UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) November 26, 2014

EBIX, INC.

(Exact name of registrant as specified in its charter)

|

| | | | |

Delaware | | 0-15946 | | 77-0021975 |

(State or other jurisdiction | | (Commission File Number) | | (IRS Employer |

of incorporation) | | | | Identification No.) |

|

| | |

5 Concourse Parkway, Suite 3200, Atlanta, Georgia | | 30328 |

(Address of principal executive offices) | | (Zip Code) |

Registrant's telephone number, including area code (678) 281-2020

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01. Entry into a Material Definitive Agreement.

On November 26, 2014, Ebix, Inc. (the “Company”) entered into a Director Nomination Agreement (the “Agreement”) by and among the Company, Barington Companies Equity Partners, L.P., a Delaware limited partnership (“BCEP”), Barington Companies Investors, LLC, as investment advisor to certain investment accounts (“BCI” and, together with BCEP and its Affiliates, “Barington”), Ancora Advisors, LLC (“Ancora” and, together with Barington, the “Barington Group”), James A. Mitarotonda and Joseph R. Wright, Jr. (together with Mr. Mitarotonda, the “New Nominees”) (collectively, the “Parties”). Pursuant to the Agreement, the Company’s board of directors (the “Board”) has expanded the size of the Board by two directorships, effective as of the date of the Annual Meeting of Stockholders of the Company, to be held no later than 45 days after the date of the Agreement (the “2014 Annual Meeting”), and has nominated the New Nominees (as well as all of the incumbent directors) for election at the 2014 Annual Meeting. The Agreement also provides, among other things, that:

| |

• | the Board and its Nominating and Corporate Governance Committee (the “Nominating Committee”) will consider the New Nominees for inclusion on committees of the Board, in good faith and in a manner consistent with other members of the Board in accordance with past practice; |

| |

• | during the Standstill Period (as defined below), if either New Nominee is unable to serve (or to continue to serve) as a director of the Company as a result of such person’s death, incapacity or an impediment resulting from events or circumstances outside of his control, then Barington shall be entitled to designate a replacement New Nominee so long as such replacement is reasonably acceptable to the Board and the Nominating Committee; |

| |

• | through the Standstill Period, the Barington Group and its affiliates are prohibited from taking certain actions, customarily restricted by an agreement of this kind, including soliciting proxies or written consents of shareholders, presenting proposals for action by shareholders, commencing legal action against the Company or certain of its representatives or launching a tender offer for shares of the Company; and |

| |

• | through the Standstill Period, the Barrington Group must vote all of its Company common stock for the Company’s nominees to the Board and according to the Board’s recommendations on any other routines matters, such as ratification of auditors and the advisory vote on executive compensation. |

The “Standstill Period” means the period from the effective date of the Agreement until 90 days before the date of the 2015 annual meeting or, if earlier, 10 days before any advance notice deadline for making director nominations at the 2015 annual meeting; provided, that if the Company recommends (or has notified Barington in writing of its commitment to recommend) that its stockholders vote for the re-election of the New Nominees at the 2015 annual meeting (regardless of whether the New Nominees agree to stand for re-election) and supports the New Nominees for election in no less rigorously and favorably a manner than it supports all of its other nominees, then the Standstill Period will continue until 90 days prior to the date of the 2016 annual meeting or, if earlier, 10 days prior to any advance notice deadline for making director nominations at the 2016 annual meeting.

There are no related party transactions between the Company and either the New Nominee that would require disclosure under Item 404(a) of Regulation S-K. The Board has determined that the New Nominees satisfy the requirements of independence under the NASDAQ listing standards. Each New Nominee will be eligible to receive compensation for services as a director on the same terms as the other non-employee directors.

The Company will reimburse $140,000 of the Barington Group’s out-of-pocket expenses in connection with, relating to or resulting from its letters to the Company dated November 10 and 11, 2014, the 2014 Annual Meeting, the negotiation and execution of the Agreement and the Barington Group’s efforts and actions, and any preparations therefor, before the execution and delivery of the Agreement, to consider means by which to alter the composition of the Board and related activities.

A copy of the Agreement is filed as Exhibit 99.1 hereto and the description above is qualified in its entirety by the full text of the Agreement.

On December 1, 2014, the Barington Group and the Company issued a joint press release relating to the Agreement and the nominations of the New Nominees to the Board. This press release is attached hereto as Exhibit 99.2 and is incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. The following exhibits are filed as part of this report:

|

| |

99.1 | Director Nomination Agreement, dated as of November 26, 2014, by and among Barington Companies Equity Partners, L.P., a Delaware limited partnership, Barington Companies Investors, LLC, as investment advisor to certain investment accounts, Ancora Advisors, LLC, James A. Mitarotonda, Joseph R. Wright, Jr. and Ebix, Inc. |

99.2 | Joint Press Release of Barington Group and the Company, dated December 1, 2014 |

EXHIBIT INDEX

|

| |

Exhibit Number | Description |

99.1 | Director Nomination Agreement, dated as of November 26, 2014, by and among Barington Companies Equity Partners, L.P., a Delaware limited partnership, Barington Companies Investors, LLC, as investment advisor to certain investment accounts, Ancora Advisors, LLC, James A. Mitarotonda, Joseph R. Wright, Jr. and Ebix, Inc. |

99.2 | Joint Press Release of the Company and Barington, dated December 1, 2014. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

Date: December 1, 2014 | |

| |

| EBIX, INC. |

| |

| By: | /s/ Robert Kerris |

| Name: | Robert Kerris |

| Title: | Chief Financial Officer & Corporate Secretary |

| | | |

Ebix Adds Two New Independent Nominees to its Board Slate for the 2014 Annual Meeting

ATLANTA - December 1, 2014 - Ebix, Inc. (NASDAQ: EBIX), a leading international supplier of on-demand software and e-commerce services to the insurance, financial and healthcare industries, today announced that they have added James A. Mitarotonda and Joseph R. Wright to the company’s slate of nominees to stand for election to the company's board of directors at the company's 2014 Annual Meeting of Stockholders.

As a part of an agreement reached with Barington Capital Group, L.P., which represents a group of investors that owns over 1.6% of Ebix’s common stock, Barington has agreed to vote its shares in support of all of the company's director nominees at the 2014 Annual Meeting. Barington has also agreed to certain customary “standstill” provisions. With these additions, the Ebix Board will expand to eight members, seven of whom are independent.

Robin Raina, Chairman of the Board and Chief Executive Officer of Ebix, said, “We have been actively searching for new independent Board members to add to our already highly qualified Board. We have shown a commitment to valuing the input of all our stockholders. Our productive conversations with Barington have allowed us to reach an agreement that is in the best interests of our stockholders and adds two new independent members to our Board. We are excited about our newest directors and I look forward to working with them as we execute our common goal of creating long-term stockholder value.”

James A. Mitarotonda, Chairman and Chief Executive Officer of Barington Capital Group stated, “Joe and I are delighted to join the Ebix Board. Ebix, under the leadership of Robin Raina, has an impressive record of profitable growth, and generates high margins due to its competitive position in attractive markets. We look forward to working collaboratively with our fellow Board members and Robin to drive value for all shareholders.”

Joseph R. Wright currently serves on President Obama and Secretary Hagel’s Defense Business Board. Besides being appointed to the President’s Commission on the U.S. Postal Service Reform and the National Security Telecommunications Advisory Committee by President George W. Bush, he has served in the US Government under previous administrations in varying capacities and has received the Distinguished Citizens Award from President Reagan in 1988. He is currently the Chairman of the Investment Committee of the ClearSky Fund of NextEra, is Executive Chairman of the Board of MTN Satellite Communications and serves as Senior Advisor to Chart Capital Partners and the Comvest Group.

James A. Mitarotonda is the chairman, president and chief executive officer of Barington Capital Group, L.P., an investment firm that has assisted numerous companies in improving their financial and share price performance. He currently serves as a director of A. Schulman, Inc. and The Pep Boys - Manny, Moe & Jack and is a former director of a number of publicly traded companies.

About Ebix, Inc.

A leading international supplier of On-Demand software and E-commerce services to the insurance, financial and healthcare industries, Ebix, Inc., (NASDAQ: EBIX) provides end-to-end solutions ranging from infrastructure exchanges, carrier systems, agency systems and risk compliance solutions to custom software development for all entities involved in the insurance industry.

With 40+ offices across Australia, Brazil, Canada, India, New Zealand, Singapore, the US and the UK, Ebix powers multiple exchanges across the world in the field of life, annuity, health and property & casualty insurance. Through its various SaaS-based software platforms, Ebix employs hundreds of insurance and technology professionals to provide products, support and consultancy to thousands of customers on six continents. For more information, visit the Company’s website at www.ebix.com.

About Barington Capital Group, L.P.

Barington Capital Group, L.P. is an investment firm that, through its affiliates, manages a value-oriented, activist investment fund that was established by James A. Mitarotonda in January 2000. The Fund invests in undervalued publicly traded companies that Barington believes could appreciate significantly in value as a result of a change in corporate strategy or from various operational, financial or corporate governance improvements. Barington’s investment team, senior advisors and industry contacts are seasoned operating specialists, experienced in working with companies to design and implement initiatives to improve their financial and share price performance.

SAFE HARBOR REGARDING FORWARD-LOOKING STATEMENTS

As used herein, the terms “Ebix,” “the Company,” “we,” “our” and “us” refer to Ebix, Inc., a Delaware corporation, and its consolidated subsidiaries as a combined entity, except where it is clear that the terms mean only Ebix, Inc.

The information contained in this Press Release contains forward-looking statements and information within the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934. This information includes assumptions made by, and information currently available to management, including statements regarding future economic performance and financial condition, liquidity and capital resources, acceptance of the Company’s products by the market, and management’s plans and objectives. In addition, certain statements included in this and our future filings with the Securities and Exchange Commission (“SEC”), in press releases, and in oral and written statements made by us or with our approval, which are not statements of historical fact, are forward-looking statements. Words such as “may,” “could,” “should,” “would,” “believe,” “expect,” “anticipate,” “estimate,” “intend,” “seeks,” “plan,” “project,” “continue,” “predict,” “will,” “should,” and other words or expressions of similar meaning are intended by the Company to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements are found at various places throughout this report and in the documents incorporated herein by reference. These statements are based on our current expectations about future events or results and information that is currently available to us, involve assumptions, risks, and uncertainties, and speak only as of the date on which such statements are made.

Our actual results may differ materially from those expressed or implied in these forward-looking statements. Factors that may cause such a difference, include, but are not limited to those discussed in our Annual Report on Form 10-K and subsequent reports filed with the SEC, as well as: the risk of an unfavorable outcome of the pending governmental investigations or shareholder class action lawsuits, reputational harm caused by such investigations and lawsuits, the willingness of independent insurance agencies to outsource their computer and other processing needs to third parties; pricing and other competitive pressures and the Company’s ability to gain or maintain share of sales as a result of actions by competitors and others; changes in estimates in critical accounting judgments; changes in or failure to comply with laws and regulations, including accounting standards, taxation requirements (including tax rate changes, new tax laws and revised tax interpretations) in domestic or foreign jurisdictions; exchange rate fluctuations and other risks associated with investments and operations in foreign countries (particularly in Australia and India wherein we have significant operations); equity markets, including market disruptions and significant interest rate fluctuations, which may impede our access to, or increase the cost of, external financing; and international conflict, including terrorist acts.

Except as expressly required by the federal securities laws, the Company undertakes no obligation to update any such factors, or to publicly announce the results of, or changes to any of the forward-looking statements contained herein to reflect future events, developments, changed circumstances, or for any other reason.

Readers should carefully review the disclosures and the risk factors described in the documents we file from time to time with the SEC, including future reports on Forms 10-Q and 8-K, and any amendments thereto.

You may obtain our SEC filings at our website, www.ebix.com under the “Investor Information” section, or over the Internet at the SEC’s website, www.sec.gov.

Contact:

Rebecca Kral, Edelman - 212-729-2483 or rebecca.kral@edelman.com

Aaron Tikkoo - 678-281-2027 or atikkoo@ebix.com

DIRECTOR NOMINATION AGREEMENT

November 26, 2014

This Director Nomination Agreement, dated as of November 26, 2014 (this “Agreement”), is by and among Barington Companies Equity Partners, L.P., a Delaware limited partnership (“BCEP”), Barington Companies Investors, LLC, as investment advisor to certain investment accounts (“BCI,” and, together with BCEP and its Affiliates, “Barington”), Ancora Advisors, LLC (“Ancora,” and, together with Barington, the “Barington Group”), James A. Mitarotonda and Joseph R. Wright, Jr. (together with Mr. Mitarotonda, the “New Nominees”) and Ebix, Inc., a Delaware corporation (the “Company”) (collectively, the “Parties”). In consideration of, and reliance upon, the mutual covenants and agreements contained herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree as follows:

| |

1. | Board Representation and Board Matters. Each Party agrees that: |

| |

(a) | (i) As promptly as practicable after the date hereof, the Board of Directors of the Company (the “Board”) will, effective as of the date of the Annual Meeting of Stockholders of the Company to be held in 2014 or held shortly thereafter (the “2014 Annual Meeting”), increase the size of the Board by two directorships and nominate Messrs. Mitarotonda and Wright for election to the Board, to be included on the slate of directors to be elected at the 2014 Annual Meeting. The 2014 Annual Meeting shall be held no later than 45 days after the date of this Agreement. |

| |

(i) | The Company shall support the New Nominees for election by the Company’s stockholders at the 2014 Annual Meeting in no less rigorously and favorably a manner than it supports all of its other nominees including, without limitation, recommending that the Company’s stockholders vote in favor of the election of the New Nominees at the 2014 Annual Meeting. None of the Company, the Board or the Nominating and Corporate Governance Committee of the Board (the “Nominating Committee”) shall take any position, make any statements or take any action inconsistent with such recommendation. |

| |

(ii) | The New Nominees shall be considered by the Nominating Committee and the Board for inclusion on committees of the Board in good faith in a manner consistent with other members of the Board, in accordance with past practice, for which purpose their respective qualifications and experience shall be reasonably considered. |

| |

(iii) | Prior to the execution of this Agreement, (A) each of the New Nominees has completed and submitted to the Company a director and officer questionnaire (in the same form as completed by other members of the Board); and (B) the Board has reviewed and approved the qualifications of the New Nominees to serve as members of the Board and has determined that each New Nominee currently satisfies the conditions set forth in (c) below. |

| |

(b) | As a condition to the New Nominees’ (i) nominations to the Board, (ii) continuing service as members of the Board and (iii) any subsequent nomination for election as a director of the Company at any subsequent annual meeting, each of the New Nominees will provide, fully and completely, any information the Company reasonably requires, including information the Company requires to be disclosed in a proxy statement or other filing under applicable law, stock exchange rules or listing standards, information in connection with assessing eligibility, independence and other criteria applicable to directors or satisfying compliance and legal obligations, to the extent, in each case, consistent with the information required by the Company in accordance with past practice with respect to other members of the Board. |

| |

(c) | The New Nominees, at all times while serving as members of the Board, will: |

| |

(i) | meet all director independence and other standards of the Company, NASDAQ, any other stock exchange on which the Company’s shares are listed and the U.S. Securities and Exchange Commission (the “SEC”), applicable provisions of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and all rules and regulations promulgated thereunder, including Rule 10A-3; |

| |

(ii) | be qualified to serve as a director under the Delaware General Corporation Law (the “DGCL”); and |

| |

(iii) | not have any personal or business interest or relationship that materially conflicts with or would reasonably be expected to materially conflict with any responsibility or obligation of each New Nominee to the Company, including (1) any agreement, arrangement or understanding with any person, other than the Company, with respect to any direct or indirect compensation, reimbursement or indemnification in connection with service or action as a director of the Company, and (2) those that otherwise materially compete with any interest of the Company (including serving as a director, employee, consultant or in a similar capacity of any business that competes, in any material respect, with any business carried on by the Company), in each case to the same extent such conditions apply |

in accordance with past practice to other members of the Board (other than officers or employees of the Company) (clauses (i) through (iii), collectively, the “Conditions”). Each New Nominee will promptly advise the Board and the Nominating Committee of the Board in writing if he ceases to satisfy any Condition.

| |

(d) | Either the New Nominee in question, in the case of clause (i) below, or both New Nominees, in the case of clause (ii) below, will promptly offer to resign from the Board and, if requested by the Company, promptly deliver their written resignations to the Board (which will provide for their immediate resignations), the Board having sole discretion to accept or reject such resignation, and the Company’s obligations hereunder shall thereupon terminate with respect to such New Nominee (in the case of clause (i) below) or both New Nominees (in the case of clause (ii) below), if: |

| |

(i) | either New Nominee ceases to satisfy in any material respect any condition in clauses (b) or (c), and fails to substantially cure such matter within 10 business days after notice thereof from the Company; or |

| |

(ii) | any member of the Barington Group otherwise ceases to comply with or breaches, in any material respect, any term of this Agreement, and fails to substantially cure such matter within 10 business days after notice thereof from the Company. The members of the Barington Group agree to cause either the New Nominee in question (in the case of clause (i) above) or both New Nominees (in the case of this clause (ii)) to resign promptly from the Board if such New Nominee fails to resign if and when requested pursuant to this clause (d). |

| |

(e) | Barington irrevocably withdraws any deemed or purported nomination of directors contained in its letters to the Company, dated November 10 and 11, 2014, and all nominations to the Board made before the date hereof. |

| |

(f) | If at any time either New Nominee is unable to serve (or to continue to serve) as a director of the Company as a result of such person’s death, incapacity or an impediment resulting from events or circumstances outside of his control, then Barington shall be entitled to designate a replacement New Nominee (any replacement New Nominee selected in accordance with this Section 1(f), a “Replacement Nominee”), and such Replacement Nominee shall be deemed a New Nominee for all purposes of this Agreement and promptly appointed to the Board (or nominated for election to the Board if such death or incapacity occurs prior to the 2014 Annual Meeting), provided that such New Nominee is reasonably acceptable to the Board and the Nominating Committee. If such Replacement Nominee is not reasonably acceptable to the Board or the Nominating Committee, Barington will withdraw the designation of such proposed Replacement Nominee and be permitted to designate a replacement therefor (which Replacement Nominee will also be subject to the requirements of this Section 1(f)). |

| |

2. | Proxy Solicitation Materials. The Company agrees that the Company’s proxy statement (as such term is defined in Rule 14a-1 promulgated under the Exchange Act) with respect to the 2014 Annual Meeting (such proxy statement, the “2014 Proxy Statement”) and all other solicitation materials to be delivered to stockholders in connection with the 2014 Annual Meeting will be prepared in accordance with, and in a manner consistent with the intent and purpose of, this Agreement. The Company will provide Barington with true and complete copies of any portion of the 2014 Proxy Statement or other soliciting materials (as such term is used in Rule 14a-6 promulgated under the Exchange Act) with respect to the 2014 Annual Meeting, in each case that refer to the Barington Group, the New Nominees or this Agreement, at least two business days before filing such materials with the SEC in order to permit Barington a reasonable opportunity to review and comment on such portions, and will consider in good faith any comments received from Barington and its counsel relating to such portions. Except as required by applicable law, the Company will use the same or substantially similar language, or any summary thereof that is agreed upon for the foregoing filings, in all other filings with the SEC that disclose, discuss, refer to or are being filed in response to or as a result of this Agreement. Barington will provide, as promptly as reasonably practicable, all information relating to Barington, the New Nominees and other information to the extent required under applicable law to be included in the Company’s 2014 Proxy Statement and any other soliciting materials (as such term is used in Rule 14a-6 promulgated under the Exchange Act) to be filed with the SEC or delivered to stockholders in connection with the 2014 Annual Meeting. The 2014 Proxy Statement and other soliciting materials will contain the same type of information and manner of presentation concerning the New Nominees as provided for the Company’s other independent director nominees. |

| |

3. | Standstill. Further, at all times during the Standstill Period, each member of the Barington Group will not, directly or indirectly, and will cause each of its Affiliates not to, directly or indirectly: |

| |

(a) | Solicit proxies or written consents of stockholders, conduct any other type of referendum (binding or non-binding) with respect to, or from the holders of, the Voting Securities or become a “participant” (as defined in Instruction 3 to Item 4 of Schedule 14A promulgated under the Exchange Act) in or assist any person or entity not party to this Agreement (a “Third Party”) in any “solicitation” of any proxy, consent or other authority (as defined under the Exchange Act) to vote any shares of the Voting Securities. |

| |

(b) | Encourage, advise or influence any other person or assist any Third Party in encouraging, assisting or influencing any person with respect to the giving or withholding of any proxy, consent or other authority to vote or in conducting any other type of referendum with respect to the Company or the Voting Securities. |

| |

(c) | Form or join any partnership, limited partnership, syndicate or other group, other than the Barington Group (as comprised as of the date of this Agreement), including a group as defined under Section 13(d) of the Exchange Act, with respect to the Voting Securities, or otherwise support or participate in any effort by a Third Party with respect to the matters set forth in clause (a) above. |

| |

(d) | Present any proposal (whether pursuant to Rule 14a-8 under the Exchange Act or otherwise) for consideration for action by stockholders, propose any nominee for election to the Board or seek to place on, or remove from, the Board, a director. |

| |

(e) | Grant any proxy, consent or other authority to vote with respect to any matters (other than to the named proxies included in the Company’s proxy card for the 2014 Annual Meeting or any subsequent annual meeting during the Standstill Period) or deposit any of the Voting Securities held by the Barington Group in a voting trust or subject them to a voting agreement or other arrangement of similar effect. |

| |

(f) | Other than through open market broker sale transactions where the identity of the purchaser is unknown, sell, offer or agree to sell directly or indirectly, through swap or hedging transactions or otherwise, any security of the Company or any right decoupled from such underlying security held by the Barington Group to any Third Party that would knowingly result in such Third Party, together with its Affiliates, owning, controlling or otherwise having any beneficial or other ownership interest in the aggregate of 5% or more of the shares of Common Stock outstanding at such time or would increase the beneficial or other ownership interest of any Third Party who, together with its Affiliates, has a beneficial or other ownership interest in the aggregate of 5% or more of the shares of Common Stock outstanding at such time, except in each case in a transaction approved by the Board. |

| |

(g) | Make any request under Section 220 of the DGCL, other than any request made by a director under Section 220(d). |

| |

(h) | Threaten, file or otherwise commence or cause to be threatened, filed or otherwise commenced, any complaint, litigation, claim, action, suit or similar proceeding (collectively, a “Legal Proceeding”) against the Company or its Affiliates, directors, officers or employees (except (i) solely in connection with enforcing the Barington Group’s rights hereunder or (ii) any Legal Proceeding in a capacity other than as a stockholder or director of the Company and only with respect to matters not relating to corporate activities or actions) unless approved in writing in advance by the Company. |

| |

(i) | Make any public statement or statement reasonably likely to be made public (including by requiring the Company to make public disclosure) regarding the Company or its Affiliates, officers, directors, employees, businesses or strategies, unless approved in writing in advance by the Company (except to the extent, if any, required to be disclosed by the Barington Group in a Schedule 13D filing or in response to a court order or a judicial or regulatory demand). |

| |

(j) | Effect, seek to effect or in any way assist or facilitate any other person in effecting or seeking to effect any: |

| |

(i) | tender offer or exchange offer to acquire securities of the Company; |

| |

(ii) | acquisition of any interest in any material asset or business of the Company or any of its subsidiaries; |

| |

(iii) | merger, acquisition, share exchange or other business combination involving the Company or any of its subsidiaries; or |

| |

(iv) | recapitalization, restructuring, liquidation, dissolution or other extraordinary transaction with respect to the Company or any of its subsidiaries or material portion of its or their businesses. |

| |

(k) | Request in writing any waiver, consent under or any amendment of, any provision of this Agreement. |

| |

(l) | File or commence any Legal Proceeding to contest the validity of this Section 3 or to seek a release from any restriction contained in this Section 3. |

| |

(m) | Enter into any discussion, negotiation, agreement or understanding with any Third Party with respect to the foregoing or advise, assist, encourage or seek to persuade any Third Party to take any action with respect to any of the foregoing. |

For the avoidance of doubt, the provisions of this Section 3 shall not limit in any respect the actions of any director of the Company in his or her capacity as such, recognizing that such actions are subject to such director’s fiduciary duties to the Company and its stockholders.

For purposes of this Agreement, the “Standstill Period” means the period from the date hereof until 90 days prior to the date of the annual meeting of stockholders of the Company to be held in 2015 (the “2015 Annual Meeting”) or, if earlier, 10 days prior to any advance notice deadline for making director nominations at the 2015 Annual Meeting; provided, that the Standstill Period will be extended as set forth below:

| |

(n) | If the Company recommends (or has notified Barington in writing of its commitment to recommend) that its stockholders vote for the re-election of the New Nominees at the 2015 Annual Meeting (regardless of whether the New Nominees agree to stand for re-election) and supports the New Nominees for election in no less rigorously and favorably a manner than it supports all of its other nominees, then the Standstill Period will continue until 90 days prior to the date of the annual meeting of stockholders of the Company to be held in 2016 (the “2016 Annual Meeting”) or, if earlier, 10 days prior to any advance notice deadline for making director nominations at the 2016 Annual Meeting. |

| |

(o) | Notwithstanding anything in this Agreement to the contrary, until the end of the Standstill Period, the Barington Group will cause all Voting Securities with respect to which it has any voting authority, whether owned of record or beneficially owned, as of the record date for any annual or special meeting of stockholders or in connection with any solicitation of stockholder action by written consent (each a “Stockholders Meeting”) within the Standstill Period, in each case that are entitled to vote at any such Stockholders Meeting, to be present for quorum purposes and to be voted at all such Stockholders Meetings or at any adjournments or postponements thereof (i) for all directors nominated by the Board for election at such Stockholders Meeting and (ii) for all other routine matters such as the Company advisory vote on executive compensation and ratification of auditors. |

In the event that the Company does not nominate the New Nominees for re-election at the 2015 Annual Meeting, the Standstill Period ends and any member of the Barington Group nominates, or publicly announces an expectation that it will nominate, candidates for election to the Board at the 2015 Annual Meeting, the New Nominees shall resign from the Board simultaneously with any such nomination or public announcement.

| |

4. | Corporate Policies. The New Nominees will comply with all applicable corporate governance, conflict of interest, confidentiality, stock ownership and trading policies and guidelines of the Company, as approved by the Board from time to time, generally applicable to other members of the Board, and preserve the confidentiality of Company business and information, including discussions or matters considered in meetings of the Board or Board committees, to the same extent generally required of other members of the Board pursuant to such policies and guidelines. |

| |

5. | Public Announcement. The Company and Barington will announce this Agreement and the material terms hereof by means of a joint press release in the form attached hereto as Exhibit A (the “Press Release”) as soon as practicable on or after the date hereof, but in any event within two business days of the date of this Agreement. |

| |

6. | Representations and Warranties of the Parties. Each Party represents and warrants to each other Party that: |

| |

(a) | Such party has all requisite company and other power and authority to execute and deliver this Agreement and to perform its obligations hereunder. |

| |

(b) | This Agreement has been duly and validly authorized, executed and delivered by it and is a valid and binding obligation of such party, enforceable against such party in accordance with its terms. |

| |

(c) | This Agreement will not result in a violation of any terms or conditions of any agreements to which such person is a party or by which such party may otherwise be bound or of any law, rule, license, regulation, judgment, order or decree governing or affecting such party. |

| |

7. | Representations and Warranties of the Barington Group. The Barington Group represents and warrants that, as of the date of this Agreement: |

| |

(a) | It beneficially owns, in the aggregate, 587,352 shares of Common Stock. |

| |

(b) | It has a right to acquire through options an additional 121,200 shares of Common Stock. |

| |

(c) | Except for such ownership or exposure, neither the Barington Group nor any of its Affiliates has any other direct or indirect beneficial ownership of, and/or economic exposure to, any Voting Securities or rights or options to own or acquire any Voting Securities, including through any derivative transaction. |

| |

(d) | It has not, at any time during the course of the last two years, engaged in any short selling activity, or established, maintained or liquidated a "put equivalent position" (within the meaning of Rule 16a-1(h) under the Exchange Act), or entered into any agreement or was party to any arrangement the result of which could be to gain from any decline in the price of the Common Stock; or entered into any agreement, arrangement or understanding with any person that could be expected to result in such person engaging in any of the foregoing. |

| |

8. | Confidentiality. Consistent with their obligations as directors of the Company to maintain the confidentiality of Company information, and in furtherance of the Company’s policies relating to confidentiality applicable to directors, the New Nominees acknowledge and agree, subject to the next sentence, that they will not disclose Company information to any officers, directors, employees, advisers or other persons associated with any member of the Barington Group. Notwithstanding the foregoing, Mr. Mitarotonda shall be permitted to disclose such information to employees of Barington (i) to the extent permitted pursuant to Barington’s internal compliance policies and guidelines, provided (x) such employees have entered into Barington’s customary confidentiality agreement and are subject to Barington’s trading restrictions and (y) Barington and all such employees are only permitted to trade in the securities of the Company in accordance with the Company’s insider trading policies; provided, further, that Barington agrees to |

not amend such internal compliance policies and guidelines with respect to the Company’s information and securities without the Company’s written consent (not to be unreasonably withheld) or (ii) pursuant to the terms of any confidentiality agreement that the Company and Barington may enter into on mutually agreeable terms.

| |

9. | Miscellaneous. Each Party recognizes and agrees that if for any reason any provision of this Agreement is not performed in accordance with its specific terms or is otherwise breached, immediate and irreparable harm or injury would be caused for which money damages would not be an adequate remedy. Accordingly, each Party agrees that, in addition to any other remedy the other Party may be entitled to at law or equity, the other Party is entitled to seek an injunction or injunctions to prevent any breach of this Agreement and to enforce specifically the terms and provisions of this Agreement exclusively in the Chancery Court of the State of Delaware or, if that court lacks subject matter jurisdiction, the United States District Court for the District of Delaware (collectively, the “Chosen Courts”). If any action is brought in equity to enforce any provision of this Agreement, no Party will allege, and each Party hereby waives the defense, that there is an adequate remedy at law. Furthermore, each Party: |

| |

(a) | Consents to submit itself to the personal jurisdiction of the Chosen Courts if any dispute arises out of this Agreement or the transactions contemplated by this Agreement. |

| |

(b) | Agrees that it will not attempt to deny or defeat such personal jurisdiction by motion or other request for leave from any Chosen Court. |

| |

(c) | Agrees that it will not bring any action relating to this Agreement or the transactions contemplated by thereby in any court other than the Chosen Courts and each Party irrevocably waives any right to trial by jury in any such action. |

| |

(d) | Agrees to waive any bonding requirement under any applicable law, in the case any other party seeks to enforce the terms hereof by way of equitable relief. |

| |

(e) | Irrevocably consents to service of process by a reputable overnight mail delivery service, signature requested, to the address of such parties’ principal place of business or as otherwise provided by applicable law. THIS AGREEMENT WILL BE GOVERNED IN ALL RESPECTS, INCLUDING WITHOUT LIMITATION VALIDITY, INTERPRETATION AND EFFECT, BY THE LAWS OF THE STATE OF DELAWARE APPLICABLE TO CONTRACTS EXECUTED AND TO BE PERFORMED WHOLLY WITHIN SUCH STATE WITHOUT GIVING EFFECT TO THE CHOICE OF LAW PRINCIPLES OF SUCH STATE. |

| |

10. | No Waiver. Any waiver by any Party of a breach of any provision of this Agreement does not operate as, nor is construed to be, a waiver of any other breach of such provision or of any breach of any other provision of this Agreement. The failure of a Party to insist upon strict adherence to any term of this Agreement on one or more occasions is not considered to be a waiver or deprive that Party of the right thereafter to insist upon strict adherence to that term or any other term of this Agreement. |

| |

11. | Entire Agreement. This Agreement and the Exhibits hereto contain the entire understanding of the Parties with respect to the subject matter hereof and may be amended only by an agreement in writing executed by the Parties. |

| |

12. | Notices. All notices, consents, requests, instructions, approvals or other communications provided for herein and all legal process in regard hereto will be in writing and will be deemed validly given, made or served, if: |

| |

(a) | Given by facsimile or email, when such facsimile or email is transmitted to the facsimile number or email address below. |

| |

(b) | Or if given by any other mean, when actually received during normal business hours at the applicable address specified in this subsection: |

Ebix, Inc.

Five Concourse Parkway, Suite 3200

Atlanta, GA 30328

Attn: Robin Raina,

Chairman and

Chief Executive Officer

Facsimile: (678) 281-2019

Email: rraina@ebix.com

| |

(ii) | with copies to (which will not constitute notice): |

Skadden, Arps, Slate, Meagher & Flom LLP

1440 New York Avenue, NW

Washington, DC 20005

Attn: Marc S. Gerber

Facsimile: (202) 661-8280

Email: marc.gerber@skadden.com

Richard Grossman

Facsimile: (917) 777-2116

Email: richard.grossman@skadden.com

| |

(iii) | if to the Barington Group or any member thereof: |

Barington Companies Equity Partners, L.P.

c/o Barington Capital Group, L.P.

888 Seventh Avenue

17th Floor

New York, NY 10019

Attn: James A. Mitarotonda,

Chairman and CEO

Facsimile: (212) 586-7684

Email: jmitarotonda@barington.com

| |

(iv) | with copies to (which will not constitute notice): |

Barington Capital Group, L.P.

888 Seventh Avenue

17th Floor

New York, NY 10019

Attn: Jared Landaw,

Chief Operating Officer and General Counsel

Facsimile: (212) 586-7684

Email: jlandaw@barington.com

Kramer Levin Naftalis & Frankel LLP

1177 Avenue of the Americas

New York, NY 10036

Attn: Peter G. Smith,

Partner

Facsimile: (212) 715-8000

Email: psmith@kramerlevin.com

| |

13. | Severability. If at any time after the date hereof, any provision of this Agreement is held by any court of competent jurisdiction to be illegal, void or unenforceable, such provision has no force or effect, but the illegality or unenforceability of such provision has no effect on the legality or enforceability of any other provision of this Agreement. |

| |

14. | Counterparts. This Agreement may be executed in two or more counterparts, which together will constitute a single agreement. |

| |

15. | Successors and Assigns. This Agreement is not assignable by any Party but is binding on any successor of the Parties. |

| |

16. | No Third-Party Beneficiaries. This Agreement is solely for the benefit of the Parties and is not enforceable by any other person. |

| |

17. | Fees and Expenses. The Company shall pay Barington $140,000 within five business days after the date hereof to reimburse the Barington Group for out-of-pocket costs, fees and other expenses incurred by Barington in connection with, relating to or resulting from its letters to the Company dated November 10 and 11, 2014, the 2014 Annual |

Meeting, the negotiation and execution of this Agreement, and the Barington Group’s efforts and actions, and any preparations therefor, prior to the execution and delivery of this Agreement, to consider means by which to alter the composition of the Board, and related activities. Except as provided in this Section 17, neither Party is responsible for any cost, fee or expense of the other Party in connection with this Agreement.

| |

18. | Expiration of Standstill Period. Upon the expiration of the Standstill Period in accordance with Section 3, this Agreement immediately and automatically terminates in its entirety and no Party has any further right or obligation under this Agreement; provided, that: |

| |

(a) | the New Nominees shall continue to comply with Company policies that by their terms continue to apply to former directors of the Company (e.g., confidentiality obligations and trading policies); and |

| |

(b) | no party is released from any breach of this Agreement that occurred before its termination. |

| |

19. | Interpretation and Construction. Each Party acknowledges that it has been represented by counsel of its choice throughout all negotiations that have preceded the execution of this Agreement and that each Party has executed the same with the advice of said independent counsel. Each Party and its counsel cooperated and participated in the drafting and preparation of this Agreement and any and all drafts relating thereto exchanged among the Parties is deemed the work product of all Parties and may not be construed against any Party by reason of its drafting or preparation. Accordingly, any rule of law or any legal decision that would require interpretation of any ambiguities in this Agreement against any Party that drafted or prepared it is of no application and is hereby expressly waived by each Party and any controversy over any interpretation of this Agreement will be decided without regard to events of drafting or preparation. The section headings contained in this Agreement are for reference only and do not affect in any way the meaning or interpretation of this Agreement. |

| |

20. | Representative. Each member of the Barington Group hereby irrevocably appoints Barington Capital Group, L.P. as such member’s attorney-in-fact and representative (the “Barington Representative”), in such member’s place and stead, to do any and all things and to execute any and all documents and give and receive any and all notices or instructions in connection with this Agreement and the transactions contemplated hereby. The Company shall be entitled to rely, and being binding on each member of the Barington Group, upon any action taken by the Barington Representative or upon any document, notice, instruction or other writing given or executed by the Barington Representative. |

| |

21. | Other Definitions. As used in this Agreement: |

| |

(a) | “Affiliate” has the meaning in Rule 12b-2, promulgated by the SEC under the Exchange Act; |

| |

(b) | “Person” means any individual, corporation (including not-for-profit), general or limited partnership, limited liability or unlimited liability company, joint venture, estate, trust, association, organization or other entity of any kind or nature; |

| |

(c) | “Voting Security” means: |

| |

(i) | the common stock, par value $0.01 per share, of the Company (the “Common Stock”); |

| |

(ii) | all other securities of the Company entitled to vote in the election of directors; and |

| |

(iii) | all securities convertible into, or exercisable or exchangeable for, Common Stock or for other securities described in clause (ii) above, whether or not subject to the passage of time or any other contingency; and |

| |

(d) | “Beneficial owner” and “beneficially own” have their respective meanings in Rule 13d-3, promulgated by the SEC under the Exchange Act. |

***

IN WITNESS WHEREOF, each Party has executed this Agreement or caused the same to be executed by its duly authorized representative as of the date first above written.

EBIX, INC.

By: /s/ Robin Raina

Name: Robin Raina

Title: Chairman and CEO

BARINGTON COMPANIES EQUITY PARTNERS, L.P.

By: Barington Companies Investors, LLC, its General Partner

By: /s/ James A. Mitarotonda

Name: James A. Mitarotonda

Title: Managing Member

BARINGTON COMPANIES INVESTORS, LLC, as investment advisor

By: /s/ James A. Mitarotonda

Name: James A. Mitarotonda

Title: Managing Member

JAMES A. MITAROTONDA

/s/ James A. Mitarotonda

JOSEPH R. WRIGHT, JR.

/s/ Joseph R. Wright, Jr.

ANCORA ADVISORS, LLC

By: /s/ Brian R. Hopkins

Name: Brian R. Hopkins

Title: Managing Director

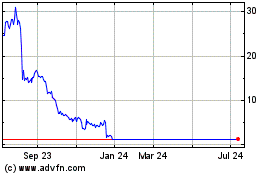

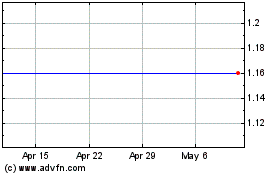

Ebix (NASDAQ:EBIX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ebix (NASDAQ:EBIX)

Historical Stock Chart

From Apr 2023 to Apr 2024