0000897078

false

0000897078

2023-08-01

2023-08-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): August 1, 2023

Resonate

Blends, Inc.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

000-21202 |

|

58-1588291 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification No.) |

26565

Agoura Road, Suite 200

Calabasas,

CA |

|

91302 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: 571-888-0009

(Former

name or former address, if changed since last report) |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act: None

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

SECTION

1 - REGISTRANT’S BUSINESS AND OPERATIONS

ITEM

1.01 - ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

On

August 1, 2023, we issued a Promissory Note to an accredited investor in the principal amount of $265,000. We received $250,000 from

the note after applying the original issue discount of $15,000 in the transaction. On August 9, 2023, we issued another Promissory Note

to an accredited investor in the principal amount of $55,000. We received $50,000 from the note after applying the original issue discount

of $5,000 in the transaction.

The

maturity date for repayment of the principal on the above notes is three months from issuance. There is no penalty or premium for prepayments,

but if we are in default, the interest rate is 18% per annum.

All

principal on the notes is convertible at the investors’ option into our common stock in the next funding round which, if it occurs,

is expected to be priced at approximately $.08 per share issued in a preferred stock with a 4% coupon with warrant coverage.

We

were required to issue a total of 762,500 shares of our common stock in connection with the notes as commitment shares.

The

issuance of the commitment shares and securities that may be issuable upon any conversion of the notes have not been registered under

the Securities Act of 1933, as amended, and therefore may not be offered or sold in the United States absent registration or an applicable

exemption from registration requirements. For these issuances, the Company relied on the exemption from federal registration under Section

4(a)(2) of the Act and/or Rule 506 promulgated thereunder, based on our belief that the offer and sale of such securities did not involve

a public offering.

The

foregoing description of the notes, and the transactions contemplated thereby does not purport to be complete and is subject to, and

qualified in its entirety by reference to, the full text of the notes, which are included in this Current Report as Exhibits 4.1 and

4.2 and are incorporated herein by reference.

SECTION

2 - FINANCIAL INFORMATION

Item

2.03 – Creation of a Direct Financial Obligation

The

information set forth in Items 1.01 is incorporated into this Item 2.03 by reference.

SECTION

9 – Financial Statements and Exhibits

Item

9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Resonate

Blends

| /s/ Geoffrey

Selzer |

|

| Geoffrey Selzer |

|

| Chief Executive Officer |

|

| Date: August 23, 2023 |

|

Exhibit

4.1

THIS

PROMISSORY NOTE HAS NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR ANY STATE SECURITIES LAWS AND THIS NOTE, THE

SECURITIES AND ANY INTEREST THEREIN MAY NOT BE OFFERED, SOLD, TRANSFERRED, PLEDGED OR OTHERWISE DISPOSED OF EXCEPT PURSUANT TO AN EFFECTIVE

REGISTRATION STATEMENT UNDER SUCH ACT OR SUCH LAWS OR AN EXEMPTION FROM REGISTRATION UNDER SUCH ACT AND SUCH LAWS, WHICH, IN THE OPINION

OF COUNSEL FOR THE LENDER, WHICH COUNSEL AND OPINION ARE REASONABLY SATISFACTORY TO COUNSEL FOR THIS COMPANY, IS AVAILABLE.

PROMISSORY

NOTE

Principal

Amount: $250,000

Original

Interest Discount: $15,000

Total

Note: $265,000 |

Effective

Date: August 1, 2023 |

FOR

VALUE RECEIVED, Resonate Blends, Inc., located at 26565 Agoura Road, Suite 200, Calabasas, CA 91302, (hereinafter referred to as “Borrower”),

promises to pay to the order of ___________________________________(hereinafter referred to as “Lender”), the principal sum

of $250,000, in lawful money of the United States of America, with interest thereon to be computed on the unpaid principal balance from

time to time outstanding at the Applicable Interest Rate (hereinafter defined) (all duties and obligations of Borrower pursuant to this

Note are hereinafter referred to as “Debt”).

1.

PAYMENT OPTIONS

Borrower

shall make payments due under this Promissory Note (“Note”) to Lender at the above captioned address, or such other address

as Lender shall designate in writing. Payments will be applied first to accrued interest, then unpaid fees, and then principal. All principal

and accrued interest shall be due and payable no later than the date three (3) months from the date of this Note (the “Maturity

Date”). All amounts due under this Note shall be payable without setoff, counterclaim or any other deduction whatsoever. The Borrower

can payoff this Note early with no prepayment penalties applied.

This

Note has a personal guarantee for the full principal amount to Resonate Blends, Inc. by Darshan Vyas, Principal of Pegasus. Resonate

Blends, Inc. in return will guarantee the Lender.

If

the Lender would rather convert this Note into KOAN common stock in lieu of a complete payoff:

Conversion

into Next Funding Round: The Lender can also choose to receive its payment in common stock of the Borrower. The Note will convert

into common stock into the next funding round expected to be priced at $.08 per share issued in a Series Preferred (“Pref”)

with a 4% coupon payable until the Pref is converted into common stock. A 2-year cash Warrant with 50% coverage priced at $.25 is also

available as part of this conversion. If the note is converted into the proposed financing at $.08, this would equal 3,312,500 shares

prior to any interest accrued from the Pref. If the financing terms are less than $.08, the Lender would also receive the lower price

on the note conversion.

2.

ORIGINAL INTEREST DISCOUNT (“OID”) & COMMITMENT SHARES

The

Lender shall receive an OID of $15,000 immediately at the signing of this Note. The new Note amount will have a $265,000

payoff or the Lender can convert the $265,000 note into the next financing round as outlined in Section 1 of this note.

Commitment

Shares: Lender shall receive 650,000 Commitment Shares issued at the signing of this Note for the $250,000 loan.

3.

PREPAYMENT

This

Note may be prepaid in whole at any time prior to the Maturity Date of this Note with all accrued interest due at the time of prepayment.

4.

DEFAULT AND ACCELERATION

A

breach under this Note shall constitute an “Event of Default.” So long as an Event of Default exists, Lender may, at its

option, without notice or demand to Borrower, declare the Debt immediately due and payable. All remedies hereunder and at law or in equity

shall be cumulative. In the event that it should become necessary to employ counsel to collect the Debt or to protect or foreclose the

security for the Debt or to defend against any claims asserted by Borrower under this Note, Borrower also agrees to pay to Lender all

costs of collection or defense incurred by Lender, including reasonable attorneys’ fees for the services of counsel whether or

not suit be brought. During the occurrence of an Event of Default, Borrower shall pay interest on the entire unpaid principal sum at

the rate equal to 18% per annum.

5.

SAVINGS CLAUSE

This

Note is subject to the express condition that at no time shall Borrower be obligated or required to pay interest on the principal balance

due hereunder at a rate which could subject Lender to either civil or criminal liability as a result of being in excess of the maximum

interest rate which Borrower is permitted by applicable law to contract or agree to pay. If by the terms of this Note, Borrower is at

any time required or obligated to pay interest on the principal balance due hereunder at a rate in excess of such maximum rate, the Applicable

Interest Rate or the Default Rate, as the case may be, shall be deemed to be immediately reduced to such maximum rate and all previous

payments in excess of the maximum rate shall be deemed to have been payments in reduction of principal and not on account of the interest

due hereunder. All sums paid or agreed to be paid to Lender for the use, forbearance, or detention of the Debt, shall, to the extent

permitted by applicable law, be amortized, prorated, allocated, and spread throughout the full stated term of this Note until payment

in full so that the rate or amount of interest on account of the Debt does not exceed the maximum lawful rate of interest from time to

time in effect and applicable to the Debt for so long as the Debt is outstanding. Notwithstanding anything to the contrary contained

herein, it is not the intention of Lender to accelerate the maturity of any interest that has not accrued at the time of such acceleration

or to collect unearned interest at the time of such acceleration.

6.

WAIVER

Borrower

and any endorsers, sureties or guarantors hereof jointly and severally waive presentment and demand for payment, notice of intent to

accelerate maturity, notice of acceleration of maturity, protest and notice of protest and non-payment, all applicable exemption rights,

valuation and appraisement, notice of demand, and all other notices in connection with the delivery, acceptance, performance, default

or enforcement of the payment of this Note and the bringing of suit and diligence in taking any action to collect any sums owing hereunder.

7.

NOTICES

Any

notice or communication required or permitted hereunder shall be made in writing and given by facsimile, certified mail, hand delivery

or overnight mail to the address provided herein, unless an alternative address is provided in writing. Each party may change the address

or addressee to receive notice from time to time by giving notice in the foregoing manner. The person entitled to notice may waive any

notice required under this Agreement in writing. Simultaneous email verification of any notice issued under this Section is requested,

but not required. Notices may be given at the addresses set forth in the introductory paragraph unless otherwise provided in writing

from one party to the other party.

8.

TRANSFER

Lender

shall have the right at any time or from time to time to sell or assign this Note and the loan evidenced by this Note. Borrower shall

execute, acknowledge and deliver any and all instruments requested by Lender to satisfy such purchasers or participants that the unpaid

indebtedness evidenced by this Note is outstanding upon the terms and provisions set out in this Note. To the extent, if any, specified

in such assignment or participation, such assignee(s) or participant(s) shall have the rights and benefits with respect to this Note

as such assignee(s) or participant(s) would have if they were the Lender hereunder. Borrower may not assign its obligations under this

Note without the prior written consent of Lender.

9.

APPLICABLE LAW

This

Note shall be governed by and construed in accordance with the laws of the State of Nevada (without regard to any conflict of laws or

principles) and the applicable laws of the United States of America.

10.

NO ORAL CHANGE

The

provisions of this Note may be amended or revised only by an instrument in writing signed by the Borrower and Lender. This Note embodies

the final, entire agreement of Borrower and Lender and supersedes any and all prior commitments, agreements, representations and understandings,

whether written or oral, relating to the subject matter hereof and thereof and may not be contradicted or varied by evidence of prior,

contemporaneous or subsequent oral agreements or discussions of Borrower and Lender. There are no oral agreements between Borrower and

Lender.

Executed

as of the day and year first above written.

| |

BORROWER:

|

| |

|

|

| |

Resonate Blends, Inc.

|

| |

|

|

| |

By: |

|

| |

Name: |

Geoffrey

Selzer

|

| |

Title: |

CEO

|

Exhibit

4.2

THIS

PROMISSORY NOTE HAS NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR ANY STATE SECURITIES LAWS AND THIS NOTE, THE

SECURITIES AND ANY INTEREST THEREIN MAY NOT BE OFFERED, SOLD, TRANSFERRED, PLEDGED OR OTHERWISE DISPOSED OF EXCEPT PURSUANT TO AN EFFECTIVE

REGISTRATION STATEMENT UNDER SUCH ACT OR SUCH LAWS OR AN EXEMPTION FROM REGISTRATION UNDER SUCH ACT AND SUCH LAWS, WHICH, IN THE OPINION

OF COUNSEL FOR THE LENDER, WHICH COUNSEL AND OPINION ARE REASONABLY SATISFACTORY TO COUNSEL FOR THIS COMPANY, IS AVAILABLE.

PROMISSORY

NOTE

Principal

Amount: $50,000

Original

Interest Discount: $5,000

Total

Note: $55,000 |

Effective

Date: August 9, 2023 |

FOR

VALUE RECEIVED, Resonate Blends, Inc., located at 26565 Agoura Road, Suite 200, Calabasas, CA 91302, (hereinafter referred to as “Borrower”),

promises to pay to the order of ___________________________________(hereinafter referred to as “Lender”), the principal sum

of $50,000, in lawful money of the United States of America, with interest thereon to be computed on the unpaid principal balance from

time to time outstanding at the Applicable Interest Rate (hereinafter defined) (all duties and obligations of Borrower pursuant to this

Note are hereinafter referred to as “Debt”).

1.

PAYMENT OPTIONS

Borrower

shall make payments due under this Promissory Note (“Note”) to Lender at the above captioned address, or such other address

as Lender shall designate in writing. Payments will be applied first to accrued interest, then unpaid fees, and then principal. All principal

and accrued interest shall be due and payable no later than the date three (3) months from the date of this Note (the “Maturity

Date”). All amounts due under this Note shall be payable without setoff, counterclaim or any other deduction whatsoever. The Borrower

can payoff this Note early with no prepayment penalties applied.

This

Note has a personal guarantee for the full principal amount to Resonate Blends, Inc. by Darshan Vyas, Principal of Pegasus. Resonate

Blends, Inc. in return will guarantee the Lender.

If

the Lender would rather convert this Note into KOAN common stock in lieu of a complete payoff:

Conversion

into Next Funding Round: The Lender can also choose to receive its payment in common stock of the Borrower. The Note will convert

into common stock into the next funding round expected to be priced at $.08 per share issued in a Series Preferred (“Pref”)

with a 4% coupon payable until the Pref is converted into common stock. A 2-year cash Warrant with 50% coverage priced at $.25 is also

available as part of this conversion. If the note is converted into the proposed financing at $.08, this would equal 1,450,000 prior to any interest accrued from the Pref. If the financing terms are less than $.08, the Lender would also receive the lower price

on the note conversion.

2.

ORIGINAL INTEREST DISCOUNT (“OID”) & COMMITMENT SHARES

The

Lender shall receive an OID of $5,000 immediately at the signing of this Note. The new Note amount will have a $55,000

payoff or the Lender can convert the $55,000 note into the next financing round as outlined in Section 1 of this note.

Commitment

Shares: Lender shall receive 112,500 Commitment Shares issued at the signing of this Note for the $50,000 loan.

3.

PREPAYMENT

This

Note may be prepaid in whole at any time prior to the Maturity Date of this Note with all accrued interest due at the time of prepayment.

4.

DEFAULT AND ACCELERATION

A

breach under this Note shall constitute an “Event of Default.” So long as an Event of Default exists, Lender may, at its

option, without notice or demand to Borrower, declare the Debt immediately due and payable. All remedies hereunder and at law or in equity

shall be cumulative. In the event that it should become necessary to employ counsel to collect the Debt or to protect or foreclose the

security for the Debt or to defend against any claims asserted by Borrower under this Note, Borrower also agrees to pay to Lender all

costs of collection or defense incurred by Lender, including reasonable attorneys’ fees for the services of counsel whether or

not suit be brought. During the occurrence of an Event of Default, Borrower shall pay interest on the entire unpaid principal sum at

the rate equal to 18% per annum.

5.

SAVINGS CLAUSE

This

Note is subject to the express condition that at no time shall Borrower be obligated or required to pay interest on the principal balance

due hereunder at a rate which could subject Lender to either civil or criminal liability as a result of being in excess of the maximum

interest rate which Borrower is permitted by applicable law to contract or agree to pay. If by the terms of this Note, Borrower is at

any time required or obligated to pay interest on the principal balance due hereunder at a rate in excess of such maximum rate, the Applicable

Interest Rate or the Default Rate, as the case may be, shall be deemed to be immediately reduced to such maximum rate and all previous

payments in excess of the maximum rate shall be deemed to have been payments in reduction of principal and not on account of the interest

due hereunder. All sums paid or agreed to be paid to Lender for the use, forbearance, or detention of the Debt, shall, to the extent

permitted by applicable law, be amortized, prorated, allocated, and spread throughout the full stated term of this Note until payment

in full so that the rate or amount of interest on account of the Debt does not exceed the maximum lawful rate of interest from time to

time in effect and applicable to the Debt for so long as the Debt is outstanding. Notwithstanding anything to the contrary contained

herein, it is not the intention of Lender to accelerate the maturity of any interest that has not accrued at the time of such acceleration

or to collect unearned interest at the time of such acceleration.

6.

WAIVER

Borrower

and any endorsers, sureties or guarantors hereof jointly and severally waive presentment and demand for payment, notice of intent to

accelerate maturity, notice of acceleration of maturity, protest and notice of protest and non-payment, all applicable exemption rights,

valuation and appraisement, notice of demand, and all other notices in connection with the delivery, acceptance, performance, default

or enforcement of the payment of this Note and the bringing of suit and diligence in taking any action to collect any sums owing hereunder.

7.

NOTICES

Any

notice or communication required or permitted hereunder shall be made in writing and given by facsimile, certified mail, hand delivery

or overnight mail to the address provided herein, unless an alternative address is provided in writing. Each party may change the address

or addressee to receive notice from time to time by giving notice in the foregoing manner. The person entitled to notice may waive any

notice required under this Agreement in writing. Simultaneous email verification of any notice issued under this Section is requested,

but not required. Notices may be given at the addresses set forth in the introductory paragraph unless otherwise provided in writing

from one party to the other party.

8.

TRANSFER

Lender

shall have the right at any time or from time to time to sell or assign this Note and the loan evidenced by this Note. Borrower shall

execute, acknowledge and deliver any and all instruments requested by Lender to satisfy such purchasers or participants that the unpaid

indebtedness evidenced by this Note is outstanding upon the terms and provisions set out in this Note. To the extent, if any, specified

in such assignment or participation, such assignee(s) or participant(s) shall have the rights and benefits with respect to this Note

as such assignee(s) or participant(s) would have if they were the Lender hereunder. Borrower may not assign its obligations under this

Note without the prior written consent of Lender.

9.

APPLICABLE LAW

This

Note shall be governed by and construed in accordance with the laws of the State of Nevada (without regard to any conflict of laws or

principles) and the applicable laws of the United States of America.

10.

NO ORAL CHANGE

The

provisions of this Note may be amended or revised only by an instrument in writing signed by the Borrower and Lender. This Note embodies

the final, entire agreement of Borrower and Lender and supersedes any and all prior commitments, agreements, representations and understandings,

whether written or oral, relating to the subject matter hereof and thereof and may not be contradicted or varied by evidence of prior,

contemporaneous or subsequent oral agreements or discussions of Borrower and Lender. There are no oral agreements between Borrower and

Lender.

Executed

as of the day and year first above written.

| |

BORROWER:

|

| |

|

|

| |

Resonate Blends, Inc.

|

| |

|

|

| |

By: |

|

| |

Name: |

Geoffrey

Selzer

|

| |

Title: |

CEO

|

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

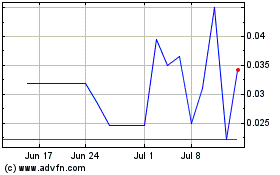

Resonate Blends (PK) (USOTC:KOAN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Resonate Blends (PK) (USOTC:KOAN)

Historical Stock Chart

From Nov 2023 to Nov 2024