TIDMKSPI

RNS Number : 3980F

JSC Kaspi.kz

16 November 2020

Kaspi.kz Announces Third Quarter 2020 Results

Kaspi.kz Super App MAU up 68%, revenue up 21% and net income up

32% YoY in Q3'20

Almaty, Kazakhstan, 16 November 2020 - JSC Kaspi.kz ("Kaspi.kz",

"we", or the "Company") which operates the Kaspi.kz Super App,

Kazakhstan's leading mobile app, today publishes its interim

condensed consolidated IFRS financial results for the third quarter

and nine months ended September 30, 2020.

Third Quarter 2020 Key Highlights

Kaspi.kz Super App

MAU up 68% reaching 8.5 million, DAU up 172% reaching 4.3

million

Kaspi.kz's Super App serves as single gateway to our Ecosystem

and gives our Payments, Marketplace and Fintech Platforms an

unrivalled market position and competitive advantage.

During the third quarter of 2020, Super App user and engagement

levels reached all-time highs.

-- Kaspi.kz Super App MAU (Monthly Active Users) increased by

68% year-over-year during the quarter ending 30 September 2020 to

reach 8.5 million.

-- As the Kaspi.kz Super App has become ever more integral to

consumers' daily lives, DAU (Daily Active Users) increased 172%

year-over-year, a substantially faster rate than MAU. The ratio of

DAU to MAU reached 51%, up from 32% during the quarter ending 30

September 2019.

-- Average monthly transactions per active consumer increased by

94% year-over-year to 23.4 from 12.0 for the quarter ending 30

September 2019.

-- Kaspi.kz is now almost entirely a mobile app only Ecosystem,

with 92% of transactions taking place through our Super App in

September 2020, compared to 75% in September 2019.

Kaspi.kz consolidated performance

Revenue up 21%, net income up 32%, net income margin reaching

42.5%

-- During the third quarter of 2020, the Company generated total

revenue of KZT161,763 million, demonstrating 21% adjusted[1]

year-over-year growth. For the first nine months of 2020 revenue

reached KZT460,859 million, equivalent to 28% adjusted

year-over-year growth.

-- During the third quarter of 2020, adjusted net income

increased 32% year-over-year to KZT68,804 million. For the first

nine months of 2020 net income reached KZT184,383 million,

equivalent to 43% adjusted year-over-year growth.

-- Net income margin reached 42.5% from adjusted 39.2% for the

quarter ended 30 September 2019. Net income margin reached 40.0%

from adjusted 35.8% for the nine months ended 30 September 2019.

Our profitability has benefited from material cost savings as we

have transitioned payment volumes away from third-party network

providers to our own proprietary payment network, improving cost of

risk year-over-year and the operating leverage inherent in our

business model.

-- Our net income continues to diversify quickly and our

Payments and Marketplace Platforms accounted for 33% of

consolidated net income in the nine months ending 30 September

2020, up from 25% in the same period in 2019.

-- For full-year 2020 better than expected trends now lead us to

expect Kaspi.kz consolidated net income of around KZT270

billion.

Mikhail Lomtadze, Kaspi.kz CEO and co-founder, commented:

"Having successfully completed our IPO in October, we are very

pleased to present an excellent first set of financial results as a

public company. During the third quarter of 2020, Kaspi.kz once

again demonstrated strong operating and financial momentum and

we're delighted with the results. Super App MAU increased 68%

year-over-year to 8.5 million, with engagement levels once again

hitting record highs. Adjusted net income growth of 32%

year-over-year and net income margin reaching 42.5%, amidst an

extremely challenging backdrop, illustrates the strength of our

diversified platforms, the scalability of our business and our

earnings power.

Our growth since the start of the Covid-19 pandemic reinforces

the essential role we have come to play in our consumer's daily

lives. During the fourth quarter our focus will remain on helping

consumers and merchants navigate the impact of the pandemic, with

our business model well positioned to capture the opportunities

arising from increased digital payments, commerce and financial

services. User and financial momentum since the start of the

current quarter is strong and we are now more optimistic about our

full year 2020 net income outlook than at the time of our IPO.

With the underlying drivers of the Kaspi.kz Ecosystem enhanced

and the digital economy in Kazakhstan continuing to offer

multi-year structural growth, we are as opportunistic as we have

ever been. Looking into 2021 we will continually add new and

innovative digital products and services to our Kaspi.kz Super App.

Kaspi Travel will be launched imminently and we're rapidly rolling

out Kaspi Pay and Kaspi QR, our QR contactless payments solution.

Although Kaspi Pay and Kaspi QR are still in their early days, we

are extremely encouraged by the initial take-up and usage trends.

We expect these initiatives combined with a healthy product

pipeline to allow us to continue growing our overall user base and

further increase existing user engagement. As we discussed with

investors during our IPO the result should be accelerating top-line

growth, increasing profitability and rapid progress towards our

midterm strategic goal of delivering the majority of our profits

from our Payments and Marketplace Platforms."

Business Highlights for the Quarter Ended September 30, 2020

The Kaspi.kz Ecosystem is comprised of market leading Payments,

Marketplace and Fintech platforms, centered around our consumers'

everyday needs.

Payments Platform

TPV up 189%, revenue up 85%, net income up 114%

Our Payments Platform has always offered consumers a highly

convenient way to shop, pay bills and make P2P payments via the

Kaspi.kz Super App. As has been the case globally, COVID-19 has

accelerated consumer adoption of contactless mobile payments. We

continue to add merchants at a rapid rate and Kaspi.kz's Payments

Platform continues to cement its position as the Kazakhstan

consumers' digital payments method of choice.

-- Throughout the year payments volume growth has remained rapid

and resilient to changes in the economic backdrop. During the third

quarter Total Payment Value (TPV) increased by 189% year-over-year

reaching KZT7.0 trillion. Revenue Generating TPV (RTPV) increased

by 86% over the same period to reach KZT1.7 trillion.

-- Our Payments Platform is amongst our most important drivers

to attract new consumers into the Kaspi.kz Ecosystem and increase

engagement. Despite being the largest of our platforms by number of

active consumers, Payments Platform consumer growth remained

strong, up by 67% year-over-year reaching 7.3 million active

consumers. Number of transactions reached 718 million, up by 212%

year-over-year.

-- Payments Platform revenue increased by 85% year-over-year

reaching KZT34,012 million during the quarter ending 30 September

2020 .

-- Net income increased by 114% year-on-year reaching KZT17,778

million with 3Q20 net income margin increasing significantly to

52.3% from 45.1% in 3Q19. Payments Platform profitability benefited

from cost savings as we continue to transition payment volumes away

from third-party network providers to our own proprietary payment

network combined with the platforms inherent operating

leverage.

-- Since the launch of our proprietary payments network in 2019,

we have continually taken share from other payment networks,

including Mastercard and Visa. In September 2020, Kaspi.kz

processed transactions accounted for 68% of total processed payment

volumes in Kazakhstan[2]. By creating our own closed-loop

proprietary payments network, eliminating the need for 3(rd) party

processors and payment networks, our Payments Platform not only

enables us to offer a complete end-to-end customer experience but

has resulted in material cost savings. We are now rapidly rolling

out our Kaspi Pay and Kaspi QR payments solution. We expect to be

able to provide more details on the contribution of Kaspi Pay to

Payments Platform volumes over the course of next year but initial

take-up and usage trends are adding to our optimism around the

outlook for our Payments Platform in 2021 and beyond.

Marketplace Platform

GMV up 48%, revenue up 71%, net income up 71%

Our Marketplace Platform connects merchants with consumers,

enabling merchants to increase their sales and consumers to buy a

broad selection of products and services from a wide range of

merchants. COVID-19-related restrictions on the operation of

physical retail have led to significant changes in the shopping

behaviour of consumers, and our Marketplace Platform with its

leading market share in e-commerce and Kaspi Delivery solution is

meeting the rapidly evolving needs of shoppers and merchants in

Kazakhstan.

-- Total Marketplace GMV reached KZT206 billion, representing an

increase of 48% year-over-year for the quarter ending 30 September

2020. The growth of our GMV was driven by our E-commerce. During

the third quarter of 2020, E-commerce Gross Merchandize Value (GMV)

growth accelerated significantly to 220% year-over-year.

-- Growth in active Marketplace Platform consumers has remained

robust throughout the year. During the quarter ending 30 September

2020 Marketplace active consumers reached 2.9 million, equivalent

to an increase of 21% year-over-year. Product listings which are

one of the most important drivers of consumer engagement and

purchases, increased 183% year-over-year and the number of active

stores reached 28 312, increasing 68% year-over-year.

-- Higher year-over-year take-rate in the quarter ending

September 30 2020 resulted in Marketplace revenue growing faster

than GMV and increasing 71% year-over-year to KZT16,020 million.

For the first nine months of 2020 Marketplace revenue increased 40%

year-over-year to KZT35,171 million.

-- For the quarter ending September 30 2020 n et income reached

KZT9,471 million, representing a 71% increase year-over-year with

3Q20 net income profitability stable at 59.1% compared with 59.4%

in the quarter ending 30 September 2019. For the first nine months

of 2020 Marketplace net income increased 29% year-over-year to

KZT19,684 million.

-- For the rolling 12 months ending 30 September of 2020,

E-commerce accounted for 44% of our overall Marketplace GMV and

during the third quarter of 2020 more than 50% of Marketplace GMV.

Going forward, we expect to see our E-commerce GMV grow at a

significantly faster rate than our total GMV. However, as COVID-19

related restrictions on the operation of physical retail are eased,

Mobile Commerce should continue to see accelerating growth and

remain an important component of total Marketplace GMV . Taken

together current trends in E-commerce and Mobile Commerce underpin

our expectation of strong Marketplace growth in 2021.

Fintech Platform

TFV down 14%, revenue up 6%, net income up 8%

Through the Fintech Platform we offer our consumers instant and

seamless access to digital finance including our buy-now-pay-later,

consumer finance and deposit products. We have been rapidly

transitioning to making our Fintech products mobile only and as

with our Payments and Marketplace Platforms, COVID-19 has only

served to accelerate this trend.

-- During the third quarter of 2020 Total Finance Value (TFV)

declined 14% year-on-year reaching KZT446 billion. This was however

a more modest decline than the 62% year-on-year reduction in the

second quarter of 2020. The short-term nature of all our financing

and more specifically buy-now-pay-later products allows us to

quickly ramp-up or scale back origination as we observe changes in

the consumer environment. With this in mind monthly origination

since September has been above pre-COVID-19 levels and TFV in

October 2020 was the highest month year-to-date.

-- Our average net loan portfolio increased by 5%

year-over-year, reaching KZT1.2 trillion for the quarter ending 30

September 2020. Overall loan portfolio growth despite lower

year-over-year origination reflects the impact of our loan payment

deferral program, which allowed enrolled consumers to defer their

payments for 3 months. By the end of September 2020 95% of

consumers that participated in the deferral program had made their

first payment and the program had no material impact on our cost of

risk.

-- Yield declined to 32.9% from 33.9% during the quarter ending

30 September 2019 but increased to 33.1% from 32.2% during the

first nine months of 2019. Lower yield in the third quarter of 2020

reflected changes in the product mix, with general purpose consumer

loans accounting for a lower share of TFV.

-- Fintech Platform active consumers reached 3.4 million during

the quarter ending 30 September 2020, equivalent to an increase of

8% year-on-year. Growth in new active consumers is at a slower rate

than in our Payments and Marketplace Platforms which in part

reflects our more cautious approach to new lending since March.

-- During the quarter ending 30 September 2020 our cost of risk

improved to 1.0% from 3.1% adjusted cost of risk in the same period

in 2019. Improving cost of risk reflects the strength of our data

driven real time risk management capabilities, which have enabled

us to quickly adjust origination to reflect the new economic

reality, as well as our continuous efforts to improve the success

of our collection processes. Improving cost of risk also reflects

the partial reversal of macro factor adjustments made in the first

half of 2020, due to better than forecast economic trends and our

excellent results collecting loans, delinquent more than 90 days.

Although we have increased TFV origination in recent months, we

continue to only lend to those consumers whose income and spending

has remained resilient throughout the COVID-19 related downturn and

this will likely continue to have positive implications for our

cost of risk in the final quarter of 2020 and into 2021.

-- Fintech Platform revenue increased by adjusted 6%

year-over-year reaching KZT111,731 million during the quarter

ending 30 September 2020. For the first nine months of 2020

adjusted revenue increased 18% year-over-year to KZT343,082

million. Slower top-line growth during the third quarter reflects

lower levels of origination since April 2020 but will accelerate in

2021 as higher TFV origination since September contributes to

revenue next year.

-- In the third quarter of 2020, our Fintech Platform's net

income increased by adjusted 8% year-over-year reaching net income

of KZT41,555 million, with net income margin reaching 37.2% from

adjusted 36.3% in the quarter ending 30 September 2019. For the

first nine months of 2020 net income increased adjusted 28%

year-over-year to KZT123,036 million with net income margin

reaching 35.9% from adjusted 33.1% in in the first nine months of

2019. Improving profitability reflects improving yield and cost of

risk trends, combined with our increasing scalability as TFV

origination has become almost entirely Super App only in 2020. Our

ROE (return of equity) reached 68.9% for the nine months ending 30

September 2020, up from 65.6% for the same period in 2019.

Guidance for full-year 2020

We expect to deliver strong year-over-year growth across all our

Platforms in the final quarter of 2020 with full-year 2020 Kaspi.kz

consolidated net income of around KZT270 billion. Since the time of

our IPO, trends in our Marketplace and Fintech Platforms have been

better than we anticipated and our Payments Platform continues to

deliver strong results in-line with the guidance we provided.

Payments

We continue to expect year-on-year growth of our Payments

Platform RTPV at a level of 80-85% in 2020. We also continue to

expect average balances on current accounts to demonstrate high 60%

year-on-year growth in 2020.

Payments Take Rate is expected to remain broadly flat in 2020

compared to 2019.

We target a low 50% Net Income Margin for the Payments Platform

in 2020.

Marketplace

We now expect our Marketplace Platform to deliver year-on-year

GMV growth of around 30%, which is at the top-end of our previous

guidance of between 25% to 30% growth.

Marketplace Take Rate should demonstrate slight year-on-year

expansion in 2020.

We continue to anticipate the Marketplace Platform's Net Income

Margin to stand at the level of low 60% in 2020.

Fintech

We continue to expect our TFV to demonstrate a year-on-year

decline of around 10% in 2020 as we lend only to consumers whose

income and spending has remained resilient thought the COVID-19

related slowdown.

We continue to target a TFV to Average Net Loan Portfolio

Conversion Rate of around 1.4 in 2020.

We expect our 2020 Fintech Average Yield levels to remain

largely flat compared to our 2019 Fintech Average Yield of 32.2%

but now expect our Fintech Net Income Margin to be in the high-30%

range which is above our previous guidance of mid-30% due to the

combination of lower than expected cost of risk and the Fintech

Platform's operating leverage.

Conference Call Information

Kaspi.kz will host a conference call and webcast at 1.00pm

(London) (8.00am U.S. Eastern Time, 7.00pm Nur-Sultan time) to

review and discuss the company's results for the third quarter.

https://www.lsegissuerservices.com/spark/KaspiKZJSC/events/ab716e86-5ebb-4a5d-8310-261dfa755374

We recommend using the dial-in option if you plan to ask

questions. Please use the conference ID number 9928626 when

prompted.

-- UK Participant Local Dial-In Number: (0) 20 3107 0289

-- US Participant Local Dial-In Number: (833) 922-1411

-- Russia Participant Dial-In Number: 81080025581012

For a list of global dial-in numbers, please click here .

Following the call, a webcast replay will be available at the

Kaspi.kz Investor Relations website.

Kaspi.kz Consolidated Income Statement

9M 2019, 9M 2019 9M 2020, 3Q 2019, 3Q 2019 3Q 2020,

KZT ADJUSTED, KZT MM KZT MM ADJUSTED, KZT MM

MM KZT MM KZT MM

----------------------------- --------- ---------- --------- --------- ---------- --------

136 , 133 ,3 161 ,

Revenue 363,158 360,258 460,859 296 96 763

----------------------------- --------- ---------- --------- --------- ---------- --------

growth, % - - 27.9% - - 21 .3%

----------------------------- --------- ---------- --------- --------- ---------- --------

Interest Revenue 189,192 186,292 239,077 70 , 629 67,7 29 82 , 393

----------------------------- --------- ---------- --------- --------- ---------- --------

Fees, Commissions

& Other 120,996 120,996 126,553 43 , 010 43 , 010 39 , 663

----------------------------- --------- ---------- --------- --------- ---------- --------

Transaction & Membership

Revenue 25,073 25,073 33,355 9,312 9,312 15 , 218

----------------------------- --------- ---------- --------- --------- ---------- --------

Seller Fees 34,946 34,946 64,182 14 , 776 14 , 776 26 , 417

----------------------------- --------- ---------- --------- --------- ---------- --------

Other gains and ( 1 , 431 ( 1 , 431 ( 1 ,

losses (7,049) (7,049) (2,308) ) ) 928 )

----------------------------- --------- ---------- --------- --------- ---------- --------

( 51

( 43 , ( 43 , , 967

Cost of revenue (128,932) (128,932) (145,469) 608 ) 608 ) )

----------------------------- --------- ---------- --------- --------- ---------- --------

1 9 .

growth, % - - 12.8% - - 2 %

----------------------------- --------- ---------- --------- --------- ---------- --------

3 2 .

% of revenue 35.5% 35.8% 31.6% 3 2 .0% 3 2 .7% 1 %

----------------------------- --------- ---------- --------- --------- ---------- --------

( 29 , ( 29 , ( 36 ,

Interest Expenses (87,975) (87,975) (100,883) 134 ) 134 ) 503 )

----------------------------- --------- ---------- --------- --------- ---------- --------

( 4,131 ( 4,131 ( 4 ,0

Transaction Expenses (10,344) (10,344) (11,061) ) ) 74 )

----------------------------- --------- ---------- --------- --------- ---------- --------

( 10 , ( 10 , ( 11 ,

Operating Expenses (30,613) (30,613) (33,525) 343 ) 343 ) 390 )

----------------------------- --------- ---------- --------- --------- ---------- --------

89 ,7 109 ,

Total net revenue 234,226 231,326 315,390 92 , 688 88 796

----------------------------- --------- ---------- --------- --------- ---------- --------

growth, % - - 36.3% - - 22 .3%

----------------------------- --------- ---------- --------- --------- ---------- --------

6 8 . 6 7 .

margin, % 64.5% 64.2% 68.4% 0 % 67.3% 9 %

----------------------------- --------- ---------- --------- --------- ---------- --------

Technology & product ( 5 , 038 ( 5 , 038 ( 6 ,

development (14,491) (14,491) (18,653) ) ) 558 )

----------------------------- --------- ---------- --------- --------- ---------- --------

( 6 , 577 ( 6 , 577 ( 13 ,

Sales and marketing (18,071) (18,071) (31,108) ) ) 295 )

----------------------------- --------- ---------- --------- --------- ---------- --------

General and administrative ( 3 , 278 ( 3 , 278 ( 3 ,

expenses (8,981) (8,981) (10,174) ) ) 452 )

----------------------------- --------- ---------- --------- --------- ---------- --------

( 6 , 522 ( 10 , (4, 455

Provision expense (29,734) (33,734) (34,550) ) 522 ) )

----------------------------- --------- ---------- --------- --------- ---------- --------

64 ,3 82 ,

Operating income 162,949 156,049 220,905 71 , 273 73 036

----------------------------- --------- ---------- --------- --------- ---------- --------

growth, % - - 41.6% - - 27 .4%

----------------------------- --------- ---------- --------- --------- ---------- --------

52 . 3 48 . 3 50 .

margin, % 44.9% 43.3% 47.9% % % 7 %

----------------------------- --------- ---------- --------- --------- ---------- --------

( 13 , ( 13 ,

Income tax (28,102) (26,912) (36,522) 427 ) ( 12 ,127) 23 2)

----------------------------- --------- ---------- --------- --------- ---------- --------

57 ,84 52 ,24 68 ,

Net income 134,847 129,137 184,383 6 6 80 4

----------------------------- --------- ---------- --------- --------- ---------- --------

growth, % - - 42.8% - - 31.7%

----------------------------- --------- ---------- --------- --------- ---------- --------

42 . 4 4 2 .

margin, % 37.1% 35.8% 40.0% % 39.2% 5 %

----------------------------- --------- ---------- --------- --------- ---------- --------

Source: Interim condensed consolidated IFRS financial results

for the third quarter and nine months ended September 30, 2020.

FY19 & 3Q19 revenue and net income adjusted as per Kaspi.kz

management accounts.

Kaspi.kz Consolidated Balance Sheet

31-Dec-2019, 30-Sep-2020,

KZT MM KZT MM

--------------------------- ------------ ------------

Cash and cash equivalents 239,140 269,626

--------------------------- ------------ ------------

Mandatory cash balances

with NBK 25,243 25,996

--------------------------- ------------ ------------

Due from banks 43,484 41,705

--------------------------- ------------ ------------

Investment securities

and derivatives 474,581 821,008

--------------------------- ------------ ------------

Loans to customers 1,292,104 1,253,699

--------------------------- ------------ ------------

Property, equipment

and intangible assets 60,985 70,536

--------------------------- ------------ ------------

Other assets 52,044 63,091

--------------------------- ------------ ------------

Total assets 2,187,581 2,545,661

--------------------------- ------------ ------------

Due to banks 3,000 -

--------------------------- ------------ ------------

Customer accounts 1,626,973 1,975,735

--------------------------- ------------ ------------

Debt securities issued 138,574 135,648

--------------------------- ------------ ------------

Insurance reserves 3,608 2,996

--------------------------- ------------ ------------

Other liabilities 42,018 52,031

--------------------------- ------------ ------------

Subordinated debt 77,786 76,254

--------------------------- ------------ ------------

Total liabilities 1,891,959 2,242,664

--------------------------- ------------ ------------

Share capital 95,825 95,825

--------------------------- ------------ ------------

Additional paid-in-capital 506 506

--------------------------- ------------ ------------

Revaluation reserve

of financial assets 472 4,654

--------------------------- ------------ ------------

Retained earnings 195,232 198,630

--------------------------- ------------ ------------

Total equity attributable

to Shareholders of

the Company 292,035 299,615

--------------------------- ------------ ------------

Non-controlling interests 3,587 3,382

--------------------------- ------------ ------------

Total equity 295,622 302,997

--------------------------- ------------ ------------

Total liabilities and

equity 2,187,581 2,545,661

--------------------------- ------------ ------------

Source: Interim condensed consolidated IFRS financial results

for the third quarter and nine months ended September 30, 2020

About Kaspi.kz

Kaspi.kz is the largest Payments, Marketplace and Fintech

Ecosystem in Kazakhstan with a leading market share in each of its

key services and products. At the core of the Kaspi.kz Ecosystem is

the Kaspi.kz Super App, the leading mobile app in the country.

The Kaspi.kz Super App serves as a single gateway to all

services and is an integral part of people's daily lives in

Kazakhstan. As people's lives become increasingly digitalised,

Super App usage is expected to grow supported by accelerating

consumer adoption of cashless payments, e-Commerce and digital

financial services.

Kaspi.kz's Ecosystem business model, where the growth and

development of one service contributes to the growth and

development of other services, creates a powerful virtuous cycle. A

growing number of services being used by consumers results in

synergies across all Platforms, structurally high profitability and

creates a powerful self-reinforcing network effect, giving Kaspi.kz

strong competitive advantages.

Kaspi.kz has been listed on the London Stock Exchange since

2020.

For further information:

David Ferguson, +44 7427 751 275

David.ferguson@kaspi.kz

Forward-looking statements

Some of the information in this announcement may contain

projections or other forward-looking statements regarding future

events or the future financial performance of Kaspi.kz. You can

identify forward looking statements by terms such as "expect",

"believe", "anticipate", "estimate", "intend", "will", "could,"

"may" or "might", the negative of such terms or other similar

expressions. Kaspi.kz wish to caution you that these statements are

only predictions and that actual events or results may differ

materially. Kaspi.kz does not intend to update these statements to

reflect events and circumstances occurring after the date hereof or

to reflect the occurrence of unanticipated events. Many factors

could cause the actual results to differ materially from those

contained in projections or forward-looking statements of Kaspi.kz,

including, among others, general economic conditions, the

competitive environment, risks associated with operating in

Kazakhstan, rapid technological and market change in the industries

the Company operates in, as well as many other risks specifically

related to Kaspi.kz and its respective operations.

[1] Adjustment is related to 3Q19 revenue and net income, and

excludes the one-off positive gain from the Kazakhstan government's

debt forgiveness program - partial reimbursement of penalties and

fines on delinquent loans and partial repayment of loans to certain

categories of borrowers. We have decreased 3Q19 revenue by KZT2.9bn

and increased provisions by KZT4.0bn (both before tax) to normalise

for this one-off positive effect in 3Q19.

[2] According to the NBK, in September 2020, Kaspi.kz's

proprietary payment network transactions accounted for 68% of total

payment network transactions in Kazakhstan, while Visa, Mastercard

and other international providers had an aggregate share of 26% of

total payment network transactions in the country.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRTUNVNRROUAARA

(END) Dow Jones Newswires

November 16, 2020 02:00 ET (07:00 GMT)

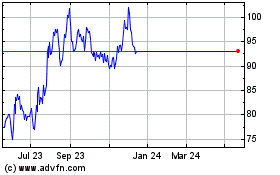

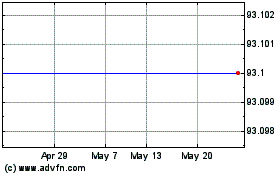

Kaspikz JSC (LSE:KSPI)

Historical Stock Chart

From May 2024 to Jun 2024

Kaspikz JSC (LSE:KSPI)

Historical Stock Chart

From Jun 2023 to Jun 2024