NOTICE TO UPS EMPLOYEES: Klayman & Toskes, P.A. Continues to Investigate & Pursue Claims on Behalf of Current & Former UPS Em...

October 05 2017 - 2:39PM

Business Wire

The Securities Arbitration Law Firm of Klayman & Toskes,

P.A. (“K&T”), www.nasd-law.com, continues to investigate claims

for current and former UPS (NYSE:UPS) employees for losses

sustained from unsuitable covered call writing strategies for

concentrated UPS stock positions.

In a recently filed FINRA claim [FINRA Case No. 17-00613], the

Claimant, who worked with UPS for 31 years and accumulated more

than 13,600 shares of the company’s shares, invested his shares

after UPS went public. As a part of the investment strategy that

was recommended to him, a hypo loan collateralized by his shares

was taken and a call writing strategy was employed which lead to

the Claimant losing his shares. The Claimant’s specific investment

objective was not to lose his shares, which the firm assured him he

would not. More importantly, the Claimant was earning much needed

quarterly dividends, which he relied upon in his retirement. The

strike prices that the stock was sold at were far too low given

market conditions, and the firm failed to buy back the call

options. These recommendations led to the Complainant losing all

his shares as well as his much-needed dividend payments.

The sole purpose of this release is to investigate whether the

covered call strategies deployed by investment firms were suitable

for UPS investors with concentrated stock positions which were

acquired through Managers Incentive Programs. Current and former

UPS employees who held accounts at full-service brokerage firms,

and have information relating to the manner in with the firm

handled their concentrated, leveraged portfolios, are encouraged to

contact the attorneys of Klayman & Toskes, P.A., at (888)

997-9956, or visit our firm’s website at www.nasd-law.com.

About Klayman & Toskes, P.A.

K&T is a leading national securities law firm which

practices exclusively in the field of securities arbitration and

litigation on behalf of retail and institutional investors

throughout the world in large and complex securities matters. The

firm represents high net-worth, ultra-high net-worth, and

institutional investors, such as non-profit organizations, unions,

public pension funds, and multi-employer pension funds. K&T has

office locations in California, Florida, New York, and Puerto

Rico.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171005006240/en/

Klayman & Toskes, PALawrence L. Klayman, Esq.,

888-997-9956lklayman@nasd-law.comwww.nasd-law.com

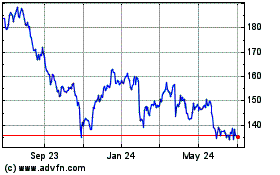

United Parcel Service (NYSE:UPS)

Historical Stock Chart

From Apr 2024 to May 2024

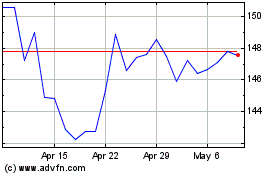

United Parcel Service (NYSE:UPS)

Historical Stock Chart

From May 2023 to May 2024