UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): December 11, 2015

PRESSURE

BIOSCIENCES, INC.

(Exact

name of registrant as specified in its charter)

| Massachusetts |

|

000-21615 |

|

04-2652826 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

14

Norfolk Avenue

South

Easton, Massachusetts 02375

(Address

of principal executive offices)(Zip Code)

Registrant’s

telephone number, including area code: (508) 230-1828

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

[ ] Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Cautionary

Note on Forward-Looking Statements

This

Current Report on Form 8-K (this “Report”) contains, or may contain, among other things, certain “forward-looking

statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”),

and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Such forward-looking

statements involve significant risks and uncertainties. Such statements may include, without limitation, statements with respect

to the Company’s plans, objectives, projections, expectations and intentions and other statements identified by words such

as “projects,” “may,” “will,” “could,” “would,” “should,”

“believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,”

or similar expressions. These statements are based upon the current beliefs and expectations of the Company’s management

and are subject to significant risks and uncertainties, including those detailed in the Company’s filings with the Securities

and Exchange Commission (the “SEC”). Actual results may differ significantly from those set forth in the forward-looking

statements. These forward-looking statements involve certain risks and uncertainties that are subject to change based on various

factors (many of which are beyond the Company’s control). The Company undertakes no obligation to publicly update any forward-looking

statements, whether as a result of new information, future events or otherwise, except as required by applicable law.

Item

1.01 Entry into a Material Definitive Agreement.

On

December 11, 2015, in connection with the fourth closing (the “Fourth Closing”) of a private placement equity

financing previously disclosed by Pressure BioSciences Inc. (the “Company”) on its Current Report on Form 8-K

filed by the Company on July 28, 2015 (the “July 28 Current Report”), which is incorporated by reference herein

(excluding Exhibit 99.1 thereto), and pursuant to the Subscription Agreement, dated as of December 11, 2015, by and among the

Company and various individuals (each, a “Purchaser” and together “Purchasers”) the Company sold

and issued to the Purchasers Senior Secured Convertible Debentures (the “Debentures”) and warrants to purchase

shares of common stock equal to 50% of the number of shares issuable pursuant to the subscription amount (the “Warrants”)

for an aggregate purchase price of $730,000 (the “Purchase Price”) for the Fourth Closing, bringing the total

raised in the Offering to $4,755,000. For the Fourth Closing, the Company netted $657,000 in cash after taking into account fees

related to the Offering.

In

connection with the Subscription Agreement and Debentures, the Company entered into a Security Agreement with the Purchasers and

a FINRA-registered broker dealer that acted as the placement agent whereby the Company agreed to grant to Purchasers an unconditional

and continuing, first priority security interest in all of the assets and property of the Company to secure the prompt payment,

performance and discharge in full of all of Company’s obligations under the Debentures, Warrants and the other transaction

documents. The form of Subscription Agreement, form of Debenture, form of Warrant, and Security Agreement were filed as Exhibit

10.1, 4.1, 4.2, and 10.2 to the July 28 Current Report respectively, each of which is incorporated by reference herein.

Item

3.02 Unregistered Sales of Equity Securities.

Reference

is made to the disclosure set forth under Item 1.01 of this Report, which disclosure is incorporated herein by reference.

The

issuance of the securities described above were completed in accordance with the exemption provided by Section 4(a)(2) of the

Securities Act of 1933, as amended.

Item

8.01 Other Items

On

December 15, 2015, we issued a press release relating to this Fourth Closing. The press release is attached hereto as Exhibit

99.1.

Item

9.01 Financial Statements and Exhibits

(d)

Exhibits

Exhibit

Number

|

|

Exhibit

Description |

| |

|

|

| 4.1 |

|

Form

of Debenture (incorporated by reference to the Current Report on Form 8-K, dated July 28, 2015) |

| |

|

|

| 4.2 |

|

Form

of Warrant (incorporated by reference to the Current Report on Form 8-K, dated July 28, 2015) |

| |

|

|

| 10.1 |

|

Subscription

Agreement (incorporated by reference to the Current Report on Form 8-K, dated July 28, 2015) |

| |

|

|

| 10.2 |

|

Security

Agreement (incorporated by reference to the Current Report on Form 8-K, dated July 28, 2015) |

| |

|

|

| 99.1 |

|

Press

Release |

| |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf

by the undersigned, thereunto duly authorized.

| |

PRESSURE

BIOSCIENCES, INC. |

| |

|

|

| Dated:

December 17, 2015 |

By: |

/s/

Richard T. Schumacher |

| |

|

Richard

T. Schumacher |

| |

|

President |

FOR

IMMEDIATE RELEASE

| Investor

Contacts: |

|

|

| Richard

T. Schumacher, President & CEO, PBI |

|

(508)

230-1828 (T) |

| Jeffrey

N. Peterson, Chairman, PBI |

|

(650)

812-8121 (T) |

| Redwood

Investment Group |

|

(714)

978-4425 (T) |

Pressure

BioSciences Eliminates All Remaining Variable Rate

(Floorless)

Convertible Notes

Company

Closes Additional $730,000 of $5 Million PIPE;

Funding

Received to Date Reaches $4,755,000

South

Easton, MA, December 15, 2015 – Pressure BioSciences, Inc. (OTCQB: PBIO) (“PBI” and the “Company”),

a leader in the development and sale of broadly enabling, pressure cycling technology (“PCT”)-based sample preparation

solutions to the worldwide life sciences industry, today announced it has eliminated 100% of the Company’s variable rate

(floorless) convertible debt following the receipt of $730,000 in gross proceeds from the fourth closing of its $5 million Private

Placement (the “Offering”). This closing increased the total amount raised in the Offering to $4,755,000. One or more

additional closings are expected in the near future.

Pursuant

to the Subscription Agreement, the Company will issue to the investors, senior secured convertible debentures with a fixed conversion

price of $0.28 per restricted common share, and common stock purchase warrants exercisable into a total of 1,303,571 shares of

restricted common stock at an exercise price of $0.40 per share. The Company is under no obligation to file a registration statement

to register the shares underlying the Debentures and Warrants. The Company netted $657,000 in cash from the fourth closing after

taking into account fees related to the Offering.

Mr.

Richard T. Schumacher, President and CEO of PBI, commented: “With the funds raised to date, we have successfully completed

the number one goal of the Offering: the elimination of 100% of the Company’s variable rate (floorless) convertible debt.

Since the initial close of the Offering in July 2015, we have paid off approximately $2.7 million of variable rate loans. Although

we have never allowed any of this debt to convert under the terms of the loans, I am certain it is very comforting to all stakeholders

in PBI to know that all of these loans are now completely paid off.”

Mr.

Schumacher continued: “Funds received in the Offering have also been used for important and timely operating activities.

Specifically, we have begun to expand our marketing and sales areas while concomitantly increasing our manufacturing and other

operating capabilities.”

This

press release is not an offer to sell or a solicitation of offers to participate in the Offering. The units, including the shares

underlying the Debentures and Warrants, have not been registered under the Securities Act and may not be sold in the United States

absent registration under the Securities Act or an applicable exemption from registration.

For

more information on the Offering, please see the Form 8-K filed by the Company on July 28, 2015.

About

Pressure BioSciences, Inc.

Pressure

BioSciences, Inc. (“PBI”) (OTCQB: PBIO) develops, markets, and sells proprietary laboratory instrumentation and associated

consumables to the estimated $6 billion life sciences sample preparation market. Our products are based on the unique properties

of both constant (i.e., static) and alternating (i.e., pressure cycling technology, or PCT) hydrostatic pressure. PCT is a patented

enabling technology platform that uses alternating cycles of hydrostatic pressure between ambient and ultra-high levels to safely

and reproducibly control bio-molecular interactions. To date, we have installed over 250 PCT systems in approximately 160 sites

worldwide. There are over 100 publications citing the advantages of the PCT platform over competitive methods, many from key opinion

leaders. Our primary application development and sales efforts are in the biomarker discovery and forensics areas. Customers also

use our products in other areas, such as drug discovery & design, bio-therapeutics characterization, soil & plant biology,

vaccine development, histology, and forensic applications.

Forward

Looking Statements

Statements

contained in this press release regarding PBI’s intentions, hopes, beliefs, expectations, or predictions of the future are

“forward-looking’’ statements within the meaning of the Private Securities Litigation Reform Act of 1995. These

statements are based upon the Company’s current expectations, forecasts, and assumptions that are subject to risks, uncertainties,

and other factors that could cause actual outcomes and results to differ materially from those indicated by these forward-looking

statements. These risks, uncertainties, and other factors include, but are not limited to, the risks and uncertainties discussed

under the heading “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31,

2014, in the Company’s Quarterly Report on Form 10-Q for the period ended September 30, 2015, and other reports filed by

the Company from time to time with the SEC. The Company undertakes no obligation to update any of the information included in

this release, except as otherwise required by law.

For

more information about PBI and this press release, please click on the following website link:

http://www.pressurebiosciences.com

Please

visit us on Facebook, LinkedIn, and Twitter

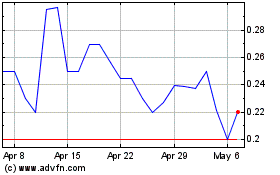

Pressure Biosciences (QB) (USOTC:PBIO)

Historical Stock Chart

From Apr 2024 to May 2024

Pressure Biosciences (QB) (USOTC:PBIO)

Historical Stock Chart

From May 2023 to May 2024