-Reports Net Income Available to Common

Stockholders of $34.8 Million, or $0.22 per Diluted

Share--Home Sales Revenue of $578.7 Million for the

Quarter--Homebuilding Gross Margin of 20.1% for the

Quarter-

TRI Pointe Group, Inc. (the "Company") (NYSE: TPH) today

announced results for the third quarter ended September 30,

2016.

Results and Operational Data for Third Quarter 2016 and

Comparisons to Third Quarter 2015

- Net income available to common

stockholders was $34.8 million, or $0.22 per diluted share,

compared to $50.2 million, or $0.31 per diluted share

- New home orders of 932 compared to 996,

a decrease of 6%

- Active selling communities averaged

119.0 compared to 120.8, a decrease of 1%

- New home orders per average selling

community were 7.8 orders (2.6 monthly) compared to 8.2 orders (2.7

monthly)

- Cancellation rate of 17% compared to

16%, an increase of 100 basis points

- Backlog units at quarter end of 1,711

homes compared to 1,856, a decrease of 8%

- Dollar value of backlog at quarter end

of $950.2 million compared to $1.110 billion, a decrease of

14%

- Average sales price in backlog at

quarter end of $555,000 compared to $598,000, a decrease of 7%

- Home sales revenue of $578.7 million

compared to $642.4 million, a decrease of 10%

- New home deliveries of 1,019 homes

compared to 1,138 homes, a decrease of 10%

- Average sales price of homes delivered

of $568,000 compared to $564,000, an increase of 1%

- Homebuilding gross margin percentage of

20.1% compared to 21.0%, a decrease of 90 basis points

- Excluding interest, impairments and lot

option abandonments, adjusted homebuilding gross margin percentage

was 22.7%*

- SG&A expense as a percentage of

homes sales revenue of 10.9% compared to 8.8%, an increase of 210

basis points

- Ratios of debt-to-capital and net

debt-to-capital of 43.7% and 41.3%*, respectively, as of

September 30, 2016

- Repurchased 852,500 shares of common

stock at an average price of $12.22 for an aggregate dollar amount

of $10.4 million in the three months ended September 30,

2016

- Ended third quarter of 2016 with cash

of $128.7 million and $420.7 million of availability under the

Company's unsecured revolving credit facility

* See "Reconciliation of Non-GAAP Financial Measures"

“We are pleased with the progress we made this quarter,” said

TRI Pointe Group Chief Executive Officer Doug Bauer. “TRI Pointe

delivered on its stated guidance for our ending community count,

deliveries, home sales revenue and homebuilding gross margin

percentage. While the absorption pace in the quarter was slightly

lower than it was last year, I am encouraged by the 26%

year-over-year increase in new home orders we experienced in the

month of September. We expect to continue this momentum into the

fourth quarter due to the success of our new community

openings.”

Third Quarter 2016 Operating Results

Net income available to common stockholders was $34.8 million,

or $0.22 per diluted share in the third quarter of 2016, compared

to net income available to common stockholders of $50.2 million, or

$0.31 per diluted share for the third quarter of 2015. The decrease

in net income available to common stockholders was primarily driven

by an $18.5 million decrease in homebuilding gross margin due to a

90 basis point decrease in homebuilding gross margin percentage and

lower home sales revenue, which resulted from a 10% decrease in new

home deliveries.

Home sales revenue decreased $63.7 million, or 10%, to $578.7

million for the third quarter of 2016, as compared to $642.4

million for the third quarter of 2015. The decrease was primarily

attributable to a 10% decrease in new home deliveries to 1,019,

offset by an increase in average selling price of homes delivered

to $568,000 compared to $564,000 in the third quarter of 2015. The

decrease in deliveries was primarily related to the timing of

deliveries for the year, as we delivered a large number of our

backlog units in the second quarter of 2016, which resulted in a

lower number of backlog units going into the quarter compared to

the prior year period. For the nine months ended September 30,

2016, deliveries were up 7% compared to the same period in the

prior year.

New home orders decreased 6% to 932 homes for the third quarter

of 2016, as compared to 996 homes for the same period in 2015,

which was up 24% from 803 orders for the same period in 2014.

Average selling communities was 119.0 for the third quarter of 2016

compared to 120.8 for the third quarter of 2015. The Company’s

overall absorption rate per average selling community for the third

quarter of 2016 was 7.8 orders (2.6 monthly) compared to 8.2 orders

(2.7 monthly) during the third quarter of 2015.

The Company ended the quarter with 1,711 homes in backlog,

representing approximately $950.2 million. The average sales price

of homes in backlog as of September 30, 2016 decreased

$43,000, or 7%, to $555,000 compared to $598,000 at September 30,

2015.

Homebuilding gross margin percentage for the third quarter of

2016 decreased to 20.1% compared to 21.0% for the third quarter of

2015. Excluding interest and impairments and lot option

abandonments in cost of home sales, adjusted homebuilding gross

margin percentage was 22.7%* for the third quarter of 2016 compared

to 23.1%* for the third quarter of 2015. The decrease in

homebuilding gross margin percentage was largely due to the mix of

homes delivered, with 50 less homes delivered from California which

have gross margins above the Company average.

Selling, general and administrative ("SG&A") expense for the

third quarter of 2016 increased to 10.9% of home sales revenue as

compared to 8.8% for the third quarter of 2015 due to decreased

leverage as a result of the 10% decrease in home sales revenue.

“Overall, we continue to see encouraging trends in all of our

markets,” said TRI Pointe Group President and Chief Operating

Officer Tom Mitchell. “Due to lower new home orders for the

quarter, full year deliveries will likely be on the lower end of

our previously stated range of 4,200 to 4,400 homes. That said, we

expect to end the year with 125 active selling communities compared

to 104 at the end of the prior year. We think this community count

growth and the progress we have made in accelerating the

development of our longer dated assets in California will enable us

to continue to create shareholder value through our homebuilding

operations and reach our goal of delivering 5,100 to 5,400 homes in

2018.”

* See “Reconciliation of Non-GAAP Financial Measures”

Outlook

For the fourth quarter of 2016, the Company expects to open nine

new communities, and close out of seven, resulting in 125 active

selling communities as of December 31, 2016. In addition, the

Company anticipates delivering approximately 85% of its 1,711 units

in backlog as of September 30, 2016. The Company anticipates its

homebuilding gross margin percentage to be approximately 20% for

the fourth quarter, resulting in a full year homebuilding gross

margin percentage in a range of 20.5% to 21.5%. Finally, the

Company expects its SG&A expense ratio to be approximately 9%

for the fourth quarter, resulting in a full year SG&A expense

ratio in a range of 10.5% to 10.7%.

Earnings Conference Call

The Company will host a conference call via live webcast for

investors and other interested parties beginning at 10:00 a.m.

Eastern Time on Thursday, October 27, 2016. The call will be

hosted by Doug Bauer, Chief Executive Officer; Tom Mitchell,

President and Chief Operating Officer; and Mike Grubbs, Chief

Financial Officer.

Interested parties can listen to the call live on the internet

through the Investor Relations section of the Company’s website at

www.TRIPointeGroup.com. Listeners

should go to the website at least fifteen minutes prior to the call

to download and install any necessary audio software. The call can

also be accessed by dialing 1-877-407-3982 for domestic

participants or 1-201-493-6780 for international participants.

Participants should ask for the TRI Pointe Group Third Quarter 2016

Earnings Conference Call. Those dialing in should do so at least

ten minutes prior to the start. The replay of the call will be

available for two weeks following the call. To access the replay,

the domestic dial-in number is 1-844-512-2921, the international

dial-in number is 1-412-317-6671, and the reference code is

#13646378. An archive of the webcast will be available on the

Company’s website for a limited time.

About TRI Pointe Group, Inc.

Headquartered in Irvine, California, TRI Pointe Group, Inc.

(NYSE: TPH) is one of the top ten largest public homebuilders by

equity market capitalization in the United States. The company

designs, constructs and sells premium single-family homes through

its portfolio of six quality brands across eight states, including

Maracay Homes in Arizona; Pardee Homes in California and Nevada;

Quadrant Homes in Washington; Trendmaker Homes in Texas; TRI Pointe

Homes in California and Colorado; and Winchester Homes in Maryland

and Virginia. Additional information is available at www.TRIPointeGroup.com.

Forward-Looking Statements

Various statements contained in this press release, including

those that express a belief, expectation or intention, as well as

those that are not statements of historical fact, are

forward-looking statements. These forward-looking statements may

include projections and estimates concerning the timing and success

of specific projects and our future production, land and lot sales,

operational and financial results, financial condition, prospects,

and capital spending. Our forward-looking statements are generally

accompanied by words such as “anticipate,” “believe,” “estimate,”

“goal,” “expect,” “intend,” “project,” “potential,” “plan,”

“predict,” “will,” or other words that convey future events or

outcomes. The forward-looking statements in this press release

speak only as of the date of this press release, and we disclaim

any obligation to update these statements unless required by law,

and we caution you not to rely on them unduly. These

forward-looking statements are inherently subject to significant

business, economic, competitive, regulatory and other risks,

contingencies and uncertainties, most of which are difficult to

predict and many of which are beyond our control. The following

factors, among others, may cause our actual results, performance or

achievements to differ materially from any future results,

performance or achievements expressed or implied by these

forward-looking statements: the effect of general economic

conditions, including employment rates, housing starts, interest

rate levels, availability of financing for home mortgages and

strength of the U.S. dollar; market demand for our products, which

is related to the strength of the various U.S. business segments

and U.S. and international economic conditions; levels of

competition; the successful execution of our internal performance

plans, including restructuring and cost reduction initiatives;

global economic conditions; raw material prices; oil and other

energy prices; the effect of weather, including the continuing

drought in California; the risk of loss from earthquakes,

volcanoes, fires, floods, droughts, windstorms, hurricanes, pest

infestations and other natural disasters; transportation costs;

federal and state tax policies; the effect of land use, environment

and other governmental regulations; legal proceedings and disputes;

risks relating to any unforeseen changes to or effects on

liabilities, future capital expenditures, revenues, expenses,

earnings, synergies, indebtedness, financial condition, losses and

future prospects; changes in accounting principles; risks related

to unauthorized access to our computer systems, theft of our

customers’ confidential information or other forms of cyber-attack;

our relationship, and actual and potential conflicts of interest,

with Starwood Capital Group or its affiliates; and additional

factors discussed under the sections captioned “Risk Factors”

included in our annual and quarterly reports filed with the

Securities and Exchange Commission. The foregoing list is not

exhaustive. New risk factors may emerge from time to time and it is

not possible for management to predict all such risk factors or to

assess the impact of such risk factors on our business.

KEY OPERATIONS AND FINANCIAL

DATA

(dollars in thousands)

(unaudited)

Three Months Ended September 30, Nine Months Ended

September 30, 2016 2015

Change 2016 2015

Change Operating Data: Home sales revenue $ 578,653 $

642,352 $ (63,699 ) $ 1,558,633 $ 1,443,855 $ 114,778 Homebuilding

gross margin $ 116,330 $ 134,809 $ (18,479 ) $ 339,073 $ 294,664 $

44,409 Homebuilding gross margin % 20.1 % 21.0 % (0.9 )% 21.8 %

20.4 % 1.4 % Adjusted homebuilding gross margin %* 22.7 % 23.1 %

(0.4 )% 24.0 % 22.4 % 1.6 % Land and lot sales revenue $ 2,535 $

4,876 $ (2,341 ) $ 70,204 $ 74,366 $ (4,162 ) Land and lot gross

margin $ 801 $ 1,425 $ (624 ) $ 53,231 $ 57,042 $ (3,811 ) Land and

lot gross margin % 31.6 % 29.2 % 2.4 % 75.8 % 76.7 % (0.9 )%

SG&A expense $ 63,002 $ 56,774 $ 6,228 $ 180,436 $ 162,108 $

18,328

SG&A expense as a % of home sales

revenue

10.9 % 8.8 % 2.1 % 11.6 % 11.2 % 0.4 %

Net income available to common

stockholders

$ 34,834 $ 50,162 $ (15,328 ) $ 137,310 $ 120,389 $ 16,921 Adjusted

EBITDA* $ 74,215 $ 99,135 $ (24,920 ) $ 262,945 $ 233,079 $ 29,866

Interest incurred $ 18,601 $ 15,454 $ 3,147 $ 50,030 $ 45,779 $

4,251 Interest in cost of home sales $ 14,385 $ 13,189 $ 1,196 $

34,653 $ 27,540 $ 7,113 Other Data: Net new home orders 932

996 (64 ) 3,339 3,428 (89 ) New homes delivered 1,019 1,138 (119 )

2,784 2,604 180 Average selling price of homes delivered $ 568 $

564 $ 4 $ 560 $ 554 $ 6 Average selling communities 119.0 120.8

(1.8 ) 117.0 117.4 (0.4 ) Selling communities at end of period 123

118 5 N/A N/A N/A Cancellation rate 17 % 16 % 1 % 14 % 14 % 0 %

Backlog (estimated dollar value) $ 950,171 $ 1,109,867 $ (159,696 )

Backlog (homes) 1,711 1,856 (145 ) Average selling price in backlog

$ 555 $ 598 $ (43 )

September 30, December 31,

2016 2015 Change Balance Sheet Data: Cash and

cash equivalents $ 128,715 $ 214,485 $ (85,770 ) Real estate

inventories $ 2,969,148 $ 2,519,273 $ 449,875 Lots owned or

controlled 29,713 27,602 2,111 Homes under construction (1) 1,973

1,531 442 Homes completed, unsold 291 351 (60 ) Debt $ 1,384,482 $

1,170,505 $ 213,977 Stockholders' equity $ 1,785,460 $ 1,664,683 $

120,777 Book capitalization $ 3,169,942 $ 2,835,188 $ 334,754 Ratio

of debt-to-capital 43.7 % 41.3 % 2.4 % Ratio of net

debt-to-capital* 41.3 % 36.5 % 4.8 % (1) Homes

under construction included 52 and 69 models at September 30, 2016

and December 31, 2015, respectively. * See “Reconciliation of

Non-GAAP Financial Measures”

CONSOLIDATED BALANCE SHEETS

(in thousands, except share amounts)

September 30, December 31, 2016

2015 Assets (unaudited) Cash and cash equivalents $

128,715 $ 214,485 Receivables 35,321 43,710 Real estate inventories

2,969,148 2,519,273 Investments in unconsolidated entities 17,205

18,999 Goodwill and other intangible assets, net 161,629 162,029

Deferred tax assets, net 111,887 130,657 Other assets 65,998

48,918 Total assets $ 3,489,903 $ 3,138,071

Liabilities Accounts payable $ 77,667 $ 64,840 Accrued

expenses and other liabilities 219,396 216,263 Unsecured revolving

credit facility 200,000 299,392 Seller financed loans 17,758 2,434

Senior notes 1,166,724 868,679 Total liabilities 1,681,545

1,451,608 Commitments and contingencies

Equity Stockholders' Equity:

Preferred stock, $0.01 par value,

50,000,000 shares authorized; no shares issued and outstanding as

of September 30, 2016 and December 31, 2015, respectively

— —

Common stock, $0.01 par value, 500,000,000

shares authorized; 160,064,678 and 161,813,750 shares issued and

outstanding at September 30, 2016 and December 31, 2015,

respectively

1,601 1,618 Additional paid-in capital 894,681 911,197 Retained

earnings 889,178 751,868 Total stockholders' equity

1,785,460 1,664,683 Noncontrolling interests 22,898 21,780

Total equity 1,808,358 1,686,463 Total liabilities and

equity $ 3,489,903 $ 3,138,071

CONSOLIDATED STATEMENT OF

OPERATIONS

(in thousands, except share and per share

amounts)

(unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2016 2015 2016

2015 Homebuilding: Home sales revenue $

578,653 $ 642,352 $ 1,558,633 $ 1,443,855 Land and lot sales

revenue 2,535 4,876 70,204 74,366 Other operations revenue 606

613 1,790 2,213 Total revenues 581,794

647,841 1,630,627 1,520,434 Cost of home sales 462,323 507,543

1,219,560 1,149,191 Cost of land and lot sales 1,734 3,451 16,973

17,324 Other operations expense 575 570 1,724 1,704 Sales and

marketing 31,852 30,038 90,621 78,958 General and administrative

31,150 26,736 89,815 83,150 Restructuring charges 128 2,010

478 2,730 Homebuilding income from operations

54,032 77,493 211,456 187,377 Equity in (loss) income of

unconsolidated entities (20 ) (150 ) 181 (82 ) Other income, net 21

47 287 272 Homebuilding income before

income taxes 54,033 77,390 211,924 187,567

Financial Services: Revenues 235 300 762 482 Expenses

72 47 183 131 Equity in income (loss) of unconsolidated entities

1,247 147 3,246 (2 ) Financial services income

before income taxes 1,410 400 3,825 349

Income before income taxes 55,443 77,790 215,749 187,916

Provision for income taxes (20,298 ) (28,021 ) (77,701 ) (66,088 )

Net income 35,145 49,769 138,048 121,828 Net (income) loss

attributable to noncontrolling interests (311 ) 393 (738 )

(1,439 ) Net income available to common stockholders $ 34,834

$ 50,162 $ 137,310 $ 120,389 Earnings

per share Basic $ 0.22 $ 0.31 $ 0.85 $ 0.74 Diluted $ 0.22 $ 0.31 $

0.85 $ 0.74 Weighted average shares outstanding Basic 160,614,055

161,772,893 161,456,520 161,651,177 Diluted 161,267,509 162,366,744

161,916,352 162,299,282

MARKET DATA BY REPORTING SEGMENT &

STATE

(dollars in thousands)

(unaudited)

Three Months Ended September 30, Nine Months Ended

September 30, 2016 2015 2016

2015 New

Homes

Delivered

Average

Sales

Price

New

Homes

Delivered

Average

Sales

Price

New

Homes

Delivered

Average

Sales

Price

New

Homes

Delivered

Average

Sales

Price

New Homes Delivered: Maracay Homes 165 $ 412 131 $ 386 400 $

403 307 $ 380 Pardee Homes 302 623 314 543 828 587 724 506 Quadrant

Homes 90 531 117 406 287 515 297 426 Trendmaker Homes 121 516 163

495 335 506 394 512 TRI Pointe Homes 260 645 298 752 678 667 611

756 Winchester Homes 81 550 115 599 256

554 271 631 Total 1,019 $ 568

1,138 $ 564 2,784 $ 560 2,604 $

554

Three Months Ended September 30, Nine

Months Ended September 30, 2016 2015 2016

2015 New

Homes

Delivered

Average

Sales

Price

New

Homes

Delivered

Average

Sales

Price

New

Homes

Delivered

Average

Sales

Price

New

Homes

Delivered

Average

Sales

Price

New Homes Delivered: California 412 $ 716 462 $ 720 1,093 $

707 969 $ 700 Colorado 30 526 51 512 118 505 128 488 Maryland 55

510 58 483 169 504 120 528 Virginia 26 634 57 716 87 650 151 714

Arizona 165 412 131 386 400 403 307 380 Nevada 120 377 99 361 295

360 238 368 Texas 121 516 163 495 335 506 394 512 Washington 90

531 117 406 287 515 297

426 Total 1,019 $ 568 1,138 $ 564

2,784 $ 560 2,604 $ 554

MARKET DATA BY REPORTING SEGMENT &

STATE, continued

(unaudited)

Three Months Ended September 30, Nine Months Ended

September 30, 2016 2015 2016

2015

Net NewHomeOrders

AverageSellingCommunities

Net NewHomeOrders

AverageSellingCommunities

Net New

Home

Orders

Average

Selling

Communities

Net New

Home

Orders

Average

Selling

Communities

Net New Home Orders: Maracay Homes 134 17.8 150 17.2 526

18.1 495 17.3 Pardee Homes 283 22.5 291 25.0 936 22.8 954 22.8

Quadrant Homes 49 7.3 87 11.8 274 8.5 353 10.8 Trendmaker Homes 130

29.0 125 25.0 385 26.8 381 26.0 TRI Pointe Homes 239 28.7 234 28.3

883 27.3 935 27.0 Winchester Homes 97 13.7 109

13.5 335 13.5 310 13.5 Total 932

119.0 996 120.8 3,339 117.0

3,428 117.4

Three Months Ended September

30, Nine Months Ended September 30, 2016

2015 2016 2015

Net NewHome

Orders

AverageSellingCommunities

Net NewHomeOrders

AverageSellingCommunities

Net NewHomeOrders

AverageSellingCommunities

Net NewHomeOrders

AverageSellingCommunities

Net New Home Orders: California 380 35.0 392 35.5 1,333 34.3

1,421 33.2 Colorado 31 5.0 34 6.0 107 4.8 168 6.4 Maryland 72 7.2

71 6.0 214 6.7 165 5.8 Virginia 25 6.5 38 7.5 121 6.8 145 7.7

Arizona 134 17.8 150 17.2 526 18.1 495 17.3 Nevada 111 11.2 99 11.8

379 11.0 300 10.2 Texas 130 29.0 125 25.0 385 26.8 381 26.0

Washington 49 7.3 87 11.8 274

8.5 353 10.8 Total 932 119.0 996

120.8 3,339 117.0 3,428 117.4

MARKET DATA BY REPORTING SEGMENT &

STATE, continued

(dollars in thousands)

(unaudited)

As of September 30, 2016 As of September 30,

2015 BacklogUnits

BacklogDollarValue

AverageSalesPrice

BacklogUnits

BacklogDollarValue

AverageSalesPrice

Backlog: Maracay Homes 329 $ 144,127 $ 438 293 $ 118,164 $

403 Pardee Homes 382 182,263 477 448 296,477 662 Quadrant Homes 130

83,467 642 169 79,955 473 Trendmaker Homes 186 98,874 532 205

108,250 528 TRI Pointe Homes 495 319,823 646 567 388,336 685

Winchester Homes 189 121,617 643 174

118,685 682 Total 1,711 $ 950,171 $ 555

1,856 $ 1,109,867 $ 598

As of

September 30, 2016 As of September 30, 2015

BacklogUnits

BacklogDollarValue

AverageSalesPrice

BacklogUnits

BacklogDollarValue

AverageSalesPrice

Backlog: California 641 $ 387,125 $ 604 770 $ 577,053 $ 749

Colorado 73 42,809 586 124 62,445 504 Maryland 122 75,444 618 98

59,200 604 Virginia 67 46,172 689 76 59,485 783 Arizona 329 144,127

438 293 118,164 403 Nevada 163 72,153 443 121 45,315 375 Texas 186

98,874 532 205 108,250 528 Washington 130 83,467 642

169 79,955 473 Total 1,711 $ 950,171

$ 555 1,856 $ 1,109,867 $ 598

MARKET DATA BY REPORTING SEGMENT &

STATE, continued

(unaudited)

September 30, December 31, 2016

2015 Lots Owned or Controlled: Maracay Homes 2,258

1,811 Pardee Homes 16,987 16,679 Quadrant Homes 1,895 1,274

Trendmaker Homes 2,130 1,858 TRI Pointe Homes 3,960 3,628

Winchester Homes 2,483 2,352 Total 29,713 27,602

September 30, December 31, 2016

2015 Lots Owned or Controlled: California 17,452

17,527 Colorado 1,159 876 Maryland 1,875 1,716 Virginia 608 636

Arizona 2,258 1,811 Nevada 2,336 1,904 Texas 2,130 1,858 Washington

1,895 1,274 Total 29,713 27,602

September 30, December 31, 2016 2015

Lots by Ownership Type: Lots owned 25,228 24,733 Lots

controlled (1) 4,485 2,869 Total 29,713 27,602

(1) As of September 30, 2016 and December 31, 2015,

lots controlled included lots that were under land option contracts

or purchase contracts.

RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES(unaudited)

In this press release, we utilize certain financial measures

that are non-GAAP financial measures as defined by the Securities

and Exchange Commission. We present these measures because we

believe they and similar measures are useful to management and

investors in evaluating the Company’s operating performance and

financing structure. We also believe these measures facilitate the

comparison of our operating performance and financing structure

with other companies in our industry. Because these measures are

not calculated in accordance with Generally Accepted Accounting

Principles (“GAAP”), they may not be comparable to other similarly

titled measures of other companies and should not be considered in

isolation or as a substitute for, or superior to, financial

measures prepared in accordance with GAAP.

The following tables reconcile homebuilding gross margin

percentage, as reported and prepared in accordance with GAAP, to

the non-GAAP measure adjusted homebuilding gross margin percentage.

We believe this information is meaningful as it isolates the impact

that leverage has on homebuilding gross margin and permits

investors to make better comparisons with our competitors, who

adjust gross margins in a similar fashion.

Three Months Ended September 30,

2016 %

2015 % (dollars in thousands)

Home sales revenue $ 578,653 100.0 % $ 642,352 100.0 % Cost of home

sales 462,323 79.9 % 507,543 79.0 % Homebuilding

gross margin 116,330 20.1 % 134,809 21.0 % Add: interest in cost of

home sales 14,385 2.5 % 13,189 2.1 % Add: impairments and lot

option abandonments 389 0.1 % 366 0.1 % Adjusted

homebuilding gross margin $ 131,104 22.7 % $ 148,364

23.1 % Homebuilding gross margin percentage 20.1 % 21.0 % Adjusted

homebuilding gross margin percentage 22.7 % 23.1 %

Nine Months Ended September 30, 2016 %

2015 % (dollars in thousands) Home sales revenue $

1,558,633 100.0 % $ 1,443,855 100.0 % Cost of home sales 1,219,560

78.2 % 1,149,191 79.6 % Homebuilding gross margin

339,073 21.8 % 294,664 20.4 % Add: interest in cost of home sales

34,653 2.2 % 27,540 1.9 % Add: impairments and lot option

abandonments 678 0.0 % 1,593 0.1 % Adjusted

homebuilding gross margin $ 374,404 24.0 % $ 323,797

22.4 % Homebuilding gross margin percentage 21.8 % 20.4 % Adjusted

homebuilding gross margin percentage 24.0 % 22.4 %

RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES (continued)(unaudited)

The following table reconciles the Company’s ratio of

debt-to-capital to the non-GAAP ratio of net debt-to-capital. We

believe that the ratio of net debt-to-capital is a relevant

financial measure for management and investors to understand the

leverage employed in our operations and as an indicator of the

Company’s ability to obtain financing.

September 30,

2016 December 31,

2015 Unsecured revolving credit facility $ 200,000 $ 299,392

Seller financed loans 17,758 2,434 Senior notes 1,166,724

868,679 Total debt 1,384,482 1,170,505

Stockholders’ equity 1,785,460 1,664,683 Total

capital $ 3,169,942 $ 2,835,188 Ratio of

debt-to-capital(1) 43.7 % 41.3 % Total debt $ 1,384,482 $

1,170,505 Less: Cash and cash equivalents (128,715 ) (214,485 ) Net

debt 1,255,767 956,020 Stockholders’ equity 1,785,460

1,664,683 Total capital $ 3,041,227 $ 2,620,703

Ratio of net debt-to-capital(2) 41.3 % 36.5 % (1)

The ratio of debt-to-capital is computed as the

quotient obtained by dividing debt by the sum of debt plus equity.

(2) The ratio of net debt-to-capital is computed as the quotient

obtained by dividing net debt (which is debt less cash and cash

equivalents) by the sum of net debt plus equity.

RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES (continued)(unaudited)

The following table calculates the non-GAAP measures of EBITDA

and Adjusted EBITDA and reconciles those amounts to net income, as

reported and prepared in accordance with GAAP. EBITDA means net

income before (a) interest expense, (b) income taxes,

(c) depreciation and amortization, (d) expensing of

previously capitalized interest included in costs of home sales and

(e) amortization of stock-based compensation. Adjusted EBITDA

means EBITDA before (f) impairment and lot option abandonments

and (g) restructuring charges. Other companies may calculate EBITDA

and Adjusted EBITDA (or similarly titled measures) differently. We

believe EBITDA and Adjusted EBITDA are useful measures of the

Company’s ability to service debt and obtain financing.

Three Months Ended September 30,

Nine Months Ended September 30, 2016

2015 2016

2015 (in thousands) Net income available to common

stockholders $ 34,834 $ 50,162 $ 137,310 $ 120,389 Interest

expense: Interest incurred 18,601 15,454 50,030 45,779 Interest

capitalized (18,601 ) (15,454 ) (50,030 ) (45,779 ) Amortization of

interest in cost of sales 14,415 13,339 34,808 28,019 Provision for

income taxes 20,298 28,021 77,701 66,088 Depreciation and

amortization 866 2,244 2,322 5,414 Amortization of stock-based

compensation 3,285 2,994 9,648 8,536

EBITDA 73,698 96,760 261,789 228,446 Impairments and lot

abandonments 389 365 678 1,903 Restructuring charges 128

2,010 478 2,730 Adjusted EBITDA $ 74,215

$ 99,135 $ 262,945 $ 233,079

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161027005513/en/

Investor Relations Contact:Chris Martin, TRI Pointe

GroupDrew Mackintosh, Mackintosh Investor RelationsInvestorRelations@TRIPointeGroup.com949-478-8696orMedia

Contact:Carol Ruizcruiz@newgroundco.com310-437-0045

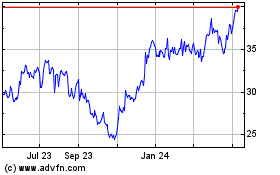

TRI Pointe Homes (NYSE:TPH)

Historical Stock Chart

From Aug 2024 to Sep 2024

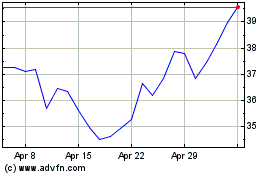

TRI Pointe Homes (NYSE:TPH)

Historical Stock Chart

From Sep 2023 to Sep 2024