Report of Foreign Issuer (6-k)

October 13 2016 - 6:02AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

SECURITIES EXCHANGE ACT OF 1934

For the month of October, 2016

(Commission File No. 001-34429),

PAMPA ENERGIA S.A.

(PAMPA ENERGY INC.)

Argentina

(Jurisdiction of incorporation or organization)

Ortiz de Ocampo 3302

Building #4

C1425DSR

Buenos Aires

Argentina

(Address of principal executive offices)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F ___X___ Form 40-F ______

(Indicate by check mark whether the registrant by furnishing the

information contained in this form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.)

Yes ______ No ___X___

(If "Yes" is marked, indicate below the file number assigned to the

registrant in connection with Rule 12g3-2(b): 82- .)

Pampa Energía announces General Ordinary Shareholders’ meeting for November 17, 2016.

Buenos Aires, October 12, 2016.

Pampa Energía S.A. (‘Pampa’ or the ‘Company’; NYSE: PAM; BCBA: PAMP) announced that it will hold an Ordinary Shareholders’ Meeting to be held at first and second call on November 17, 2016, at 11:00 a.m. and 12:00 noon, respectively, at Maipú 1, City of Buenos Aires, to deal with the following agenda:

1) Appointment of two shareholders to approve and sign the meeting’s minutes.

2) Consideration of increase of the Company’s global note program (for the issuance of simple, non-convertible notes), whose current outstanding amount is up to US$500,000,000 (Five Hundred Million U.S. Dollars) (or its equivalent in other currencies) (the “Note Program”) by up to US$1,000,000,000 (One Billion U.S. Dollars) (or its equivalent in other currencies). Consideration of issuance of (simple, non-convertible) notes under such program for up to the maximum amount referred to in the Note Program outstanding at any time, to be issued in one or more series and/or tranches.

3) Consideration of (i) delegation to the Board of Directors of the broadest powers to determine all the terms and conditions governing the Note Program (including, without limitation, time, price, payment method and conditions, use of proceeds) and the different series and/or tranches of notes to be issued thereunder, with powers to amend the terms and conditions approved by this Shareholders’ Meeting, except for the maximum amount thereby approved; (ii) grant of authorization to the Board of Directors so that, without need of any subsequent ratification by the Shareholders’ Meeting, it may approve, execute, deliver and/or sign any agreement, contract, document, instrument and/or title related to the Note Program and/or the issuance of the various series and/or tranches of notes thereunder; (iii) grant of authorization to the Board of Directors so that it may file any applications, carry out any proceedings and/or take any steps before the Argentine Securities Commission and/or Mercado de Valores, the Buenos Aires Stock Exchange, Mercado Abierto Electrónico or other securities exchanges or markets, as determined by the Board of Directors or its appointees from time to time in connection with the Note Program and/or the notes issued thereunder; and (iv) grant of authorization to the Board of Directors so that it may sub-delegate to one or more of its members and/or one or more individuals deemed suitable by them from time to time, all the powers and authorizations referred to in paragraphs (i) through (iii) above of this Agenda item.

4) Reinstatement of Statutory Reserve.

5) Appointment of one Alternate Statutory Auditor to replace the resigning Alternate Statutory Auditor, Ms. Victoria Hitce.

6) Grant of authorizations to carry out all such proceedings and make all such filings as required for obtaining the relevant registrations.

NOTE 1:

Shareholders shall send the relevant certificates evidencing their book-entry share account balances, as issued by Caja de Valores S.A., to Maipú 1, City of Buenos Aires, on business days from 10:00 a.m. to 6:00 p.m., on or before November 11, 2016.

NOTE 2:

As set forth in the Rules issued by the Argentine Securities Commission (2013 revision), upon registration for attending the Shareholders’ Meeting the shareholders shall provide the following details: full name or corporate name; identity document type and number in the case of physical persons or registration data in the case of artificial persons, specifying the Register where they are recorded and their jurisdiction and domicile, and indicating their nature. Identical data shall be furnished by each person who attends the Shareholders’ Meeting as representative of any shareholder.

NOTE 3:

Shareholders are reminded that pursuant to the provisions of the Rules issued by the Argentine Securities Commission (2013 revision) if the shareholders were companies organized abroad (i) they shall identify the beneficial holders of the shares of stock of the foreign company and the number of shares that will be voted; and (ii) the representative appointed to make the voting at the Shareholders’ Meeting shall be duly registered with the relevant Public Register, in accordance with Section 118 or 123 of the Argentine Companies Law.

NOTE 4:

Shareholders are asked to be present at least 15 minutes before the time the Shareholders’ Meeting is due to begin.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: October 12, 2016

|

Pampa Energía S.A.

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Ricardo Torres

|

|

|

|

Name: Ricardo Torres

Title: Co-Chief Executive Officer

|

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates offuture economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will a ctually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

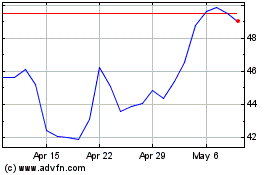

Pampa Energia (NYSE:PAM)

Historical Stock Chart

From Apr 2024 to May 2024

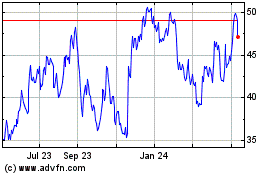

Pampa Energia (NYSE:PAM)

Historical Stock Chart

From May 2023 to May 2024