UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No.__)

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☑ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

INTEGRATED BIOPHARMA, INC.

(Name of Registrant as Specified In Its Charter)

(Not Applicable)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☑ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Dated Filed:

INTEGRATED BIOPHARMA, INC.

225 Long Avenue

Hillside, New Jersey 07205

October 28, 2019

To Our Stockholders:

On behalf of the Board of Directors, it is our pleasure to invite you to attend the 2019 Annual Meeting of Stockholders of Integrated BioPharma, Inc. (the “Company”), which will be held at 9:00 a.m. local time, on December 2, 2019 at the Company’s Executive Offices, located at 225 Long Avenue, Hillside, New Jersey 07205.

At the Annual Meeting, you will be asked to (i) provide a non-binding, advisory vote on the frequency of the stockholder vote on executive compensation, (ii) provide a non-binding, advisory vote on executive compensation, and (iii) ratify the appointment of the Company's independent auditors for the 2020 fiscal year. These matters are described in detail in the accompanying Notice of Annual Meeting of Stockholders and Proxy Statement. A proxy is included along with the Proxy Statement. These materials are being sent to stockholders on or about October 28, 2019.

It is important that your shares be represented at the Annual Meeting, whether or not you are able to attend. Accordingly, you are urged to sign, date and mail the enclosed proxy promptly. If you later decide to attend the Annual Meeting, you may revoke your proxy and vote your shares in person.

|

|

Sincerely,

|

|

|

|

|

|

/s/ Christina Kay

|

|

|

Christina Kay

|

|

|

Co-Chief Executive Officer

|

|

|

|

|

|

/s/ Riva Sheppard

|

|

|

Riva Sheppard

|

|

|

Co-Chief Executive Officer

|

INTEGRATED BIOPHARMA, INC.

225 Long Avenue

Hillside, New Jersey 07205

Notice of Annual Meeting of Stockholders

to be Held on December 2, 2019

and

Important Notice Regarding the Availability of Proxy Materials

for the Annual Meeting of Stockholders

To be Held on December 2, 2019

9:00am, Local Time

To the Stockholders of Integrated BioPharma, Inc.:

NOTICE IS HEREBY GIVEN that the 2019 Annual Meeting of Stockholders (the “Meeting”) of Integrated BioPharma, Inc., a Delaware corporation (the “Company”), will be held on December 2, 2019, at 9:00 a.m., local time, at the Company’s Executive Offices, located at 225 Long Avenue, Hillside, New Jersey 07205, for the purpose of considering and acting upon the following proposals:

|

|

1.

|

To provide a non-binding, advisory vote on the frequency of the stockholder vote on executive compensation;

|

|

|

2.

|

To provide a non-binding, advisory vote on executive compensation;

|

|

|

3.

|

To ratify the appointment of the Company’s independent accountants for the fiscal year ending June 30, 2020; and

|

|

|

4.

|

The transaction of such other business as may properly come before this Annual Meeting or any adjournment thereof.

|

Only holders of record of the Company’s common stock, par value $.002 per share (“Common Stock”), at the close of business on October 22, 2019 (the “Record Date”), are entitled to vote on the matters to be presented at this Annual Meeting. The number of shares of Common Stock outstanding on the Record Date and entitled to vote was 29,565,943.

The proxy statement and the Company’s annual report are available at https://materials.proxyvote.com/45811V.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” PROPOSALS NO. 1, NO. 2 AND NO. 3 TO BE PRESENTED TO THE COMPANY’S STOCKHOLDERS AT THE MEETING.

|

|

By order of the Board of Directors.

|

|

|

|

|

|

/s/ Dina L. Masi

|

|

|

Dina L. Masi

|

|

|

Secretary

|

|

Hillside, New Jersey

|

|

|

October 28, 2019

|

|

It is important that your shares be represented at this meeting in order that a quorum may be assured. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, YOU ARE URGED TO LOGIN AND VOTE ON THE INTERNET AT PROXYVOTE.COM OR DATE, SIGN AND PROMPTLY MAIL THE ENCLOSED CARD IN THE POSTAGE PREPAID ENVELOPE PROVIDED AND TO DO SO IN ADEQUATE TIME FOR YOUR DIRECTIONS TO BE RECEIVED AND TABULATED PRIOR TO THE SCHEDULED MEETING.

INTEGRATED BIOPHARMA, INC.

225 Long Avenue

Hillside, New Jersey 07205

PROXY STATEMENT

2019 ANNUAL MEETING OF STOCKHOLDERS

To be held on December 2, 2019

GENERAL INFORMATION

This Proxy Statement is furnished in connection with the solicitation of proxies on behalf of the Board of Directors of Integrated BioPharma, Inc., a Delaware corporation (the “Company”), to be voted at the 2019 Annual Meeting of Stockholders of the Company (the “Annual Meeting”) to be held at the Company’s Executive Offices, 225 Long Avenue, Hillside, New Jersey 07205 on December 2, 2019, at 9:00 a.m. local time, or at any postponement or adjournment thereof. This Proxy Statement, the Notice of Annual Meeting and the accompanying form of proxy are first being mailed to stockholders on or about October 28, 2019.

Only holders of record of the Company’s common stock, par value $.002 per share (“Common Stock”), at the close of business on October 22, 2019 (the “Record Date”), are entitled to vote on the matters to be presented at the Annual Meeting. The number of shares of Common Stock outstanding on the Record Date and entitled to vote is 29,565,943.

Holders of Common Stock are entitled to one vote on each matter to be voted upon by the stockholders at the Annual Meeting for each share held.

At the Annual Meeting, stockholders will be asked to (i) provide a non-binding, advisory vote on the frequency of the stockholder vote on executive compensation (the “Advisory Frequency Proposal) (ii) provide a non-binding, advisory vote on executive compensation (the “Advisory Compensation Proposal”) and (iii) consider and vote upon the proposal to ratify the appointment of Friedman LLP as the Company’s independent auditors for the fiscal year ending June 30, 2020 (the “Independent Auditors Proposal”). At the Annual Meeting, stockholders may also be asked to consider and take action with respect to such other matters as may properly come before the Annual Meeting.

Holders of Common Stock as of the Record Date are entitled to vote at the Annual Meeting. Whether you plan to attend the Annual Meeting or not, we urge you to vote by proxy. All shares represented by valid proxies that we receive through this solicitation, and that are not revoked, will be voted in accordance with your instructions on the proxy card or as instructed via Internet or telephone. You may specify whether your shares should be voted for, against or abstain with respect to each proposal. Voting by proxy will not affect your right to attend the Annual Meeting. If your shares are registered directly in your name through our stock transfer agent, Continental Stock Transfer, or you have stock certificates, you may vote:

|

|

●

|

By phone. Call toll free 800-690-6903.

|

|

|

●

|

By Internet. Go to www.proxyvote.com and follow the on-screen instructions.

|

|

|

●

|

In person. If you attend the meeting, you may deliver your completed proxy card in person or you may vote by completing a ballot, which will be available at the Annual Meeting.

|

If your shares are held in “street name” (held in the name of a bank, broker or other nominee), you must provide the bank, broker or other nominee with instructions on how to vote your shares and can do so as follows:

|

|

●

|

By Internet or by telephone. Follow the instructions you receive from your broker to vote by Internet or telephone.

|

|

|

●

|

In person at the meeting. Contact the broker or other nominee who holds your shares to obtain a broker’s proxy card and bring it with you to the meeting. You will not be able to attend the Annual Meeting unless you have a proxy card from your broker.

|

YOUR PROXY CARD WILL BE VALID ONLY IF YOU COMPLETE, SIGN, DATE, AND RETURN IT BEFORE THE MEETING DATE.

QUORUM AND VOTE REQUIREMENTS

The presence, in person or by proxy, of holders of record of a majority of the shares of Common Stock issued and outstanding and entitled to vote is required for a quorum to transact business at the Annual Meeting, but if a quorum is not present, the Annual Meeting may be adjourned from time to time until a quorum is obtained. The proposals set forth herein and all other matters to properly come before the Annual Meeting will be determined by the affirmative vote of the holders of a majority of the shares of Common Stock present, in person or by proxy, and entitled to vote at the Annual Meeting. Brokers or other nominees who hold shares of Common Stock in “street name” for a beneficial owner of those shares typically have the authority to vote in their discretion on “routine” proposals when they receive instructions from beneficial owners. However, brokers are not allowed to exercise their voting discretion with respect to approval of matters which are “non-routine” without specific instruction from the beneficial owner. The Advisory Frequency Proposal and the Advisory Compensation Proposal are non-routine proposals, and therefore brokers are not entitled to vote without your instructions. The ratification of independent auditors is a routine proposal, and therefore, your broker can vote on the independent auditors’ proposal without specific instructions from you. Broker “non-votes” (i.e. proxies from brokers or nominees indicating that such persons have not received instructions from the beneficial owner or other persons entitled to vote shares as to a matter with respect to which the brokers or nominees do not have discretionary power to vote) and shares for which duly executed proxies have been received but with respect to which holders of shares have abstained from voting will be treated as present for purposes of determining the presence of a quorum at the Annual Meeting. Broker non-votes will have no impact on the Advisory Frequency Proposal or the Advisory Compensation Proposal and broker non-votes are inapplicable to the Independent Auditors Proposal because the broker has discretionary authority to vote your shares with respect to such proposal. Abstentions will not be counted as either a vote cast for or against any proposal.

SOLICITATION AND REVOCATION

PROXIES IN THE FORM ENCLOSED ARE BEING SOLICITED BY, AND ON BEHALF OF, THE BOARD OF DIRECTORS. THE PERSONS NAMED IN THE ACCOMPANYING FORM OF PROXY HAVE BEEN DESIGNATED AS PROXIES BY THE BOARD OF DIRECTORS.

All Common Stock represented by properly executed proxies which are returned and not revoked prior to the time of the Annual Meeting will be voted in accordance with the instructions, if any, given thereon. If no instructions are provided in an executed proxy, it will be voted (i) with respect to Proposal 1, FOR a stockholder vote on executive compensation every three years, (ii) with respect to Proposal 2, FOR the Advisory Compensation Proposal, and (iii) with respect to Proposal 3, FOR the Independent Auditors Proposal, and in accordance with the proxy holder’s discretion as to any other business raised at the Annual Meeting. Any stockholder who executes a proxy may revoke it at any time before it is voted by delivering to the Company a written statement revoking such proxy, by executing and delivering a later dated proxy, or by voting in person at the Annual Meeting. Attendance at the Annual Meeting by a stockholder who has executed and delivered a proxy to the Company shall not in and of itself constitute a revocation of such proxy.

The Company will bear its own cost for the solicitation of proxies. Proxies will be solicited initially by mail. Further solicitation may be made by directors, officers, and employees of the Company personally, by telephone, or otherwise, but any such person will not be specifically compensated for such services. The Company also intends to make, through banks, brokers or other persons, a solicitation of proxies of beneficial holders of the Common Stock. Upon request, the Company will reimburse brokers, dealers, banks and similar entities acting as nominees for reasonable expenses incurred in forwarding copies of the proxy materials relating to the Annual Meeting to the beneficial owners of Common Stock which such persons hold of record.

No Appraisal Rights

Under the Delaware General Corporation Law, our stockholders are not entitled to appraisal rights with respect to the proposals set forth herein, and we will not independently provide our stockholders with any such rights.

DIRECTORS

The Company's Board of Directors is currently composed of six (6) directors, divided into three classes of directors serving staggered three-year terms. The Class I directors, whose terms of office expire in 2021, are Mr. E. Gerald Kay, Ms. Riva Sheppard and Mr. Carl DeSantis. The Class II directors, whose terms of office expire in 2020, are Mr. William Milmoe, Ms. Christina Kay and Mr. Robert Canarick. There are currently no Class III directors, as the Company has been unable to attract qualified candidates to fill the vacancy created when the term of the former Class III Director expired.

The following table sets forth certain information with respect to the members of the Company’s Board of Directors as of the Fiscal Year Ended June 30, 2019:

|

|

|

|

|

Class of

|

|

Director

|

|

|

|

Age

|

|

Directors

|

|

Since

|

|

E. Gerald Kay............................................................................................................…………..

|

|

83

|

|

Class I

|

|

1980

|

|

Riva Sheppard .........................................................................................................…………...

|

|

52

|

|

Class I

|

|

1991

|

|

Carl DeSantis ............................................................................................................………….

|

|

80

|

|

Class I

|

|

2003

|

|

Christina Kay............................................................................................................…………..

|

|

49

|

|

Class II

|

|

1994

|

|

Robert Canarick.........................................................................................................………….

|

|

69

|

|

Class II

|

|

1994

|

|

William Milmoe.........................................................................................................………….

|

|

71

|

|

Class II

|

|

2008

|

Mr. E. Gerald Kay has served as President of the Company since April 7, 2009, as Chairman of the Board of the Company and its predecessor since 1980, and as Chief Executive Officer of the Company from April 7, 2009 until May 1, 2019. Mr. Kay also served as Chief Executive Officer of the Company from May 9, 2003 until November 5, 2008 and President from May 1999 until May 3, 2003. Mr. Kay is not a director of any other public company.

Director Qualifications:

As a long-time owner and officer of the Company, Mr. Kay has tremendous knowledge of the Company’s history, strategies, manufacturing processes and culture. As Chairman, President and Chief Executive Officer of the Company, he has developed numerous key business relationships with the Company’s significant shareholders, customers, suppliers, lenders and personnel which continue to contribute to the Company’s ongoing businesses.

Ms. Riva Sheppard has served as Co-Chief Executive Officer of the Company since May 1, 2019 and as a director of the Company since May 1991. Ms. Sheppard has also served as Executive Vice President from November 2005 to May 1, 2019 and as Vice President from May 1991 to November 2005. Ms. Sheppard is the daughter of E. Gerald Kay and the sister of Christina Kay. Ms. Sheppard is not a director of any other public company.

Director Qualifications:

As a long-time owner and officer of the Company, Ms. Sheppard has tremendous knowledge of the Company’s history, strategies, manufacturing processes and culture. As Executive Vice President of the Company, she has developed numerous key business relationships with the Company’s customers, suppliers and personnel which continue to contribute to the Company’s ongoing businesses and continues to maintain these relationships as the Company’s Co-Chief Executive Officer.

Mr. Carl DeSantis has served as director of the Company since 2003. Mr. DeSantis has served as Chairman of CDS International Holdings, Inc., a private investment firm since June of 2001. Prior to that, he was Chairman of Rexall Sundown, Inc., a publicly-held manufacturer of vitamins and supplements. Mr. DeSantis is not a director of any other public company.

Director Qualifications:

Mr. DeSantis has in-depth knowledge of the nutraceutical business and over 46 years of general business experience. In addition, Mr. DeSantis has significant ownership in the Company.

Ms. Christina Kay has served as Co-Chief Executive Officer of the Company since May 1, 2019 and as a director of the Company since December 1994. Ms. Kay has also served as Executive Vice President from November 2005 to May 1, 2019 and as Vice President from December 1994 to November 2005. Ms. Kay is the daughter of E. Gerald Kay and the sister of Riva Sheppard. Ms. Kay is not a director of any other public company.

Director Qualifications:

As a long-time owner and officer of the Company, Ms. Kay has tremendous knowledge of the Company’s history, strategies, manufacturing processes and culture. As Executive Vice President of the Company, she has developed numerous key business relationships with the Company’s customers, suppliers and personnel which continue to contribute to the Company’s ongoing businesses and continues to maintain these relationships as the Company’s Co-Chief Executive Officer.

Mr. Robert Canarick has served as a director of the Company since December 1994. From January 1998 until August of 2001 he served as general counsel of NIA Group, LLC, an all lines independent Insurance agency. From August 2001 until December 2017 he served as President of Links Insurance Services, LLP. (“Links”) and from January 2017 as an employee of Links. Mr. Canarick is a former attorney and certified public accountant. Mr. Canarick is not a director of any other public company.

Director Qualifications:

Mr. Canarick is a former attorney and certified public accountant and has 42 years of relevant business and financial experience. Mr. Canarick also provides legal and practical guidance and insights into our risk management and legal matters.

William H. Milmoe has been a director of our Company since December 2008. Since January 2006, Mr. Milmoe has served as President and Chief Financial Officer of CDS International Holdings, Inc., a private investment firm. From 1997 to January 2006, he was CDS International Holdings, Inc.’s Chief Financial Officer and Treasurer. Mr. Milmoe is a certified public accountant with over 40 years of broad business experience in both public accounting and private industry. His financial career has included positions with PricewaterhouseCoopers, General Cinema Corporation, an independent bottler of Pepsi Cola products and movie exhibitor. Mr. Milmoe is a member of both the Florida and the American Institute of Certified Public Accountants. Mr. Milmoe also serves as a director of Celsius Holdings, Inc., a public company.

Director Qualifications:

Mr. Milmoe is a certified public accountant and has 42 years of relevant business and financial experience. Mr. Milmoe uses his substantial experience to provide practical guidance and insights to the Company.

Family Relationships

Other than as described above, there are no family relationships among our executive officers and directors.

Involvement in Certain Legal Proceedings

During the past ten years, none of the persons serving as executive officers and/or directors of the Company has been the subject matter of any of the following legal proceedings that are required to be disclosed pursuant to Item 401(f) of Regulation S-K including: (a) any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; (b) any criminal convictions; (c) any order, judgment, or decree permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities; (d) any finding by a court, the SEC or the CFTC to have violated a federal or state securities or commodities law, any law or regulation respecting financial institutions or insurance companies, or any law or regulation prohibiting mail or wire fraud; or (e) any sanction or order of any self-regulatory organization or registered entity or equivalent exchange, association or entity. Further, no such legal proceedings are believed to be contemplated by governmental authorities against any director or executive officer.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), requires the Company's directors, executive officers and holders of more than 10% of the Company's common stock to file reports of ownership and changes in ownership of common stock with the Securities and Exchange Commission (the “SEC”). Based solely on our review, all required filings regarding changes of ownership were filed during the Fiscal Year Ended June 30, 2019.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding the number of shares of common stock of Integrated BioPharma beneficially owned on October 22, 2019, by:

|

|

●

|

each person who is known by the Company to beneficially own five percent (5%) or more of the common stock of the Company;

|

|

|

●

|

each of the directors and executive officers of the Company; and

|

|

|

●

|

all of the Company’s directors and executive officers, as a group.

|

|

|

|

Number of Shares

|

|

Percent of Shares

|

|

Name of Beneficial Owner (1)

|

|

Beneficially Owned (2)

|

|

Beneficially Owned (3)

|

|

Carl DeSantis .....................................................................................................................................

|

|

13,009,391 (4)

|

|

43.7%

|

|

William H. Milmoe.............................................................................................................................

|

|

10,837,840 (5)

|

|

36.4%

|

|

E. Gerald Kay .....................................................................................................................................

|

|

5,387,556 (6)

|

|

18.0%

|

|

Christina Kay.......................................................................................................................................

|

|

1,548,467 (7)

|

|

5.2%

|

|

Riva Sheppard.....................................................................................................................................

|

|

1,548,467 (7)

|

|

5.2%

|

|

Dina L. Masi ......................................................................................................................................

|

|

422,200 (8)

|

|

1.4%

|

|

Robert Canarick .................................................................................................................................

|

|

409,233 (9)

|

|

1.4%

|

|

Directors and executive officers as a group (7 persons).....................................................................

|

|

22,613,981(10)

|

|

71.3%

|

|

|

|

|

|

|

|

(1)

|

The address of each of the persons listed is c/o Integrated BioPharma Inc., 225 Long Avenue, Hillside, New Jersey 07205.

|

|

(2)

|

Unless otherwise indicated, includes shares owned by a spouse, minor children, by relatives sharing the same home, and entities owned or controlled by the named person. Also includes shares if the named person has the right to acquire such shares within 60 days after October 22, 2019, by the exercise of warrant, stock option or other right. Unless otherwise noted, shares are owned of record and beneficially by the named person.

|

|

(3)

|

Based upon 29,565,943 shares of common stock outstanding on October 22, 2019.

|

|

(4)

|

Includes (i) 2,242,809 shares owned by Carl DeSantis Revocable Trust; (ii) 10,524,173 shares of common stock owned by CD Financial, LLC of which Mr. DeSantis is the manager; and (iii) 225,000 shares of common stock issuable upon exercise of presently exercisable stock options.

|

|

(5)

|

(Includes (i) 10,524,173 shares of common stock owned by CD Financial, LLC of which Mr. Milmoe is an executive officer; and (ii) 225,000 shares of common stock issuable upon exercise of presently exercisable stock options.

|

|

(6)

|

Includes (i) 819,629 shares of common stock held by EGK LLC, of which Mr. Kay is the manager and (ii) 325,000 shares of common stock issuable upon exercise of presently exercisable stock options. Mr. Kay shares dispositive power with Christina Kay with respect to 169,358 shares of common stock and with Riva Sheppard with respect to 169,358 shares of common stock.

|

|

(7)

|

Includes 375,000 shares of common stock issuable upon exercise of presently exercisable stock options. Ms. Sheppard and Ms. Kay each share dispositive power with E. Gerald Kay with respect to 169,358 shares of common stock.

|

|

(8)

|

Includes 325,000 shares of common stock issuable upon exercise of presently exercisable stock options.

|

|

(9)

|

Includes 350,000 shares of common stock issuable upon exercise of presently exercisable stock options.

|

|

(10)

|

Includes (i) 819,629 shares owned by EGK LLC of which Mr. Kay is the manager; (ii) 2,242,809 shares owned by Carl DeSantis Revocable Trust and (iii) 2,200,000 shares of common stock issuable upon exercise of presently exercisable stock options.

|

Securities Authorized for Issuance Under Equity Compensation Plans

The following table includes information as of June 30, 2019 relating to the Company's stock option plans, which comprise all of the Company's equity compensation plans. The table provides the number of securities to be issued upon the exercise of outstanding options under such plans, the weighted-average exercise price of such outstanding options and the number of securities remaining available for future issuance under such plans.

The following table provides information, as of June 30, 2019, about the Company's equity compensation plans:

|

|

|

Equity Compensation Plan Information

|

|

|

|

|

Number of securities to be issued upon exercise of outstanding options, warrants and rights

|

|

|

Weighted-average exercise price of outstanding options, warrants and rights

|

|

|

Number of securities remaining available for future issuance under equity compensation plans (excluding securities

|

|

|

|

|

(a)

|

|

|

(b)

|

|

|

reflected in column (a))

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity compensation plans approved by security holders

|

|

|

3,761,500

|

|

|

$

|

0.16

|

|

|

|

7,873,169

|

|

|

Equity compensation plans not approved by security holders

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Totals

|

|

|

3,761,500

|

|

|

|

|

|

|

|

|

|

CORPORATE GOVERNANCE

Our common stock is not currently listed on a national securities exchange and as such we have used the definition of “independence” as defined by The NASDAQ Stock Market to make a determination on the independence of our directors. Based on such definition, we have concluded that Mr. Canarick is deemed to be “independent”.

The Board of Directors held two meetings, the Audit Committee held four meetings and the Compensation Committee held two meetings during the Fiscal Year Ended June 30, 2019 which were attended by all Board Members and all directors serving on such committees, as applicable.

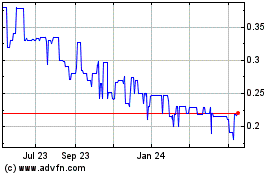

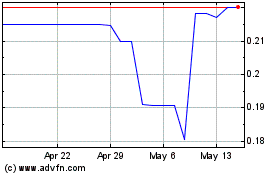

In the fiscal year ended June 30, 2019, each non-officer Director who was a director as of the date of the Board of Directors Meeting held on May 22, 2019 was granted options to purchase Common Stock under the Company’s 2001 Stock Option Plan, with an exercise price of $0.21 ($0.23 if a greater than 10% owner), which represents the fair market value of the shares of common stock as of the grant date, for his services to the Board of Directors. An aggregate of 450,000 shares were granted. Two thirds of the underlying shares (300,000) vested on the grant date for the three non-officer Board members. The remaining one third or 150,000 underlying shares of the options were vest in twelve (12) equal monthly installments on the 1st of each month representing the non-officer Director’s compensation for the fiscal year ended June 30, 2020.

The Audit Committee’s current members are Mr. Canarick, who is an independent director, and Mr. Milmoe, who is not an independent director. Mr. Milmoe was appointed to the Audit Committee in September 2009 until such time as the Board replaces him with a qualified independent director. Mr. Milmoe meets the requirements set forth for an "audit committee financial expert", as defined in the applicable SEC rules. In making this determination, our Board of Directors has considered the formal education and nature and scope of his previous professional experience. The Company is not actively seeking an independent director at this time. The Company has no immediate plans to search for a new independent board member in the ensuing fiscal year. The Audit Committee periodically consults with the Company’s management and independent public accountants on financial matters, including the Company’s internal financial controls and procedures. The Audit Committee operates under a written Charter, a copy which is available on the Company’s website at http://www.ibiopharma.com//charter.htm. The Audit Committee met four times in the Fiscal Year Ended June 30, 2019, all of which were attended by Mr. Canarick and Mr. Milmoe.

At the Board Meeting held in September 2016, the Board of Directors formed a Compensation Committee composed of Mr. Kay, Mr. Milmoe and Mr. Canarick. The Compensation Committee met twice in the fiscal year ended June 30, 2019. The Board set the initial function of the Compensation Committee as developing an Incentive Compensation Plan for the Company’s executive officers and staff, reviewing executive management compensation and reporting back to the Board of Directors their recommendations.

The Company does not have a standing nominating committee. With respect to nominating matters, the entire Board performs this function due to the limited number of independent directors currently on the Board. At such time, if any, as the Board composition changes or the Board otherwise deems appropriate, the Company may establish a separate nominating committee. As a result, the entire Board participates in the consideration of Board nominees. The Board, at this time, does not have a policy with regard to consideration of diversity in considering director nominees.

The Company’s common stock is currently quoted on the OTQOB regulated by the OTC Markets, a regulated quotation service that displays real-time quotes, last-sale prices and volume information in over-the-counter securities (“OTCQB”). OTCQB regulations do not require the Company to have audit, nomination or compensation committees. In addition, if the Company’s Common Stock were to be relisted on the NASDAQ Global Market, the Company determined that due to the beneficial ownership by E. Gerald Kay and certain of his family members and Carl DeSantis of greater than 50% of the Common Stock of the Company outstanding as of October 22, 2019, the Company would be a “controlled company” as defined by the NASDAQ Global Market. As such, the Company would be exempt from certain requirements of the NASDAQ Global Market standards, including the requirement to maintain a majority of independent directors on the Company’s Board of Directors and the requirements regarding the determination of compensation of executive officers and the nomination of directors by independent directors.

Code of Ethics

The Company has adopted a Code of Ethics which applies to our directors, officers, senior management and certain other of our employees, including our principal executive officer, principal financial officer, principal accounting officer, controller or persons performing similar functions. Our Code of Ethics was filed as an exhibit to our Annual Report on Form 10-KSB for the Fiscal Year Ended June 30, 2004, as filed with the SEC on September 28, 2004, as amended as of November 10, 2004.

Governance Structure

The Company has chosen to combine the principal executive officer and chairman of the board positions. Given the relatively small size of the Company and that a majority of the voting control of the Company is with members of our board, the Company believes that combining the principal executive officer and board chairman positions is the most efficient board leadership structure.

No lead independent director has been designated to chair meetings of the independent directors, since we currently only have one independent director.

Board of Directors Role in Risk Oversight

The Company’s audit committee is primarily responsible for overseeing the Company’s risk management processes on behalf of the full board. The audit committee has periodic meetings with management, during which the audit committee receives reports from management regarding the Company’s assessment of risks and discusses with management the Company’s policies with respect to risk assessment, the Company’s major financial risk exposures and the steps to be taken to monitor and mitigate these exposures. While the audit committee is responsible for risk oversight and for ensuring that material risk is identified and managed properly, the Company’s management is responsible for the day-to-day risk management processes. We believe this division of responsibilities is the most effective approach for addressing the risks facing our Company.

EXECUTIVE OFFICERS

The following individual is an executive officer of the Company but is not a director or nominee for director:

Dina L. Masi, age 58, is Senior Vice President, Chief Financial Officer and Secretary of the Company. Ms. Masi joined the Company on November 17, 2005. Previously, Ms. Masi operated a financial services consulting firm, DLM Accounting and Financial Services, LLC, providing accounting and financial services to small business owners and SEC registrants from May 2005 to November 2005. From June 2002 to December 2004, Ms. Masi served as the Chief Financial Officer and Senior Vice President of Prescott Funding, LLC, a licensed residential mortgage lender specializing in non-conforming consumer lending. Ms. Masi also served as the Chief Financial Officer and Senior Vice President of Fintek, Inc., a privately owned financial consulting services company, from July 2001 to September 2005, and as Management Information Officer from February 1998 to July 2001.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Overview

The goal of our named executive officer compensation program is the same as our goal for operating the Company - to create long-term value for our stockholders. Toward this goal, we have designed and implemented our compensation programs for our named executives to reward them for sustained financial and operating performance and leadership

excellence, to align their interests with those of our stockholders and to encourage them to remain with the Company for long and productive careers. Most of our compensation elements simultaneously fulfill one or more of our performance, alignment and retention objectives. These elements consist of salary and annual bonus, equity incentive compensation, retirement and other benefits. In deciding on the type and amount of compensation for each executive, we focus on both current pay and the opportunity for future compensation. We combine the compensation elements for each executive in a manner we believe optimizes the executive’s contribution to the Company.

Compensation Objectives

Performance. Our four executives who are identified in the Summary Compensation Table below (whom we refer to as our named executives) have a combined total of 107 years with the Company, during which they have held different positions and been, in some cases, promoted to increasing levels of responsibility. The amount of compensation for each named executive reflects his or her superior management experience, continued high performance and exceptional career of service to the Company over a long period of time. A key element of compensation that depends upon the named executive’s performance is equity incentive compensation in the form of stock options and restricted stock units (“RSUs”), subject to vesting schedules that require continued service with the Company.

Base salary is designed to be commensurate with the executive’s scope of responsibilities, demonstrated leadership abilities, and management experience and effectiveness. Our other elements of compensation focus on motivating and challenging the executive to achieve superior, longer-term, sustained results. There were no increases in base compensation in the Fiscal Year Ended June 30, 2019, for each of the four named executive officers.

Alignment. We seek to align the interests of the named executives with those of our investors by evaluating executive performance on the basis of key financial measurements which we believe closely correlate to long-term stockholder value, including revenue, operating profit, earnings per share, operating margins, return on total equity or total capital, cash flow from operating activities and total stockholder return. Equity incentive compensation awards align the interests of the named executives with stockholders because the total value of those awards corresponds to stock price appreciation.

Retention. Our senior executives have been presented with other professional opportunities, including ones at potentially higher compensation levels. We attempt to retain our executives by using continued service as a determinant of total pay opportunity, with the extended vesting terms of stock option and RSU awards.

Implementing Our Objectives

Determining Compensation. We rely upon our judgment in making compensation decisions, after reviewing the performance of the Company and carefully evaluating an executive’s performance during the year against established goals, leadership qualities, operational performance, business responsibilities, career with the Company, current compensation arrangements and long-term potential to enhance stockholder value. Specific factors affecting compensation decisions for the named executives include:

● key financial measurements such as revenue, operating profit, earnings per share, operating margins, return on total equity or total capital, cash flow from operating activities and total stockholder return;

● strategic objectives such as acquisitions, dispositions or joint ventures, technological innovation and globalization;

● promoting commercial excellence by launching new or continuously improving products or services, being a leading market player and attracting and retaining customers;

● achieving specific operational goals for the Company, including improved productivity, simplification and risk management;

● achieving excellence in their organizational structure and among their employees; and

● supporting our values by promoting a culture of unyielding integrity through compliance with law and our ethics policies, as well as commitment to community leadership and diversity.

We generally do not adhere to rigid formulas or necessarily react to short-term changes in business performance in determining the amount and mix of compensation elements. We consider competitive market compensation paid by other companies, but we do not attempt to maintain a certain target percentile within a peer group or otherwise rely on those data to determine executive compensation. We incorporate flexibility into our compensation programs and in the assessment process to respond to and adjust for the evolving business environment.

We strive to achieve an appropriate mix between equity incentive awards and cash payments in order to meet our objectives. Any apportionment goal is not applied rigidly and does not control our compensation decisions; we use it as another tool to assess an executive’s total pay opportunities and whether we have provided the appropriate incentives to accomplish our compensation objectives. Our mix of compensation elements is designed to reward recent results and motivate long-term performance through a combination of cash and equity incentive awards. We also seek to balance compensation elements that are based on financial, operational and strategic metrics with others that are based on the performance of our shares. We believe the most important indicator of whether our compensation objectives are being met is our ability to motivate our named executives to deliver superior performance and retain them to continue their careers with us on a cost-effective basis.

No Employment and Severance Agreements. Our named executives do not have employment, severance or change-of-control agreements. Our named executives serve at the will of the Board, which enables the Company to terminate their employment with discretion as to the terms of any severance arrangement. This is consistent with the Company’s performance-based employment and compensation philosophy. In addition, our policies on employment, severance and retirement arrangements help retain our executives by subjecting to forfeiture significant elements of compensation that they have accrued over their careers at the Company if they leave the Company prior to retirement.

Role of Board and CEO. The Board of Directors has primary responsibility in developing and evaluating potential candidates for executive positions, including the CEO, and for overseeing the development of executive succession plans. As part of this responsibility, the Board oversees the design, development and implementation of the compensation program for the CEO and the other named executives. The Board evaluates the performance of the CEO and determines CEO compensation in light of the goals and objectives of the compensation program. The CEO and the Board together assess the performance of the other named executives and determine their compensation, based on initial recommendations from the CEO. In September 2016, the Board of Directors created a Compensation Committee to take over this role from the Board and CEO. The Compensation Committee recommended the compensation for the named executive officers in the fiscal year ended June 30, 2019.

In the fiscal year ended June 30, 2019, the Board named Ms. Christina Kay and Ms. Riva Sheppard, effective, May 1, 2019, as Co-CEOs upon the resignation of our past CEO, E. Gerald Kay, who remains as President and Executive Chairman and a member of the Compensation Committee. The Co-CEOs attend the Compensation Committee meetings as invited guests and assist the committee in reaching compensation decisions with respect to the named executives other than themselves. The remaining named executive does not play a role in her own compensation determination, other than discussing individual performance objectives with the Co-CEOs.

Role of Compensation Consultants. We have not used the services of any compensation consultants in matters affecting senior executive or director compensation. In the future, either the Company or the Board may engage or seek the advice of compensation consultants.

Equity Grant Practices. The exercise price of each stock option awarded to our senior executives under our long-term incentive plan is the closing price of our stock on the date of grant. Scheduling decisions are made without regard to anticipated earnings or other major announcements by the Company.

Tax Deductibility of Compensation. Section 162(m) of the Internal Revenue Code of 1986, as amended, imposes a $1 million limit on the amount that a public Company may deduct for compensation paid to the Company’s CEOs or any of the Company’s four other most highly compensated executive officers who are employed as of the end of the year. This limitation does not apply to compensation that meets the requirements under Section 162(m) for “qualifying performance-based” compensation (i.e., compensation paid only if the individual’s performance meets pre-established objective goals based on performance criteria approved by stockholders). For the year ended June 30, 2019, the deduction for compensation paid to the Company’s “covered employees” was not limited by Section 162(m).

Potential Impact on Compensation from Executive Misconduct. If the Board determines that an executive officer has engaged in fraudulent or intentional misconduct, the Board would take action to remedy the misconduct, prevent its recurrence, and impose such discipline on the wrongdoers as would be appropriate. Discipline would vary depending on the facts and circumstances, and may include, without limit, (1) termination of employment, (2) initiating an action for breach of fiduciary duty, and (3) if the misconduct resulted in a significant restatement of the Company’s financial results, seeking reimbursement of any portion of performance-based or incentive compensation paid or awarded to the executive that is greater than would have been paid or awarded if calculated based on the restated financial results. These remedies would be in addition to, and not in lieu of, any actions imposed by law enforcement agencies, regulators or other authorities.

Elements Used to Achieve Compensation Objectives

Annual cash compensation

Base salary. Base salaries for our named executives depend on the scope of their responsibilities, their performance, and the period over which they have performed those responsibilities. Decisions regarding salary increases take into account the executive’s current salary and the amounts paid to the executive’s peers within and outside the Company. Base salaries are reviewed approximately every 12 months, but are not automatically increased if the Board believes that other elements of compensation are more appropriate in light of our stated objectives. This strategy is consistent with the Company’s primary intent of offering compensation that is contingent on the achievement of performance objectives.

Bonus. The Company did not pay bonuses to the named executives in the fiscal year ended June 30, 2019, but does not rule out doing so in the future when appropriate.

The salaries paid to the named executives during the year ended June 30, 2019 are discussed below and shown in the Summary Compensation Table below.

Equity awards

The Company’s equity incentive compensation program is designed to recognize scope of responsibilities, reward demonstrated performance and leadership, motivate future superior performance, align the interests of the executive with our stockholders’ and retain the executives through the term of the awards. We consider the grant size and the appropriate combination of stock options when making award decisions. The amount of equity incentive compensation grants are based upon the strategic, operational and financial performance of the Company overall and reflects the executives’ expected contributions to the Company’s future success. Existing ownership levels are not a factor in award determination, as we do not want to discourage executives from holding significant amounts of our stock.

We have expensed stock option and RSU grants in accordance with United States generally accepted accounting principles. When determining the appropriate amount of stock options and RSUs, our goal is to weigh the cost of these grants with their potential benefits as a compensation tool. Stock options only have value to the extent the price of our stock on the date of exercise exceeds the exercise price on grant date, and thus are an effective compensation element only if the stock price grows over the term of the award. In this sense, stock options are a motivational tool.

Each of the named executives received grants of stock options in the year ended June 30, 2019. There were no awards of RSU grants in the fiscal year ended June 30, 2019. Fifty percent (50%) of the stock options granted became exercisable on the grant date, May 24, 2019, the remaining fifty percent (50%) become exercisable in three (3) equal annual installments each on the annual anniversary date of the vesting date (May 24) and have a maximum ten-year term (see outstanding equity table filed herein). We believe that this vesting schedule aids the Company in retaining executives and motivating longer-term performance. Under the terms of the Company’s long-term incentive plan, unvested stock options and RSUs are forfeited if the executive voluntarily leaves the Company.

Other Compensation

Other compensation paid to executive officers includes the total matching contribution of the Integrated BioPharma, Inc. 401(k) Profit Sharing Plan of the named executive officer.

Compensation for the Named Executives in the year ended June 30, 2019

Strength of Company performance. The specific compensation decisions made for each of the named executives for the year ended June 30, 2019 reflect the performance of the Company against key financial and operational measurements. A more detailed analysis of our financial and operational performance is contained in the Management’s Discussion & Analysis section of our most recent Annual Report on Form 10-K filed with the SEC.

CEOs compensation. In determining Mr. Kay’s compensation for the year ended June 30, 2019, the Board considered his performance against the Company’s financial, strategic and operational goals for the year. In the Fiscal Year Ended June 30, 2019, Mr. Kay received $197,693 in salary and $28,811 in other compensation for his service as the Chief Executive Officer and President of the Company. Mr. Kay’s compensation for the 2019 fiscal year was based on qualitative managerial efforts and business.

In determining Ms. Kay’s compensation for the year ended June 30, 2019, the Board considered her performance against the Company’s financial, strategic and operational goals for the year. In the Fiscal Year Ended June 30, 2019, Ms. Kay received $179,302 in salary and $6,818 in other compensation for her service as the Co-Chief Executive Officer and Executive Vice President of the Company. Ms. Kay’s compensation for the 2019 fiscal year was based on qualitative managerial efforts and business and her promotion to her new role as Co-CEO.

In determining Mrs. Sheppard’s compensation for the year ended June 30, 2019, the Board considered her performance against the Company’s financial, strategic and operational goals for the year. In the Fiscal Year Ended June 30, 2019, Mrs. Sheppard received $178,002 in salary and $5,808 in other compensation for her service as the Co-Chief Executive Officer and Executive Vice President of the Company. Ms. Kay’s compensation for the 2019 fiscal year was based on qualitative managerial efforts and business and her promotion to her new role as Co-CEO.

CFO compensation. In determining Ms. Masi’s compensation for the year ended June 30, 2019, the Board considered her performance against her financial, strategic and operational goals for the year. In the Fiscal Year Ended June 30, 2019, Ms. Masi received $230,750 in salary and $8,800 in other compensation for her service as an executive officer of the Company. Ms. Masi’s compensation for the 2019 fiscal year was based on qualitative managerial efforts and business.

Report of the Board of Directors

The Board of Directors has reviewed and discussed with our management the Compensation Discussion and Analysis included in this Proxy. Based on that review and discussion, the Board has recommended that the Compensation Discussion and Analysis be included in this Proxy.

|

October 28, 2019

|

BOARD OF DIRECTORS

|

|

|

|

|

|

E. Gerald Kay

|

|

|

Riva Sheppard

|

|

|

Carl DeSantis

|

|

|

Christina Kay

|

|

|

William H Milmoe

|

|

|

Robert Canarick

|

Summary Compensation Table for 2019

The table below summarizes the total compensation paid or earned by our Chief Executive Officer and our Chief Financial Officer and two other most highly compensated executive officers who were serving as executive officers (the “Named Executive Officers”) for each of the last three completed fiscal years.

|

Name and Principal Position

|

|

Year

|

|

Salary ($)

|

|

|

Bonus ($)

|

|

|

Stock Awards ($)

|

|

|

Option Awards ($)(1)

|

|

|

Non-Equity Incentive Plan Compensation ($)

|

|

|

Change in Pension Value and Non-Qualified Deferred Compensation Earnings ($)

|

|

|

All Other Compen-sation ($) (2)

|

|

|

Total ($)

|

|

|

E.Gerald Kay

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chairman and President

|

|

2019

|

|

$

|

197,693

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

16,689

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

28,511

|

|

|

|

242,893

|

|

|

Chairman and

|

|

2018

|

|

|

196,829

|

|

|

|

-

|

|

|

|

-

|

|

|

|

1,458

|

|

|

|

-

|

|

|

|

-

|

|

|

|

27,335

|

|

|

|

225,622

|

|

|

Chief Executive Officer

|

|

2017

|

|

|

182,922

|

|

|

|

-

|

|

|

|

-

|

|

|

|

1,590

|

|

|

|

-

|

|

|

|

-

|

|

|

|

22,345

|

|

|

|

206,857

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Christina Kay

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Co-Chief Executive Officer

|

|

2019

|

|

|

179,302

|

|

|

|

-

|

|

|

|

-

|

|

|

|

18,884

|

|

|

|

-

|

|

|

|

-

|

|

|

|

6,818

|

|

|

|

205,004

|

|

|

Executive Vice President

|

|

2018

|

|

|

178,284

|

|

|

|

-

|

|

|

|

-

|

|

|

|

1,543

|

|

|

|

-

|

|

|

|

-

|

|

|

|

6,462

|

|

|

|

186,289

|

|

|

|

|

2017

|

|

|

172,963

|

|

|

|

-

|

|

|

|

-

|

|

|

|

1,683

|

|

|

|

-

|

|

|

|

-

|

|

|

|

6,203

|

|

|

|

180,849

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Riva Sheppard

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Co-Chief Executive Officer

|

|

2019

|

|

|

178,002

|

|

|

|

-

|

|

|

|

-

|

|

|

|

18,884

|

|

|

|

-

|

|

|

|

-

|

|

|

|

5,808

|

|

|

|

202,694

|

|

|

Executive Vice President

|

|

2018

|

|

|

175,583

|

|

|

|

-

|

|

|

|

-

|

|

|

|

1,543

|

|

|

|

-

|

|

|

|

-

|

|

|

|

5,549

|

|

|

|

182,675

|

|

|

|

|

2017

|

|

|

173,604

|

|

|

|

-

|

|

|

|

-

|

|

|

|

1,683

|

|

|

|

-

|

|

|

|

-

|

|

|

|

5,454

|

|

|

|

180,741

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dina Masi

|

|

2019

|

|

|

230,750

|

|

|

|

-

|

|

|

|

-

|

|

|

|

11,330

|

|

|

|

-

|

|

|

|

-

|

|

|

|

8,800

|

|

|

|

250,880

|

|

|

Chief Financial Officer and

|

|

2018

|

|

|

231,434

|

|

|

|

-

|

|

|

|

-

|

|

|

|

1,543

|

|

|

|

-

|

|

|

|

-

|

|

|

|

8,046

|

|

|

|

241,023

|

|

|

Senior Vice President

|

|

2017

|

|

|

227,151

|

|

|

|

-

|

|

|

|

-

|

|

|

|

1,683

|

|

|

|

-

|

|

|

|

-

|

|

|

|

7,269

|

|

|

|

236,103

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) - The amounts in this column reflect the dollar amount recognized as expense with respect to stock options for financial statement reporting purposes during the fiscal year ended June 30, 2019, 2018 and 2017, in accordance with United States generally accepted accounting principles and thus includes amounts from awards granted prior to each twelve month period ended, respectively. Assumptions used in the calculation of these amounts are included in Note 12 and Note 13 to the audited financial statements included in our 2015 and 2019 annual reports, respectively.

|

|

|

|

(2) - The amount shown in this column reflects for each named executive officer the total estimated value of the matching contribution to the Integrated BioPharma, Inc. 401(k) Profit Sharing Plan and for Mr. Kay also includes payments made for long term care insurance premiums for him and his spouse in the amounts of $22,382, $21,442 and $16,642 in the fiscal years ended June 30, 2019, 2018 and 2017, respectively.

|

|

|

Grants of Plan-Based Awards for 2019

The table below reports all grants of plan-based awards made during fiscal 2019 to the Named Executive Officers of the Company:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All Other

|

|

|

|

|

|

|

Grant

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Option

|

|

|

|

|

|

|

Date Fair

|

|

|

|

|

|

Estimated Possible Payouts

|

|

|

Awards:

|

|

|

Exercise

|

|

|

Value of

|

|

|

|

|

|

Under Equity Incentive

|

|

|

Number of

|

|

|

or Base

|

|

|

Stock and

|

|

|

|

|

|

Plan Awards

|

|

|

Securities

|

|

|

Price of

|

|

|

Option

|

|

|

|

|

|

Threshold

|

|

|

Target

|

|

|

Maximum

|

|

|

Underlying

|

|

|

Option

|

|

|

Awards

|

|

|

Name

|

Grant Date

|

|

$

|

(

|

)

|

|

$

|

(

|

)

|

|

$

|

(

|

)

|

|

Options

|

|

|

Awards

|

|

|

($)(a)

|

|

|

E. Gerald Kay

|

05/24/2019

|

|

|

-0-

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

|

250,000

|

|

|

|

0.23

|

|

|

$

|

32,477

|

|

|

Christina Kay

|

05/24/2019

|

|

|

-0-

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

|

250,000

|

|

|

|

0.21

|

|

|

|

36,747

|

|

|

Riva Sheppard

|

05/24/2019

|

|

|

-0-

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

|

250,000

|

|

|

|

0.21

|

|

|

|

36,747

|

|

|

Dina Masi

|

05/24/2019

|

|

|

-0-

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

|

150,000

|

|

|

|

0.21

|

|

|

|

22,048

|

|

Outstanding Equity Awards at Fiscal Year End 2019

|

|

|

Option Awards

|

|

Stock Awards

|

|

|

|

|

Number of

Securities

Underlying

|

|

|

Number of

Securities

Underlying

|

|

|

|

|

|

|

Number of Shares or Units

|

|

|

Market Value of Shares or Units of

|

|

|

|

|

Unexercised

|

|

|

Unexercised

|

|

Option

|

|

|

|

of Stock That

|

|

|

Stock That

|

|

|

|

|

Options

|

|

|

Options

|

|

Exercise

|

|

|

|

Have Not

|

|

|

Have Not

|

|

|

|

|

Exercisable

|

|

|

Unexercisable

|

|

Price

|

|

Option

|

|

Vested

|

|

|

Vested

|

|

|

Name

|

|

(#)

|

|

|

(#)

|

|

|

($)

|

|

Expiration Date

|

|

(#)

|

|

|

|

($)(1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E. Gerald Kay

|

|

|

200,000

|

|

(a)

|

|

|

0.10

|

|

06/02/2020

|

|

|

|

|

|

|

|

|

|

|

|

|

250,000

|

|

(b)

|

|

|

0.23

|

|

05/24/2024

|

|

|

125,000

|

|

|

|

28,750

|

|

|

Christina Kay

|

|

|

250,000

|

|

(a)

|

|

|

0.09

|

|

06/02/2025

|

|

|

|

|

|

|

|

|

|

|

|

|

250,000

|

|

(b)

|

|

|

0.21

|

|

05/24/2029

|

|

|

125,000

|

|

|

|

28,750

|

|

|

Riva Sheppard

|

|

|

250,000

|

|

(a)

|

|

|

0.09

|

|

06/02/2025

|

|

|

|

|

|

|

|

|

|

|

|

|

250,000

|

|

(b)

|

|

|

0.21

|

|

05/24/2029

|

|

|

125,000

|

|

|

|

28,750

|

|

|

Dina L. Masi

|

|

|

250,000

|

|

(a)

|

|

|

0.09

|

|

06/02/2025

|

|

|

|

|

|

|

|

|

|

|

|

|

150,000

|

|

(b)

|

|

|

0.21

|

|

05/24/2029

|

|

|

75,000

|

|

|

|

17,250

|

|

(1) The market value of the restricted shares was computed using $0.23, the closing share price of the Company’s common shares on June 30, 2019.

(a) Common share options granted on 06/02/2015 which vested 75% on the grant date and 25% vesting over a three-year period.

(b) Common share options granted on 05/24/2019 which vested 50% on the grant date and 50% vesting over a three-year period.

Option Exercises and Stock Vested for 2019

The named executive officers exercised stock options and had stock vested during the fiscal year ended June 30, 2019 as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Option Awards

|

|

|

|

Stock Awards

|

|

(a)

|

|

|

(b)

|

|

|

|

(c)

|

|

|

|

(d)

|

|

|

|

(e)

|

|

|

|

|

Number of Shares

|

|

|

|

Value Realized

|

|

|

|

Number of Shares

|

|

|

|

Value Realized on

|

|

|

|

|

Acquired on Exercise

|

|

|

|

on Exercise

|

|

|

|

Acquired on Vesting

|

|

|

|

Vesting

|

|

Name

|

|

|

(#)

|

|

|

|

($)(1)

|

|

|

|

(#)

|

|

|

|

($)(2)

|

|

E. Gerald Kay

|

|

|

|

100,000

|

|

|

|

|

5,000

|

|

|

|

|

125,000

|

|

|

|

|

$ 16,238

|

|

Christina Kay

|

|

|

|

100,000

|

|

|

|

|

1,000

|

|

|

|

|

125,000

|

|

|

|

|

18,374

|

|

Riva Sheppard

|

|

|

|

100,000

|

|

|

|

|

1,000

|

|

|

|

|

125,000

|

|

|

|

|

18,374

|

|

Dina L. Masi

|

|

|

|

-0-

|

|

|

|

|

-0-

|

|

|

|

|

75,000

|

|

|

|

|

11,024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

|

The market price used in determining the value realized was calculated using the close of the share price on the OTC Market on the date of exercise.

|

|

|

|

|

|

(2)

|

|

The market price used in determining the value realized was calculated using the close of the share price on the OTC Market on the date of vesting.

|

Potential Payments upon Termination or Change in Control

The Company does not have any agreements or arrangements with its executive officers that would entitle such named executive officers to payments or the provision of other benefits upon termination of employment.

Employment Contracts, Termination of Employment and Change-in-Control Arrangements

The Company currently does not have any employment contracts or other similar agreements or arrangements with any of its executive officers.

Director Compensation for 2019

|

|

|

Fees Earned or

Paid in Cash

($)

|

|

|

Stock

Awards

($) (a)

|

|

|

Option

Awards

($) (b)

|

|

|

All Other

Compensation

($)

|

|

|

Total

($)

|

|

|

E. Gerald Kay (c)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Riva Sheppard (c)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Carl DeSantis

|

|

$

|

-0-

|

|

|

$

|

-0-

|

|

|

$

|

17,510

|

|

|

$

|

-0-

|

|

|

$

|

17,510

|

|

|

Christina Kay (c)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Robert Canarick

|

|

|

-0-

|

|

|

|

-0-

|

|

|

|

14,699

|

|

|

|

-0-

|

|

|

|

14,699

|

|

|

William H Milmoe

|

|

|

-0-

|

|

|

|

-0-

|

|

|

|

14,699

|