JSC Kaspi.kz Moody's Raises Outlook and Upgrades Rating (4200E)

November 05 2020 - 8:35AM

UK Regulatory

TIDMKSPI

RNS Number : 4200E

JSC Kaspi.kz

05 November 2020

Moody's raises outlook to positive and upgrades national-scale

long-term deposit rating for Kaspi.kz subsidiary Kaspi Bank

Almaty, Kazakhstan - 5 November, 2020 - Moody's Investors

Service ("Moody's") raises the outlook on Kaspi.kz (KSPI)

subsidiary Kaspi Bank's global scale long-term deposit ratings and

the overall issuer outlook to positive from stable. Moody's also

upgraded its national scale long-term deposit rating to A1.kz from

A2.kz and affirmed its national scale long-term CRR of A1.kz.

Mikheil Lomtadze, Kaspi.kz co-founder and CEO, commented:

"Moody's decision to move its outlook to positive and upgrade

its national scale deposit rating recognises our growing market

share and rapidly diversifying profitability as our Payments

platform scales. All of this is a direct result of our Super App

strategy, which has made our market leading Payments, Marketplace

and Fintech platforms integral to people's daily lives in

Kazakhstan. As we continue to develop new innovative products and

services and play a major role in Kazakhstan's digital

transformation, we expect our relevance to consumers and merchants

to increase further, with Kaspi.kz continuing to see strong revenue

and profitability growth into the medium-term."

At the core of our Ecosystem is the Kaspi.kz Super App, the

leading mobile app in the country, which serves as a single gateway

to all of our platforms and through which consumers can access our

digital finance products. Our buy-now-pay-later consumer finance

products are also integrated into our Marketplace platform to give

our users a seamless shopping experience.

Our large and engaged Super App user base allows us to

continually collect a wealth of proprietary data around consumer

daily activity, which we leverage to make superior credit decisions

within seconds while constantly reducing the average size of

financing and its maturity, and improving cost of risk.

Moody's affirmed Kaspi Bank's long-term local and foreign

currency deposit ratings of Ba2, Baseline Credit Assessment (BCA)

and Adjusted BCA of b1, long-term local currency senior unsecured

Medium Term Notes (MTN) program rating of (P)B1, long-term local

currency subordinate debt rating of B2 and subordinate MTN program

rating of (P)B2, long-term Counterparty Risk (CR) Assessment of

Ba2(cr) and long-term Counterparty Risk Ratings (CRRs) of Ba2.

Moody's also affirmed Kaspi Bank's short-term deposit ratings

and CRRs of Not Prime and its short-term CR Assessment of Not

Prime(cr).

About Kaspi.kz

Kaspi.kz is the largest Payments, Marketplace and Fintech

Ecosystem in Kazakhstan with a leading market share in each of its

key services and products. At the core of the Kaspi.kz Ecosystem is

the Kaspi.kz Super App, the leading mobile app in the country.

The Kaspi.kz Super App serves as a single gateway to all

services and is an integral part of people's daily lives in

Kazakhstan. As people's daily lives become increasingly

digitalised, Super App usage is expected to grow supported by

accelerating consumer adoption of cashless payments, e-Commerce and

digital financial services.

Kaspi.kz's Ecosystem business model, where the growth and

development of one service contributes to the growth and

development of other services, creates a powerful virtuous cycle. A

growing number of services being used by consumers results in

synergies across all Platforms, structurally high profitability and

creates a powerful self-reinforcing network effect, giving Kaspi.kz

strong competitive advantages.

For further information:

David Ferguson

+44 7427 751 275

david.ferguson@kaspi.kz

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFLFVVLVLEIII

(END) Dow Jones Newswires

November 05, 2020 08:35 ET (13:35 GMT)

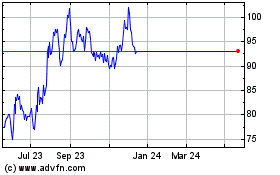

Kaspikz JSC (LSE:KSPI)

Historical Stock Chart

From May 2024 to Jun 2024

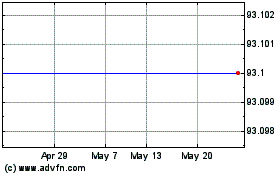

Kaspikz JSC (LSE:KSPI)

Historical Stock Chart

From Jun 2023 to Jun 2024