Have The Natural Gas ETFs Finally Bottomed Out? - ETF News And Commentary

March 08 2012 - 6:01AM

Zacks

Although many energy commodities are surging, natural gas is

still feeling the pain of weak prices. The commodity remains under

pressure as new supplies of the key fuel are brought online all the

time, making the historic oversupply situation even more of an

issue. It also hasn’t helped that the winter has been unseasonably

warm across much of the nation, reducing demand for the product as

a key input for power plants as well.

These trends have pushed some more intrepid investors to predict

a bottom in natural gas prices, declaring that eventually, this

rough bear market in prices, which has seen the value of front

month natural gas contracts decline from about $12/mm BTU in 2008

down to its current price around the $2.5 mark, has to end. Yet

while investors continually call for the bottom in natural gas

prices, the key commodity just keeps falling. In fact, prices have

fallen by 50% in the past one year period and they are now near a

10 year low while inventories look to approach the highest winter

close since 1983 when they hit 2.1 trillion cubic feet (read

Commodity ETFs Plunge On Supply Forecast).

As a result of this, the outlook for natural gas still looks

shaky going forward, especially given broad uncertainty over CNG

and LNG implementation on a large scale. With this overhang,

natural gas may not have reached a bottom just yet, especially if

more gas supplies are brought online or if weather remains

unfavorable to demand. On the other hand, a supply shock—be it in

the form of weather or regulation—coupled with increased demand

from new gas uses could make some investors look back on this time

as the moment to buy (read Three ETFs For An Iranian Crisis).

While no one knows for sure which path will be the case, at

least investors still have a plethora of options to play the fuel.

Below, we highlight some of the pros and cons of each approach as

well as a brief discussion of what investors can expect to see in

each of these natural gas ETFs:

Natural Gas Futures ETFs

For investors seeking direct exposure to natural gas prices, the

United States Natural Gas Fund (UNG) will be tough

to beat. The fund sees volume of close to four million shares a day

and has AUM of nearly $900 million, suggesting tight bid ask

spreads for the product. However, the fund has seen heavy contango

in recent months and years, coupled with the general decline in

value of natural gas prices. Thanks to this, UNG has lost about 52%

over the past 52 weeks including more than one-third of its value

in the past three months alone (see Inside The Forgotten Energy

ETFs).

Beyond UNG, there are a number of other options as well,

including the fund’s cousin the United States 12 Month

Natural Gas Fund (UNL).

This product sees slightly less in contango thanks to its approach

which spreads out exposure across 12 months of the curve, helping

to push the fund down ‘just’ 42.5% over the past 52 weeks, although

it does see tiny volumes in comparison. In addition to this choice,

investors also have the iPath DJ-UBS Natural Gas TR Sub

Index ETN (GAZ) for

those seeking the ETN structure, Teucrium’s Natural Gas

Fund (NAGS) which

spreads out exposure across multiple points on the curve, and the

iPath Seasonal Natural Gas ETN

(DCNG) which only offers

exposure to December contracts.

Natural Gas Equity ETFs

Given the uncertain future of the commodity, as well as recent

price weakness, some investors may want to play natural gas via an

equity route instead. This path may see less volatility than

commodities, and also help to avoid the contango issue too. On this

front, investors currently have two options; the First

Trust ISE Revere Natural Gas Index Fund

(FCG) and the brand new

Market Vectors Unconventional Oil & Gas ETF

(FRAK).

FCG holds 30 securities in total, charging investors 60 basis

points a year for access to its basket of natural gas focused

stocks. The product has a heavy focus on exploration and production

firms as these securities make up nearly 80% of the total exposure.

From a performance perspective, the fund is down just 14% over the

past year but is up 6.6% in the past quarter. FRAK on the other

hand could see some of same key risk/reward points as FCG but could

also see a heavy influence from the oil shale market as well.

Still, the product has a similar 80% focus on energy exploration

companies so it could be another way to play the natural gas market

(read Is HAP The Best Commodity Producer ETF?).

Short Natural Gas ETN

Given the oversupply situation and the lack of new uses for

large amounts of natural gas at this time, some may want to take a

short position in natural gas. Until recently, this was tough to do

with ETPs but appears to have changed with the launch of the

VelocityShares 3x Inverse Natural Gas ETN

(DGAZ). The note looks

to provide triple the daily inverse performance of natural gas

futures while collateralizing the investment with a purchase of

short-term Treasury bills. This could make DGAZ a great pick for

those who think that the oversupply situation in the natural gas

market has further to run and that prices of the important fuel are

headed sharply lower again this year.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

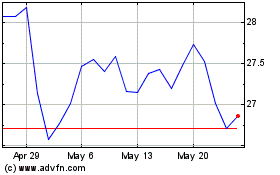

First Trust Natural Gas ... (AMEX:FCG)

Historical Stock Chart

From Apr 2024 to May 2024

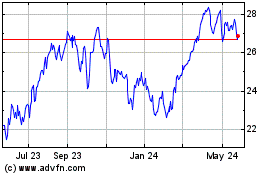

First Trust Natural Gas ... (AMEX:FCG)

Historical Stock Chart

From May 2023 to May 2024