NUCOR

Revenue Growth Disappoints

Nucor Corp. reported weaker-than-expected revenue growth its

third-quarter even amid steel price trends that have improved after

the U.S. government cracked down on low-price steel imports from

China, and projected a downbeat view for its fourth quarter.

Shares fell 4.7%, to $45.77 in morning trading.

The company said earnings in the fourth quarter are expected to

decrease "notably" compared with the third quarter because of lower

margins in the steel mills segment, with the most significant

impact being on the sheet mills. For the latest period, which ended

Oct. 1, average sales price per ton increased 11% from the second

quarter and increased 2% from the year-ago period.

Nucor has previously attributed higher steel prices in part to

inventory reductions and weaker levels of imports since the U.S.

Commerce Department's move to impose tariffs in response to a surge

of low-price steel imports, especially from China. But the company

has also said that since roughly half of its sheet steel shipments

are under contract, there will be a lag before the company gets the

full benefit of the improved pricing trends.

Nucor said earnings were helped in the third quarter because of

stronger performance in its steel mills and raw materials segments,

while market conditions for plate and bar mills remained pressured

by high levels of imports.

Overall, Nucor reported a profit of $270 million, or 84 cents a

share, up from $227.1 million, or 71 cents a share, a year earlier.

The company expected per-share earnings of 85 cents to 90

cents.

Sales rose 1.5%, to $4.29 billion, as analysts were expecting

4.51 billion, according to Thomson Reuters.

--Joshua Jamerson

PULTEGROUP

Housing Demand Remains Healthy

PulteGroup Inc. said earnings rose 19% in the third quarter amid

better-than-expected new order growth as demand in the U.S. housing

market remained solid.

However, the company missed its gross margin guidance and

doesn't see margins improving in 2017. Shares were down 4.2% at

$19.06 in morning trading.

The results come after the home builder last month resolved a

public dispute between management and the company's founder over

PulteGroup's future. Ryan Marshall was named chief executive,

replacing Richard J. Dugas Jr., who had been embroiled in a public

battle with PulteGroup founder William J. Pulte over the direction

of the company.

On Thursday's call, Mr. Marshall said he was happy the company

has "removed any uncertainties related to company leadership."

"Now we can focus conversations on talking about the business,"

he said.

After hedge fund Elliott Management Corp. took a stake in the

company earlier this year, executives also announced a plan to slow

the company's growth in future land spending. Mr. Marshall said

Thursday that he wants the company to continue bringing down its

inventory of land to meet goals of "generating higher returns while

managing our risk."

Based on the number of homes delivered, Mr. Marshall said the

company currently owns about 5.2 years worth of lots. He said in

the coming years he would like to get that number down to around

three years worth of owned lots.

For the quarter that ended in September, new orders at

PulteGroup grew by 17% to 4,775 homes. Analysts polled by FactSet

had expected new unit orders of 4,546.

Gross margin in the latest period was 21.1%, 10 basis points

below the company's guidance range, pressured by higher land and

labor costs, and labor rate inflation. On a conference call with

analysts, Chief Financial Officer Robert O'Shaughnessy said that

"assuming those conditions continue," the company decided to lower

its fourth-quarter margins guidance to a range of 20.5% to 21%. Mr.

O'Shaughnessy said he expects that the trend to continue into

2017.

Citing an improving economy and more demand from first-time

buyers, Mr. Marshall also said he expects the company to focus more

on that segment than earlier in the recovery. "As the economy and,

frankly, the housing-recovery cycle has continued to progress,

we're seeing strength from the first-time buyers, and thus

additional opportunities for us to put capital to work," he

said.

In September, rival home builders KB Home and Lennar Corp.

posted better-than-expected earnings amid gains in new orders.

Home-building in the U.S. fell in September after a rebound in

June. But builders received more permits, a sign that residential

construction should pick up in the coming months amid steady

demand.

Mr. Dugas left the CEO post in September but will remain

chairman through the company's annual meeting, expected to be held

in May 2017. He first said in April he would be retiring next year

amid pressure from Mr. Pulte, the company's largest shareholder.

But Mr. Pulte demanded Mr. Dugas's immediate resignation, arguing

in a series of letters that PulteGroup's stock performance and

sales volume have lagged behind rival home builders throughout the

housing recovery.

Overall, PulteGroup reported a profit of $128.5 million, or 37

cents a share, compared with $107.8 million, or 30 cents a share,

in the year-earlier period. The company said excluding certain

items, such as those associated with a contract settlement and

previously announced plans to reduce overhead expenses, the company

earned 43 cents a share. Analysts had expected 44 cents a share in

earnings, according to FactSet. Total revenue grew 29% to $1.94

billion, meeting expectations.

--Joshua Jamerson and Chris Kirkham

UNION PACIFIC

Commodities Slump Weighs on Earnings

Union Pacific Corp. said its third-quarter earnings fell 13% as

the railroad operator, like others, said it continued to be hit by

weak demand for commodities it transports.

The Omaha, Neb., company's shares, up 24% this year, fell 3.1%

to $94.12 in recent premarket trading as the results missed

expectations.

Union Pacific's total freight volume declined 5.8%, led by a 14%

drop in coal volume. Shipments in its intermodal business, which

moves freight using a combination of trains and trucks, declined

6.7% and industrial products volume dropped 11%. Agricultural

volume, which rose 11%, was the only exception.

Freight revenue dropped 7.2% on the weaker freight volume and

lower fuel surcharge revenue that offset benefits from higher

prices.

The weaker demand was partly offset by lower operating expenses,

which declined 4.2%.

In prepared remarks Thursday, Chief Executive Lance Fritz said

sectors such as grain and energy "are showing signs of life" though

challenges continue from the broader economy, a relatively strong

U.S. dollar and soft demand for consumer goods.

Overall, Union Pacific reported a profit of $1.13 billion, or

$1.36 a share, down from $1.3 billion, or $1.50 a share, a year

earlier. Revenue decreased 7% to $5.17 billion.

Analysts polled by Thomson Reuters expected per-share profit of

$1.40 and revenue of $5.18 billion.

Last week CSX Corp. reported weaker third-quarter results as

slumping coal shipments continued to pressure its results, though

cost-cutting efforts helped the company's performance beat

expectations.

On Tuesday, Kansas City Southern's third-quarter results also

declined as revenue was dented by weak freight volume, led by

declines in crude and frac sand shipments. The company said events

such flooding outages and service disruptions on its Mexican

network also resulted in additional operating costs.

Norfolk Southern Corp. is set to report on Oct. 26.

--Tess Stynes

(END) Dow Jones Newswires

October 21, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

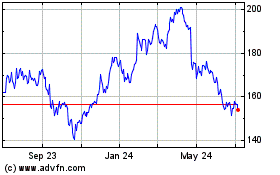

Nucor (NYSE:NUE)

Historical Stock Chart

From Apr 2024 to May 2024

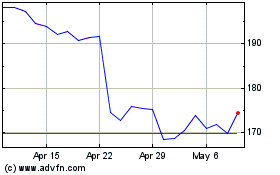

Nucor (NYSE:NUE)

Historical Stock Chart

From May 2023 to May 2024