United States

Securities

And Exchange Commission

Washington, D.C. 20549

FORM 1-SA

☒ SEMI-ANNUAL REPORT PURSUANT TO REGULATION

A

or

☐ SPECIAL FINANCIAL REPORT PURSUANT TO REGULATION A

For the fiscal semiannual period ended June 30, 2024

XCELERATE INC

(Exact name of issuer as specified in its charter)

| Florida |

65-0710392 |

| State or other jurisdiction of incorporation or organization |

(I.R.S. Employer Identification No.) |

110 Renaissance Circle

Mauldin, South Carolina 29662

(Full mailing address of principal executive offices)

854-900-2020

(Issuer’s telephone number, including area code)

TABLE OF CONTENTS

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING

INFORMATION

We make statements in this Semi-Annual

Report on Form 1-SA (the “Report”) that are forward-looking statements within the meaning of the federal securities laws.

The words “outlook,” “believe,” “estimate,” “potential,” “projected,” “expect,”

“anticipate,” “intend,” “plan,” “seek,” “may,” “could” and similar

expressions or statements regarding future periods are intended to identify forward-looking statements. These forward-looking statements

involve known and unknown risks, uncertainties and other important factors that could cause our actual results, performance or achievements,

or industry results, to differ materially from any predictions of future results, performance or achievements that we express or imply

in this Report or in the information incorporated by reference into this Report.

The forward-looking statements

included in this Report are based upon our current expectations, plans, estimates, assumptions and beliefs that involve numerous risks

and uncertainties. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive

and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which

are beyond our control. Although we believe that the expectations reflected in such forward-looking statements are based on reasonable

assumptions, our actual results and performance could differ materially from those set forth in the forward-looking statements.

Item 1. Management’s

Discussion and Analysis of Financial Condition and Results of Operations

Corporate History

We

were incorporated under the laws of the State of Florida on November 26, 1996, under the name Stirus Research & Development, Inc.

On November 19, 1998, our name was changed to Mecaserto, Inc. Thereafter, our name was changed to National Business Holdings, Inc. on

May 4, 2004, and on May 28, 2004, we entered into a share exchange agreement with Shava, Inc., a reporting company under Section 12(g)

of the Securities Exchange Act of 1934, as amended. On December 27, 2004, National Business Holdings, Inc. acquired Union Dental Corp.

and Direct Dental Services, Inc. On May 1, 2005, we Company changed our name to Union Dental Holdings, Inc. On April 22, 2009, we filed

a Form 15 with the SEC, terminating our reporting obligations under the Securities Exchange Act of 1934, as amended. On October 1, 2015,

Union Dental Holdings, Inc. executed an Assignment for the Benefit of Creditors assigning all of its rights in its assets to a secured

creditor. On October 5, 2016, the case was closed.

On January 6, 2020, without the

knowledge or consent of the sole officer and director and controlling shareholder, an individual who had no approval or control filed

a notice of reinstatement in Florida. On March 3, 2020, the same individual filed a name change to Oilvite, Inc. in an unauthorized attempt

to gain control of our Company and otherwise engage in corporate identity theft. On July 13, 2020, we filed Articles of Amendment in Florida

changing our name back to “Union Dental Holdings, Inc.” from Oilvite Inc.

Effective as of May 1, 2020, our

former sole officer and director resigned as sole officer and director and appointed Michael F. O’Shea to his current positions

with us. Also, at this time he transferred all of his ownership in our Company to Michael F. O’Shea.

On October 23, 2020, we filed

Articles of Amendment in Florida changing our name to “Xcelerate, Inc.”

Our principal place of business

is located at 110 Renaissance Circle, Mauldin, SC 29662. Our phone number is (854) 900-2020 and our website address is www.xcelerate.global.

Except as disclosed hereinabove,

we have not been subject to any bankruptcy, receivership or similar proceeding.

Current Business

As of the date of this Report

we are a healthcare services and products company engaged in three separate but related businesses within the medical, health and wellness

sectors. We are currently focused on (i) the development of medical technology and virtual health services to help patients in developing

countries meet their medical needs by extending the reach of physicians through the technology; (ii) the formulation, packaging and marketing

of consumer health and beauty, clinically tested skin and hair care products; and (iii) owning and licensing the rights to various forms

of medical equipment. As of the date of this Report we are concentrating on the initial 2 businesses and expect to devote our resources

to the success of these businesses but if any opportunity arises for us to monetize the licensing of rights to third parties we may pursue

the same.

In 2024 we filed a registration

statement with the SEC wherein we are attempting to engage in an underwritten public offering of our securities. As of the date of this

Report we are continuing our efforts to successfully consummate this offering. However, we have experienced various unintended and unforeseen

setbacks in our efforts, including retaining new independent accountants after the SEC banned our prior auditor from practicing before

the Commission. We have retained a new auditor, who has re-audited our financial statements for the years ended December 31, 2023 and

2022.

A detailed description of

our current business activities is more fully included in our registration statement on Form S-1 previously filed with the SEC, which

is incorporated herein as if set forth.

Going

Concern

Our financial statements

contained in this Report have been prepared assuming that we will continue as a going concern, which contemplates the realization of

assets and liquidation of liabilities in the normal course of business. The financial statements do not include any adjustment that

might result from the outcome of this uncertainty. We have a minimal operating history and minimal revenues or earnings from

operations. We have no significant assets or financial resources. We will, in all likelihood, sustain operating expenses without

corresponding revenues for the immediate future. See “Item 3. Financial Statements.”

Results of Operations

Comparison of Results of Operations for the Six

Months ended June 30, 2024 and 2023

We successfully closed the

acquisition of 51% of both the ESN Group and Afiya in July 2023. Revenue of $1,577,720 was generated out of the operations of the ESN

Group during the six months ended June 30, 2024. Because we did not own any interest in the ESN Group at June 30, 2023, we did not book

any revenue or other results of operations attributable to the ESN Group for the six months ended June 30, 2023.

General and administrative

expense was $734,020 during the six months ended June 30, 2024, compared to general and administrative expense of $1,645,353 during the

six months ended June 30, 2023, a decrease of $911,333. General and administrative expense include non-cash stock based compensation of

$1,453,500 for six months ended June 30, 2023, compared to $-0- for the six months ended June 30, 2024. Excluding stock based compensation

in the 2023 period, general and administrative expenses were 734,020, compared to $191,853, an increase of $542,167. This increase is

primarily attributable to the inclusion of general and administrative expenses for the ESN Group which was acquired in July 2023, as well

as the inclusion of $78,294 in amortization of intangible assets during the six months ended June 30, 2024, compared to $-0- during the

same six months ended June 30, 2023.

Interest expense for the

six months ended June 30, 2024 was $-0- compared to non-cash $157,500 in stock based fees paid for financing expense during the six months

ended June 20, 2023. We had no interest expense during the six months ended June 30, 2024, because all of our debt was with affiliates

and was interest free.

As a result of the foregoing,

we incurred a net loss attributable to Xcelerate Inc. of $397,235 during the six months ended June 30, 2024, compared to a net loss attributable

to Xcelerate Inc. of $1,802,853 during the six month period ended June 30, 2023.

Liquidity and Capital Resources

As of June 30, 2024, we had cash and cash equivalents

of $110,478.

As discussed in Note 2 to

the audited financial statements included in our annual report on Form 1-K as filed with the SEC on April 29, 2024, we incurred significant

continuing losses in 2023 and 2022. Our total accumulated deficits as of June 30, 2024 and December 31, 2023, were $10,208,111 and $9,810,877,

respectively. Our ability to continue operating and our ability to implement our business plan is highly dependent upon continued funding

from the debt and/or equity markets. Our historical and ongoing dependence on proceeds from debt and/or equity issuances to fund operating

expenses could raise substantial doubt about our ability to continue as a going concern. The financial statements included in this Report

have been prepared assuming that we will continue as a going concern and, accordingly, do not include any adjustments relating to any

going concern uncertainty.

Cash used in operating activities

was $412,866 for the six month ended June 30, 2024, compared to $147,183 for the six months ended June 30, 2023. The increase of $265,684

in cash used in operating activities in the June 30, 2024 period is attributable to an increase in cash operating losses in 2024, partially

offset by changes in assets and liabilities.

Cash flows used in investing

activities was $-0- during the six months ended June 30, 2024, compared to $90,000 for the six months ended June 30, 2023. The difference

is attributable to an investment in ASA in the 2023 period.

Net cash flows provided by

financing activities totaled $285,317 during the six months ended June 30, 2024, compared to $224,007 during the six month periods ended

June 30, 2023. Subsequent to our Regulation A Offering in 2022, all of the funding for our operations has been provided by our CEO and

affiliated shareholders in the form of interest-free demand loans. As of June 30, 2024 and December 31, 2023, the balance of notes payable

was $1,706,110 and $1,420,793, respectively. The composition of the notes payable balance as of June 30, 2024, was $1,300,000 due to two

shareholders and $406,110 due to our CEO.

Management believes that we will

require up to $5.0 million in additional funding in order to implement our current business plan and begin generating profits, primarily

to be utilized in our proposed Africa operations and expansion of the ESN Group operations. This figure does not include any additional

acquisitions that may present themselves.

In 2024 we filed a registration

statement on Form S-1 with the SEC as part of a proposed firm commitment to public offering of our securities, to be offered by Craft

Capital Corp. for up to $5 million. This registration statement has not yet been declared effective by the SEC and there are no assurances

that this will occur. Currently, we do not have any other firm committed arrangements for financing and can provide no assurance to investors

that we will be able to obtain financing when required. No assurance can be given that we will obtain access to capital markets in the

future or that financing, adequate to satisfy the cash requirements of implementing our business strategies, will be available on acceptable

terms. Our inability to gain access to capital markets or obtain acceptable financing could have an adverse effect upon the results of

its operation and upon our financial condition.

As disclosed above, on July

24, 2023, we completed an acquisition of a majority interest in both ESN Group, Inc. (“ESN”) and California Skin Research,

Inc., (“CSRI”), (collectively the “ESN Group”) and their portfolio of health care and skin care products, including

Ceramedx® (www.ceramedx.com), the first natural ” plant-based” ingredient therapeutic product and Earth Science Beauty

(www.earthsciencebeauty.com). We acquired an aggregate of 51% interest in both of the aforesaid companies by subscribing for shares in

ESN and purchasing shares from two of the former principals of the ESN Group in private sales. To acquire these interests we also repaid

outstanding debt and purchased shares from current shareholders, each of whom retained a minority interest in the ESN Group. The aggregate

cost of these acquisitions was approximately $463,000. We utilized available cash, as well as interest-free demand loans from a principal

shareholder and another unaffiliated person, to fund these acquisitions. We issued an aggregate of 3,000,000 common shares as consideration

for the loans.

In May 2022, we entered into an

agreement to acquire a portfolio of patents, patents pending and technology licenses from HS Pharmaceuticals LLC, in consideration for

the issuance of 10 million common shares. These shares are to be issued upon our receipt of the patent assignments. The assignments were

received by us in September 2023 and the shares were issued.

Inflation

Although our operations are influenced

by general economic conditions, we do not believe that inflation had a material effect on our results of operations during the six month

period ended June 30, 2024.

Critical Accounting Policies

and Estimates

Critical Accounting Estimates

Use of Estimates

The preparation of financial

statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of liabilities

and disclosure of contingent assets and liabilities at the date of the condensed consolidated financial statements. The most significant

estimates relate to the calculation of stock-based compensation, accounting for the ASA transaction, accounting for the acquisition of

the ESN Group, income taxes and contingencies. We base our estimates on historical experience, known or expected trends, and various other

assumptions that are believed to be reasonable given the quality of information available as of the date of our condensed consolidated

financial statements. The results of these assumptions provide the basis for making estimates about the carrying amounts of assets and

liabilities that are not readily apparent from other sources. Actual results could differ from these estimates and could materially impact

our consolidated financial statements. There have been no material changes to our accounting estimates since the issuance of our financial

statements for the fiscal year ended December 31, 2023.

On April 5, 2012, the JOBS

Act was enacted. Section 107 of the JOBS Act provides that an “emerging growth company” can take advantage of the extended

transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (“Securities Act”) for complying

with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting

standards until those standards would otherwise apply to private companies.

We have chosen to take advantage

of the extended transition periods available to emerging growth companies under the JOBS Act for complying with new or revised accounting

standards until those standards would otherwise apply to private companies provided under the JOBS Act. As a result, our financial

statements may not be comparable to those of companies that comply with public company effective dates for complying with new or revised

accounting standards.

We are in the process of evaluating

the benefits of relying on other exemptions and reduced reporting requirements provided by the JOBS Act. Subject to certain

conditions set forth in the JOBS Act, as an “emerging growth company,” we intend to rely on certain of these exemptions, including

without limitation, (i) providing an auditor’s attestation report on our system of internal controls over financial reporting

pursuant to Section 404(b) of the Sarbanes-Oxley Act and (ii) complying with any requirement that may be adopted by the Public

Company Accounting Oversight Board (“PCAOB”) regarding mandatory audit firm rotation or a supplement to the auditor’s

report providing additional information about the audit and the financial statements, known as the auditor discussion and analysis. We

will remain an “emerging growth company” until the earliest of (i) the last day of the fiscal year in which we have total

annual gross revenues of $1.07 billion or more; (ii) the last day of our fiscal year following the fifth anniversary of the

date of the completion of this offering; (iii) the date on which we have issued more than $1 billion in nonconvertible debt

during the previous three years; or (iv) the date on which we are deemed to be a large accelerated filer under the rules of the SEC.

Leases

We follow the guidance in

ASC 842 “Accounting for Leases,” as amended, which requires us to evaluate the lease agreements we enter into to

determine whether they represent operating or capital leases at the inception of the lease. Our Company is not a party to any lease

agreements. Our CEO provides office space at no cost to us.

Recently Adopted Accounting Standards

We do not believe that any other

recently issued effective pronouncements, or pronouncements issued but not yet effective, if adopted, would have a material effect on

the accompanying financial statements.

Off-Balance Sheet Arrangements

As of

the date of this Report there were no off-balance sheet arrangements.

Item 2. Other

Information

None.

Item 3. Financial Statements

XCELERATE, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

| | |

June 30, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| | |

(Unaudited) | | |

| |

| ASSETS | |

| | |

| |

| | |

| | |

| |

| Current assets | |

| | | |

| | |

| Cash | |

$ | 110,478 | | |

$ | 238,028 | |

| Account receivable | |

| 277,893 | | |

| 186,170 | |

| Inventory | |

| 457,369 | | |

| 414,951 | |

| Other assets | |

| 12,557 | | |

| 12,557 | |

| Total current assets | |

| 858,296 | | |

| 851,705 | |

| Right of use asset | |

| – | | |

| 20,829 | |

| Goodwill | |

| 429,185 | | |

| 429,185 | |

| Intangible assets | |

| 542,498 | | |

| 617,242 | |

| Total Assets | |

$ | 1,829,980 | | |

$ | 1,918,963 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS' DEFICIT | |

| | | |

| | |

| | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 781,063 | | |

$ | 632,808 | |

| Lease liabilities-short term | |

| – | | |

| 21,968 | |

| Notes payable related parties | |

| 1,706,110 | | |

| 1,420,793 | |

| Total liabilities | |

| 2,487,173 | | |

| 2,075,569 | |

| | |

| | | |

| | |

| Shareholders' Deficit | |

| | | |

| | |

| Series A Preferred stock, par value $0.0001, -0- shares authorized; -0- and -0- shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively | |

| – | | |

| – | |

| Series B Preferred stock, par value $0.0001, 25,000,000 shares authorized; 120,000 and 120,000 shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively | |

| 12 | | |

| 12 | |

| Common stock, par value $0.0001, 1,000,000,000 shares authorized; 434,446,072

and 434,446,072 shares issued and outstanding as of June 30, 2024 and December 31, 2023 | |

| 43,444 | | |

| 43,444 | |

| Additional paid in capital | |

| 9,620,691 | | |

| 9,620,691 | |

| Accumulated deficit | |

| (10,208,111 | ) | |

| (9,810,877 | ) |

| Total Xcelerate, Inc. Stockholders’ Deficit | |

| (543,964 | ) | |

| (146,730 | ) |

| Non-controlling interests | |

| (113,229 | ) | |

| (9,877 | ) |

| Total Stockholders' Deficit | |

| (657,193 | ) | |

| (156,607 | ) |

| Total Liabilities and Stockholders' Deficit | |

$ | 1,829,980 | | |

$ | 1,918,963 | |

The accompanying notes

are an integral part of these unaudited condensed consolidated financial statements.

XCELERATE, INC.

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | |

Three months | | |

Three months | | |

Six months | | |

Six months | |

| | |

ended | | |

ended | | |

ended | | |

ended | |

| | |

June 30, | | |

June 30, | | |

June 30, | | |

June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| Revenue | |

$ | 766,329 | | |

$ | – | | |

$ | 1,577,720 | | |

$ | – | |

| Cost of sales | |

| 599,612 | | |

| – | | |

| 1,265,992 | | |

| – | |

| Gross margin | |

| 166,717 | | |

| – | | |

| 311,727 | | |

| – | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating Expenses: | |

| | | |

| | | |

| | | |

| | |

| Amortization of intangible assets | |

| 39,147 | | |

| – | | |

| 78,294 | | |

| – | |

| General and administrative expenses | |

| 375,690 | | |

| 1,417,887 | | |

| 734,020 | | |

| 1,645,353 | |

| Total operating expenses | |

| 414,837 | | |

| 1,417,887 | | |

| 812,314 | | |

| 1,645,353 | |

| Loss from operations | |

| (248,120 | ) | |

| (1,417,887 | ) | |

| (500,587 | ) | |

| (1,645,353 | ) |

| Other income (expense) | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| – | | |

| – | | |

| – | | |

| (157,500 | ) |

| Total other expense | |

| – | | |

| – | | |

| – | | |

| (157,500 | ) |

| Loss before provision for income taxes | |

| (248,120 | ) | |

| (1,417,887 | ) | |

| (500,587 | ) | |

| (1,802,853 | ) |

| Provision for income taxes | |

| – | | |

| – | | |

| – | | |

| – | |

| Net loss | |

| (248,120 | ) | |

| (1,417,887 | ) | |

| (500,587 | ) | |

| (1,802,853 | ) |

| Less: Net loss attributable to

non-controlling interests | |

| (46,607 | ) | |

| – | | |

| (103,352 | ) | |

| – | |

| Net loss attributable to Xcelerate, Inc. | |

$ | (201,513 | ) | |

$ | (1,417,887 | ) | |

$ | (397,234 | ) | |

$ | (1,802,853 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted earnings(loss) per common share | |

$ | (0.00 | ) | |

$ | (0.00 | ) | |

$ | (0.00 | ) | |

$ | (0.00 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of shares outstanding | |

| 434,446,072 | | |

| 389,946,072 | | |

| 434,446,072 | | |

| 366,246,072 | |

The accompanying notes

are an integral part of these unaudited condensed consolidated financial statements.

XCELERATE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES

IN STOCKHOLDERS' EQUITY

FOR THE SIX MONTHS ENDED JUNE 30, 2024 AND 2023

(Unaudited)

| | |

Preferred Stock

Series A | | |

Preferred Stock

Series B | | |

Common

Stock | | |

Additional

Paid-in | | |

Accumulated | | |

Non-controlling | | |

Total

Stockholders' | |

| | |

Shares | |

Value | | |

Shares | |

Value | | |

Shares | |

Value | | |

Capital | | |

(Deficit) | | |

interest | | |

Deficit | |

| Balance, December 31, 2021 | |

– | |

$ | – | | |

120,000 | |

$ | 12 | | |

385,446,072 | |

$ | 38,544 | | |

$ | 7,022,991 | | |

$ | (7,079,931 | ) | |

$ | – | | |

$ | (18,384 | ) |

| | |

| |

| | | |

| |

| | | |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| Common stock issued for services and financing fees | |

– | |

| – | | |

– | |

| – | | |

9,000,000 | |

| 900 | | |

| 314,100 | | |

| – | | |

| – | | |

| 315,000 | |

| | |

| |

| | | |

| |

| | | |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

– | |

| – | | |

– | |

| – | | |

– | |

| – | | |

| – | | |

| (384,967 | ) | |

| – | | |

| (384,967 | ) |

| | |

| |

| | | |

| |

| | | |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, March 31, 2023 | |

– | |

$ | – | | |

120,000 | |

$ | 12 | | |

394,446,072 | |

$ | 39,444 | | |

$ | 7,337,091 | | |

$ | (7,464,898 | ) | |

$ | – | | |

$ | (88,351 | ) |

| | |

| |

| | | |

| |

| | | |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| Common stock issued for services | |

– | |

| – | | |

– | |

| – | | |

24,000,000 | |

| 2,400 | | |

| 1,293,600 | | |

| – | | |

| – | | |

| 1,296,000 | |

| | |

| |

| | | |

| |

| | | |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

– | |

| – | | |

– | |

| – | | |

– | |

| – | | |

| – | | |

| (1,417,886 | ) | |

| – | | |

| (1,417,886 | ) |

| | |

| |

| | | |

| |

| | | |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, June 30, 2023 | |

– | |

$ | – | | |

120,000 | |

$ | 12 | | |

418,446,072 | |

$ | 41,844 | | |

$ | 8,630,691 | | |

$ | (8,882,784 | ) | |

$ | – | | |

$ | (210,237 | ) |

| | |

Preferred Stock

Series A | | |

Preferred Stock

Series B | | |

Common

Stock | | |

Additional Paid-in | | |

Accumulated | | |

Non-controlling | | |

Total Stockholders' | |

| | |

Shares | |

Value | | |

Shares | |

Value | | |

Shares | |

Value | | |

Capital | | |

(Deficit) | | |

interest | | |

Deficit | |

| Balance, December 31, 2023 | |

– | |

$ | – | | |

120,000 | |

$ | 12 | | |

434,446,072 | |

$ | 43,444 | | |

$ | 9,620,691 | | |

$ | (9,810,877 | ) | |

$ | (9,877 | ) | |

$ | (156,607 | ) |

| | |

| |

| | | |

| |

| | | |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| Non controlling interest | |

– | |

| – | | |

– | |

| – | | |

– | |

| – | | |

| – | | |

| – | | |

| (56,745 | ) | |

| (56,745 | ) |

| | |

| |

| | | |

| |

| | | |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

– | |

| – | | |

– | |

| – | | |

– | |

| – | | |

| – | | |

| (195,721 | ) | |

| – | | |

| (195,721 | ) |

| | |

| |

| | | |

| |

| | | |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, March 31, 2024 | |

– | |

$ | – | | |

120,000 | |

$ | 12 | | |

434,446,072 | |

$ | 43,444 | | |

$ | 9,620,691 | | |

$ | (10,006,598 | ) | |

$ | (66,622 | ) | |

$ | (409,074 | ) |

| | |

| |

| | | |

| |

| | | |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| Non controlling interest | |

– | |

| – | | |

– | |

| – | | |

– | |

| – | | |

| – | | |

| – | | |

| (46,607 | ) | |

| (46,607 | ) |

| | |

| |

| | | |

| |

| | | |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

– | |

| – | | |

– | |

| – | | |

– | |

| – | | |

| – | | |

| (201,513 | ) | |

| – | | |

| (201,513 | ) |

| | |

| |

| | | |

| |

| | | |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, June 30, 2024 | |

– | |

$ | – | | |

120,000 | |

$ | 12 | | |

434,446,072 | |

$ | 43,444 | | |

$ | 9,620,691 | | |

$ | (10,208,111 | ) | |

$ | (113,229 | ) | |

$ | (657,193 | ) |

The accompanying notes

are an integral part of these unaudited condensed consolidated financial statements.

XCELERATE, INC.

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | |

Six months | | |

Six months | |

| | |

ended | | |

ended | |

| | |

June 30, | | |

June 30, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Cash Flows From Operating Activities: | |

| | | |

| | |

| Net loss | |

$ | (500,587 | ) | |

$ | (1,802,853 | ) |

| Stock-based compensation | |

| – | | |

| 1,611,000 | |

| Amortization expense | |

| 78,294 | | |

| – | |

| Changes in assets and liabilities | |

| | | |

| | |

| Accounts receivable | |

| (91,723 | ) | |

| – | |

| Inventory | |

| (42,418 | ) | |

| – | |

| Intangible assets | |

| – | | |

| (4,000 | ) |

| Right of use assets, net | |

| (1,139 | ) | |

| – | |

| Accounts payable | |

| 144,707 | | |

| 48,670 | |

| Net cash (used in) operating activities | |

| (412,866 | ) | |

| (147,183 | ) |

| | |

| | | |

| | |

| Cash Flows From Investing Activities | |

| | | |

| | |

| Investment in acquisition target | |

| – | | |

| (90,000 | ) |

| Net cash (used in) investing activities | |

| – | | |

| (90,000 | ) |

| | |

| | | |

| | |

| Cash Flows From Financing Activities: | |

| | | |

| | |

| Proceeds from related party loans | |

| 285,317 | | |

| 224,007 | |

| Net cash provided by financing activities | |

| 285,317 | | |

| 224,007 | |

| | |

| | | |

| | |

| Net Decrease In Cash | |

| (127,549 | ) | |

| (13,176 | ) |

| Cash At The Beginning Of The Period | |

| 238,028 | | |

| 18,815 | |

| Cash At The End Of The Period | |

$ | 110,478 | | |

$ | 5,639 | |

| | |

| | | |

| | |

| Non-cash investing and financing activities: | |

$ | – | | |

$ | – | |

The accompanying notes

are an integral part of these unaudited condensed consolidated financial statements.

XCELERATE, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

FOR THE SIX MONTHS ENDED JUNE 30, 2024 AND 2023

NOTE 1 – ORGANIZATION AND DESCRIPTION OF BUSINESS

Xcelerate Inc. (the “Company”) f/k/a Union

Dental Holdings, Inc,. is a Florida corporation incorporated on November 26, 1996, under the name Stirus Research & Development, Inc.

The Company has gone through several name changes since inception. Most recently the Company was known as Union Dental Holdings, Inc.

In May 2020, the Company’s current CEO assumed his positions as the Company’s director and CEO and began implementing the

Company’s new business plan described herein. On October 23, 2020, the Company changed its name to “Xcelerate, Inc.”

On January 6, 2020, without the knowledge or consent

of the sole officer and director and controlling shareholder, an individual who had no approval or control filed a notice of reinstatement

in Florida. Then on March 3, 2020, the same individual filed a name change to Oilvite, Inc. in an unauthorized attempt to gain control

of the Company and otherwise engage in corporate identity theft. The individual’s efforts were discovered by the Company’s

transfer agent who refused to take instructions from anyone other than the sole officer and director and control shareholder who she knew

had not transferred control of the Company and ultimately the individual’s efforts were stopped without further damage or inconvenience.

On July 13, 2020, the Company filed Articles of Amendment in Florida changing the name of the Company back to “Union Dental Holdings,

Inc.” from Oilvite Inc.

In December 2021, the Company signed a Membership

Interest Purchase Agreement to acquire a 51% interest in ASA Africa, LLC, a Wyoming limited liability company (“ASA”), that

was a start-up medical technology and virtual health company that management believes is uniquely positioned to help patients in developing

countries meet their medical needs by extending the reach of physicians through the technology. This technology is centered around patented

and patent pending software that uses and incorporates artificial intelligence (“AI”) and Augmented Reality (“AR”)

licensed from AdviNOW, an Arizona based medical software company who developed and holds patents for the licensed software.

ASA’s vision is to be the technology platform

that allows “leapfrogging” advancement in the delivery of world class healthcare, initially in Africa, the continent with

the largest population growth and high smartphone utilization for services, but without the ability to grow healthcare services in the

traditional manner. The Company paid $320,000 in cash and issued 4,000,000 shares of common stock valued at $3,018 for its interest in

ASA. As a result, on July 24, 2023, ASA became a 51% subsidiary of the Company.

On or about January 19, 2022, the Company filed a

Form 1-A Offering Circular with the SEC pursuant to Regulation A promulgated under the Securities Act of 1933, as amended. This offering

closed on February 3, 2023, with gross proceeds of $400,000 from the sale of 8,000,000 common shares at a price of $0.05 per share.

On July 24, 2023, the Company completed

an acquisition of a majority interest in two related private companies, ESN Group, Inc. (“ESN”) and California Skin Research,

Inc., (“CSRI”), (collectively the “ESN Group”) and their portfolio of health care and skin care products, including

Ceramedx® (www.ceramedx.com), a natural “plant-based” ingredient therapeutic product and Earth Science Beauty (www.earthsciencebeauty.com).

The Company acquired an aggregate of 51% interest in both of the aforesaid companies by subscribing for shares in ESN and purchasing

shares from two of the former principals of the ESN Group in private sales. To acquire these interests the Company also repaid outstanding

debt and purchased shares from current shareholders of the ESN Group, each of whom retained a minority interest in the ESN Group.

The aggregate cost of these acquisitions was $456,312.

The Company funded the acquisition through a $400,000 interest-free loan from an unaffiliated person, as well interest-free loans from

the Company’s CEO. The Company issued 3,000,000 shares of its common stock in consideration for the $400,000 loan. The ESN Group

of companies offer Earth Science® nature-inspired beauty and personal care products and Ceramedx® therapeutic skincare solutions.

The offered products are paraben-free, cruelty-free products with ingredients that include plant-based nutrients and antioxidants, soothing

botanicals, hydrating moisturizers and pure essential oils.

As part of these transactions, the Company retained

the services of John Jay Kline, the former President of the ESN Group of companies, who has continued to operate both companies on the

Company’s behalf. As part of the consideration for his employment, in July 2023 the Company agreed to issue him 2,000,000 shares

of common stock. These shares were valued at $0.1170 each, or a total of $234,000.

The Company’s year-end is December 31.

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES

Basis of Presentation

The accompanying condensed consolidated financial

statements have been prepared in accordance with the Financial Accounting Standards Board (“FASB”) “FASB Accounting

Standard Codification™” (the “Codification”) which is the source of authoritative accounting principles

recognized by the FASB to be applied by nongovernmental entities in the preparation of condensed consolidated financial statements in

conformity with generally accepted accounting principles (“GAAP”) in the United States.

Principles of consolidation

The accompanying condensed consolidated financial

statements include the accounts of the Company and 51% subsidiaries, ESN and AFA. The Company recognizes the noncontrolling interests

related to these less-than-wholly-owned subsidiaries, as equity in the condensed consolidated financial statements separate from the parent

entity’s equity. The net loss attributable to the noncontrolling interest is included in net loss in the condensed consolidated

statements of operations. All material intercompany accounts and transactions have been eliminated in consolidation.

Going Concern

The accompanying condensed consolidated financial

statements have been prepared assuming the Company will continue as a going concern, which contemplates the realization of assets and

the satisfaction of liabilities in the normal course of business for the twelve months following the date of these condensed consolidated

financial statements. As of June 30, 2024, the Company had an accumulated deficit of $10,208,111 and negative working capital of $1,628,877.

Because the Company does not expect that existing

operational cash flow will be sufficient to fund presently anticipated operations, this raises substantial doubt about the Company’s

ability to continue as a going concern. Therefore, the Company will need to raise additional funds and is currently exploring alternative

sources of financing. Historically, the Company raised capital through private placements, to finance working capital needs and may attempt

to raise capital through the sale of common stock or other securities and obtaining some short-term loans. The Company will be required

to continue to do so until its operations become profitable. Also, the Company has, in the past, paid for consulting services with its

common stock to maximize working capital, and intends to continue this practice where feasible.

Management’s Representation of Interim

Condensed Financial Statements

The accompanying unaudited condensed

consolidated financial statements have been prepared by the Company without audit pursuant to the rules and regulations of the

Securities and Exchange Commission (“SEC”). The Company uses the same accounting policies in preparing quarterly and

annual condensed financial statements. Certain information and footnote disclosures normally included in condensed financial

statements prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) have been

condensed or omitted as allowed by such rules and regulations, and management believes that the disclosures are adequate to make the

information presented not misleading. These condensed financial statements include all of the adjustments, which in the opinion of

management are necessary to a fair presentation of financial position and results of operations. All such adjustments are of a

normal and recurring nature. Interim results are not necessarily indicative of results for a full year.

Use of Estimates

The preparation of financial statements in conformity

with US GAAP requires management to make estimates and assumptions that affect the reported amounts of liabilities and disclosure of contingent

assets and liabilities at the date of the condensed financial statements. The most significant estimates relate to the calculation of

stock-based compensation, accounting for the ASA transaction, accounting for the acquisition of the ESN, income taxes and contingencies.

The Company bases its estimates on historical experience, known or expected trends, and various other assumptions that are believed to

be reasonable given the quality of information available as of the date of these condensed financial statements. The results of these

assumptions provide the basis for making estimates about the carrying amounts of assets and liabilities that are not readily apparent

from other sources. Actual results could differ from these estimates and could materially impact the Company’s consolidated financial

statements. There have been no material changes to the Company’s accounting estimates since the issuance of the Company’s

financial statements for the fiscal year ended December 31, 2023.

Cash and cash equivalents

The Company considers all highly liquid temporary

cash investments with an original maturity of three months or less to be cash equivalents. On June 30, 2024 and December 31, 2023, the

Company’s cash equivalents totaled $110,478 and $238,028, respectively.

Credit risk

The Company maintains its cash and cash equivalent

balances in a financial institution that are insured by the Federal Deposit Insurance Corporation (“FDIC”) for up to $250,000

per depositor. While the Company’s cash balances typically exceed this limit, management does not believe the credit risk related

to these balances is significant.

Accounts receivable, net

Management reviews outstanding balances on a regular

basis to determine collectability. Collectability is based on customer history, the aging of amounts due, as well as any other current

circumstances that could affect the collectability of amounts. When receivables are considered uncollectible, they are charged off against

the allowance account. As of June 30, 2024 and December 31, 2023, accounts receivable balances were of $277,893 and $186,170, net of allowances

for uncollectible amounts, respectively.

Inventories, net

Inventories which are comprised of finished goods,

bulk products, containers and packaging, are valued at the lower of cost or net realizable value. The Company’s inventories are

valued under the first in, first out (“Fifo”) method or average cost method. The Company evaluates inventory levels quarterly

value based upon assumptions about future demand and market conditions. Any inventory that has a cost basis in excess of its expected

net realizable value, inventory that becomes obsolete, inventory in excess of expected sales requirements, inventory that fails to meet

commercial sale specifications or is otherwise impaired is written down with a corresponding charge to the statement of operations in

the period that the impairment is first identified. During the year ended December 31, 2023, the Company identified $99,274 in slow moving

and obsolete inventory that was expensed. As of June 30, 2024 and December 31, 2023, the balance of inventories were $457,369 and $414,951

respectively.

Business Combinations

Under the acquisition method of accounting, the Company

allocates the fair value of the total consideration transferred to the tangible and identifiable intangible assets acquired and liabilities

assumed based on their estimated fair values on the date of acquisition. The fair values assigned, defined as the price that would be

received to sell an asset or paid to transfer a liability in an orderly transaction between willing market participants, are based on

estimates and assumptions determined by management. These valuations require the Company’s to make significant estimates and assumptions,

especially with respect to intangible assets. The Company records the excess consideration over the aggregate fair value of tangible and

intangible assets, net of liabilities assumed, as goodwill.

If the initial accounting for a business combination

is incomplete by the end of a reporting period that falls within the measurement period, the Company reports provisional amounts in its

condensed consolidated financial statements. During the measurement period, the Company adjusts the provisional amounts recognized at

the acquisition date to reflect new information obtained about facts and circumstances that existed as of the acquisition date that, if

known, would have affected the measurement of the amounts recognized as of that date and the Company record those adjustments to its condensed

consolidated financial statements.

Goodwill and Intangible Assets

Goodwill represents the future economic benefit arising

from other assets acquired that could not be individually identified and separately recognized. Initially, the Company measures goodwill

based upon the value of the consideration paid plus or minus net assets assumed. This initial measurement is subject to adjustment based

on an independent third party valuation study performed within one year of the acquisition date. The goodwill arising from the Company’s

acquisition is attributable to the value of the potential expanded market opportunity with new customers. Intangible assets have either

an identifiable or indefinite useful life. Intangible assets with identifiable useful lives are amortized on a straight-line basis over

their economic or legal life, whichever is shorter. The Company’s amortizable intangible assets consist primarily of customer relationships.

The useful life of these customer relationships is estimated to be three years.

Goodwill is not amortized but is subject to annual

impairment testing unless circumstances dictate more frequent assessments. The Company performs an annual impairment assessment for goodwill

during the fourth quarter of each year and more frequently whenever events or changes in circumstances indicate that the fair value of

the asset may be less than the carrying amount. Goodwill impairment testing compares the fair value of the reporting unit to its carrying

amount. The fair value of the reporting unit is determined by considering both the income approach and market approaches. The fair values

calculated under the income approach and market approaches are weighted based on circumstances surrounding the reporting unit. Under the

income approach, the Company determines fair value based on estimated future cash flows of the reporting unit, which are discounted to

the present value using discount factors that consider the timing and risk of cash flows. For the discount rate, the Company relies on

the capital asset pricing model approach, which includes an assessment of the risk-free interest rate, the rate of return from publicly

traded stocks, the Company’s risk relative to the overall market, the Company’s size and industry and other Company specific

risks. Other significant assumptions used in the income approach include the terminal value, growth rates, future capital expenditures

and changes in future working capital requirements. The market approaches use key multiples from guideline businesses that are comparable

and are traded on a public market. If the fair value of the reporting unit is greater than its carrying amount, there is no impairment.

If the reporting unit’s carrying amount exceeds its fair value, then an impairment loss is recognized in an amount equal to the

excess.

Property and equipment, net

Property and equipment is recorded at cost. Assets

with an estimated useful life greater than one year and cost exceeding $2,500 are capitalized. Depreciation expense is calculated using

the straight line method over the estimated useful lives of the assets, noted below. Maintenance and repairs are charged to expense as

incurred.

| |

Estimated

useful lives

(years) |

| Office & computer |

5 |

| Furniture & fixtures |

7 |

| Warehouse/production equipment |

7 |

All property of the Company was fully depreciated

as of June 30, 2024 and December 31, 2023.

Income taxes

The Company accounts for income taxes under FASB ASC

740, “Accounting for Income Taxes”. Under FASB ASC 740, deferred tax assets and liabilities are recognized for the

future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities

and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable

income in the years in which those temporary differences are expected to be recovered or settled. Under FASB ASC 740, the effect on deferred

tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. FASB ASC 740-10-05,

“Accounting for Uncertainty in Income Taxes” prescribes a recognition threshold and a measurement attribute for the

financial statement recognition and measurement of tax positions taken or expected to be taken in a tax return. For those benefits to

be recognized, a tax position must be more-likely-than-not to be sustained upon examination by taxing authorities.

The amount recognized is measured as the largest amount

of benefit that is greater than 50 percent likely of being realized upon ultimate settlement. The Company assesses the validity of its

conclusions regarding uncertain tax positions annually to determine if facts or circumstances have arisen that might cause it to change

its judgment regarding the likelihood of a tax position’s sustainability under audit.

Leases

Under Financial Accounting Standards Board Accounting

Standards Codification (“FASB ASC”) 842, the determination of whether an arrangement is a lease is made at the lease’s

inception and a contract is (or contains) a lease if it conveys the right to control the use of an identified asset for a period of time

in exchange for consideration. Control is defined under the standard as having both the right to obtain substantially all of the economic

benefits from use of the asset and the right to direct the use of the asset. Management only reassesses its determination if the terms

and conditions of the contract are changed. Operating leases are included in operating lease right-of-use (“ROU”) assets and

operating lease liabilities in the consolidated balance sheets.

ROU assets represent the right to use an underlying

asset for the lease term, and lease liabilities represent the obligation to make lease payments. Operating lease ROU assets and liabilities

are recognized at the lease commencement date based on the present value of lease payments over the lease term. The Company uses the implicit

rate when it is readily determinable. Since the Company’s leases do not provide an implicit rate, to determine the present value

of lease payments, management uses the Company’s incremental borrowing rate based on the information available at lease commencement.

Operating lease ROU assets also includes any lease payments made and excludes any lease incentives. Lease expense for lease payments is

recognized on a straight-line basis over the lease term. Leases with an initial term of 12 months or less are not recorded on the consolidated

balance sheets. The Company has lease agreements with lease and non-lease components, for which it has made an accounting policy election

to account for these as a single lease component.

Impairment of long-lived assets

Long-lived assets are evaluated for impairment whenever

events, or changes in circumstances, indicate that the carrying amount of an asset may not be recoverable. The carrying amount of a long-lived

asset is not considered recoverable if it exceeds the sum of the undiscounted cash flows expected to result from the use and eventual

disposition of the asset. An impairment loss, if any, is measured as the amount by which the carrying amount of a long-lived asset exceeds

its fair value. Management has determined that long-lived assets were not impaired on June 30, 2024 and December 31, 2023.

Revenue and cost recognition

Revenues are accounted for in accordance with FASB

ASC 606, Revenue from Contracts with Customers when the control of the various manufactured products is transferred to the Company’s

customers in an amount that reflects the consideration the Company expects to be entitled to in exchange for these products. The Company’s

revenue contracts generally represent a single performance obligation to sell its products to customers. Commercial orders which have

terms are recognized as revenue upon shipment. Sales are recorded net of discounts and returns.

The Company’s revenues are primarily supported

by distributors that fulfill the Company’s contracts. The Company negotiates the wholesale price of its products with the retailer

and the Company’s distributors purchase the products at the negotiated discount price; these distributors then negotiate a service

arrangement with the ultimate customer.

Net Loss per Share

Net loss per common share is computed by dividing

net loss by the weighted average common shares outstanding during the period as defined by Financial Accounting Standards, ASC Topic 260,

“Earnings per Share.” Basic earnings per common share (“EPS”) calculations are determined by dividing net income

by the weighted average number of shares of common stock outstanding during the year. Diluted earnings per common share calculations are

determined by dividing net income by the weighted average number of common shares and dilutive common share equivalents outstanding.

Recently adopted accounting standards

In February 2016, the FASB issued Accounting Standards

Update (“ASU”) 2016-02, Leases (Topic 842), that requires lessees to recognize most leases on their balance sheets

related to the rights and obligations created by those leases. The accounting treatment for finance leases and lessors remains relatively

unchanged. The accounting standards update also requires additional qualitative and quantitative disclosures related to the nature, timing

and uncertainty of cash flows arising from leases. In July 2018, the FASB approved an amendment to the new guidance that introduced an

alternative modified retrospective transition approach granting companies the option of using the effective date of the new standard as

the date of initial application. The Company adopted the standard using the effective date method on January 1, 2022.

The Company elected the transition package of

practical expedients that is permitted by the standard. The package of practical expedients allows the Company to not reassess previous

accounting conclusions regarding whether existing arrangements are or contain leases, the classification of existing leases, and

the treatment of initial direct costs. Additionally, the Company elected certain other practical expedients offered by the new standard

which it will apply to all asset classes, including the option not to separate lease and non-lease components and instead to account for

them as a single lease component and the option not to recognize ROU assets and related liabilities that arise from short-term

leases (i.e., leases with terms of twelve months or less that do not include an option to purchase the underlying asset that the

Company is reasonably certain to exercise).

As part of its adoption of the new lease accounting

standard, the Company also implemented new internal controls and updated accounting policies and procedures, operational processes and

documentation practices to enable the preparation of financial information on adoption.

NOTE 3 – INVENTORY

Inventory, net is stated at the lower of cost or net

realizable value at Fifo with cost determined under the moving average method. As of June 30, 2024 and December 31, 2023, inventory, net

was 457,369 and $414,951, respectively.

NOTE 4 – BUSINESS ACQUISITIONS

During the three months ended September 30, 2023,

the Company entered into various agreements with two sellers to acquire the ESN Group, Inc. and California Skin Research, Inc, as well

as acquired its majority interest in ASA. See Note 1, above. to these condensed consolidated financial statements.

For the acquisition of ESN and ASA, the following

table summarizes the acquisition date fair value of the consideration paid, identifiable assets acquired and liabilities assumed:

The value of $0.0007545 per common share paid as part

of the consideration to acquire ASA was derived based upon the trading price of the Company’s common stock on the date of the transaction.

The Company believes that represented the fair market value of common stock at the time of issuance.

The Company allocated the fair value of the total

consideration paid of $572,247 as follows: $429,185 was allocated to goodwill and $143,062 was allocated to intangible

assets, comprised primarily of customer relationships with a life of three years. The value of goodwill represented the Company’s

ability to generate profitable operations going forward.

NOTE 5 – GOODWILL AND INTANGIBLE ASSETS

As of June 30, 2024, the balances of goodwill

and intangible assets were $429,185 and $542,498, respectively. As of December 31, 2023, intangible assets were comprised of $111,270

relating to the acquisition of ASA and ESN, being amortized at the rate of $3,974 per month over the remaining 28 month period, and $466,825

in intellectual property being amortized at the rate of $9,075 per month over the remaining 54 month period.

NOTE 6 – NOTES PAYABLE RELATED PARTIES

A significant portion of the funding for the Company’s

operations has been provided by its CEO and other affiliated shareholders in the form of interest-free demand loans. As of June 30, 2024

and December 31, 2023, the balance of notes payable was $1,706,110 and $1,420,793, respectively. During the six months ended June 30,

2024, the Company’s CEO provided the Company with interest-free demand loans of $96,500.

The composition of the notes payable balance as of

June 30, 2024, was $1,300,000 due to two shareholders and $406,110 due to the Company’s CEO.

NOTE 7 – EQUITY

Common Stock

The Company has authorized 1,000,0000,000 shares of

$0.0001 par value, common stock. As of June 30, 2024 and December 31, 2023, there were 434,446,072 and 434,447,072 shares of common stock

issued and outstanding, respectively.

No shares were issued during the six months ended

June 30, 2024.

2023 Activity

During the year ended December 31, 2023, the Company

issued a total of 49,000,000 common shares comprised of the following:

| |

· |

39,000,000 shares were issued to service providers, for financing fees and its advisory board. These shares were valued at approximately $0.042 per share based on the trading price of the Company’s common stock on the date of approval by the Company’s Board of Directors for this share issuance. As a result, the Company recorded a non-cash charge of $2,058,100 for stock-based compensation on its Statement of Operations for the year ended December 31, 2023. |

| |

|

|

| |

· |

10,000,000 shares were issued to purchase intellectual property. These shares were valued at $.05445 based upon the trading price of the Company’s common stock on the date the Company acquired the intellectual property. |

2022 Activity

On or about January 19, 2022, the Company filed a

Form 1-A Offering Circular with the SEC pursuant to Regulation A promulgated under the Securities Act of 1933, as amended. Under the terms

of the Offering the Company offered up to 20,000,000 common shares at a price of $0.05 per share for total proceeds of $1,000,000 if fully

subscribed. During the year ended December 31, 2022, the Company raised a total of $400,000 in this Offering from the sale of 8,000,000

shares to investors at a price of $0.05 per share.

During the year ended December 31, 2022, the Company

issued 13,000,000 common shares to service providers and its advisory board. These shares were valued at $0.05 per share consistent with

the offering price of the Company’s Regulation A offering described above. As a result, the Company recorded a non-cash charge of

$650,000 for stock based compensation on its Statement of Operations for year ended December 31, 2022.

Preferred Stock

The Company has authorized 25,000,000 shares of Preferred

Stock, par value $0.0001 per share.

As a result of issues raised by OTC Markets in February

2021, the Company and Mr. O’Shea mutually agreed to redeem all of the Company’s issued and outstanding Series A Preferred

Shares back to the Company. Also in February 2021, the Company’s Board of Directors authorized the creation of Series B Preferred

Shares and issued an aggregate of 120,000 of these Series B Preferred Shares to Mr. O’Shea in consideration for his agreement to

redeem the Series A Preferred Shares. Each Share of Series B Preferred Stock is entitled to 1,000 votes on all matters submitted to the

Company’s shareholders. They are not convertible into shares of the Company’s Common Stock. No compensation expense was recognized

on this transaction because the fair market value of the Series A Preferred shares redeemed were estimated to be equivalent to the fair

market value of the Series B Preferred shares.

As of June 30, 2024 and December 31, 2023, there were

120,000 Preferred B shares outstanding.

Item 4. Exhibits

Index to Exhibits

________________

| (1) |

Incorporated by reference to Exhibit 3.1 to the Registrant’s Form 10-SB filed with the SEC on April 17, 2001 |

|

| (2) |

Incorporated by reference to Exhibit 2.1 to the Registrant’s Form 1-A filed with the SEC on January 19, 2022 |

|

| (3) |

Incorporated by reference to Exhibit 2.2 to the Registrant’s Form 1-A filed with the SEC on January 19, 2022 |

|

| (4) |

Incorporated by reference to Exhibit 2.3 to the Registrant’s Form 1-A filed with the SEC on January 19, 2022 |

|

| (5) |

Incorporated by reference to Exhibit 10.2 to the Registrant’s Form 1-SA filed with the SEC on September 22, 2023 |

|

| (6) |

Incorporated by reference to Exhibit 10.3 to the Registrant’s Form 1-SA filed with the SEC on September 22, 2023 |

|

| (7) |

Incorporated by reference to Exhibit 10.4 to the Registrant’s Form 1-SA filed with the SEC on September 22, 2023 |

|

| (8) |

Incorporated by reference to Exhibit 10.5 to the Registrant’s Form 1-SA filed with the SEC on September 22, 2023 |

|

| (9) |

Incorporated by reference to Exhibit 21 to the Registrants Form S-1 registration statement filed with SEC on November 13, 2023 |

|

| (10) |

Incorporated by reference to Exhibit 10 to the Registrants Form S-1/A registration statement filed with SEC on January 19, 2024 |

|

| (11) |

Incorporated by reference to Exhibit 107 to the Registrants Form S-1 registration statement filed with SEC on November 13, 2023 |

|

SIGNATURES

Pursuant to the requirements of

Regulation A, the issuer has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, on September

24, 2024.

Xcelerate, Inc.

By: /s/ Michael F. O’Shea

Michael F. O’Shea,

Principal Executive Officer

Principal Financial Officer

Exhibit 10.8

Patent License Agreement

THIS PATENT LICENSE AGREEMENT (hereinafter referred to as the "Agreement")

is made by and between Xcelerate, Inc. a Florida publicly traded corporation with principal offices at 110 Renaissance Circle Mauldin,

SC 29662, being referred to herein as the ("Licensee") and Consulting Group of Jocassee, Inc. a South Carolina corporation with

principal offices at 582 Gravely Rd. Pickens, SC 29671, being referred to herein as the ("Licensor")

Background

WHEREAS, Licensor is the owner of U.S. Patent # 10718586,

as assigned to Consulting Group of Jocassee, Inc. on 28 May 2019. ("Licensed Patent");

WHEREAS, Licensee has assembled an internationally recognized team

of translational clinicians and engineers to identify and acquire engineering advancements and intellectual property that does not have

immediately obvious applications to medical technology and clinical care;

WHEREAS, Licensor has agreed to provide a license to the Licensee for

defined use of the Licensed Patent;

The parties agree as follows:

1. DEFINITIONS

1.1 Licensed Patent." Licensed Patent" as used in this Agreement

shall mean claims derived from Anja Glisovic et. al, "Enhanced Metal Matrix Composite Weapon Barrels", U.S. Patent # 10718586,

as assigned to Consulting Group of Jocassee, Inc. on 28 May 2019, and any patent issued in the future from any reissue, reexamination,

divisional, continuation, and/or continuation-in-part of the Licensed Patents, including any foreign counterpart thereof.

1.2 Territory.

"Territory" as used in this Agreement shall mean worldwide.

1.3 Effective Date. "Effective

Date" shall mean 30 September 2020.

1.4 Term.

"Term" as used in this Agreement shall mean the period beginning on the Effective Date and ending with the expiration of the

Licensed Patent or the termination of this Agreement, whichever occurs first. This Agreement shall, if not terminated sooner, terminate

at the end of the Term.

2. LICENSE

2.1 License Grant. Subject to the terms and conditions of this Agreement

Licensor hereby grants to Licensee a nontransferable exclusive license under the Licensed Patent for the Term in the Territory to all

of the patent and intellectual rights associated with, as they pertain to the business of the manufacture, sale, marketing and distribution

of medical instruments and devices.

2.2 Basis. The foregoing license is granted solely under the Licensed

Patent. No license under any other patents or intellectual property of Licensor is granted, either expressly or by implication.

3. PAYMENTS

3.1 Consideration. Consideration for the License shall be the issuance

of 5 million shares of the restricted common stock of the Licensee (the "License Price") to be issued at Closing. The Licensee

shall be responsible for and shall pay any taxes payable upon a transfer of the Licenses.

3.2 Royalty. In addition to the Consideration the Licensee

shall pay a Royalty equal to 5% of the gross revenue derived by the Licensee from the sale of products developed by the Licensee using

the patent and intellectual rights associated the License.

3.3 Payment. All Royalty payments to Licensor shall be made

quarterly by Licensee, with the first quarter being defined as January 1 through March 31, the second quarter as April 1 through June

30, the third quarter as July 1 through September 30, and the fourth quarter as October 1 through December 31. Payment of Royalties shall

be made to Licensor not later than the thirtieth (30th) day (the "Due Date") after the end of the period to which the payment

relates.

4. CONFIDENTIALTY

4.1 General. Except as contemplated hereby or required by a court of

competent authority, Licensee and its members and managers shall keep confidential and shall not disclose to third parties and shall use

reasonable efforts to prevent any affiliates and any present or former employee, agent and representative of such Licensee and its members

and managers from disclosing to third parties without the prior written consent of Licensor.

5 TERMINATION

5.1 Termination by Licensor. In addition to all other remedies licensor

may have, Licensor may terminate this Agreement and the licenses granted in this Agreement in the event that:

(a)

Licensee fails to pay any amount due under this Agreement on the due date for payment and remains in default five (5) Business

Days after Licensor 's written notice to make such payment.

(b)

Licensee breaches this Agreement (other than through a failure to pay any amounts due under this Agreement) and, if such breach

is curable, fails to cure such breach within twenty (20) Business Days of Licensor 's written notice of such breach;

(c)

Licensee: (I) is dissolved or liquidated or takes any corporate action for such purpose; (ii) becomes insolvent or is generally

unable to pay, or fails to pay, its debts as they become due; (iii) files or has filed against it a petition for voluntary or involuntary

bankruptcy or otherwise becomes subject, voluntarily or involuntarily, to any proceeding under any domestic or foreign bankruptcy or insolvency

law; (iv) makes or seeks to make a general assignment for the benefit of creditors; or (v) applies for or has a receiver, trustee, custodian,

or similar agent appointed by order of any court of competent jurisdiction to take charge of or sell any material portion of its property

or business;

5.2 Termination by Licensee. If the Licensed Patent or Licensor's

ownership interest therein is determined to be invalid or unenforceable by any court or tribunal of competent jurisdiction , and the determination

becomes final in that it is not furtll er reviewable through appeal or exhaustion of all permissible petitions or applications for rehearing

or review or the Licensed Patent no longer includes any Valid Claims, Licensee may terminate this Agreement at will and shall have no

further obligations hereunder, except to pay any accrued but unpaid Royalty.

5.3 Effect of Termination. After the termination of this

Agreement, Licensee shall have no rights under the Licensed Patent or Licensed Know-How.

6. RELATIONSHIP OF PARTIES

Nothing in this Agreement will be construed to constitute the

parties as partners or joint venture or constitute either party as agent of the other, nor will any similar relationship be deemed to

exist between them. Neither party shall hold itself out contrary to the terms of this paragraph and neither party shall become liable

by reason of any representation , act, or omission of the other contrary to the provisions of this paragraph. This Agreement is not for

the benefit of any third party and shall not be deemed to give any right or remedy to any such party, whether referred to in this Agreement

or not.

7. GOVERNING LAW

This Agreement and all related documents, and all matters arising out

of or relating to this Agreement are governed by, and construed in accordance with, the laws of the State of South Carolina, United States

of America, without regard to the conflict of law's provisions thereof to the extent such principles or rules would require or permit

the application of the laws of any jurisdiction other than those of the State of South Carolina.

8. MISCELLANEOUS

8.1 Notices. All notices given in connection with this Agreement shall

be in writing and shall be deemed given upon actual receipt by the addressee. Notices shall be personally delivered or sent by telex or

facsimile (with prompt confirmation by registered or certified air mail, postage prepaid) or by registered or certified air mail, postage

prepaid, addressed to the party to be notified at the following address, or at such other address as the party may designate by notice:

Licensor:

Steve Gravely, President

Consulting Group of Jocassee, Inc.

582 Gravely Rd. Pickens, SC 29671

Licensee:

Michael O'Shea, CEO

Xcelerate, Inc.

110 Renaissance Circle Mauldin, SC 29662

8.2 No Other Agreement. The parties each represent that in

entering into this Agreement, they rely on no promise, inducement, or other agreement not expressly contained in this Agreement; that

they have read this Agreement and discussed it thoroughly with their respective legal counsel; that they understand all of the provisions

of this Agreement and intend to be bound by them; and that they enter into this Agreement voluntarily .

8.3 Entire Agreement. This Agreement constitutes the complete

and exclusive statement of the terms and conditions between the parties, which supersedes and merges all prior proposals, understandings,

and all other agreements, oral and written, between the parties relating to the subject of this Agreement.

8.4 Counterparts. This Agreement may be executed

in counterparts, which taken together shall constitute one document.

8.5 Equitable Relief. Each Party acknowledges that a breach by the

other Party of this Agreement may cause the non-breaching Party irreparable harm, for which an award of damages would not be adequate

compensation and, in the event of such a breach or threatened breach, the non-breaching Party will be entitled to seek equitable relief,

including in the form of a restraining order, orders for preliminary or permanent injunction, specific performance, and any other relief

that may be available from any court, and the Parties hereby waive any requirement for the securing or posting of any bond or the showing

of actual monetary damages in connection with such relief. These remedies are not exclusive but are in addition to all other remedies

available under this Agreement at law or in equity, subject to any express exclusions or limitations in this Agreement to the contrary.

The Parties agree to the terms of this Agreement above

and have executed this Agreement by their duly authorized representatives.

| Consulting Group of Jocassee, Inc. |

|

Xcelerate, Inc. |

| |

|

|

| |

|

|

|

|

| /s/ Steve Gravely |

|

/s/ Michael O'Shea |

| Name: |

Steve Gravely |

|

Name: |

Michael O'Shea |

| Title: |

President |

|

Title: |

CEO |

| Date: |

September 10, 2020 |

|

Date: |

September 10, 2020 |

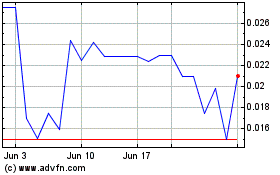

Xcelerate (QB) (USOTC:XCRT)

Historical Stock Chart

From Sep 2024 to Oct 2024

Xcelerate (QB) (USOTC:XCRT)

Historical Stock Chart

From Oct 2023 to Oct 2024