Tullett Prebon in Talks to Buy ICAP's Broking Business

November 06 2015 - 7:30AM

Dow Jones News

Interdealer broker Tullett Prebon PLC is in advanced discussions

to acquire the global broking business of its rival ICAP PLC,

according to statements issued by both firms Friday.

The acquisition, which is still under discussion and yet to be

completed, is the latest shake-up for the squeezed broking business

of the City of London.

The business has come under mounting pressure as trading

activity has shifted from voice to electronic platforms.

Profitability has also been hit by stricter regulation.

Any deal would include ICAP's technology and broking platforms.

Under a deal Tullett would issue new shares, which would be

distributed to ICAP's shareholders, the firms said. ICAP would

retain a minority stake in the enlarged Tullett Prebon group.

ICAP's global broking business together with iSwap totaled £ 808

million ($1.25 billion) in the year to March 31, compared with

ICAP's total revenue of £ 1.28 billion.

London-based ICAP and Tullett Prebon are among the world's

largest interdealer brokers. They act as intermediaries between

investment banks and the market, by selling financial instruments

such as bonds, currencies and derivatives.

Both firms announced head count reductions and strategic reviews

to their business in recent months.

"Consolidation in this industry, and the disappearance of some

names, is inevitable," said Frederic Ponzo, managing partner of

consultancy Greyspark. He described the pressure from the shift to

electronic trading and regulation for the brokers as "massive."

Write to Chiara Albanese at chiara.albanese@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 06, 2015 07:15 ET (12:15 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

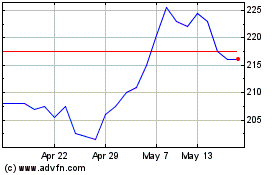

Tp Icap (LSE:TCAP)

Historical Stock Chart

From Apr 2024 to May 2024

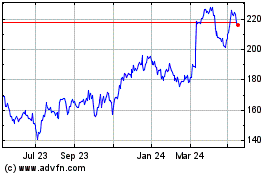

Tp Icap (LSE:TCAP)

Historical Stock Chart

From May 2023 to May 2024