Nestlé Will Miss Its Long-Term Sales Target -- WSJ

October 21 2016 - 3:02AM

Dow Jones News

By Brian Blackstone

VEVEY, Switzerland -- Nestlé SA reported subdued sales growth

and said it would fall short of a key revenue growth benchmark for

a fourth straight year, underscoring the difficult environment for

major global consumer goods companies.

The results, which were below analysts' expectations, came on

the heels of recent figures from peers such as Unilever PLC and

Danone SA that also showed slower growth.

These companies, like Nestlé, face headwinds including weaker

global growth particularly in emerging markets, volatile

currencies, changing consumer tastes and a difficulty raising

prices in an environment of low inflation or even falling prices,

known as deflation.

Vevey-based Nestlé, owner of Crunch candy bars, Puppy Chow pet

food and Nespresso coffee, said Thursday that sales for the first

nine months of the year were 65.5 billion Swiss francs ($66.2

billion), up from 64.9 billion Swiss francs a year earlier and

slightly below analysts' expectations.

Organic sales -- which strip out the effects of currency swings

and acquisitions -- rose 3.3% from the previous year. Nestlé said

it expects organic sales growth of 3.5% for 2016 as a whole, down

from its previous forecast of around 4.2%.

It would be the weakest rise in at least 20 years.

Nestlé shares fell more than 1% in early European trading but

then recovered somewhat and were just 0.3% lower late Thursday at

74.5 francs.

"The revised guidance might not be a real surprise, however,

[it] is nevertheless a negative for a stock living on a reputation

of being defensive and diversified," said analysts at Baader Helvea

Equity Research.

Failure in 2016 to achieve organic sales growth of between 5%

and 6% would mark the fourth successive year the company has missed

its long-term goal, which it refers to as the "Nestlé Model."

Still, Chief Executive Paul Bulcke said the company was sticking

with the "ambition" of 5% to 6% growth.

"I do believe that in normal conditions that 5%-6% is definitely

something we have to aspire to," Mr. Bulcke said in an interview.

"We're living in quite special conditions. Everyone has to admit

that."

He said a mix of faster global economic growth and rising prices

should create the conditions for Nestlé to reach its growth

objective again. "The atmosphere is a little bit depressed in

general and that is affecting the macroeconomics of our industry to

a certain extent," he said.

When inflation is unusually subdued, or when consumer prices

fall, consumers get a boost in the shape of higher disposable

incomes. The flip side is that companies such as Nestlé rely in

part on being able to lift their own prices to generate growth, and

when they can't, it affects revenue.

Meanwhile, Nestlé has faced problems of its own, particularly a

recall of its Maggi noodles in India last year and weakness in its

frozen foods business in the U.S. Nestlé said Thursday that its

Maggi business "continued to gain back market share and

comparatives turned favorable."

"Bulcke has been fighting fires over the last three or four

years," said Jon Cox, head of Swiss equities at Kepler Cheuvreux.

"He inherited a business that did very well up until 2012. After

2013 he has been struggling to get growth back in a much more

competitive environment."

In an effort to spur growth, the company has expanded its

nutrition-and-health-sciences business. Reflecting that emphasis,

the company in late June tapped Ulf Mark Schneider -- the former

head of German health-care company Fresenius SE -- to be its next

chief executive starting Jan. 1.

Mr. Bulcke, who has been CEO since 2008, will become Nestlé

board chairman next year.

Write to Brian Blackstone at brian.blackstone@wsj.com

(END) Dow Jones Newswires

October 21, 2016 02:47 ET (06:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

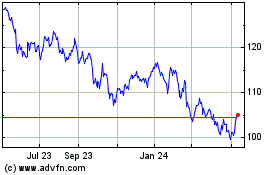

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Apr 2024 to May 2024

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From May 2023 to May 2024