 a year earlier.

At its July 2023 meeting, the Board of Directors approved a cash dividend of $0.32 per common share. The cash dividend is payable to shareholders of record on August 1, 2023, and will be paid on August 11, 2023.

Christopher J. Murphy III, Chairman and Chief Executive Officer, commented, “We are pleased that the strong start in 2023 continued throughout the second quarter. In the second quarter of 2023, average loans grew $104.95 million, up 1.74% while average deposits grew $70.08 million, up 1.02% from the previous quarter. Credit quality during the quarter remained steady with low levels of nonperforming assets. Our liquidity position is solid, our strong capital position continued, and deposit balances increased modestly during the period from expected seasonal trends. The tax-equivalent net interest margin continues to be under pressure at 3.48%, down 12 basis points from the prior quarter, as rate competition on deposits remains elevated.

“We were incredibly pleased to learn during the second quarter that 1st Source was included on the Forbes ‘Best In State Banks’ list, ranking #1 in Indiana! The list was compiled in partnership with market research firm Statista, and the result of an independent survey conducted of bank customers across the state. Being named among the ‘Best In State Banks’ in Indiana by our clients for the second consecutive year, and #1 in the state for the first time, is an important and gratifying recognition for us. We strive every day to show our clients they have made the right choice for their financial future by entrusting us to be their partner. Being named the best bank in Indiana by our clients lets us know that we are living our mission to help people achieve security, build wealth and realize their dreams in all that we do.

“We were also happy to learn that 1st Source was named among the Keefe, Bruyette & Woods, Inc. (KBW) Bank Honor Roll for the fifth consecutive year. We are proud to be one of the 14 honorees, placing us among the top 4% of eligible banks in the country. To be considered for this recognition, banks must be publicly traded institutions with more than $500 million in total assets and must have had 10 consecutive years of increased earnings per share. We strive to strike the right balance in our performance over the longer term and the ways we deliver positive results for our clients, shareholders, colleagues and communities. Receiving this honor once again is welcome recognition that our efforts are successful.

“As part of a strategic initiative to grow our commercial banking footprint and refocus the efforts of some of our leadership team, two significant changes were made this quarter as well. The first being, we opened a loan production office in the Indianapolis area, currently open by appointment only, which serves the community with small business loans and other commercial credit needs. The team will grow over time, and we look forward to serving business clients in this market. It was also announced that Larry Mayers, who has long served as Fort Wayne Regional President and Business Banking Group Head, would step away from his regional duties to focus solely on his business banking responsibilities. Luke Squires was named as his successor, taking over the role of Regional President of the Fort Wayne region and Cecile Weir replaced Luke as head of Business Banking in Fort Wayne. These changes align with 1st Source Bank’s community banking model. They continue our tradition of promoting from within and enhance our position as a community bank with a strong client focus and local leaders who strongly live the 1st Source values and who have the authority and responsibility to serve clients well and grow the Bank.

“We announced in April the re-election of three board members – Christopher J. Murphy III, Chairman, President and Chief Executive Officer of 1st Source Corporation and Chairman of 1st Source Bank; Timothy K. Ozark, Chairman, TKO Finance Corporation; and Todd F. Schurz, Former President and Chief Executive Officer, Schurz Communications, Inc. – and the election of Andrea G. Short, President and Chief Executive Officer of 1st Source Bank as a new addition to the 1st Source Corporation Board of Directors. They all bring unique and valuable perspective to the Board and are knowledgeable business leaders with passion for 1st Source’s mission, making them ideal stewards for the future of the Company.

“Lastly, I must mention, after the quarter ended, just last week, we lost a friend, a partner, and a leader in the Bank and the community when Ernestine Raclin, our Chairman Emeritus died at the age of 95. The community joined us in celebrating her life and we acknowledge here the role she played in establishing the vision of who we are today - focusing on our Mission and living our values. Her legacy will live on in the way we serve our clients, and

communities for generations to come. I thank you all for the outpouring of condolences and the messages celebrating her spirit. She loved this organization and the people here so dearly, and we’ll all miss her and honor her well into the future,” Mr. Murphy concluded.

SECOND QUARTER 2023 FINANCIAL RESULTS

Loans

Second quarter average loans and leases increased $104.95 million to $6.14 billion, up 1.74% from the previous quarter and increased $673.35 million, up 12.31% from the year ago second quarter. Year-to-date average loans and leases increased $692.50 million to $6.09 billion, up 12.83% from the first six months of 2022. Growth during the quarter occurred primarily within the Auto and Light Truck, Construction Equipment, and Commercial Real Estate portfolios.

The Company has traditionally maintained a conservative approach to commercial real estate loans and non-owner occupied properties. At June 30, 2023, approximately 5% of the Company’s total loans and leases are collateralized by non-owner occupied commercial real estate. The Company finances a minimal amount of commercial real estate secured by non-owner occupied office property where third-party tenant rents are the primary source of repayment. All non-owner occupied commercial real estate office projects are performing as agreed.

Deposits

Average deposits of $6.94 billion, grew $70.08 million, up 1.02% from the previous quarter and grew $143.29 million or 2.11% compared to the quarter ended June 30, 2022. Average deposits for the first six months of 2023 were $6.90 billion, an increase of $197.41 million, up 2.94% from the same period a year ago. Average balances were modestly higher primarily due to expected seasonal public fund deposit inflows during the quarter.

End of period deposits were $6.98 billion at June 30, 2023, compared to $6.80 billion at March 31, 2023. Balances were higher primarily due to higher public funds, time, and brokered deposits which were offset by a decrease in noninterest-bearing deposits and a slight decrease in savings account deposits. Rate competition for deposits persisted during the quarter from various areas including traditional bank and credit union competitors, money market funds, bond markets, and other non-bank alternatives.

Net Interest Income and Net Interest Margin

Second quarter 2023 tax-equivalent net interest income declined $1.10 million to $68.70 million, down 1.57% from the previous quarter and increased $5.11 million, up 8.04% from the second quarter a year ago. For the first six months of 2023, tax-equivalent net interest income increased $15.18 million to $138.49 million, up 12.31% from the first half of 2022.

Second quarter 2023 net interest margin was 3.47%, a decline of 12 basis points from the 3.59% in the previous quarter and an increase of 16 basis points from the same period in 2022. On a fully tax-equivalent basis, second quarter 2023 net interest margin was 3.48%, down by 12 basis points compared to the 3.60% in the previous quarter and an increase of 16 basis points from the same period in 2022. The 12-basis point decrease from the prior quarter was primarily due to higher rates on interest-bearing deposits mainly from competitive market pressures and increased borrowing rates. Higher market rates due to multiple Federal Reserve rate increases during 2022 and 2023 contributed to net interest margin expansion compared to the previous year’s second quarter.

Net interest margin for the first six months of 2023 was 3.53%, an increase of 29 basis points compared to the first six months of 2022. Similarly, net interest margin on a fully-tax-equivalent basis for the first half of 2023 was 3.54%, an increase of 29 basis points compared to the first half of the prior year.

Noninterest Income

Second quarter 2023 noninterest income decreased $0.55 million to $22.77 million, down 2.38% from the previous quarter and was relatively flat compared to the second quarter a year ago. For the first six months of 2023, noninterest income held steady from the same period a year ago.

The decrease in noninterest income compared to the previous quarter was due to gains on the sale of renewable energy tax equity investments of $1.11 million during the previous quarter. These were offset by higher seasonal tax preparation fee income recognized in the second quarter of 2023 from our Trust and Wealth Advisory Services Group.

Noninterest Expense

Second quarter 2023 noninterest expense of $49.17 million was relatively flat from the prior quarter and increased $3.51 million, or 7.69% from the second quarter a year ago. For the first six months of 2023, noninterest expense was $98.59 million, an increase of $7.60 million, or 8.35% from the same period a year ago.

The increase in noninterest expense for the second quarter and first six months of 2023 was mainly the result of higher salaries from normal merit increases, the impact of wage inflation and an increase in the number of employees due to fewer open positions. A rise in group insurance claims, increased data processing and technology project costs, and higher FDIC insurance premiums also contributed to higher expenses. These were offset by a $1.08 million reversal of accrued legal fees during the first quarter of 2023 and lower leased equipment depreciation.

Credit

The allowance for loan and lease losses as of June 30, 2023, was 2.31% of total loans and leases compared to 2.33% at March 31, 2023, and 2.39% at June 30, 2022. Net recoveries of $0.98 million were recorded for the second quarter of 2023 compared with $0.19 million of net recoveries in the prior quarter and net recoveries of $0.40 million in the same quarter a year ago.

The provision for credit losses was $0.05 million for the second quarter of 2023, a decrease of $3.00 million from the previous quarter and a decrease of $2.46 million compared with the same period in 2022. The decrease in provision for credit losses compared to the previous quarter was primarily due to increased net recoveries and a reduction in highly reserved special attention loan balances. The ratio of nonperforming assets to loans and leases was 0.33% as of June 30, 2023, compared to 0.30% on March 31, 2023, and 0.60% on June 30, 2022.

Capital

As of June 30, 2023, the common equity-to-assets ratio was 10.95%, compared to 10.91% at March 31, 2023, and 10.66% a year ago. The tangible common equity-to-tangible assets ratio was 10.05% at June 30, 2023, compared to 10.01% at March 31, 2023, and 9.72% a year earlier. The Common Equity Tier 1 ratio, calculated under banking regulatory guidelines was 13.59% at June 30, 2023 compared to 13.51% at March 31, 2023 and 13.79% a year ago. During the second quarter of 2023, 33,276 shares were repurchased for treasury reducing common shareholders’ equity by $1.41 million.

The Company has a long history of maintaining conservative capital levels and the risk-based capital ratios remained strong during the second quarter, even when adjusting for unrealized losses on the available-for-sale securities portfolio.

Liquidity

The Company maintains prudent strategies to support a strong liquidity position. Sources of liquidity include unencumbered available-for-sale securities, Federal Home Loan Bank (FHLB) advances, the Federal Reserve Bank (FRB) discount window and Bank Term Funding Program, Federal Funds lines from correspondent banks and brokered and listing services deposits. Total net available liquidity was $3.23 billion at June 30, 2023, which accounted for approximately 50% of total deposits net of brokered and listing services certificates of deposit.

The investment portfolio is managed with a prioritized focus on liquidity. Investment securities accounted for 19.74% of total assets at June 30, 2023, with the entirety of the portfolio classified as available-for-sale. The Company had no held-to-maturity securities therefore all market value adjustments resulting in unrealized gains and losses were reflected on the Consolidated Statements of Financial Condition. The modified duration of the total investment portfolio was calculated at 3.3 years.

ABOUT 1ST SOURCE CORPORATION

1st Source common stock is traded on the NASDAQ Global Select Market under “SRCE” and appears in the National Market System tables in many daily newspapers under the code name “1st Src.” Since 1863, 1st Source has been committed to the success of its clients, individuals, businesses and the communities it serves. For more information, visit www.1stsource.com.

1st Source serves the northern half of Indiana and southwest Michigan and is the largest locally controlled financial institution headquartered in the area. While delivering a comprehensive range of consumer and commercial banking services through its community bank offices, 1st Source has distinguished itself with highly personalized services. 1st Source Bank also competes for business nationally by offering specialized financing services for new and used private and cargo aircraft, automobiles for leasing and rental agencies, medium and heavy-duty trucks, and construction equipment. The Corporation includes 79 banking centers, 18 1st Source Bank Specialty Finance Group locations nationwide, nine Wealth Advisory Services locations and 10 1st Source Insurance offices.

FORWARD LOOKING STATEMENTS

Except for historical information contained herein, the matters discussed in this document express “forward-looking statements.” Generally, the words “believe,” “contemplate,” “seek,” “plan,” “possible,” “assume,” “hope,” “expect,” “intend,” “targeted,” “continue,” “remain,” “estimate,” “anticipate,” “project,” “will,” “should,” “indicate,” “would,” “may” and similar expressions indicate forward-looking statements. Those statements, including statements, projections, estimates or assumptions concerning future events or performance, and other statements that are other than statements of historical fact, are subject to material risks and uncertainties. 1st Source cautions readers not to place undue reliance on any forward-looking statements, which speak only as of the date made.

1st Source may make other written or oral forward-looking statements from time to time. Readers are advised that various important factors could cause 1st Source’s actual results or circumstances for future periods to differ materially from those anticipated or projected in such forward-looking statements. Such factors, among others, include changes in laws, regulations or accounting principles generally accepted in the United States; 1st Source’s competitive position within its markets served; increasing consolidation within the banking industry; unforeseen changes in interest rates; unforeseen downturns in the local, regional or national economies or in the industries in which 1st Source has credit concentrations; and other risks discussed in 1st Source’s filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K, which filings are available from the SEC. 1st Source undertakes no obligation to publicly update or revise any forward-looking statements.

NON-GAAP FINANCIAL MEASURES

The accounting and reporting policies of 1st Source conform to generally accepted accounting principles (“GAAP”) in the United States and prevailing practices in the banking industry. However, certain non-GAAP performance measures are used by management to evaluate and measure the Company’s performance. Although these non-GAAP financial measures are frequently used by investors to evaluate a financial institution, they have limitations as analytical tools, and should not be considered in isolation, or as a substitute for analyses of results as reported under GAAP. These include taxable-equivalent net interest income (including its individual components), net interest margin (including its individual components), the efficiency ratio, tangible common equity-to-tangible assets ratio and tangible book value per common share. Management believes that these measures provide users of the Company’s financial information a more meaningful view of the performance of the interest-earning assets and interest-bearing liabilities and of the Company’s operating efficiency. Other financial holding companies may define or calculate these measures differently.

Management reviews yields on certain asset categories and the net interest margin of the Company and its banking subsidiaries on a fully taxable-equivalent (“FTE”) basis. In this non-GAAP presentation, net interest income is adjusted to reflect tax-exempt interest income on an equivalent before-tax basis. This measure ensures comparability of net interest income arising from both taxable and tax-exempt sources. Net interest income on a FTE basis is also used in the calculation of the Company’s efficiency ratio. The efficiency ratio, which is calculated by dividing non-interest expense by total taxable-equivalent net revenue (less securities gains or losses and lease depreciation), measures how much it costs to produce one dollar of revenue. Securities gains or losses and lease depreciation are excluded from this calculation to better match revenue from daily operations to operational expenses. Management considers the tangible common equity-to-tangible assets ratio and tangible book value per common share as useful measurements of the Company’s equity.

See the table marked “Reconciliation of Non-GAAP Financial Measures” for a reconciliation of certain non-GAAP financial measures used by the Company with their most closely related GAAP measures.

# # #

(charts attached)

| | | | | | | | | | | | | | | | | | | | |

| 1st SOURCE CORPORATION | | | | | | |

| 2nd QUARTER 2023 FINANCIAL HIGHLIGHTS | | | | | | |

| (Unaudited - Dollars in thousands, except per share data) | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, | March 31, | June 30, | | June 30, | June 30, |

| 2023 | 2023 | 2022 | | 2023 | 2022 |

| AVERAGE BALANCES | | | | | | |

| Assets | $ | 8,362,308 | | $ | 8,323,431 | | $ | 8,092,316 | | | $ | 8,342,977 | | $ | 8,050,758 | |

| Earning assets | 7,921,528 | | 7,864,595 | | 7,685,631 | | | 7,893,218 | | 7,653,120 | |

| Investments | 1,697,699 | | 1,768,621 | | 1,835,974 | | | 1,732,964 | | 1,861,374 | |

| Loans and leases | 6,141,157 | | 6,036,203 | | 5,467,808 | | | 6,088,970 | | 5,396,472 | |

| Deposits | 6,939,082 | | 6,869,006 | | 6,795,793 | | | 6,904,237 | | 6,706,826 | |

| Interest bearing liabilities | 5,496,112 | | 5,345,498 | | 5,049,145 | | | 5,421,221 | | 4,981,675 | |

| Common shareholders’ equity | 926,157 | | 890,294 | | 861,134 | | | 908,325 | | 885,826 | |

| Total equity | 985,406 | | 949,879 | | 915,714 | | | 967,742 | | 939,801 | |

| INCOME STATEMENT DATA | | | | | | |

| Net interest income | $ | 68,516 | | $ | 69,565 | | $ | 63,462 | | | $ | 138,081 | | $ | 123,080 | |

Net interest income - FTE(1) | 68,695 | | 69,791 | | 63,585 | | | 138,486 | | 123,311 | |

| Provision for credit losses | 47 | | 3,049 | | 2,503 | | | 3,096 | | 4,736 | |

| Noninterest income | 22,769 | | 23,323 | | 22,830 | | | 46,092 | | 45,975 | |

| Noninterest expense | 49,165 | | 49,421 | | 45,655 | | | 98,586 | | 90,991 | |

| Net income | 32,447 | | 31,131 | | 29,330 | | | 63,578 | | 56,731 | |

| Net income available to common shareholders | 32,435 | | 31,124 | | 29,314 | | | 63,559 | | 56,704 | |

| PER SHARE DATA | | | | | | |

| Basic net income per common share | $ | 1.30 | | $ | 1.25 | | $ | 1.18 | | | $ | 2.55 | | $ | 2.28 | |

| Diluted net income per common share | 1.30 | | 1.25 | | 1.18 | | | 2.55 | | 2.28 | |

| Common cash dividends declared | 0.32 | | 0.32 | | 0.31 | | | 0.64 | | 0.62 | |

Book value per common share(2) | 37.31 | | 36.81 | | 34.74 | | | 37.31 | | 34.74 | |

Tangible book value per common share(1) | 33.92 | | 33.42 | | 31.33 | | | 33.92 | | 31.33 | |

| Market value - High | 47.94 | | 53.85 | | 48.42 | | | 53.85 | | 52.70 | |

| Market value - Low | 38.77 | | 42.50 | | 42.29 | | | 38.77 | | 42.29 | |

| Basic weighted average common shares outstanding | 24,686,435 | | 24,687,087 | | 24,691,747 | | | 24,686,760 | | 24,717,625 | |

| Diluted weighted average common shares outstanding | 24,686,435 | | 24,687,087 | | 24,691,747 | | | 24,686,760 | | 24,717,625 | |

| KEY RATIOS | | | | | | |

| Return on average assets | 1.56 | % | 1.52 | % | 1.45 | % | | 1.54 | % | 1.42 | % |

| Return on average common shareholders’ equity | 14.05 | | 14.18 | | 13.65 | | | 14.11 | | 12.91 | |

| | | | | | |

| | | | | | |

| | | | | | |

| Average common shareholders’ equity to average assets | 11.08 | | 10.70 | | 10.64 | | | 10.89 | | 11.00 | |

End of period tangible common equity to tangible assets(1) | 10.05 | | 10.01 | | 9.72 | | | 10.05 | | 9.72 | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Risk-based capital - Common Equity Tier 1(4) | 13.59 | | 13.51 | | 13.79 | | | 13.59 | | 13.79 | |

Risk-based capital - Tier 1(4) | 15.20 | | 15.15 | | 15.53 | | | 15.20 | | 15.53 | |

Risk-based capital - Total(4) | 16.46 | | 16.41 | | 16.79 | | | 16.46 | | 16.79 | |

| Net interest margin | 3.47 | | 3.59 | | 3.31 | | | 3.53 | | 3.24 | |

Net interest margin - FTE(1) | 3.48 | | 3.60 | | 3.32 | | | 3.54 | | 3.25 | |

| Efficiency ratio: expense to revenue | 53.86 | | 53.20 | | 52.91 | | | 53.53 | | 53.82 | |

Efficiency ratio: expense to revenue - adjusted(1) | 53.23 | | 52.92 | | 51.72 | | | 53.07 | | 52.49 | |

| Net recoveries to average loans and leases | (0.06) | | (0.01) | | (0.03) | | | (0.04) | | (0.02) | |

| Loan and lease loss allowance to loans and leases | 2.31 | | 2.33 | | 2.39 | | | 2.31 | | 2.39 | |

| Nonperforming assets to loans and leases | 0.33 | | 0.30 | | 0.60 | | | 0.33 | | 0.60 | |

| | | | | | |

| | | | | |

| | | | | | |

| June 30, | March 31, | December 31, | | September 30, | June 30, |

| 2023 | 2023 | 2022 | | 2022 | 2022 |

| END OF PERIOD BALANCES | | | | | | |

| Assets | $ | 8,414,818 | | $ | 8,329,803 | | $ | 8,339,416 | | | $ | 8,097,486 | | $ | 8,029,359 | |

| Loans and leases | 6,215,343 | | 6,116,716 | | 6,011,162 | | | 5,762,078 | | 5,551,216 | |

| Deposits | 6,976,518 | | 6,801,464 | | 6,928,265 | | | 6,621,231 | | 6,744,896 | |

| Allowance for loan and lease losses | 143,542 | | 142,511 | | 139,268 | | | 135,736 | | 132,865 | |

| Goodwill and intangible assets | 83,897 | | 83,901 | | 83,907 | | | 83,911 | | 83,916 | |

| Common shareholders’ equity | 921,020 | | 909,159 | | 864,068 | | | 826,059 | | 856,251 | |

| Total equity | 980,087 | | 968,444 | | 923,766 | | | 886,360 | | 910,667 | |

| ASSET QUALITY | | | | | | |

| Loans and leases past due 90 days or more | $ | 56 | | $ | 24 | | $ | 54 | | | $ | 165 | | $ | 50 | |

| Nonaccrual loans and leases | 20,481 | | 18,062 | | 26,420 | | | 27,813 | | 33,490 | |

| Other real estate | 193 | | 117 | | 104 | | | — | | — | |

| Repossessions | 47 | | 445 | | 327 | | | 26 | | 102 | |

| Equipment owned under operating leases | — | | — | | 22 | | | 1 | | 43 | |

| Total nonperforming assets | $ | 20,777 | | $ | 18,648 | | $ | 26,927 | | | $ | 28,005 | | $ | 33,685 | |

(1) See “Reconciliation of Non-GAAP Financial Measures” for more information on this performance measure/ratio.

(2) Calculated as common shareholders’ equity divided by common shares outstanding at the end of the period.

(3) Calculated as the sum of available-for-sale securities and loan and leases that mature or reprice in over 5 years as a percent of total assets.

(4) Calculated under banking regulatory guidelines.

| | | | | | | | | | | | | | | | | | | | | | | |

| 1st SOURCE CORPORATION | | | | | | | |

| CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION | | | | | | | |

| (Unaudited - Dollars in thousands) | | | | | | | |

| June 30, | | March 31, | | December 31, | | June 30, |

| 2023 | | 2023 | | 2022 | | 2022 |

| ASSETS | | | | | | | |

| Cash and due from banks | $ | 86,742 | | | $ | 66,866 | | | $ | 84,703 | | | $ | 116,915 | |

| Federal funds sold and interest bearing deposits with other banks | 25,933 | | | 27,171 | | | 38,094 | | | 164,848 | |

Investment securities available-for-sale | 1,661,405 | | | 1,713,480 | | | 1,775,128 | | | 1,836,389 | |

| Other investments | 25,320 | | | 25,293 | | | 25,293 | | | 25,538 | |

| Mortgages held for sale | 2,321 | | | 2,068 | | | 3,914 | | | 5,525 | |

| Loans and leases, net of unearned discount: | | | | | | | |

| Commercial and agricultural | 797,188 | | | 795,429 | | | 812,031 | | | 842,618 | |

| Solar | 376,905 | | | 375,330 | | | 381,163 | | | 350,472 | |

| Auto and light truck | 901,054 | | | 875,564 | | | 808,117 | | | 708,720 | |

| Medium and heavy duty truck | 319,634 | | | 326,588 | | | 313,862 | | | 278,334 | |

| Aircraft | 1,060,340 | | | 1,056,829 | | | 1,077,722 | | | 959,876 | |

| Construction equipment | 1,012,969 | | | 991,412 | | | 938,503 | | | 803,734 | |

| Commercial real estate | 985,323 | | | 954,221 | | | 943,745 | | | 931,058 | |

| Residential real estate and home equity | 617,495 | | | 594,618 | | | 584,737 | | | 535,589 | |

| Consumer | 144,435 | | | 146,725 | | | 151,282 | | | 140,815 | |

| Total loans and leases | 6,215,343 | | | 6,116,716 | | | 6,011,162 | | | 5,551,216 | |

| Allowance for loan and lease losses | (143,542) | | | (142,511) | | | (139,268) | | | (132,865) | |

| Net loans and leases | 6,071,801 | | | 5,974,205 | | | 5,871,894 | | | 5,418,351 | |

| Equipment owned under operating leases, net | 26,582 | | | 30,083 | | | 31,700 | | | 36,579 | |

| Net premises and equipment | 44,089 | | | 44,034 | | | 44,773 | | | 45,250 | |

| Goodwill and intangible assets | 83,897 | | | 83,901 | | | 83,907 | | | 83,916 | |

| Accrued income and other assets | 386,728 | | | 362,702 | | | 380,010 | | | 296,048 | |

| Total assets | $ | 8,414,818 | | | $ | 8,329,803 | | | $ | 8,339,416 | | | $ | 8,029,359 | |

| LIABILITIES | | | | | | | |

| Deposits: | | | | | | | |

| Noninterest-bearing demand | $ | 1,721,947 | | | $ | 1,815,123 | | | $ | 1,998,151 | | | $ | 2,032,566 | |

| Interest-bearing deposits: | | | | | | | |

| Interest-bearing demand | 2,528,231 | | | 2,403,818 | | | 2,591,464 | | | 2,644,590 | |

| Savings | 1,163,166 | | | 1,171,418 | | | 1,198,191 | | | 1,282,791 | |

| Time | 1,563,174 | | | 1,411,105 | | | 1,140,459 | | | 784,949 | |

| Total interest-bearing deposits | 5,254,571 | | | 4,986,341 | | | 4,930,114 | | | 4,712,330 | |

| Total deposits | 6,976,518 | | | 6,801,464 | | | 6,928,265 | | | 6,744,896 | |

| Short-term borrowings: | | | | | | | |

| Federal funds purchased and securities sold under agreements to repurchase | 69,308 | | | 73,396 | | | 141,432 | | | 162,649 | |

| Other short-term borrowings | 118,377 | | | 229,640 | | | 74,097 | | | 5,190 | |

| Total short-term borrowings | 187,685 | | | 303,036 | | | 215,529 | | | 167,839 | |

| Long-term debt and mandatorily redeemable securities | 46,649 | | | 46,714 | | | 46,555 | | | 48,459 | |

| Subordinated notes | 58,764 | | | 58,764 | | | 58,764 | | | 58,764 | |

| Accrued expenses and other liabilities | 165,115 | | | 151,381 | | | 166,537 | | | 98,734 | |

| Total liabilities | 7,434,731 | | | 7,361,359 | | | 7,415,650 | | | 7,118,692 | |

| SHAREHOLDERS’ EQUITY | | | | | | | |

Preferred stock; no par value Authorized 10,000,000 shares; none issued or outstanding | — | | | — | | | — | | | — | |

Common stock; no par value Authorized 40,000,000 shares; issued 28,205,674 shares at June 30, 2023, March 31, 2023, December 31, 2022, and June 30, 2022, respectively | 436,538 | | | 436,538 | | | 436,538 | | | 436,538 | |

| Retained earnings | 744,442 | | | 719,495 | | | 694,862 | | | 646,600 | |

Cost of common stock in treasury (3,523,113, 3,510,122, 3,543,388, and 3,555,267 shares at June 30, 2023, March 31, 2023, December 31, 2022, and June 30, 2022, respectively) | (120,410) | | | (119,409) | | | (119,642) | | | (119,876) | |

| Accumulated other comprehensive loss | (139,550) | | | (127,465) | | | (147,690) | | | (107,011) | |

| Total shareholders’ equity | 921,020 | | | 909,159 | | | 864,068 | | | 856,251 | |

| Noncontrolling interests | 59,067 | | | 59,285 | | | 59,698 | | | 54,416 | |

| Total equity | 980,087 | | | 968,444 | | | 923,766 | | | 910,667 | |

| Total liabilities and equity | $ | 8,414,818 | | | $ | 8,329,803 | | | $ | 8,339,416 | | | $ | 8,029,359 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 1st SOURCE CORPORATION | | | | | | | | | |

| CONSOLIDATED STATEMENTS OF INCOME | | | | | | | | | |

| (Unaudited - Dollars in thousands, except per share amounts) | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, | | March 31, | | June 30, | | June 30, | | June 30, |

| 2023 | | 2023 | | 2022 | | 2023 | | 2022 |

| Interest income: | | | | | | | | | |

| Loans and leases | $ | 93,300 | | | $ | 86,689 | | | $ | 60,415 | | | $ | 179,989 | | | $ | 115,623 | |

| Investment securities, taxable | 5,946 | | | 6,648 | | | 6,289 | | | 12,594 | | | 12,633 | |

| Investment securities, tax-exempt | 330 | | | 482 | | | 157 | | | 812 | | | 291 | |

| Other | 978 | | | 637 | | | 1,168 | | | 1,615 | | | 1,531 | |

| Total interest income | 100,554 | | | 94,456 | | | 68,029 | | | 195,010 | | | 130,078 | |

| Interest expense: | | | | | | | | | |

| Deposits | 28,870 | | | 21,263 | | | 3,553 | | | 50,133 | | | 5,929 | |

| Short-term borrowings | 1,625 | | | 1,393 | | | 23 | | | 3,018 | | | 47 | |

| Subordinated notes | 1,028 | | | 1,020 | | | 851 | | | 2,048 | | | 1,674 | |

| Long-term debt and mandatorily redeemable securities | 515 | | | 1,215 | | | 140 | | | 1,730 | | | (652) | |

| Total interest expense | 32,038 | | | 24,891 | | | 4,567 | | | 56,929 | | | 6,998 | |

| Net interest income | 68,516 | | | 69,565 | | | 63,462 | | | 138,081 | | | 123,080 | |

| Provision for credit losses | 47 | | | 3,049 | | | 2,503 | | | 3,096 | | | 4,736 | |

| Net interest income after provision for credit losses | 68,469 | | | 66,516 | | | 60,959 | | | 134,985 | | | 118,344 | |

| Noninterest income: | | | | | | | | | |

| Trust and wealth advisory | 6,467 | | | 5,679 | | | 6,087 | | | 12,146 | | | 12,001 | |

| Service charges on deposit accounts | 3,118 | | | 3,003 | | | 2,942 | | | 6,121 | | | 5,734 | |

| Debit card | 4,701 | | | 4,507 | | | 4,561 | | | 9,208 | | | 8,755 | |

| Mortgage banking | 926 | | | 802 | | | 1,062 | | | 1,728 | | | 2,439 | |

| Insurance commissions | 1,641 | | | 2,029 | | | 1,568 | | | 3,670 | | | 3,473 | |

| Equipment rental | 2,326 | | | 2,503 | | | 3,295 | | | 4,829 | | | 6,957 | |

| Losses on investment securities available-for-sale | — | | | (44) | | | — | | | (44) | | | — | |

| Other | 3,590 | | | 4,844 | | | 3,315 | | | 8,434 | | | 6,616 | |

| Total noninterest income | 22,769 | | | 23,323 | | | 22,830 | | | 46,092 | | | 45,975 | |

| Noninterest expense: | | | | | | | | | |

| Salaries and employee benefits | 28,236 | | | 28,597 | | | 25,562 | | | 56,833 | | | 51,029 | |

| Net occupancy | 2,676 | | | 2,622 | | | 2,524 | | | 5,298 | | | 5,335 | |

| Furniture and equipment | 1,414 | | | 1,307 | | | 1,384 | | | 2,721 | | | 2,679 | |

| Data processing | 6,268 | | | 6,157 | | | 5,402 | | | 12,425 | | | 10,610 | |

| Depreciation – leased equipment | 1,876 | | | 2,022 | | | 2,664 | | | 3,898 | | | 5,679 | |

| Professional fees | 1,704 | | | 682 | | | 2,094 | | | 2,386 | | | 3,702 | |

| FDIC and other insurance | 1,344 | | | 1,360 | | | 893 | | | 2,704 | | | 1,743 | |

| Business development and marketing | 1,649 | | | 1,972 | | | 1,669 | | | 3,621 | | | 2,937 | |

| | | | | | | | | |

| Other | 3,998 | | | 4,702 | | | 3,463 | | | 8,700 | | | 7,277 | |

| Total noninterest expense | 49,165 | | | 49,421 | | | 45,655 | | | 98,586 | | | 90,991 | |

| Income before income taxes | 42,073 | | | 40,418 | | | 38,134 | | | 82,491 | | | 73,328 | |

| Income tax expense | 9,626 | | | 9,287 | | | 8,804 | | | 18,913 | | | 16,597 | |

| Net income | 32,447 | | | 31,131 | | | 29,330 | | | 63,578 | | | 56,731 | |

| Net (income) loss attributable to noncontrolling interests | (12) | | | (7) | | | (16) | | | (19) | | | (27) | |

| Net income available to common shareholders | $ | 32,435 | | | $ | 31,124 | | | $ | 29,314 | | | $ | 63,559 | | | $ | 56,704 | |

| Per common share: | | | | | | | | | |

| Basic net income per common share | $ | 1.30 | | | $ | 1.25 | | | $ | 1.18 | | | $ | 2.55 | | | $ | 2.28 | |

| Diluted net income per common share | $ | 1.30 | | | $ | 1.25 | | | $ | 1.18 | | | $ | 2.55 | | | $ | 2.28 | |

| Cash dividends | $ | 0.32 | | | $ | 0.32 | | | $ | 0.31 | | | $ | 0.64 | | | $ | 0.62 | |

| Basic weighted average common shares outstanding | 24,686,435 | | | 24,687,087 | | | 24,691,747 | | | 24,686,760 | | | 24,717,625 | |

| Diluted weighted average common shares outstanding | 24,686,435 | | | 64,687,087 | | | 24,691,747 | | | 24,686,760 | | | 24,717,625 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 1st SOURCE CORPORATION | | | | | | | | | | | | | | | | | |

| DISTRIBUTION OF ASSETS, LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | | | | | | |

| INTEREST RATES AND INTEREST DIFFERENTIAL | | | | | | | | | | |

| (Unaudited - Dollars in thousands) | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | |

| June 30, 2023 | | March 31, 2023 | | June 30, 2022 |

| Average

Balance | | Interest Income/Expense | | Yield/

Rate | | Average

Balance | | Interest Income/Expense | | Yield/

Rate | | Average

Balance | | Interest Income/Expense | | Yield/

Rate |

| ASSETS | | | | | | | | | | | | | | | | | |

| Investment securities available-for-sale: | | | | | | | | | | | | | | | | | |

| Taxable | $ | 1,655,790 | | | $ | 5,946 | | | 1.44 | % | | $ | 1,711,177 | | | $ | 6,648 | | | 1.58 | % | | $ | 1,805,044 | | | $ | 6,289 | | | 1.40 | % |

Tax exempt(1) | 41,909 | | | 411 | | | 3.93 | % | | 57,444 | | | 605 | | | 4.27 | % | | 30,930 | | | 195 | | | 2.53 | % |

| Mortgages held for sale | 1,879 | | | 28 | | | 5.98 | % | | 2,410 | | | 32 | | | 5.38 | % | | 4,889 | | | 52 | | | 4.27 | % |

Loans and leases, net of unearned discount(1) | 6,141,157 | | | 93,370 | | | 6.10 | % | | 6,036,203 | | | 86,760 | | | 5.83 | % | | 5,467,808 | | | 60,448 | | | 4.43 | % |

| Other investments | 80,793 | | | 978 | | | 4.86 | % | | 57,361 | | | 637 | | | 4.50 | % | | 376,960 | | | 1,168 | | | 1.24 | % |

Total earning assets(1) | 7,921,528 | | | 100,733 | | | 5.10 | % | | 7,864,595 | | | 94,682 | | | 4.88 | % | | 7,685,631 | | | 68,152 | | | 3.56 | % |

| Cash and due from banks | 72,880 | | | | | | | 71,921 | | | | | | | 90,101 | | | | | |

| Allowance for loan and lease losses | (144,337) | | | | | | | (141,054) | | | | | | | (132,020) | | | | | |

| Other assets | 512,237 | | | | | | | 527,969 | | | | | | | 448,604 | | | | | |

| Total assets | $ | 8,362,308 | | | | | | | $ | 8,323,431 | | | | | | | $ | 8,092,316 | | | | | |

| | | | | | | | | | | | | | | | | |

LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | | | | | | | | | | | | |

| Interest-bearing deposits | $ | 5,192,206 | | | $ | 28,870 | | | 2.23 | % | | $ | 4,988,093 | | | $ | 21,263 | | | 1.73 | % | | $ | 4,753,331 | | | $ | 3,553 | | | 0.30 | % |

| Short-term borrowings: | | | | | | | | | | | | | | | | | |

| Securities sold under agreements to repurchase | 69,301 | | | 32 | | | 0.19 | % | | 134,501 | | | 40 | | | 0.12 | % | | 176,994 | | | 23 | | | 0.05 | % |

| Other short-term borrowings | 129,230 | | | 1,593 | | | 4.94 | % | | 118,760 | | | 1,353 | | | 4.62 | % | | 5,394 | | | — | | | — | % |

| Subordinated notes | 58,764 | | | 1,028 | | | 7.02 | % | | 58,764 | | | 1,020 | | | 7.04 | % | | 58,764 | | | 851 | | | 5.81 | % |

Long-term debt and mandatorily redeemable securities | 46,611 | | | 515 | | | 4.43 | % | | 45,380 | | | 1,215 | | | 10.86 | % | | 54,662 | | | 140 | | | 1.03 | % |

Total interest-bearing liabilities | 5,496,112 | | | 32,038 | | | 2.34 | % | | 5,345,498 | | | 24,891 | | | 1.89 | % | | 5,049,145 | | | 4,567 | | | 0.36 | % |

Noninterest-bearing deposits | 1,746,876 | | | | | | | 1,880,913 | | | | | | | 2,042,462 | | | | | |

| Other liabilities | 133,914 | | | | | | | 147,141 | | | | | | | 84,995 | | | | | |

| Shareholders’ equity | 926,157 | | | | | | | 890,294 | | | | | | | 861,134 | | | | | |

Noncontrolling interests | 59,249 | | | | | | | 59,585 | | | | | | | 54,580 | | | | | |

Total liabilities and equity | $ | 8,362,308 | | | | | | | $ | 8,323,431 | | | | | | | $ | 8,092,316 | | | | | |

| Less: Fully tax-equivalent adjustments | | | (179) | | | | | | | (226) | | | | | | | (123) | | | |

Net interest income/margin (GAAP-derived)(1) | | | $ | 68,516 | | | 3.47 | % | | | | $ | 69,565 | | | 3.59 | % | | | | $ | 63,462 | | | 3.31 | % |

Fully tax-equivalent adjustments | | | 179 | | | | | | | 226 | | | | | | | 123 | | | |

Net interest income/margin - FTE(1) | | | $ | 68,695 | | | 3.48 | % | | | | $ | 69,791 | | | 3.60 | % | | | | $ | 63,585 | | | 3.32 | % |

| (1) See “Reconciliation of Non-GAAP Financial Measures” for more information on this performance measure/ratio. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| 1st SOURCE CORPORATION | | | | | | | | | | | |

| DISTRIBUTION OF ASSETS, LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | |

| INTEREST RATES AND INTEREST DIFFERENTIAL | | | | | |

| (Unaudited - Dollars in thousands) | | | | | | | | | | | |

| Six Months Ended |

| June 30, 2023 | | June 30, 2022 |

| Average

Balance | | Interest Income/Expense | | Yield/

Rate | | Average

Balance | | Interest Income/Expense | | Yield/

Rate |

| ASSETS | | | | | | | | | | | |

| Investment securities available-for-sale: | | | | | | | | | | | |

| Taxable | $ | 1,683,330 | | | $ | 12,594 | | | 1.51 | % | | $ | 1,831,156 | | | $ | 12,633 | | | 1.39 | % |

Tax exempt(1) | 49,634 | | | 1,016 | | | 4.13 | % | | 30,218 | | | 360 | | | 2.40 | % |

| Mortgages held for sale | 2,143 | | | 60 | | | 5.65 | % | | 6,829 | | | 119 | | | 3.51 | % |

Loans and leases, net of unearned discount(1) | 6,088,970 | | | 180,130 | | | 5.97 | % | | 5,396,472 | | | 115,666 | | | 4.32 | % |

| Other investments | 69,141 | | | 1,615 | | | 4.71 | % | | 388,445 | | | 1,531 | | | 0.79 | % |

Total earning assets(1) | 7,893,218 | | | 195,415 | | | 4.99 | % | | 7,653,120 | | | 130,309 | | | 3.43 | % |

| Cash and due from banks | 72,403 | | | | | | | 83,618 | | | | | |

| Allowance for loan and lease losses | (142,705) | | | | | | | (130,343) | | | | | |

| Other assets | 520,061 | | | | | | | 444,363 | | | | | |

| Total assets | $ | 8,342,977 | | | | | | | $ | 8,050,758 | | | | | |

| | | | | | | | | | | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | | | | | | |

| Interest-bearing deposits | 5,090,713 | | | 50,133 | | | 1.99 | % | | 4,670,746 | | | 5,929 | | | 0.26 | % |

| Short-term borrowings: | | | | | | | | | | | |

| Securities sold under agreements to repurchase | 101,721 | | | 72 | | | 0.14 | % | | 184,509 | | | 46 | | | 0.05 | % |

| Other short-term borrowings | 124,024 | | | 2,946 | | | 4.79 | % | | 5,383 | | | 1 | | | 0.04 | % |

| Subordinated notes | 58,764 | | | 2,048 | | | 7.03 | % | | 58,764 | | | 1,674 | | | 5.74 | % |

Long-term debt and mandatorily redeemable securities | 45,999 | | | 1,730 | | | 7.58 | % | | 62,273 | | | (652) | | | (2.11) | % |

Total interest-bearing liabilities | 5,421,221 | | | 56,929 | | | 2.12 | % | | 4,981,675 | | | 6,998 | | | 0.28 | % |

| Noninterest-bearing deposits | 1,813,524 | | | | | | | 2,036,080 | | | | | |

| Other liabilities | 140,490 | | | | | | | 93,202 | | | | | |

| Shareholders’ equity | 908,325 | | | | | | | 885,826 | | | | | |

| Noncontrolling interests | 59,417 | | | | | | | 53,975 | | | | | |

Total liabilities and equity | $ | 8,342,977 | | | | | | | $ | 8,050,758 | | | | | |

| Less: Fully tax-equivalent adjustments | | | (405) | | | | | | | (231) | | | |

Net interest income/margin (GAAP-derived)(1) | | | $ | 138,081 | | | 3.53 | % | | | | $ | 123,080 | | | 3.24 | % |

Fully tax-equivalent adjustments | | | 405 | | | | | | | 231 | | | |

Net interest income/margin - FTE(1) | | | $ | 138,486 | | | 3.54 | % | | | | $ | 123,311 | | | 3.25 | % |

| (1) See “Reconciliation of Non-GAAP Financial Measures” for more information on this performance measure/ratio. |

| | | | | | | | | | | | | | | | | | | | | | | |

| 1st SOURCE CORPORATION | | | | | |

| RECONCILIATION OF NON-GAAP FINANCIAL MEASURES | | | | |

| (Unaudited - Dollars in thousands, except per share data) | | | | |

| | | | | | | |

| | Three Months Ended | | Six Months Ended |

| | June 30, | March 31, | June 30, | | June 30, | June 30, |

| | 2023 | 2023 | 2022 | | 2023 | 2022 |

| Calculation of Net Interest Margin | | | | | | |

| (A) | Interest income (GAAP) | $ | 100,554 | | $ | 94,456 | | $ | 68,029 | | | $ | 195,010 | | $ | 130,078 | |

| Fully tax-equivalent adjustments: | | | | | | |

| (B) | – Loans and leases | 98 | | 103 | | 85 | | | 201 | | 162 | |

| (C) | – Tax exempt investment securities | 81 | | 123 | | 38 | | | 204 | | 69 | |

| (D) | Interest income – FTE (A+B+C) | 100,733 | | 94,682 | | 68,152 | | | 195,415 | | 130,309 | |

| (E) | Interest expense (GAAP) | 32,038 | | 24,891 | | 4,567 | | | 56,929 | | 6,998 | |

| (F) | Net interest income (GAAP) (A-E) | 68,516 | | 69,565 | | 63,462 | | | 138,081 | | 123,080 | |

| (G) | Net interest income - FTE (D-E) | 68,695 | | 69,791 | | 63,585 | | | 138,486 | | 123,311 | |

| (H) | Annualization factor | 4.011 | | 4.056 | | 4.011 | | | 2.017 | | 2.017 | |

| (I) | Total earning assets | $ | 7,921,528 | | $ | 7,864,595 | | $ | 7,685,631 | | | $ | 7,893,218 | | $ | 7,653,120 | |

| Net interest margin (GAAP-derived) (F*H)/I | 3.47 | % | 3.59 | % | 3.31 | % | | 3.53 | % | 3.24 | % |

| Net interest margin – FTE (G*H)/I | 3.48 | % | 3.60 | % | 3.32 | % | | 3.54 | % | 3.25 | % |

| | | | | | | |

| Calculation of Efficiency Ratio | | | | | | |

| (F) | Net interest income (GAAP) | $ | 68,516 | | $ | 69,565 | | $ | 63,462 | | | $ | 138,081 | | $ | 123,080 | |

| (G) | Net interest income – FTE | 68,695 | | 69,791 | | 63,585 | | | 138,486 | | 123,311 | |

| (J) | Plus: noninterest income (GAAP) | 22,769 | | 23,323 | | 22,830 | | | 46,092 | | 45,975 | |

| (K) | Less: gains/losses on investment securities and partnership investments | (748) | | (1,522) | | (636) | | | (2,270) | | (1,080) | |

| (L) | Less: depreciation – leased equipment | (1,876) | | (2,022) | | (2,664) | | | (3,898) | | (5,679) | |

| (M) | Total net revenue (GAAP) (F+J) | 91,285 | | 92,888 | | 86,292 | | | 184,173 | | 169,055 | |

| (N) | Total net revenue – adjusted (G+J–K–L) | 88,840 | | 89,570 | | 83,115 | | | 178,410 | | 162,527 | |

| (O) | Noninterest expense (GAAP) | 49,165 | | 49,421 | | 45,655 | | | 98,586 | | 90,991 | |

| (L) | Less:depreciation – leased equipment | (1,876) | | (2,022) | | (2,664) | | | (3,898) | | (5,679) | |

| | | | | | | |

| (P) | Noninterest expense – adjusted (O–L) | 47,289 | | 47,399 | | 42,991 | | | 94,688 | | 85,312 | |

| Efficiency ratio (GAAP-derived) (O/M) | 53.86 | % | 53.20 | % | 52.91 | % | | 53.53 | % | 53.82 | % |

| Efficiency ratio – adjusted (P/N) | 53.23 | % | 52.92 | % | 51.72 | % | | 53.07 | % | 52.49 | % |

| | | | | | | |

| | | | | |

| | | | | |

| | | | |

| | End of Period | | | |

| | June 30, | March 31, | June 30, | | | |

| | 2023 | 2023 | 2022 | | | |

| Calculation of Tangible Common Equity-to-Tangible Assets Ratio | | | | | |

| (Q) | Total common shareholders’ equity (GAAP) | $ | 921,020 | | $ | 909,159 | | $ | 856,251 | | | | |

| (R) | Less: goodwill and intangible assets | (83,897) | | (83,901) | | (83,916) | | | | |

| (S) | Total tangible common shareholders’ equity (Q–R) | $ | 837,123 | | $ | 825,258 | | $ | 772,335 | | | | |

| (T) | Total assets (GAAP) | 8,414,818 | | 8,329,803 | | 8,029,359 | | | | |

| (R) | Less: goodwill and intangible assets | (83,897) | | (83,901) | | (83,916) | | | | |

| (U) | Total tangible assets (T–R) | $ | 8,330,921 | | $ | 8,245,902 | | $ | 7,945,443 | | | | |

| Common equity-to-assets ratio (GAAP-derived) (Q/T) | 10.95 | % | 10.91 | % | 10.66 | % | | | |

| Tangible common equity-to-tangible assets ratio (S/U) | 10.05 | % | 10.01 | % | 9.72 | % | | | |

| | | | | | | |

| | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Calculation of Tangible Book Value per Common Share | | | | | | |

| (Q) | Total common shareholders’ equity (GAAP) | $ | 921,020 | | $ | 909,159 | | $ | 856,251 | | | | |

| (V) | Actual common shares outstanding | 24,682,561 | | 24,695,552 | | 24,650,407 | | | | |

| Book value per common share (GAAP-derived) (Q/V)*1000 | $ | 37.31 | | $ | 36.81 | | $ | 34.74 | | | | |

| Tangible common book value per share (S/V)*1000 | $ | 33.92 | | $ | 33.42 | | $ | 31.33 | | | | |

The NASDAQ Stock Market National Market Symbol: “SRCE” (CUSIP #336901 10 3)

Please contact us at shareholder@1stsource.com

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

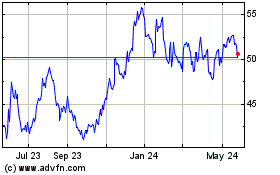

1st Source (NASDAQ:SRCE)

Historical Stock Chart

From Apr 2024 to May 2024

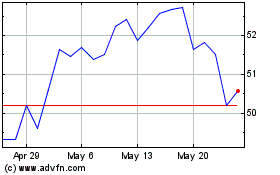

1st Source (NASDAQ:SRCE)

Historical Stock Chart

From May 2023 to May 2024