0000839087false--12-31Q220230.01100000000000.001250000000103080870.45001630000000008390872023-01-012023-06-3000008390872022-12-012022-12-3100008390872019-05-012019-05-100000839087vaso:MedTechNoteMember2023-06-300000839087vaso:MedTechNoteMember2022-12-310000839087vaso:MedTechNoteMember2023-04-012023-06-300000839087vaso:MedTechNoteMember2022-01-012022-06-300000839087vaso:MedTechNoteMember2022-04-012022-06-300000839087vaso:MedTechNoteMember2023-01-012023-06-300000839087vaso:CommissionRevenuesMember2022-01-012022-06-300000839087vaso:CommissionRevenuesMember2022-04-012022-06-300000839087vaso:CommissionRevenuesMember2023-04-012023-06-300000839087vaso:CommissionRevenuesMember2023-01-012023-06-300000839087vaso:ExtendedServiceContractsMember2022-01-012022-06-300000839087vaso:ExtendedServiceContractsMember2022-04-012022-06-300000839087vaso:ExtendedServiceContractsMember2023-01-012023-06-300000839087vaso:ExtendedServiceContractsMember2023-04-012023-06-300000839087us-gaap:ComputerSoftwareIntangibleAssetMember2022-12-310000839087us-gaap:ComputerSoftwareIntangibleAssetMember2023-06-300000839087vaso:PatentsAndTechnologyMember2022-12-310000839087vaso:PatentsAndTechnologyMember2023-06-300000839087us-gaap:CustomerRelationshipsMember2022-12-310000839087us-gaap:CustomerRelationshipsMember2023-06-3000008390872021-01-012021-12-3100008390872020-12-310000839087us-gaap:FairValueInputsLevel3Member2022-12-310000839087us-gaap:FairValueInputsLevel2Member2022-12-310000839087us-gaap:FairValueInputsLevel1Member2022-12-310000839087us-gaap:FairValueInputsLevel3Member2023-06-300000839087us-gaap:FairValueInputsLevel2Member2023-06-300000839087us-gaap:FairValueInputsLevel1Member2023-06-300000839087us-gaap:RestrictedStockMember2022-01-012022-06-300000839087us-gaap:RestrictedStockMember2022-04-012022-06-300000839087us-gaap:RestrictedStockMember2023-01-012023-06-300000839087us-gaap:RestrictedStockMember2023-04-012023-06-300000839087vaso:GeHealthcareMemberus-gaap:AccountsReceivableMember2022-12-310000839087vaso:GeHealthcareMemberus-gaap:AccountsReceivableMember2023-06-300000839087vaso:GeHealthcareMemberus-gaap:AccountsReceivableMember2022-01-012022-12-310000839087vaso:GeHealthcareMemberus-gaap:AccountsReceivableMember2023-01-012023-06-300000839087vaso:GeHealthcareMemberus-gaap:SalesRevenueNetMember2022-01-012022-06-300000839087vaso:GeHealthcareMemberus-gaap:SalesRevenueNetMember2022-04-012022-06-300000839087vaso:GeHealthcareMemberus-gaap:SalesRevenueNetMember2023-01-012023-06-300000839087vaso:GeHealthcareMemberus-gaap:SalesRevenueNetMember2023-04-012023-06-300000839087vaso:CorporatesSegmentsMember2022-12-310000839087vaso:CorporatesSegmentsMember2023-06-300000839087vaso:EquipmentSegmentMember2022-12-310000839087vaso:EquipmentSegmentMember2023-06-300000839087vaso:ProfessionalSalesServiceSegmentMember2022-12-310000839087vaso:ProfessionalSalesServiceSegmentMember2023-06-300000839087vaso:ITSegmentMember2022-12-310000839087vaso:ITSegmentMember2023-06-300000839087vaso:CorporatesSegmentMember2022-01-012022-06-300000839087vaso:CorporatesSegmentMember2022-04-012022-06-300000839087vaso:CorporatesSegmentMember2023-04-012023-06-300000839087vaso:CorporatesSegmentMember2023-01-012023-06-300000839087us-gaap:EquipmentMember2022-01-012022-06-300000839087us-gaap:EquipmentMember2022-04-012022-06-300000839087us-gaap:EquipmentMember2023-04-012023-06-300000839087us-gaap:EquipmentMember2023-01-012023-06-300000839087us-gaap:AllOtherSegmentsMember2022-01-012022-06-300000839087us-gaap:AllOtherSegmentsMember2022-04-012022-06-300000839087us-gaap:AllOtherSegmentsMember2023-04-012023-06-300000839087us-gaap:AllOtherSegmentsMember2023-01-012023-06-300000839087vaso:InformationTechnologySegmentMember2022-01-012022-06-300000839087vaso:InformationTechnologySegmentMember2022-04-012022-06-300000839087vaso:InformationTechnologySegmentMember2023-04-012023-06-300000839087vaso:InformationTechnologySegmentMember2023-01-012023-06-300000839087vaso:TotalRevenueMember2022-01-012022-06-300000839087vaso:RevenueRecognizedEquipmentSegmentMember2022-01-012022-06-300000839087vaso:RevenueRecognizedProfessionalSalesServicesMember2022-01-012022-06-300000839087vaso:RevenueRecognizedItSegmentMember2022-01-012022-06-300000839087vaso:TotalRevenueMember2022-04-012022-06-300000839087vaso:TotalRevenueMember2023-04-012023-06-300000839087vaso:TotalRevenueMember2023-01-012023-06-300000839087vaso:RevenueRecognizedEquipmentSegmentMember2022-04-012022-06-300000839087vaso:RevenueRecognizedEquipmentSegmentMember2023-04-012023-06-300000839087vaso:RevenueRecognizedEquipmentSegmentMember2023-01-012023-06-300000839087vaso:RevenueRecognizedProfessionalSalesServicesMember2022-04-012022-06-300000839087vaso:RevenueRecognizedProfessionalSalesServicesMember2023-04-012023-06-300000839087vaso:RevenueRecognizedProfessionalSalesServicesMember2023-01-012023-06-300000839087vaso:RevenueRecognizedItSegmentMember2022-04-012022-06-300000839087vaso:RevenueRecognizedItSegmentMember2023-04-012023-06-300000839087vaso:RevenueRecognizedItSegmentMember2023-01-012023-06-300000839087vaso:RevenueRecognizedAtAPointOfTimeMember2022-01-012022-06-300000839087vaso:EquipmentSegmentMemberus-gaap:TransferredAtPointInTimeMember2022-01-012022-06-300000839087vaso:ProfessionalSalesServiceSegmentMemberus-gaap:TransferredAtPointInTimeMember2022-01-012022-06-300000839087vaso:ITSegmentMemberus-gaap:TransferredAtPointInTimeMember2022-01-012022-06-300000839087vaso:RevenueRecognizedAtAPointOfTimeMember2022-04-012022-06-300000839087vaso:RevenueRecognizedAtAPointOfTimeMember2023-04-012023-06-300000839087vaso:RevenueRecognizedAtAPointOfTimeMember2023-01-012023-06-300000839087vaso:EquipmentSegmentMemberus-gaap:TransferredAtPointInTimeMember2022-04-012022-06-300000839087vaso:EquipmentSegmentMemberus-gaap:TransferredAtPointInTimeMember2023-04-012023-06-300000839087vaso:EquipmentSegmentMemberus-gaap:TransferredAtPointInTimeMember2023-01-012023-06-300000839087vaso:ProfessionalSalesServiceSegmentMemberus-gaap:TransferredAtPointInTimeMember2022-04-012022-06-300000839087vaso:ProfessionalSalesServiceSegmentMemberus-gaap:TransferredAtPointInTimeMember2023-04-012023-06-300000839087vaso:ProfessionalSalesServiceSegmentMemberus-gaap:TransferredAtPointInTimeMember2023-01-012023-06-300000839087vaso:ITSegmentMemberus-gaap:TransferredAtPointInTimeMember2022-04-012022-06-300000839087vaso:ITSegmentMemberus-gaap:TransferredAtPointInTimeMember2023-04-012023-06-300000839087vaso:ITSegmentMemberus-gaap:TransferredAtPointInTimeMember2023-01-012023-06-300000839087vaso:RevenueOverTimeMember2022-01-012022-06-300000839087vaso:EquipmentSegmentMemberus-gaap:TransferredOverTimeMember2022-01-012022-06-300000839087vaso:ProfessionalSalesServiceSegmentMemberus-gaap:TransferredOverTimeMember2022-01-012022-06-300000839087vaso:ITSegmentMemberus-gaap:TransferredOverTimeMember2022-01-012022-06-300000839087vaso:RevenueOverTimeMember2022-04-012022-06-300000839087vaso:RevenueOverTimeMember2023-04-012023-06-300000839087vaso:RevenueOverTimeMember2023-01-012023-06-300000839087vaso:EquipmentSegmentMemberus-gaap:TransferredOverTimeMember2022-04-012022-06-300000839087vaso:EquipmentSegmentMemberus-gaap:TransferredOverTimeMember2023-04-012023-06-300000839087vaso:EquipmentSegmentMemberus-gaap:TransferredOverTimeMember2023-01-012023-06-300000839087vaso:ProfessionalSalesServiceSegmentMemberus-gaap:TransferredOverTimeMember2022-04-012022-06-300000839087vaso:ProfessionalSalesServiceSegmentMemberus-gaap:TransferredOverTimeMember2023-04-012023-06-300000839087vaso:ProfessionalSalesServiceSegmentMemberus-gaap:TransferredOverTimeMember2023-01-012023-06-300000839087vaso:ITSegmentMemberus-gaap:TransferredOverTimeMember2022-04-012022-06-300000839087vaso:ITSegmentMemberus-gaap:TransferredOverTimeMember2023-04-012023-06-300000839087vaso:ITSegmentMemberus-gaap:TransferredOverTimeMember2023-01-012023-06-300000839087vaso:RevenueRecognizedMember2022-01-012022-06-300000839087vaso:EquipmentSegmentMember2022-01-012022-06-300000839087vaso:ProfessionalSalesServiceSegmentMember2022-01-012022-06-300000839087vaso:ITSegmentMember2022-01-012022-06-300000839087vaso:RevenueRecognizedMember2022-04-012022-06-300000839087vaso:RevenueRecognizedMember2023-04-012023-06-300000839087vaso:RevenueRecognizedMember2023-01-012023-06-300000839087vaso:EquipmentSegmentMember2022-04-012022-06-300000839087vaso:EquipmentSegmentMember2023-04-012023-06-300000839087vaso:EquipmentSegmentMember2023-01-012023-06-300000839087vaso:ProfessionalSalesServiceSegmentMember2022-04-012022-06-300000839087vaso:ProfessionalSalesServiceSegmentMember2023-04-012023-06-300000839087vaso:ProfessionalSalesServiceSegmentMember2023-01-012023-06-300000839087vaso:ITSegmentMember2022-04-012022-06-300000839087vaso:ITSegmentMember2023-04-012023-06-300000839087vaso:ITSegmentMember2023-01-012023-06-300000839087vaso:MedicalEquipmentServiceMember2022-01-012022-06-300000839087vaso:MedicalEquipmentServiceMembervaso:EquipmentSegmentMember2022-01-012022-06-300000839087vaso:MedicalEquipmentServiceMembervaso:ProfessionalSalesServiceSegmentMember2022-01-012022-06-300000839087vaso:MedicalEquipmentServiceMembervaso:ITSegmentMember2022-01-012022-06-300000839087vaso:MedicalEquipmentServiceMembervaso:EquipmentSegmentMember2022-04-012022-06-300000839087vaso:MedicalEquipmentServiceMembervaso:EquipmentSegmentMember2023-04-012023-06-300000839087vaso:MedicalEquipmentServiceMembervaso:EquipmentSegmentMember2023-01-012023-06-300000839087vaso:MedicalEquipmentServiceMember2022-04-012022-06-300000839087vaso:MedicalEquipmentServiceMember2023-04-012023-06-300000839087vaso:MedicalEquipmentServiceMember2023-01-012023-06-300000839087vaso:MedicalEquipmentServiceMembervaso:ProfessionalSalesServiceSegmentMember2022-04-012022-06-300000839087vaso:MedicalEquipmentServiceMembervaso:ProfessionalSalesServiceSegmentMember2023-04-012023-06-300000839087vaso:MedicalEquipmentServiceMembervaso:ProfessionalSalesServiceSegmentMember2023-01-012023-06-300000839087vaso:MedicalEquipmentServiceMembervaso:ITSegmentMember2022-04-012022-06-300000839087vaso:MedicalEquipmentServiceMembervaso:ITSegmentMember2023-04-012023-06-300000839087vaso:MedicalEquipmentServiceMembervaso:ITSegmentMember2023-01-012023-06-300000839087vaso:MedicalEquipmentSalesMember2022-01-012022-06-300000839087vaso:MedicalEquipmentSalesMembervaso:EquipmentSegmentMember2022-01-012022-06-300000839087vaso:MedicalEquipmentSalesMembervaso:ProfessionalSalesServiceSegmentMember2022-01-012022-06-300000839087vaso:MedicalEquipmentSalesMembervaso:ITSegmentMember2022-01-012022-06-300000839087vaso:MedicalEquipmentSalesMember2022-04-012022-06-300000839087vaso:MedicalEquipmentSalesMember2023-04-012023-06-300000839087vaso:MedicalEquipmentSalesMember2023-01-012023-06-300000839087vaso:MedicalEquipmentSalesMembervaso:EquipmentSegmentMember2022-04-012022-06-300000839087vaso:MedicalEquipmentSalesMembervaso:EquipmentSegmentMember2023-04-012023-06-300000839087vaso:MedicalEquipmentSalesMembervaso:EquipmentSegmentMember2023-01-012023-06-300000839087vaso:MedicalEquipmentSalesMembervaso:ProfessionalSalesServiceSegmentMember2022-04-012022-06-300000839087vaso:MedicalEquipmentSalesMembervaso:ProfessionalSalesServiceSegmentMember2023-04-012023-06-300000839087vaso:MedicalEquipmentSalesMembervaso:ProfessionalSalesServiceSegmentMember2023-01-012023-06-300000839087vaso:MedicalEquipmentSalesMembervaso:ITSegmentMember2022-04-012022-06-300000839087vaso:MedicalEquipmentSalesMembervaso:ITSegmentMember2023-04-012023-06-300000839087vaso:MedicalEquipmentSalesMembervaso:ITSegmentMember2023-01-012023-06-300000839087vaso:CommisionsMember2022-01-012022-06-300000839087vaso:CommissionsMembervaso:EquipmentSegmentMember2022-01-012022-06-300000839087vaso:CommissionsMembervaso:ProfessionalSalesServiceSegmentMember2022-01-012022-06-300000839087vaso:CommissionsMembervaso:ITSegmentMember2022-01-012022-06-300000839087vaso:CommisionsMember2022-04-012022-06-300000839087vaso:CommisionsMember2023-04-012023-06-300000839087vaso:CommisionsMember2023-01-012023-06-300000839087vaso:CommissionsMembervaso:EquipmentSegmentMember2022-04-012022-06-300000839087vaso:CommissionsMembervaso:EquipmentSegmentMember2023-04-012023-06-300000839087vaso:CommissionsMembervaso:EquipmentSegmentMember2023-01-012023-06-300000839087vaso:CommissionsMembervaso:ProfessionalSalesServiceSegmentMember2023-01-012023-06-300000839087vaso:CommissionsMembervaso:ProfessionalSalesServiceSegmentMember2022-04-012022-06-300000839087vaso:CommissionsMembervaso:ProfessionalSalesServiceSegmentMember2023-04-012023-06-300000839087vaso:CommissionsMembervaso:ITSegmentMember2023-01-012023-06-300000839087vaso:CommissionsMembervaso:ITSegmentMember2022-04-012022-06-300000839087vaso:CommissionsMembervaso:ITSegmentMember2023-04-012023-06-300000839087vaso:SoftwareSalesAndSupportMember2022-01-012022-06-300000839087vaso:SoftwareSalesAndSupportMembervaso:EquipmentSegmentMember2022-01-012022-06-300000839087vaso:SoftwareSalesAndSupportMembervaso:ProfessionalSalesServiceSegmentMember2022-01-012022-06-300000839087vaso:SoftwareSalesAndSupportMembervaso:ITSegmentMember2022-01-012022-06-300000839087vaso:SoftwareSalesAndSupportMember2023-01-012023-06-300000839087vaso:SoftwareSalesAndSupportMember2022-04-012022-06-300000839087vaso:SoftwareSalesAndSupportMember2023-04-012023-06-300000839087vaso:SoftwareSalesAndSupportMembervaso:EquipmentSegmentMember2022-04-012022-06-300000839087vaso:SoftwareSalesAndSupportMembervaso:EquipmentSegmentMember2023-04-012023-06-300000839087vaso:SoftwareSalesAndSupportMembervaso:EquipmentSegmentMember2023-01-012023-06-300000839087vaso:SoftwareSalesAndSupportMembervaso:ProfessionalSalesServiceSegmentMember2022-04-012022-06-300000839087vaso:SoftwareSalesAndSupportMembervaso:ProfessionalSalesServiceSegmentMember2023-04-012023-06-300000839087vaso:SoftwareSalesAndSupportMembervaso:ProfessionalSalesServiceSegmentMember2023-01-012023-06-300000839087vaso:SoftwareSalesAndSupportMembervaso:ITSegmentMember2022-04-012022-06-300000839087vaso:SoftwareSalesAndSupportMembervaso:ITSegmentMember2023-04-012023-06-300000839087vaso:SoftwareSalesAndSupportMembervaso:ITSegmentMember2023-01-012023-06-300000839087vaso:NetworkServiceMember2022-01-012022-06-300000839087vaso:NetworkServicesMembervaso:EquipmentSegmentMember2022-01-012022-06-300000839087vaso:NetworkServicesMembervaso:ProfessionalSalesServiceSegmentMember2022-01-012022-06-300000839087vaso:NetworkServicesMembervaso:ITSegmentMember2022-04-012022-06-300000839087vaso:NetworkServiceMember2022-04-012022-06-300000839087vaso:NetworkServiceMember2023-04-012023-06-300000839087vaso:NetworkServiceMember2023-01-012023-06-300000839087vaso:NetworkServicesMembervaso:EquipmentSegmentMember2022-04-012022-06-300000839087vaso:NetworkServicesMembervaso:EquipmentSegmentMember2023-04-012023-06-300000839087vaso:NetworkServicesMembervaso:EquipmentSegmentMember2023-01-012023-06-300000839087vaso:NetworkServicesMembervaso:ProfessionalSalesServiceSegmentMember2022-04-012022-06-300000839087vaso:NetworkServicesMembervaso:ProfessionalSalesServiceSegmentMember2023-04-012023-06-300000839087vaso:NetworkServicesMembervaso:ProfessionalSalesServiceSegmentMember2023-01-012023-06-300000839087vaso:NetworkServicesMembervaso:ITSegmentMember2023-01-012023-06-300000839087vaso:NetworkServicesMembervaso:ITSegmentMember2022-01-012022-06-300000839087vaso:NetworkServicesMembervaso:ITSegmentMember2023-04-012023-06-300000839087us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300000839087us-gaap:RetainedEarningsMember2023-06-300000839087us-gaap:AdditionalPaidInCapitalMember2023-06-300000839087us-gaap:TreasuryStockCommonMember2023-06-300000839087us-gaap:CommonStockMember2023-06-300000839087us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300000839087us-gaap:RetainedEarningsMember2023-04-012023-06-300000839087us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300000839087us-gaap:TreasuryStockCommonMember2023-04-012023-06-300000839087us-gaap:CommonStockMember2023-04-012023-06-3000008390872023-03-310000839087us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310000839087us-gaap:RetainedEarningsMember2023-03-310000839087us-gaap:AdditionalPaidInCapitalMember2023-03-310000839087us-gaap:TreasuryStockCommonMember2023-03-310000839087us-gaap:CommonStockMember2023-03-3100008390872023-01-012023-03-310000839087us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310000839087us-gaap:RetainedEarningsMember2023-01-012023-03-310000839087us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310000839087us-gaap:TreasuryStockCommonMember2023-01-012023-03-310000839087us-gaap:CommonStockMember2023-01-012023-03-310000839087us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000839087us-gaap:RetainedEarningsMember2022-12-310000839087us-gaap:AdditionalPaidInCapitalMember2022-12-310000839087us-gaap:TreasuryStockCommonMember2022-12-310000839087us-gaap:CommonStockMember2022-12-3100008390872022-06-300000839087us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-300000839087us-gaap:RetainedEarningsMember2022-06-300000839087us-gaap:AdditionalPaidInCapitalMember2022-06-300000839087us-gaap:TreasuryStockCommonMember2022-06-300000839087us-gaap:CommonStockMember2022-06-300000839087us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-04-012022-06-300000839087us-gaap:RetainedEarningsMember2022-04-012022-06-300000839087us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-300000839087us-gaap:TreasuryStockCommonMember2022-04-012022-06-300000839087us-gaap:CommonStockMember2022-04-012022-06-3000008390872022-03-310000839087us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-310000839087us-gaap:RetainedEarningsMember2022-03-310000839087us-gaap:AdditionalPaidInCapitalMember2022-03-310000839087us-gaap:TreasuryStockCommonMember2022-03-310000839087us-gaap:CommonStockMember2022-03-3100008390872022-01-012022-03-310000839087us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-03-310000839087us-gaap:RetainedEarningsMember2022-01-012022-03-310000839087us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-310000839087us-gaap:TreasuryStockCommonMember2022-01-012022-03-310000839087us-gaap:CommonStockMember2022-01-012022-03-3100008390872021-12-310000839087us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310000839087us-gaap:RetainedEarningsMember2021-12-310000839087us-gaap:AdditionalPaidInCapitalMember2021-12-310000839087us-gaap:TreasuryStockCommonMember2021-12-310000839087us-gaap:CommonStockMember2021-12-3100008390872022-04-012022-06-3000008390872023-04-012023-06-3000008390872022-01-012022-06-3000008390872022-12-3100008390872023-06-3000008390872023-08-12iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:purevaso:integer

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q

☒ | Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the quarterly period ended June 30, 2023

☐ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from _______________ to ______________

Commission File Number: 0-18105

VASO CORPORATION |

(Exact name of registrant as specified in its charter) |

Delaware | | 11-2871434 |

(State or other jurisdiction of . incorporation or organization) | | (IRS Employer Identification Number) |

137 Commercial St., Suite 200, Plainview, New York 11803

(Address of principal executive offices)

Registrant’s Telephone Number (516) 997-4600

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer | ☐ | Accelerated Filer | ☐ |

Non-accelerated Filer | ☒ | Smaller Reporting Company | ☒ |

| | Emerging Growth Company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Securities registered pursuant to Section 12 (b) of the Act: None

Number of Shares Outstanding of Common Stock, $.001 Par Value, at August 12, 2023 – 175,141,005

Vaso Corporation and Subsidiaries

INDEX

PART I – FINANCIAL INFORMATION

ITEM 1 - FINANCIAL STATEMENTS

Vaso Corporation and Subsidiaries

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share data)

| | June 30, 2023 | | | December 31, 2022 | |

| | (unaudited) | | | | |

ASSETS | | | | | | |

CURRENT ASSETS | | | | | | |

Cash and cash equivalents | | $ | 14,399 | | | $ | 11,821 | |

Short-term investments | | | 11,675 | | | | 8,504 | |

Accounts and other receivables, net of an allowance for credit losses and commission adjustments of $7,526 at June 30, 2023 and $6,947 at December 31, 2022 | | | 9,490 | | | | 15,524 | |

Receivables due from related parties | | | 779 | | | | 421 | |

Inventories, net | | | 1,541 | | | | 1,473 | |

Deferred commission expense | | | 3,405 | | | | 3,249 | |

Prepaid expenses and other current assets | | | 1,685 | | | | 1,008 | |

Total current assets | | | 42,974 | | | | 42,000 | |

| | | | | | | | |

| | | | | | | | |

Property and equipment, net of accumulated depreciation of $10,095 at June 30, 2023 and $9,787 at December 31, 2022 | | | 1,268 | | | | 1,340 | |

Operating lease right of use assets | | | 1,669 | | | | 1,568 | |

Goodwill | | | 15,558 | | | | 15,614 | |

Intangibles, net | | | 1,400 | | | | 1,511 | |

Other assets, net | | | 4,936 | | | | 4,726 | |

Investment in EECP Global | | | 764 | | | | 889 | |

Deferred tax assets, net | | | 5,007 | | | | 5,007 | |

Total assets | | $ | 73,576 | | | $ | 72,655 | |

| | | | | | | | |

LIABILITIES AND STOCKHOLDERS' EQUITY | | | | | | | | |

CURRENT LIABILITIES | | | | | | | | |

Accounts payable | | $ | 2,528 | | | $ | 2,270 | |

Accrued commissions | | | 2,054 | | | | 3,720 | |

Accrued expenses and other liabilities | | | 6,122 | | | | 8,891 | |

Finance lease liabilities - current | | | 67 | | | | 122 | |

Operating lease liabilities - current | | | 822 | | | | 745 | |

Sales tax payable | | | 612 | | | | 809 | |

Deferred revenue - current portion | | | 16,859 | | | | 15,139 | |

Notes payable - current portion | | | 9 | | | | 9 | |

Due to related party | | | 3 | | | | 3 | |

Total current liabilities | | | 29,076 | | | | 31,708 | |

| | | | | | | | |

LONG-TERM LIABILITIES | | | | | | | | |

Notes payable, net of current portion | | | 10 | | | | 15 | |

Finance lease liabilities, net of current portion | | | 56 | | | | 96 | |

Operating lease liabilities, net of current portion | | | 847 | | | | 823 | |

Deferred revenue, net of current portion | | | 16,727 | | | | 15,664 | |

Other long-term liabilities | | | 1,627 | | | | 1,474 | |

Total long-term liabilities | | | 19,267 | | | | 18,072 | |

| | | | | | | | |

COMMITMENTS AND CONTINGENCIES (NOTE M) | | | | | | | | |

| | | | | | | | |

STOCKHOLDERS' EQUITY | | | | | | | | |

Preferred stock, $0.01 par value; 1,000,000 shares authorized; nil shares issued and outstanding at June 30, 2023 and December 31, 2022 | | | - | | | | - | |

Common stock, $0.001 par value; 250,000,000 shares authorized; 185,449,092 and 185,435,965 shares issued at June 30, 2023 and December 31, 2022, respectively; 175,141,005 and 175,127,878 shares outstanding at June 30, 2023 and December 31, 2022, respectively | | | 185 | | | | 185 | |

Additional paid-in capital | | | 63,979 | | | | 63,952 | |

Accumulated deficit | | | (36,503 | ) | | | (39,029 | ) |

Accumulated other comprehensive loss | | | (428 | ) | | | (233 | ) |

Treasury stock, at cost, 10,308,087 shares at June 30, 2023 and December 31, 2022 | | | (2,000 | ) | | | (2,000 | ) |

Total stockholders’ equity | | | 25,233 | | | | 22,875 | |

| | $ | 73,576 | | | $ | 72,655 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

Vaso Corporation and Subsidiaries

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME

(unaudited)

(in thousands, except per share data)

| | Three months ended | | | Six months ended | |

| | June 30, | | | June 30, | |

| | 2023 | | | 2022 | | | 2023 | | | 2022 | |

Revenues | | | | | | | | | | | | |

Managed IT systems and services | | $ | 10,435 | | | $ | 10,019 | | | $ | 20,709 | | | $ | 20,022 | |

Professional sales services | | | 9,254 | | | | 8,854 | | | | 17,564 | | | | 15,461 | |

Equipment sales and services | | | 748 | | | | 629 | | | | 1,385 | | | | 1,029 | |

Total revenues | | | 20,437 | | | | 19,502 | | | | 39,658 | | | | 36,512 | |

| | | | | | | | | | | | | | | | |

Cost of revenues | | | | | | | | | | | | | | | | |

Cost of managed IT systems and services | | | 5,693 | | | | 6,342 | | | | 11,527 | | | | 12,211 | |

Cost of professional sales services | | | 1,766 | | | | 1,674 | | | | 3,285 | | | | 2,975 | |

Cost of equipment sales and services | | | 191 | | | | 150 | | | | 349 | | | | 221 | |

Total cost of revenues | | | 7,650 | | | | 8,166 | | | | 15,161 | | | | 15,407 | |

Gross profit | | | 12,787 | | | | 11,336 | | | | 24,497 | | | | 21,105 | |

| | | | | | | | | | | | | | | | |

Operating expenses | | | | | | | | | | | | | | | | |

Selling, general and administrative | | | 10,662 | | | | 9,604 | | | | 21,804 | | | | 19,606 | |

Research and development | | | 217 | | | | 170 | | | | 375 | | | | 292 | |

Total operating expenses | | | 10,879 | | | | 9,774 | | | | 22,179 | | | | 19,898 | |

Operating income | | | 1,908 | | | | 1,562 | | | | 2,318 | | | | 1,207 | |

| | | | | | | | | | | | | | | | |

Other (expense) income | | | | | | | | | | | | | | | | |

Interest and financing costs | | | (5 | ) | | | (1 | ) | | | (33 | ) | | | (24 | ) |

Interest and other income, net | | | 179 | | | | (48 | ) | | | 262 | | | | - | |

Loss on disposal of fixed assets | | | (1 | ) | | | - | | | | (2 | ) | | | (2 | ) |

Total other income, net | | | 173 | | | | (49 | ) | | | 227 | | | | (26 | ) |

| | | | | | | | | | | | | | | | |

Income before income taxes | | | 2,081 | | | | 1,513 | | | | 2,545 | | | | 1,181 | |

Income tax expense | | | (9 | ) | | | (18 | ) | | | (19 | ) | | | (30 | ) |

Net income | | | 2,072 | | | | 1,495 | | | | 2,526 | | | | 1,151 | |

| | | | | | | | | | | | | | | | |

Other comprehensive income | | | | | | | | | | | | | | | | |

Foreign currency translation loss | | | (210 | ) | | | (215 | ) | | | (195 | ) | | | (216 | ) |

Comprehensive income | | $ | 1,862 | | | $ | 1,280 | | | $ | 2,331 | | | $ | 935 | |

| | | | | | | | | | | | | | | | |

Income per common share | | | | | | | | | | | | | | | | |

- basic and diluted | | $ | 0.01 | | | $ | 0.01 | | | $ | 0.01 | | | $ | 0.01 | |

| | | | | | | | | | | | | | | | |

Weighted average common shares outstanding | | | | | | | | | | | | | | | | |

- basic | | | 174,159 | | | | 172,858 | | | | 173,895 | | | | 172,594 | |

- diluted | | | 175,120 | | | | 174,059 | | | | 175,162 | | | | 173,195 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

Vaso Corporation and Subsidiaries

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(unaudited)

(in thousands)

| | | | | | | | | | | | | | | | | | | | Accumulated | | | | |

| | | | | | | | | | | | | | Additional | | | | | | Other | | | Total | |

| | Common Stock | | | Treasury Stock | | | Paid-in- | | | Accumulated | | | Comprehensive | | | Stockholders’ | |

| | Shares | | | Amount | | | Shares | | | Amount | | | Capital | | | Deficit | | | Loss | | | Equity | |

Balance at January 1, 2022 | | | 185,436 | | | $ | 185 | | | | (10,308 | ) | | | (2,000 | ) | | $ | 63,917 | | | $ | (50,902 | ) | | $ | 110 | | | $ | 11,310 | |

Share-based compensation | | | - | | | | - | | | | - | | | | - | | | | 7 | | | | - | | | | - | | | | 7 | |

Foreign currency translation (loss) gain | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (1 | ) | | | (1 | ) |

Net (loss) income | | | - | | | | - | | | | - | | | | - | | | | - | | | | (344 | ) | | | - | | | | (344 | ) |

Balance at March 31, 2022 | | | 185,436 | | | $ | 185 | | | | (10,308 | ) | | $ | (2,000 | ) | | $ | 63,924 | | | $ | (51,246 | ) | | $ | 109 | | | $ | 10,972 | |

Share-based compensation | | | - | | | | - | | | | - | | | | - | | | | 6 | | | | - | | | | - | | | | 6 | |

Foreign currency translation (loss) gain | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (215 | ) | | | (215 | ) |

Net (loss) income | | | - | | | | - | | | | - | | | | - | | | | - | | | | 1,495 | | | | - | | | | 1,495 | |

Balance at June 30, 2022 | | | 185,436 | | | $ | 185 | | | | (10,308 | ) | | $ | (2,000 | ) | | $ | 63,930 | | | $ | (49,751 | ) | | $ | (106 | ) | | $ | 12,258 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance at January 1, 2023 | | | 185,436 | | | $ | 185 | | | | (10,308 | ) | | | (2,000 | ) | | $ | 63,952 | | | $ | (39,029 | ) | | $ | (233 | ) | | $ | 22,875 | |

Share-based compensation | | | - | | | | - | | | | - | | | | - | | | | 13 | | | | - | | | | - | | | | 13 | |

Foreign currency translation (loss) gain | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 15 | | | | 15 | |

Net (loss) income | | | - | | | | - | | | | - | | | | - | | | | - | | | | 454 | | | | - | | | | 454 | |

Balance at March 31, 2023 | | | 185,436 | | | $ | 185 | | | | (10,308 | ) | | $ | (2,000 | ) | | $ | 63,965 | | | $ | (38,575 | ) | | $ | (218 | ) | | $ | 23,357 | |

Share-based compensation | | | 13 | | | | - | | | | - | | | | - | | | | 15 | | | | - | | | | - | | | | 15 | |

Shares withheld for employee tax liability | | | - | | | | - | | | | - | | | | - | | | | (1 | ) | | | - | | | | - | | | | (1 | ) |

Foreign currency translation (loss) gain | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (210 | ) | | | (210 | ) |

Net (loss) income | | | - | | | | - | | | | - | | | | - | | | | - | | | | 2,072 | | | | - | | | | 2,072 | |

Balance at June 30, 2023 | | | 185,449 | | | $ | 185 | | | | (10,308 | ) | | $ | (2,000 | ) | | $ | 63,979 | | | $ | (36,503 | ) | | $ | (428 | ) | | $ | 25,233 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

Vaso Corporation and Subsidiaries

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

(in thousands)

| | Six months ended | |

| | June 30, | |

| | 2023 | | | 2022 | |

Cash flows from operating activities | | | | | | |

Net income | | $ | 2,526 | | | $ | 1,151 | |

Adjustments to reconcile net income to net cash provided by operating activities | | | | | | | | |

Depreciation and amortization | | | 537 | | | | 1,258 | |

Loss from investment in EECP Global | | | 125 | | | | 55 | |

Provision for credit losses and commission adjustments | | | 44 | | | | 157 | |

Share-based compensation | | | 28 | | | | 13 | |

Changes in operating assets and liabilities: | | | | | | | | |

Accounts and other receivables | | | 5,972 | | | | 8,376 | |

Inventories | | | (129 | ) | | | (509 | ) |

Deferred commission expense | | | (156 | ) | | | (27 | ) |

Prepaid expenses and other current assets | | | (884 | ) | | | 120 | |

Other assets, net | | | (291 | ) | | | (216 | ) |

Accounts payable | | | 268 | | | | (628 | ) |

Accrued commissions | | | (1,553 | ) | | | (1,040 | ) |

Accrued expenses and other liabilities | | | (2,856 | ) | | | (941 | ) |

Sales tax payable | | | (194 | ) | | | 26 | |

Deferred revenue | | | 2,783 | | | | 2,132 | |

Due to related party | | | (354 | ) | | | (275 | ) |

Other long-term liabilities | | | 153 | | | | 79 | |

Net cash provided by operating activities | | | 6,019 | | | | 9,731 | |

| | | | | | | | |

Cash flows from investing activities | | | | | | | | |

Purchases of equipment and software | | | (360 | ) | | | (358 | ) |

Purchases of short-term investments | | | (11,134 | ) | | | - | |

Redemption of short-term investments | | | 8,134 | | | | 154 | |

Net cash used in investing activities | | | (3,360 | ) | | | (204 | ) |

| | | | | | | | |

Cash flows from financing activities | | | | | | | | |

Payroll taxes paid by withholding shares | | | (1 | ) | | | - | |

Repayment of notes payable and finance lease obligations | | | (99 | ) | | | (125 | ) |

Net cash used in financing activities | | | (100 | ) | | | (125 | ) |

Effect of exchange rate differences on cash and cash equivalents | | | 19 | | | | 9 | |

| | | | | | | | |

NET INCREASE IN CASH AND CASH EQUIVALENTS | | | 2,578 | | | | 9,411 | |

Cash and cash equivalents - beginning of period | | | 11,821 | | | | 6,025 | |

Cash and cash equivalents - end of period | | $ | 14,399 | | | $ | 15,436 | |

| | | | | | | | |

SUPPLEMENTAL DISCLOSURE OF CASH INFORMATION | | | | | | | | |

Interest paid | | $ | 10 | | | $ | 29 | |

Income taxes paid | | $ | 23 | | | $ | 54 | |

| | | | | | | | |

SUPPLEMENTAL SCHEDULE OF NON-CASH INVESTING AND FINANCING ACTIVITIES | | | | | | | | |

Initial recognition of operating lease right of use asset and liability | | $ | 474 | | | $ | 1,072 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

Vaso Corporation and Subsidiaries

Notes to Condensed Consolidated Financial Statements (unaudited)

NOTE A - ORGANIZATION AND PLAN OF OPERATIONS

Vaso Corporation was incorporated in Delaware in July 1987. Unless the context requires otherwise, all references to “we”, “our”, “us”, “Company”, “registrant”, “Vaso” or “management” refer to Vaso Corporation and its subsidiaries.

Overview

Vaso Corporation principally operates in three distinct business segments in the healthcare and information technology (“IT”) industries. We manage and evaluate our operations, and report our financial results, through these three business segments.

| · | IT segment, operating through a wholly-owned subsidiary VasoTechnology, Inc., primarily focuses on healthcare IT and managed network technology services; |

| · | Professional sales service segment, operating through a wholly-owned subsidiary Vaso Diagnostics, Inc. d/b/a VasoHealthcare, primarily focuses on the sale of healthcare capital equipment for GE Healthcare (“GEHC”) into the healthcare provider middle market; and |

| · | Equipment segment, primarily focuses on the design, manufacture, sale and service of proprietary medical devices and software, operating through a wholly-owned subsidiary VasoMedical, Inc., which in turn operates through Vasomedical Solutions, Inc. for domestic business and Vasomedical Global Corp. for international business, respectively. |

VasoTechnology

VasoTechnology, Inc. was formed in May 2015, at the time the Company acquired all of the assets of NetWolves, LLC and its affiliates, including the membership interests in NetWolves Network Services, LLC (collectively, “NetWolves”). It currently consists of a managed network and security service division and a healthcare IT application VAR (value added reseller) division, VasoHealthcare IT. Its current offerings include:

| · | Managed radiology and imaging applications (channel partner of select vendors of healthcare IT products). |

| · | Managed network infrastructure (routers, switches and other core equipment). |

| · | Managed network transport (FCC licensed carrier reselling over 175 facility partners). |

| · | Managed security services. |

VasoTechnology uses a combination of proprietary technology, methodology and third-party applications to deliver its value proposition.

VasoHealthcare

VasoHealthcare commenced operations in 2010, in conjunction with the Company’s execution of its exclusive sales representation agreement (“GEHC Agreement”) with GEHC to further the sale of certain healthcare capital equipment in the healthcare provider middle market. Sales of GEHC equipment by the Company have grown significantly since then.

VasoHealthcare’s current offerings consist of:

| · | GEHC diagnostic imaging capital equipment and ultrasound systems. |

| · | GEHC service agreements for the above equipment. |

| · | GEHC training services for use of the above equipment. |

| · | GEHC and third-party financial services. |

Vaso Corporation and Subsidiaries

Notes to Condensed Consolidated Financial Statements (unaudited)

VasoMedical

VasoMedical is the Company’s business division for its proprietary medical device operations, including the design, development, manufacturing, sales and service of various medical devices in the domestic and international markets and includes the Vasomedical Global and Vasomedical Solutions business units. These devices are primarily for cardiovascular monitoring and diagnostic systems. Its current offerings consist of:

| · | Biox™ series Holter monitors and ambulatory blood pressure recorders. |

| · | ARCS® series analysis, reporting and communication software for ECG and blood pressure signals. |

| · | MobiCare® multi-parameter wireless vital-sign monitoring system. |

| · | EECP® therapy systems for non-invasive, outpatient treatment of ischemic heart disease. |

This segment uses its extensive cardiovascular device knowledge coupled with its significant engineering resources to cost-effectively create and market its proprietary technology. It works with a global distribution network of channel partners to sell its products. It also provides engineering and OEM services to other medical device companies.

NOTE B – INTERIM STATEMENT PRESENTATION

Basis of Presentation and Use of Estimates

The accompanying condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America ("U.S. GAAP") and pursuant to the accounting and disclosure rules and regulations of the Securities and Exchange Commission (the "SEC") for interim financial information. Certain information and disclosures normally included in the financial statements prepared in accordance with U.S. GAAP have been condensed or omitted pursuant to such rules and regulations. Accordingly, these condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements and related notes thereto included in the Company's Annual Report on Form 10-K for the year ended December 31, 2022, as filed with the SEC on March 31, 2023.

These unaudited condensed consolidated financial statements include the accounts of the companies over which we exercise control. In the opinion of management, the accompanying condensed consolidated financial statements reflect all adjustments (consisting of normal recurring adjustments) considered necessary for a fair presentation of interim results for the Company. The results of operations for any interim period are not necessarily indicative of results to be expected for any other interim period or the full year.

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities as of the date of the condensed consolidated financial statements, the disclosure of contingent assets and liabilities in the unaudited condensed consolidated financial statements and the accompanying notes, and the reported amounts of revenues, expenses and cash flows during the periods presented. Actual amounts and results could differ from those estimates. The estimates and assumptions the Company makes are based on historical factors, current circumstances and the experience and judgment of the Company's management. The Company evaluates its estimates and assumptions on an ongoing basis.

Vaso Corporation and Subsidiaries

Notes to Condensed Consolidated Financial Statements (unaudited)

NOTE C – REVENUE RECOGNITION

Disaggregation of Revenue

The following tables present revenues disaggregated by our business operations and timing of revenue recognition:

| (in thousands) |

| |

| | Three Months Ended June 30, 2023 | | | Three Months Ended June 30, 2022 | |

| | | | | Professional sales | | | | | | | | | | | | Professional sales | | | | | | | |

| | IT segment | | | service segment | | | Equipment segment | | | Total | | | IT segment | | | service segment | | | Equipment segment | | | Total | |

Network services | | $ | 8,946 | | | $ | - | | | $ | - | | | $ | 8,946 | | | $ | 8,890 | | | $ | - | | | $ | - | | | $ | 8,890 | |

Software sales and support | | | 1,489 | | | | - | | | | - | | | | 1,489 | | | | 1,129 | | | | - | | | | - | | | | 1,129 | |

Commissions | | | - | | | | 9,254 | | | | - | | | | 9,254 | | | | - | | | | 8,854 | | | | - | | | | 8,854 | |

Medical equipment sales | | | - | | | | - | | | | 716 | | | | 716 | | | | - | | | | - | | | | 597 | | | | 597 | |

Medical equipment service | | | - | | | | - | | | | 32 | | | | 32 | | | | - | | | | - | | | | 32 | | | | 32 | |

| | $ | 10,435 | | | $ | 9,254 | | | $ | 748 | | | $ | 20,437 | | | $ | 10,019 | | | $ | 8,854 | | | $ | 629 | | | $ | 19,502 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six Months Ended June 30, 2023 | | | Six Months Ended June 30, 2022 | |

| | | | | | Professional sales | | | | | | | | | | | | | | Professional sales | | | | | | | | |

| | IT segment | | | service segment | | | Equipment segment | | | Total | | | IT segment | | | service segment | | | Equipment segment | | | Total | |

Network services | | $ | 17,984 | | | $ | - | | | $ | - | | | $ | 17,984 | | | $ | 17,919 | | | $ | - | | | $ | - | | | $ | 17,919 | |

Software sales and support | | | 2,725 | | | | - | | | | - | | | | 2,725 | | | | 2,103 | | | | - | | | | - | | | | 2,103 | |

Commissions | | | - | | | | 17,564 | | | | - | | | | 17,564 | | | | - | | | | 15,461 | | | | - | | | | 15,461 | |

Medical equipment sales | | | - | | | | - | | | | 1,322 | | | | 1,322 | | | | - | | | | - | | | | 967 | | | | 967 | |

Medical equipment service | | | - | | | | - | | | | 63 | | | | 63 | | | | - | | | | - | | | | 62 | | | | 62 | |

| | $ | 20,709 | | | $ | 17,564 | | | $ | 1,385 | | | $ | 39,658 | | | $ | 20,022 | | | $ | 15,461 | | | $ | 1,029 | | | $ | 36,512 | |

| | Three Months Ended June 30, 2023 | | | Three Months Ended June 30, 2022 | |

| | | | | Professional sales | | | | | | | | | | | | Professional sales | | | | | | | |

| | IT segment | | | service segment | | | Equipment segment | | | Total | | | IT segment | | | service segment | | | Equipment segment | | | Total | |

Revenue recognized over time | | $ | 9,357 | | | $ | - | | | $ | 131 | | | $ | 9,488 | | | $ | 9,075 | | | $ | - | | | $ | 84 | | | $ | 9,159 | |

Revenue recognized at a point in time | | | 1,078 | | | | 9,254 | | | | 617 | | | | 10,949 | | | | 944 | | | | 8,854 | | | | 545 | | | | 10,343 | |

| | $ | 10,435 | | | $ | 9,254 | | | $ | 748 | | | $ | 20,437 | | | $ | 10,019 | | | $ | 8,854 | | | $ | 629 | | | $ | 19,502 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six Months Ended June 30, 2023 | | | Six Months Ended June 30, 2022 | |

| | | | | | Professional sales | | | | | | | | | | | | | | Professional sales | | | | | | | | |

| | IT segment | | | service segment | | | Equipment segment | | | Total | | | IT segment | | | service segment | | | Equipment segment | | | Total | |

Revenue recognized over time | | $ | 18,878 | | | $ | - | | | $ | 241 | | | $ | 19,119 | | | $ | 18,309 | | | $ | - | | | $ | 148 | | | $ | 18,457 | |

Revenue recognized at a point in time | | | 1,831 | | | | 17,564 | | | | 1,144 | | | | 20,539 | | | | 1,713 | | | | 15,461 | | | | 881 | | | | 18,055 | |

| | $ | 20,709 | | | $ | 17,564 | | | $ | 1,385 | | | $ | 39,658 | | | $ | 20,022 | | | $ | 15,461 | | | $ | 1,029 | | | $ | 36,512 | |

Transaction Price Allocated to Remaining Performance Obligations

As of June 30, 2023, the aggregate amount of transaction price allocated to performance obligations that are unsatisfied (or partially unsatisfied) for executed contracts approximates $98.6 million, of which we expect to recognize revenue as follows:

| | (in thousands) | |

| | | |

| | Fiscal years of revenue recognition | |

| | 2023 | | | 2024 | | | 2025 | | | Thereafter | |

Unfulfilled performance obligations | | $ | 24,935 | | | $ | 31,497 | | | $ | 12,648 | | | $ | 29,553 | |

Vaso Corporation and Subsidiaries

Notes to Condensed Consolidated Financial Statements (unaudited)

Contract Liabilities

Contract liabilities arise in our healthcare IT, VasoHealthcare, and VasoMedical businesses. In our healthcare IT business, payment arrangements with clients typically include an initial payment due upon contract signing and milestone-based payments based upon product delivery and go-live, as well as post go-live monthly payments for subscription and support fees. Customer payments received, or receivables recorded, in advance of go-live and customer acceptance, where applicable, are deferred as contract liabilities. Such amounts aggregated approximately $379,000 and $481,000 at June 30, 2023 and December 31, 2022, respectively, and are included in accrued expenses and other liabilities in our condensed consolidated balance sheets.

In our VasoHealthcare business, we bill amounts for certain milestones in advance of customer acceptance of the underlying equipment. Such amounts aggregated approximately $33,578,000 and $30,794,000 at June 30, 2023 and December 31, 2022, respectively, and are classified in our condensed consolidated balance sheets as either current or long-term deferred revenue. In addition, we record a contract liability for amounts expected to be repaid to GEHC due to customer order reductions. Such amounts aggregated approximately $1,124,000 and $2,577,000 at June 30, 2023 and December 31, 2022, respectively, and are included in accrued expenses and other liabilities in our condensed consolidated balance sheets.

In our VasoMedical business, we bill amounts for post-delivery services and varying duration service contracts in advance of performance. Such amounts aggregated approximately $8,000 and $9,000 at June 30, 2023 and December 31, 2022, respectively, and are classified in our condensed consolidated balance sheets as either current or long-term deferred revenue.

During the three and six months ended June 30, 2023, we recognized approximately $3.4 million and $5.6 million of revenues, respectively, that were included in our contract liability balance at April 1, 2023 and January 1, 2023, respectively.

The following table summarizes the Company’s contract receivable and contract liability balances:

| | 2023 | | | 2022 | |

Contract receivables - January 1 | | | 16,316 | | | | 15,761 | |

Contract receivables - June 30 | | | 10,541 | | | | 7,171 | |

Increase (decrease) | | | (5,775 | ) | | | (8,590 | ) |

| | | | | | | | |

Contract liabilities - January 1 | | | 33,861 | | | | 26,890 | |

Contract liabilities - June 30 | | | 35,090 | | | | 30,012 | |

Increase (decrease) | | | 1,229 | | | | 3,122 | |

The decrease in contract receivables in the first halves of 2023 and 2022 was due primarily to collections exceeding billings.

NOTE D – SEGMENT REPORTING AND CONCENTRATIONS

Vaso Corporation principally operates in three distinct business segments in the healthcare and information technology industries. We manage and evaluate our operations, and report our financial results, through these three reportable segments.

| · | IT segment, operating through a wholly-owned subsidiary VasoTechnology, Inc., primarily focuses on healthcare IT and managed network technology services; |

| | |

| · | Professional sales service segment, operating through a wholly-owned subsidiary Vaso Diagnostics, Inc. d/b/a VasoHealthcare, primarily focuses on the sale of healthcare capital equipment for GEHC into the healthcare provider middle market; and |

| | |

| · | Equipment segment, operating through a wholly-owned subsidiary VasoMedical, Inc., primarily focuses on the design, manufacture, sale and service of proprietary medical devices. |

Vaso Corporation and Subsidiaries

Notes to Condensed Consolidated Financial Statements (unaudited)

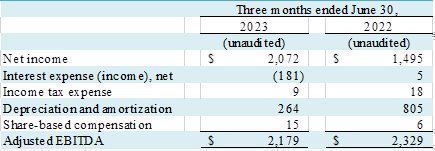

The chief operating decision maker is the Company’s Chief Executive Officer, who, in conjunction with upper management, evaluates segment performance based on operating income and adjusted EBITDA (net income (loss), plus interest expense (income), net; tax expense; depreciation and amortization; and non-cash stock-based compensation). Administrative functions such as finance, human resources, and information technology are centralized and related expenses allocated to each segment. Other costs not directly attributable to operating segments, such as audit, legal, director fees, investor relations, and others, as well as certain assets – primarily cash balances – are reported in the Corporate entity below. There are no intersegment revenues. Summary financial information for the segments is set forth below:

| (in thousands) | |

| | | | | |

| Three months ended June 30, | | | Six months ended June 30, | |

| 2023 | | | 2022 | | | 2023 | | | 2022 | |

Revenues from external customers | | | | | | | | | | | |

IT | | $ | 10,435 | | | $ | 10,019 | | | $ | 20,709 | | | $ | 20,022 | |

Professional sales service | | | 9,254 | | | | 8,854 | | | | 17,564 | | | | 15,461 | |

Equipment | | | 748 | | | | 629 | | | | 1,385 | | | | 1,029 | |

Total revenues | | $ | 20,437 | | | $ | 19,502 | | | $ | 39,658 | | | $ | 36,512 | |

| | | | | | | | | | | | | | | | |

Gross Profit | | | | | | | | | | | | | | | | |

IT | | $ | 4,742 | | | $ | 3,677 | | | $ | 9,182 | | | $ | 7,811 | |

Professional sales service | | | 7,488 | | | | 7,180 | | | | 14,279 | | | | 12,486 | |

Equipment | | | 557 | | | | 479 | | | | 1,036 | | | | 808 | |

Total gross profit | | $ | 12,787 | | | $ | 11,336 | | | $ | 24,497 | | | $ | 21,105 | |

| | | | | | | | | | | | | | | | |

Operating income (loss) | | | | | | | | | | | | | | | | |

IT | | $ | 163 | | | $ | (918 | ) | | $ | 53 | | | $ | (1,057 | ) |

Professional sales service | | | 2,149 | | | | 2,754 | | | | 3,136 | | | | 2,990 | |

Equipment | | | (106 | ) | | | (77 | ) | | | (131 | ) | | | (156 | ) |

Corporate | | | (298 | ) | | | (197 | ) | | | (740 | ) | | | (570 | ) |

Total operating income | | $ | 1,908 | | | $ | 1,562 | | | $ | 2,318 | | | $ | 1,207 | |

| | | | | | | | | | | | | | | | |

Depreciation and amortization | | | | | | | | | | | | | | | | |

IT | | $ | 236 | | | $ | 729 | | | $ | 482 | | | $ | 1,104 | |

Professional sales service | | | 21 | | | | 11 | | | | 41 | | | | 22 | |

Equipment | | | 7 | | | | 65 | | | | 14 | | | | 132 | |

Corporate | | | - | | | | - | | | | - | | | | - | |

Total depreciation and amortization | | $ | 264 | | | $ | 805 | | | $ | 537 | | | $ | 1,258 | |

| | | | | | | | | | | | | | | | |

Capital expenditures | | | | | | | | | | | | | | | | |

IT | | $ | 137 | | | $ | 145 | | | $ | 222 | | | $ | 296 | |

Professional sales service | | | 2 | | | | 7 | | | | 52 | | | | 40 | |

Equipment | | | 73 | | | | 11 | | | | 86 | | | | 21 | |

Corporate | | | - | | | | - | | | | - | | | | 1 | |

Total cash capital expenditures | | $ | 212 | | | $ | 163 | | | $ | 360 | | | $ | 358 | |

| | (in thousands) | |

| | | | | | |

| | June 30, 2023 | | | December 31, 2022 | |

Identifiable Assets | | | | | | |

IT | | $ | 22,386 | | | $ | 22,201 | |

Professional sales service | | | 16,356 | | | | 21,684 | |

Equipment | | | 6,564 | | | | 6,957 | |

Corporate | | | 28,270 | | | | 21,813 | |

Total assets | | $ | 73,576 | | | $ | 72,656 | |

GE Healthcare accounted for 45% of revenue for both of the three-month periods ended June 30, 2023 and 2022, and 44% and 42% of revenue for the six-month periods ended June 30, 2023 and 2022, respectively. GE Healthcare also accounted for $6.8 million or 72%, and $12.8 million or 83%, of accounts and other receivables at June 30, 2023 and December 31, 2022, respectively. No other customer accounted for 10% or more of revenue.

Vaso Corporation and Subsidiaries

Notes to Condensed Consolidated Financial Statements (unaudited)

NOTE E –NET INCOME PER COMMON SHARE

Basic earnings per common share is based on the weighted average number of common shares outstanding, including vested restricted shares, without consideration of potential common stock. Diluted earnings per common share is based on the weighted average number of common and potential dilutive common shares outstanding.

Diluted earnings per share were computed based on the weighted average number of shares outstanding plus all potentially dilutive common shares. A reconciliation of basic to diluted shares used in the earnings per share calculation is as follows:

| | (in thousands) |

| | Three months ended June 30, | | | Six months ended June 30, | |

| | 2023 | | | 2022 | | | 2023 | | | 2022 | |

Basic weighted average shares outstanding | | | 174,159 | | | | 172,858 | | | | 173,895 | | | | 172,594 | |

Dilutive effect of unvested restricted shares | | | 961 | | | | 1,201 | | | | 1,267 | | | | 601 | |

Diluted weighted average shares outstanding | | | 175,120 | | | | 174,059 | | | | 175,162 | | | | 173,195 | |

The following table represents common stock equivalents that were excluded from the computation of diluted earnings per share for the three and six months ended June 30, 2023 and 2022, because the effect of their inclusion would be anti-dilutive.

| | (in thousands) | |

| | Three months ended June 30, | | | Six months ended June 30, | |

| | 2023 | | | 2022 | | | 2023 | | | 2022 | |

Restricted common stock grants | | | - | | | | 2 | | | | - | | | | 2,249 | |

NOTE F – SHORT-TERM INVESTMENTS AND FINANCIAL INSTRUMENTS

The Company's short-term investments consist of bank deposits with yields based on underlying debt and equity securities and six-month US Treasury bills. The bank deposits are carried at fair value of approximately $413,000 and $433,000 at June 30, 2023 and December 31, 2022, respectively, and are classified as available-for-sale. Realized gains or losses on the bank deposits are included in net income. The US Treasury bills are classified as held-to-maturity and are carried at amortized cost of approximately $11,261,000 and $8,071,000 at June 30, 2023 and December 31, 2022, respectively. Their fair value at June 30, 2023 and December 31, 2022 is approximately $11,257,000 and $8,064,000, respectively, and the unrecognized holding (loss) gain is $(8,000) and $4,000 for the three and six months ended June 30, 2023, respectively. The Company does not expect a credit loss for its short-term investments.

Cash and cash equivalents represent cash and short-term, highly liquid investments either in certificates of deposit, treasury bills, money market funds, or investment grade commercial paper issued by major corporations and financial institutions that generally have maturities of three months or less from the date of acquisition.

The Company complies with the provisions of ASC 820 “Fair Value Measurements and Disclosures” (“ASC 820”). Under ASC 820, fair value is defined as the price that would be received to sell an asset or paid to transfer a liability (i.e., the “exit price”) in an orderly transaction between market participants at the measurement date.

In determining fair value, the Company uses various valuation approaches. ASC 820 establishes a fair value hierarchy for inputs used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that the most observable inputs be used when available. Observable inputs are those that market participants would use in pricing the asset or liability based on market data obtained from sources independent of the Company. Unobservable inputs reflect the Company’s assumptions about the inputs market participants would use in pricing the asset or liability developed based on the best information available in the circumstances. The fair value hierarchy is categorized into three levels based on the inputs as follows:

Vaso Corporation and Subsidiaries

Notes to Condensed Consolidated Financial Statements (unaudited)

Level 1

Level 1 applies to assets or liabilities for which there are quoted prices in active markets for identical assets or liabilities.

Level 2

Level 2 applies to assets or liabilities for which there are inputs other than quoted prices that are observable for the asset or liability such as quoted prices for similar assets or liabilities in active markets; quoted prices for identical assets or liabilities in markets with insufficient volume or infrequent transactions (less active markets); or model-derived valuations in which significant inputs are observable or can be derived principally from, or corroborated by, observable market data.

Level 3

Level 3 applies to assets or liabilities for which there are unobservable inputs to the valuation methodology that are significant to the measurement of the fair value of the assets or liabilities.

The carrying amount of assets and liabilities including cash and cash equivalents, short-term investments, accounts receivable, prepaids, accounts payable, accrued expenses and other current liabilities approximated their fair value as of June 30, 2023 and December 31, 2022, due to the relative short maturity of these instruments. Property and equipment, intangible assets, capital lease obligations, and goodwill are not required to be re-measured to fair value on a recurring basis. These assets are evaluated for impairment if certain triggering events occur. If such evaluation indicates that impairment exists, the respective asset is written down to its fair value.

Vaso Corporation and Subsidiaries

Notes to Condensed Consolidated Financial Statements (unaudited)

The following table presents information about the Company’s assets measured at fair value as of June 30, 2023 and December 31, 2022:

| | (in thousands) | |

| | Quoted Prices | | | Significant | | | | | | | |

| | in Active | | | Other | | | Significant | | | Balance | |

| | Markets for | | | Observable | | | Unobservable | | | as of | |

| | Identical Assets | | | Inputs | | | Inputs | | | June 30, | |

| | (Level 1) | | | (Level 2) | | | (Level 3) | | | 2023 | |

Assets | | | | | | | | | | | | |

Cash equivalents invested in money market funds | | $ | 11,660 | | | $ | - | | | $ | - | | | $ | 11,660 | |

Bank deposits (included in short term investments) | | | 413 | | | | | | | | | | | | 413 | |

| | $ | 12,073 | | | $ | - | | | $ | - | | | $ | 12,073 | |

| | | | | | | | | | | | | | | | |

| | Quoted Prices | | | Significant | | | | | | | | | |

| | in Active | | | Other | | | Significant | | | Balance | |

| | Markets for | | | Observable | | | Unobservable | | | as of | |

| | Identical Assets | | | Inputs | | | Inputs | | | December 31, | |

| | (Level 1) | | | (Level 2) | | | (Level 3) | | | 2022 | |

Assets | | | | | | | | | | | | | | | | |

Cash equivalents invested in money market funds | | $ | 7,934 | | | $ | - | | | $ | - | | | $ | 7,934 | |

Bank deposits (included in short term investments) | | | 433 | | | | | | | | | | | | 433 | |

| | $ | 8,367 | | | $ | - | | | $ | - | | | $ | 8,367 | |

NOTE G – ACCOUNTS AND OTHER RECEIVABLES, NET

The following table presents information regarding the Company’s accounts and other receivables as of June 30, 2023 and December 31, 2022:

| | (in thousands) | |

| | June 30, 2023 | | | December 31, 2022 | |

Trade receivables | | $ | 14,885 | | | $ | 22,471 | |

Unbilled receivables | | | 2,131 | | | | - | |

Allowance for credit losses and commission adjustments | | | (7,526 | ) | | | (6,947 | ) |

Accounts and other receivables, net | | $ | 9,490 | | | $ | 15,524 | |

Contract receivables under Topic 606 consist of trade receivables and unbilled receivables. Trade receivables include amounts due for shipped products and services rendered. Unbilled receivables represent variable consideration recognized in accordance with Topic 606 but not yet billable. Amounts recorded – billed and unbilled - under the GEHC Agreement are subject to adjustment in subsequent periods should the underlying sales order amount, upon which the receivable is based, change.

Allowance for doubtful accounts and commission adjustments include estimated losses resulting from the inability of our customers to make required payments, and adjustments arising from subsequent changes in sales order amounts that may reduce the amount the Company will ultimately receive under the GEHC Agreement.

Vaso Corporation and Subsidiaries

Notes to Condensed Consolidated Financial Statements (unaudited)

NOTE G – INVENTORIES, NET

Inventories, net of reserves, consist of the following:

| | (in thousands) | |

| | June 30, 2023 | | | December 31, 2022 | |

Raw materials | | $ | 810 | | | $ | 751 | |

Work in process | | | 35 | | | | 6 | |

Finished goods | | | 696 | | | | 716 | |

| | $ | 1,541 | | | $ | 1,473 | |

The Company maintained reserves for slow moving inventories of $163,000 at June 30, 2023 and December 31, 2022.

NOTE H – GOODWILL AND OTHER INTANGIBLES

Goodwill of $14,375,000 is allocated to the IT segment. The remaining $1,183,000 of goodwill is attributable to the FGE reporting unit within the Equipment segment. The NetWolves and FGE reporting units had negative net asset carrying amounts at June 30, 2023 and December 31, 2022. The components of the change in goodwill are as follows:

| | (in thousands) | |

| | Six months ended | | | Year ended | |

| | June 30, 2023 | | | December 31, 2022 | |

Beginning of period | | $ | 15,614 | | | $ | 15,722 | |

Foreign currency translation adjustment | | | (56 | ) | | | (108 | ) |

End of period | | $ | 15,558 | | | $ | 15,614 | |

The Company’s other intangible assets consist of capitalized customer-related intangibles, patent and technology costs, and software costs, as set forth in the following:

| | (in thousands) | |

| | June 30, 2023 | | | December 31, 2022 | |

Customer-related | | | | | | |

Costs | | $ | 5,831 | | | $ | 5,831 | |

Accumulated amortization | | | (4,674 | ) | | | (4,557 | ) |

| | | 1,157 | | | | 1,274 | |

| | | | | | | | |

Patents and Technology | | | | | | | | |

Costs | | | 1,894 | | | | 1,894 | |

Accumulated amortization | | | (1,894 | ) | | | (1,894 | ) |

| | | | | | | | |

Software | | | | | | | | |

Costs | | | 2,431 | | | | 2,362 | |

Accumulated amortization | | | (2,188 | ) | | | (2,125 | ) |

| | | 243 | | | | 237 | |

| | | | | | | | |

| | $ | 1,400 | | | $ | 1,511 | |

Patents and technology are amortized on a straight-line basis over their estimated useful lives of ten and eight years, respectively. The cost of significant customer-related intangibles is amortized in proportion to estimated total related revenue; cost of other customer-related intangible assets is amortized on a straight-line basis over the asset's estimated economic life of seven years. Software costs are amortized on a straight-line basis over its expected useful life of five years.

Vaso Corporation and Subsidiaries

Notes to Condensed Consolidated Financial Statements (unaudited)

Amortization expense amounted to $90,000 and $164,000 for the three months ended June 30, 2023 and 2022, respectively and $180,000 and $315,000 for the six months ended June 30, 2023 and 2022, respectively.

Amortization of intangibles for the next five years is:

| | (in thousands) | |

Years ending December 31, | | | |

Remainder of 2023 | | | 167 | |

2024 | | | 287 | |

2025 | | | 217 | |

2026 | | | 161 | |

2027 | | | 568 | |

| | $ | 1,400 | |

NOTE I – OTHER ASSETS, NET

Other assets, net consist of the following at June 30, 2023 and December 31, 2022:

| | (in thousands) | |

| | June 30, 2023 | | | December 31, 2022 | |

Deferred commission expense - noncurrent | | $ | 3,799 | | | $ | 3,864 | |

Trade receivables - noncurrent | | | 1,052 | | | | 792 | |

Other, net of allowance for loss on loan receivable of $412 at June 30, 2023 and December 31, 2022 | | | 85 | | | | 70 | |

| | $ | 4,936 | | | $ | 4,726 | |

NOTE J – ACCRUED EXPENSES AND OTHER LIABILITIES

Accrued expenses and other liabilities consist of the following at June 30, 2023 and December 31, 2022:

| | (in thousands) | |

| | June 30, 2023 | | | December 31, 2022 | |

Accrued compensation | | $ | 1,452 | | | $ | 2,652 | |

Accrued expenses - other | | | 1,594 | | | | 2,012 | |

Order reduction liability | | | 1,124 | | | | 2,577 | |

Other liabilities | | | 1,952 | | | | 1,650 | |

| | $ | 6,122 | | | $ | 8,891 | |

Vaso Corporation and Subsidiaries

Notes to Condensed Consolidated Financial Statements (unaudited)

NOTE K - DEFERRED REVENUE

The changes in the Company’s deferred revenues are as follows:

| | (in thousands) |

| | Three months ended June 30, | | | Six months ended June 30, | |

| | 2023 | | | 2022 | | | 2023 | | | 2022 | |

Deferred revenue at beginning of period | | $ | 31,553 | | | $ | 26,954 | | | $ | 30,803 | | | $ | 24,965 | |

Net additions: | | | | | | | | | | | | | | | | |

Deferred extended service contracts | | | - | | | | - | | | | 2 | | | | - | |

Deferred commission revenues | | | 5,467 | | | | 3,575 | | | | 9,482 | | | | 8,267 | |

Recognized as revenue: | | | | | | | | | | | | | | | | |

Deferred extended service contracts | | | (1 | ) | | | (1 | ) | | | (2 | ) | | | (3 | ) |

Deferred commission revenues | | | (3,433 | ) | | | (3,431 | ) | | | (6,699 | ) | | | (6,132 | ) |

Deferred revenue at end of period | | | 33,586 | | | | 27,097 | | | | 33,586 | | | | 27,097 | |

Less: current portion | | | 16,859 | | | | 18,583 | | | | 16,859 | | | | 18,583 | |

Long-term deferred revenue at end of period | | $ | 16,727 | | | $ | 8,514 | | | $ | 16,727 | | | $ | 8,514 | |

NOTE L – RELATED-PARTY TRANSACTIONS

The Company uses the equity method to account for its interest in EECP Global as it has the ability to exercise significant influence over the entity and reports its share of EECP Global operations in Other Income (Expense) on its condensed consolidated statements of operations. For the three months ended June 30, 2023 and 2022, the Company’s share of EECP Global’s loss was approximately $47,000 and $71,000, respectively, and for the six months ended June 30, 2023 and 2022, the Company’s share of EECP Global’s loss was approximately $125,000 and $55,000, respectively, and included in Other (Expense) Income in its condensed consolidated statements of operations. At June 30, 2023 and December 31, 2022 the Company recorded a net receivable from related parties of approximately $757,000 and $403,000, respectively, on its condensed consolidated balance sheet for amounts due from EECP Global for fees and cost reimbursements net of amounts due to EECP Global for receivables collected on its behalf.

NOTE M – COMMITMENTS AND CONTINGENCIES

Litigation

The Company is currently, and has been in the past, a party to various legal proceedings, primarily employee related matters, incident to its business. The Company believes that the outcome of all pending legal proceedings in the aggregate is unlikely to have a material adverse effect on the business or consolidated financial condition of the Company.

Sales Representation Agreement

In October 2021, the Company concluded an amendment of the GEHC Agreement with GEHC, originally signed on May 19, 2010 and previously extended in 2012, 2015 and 2017. The amendment extended the term of the original agreement, which began on July 1, 2010, through December 31, 2026, subject to early termination by GEHC without cause with certain conditions. Under the agreement, VasoHealthcare is the exclusive representative for the sale of select GEHC diagnostic imaging products to specific market accounts in the 48 contiguous states of the United States and the District of Columbia. The circumstances under which early termination of the agreement may occur with cause include: not materially achieving certain sales goals, not maintaining a minimum number of sales representatives, and not meeting various legal and GEHC policy requirements.

Vaso Corporation and Subsidiaries

Notes to Condensed Consolidated Financial Statements (unaudited)

Employment Agreements

On May 10, 2019, the Company modified its Employment Agreement with its President and Chief Executive Officer, Dr. Jun Ma, to provide for a five-year term with extensions, unless earlier terminated by the Company, but in no event can it extend beyond May 31, 2026. The Employment Agreement provides for annual compensation of $500,000. Dr. Ma shall be eligible to receive a bonus for each fiscal year during the employment term. The amount and the occasion for payment of such bonus, if any, shall be at the discretion of the Board of Directors. Dr. Ma shall also be eligible for an award under any long-term incentive compensation plan and grants of options and awards of shares of the Company's stock, as determined at the Board of Directors' discretion. The Employment Agreement further provides for reimbursement of certain expenses, and certain severance benefits in the event of termination prior to the expiration date of the Employment Agreement.

On December 31, 2022, the Company executed an Employment Agreement with the President of its VasoHealthcare subsidiary, Ms. Jane Moen, to provide for a twenty-seven month initial term with extensions, unless earlier terminated by the Company, but in no event can it extend beyond December 31, 2026 or the earlier termination of the GEHC Agreement. The Employment Agreement provides for annual base compensation of $350,000. Ms. Moen shall be eligible to receive bonuses for each fiscal year during the employment term. The amount and the occasion for payment of such bonuses, if any, shall be based on employment status as well as achieving certain operating targets. Ms. Moen shall also be eligible for an award under any long-term incentive compensation plan and grants of options and awards of shares of the Company’s stock, as determined at the Board of Directors’ discretion. The Employment Agreement further provides for reimbursement of certain expenses, and certain severance benefits in the event of termination prior to the expiration date of the Employment Agreement.

Vaso Corporation and Subsidiaries

ITEM 2 - MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Except for historical information contained in this report, the matters discussed are forward-looking statements that involve risks and uncertainties. When used in this report, words such as “anticipates”, “believes”, “could”, “estimates”, “expects”, “may”, “plans”, “potential” and “intends” and similar expressions, as they relate to the Company or its management, identify forward-looking statements. Such forward-looking statements are based on the beliefs of the Company’s management, as well as assumptions made by and information currently available to the Company’s management. Among the factors that could cause actual results to differ materially are the following: the effect of business and economic conditions, including the current COVID-19 pandemic which has already adversely affected operating results; the effect of the dramatic changes taking place in IT and healthcare; the impact of competitive procedures and products and their pricing; medical insurance reimbursement policies; unexpected manufacturing or supplier problems; unforeseen difficulties and delays in product development programs; the actions of regulatory authorities and third-party payers in the United States and overseas; continuation of the GEHC agreement and the risk factors reported from time to time in the Company’s SEC reports, including its recent report on Form 10-K. The Company undertakes no obligation to update forward-looking statements as a result of future events or developments.

Unless the context requires otherwise, all references to “we”, “our”, “us”, “Company”, “registrant”, “Vaso” or “management” refer to Vaso Corporation and its subsidiaries.

General Overview

COVID-19 Pandemic

The COVID-19 pandemic has had a significant impact on economies of the United States and the world, and it is possible that some negative impact to the Company’s financial condition and results of operations may continue. The pandemic caused workforce and travel restrictions and created business disruptions in supply chain, production and demand across many business sectors, and we have experienced negative impact in the recurring revenue business in our IT segment as some of our customers have been adversely affected by the shutdown, and new business in this segment appears to be slower as well. In addition, revenues in our China operations were adversely affected by its government’s lockdown policies, which have only recently been reversed.

Our Business Segments

Vaso Corporation (“Vaso”) was incorporated in Delaware in July 1987. We principally operate in three distinct business segments in the healthcare and information technology industries. We manage and evaluate our operations, and report our financial results, through these three business segments.

| · | IT segment, operating through a wholly-owned subsidiary VasoTechnology, Inc., primarily focuses on healthcare IT and managed network technology services; |

| | |

| · | Professional sales service segment, operating through a wholly-owned subsidiary Vaso Diagnostics, Inc. d/b/a VasoHealthcare, primarily focuses on the sale of healthcare capital equipment for GEHC into the healthcare provider middle market; and |

| | |

| · | Equipment segment, primarily focuses on the design, manufacture, sale and service of proprietary medical devices and software, operating through a wholly-owned subsidiary VasoMedical, Inc., which in turn operates through Vasomedical Solutions, Inc. for domestic business and Vasomedical Global Corp. for international business, respectively. |

Vaso Corporation and Subsidiaries

Critical Accounting Policies and Estimates

Our discussion and analysis of our financial condition and results of operations are based upon the accompanying unaudited condensed consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”). The preparation of financial statements in conformity with U.S. GAAP requires management to make judgments, estimates and assumptions that affect the reported amounts of assets, liabilities, revenue, expenses, and the related disclosures at the date of the financial statements and during the reporting period. Although these estimates are based on our knowledge of current events, our actual amounts and results could differ from those estimates. The estimates made are based on historical factors, current circumstances, and the experience and judgment of our management, who continually evaluate the judgments, estimates and assumptions and may employ outside experts to assist in the evaluations.

Certain of our accounting policies are deemed “critical”, as they are both most important to the financial statement presentation and require management’s most difficult, subjective or complex judgments as a result of the need to make estimates about the effect of matters that are inherently uncertain. For a discussion of our critical accounting policies, see Note B to the condensed consolidated financial statements and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the year ended December 31, 2022 as filed with the SEC on March 31, 2023.

Results of Operations – For the Three Months Ended June 30, 2023 and 2022

Revenues

Total revenue for the three months ended June 30, 2023 and 2022 was $20,437,000 and $19,502,000, respectively, representing an increase of $935,000, or 5% year-over-year. On a segment basis, revenue in the IT, professional sales services, and equipment segments increased $416,000, $400,000, and $119,000, respectively.