(FROM THE WALL STREET JOURNAL 3/19/16)

By Craig Karmin and Lisa Beilfuss

Starwood Hotels & Resorts Worldwide Inc.'s decision to spurn

Marriott International Inc. for a higher offer from a Chinese group

threatens to derail the hotel industry's rush to consolidate to

fend off competition from nimble new rivals like Airbnb Inc. and

get better deals from online travel sites.

Starwood said Friday it planned to accept an increased all-cash

bid from Anbang Insurance Group Co., which values the owner of

Westin, W Hotels and St. Regis at $13.2 billion. In November,

Starwood had accepted Marriott's offer of mostly stock, which

valued the company at $11.1 billion.

Marriott has until March 28 to come back with a sweeter offer to

hold on to its prize, and would receive a $400 million breakup fee

if Starwood goes to Anbang.

Starwood and Marriott had planned to merge and create the

world's biggest hotel company, an entity large enough to attract

travelers directly to its own website, rather than seeing them

pulled away by online travel sites, which claim up to 25% of

revenue.

Some analysts hailed that deal as a sign of the industry's

future, where scale becomes increasingly crucial at a time when the

Internet is ripping down barriers to entry.

The biggest hotel companies would also be able to analyze -- and

profit from -- the most data about customer travel and spending

habits, and would boast the largest loyalty programs to keep guests

coming back. They also can negotiate the best fees with travel

agents, including increasingly powerful online players like Expedia

Inc. and Priceline Group Inc.'s Booking.com. Rapidly expanding

home-rental companies like Airbnb are compelling hotel companies to

expand their global presence or risk losing market share.

"They have convinced us of the benefits of being bigger," said

Chad Beynon, a hotel analyst at Macquarie Securities, referring to

Marriott's management.

But if the Starwood deal falls apart, "now what's their mission

statement? Do they still believe all that?" he said.

An unraveling of the Marriott-Starwood deal could also have

ripple effects for other hoteliers considering deals. Some analysts

have said that the November announcement of the deal gave fresh

urgency to an industry already in the throes of consolidation.

Late last year, French hotel giant Accor SA agreed to acquire

FRHI Holdings Ltd. in a deal that valued the owner of the Fairmont,

Raffles and Swissotel hotel brands at around $3 billion. In

January, Commune Hotels & Resorts and Destination Hotels merged

to create the largest independent boutique hotel operator in the

U.S.

Marriott's Starwood plan was increasing pressure on rivals like

Hilton Worldwide Holdings Inc. and InterContinental Hotels Group

PLC to make their own acquisitions to keep from falling behind,

according to analysts.

"There was an interest in trying to keep pace with Marriott,"

said Ryan Meliker, a hotel analyst with investment bank Canaccord

Genuity. But if the Starwood deal falls apart, he added, "that

probably reduces that interest level."

A combination of Starwood and Marriott would create a company

with more than one million rooms and 30 brands.

Marriott said in a statement that it "continues to believe that

a combination of Marriott and Starwood is the best course for both

companies and offers the best value to Starwood shareholders." It

added that it is "carefully considering its alternatives." The

company declined further comment.

Some analysts say Marriott may not need to match the Anbang bid.

The U.S. hotel operator could argue the existing deal makes more

strategic sense and would encounter less regulatory opposition.

Hotel experts say Marriott, based in Bethesda, Md., would be

wary of a bidding war for Starwood that could dilute its equity

further or force it to borrow. Chairman Bill Marriott has had a

historic aversion to taking on too much debt and straining the

company's balance sheet, analysts say.

"I think Marriott doesn't want to get caught overpaying, and it

doesn't even want the perception that they overpaid," said Mr.

Meliker of Canaccord Genuity.

In a sign that its shareholders might not object to an end to

the company's pursuit of Starwood, Marriott stock rose 1.9% to

$73.16 Friday.

Starwood had been presented with larger offers before. Hyatt

Hotels Corp. previously offered a higher bid than the one from

Marriott, but Starwood's board preferred the management team at

Marriott, say people familiar with the matter.

Many Starwood shareholders may be inclined to accept Anbang's

higher cash offer, regardless of the long-term possibilities of a

deal with Marriott. Starwood shares surged 5.5% to $80.58 on news

of the new bid.

"We are happy to see an increased offer from Anbang which better

reflects the value of Starwood," John Paulson of Paulson & Co.,

the largest publicly disclosed shareholder in Starwood, said in a

statement. "Anbang is a proven, sophisticated buyer of related

assets and we welcome their interest in Starwood."

Anbang is teaming with Chinese investor Primavera Capital Group

and U.S. private-equity firm J.C. Flowers & Co.

Anbang has shown a recent willingness to make large, unsolicited

bids. It paid nearly $2 billion to Hilton for the Waldorf Astoria

on Manhattan's Park Avenue, the highest price ever paid for a U.S.

hotel. It reached a deal just as Hilton was exploring a more formal

sales process, according to people familiar with the matter.

Anbang's agreement to keep Hilton on as the Waldorf's manager

for 100 years -- one of the longest management contracts ever --

helped seal the deal.

This month, the Chinese insurer agreed to pay about $6.5 billion

including debt for Strategic Hotels & Resorts Inc., pre-empting

owner Blackstone Group LP's plans to market the hotels

individually, according to people familiar with that deal.

(END) Dow Jones Newswires

March 19, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

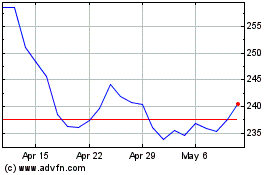

Marriott (NASDAQ:MAR)

Historical Stock Chart

From Apr 2024 to May 2024

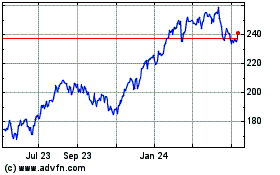

Marriott (NASDAQ:MAR)

Historical Stock Chart

From May 2023 to May 2024