An

offering statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission.

Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor

may offers to buy be accepted before the offering statement filed with the Commission is qualified. This Preliminary Offering Circular

shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state

in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We

may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion

of our sale to you that contains the URL where the Offering Circular was filed may be obtained.

THIS

OFFERING IS A TIER 2 OFFERING PURSUANT TO REGULATION A.

GENERALLY,

AS A TIER 2 OFFERING PURSUANT TO REGULATON A, NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS

MORE THAN TEN PERCENT (10%) OF THE GREATER OF YOUR ANNUAL INCOME OR YOUR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND

NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO

REVIEW RULE 251(D)(2)(I)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO WWW.INVESTOR.GOV.

THE

UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE

TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE

SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT

DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

File No. 024-11949

Post

Qualification Amendment Number Six

Regulation

A

Preliminary

Offering Circular

Under

the Securities Act of 1933

Form

1-A

Tier

Two

Mass

Megawatts Wind Power, Inc.

100

Boston Turnpike, Ste. J9B #290

Shrewsbury,

MA 01545

(Physical

Address- 523 Southbridge Street, Worcester, MA 01610)

Telephone

(508)942-3531

www.massmegawatts.com

Up

to a maximum 10,000,000 shares of Common Stock

We

are offering up to 10,000,000 shares of our common stock at a price of $0.008 per share. The shares are offered on a “best

efforts” basis directly through our officers and directors. We will pay no commissions or other fees in connection with the offering.

We will receive a maximum of $100,000 related to these sales.

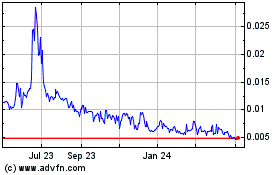

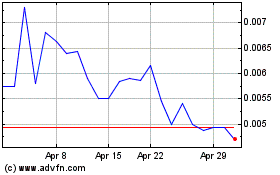

Our

common stock is quoted on the OTC markets at around $0.014 per share.

| Price

to Public |

|

Underwriting

Discount and Commission |

|

Proceeds

to Issuer |

|

Proceeds

to other persons |

| |

|

|

|

|

|

|

| $0.008 |

|

none |

|

no

minimum |

|

none |

| 10

million shares maximum |

|

none |

|

$80,000

maximum |

|

none |

THIS

INVESTMENT INVOLVES A HIGH DEGREE OF RISK. SEE “RISK FACTORS” FOR A DISCUSSION OF CERTAIN RISKS THAT YOU SHOULD CONSIDER

IN CONNECTION WITH AN INVESTMENT IN OUR SECURITIES.

NOT

AN OFFER TO SELL, NOR SOLICITING AN OFFER TO BUY, ANY SHARES OF OUR COMMON STOCK IN ANY STATE OR OTHER JURISDICTION IN WHICH SUCH SALE

IS PROHIBITED.

AN

OFFERING STATEMENT PURSUANT TO REGULATION A RELATING TO THESE SECURITIES HAS BEEN FILED WITH THE U.S. SECURITIES AND EXCHANGE COMMISSION,

WHICH WE REFER TO AS THE COMMISSION. INFORMATION CONTAINED IN THIS PRELIMINARY OFFERING CIRCULAR IS SUBJECT TO COMPLETION OR AMENDMENT.

THESE SECURITIES MAY NOT BE SOLD NOR MAY OFFERS TO BUY BE ACCEPTED BEFORE THE OFFERING STATEMENT FILED WITH THE COMMISSION IS QUALIFIED.

THIS PRELIMINARY OFFERING CIRCULAR SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY NOR MAY THERE BE ANY

SALES OF THESE SECURITIES IN ANY STATE IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL BEFORE REGISTRATION OR QUALIFICATION

UNDER THE LAWS OF ANY SUCH STATE. WE MAY ELECT TO SATISFY OUR OBLIGATION TO DELIVER A FINAL OFFERING CIRCULAR BY SENDING YOU A NOTICE

WITHIN TWO (2) BUSINESS DAYS AFTER THE COMPLETION OF OUR SALE TO YOU THAT CONTAINS THE URL WHERE THE FINAL OFFERING CIRCULAR OR THE OFFERING

STATEMENT IN WHICH SUCH FINAL OFFERING CIRCULAR WAS FILED MAY BE OBTAINED.

THIS

OFFERING IS A TIER TWO OFFERING PURSUANT TO REGULATION A,

GENERALLY,

NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN TEN PERCENT (10%) OF THE GREATER OF

YOUR ANNUAL INCOME OR YOUR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY

REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(D)(2)(I)(C) OF

REGULATION A. FOR GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO WWW.INVESTOR.GOV.

THE

UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE

TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE

SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT

DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

State

Law Exemption and Purchase Restrictions for Tier 2 Offering pursuant to Regulation A

Mass

Megawatts Wind Power, Inc. is a full SEC reporting company with audited financial statements with PCAOB (Public Company Accounting Oversight

Board) standards. Tier 2 offerings pursuant to Regulation A requires audited financial statements and PCAOB audits are eligible for Tier

2 offerings.

Our

shares of common stock are being offered and sold only to “qualified purchasers” (as defined in Regulation A). As a Tier

2 offering pursuant to Regulation A, this offering will be exempt from state law “Blue Sky” review, subject to meeting certain

state filing requirements and complying with certain anti-fraud provisions, to the extent that our shares of common stock offered hereby

is offered and sold only to “qualified purchasers”. “Qualified purchasers” include: (i) “accredited investors”

under Rule 501(a) of Regulation D under the Securities Act (“Regulation D”) and (ii) all other investors so long as their

investment in our shares of common stock do not represent more than 10% of the greater of their annual income or net worth (for natural

persons), or 10% of the greater of annual revenue or net assets at fiscal year-end (for non-natural persons). Accordingly, we reserve

the right to reject any investor’s subscription in whole or in part for any reason, including if we determine in our sole and absolute

discretion that such investor is not a “qualified purchaser” for purposes of Regulation A.

To

determine whether a potential investor is an “accredited investor” for purposes of satisfying one of the tests in the “qualified

purchaser” definition, the investor must be a natural person who has:

| |

1. |

an

individual net worth, or joint net worth with the person’s spouse or spousal equivalent, that exceeds $1,000,000 at the time

of the purchase, excluding the value of the primary residence of such person; or |

| |

|

|

| |

2. |

earned

income exceeding $200,000 in each of the two most recent years or joint income with a spouse or spousal equivalent exceeding $300,000

for those years and a reasonable expectation of the same income level in the current year. |

If

the investor is not a natural person, different standards apply. See Rule 501 of Regulation D for more details.

For

purposes of determining whether a potential investor is a “qualified purchaser,” annual income and net worth should be calculated

as provided in the “accredited investor” definition under Rule 501 of Regulation D. In particular, net worth in all cases

should be calculated excluding the value of an investor’s home, home furnishings and automobiles.

Table

of Contents

Page

number

Summary

of Company

Mass

Megawatts’ principal line of business is to develop a solar tracker for production to produce sales in the near term and wind energy

production equipment for potential applications in the longer term. The Company is currently finding locations for suitable operating

facilities for its solar project using the solar tracker technology. In addition to its solar projects, the company intends to build

and operate wind energy generated power plants utilizing proprietary MultiAxis Turbine technology after the solar tracker technology

develops to a level of consistent sales to be able to be profitable or close to profitable.

Summary

of Primary Business (Solar Tracker Product)

The

patent pending, Mass Megawatts ‘Solar Tracking System’ (STS) is a complete solar power system that is designed to

continually adjust the position of solar panels to receive the optimal level of direct sunlight throughout the day. Unlike other solar

tracking technologies, the Mass Megawatts STS utilizes a low-cost structure that adds stability to the overall solar-power system while

improving energy production levels for the customer.

Advantages

to owning a solar tracking system (STS)

| |

● |

Increases

solar energy production by 25+% over traditional solar power systems |

| |

● |

Provides

an affordable, solar-power solution for business use |

| |

● |

Reduces

(or eliminates) the need to purchase higher priced electricity from the local utility |

| |

● |

Lowers

your monthly electric bill with Net Metering. |

RISK

FACTORS

New

product might not be successful, and Uncertainty of Market Acceptance

Developing

Business presents new obstacles

Company

not at Mass Production Stage

Marketing

risk

Possible

Loss of Entire Investment

Intellectual

Property Risk

Inability

to Sell Offering and Need of Additional Financing

Stock

Market Fluctuation Risk

Growth

Management Risk

Retention

of Key Employee Retention Rick and Management Dependence

Going

Concern Qualifications

Limitations

in Site Locations

Regulatory

Risk

Supplier

Reliance

Competition

Fluctuation

of Conventional Energy Prices

Changes

in Government Incentives

Inability

to Obtain Grants

Employee

Union Activities

Product

Liability Risk

Product

Recall Risk

Insufficient

Warranty Reserves

Supplier

Ethics Risk

Cost

of Being Public Risk

No

Dividend

Dilution

Risk

Mass

Megawatts Wind Power was incorporated in 1997 in Massachusetts. Our principal offices are located Worcester, Massachusetts. Our telephone

number is (508) 942-3531. References herein to “Mass Megawatts” “we”, “us”,and “our”,

mean Mass Megawatts Wind Power, Inc. unless the context otherwise requires.

RISK

FACTORS

Investing

in our shares is risky. You should carefully consider the following risks before making an investment decision. The trading price of

our shares could decline due to any of these risks, and you could lose all or a part of your investment.

| 1. |

New

Product Development |

The

technological and operational success is the key to the Company’s success. As in the commercial development of any new mechanical

product, long-term operation may lead to the discovery of deficiencies in the solar tracker design, MAT design and/or in its manufacturing.

For instance, long-term operation might disclose that the loading exceeds design criteria, resulting in materials fatigue failure. Significant

developments in technologies, such as advanced fracking, ethanol, improved natural gas, or improvements in competitive solar trackers,

may materially and adversely affect our business and prospects in ways we do not currently anticipate. Any failure by us to develop new

technologies or to react to improvements with existing technologies, could materially delay our new technologies, which could result

in the decreased revenue and reduction of overall market share in both the solar marketplace and larger energy market.

| 2. |

Developing

Business Risks |

The

early stages of any start-up business are subject to many risks. Company success is highly influenced by the normal expenses, problems,

complications, and frequent delays associated with a new business. It is likely that Mass Megawatts will continue to require substantial

capital in addition to the proceeds of this offering. The ability to raise capital and support growth of its operations is dependent

on maintaining suitable profit margins for each investment the Company makes in its solar power technology. Additionally, numerous factors

including the nation’s economy, conditions of the capital markets in general, and conditions affecting the solar and wind energy

industry may affect Mass Megawatts’ ability to raise capital. There is no assurance that the Company’s products will result

in a commercial success.

| 3. |

Company

not at Mass Production Stage |

Currently,

we have only solar tracker prototypes for the purpose of testing and finalizing the design before any commercial or mass production.

The patent filings related to the solar trackers are pending and not yet granted. Fatigue and weather-related structural testing

has been done on a limited basis with a proof of concept prototype. The future success of the Company is dependent on its ability to

manufacture and to deliver the solar trackers on a timely basis at a sustained and acceptable cost. While the assembly capacity could

be established without much difficulty, no-full scale production is currently implemented. Increasing this assembly capacity might

involve uncertainty and risk. Any delay in the financing, design, manufacture and could materially damage our business, financial

condition, and operating results. New solar technology often experiences delays in the design and manufacture. Mass Megawatts

experienced significant delays in launching the solar tracker. We initially announced that we would begin delivering at an earlier date.

These delays resulted in additional costs and adverse publicity for our business. We may experience similar delays in launching our

production, and any such delays could be significant. In addition, final designs for the build out of the planned facilities are still

in process, and component procurement and manufacturing plans have not been finalized. We are currently evaluating our suppliers for

planned production. However, we may not be able to engage suppliers for the remaining components. In addition, we will also need to do

extensive testing to ensure that the Solar Tracker is in compliance with UL 3703 prior to beginning mass production. Our plan to is dependent

upon the timely availability of funds. The build out of our manufacturing plans in a timely manner and ability to execute plans are critical.

No

utility purchase agreement has been signed at a purchase price that would result a profit. There can be no assurances that the Company’s

own marketing efforts will be successful. The Company has not entered any distribution arrangements. The Company requires significant

investment prior to commercial introduction and may never be successfully developed or commercially successful. There can be no assurance

that we will be able to meet the expectations of our customers or will become commercially viable. The Company may not be able

to build the solar trackers to the expectations created by the early prototype. The customers may not accept our solar tracker and our

future sales could be adversely affected. In the future, the Company may be required to introduce on a regular basis new and enhanced

solar trackers. As technologies change, we will be expected to upgrade or adapt our products and introduce improved versions. We have

limited experience simultaneously designing, manufacturing and marketing our product.

| 5. |

Possible

Loss of Investment |

Prospective

investors should be aware that their entire investment could be at risk. Quarterly variations in financial results could cause the market

price of the Common Stock to fluctuate substantially. Mass Megawatts’ revenues and earnings are difficult to predict because of

the unpredictable timing related to the production goals. In addition, the stock marketing in general could experience wide price and

volume fluctuations. There are no assurances that an investment in this company will be profitable.

There

can be no assurances that patents will issue from any of the pending applications. In addition, regarding any patent that may

issue, there can be no assurance that the claims allowed will be sufficiently broad to protect the Company’s technology or that

issued patents will not be challenged or invalidated. There is no certainty that we are the first inventor of a new product covered by

pending patent applications or the first to file patent applications. We be certain that the pending patent applications of our company

or any licensor will result in issuing of patents or that there would be sufficient protection against a competitor. In addition, patent

applications filed in foreign countries are subject to laws, rules and procedures that differ from those of the United States, and thus

we cannot be certain that foreign patent applications related to issued U.S. patents will be issued. Furthermore, some foreign countries

provide significantly less effective patent protection than in the United States. The status of patents involves complex legal and factual

questions and the breadth of claims allowed is uncertain. As a result, we cannot be certain that the patent applications will result

in patent issuances. The protection against competitors with similar technology is uncertain. Additionally, patents issued are subject

to infringement and potentially be redesigned by others. Competitors may obtain patents that we need to license or design around. The

increased costs may have a negative impact on our business.

| 7. |

Risk

of Inability to Achieve the Maximum Proceeds in the Amount of the Offering |

It

will be more difficult for the company to achieve a successful implementation of its business plan if the maximum proceeds made available

through this offering cannot be raised. Wind power generating facilities require substantial investments. General economic and capital

market conditions may have a negative impact in the Company’s ability to achieve the maximum proceeds amount. If less than the

maximum proceeds are sold, the percentage of non-product manufacturing expenses (offering, legal, accounting, and advertising expenses)

to the overall use of offering proceeds will be greater than the percentage if the maximum proceeds are sold.

Although,

there is some liquidity of the company’s Common Stock on OTC Markets at the current time, there has been no guarantee of a market

for our Common Stock and the Investors may not be able to sell their shares after the offering is completed. There is no guarantee of

liquidity at any time in the future with the common stock of Mass Megawatts being traded on OTC Markets. There can be no assurance that

a significant public market will develop or be sustained after this offering. In addition, there is risk that the offering will not be

able to be completed.

Rapid

growth could impair the Company’s ability to effectively manage growth. Managing growth requires expanding the employee, operational,

and financial bases. Failure to develop efficient construction and manufacturing processes of the solar technology could have a negative

impact on the ability to manage growth. Mass Megawatts might not have the ability to execute its forward commitments to manufacture and

construct its solar trackers. If we are unable to establish and maintain confidence with business prospects among consumers, then our

financial condition and business outlook may suffer. Suppliers and installers will be less likely to invest time and resources in developing

business opportunities with Mass Megawatts if they do not have confidence with us. In order to build and maintain our business, we must

maintain confidence among customers and suppliers Many factors are largely outside our would likely harm our business and make it more

difficult to raise additional funds when needed.

| 10. |

Retention

of Key Employees Risk |

Our

key employees are not bound by any employment agreement. There can be no assurance that we will be able to successfully attract key people

necessary to grow our business. A good part of our future success is dependent upon our ability to attract key technology, sales, marketing

and support personnel and any failure to do so could adversely impact our business. The Company may in the future experience difficulty

in retaining members of our management team. Additionally, we do not have “key person” life insurance policies covering any

of our officers or other key employees. There is substantial competition for qualified individuals with the specialized knowledge of

solar energy and this competition affects both our ability to retain and hire key employees.

| 11. |

“Going

Concern” Qualifications |

Our

accountants have included an explanatory paragraph in their reports on our financial statements regarding our ability to continue as

a going concern. During the ordinary course of business, operating losses have incurred each period since inception, resulting in an

accumulated deficit and negative cash flows. Currently, management is soliciting additional equity investors to fund these losses. However,

these conditions raise substantial doubt about the Mass Megawatts, ability to continue as a going concern. The financial statements do

not include any adjustments relating to the recoverability and classification of recorded asset amounts or the amounts and classifications

of liabilities that might be necessary should the Company be unable to continue as a going concern.

| 12. |

Limited

Site Locations |

Local

regulatory, permitting, and zoning constraints may limit, delay, or affect the cost of site development. The visibility of solar energy

farms and wind turbines as well as threats to endangered or migratory birds may require wind turbines to not be sited near areas where

such species might be threatened. In addition, suitable sites may be located in areas where the availability of solar or wind resource

does not coincide with power needs, and it may be remote from adequate transmission facilities. In some otherwise favorable sites,

the energy cost may be low. Some sites might be limited with the high cost of acquiring easements and other land use rights. Site

development may be affected by social policy concerns, such as noise and visibility of wind energy systems. The danger to migratory birds

and other wildlife may require the site locations to be abandoned or moved to areas where the endangered species might not be threatened.

Other site related issues include local regulatory, zoning and permitting constraints which may delay, limit or affect the cost of site

development.

The

electric industry is subject to energy and environmental laws at the federal, state, and local levels. The Public Utility Regulatory

Act of 1978 provides qualifying facilities (“QFs”) important exemptions from substantial federal and state legislation, including

regulation as public utilities. Loss of QF status by any one of the Company’s projects could cause the Company to become a public

utility holding company, thereby causing many of the Company’s other projects to lose their QF status and become subject to regulation

as public utilities. The compliance of the regulations may be complicated or difficult. Specialized or legal assistance may be required

for the company to carry out its business. Electric generation projects also are subject to federal, state, and local laws and administrative

regulations, which govern the geographic location, zoning, land use, and operation of plants and emissions produced by said plants. Recently,

modified legislation of the Public Utility Holding Company Act of 1935 (“PURPA”) increases competition by allowing utilities

to develop production facilities that don’t qualify as QFs without being subject to regulation under PUHCA.

Interruption

of suppliers’ operations can delay delivery of components to the company, which could adversely impact the company’s

operations. Mass Megawatts purchases components from outside venders and is aware of alternative suppliers for single-sourced items.

The Company believes that the loss of any one supplier would have only a short-term impact on its production schedule. In the long term,

additional suppliers will be required as production volume increases. While we believe that we may be able to establish alternate supply

relationships and can obtain or engineer replacement components for our single source components. Mass Megawatts may be unable to do

so in the short term or at all at prices or costs that are favorable to us. In particular, while we believe that we will be able to secure

alternate sources of supply for almost all of our single sourced components on a relatively short time frame, qualifying alternate suppliers

or developing our own replacements for certain highly customized components of the solar tracker, such as the solar panels, inverters

and racking.

This

supply chain exposes us to multiple potential sources of delivery failure or component shortages Mass Megawatts is currently evaluating

our suppliers for the planned production solar tracker and we intend to establish suppliers for key components. Changes in business conditions

beyond our control or which we do not presently anticipate, could also affect our suppliers’ ability to deliver components to us

on a timely basis. If we experience increased demand, or need to replace our existing suppliers, there can be no assurance that additional

supplies of component parts will be available when required on terms that are favorable to us or that any supplier would allocate sufficient

supplies. The loss of any single or limited source supplier or the disruption in the supply of components from these suppliers could

lead to delays that could materially adversely affect our business. A failure by our suppliers to provide the components necessary to

manufacture our solar trackers could prevent us from fulfilling customer orders in a timely fashion which could result in a material

adverse effect on our business. In addition, since we have no fixed pricing arrangements with any of our suppliers which could harm our

financial condition.

Fossil

fuel-fired plants including gas-fired and petroleum-fueled power plants, are the primary competition of the Company. In addition,

the increased use of competitive bidding procedures has made obtaining power purchase agreements with utilities more competitive.

Competitive bidding generally has reduced the price utilities pay independent power producers, which, in turn, reduces the

profitability of many independent power projects. If solar power and wind power become a more widely accepted technology, large and

well-capitalized companies deciding to invest in any of the various wind power technologies, may also increase the

competition.

| 16. |

Fluctuation

of Conventional Energy Prices |

Survival

of wind-powered facilities depends on producing electricity at a cost that is competitive with other forms of generation. Low fossil

fuel prices, which reduce the cost of electricity generated by fossil fuels, may adversely affect the Company’s ability to generate

profits.

| 17 |

Changes

in Government Incentives |

Any

reduction or elimination of government incentives because of policy changes, the reduced need for such subsidies and incentives due to

the perceived success of the solar tracker may result in the reduced competitiveness. Our growth depends in part on the availability

of incentives for solar energy. Certain regulations that encourage sales of solar power equipment could be reduced or eliminated, either

currently or at any time in the future. For example, while the federal and state governments have from time-to-time enacted tax

credits and other incentives, our competitors have more resources with legislative activities.

| 18 |

Inability

in Obtain Grants |

Mass

Megawatts plans to apply for federal and state incentives including, loans, grants, and tax incentives designed to support renewable

energy technologies. We anticipate that in the future there will be new opportunities for us. Our ability to obtain funds or incentives

from government sources is subject to the approval of our applications of participating programs. The application process for these incentives

will be highly competitive. There is no assurance that the Company will be successful. If there is a lack of success in obtaining any

of these additional incentives and we cannot find alternative sources of funding to meet our planned expenditures, our business could

be materially adversely affected.

| 19 |

Employee

Union Activity |

None

of our employees are currently represented by a labor union, In the future that may change. It could result in higher employee costs

and increased potential of work stoppages. As the business grows, there can be no assurances that our employees will not join or form

a labor union or that we will not be required to become a union signatory. Mass Megawatts is neutral as to the formation of unions. We

are also directly or indirectly dependent upon companies with unionized work forces, such as suppliers and shipping companies. Those

companies may have work stoppages or strikes having a material adverse impact on our business. If a work stoppage occurs, it could delay

the manufacture and sale of our solar trackers.

| 20. |

Product

Liability Risk |

Mass

Megawatts may become subject to product liability claims. It could harm our business. A successful product liability claim against us

could require us to pay a substantial monetary award and claim could generate substantial negative publicity about any significant lawsuit

seeking damages exceeding our coverage may have a material adverse effect on our reputation. We may not be able to secure additional

product liability insurance coverage on commercially acceptable terms or at reasonable costs when needed, particularly if we do face

liability for our products and are forced to make a claim under our policy.

Any

product recall in the future may result in adverse publicity, damage our brand. Such recalls, voluntary or involuntary, involve significant

expense and diversion of management attention and other resources, which would adversely affect our brand image in our target markets

and could adversely affect our business.

| 22. |

Insufficient

Warranty Reserves |

If

our warranty reserves are inadequate to cover future warranty claims on our solar trackers, our business could be negatively impacted.

We record and adjust warranty reserves based on changes in estimated costs and actual warranty costs. However, the Company has extremely

limited operating experience with our solar trackers and little experience with warranty claims and estimating warranty reserves There

can be no assurances that our existing warranty reserves will be sufficient to cover all claims or that our limited experience with warranty

claims will adequately address the needs of our customers to their satisfaction.

Our

ethical standards are important to our company. Our suppliers are independent with their own business practices. A lack of demonstrated

compliance could lead us to seek alternative suppliers, which could increase our costs and result in delayed delivery of our products

or other disruptions. Legal violations by our suppliers or the divergence of an independent supplier’s labor or other practices

from those generally accepted as ethical could also attract adverse publicity. If we, or other manufacturers in our industry, encounter

these problems in the future, it could harm the industry’s image and our business.

| 24 |

Cost

of Being Public Risk |

As

a public company, we will incur significant expenses that we did not incur as a private company, including legal and accounting costs

associated with public company reporting and corporate governance. Mass Megawatts is planning to file a Form 10 which will result in

complying with rules implemented by the Securities and Exchange Commission. In addition, our management team will also have to adapt

to the additional requirements of being a SEC reporting company. We expect complying with these rules and regulations will substantially

increase our legal and financial compliance costs and to make some activities more time-consuming and costly. The increased costs associated

with operating as a public company will increase our expenses. Additionally, these requirements will require extra attention of our management.

The uncertainty especially among anyone not familiar with the obligations of public companies may cause more difficulty to attract and

retain qualified individuals to serve on our board of directors or as our executive officers.

Mass

Megawatts has not achieved a profit in its history and there is no guarantee of the company distributing a dividend in the near future.

We did not declare any cash distributions or dividends in the past, and we currently do not anticipate paying any cash distributions

or dividends in the foreseeable future. Our priority is supporting our operations and to finance the development of our business. Any

future determination relating to dividend policy will depend on a number of fact including capital requirements and our financial condition.

The

proposed public offering price is higher than the average price per share paid by many investors in the Company. Accordingly, new investors

in the Company will experience substantial immediate dilution with respect to their investment.

Shares

of Common Stock may be considered a penny stock. Investors may have difficulty with selling the stock due to the reduced pool of investors,

an illiquid market, and a low stock price. Our common stock is less than $5 per share and is defined as a penny stock being valued at

less than five dollars per share. Penny stocks are considered as risky and speculative. Additionally, Mass Megawatts does not meet financial

requirements that avoid being defined as a penny stock such as being registered on an Exchange with a minimum net tangible asset value

requirement or minimum required value of revenue over a three -year period. Under Section 15(h) of the Exchange Act, Broker Dealers are

required furnish a risk disclosure document with the risk of penny stocks and broker requirement of full disclosure related to rights

customers and remedies available with respect of violations by the broker dealers related to penny stock rules and related full disclosure

requirements including the potential illiquidity of the penny stock. Brokers are obligated to evaluate each individual investor experience

and objectives to determine if penny stock are suitable. The due diligence of the broker dealers may require a higher transaction cost

for trades in penny stocks. Violations of the due diligence obligations by broker dealers may result in compensation of financial losses

to investors, fines and other penalties.

Note:

In addition to the above risks, businesses are often subject to risks not foreseen or fully appreciated by management. In reviewing this

Disclosure Document, potential investors should keep in mind other possible risks that could be important.

FORWARD

LOOKING STATEMENTS

Some

of the statements under “Prospectus Summary,” “Risk Factors,” “Management’s Discussion and Analysis

of Financial Condition and Results of Operations,” “Business” and elsewhere in this prospectus constitute forward-looking

statements. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels

of activity, performance, or achievements to be materially different from any future results, levels of activity, performance, or achievements

expressed or implied by such forward-looking statements. Such factors include, among other things, those listed under “Risk Factors”

and elsewhere in this prospectus.

In

some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,”

“could,” “expects,” “plans,” anticipates”, “believes,” “estimates,”

“predicts,” “potential,” or “continue” or the negative of such terms or other comparable terminology.

Although,

we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels

of activity, performance, or achievements. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness

of such statements. We are under no duty to update any of the forward-looking statements after the date of this prospectus.

Among

the important factors that could cause actual events to differ materially from those indicated by forward- looking statements in this

registration statement the failure of the Company to achieve or maintain necessary zoning approvals with respect to the location of its

MAT power developments; to successfully produce the solar trackers and the MAT on time and remaining competitive; the inability of the

Company to sell its current turbines offered for sale or any future sale, if needed, to finance the marketing and sales of its electricity;

general economic conditions; as well as those risk factors detailed in the periodic reports filed by the company

DILUTION

Shares

Issued and Outstanding, Common Stock, no par Before the Offering (As of July 5, 2023) |

|

152,289,579

shares |

| |

|

|

| Shares

Issued and Outstanding, Common Stock, no par If the event of the successful completion of the offering can be achieved. |

|

162,289,579

shares |

PLAN

OF DISTRIBUTION

The

company will sell shares directly to the public through our officers and directors who will receive no compensation in connection with

the sale of the shares. Mass Megawatts will begin the offering promptly. The company will pursue it continuously thereafter until either

the maximum has been sold or the date at which the Offering is earlier terminated by the company at its sole discretion. This Offering

must terminate within one year after the date of the qualification of this Offering Statement unless a new offering statement is filed

with the SEC and then this Offering may continue to be offered and sold until the earlier of the qualification of the new offering statement

or one year from the qualification of this offering statement. However, we have the right to discontinue the offering after 60 days even

if the maximum has not been sold. This is a best efforts offering, and we can give no assurance that any number of shares will be sold.

USE

OF PROCEEDS (If maximum amount of $80,000 is raised).

CAUTIONARY

NOTE: After reviewing the portion of the offering a potential investor should consider whether his investment available for future development

of the Company’s business and operations, would be adequate.

| Total Proceeds | |

$ | 80,000 | | |

| 100 | % |

| Less: | |

| | | |

| | |

| Offering expenses, commissions, and finders fees | |

| 0 | | |

| 0 | % |

| Legal, Accounting, and Advertising | |

| 12,000 | | |

| 15 | % |

| Net Proceeds from Offering | |

| 68,000 | | |

| 85 | % |

| | |

| | | |

| | |

| Use of Proceeds: | |

| | | |

| | |

| | |

| | | |

| | |

| Production Facilities Expenses | |

| 10,000 | | |

| 12 | % |

| Marketing and Customer Acquisition | |

| 16,000 | | |

| 20 | % |

| Product Refinement and Improvements | |

| 10,000 | | |

| 13 | % |

| Capital Cost of Production Equipment | |

| 15,000 | | |

| 19 | % |

| Administrative | |

| 17,000 | | |

| 21 | % |

The

highest priority will be preparing to manufacture the solar tracker. In the development of the solar trackers, Mass Megawatts would first

conduct weather related and environmental testing activities. However, most of the testing has been done. Our second highest priority

is third party verification of the technology in order to be eligible for future debt financing and more favorable equity financing.

In the beginning of the marketing of the solar tracker, the Company plans to finance the sales of the trackers. Just like any new product,

outside financing and customer acceptance are major obstacles until a few sales and customer references are established. The ability

to receive bank or related financing for our customers and ourselves after a short period of time should be available. However, since

we have to earn the bank and customer acceptance, financing the initial sales will be critical.

The

next priority is our marketing program. The first effort will be toward developing strategic alliances with other solar power developers

who have done the initial steps of zoning, financing, and other requirements toward developing successful wind energy projects. The developers

may benefit from Mass Megawatt’s new product if it can be proven to be more cost effective. No assurance can be given as to the

development of a successful new product. Numerous other risks may prevent developers from considering any business relationships with

Mass Megawatts. However, the first few small projects will advance the confidence of potential allies and developers.

As

soon as the Mass Megawatts establishes on the course of its primary marketing efforts, the Company plans to establish strategic alliances

with companies involved with green marketing programs. As noted earlier, numerous other risks may prevent developers from considering

any business relationships with Mass Megawatts. No assurance can be given as to the development of a successful marketing efforts. The

Company, Mass Megawatts, will begin these efforts with “word of mouth” techniques at business organizations and with power

brokers. Other efforts include direct advertising to green pricing customers either through direct mail or advertising in the media in

conjunction with environmental related events. On a limited budget, the Company will be able to determine which marketing methods are

most effective by marketing in a very limited geographical area.

As

initial marketing efforts including “word of mouth” techniques have matured, the company will advertise in local publications

if cash flow allows continued marketing efforts. Again, as noted earlier, no assurance can be given as to the development of a successful

marketing program. If successful, television and radio advertisement could be utilized.

As

our next priority, working capital and administrative support will be used for contingencies on an “as needed” basis.

Finally,

the priority of any additional research and product development needs would be financed by the offering proceeds after the working capital

and administrative activities are satisfied.

After

using the proceeds, Mass Megawatts should be in a better position to raise more financing within one year for commercializing its product.

More

specific uses of the proceed include

$15,000

Capital Cost of Production Equipment. The cost of production molds for the custom-made parts to be produced is a fixed cost. The

composite structure below the racking system which support the moving parts would need to be standardize for easy field installation

and reduced cost of parts for the solar tracking system.

$10,000

product refinement and improvements include construction, data acquisition, experimental

retrofits/engineering and testing and testing with outside engineering companies for structural

verification to reduce foundation and racking requirements. It is possible to reduce the

cost to being below the cost of a comparable stationary unit. That has never been done before.

However, that may only have an advantage in high wind location. Our current marketing strategy

does not require it as our trackers in itself will reduce the cost of solar generated electricity.

Every year, we plan to spend some funds for product improvement.

$16,000

(or less if proceeds under $80,000)

marketing, customer acquisition expenses, and web site related promotion

$17,000

administrative expenses.

$10,000

production facilities expenses include

$4,000 warehouse space with loading dock for the office and production facilities of the tracker platforms for one year. $3,000

initial cash outlay for two employees on an as needed basis. However, the cost of sales would limit the repetition of this expense

as the cost would be covered with each sale. $3,000 for equipment and minimum inventory requirements to production.

LEGAL

PROCEEDINGS

The

Company currently have no legal proceedings to which the Company is a party to or to which its property is subject to, and, to the best

of its knowledge, no adverse legal activity is anticipated or threatened.

TRANSFER

AGENT

Mass

Megawatts Wind Power, Inc.’s transfer agent is V Stock Transfer, Inc. with an address of 18 Lafayette Place, Woodmere, New York

11598. The telephone number is (212) 828-8436.

EXPERTS

Our audited balance sheets, the statements

of our operations, shareholders’ equity and cash flows for the years ended April 30, 2021, and 2022 have been included in this

Offering Circular in reliance upon the reports of MaloneBailey LLP, an independent auditor registered public accounting firm, and L&L

CPAs, PA an independent auditor registered public accounting firm, as set forth in their reports thereon, included therein, and incorporated

herein by reference in reliance upon such reports given on the authority such firms are experts in accounting and auditing, which includes

an explanatory paragraph on our ability to continue as a going concern.

ORGANIZATION

HISTORY SINCE INCEPTION

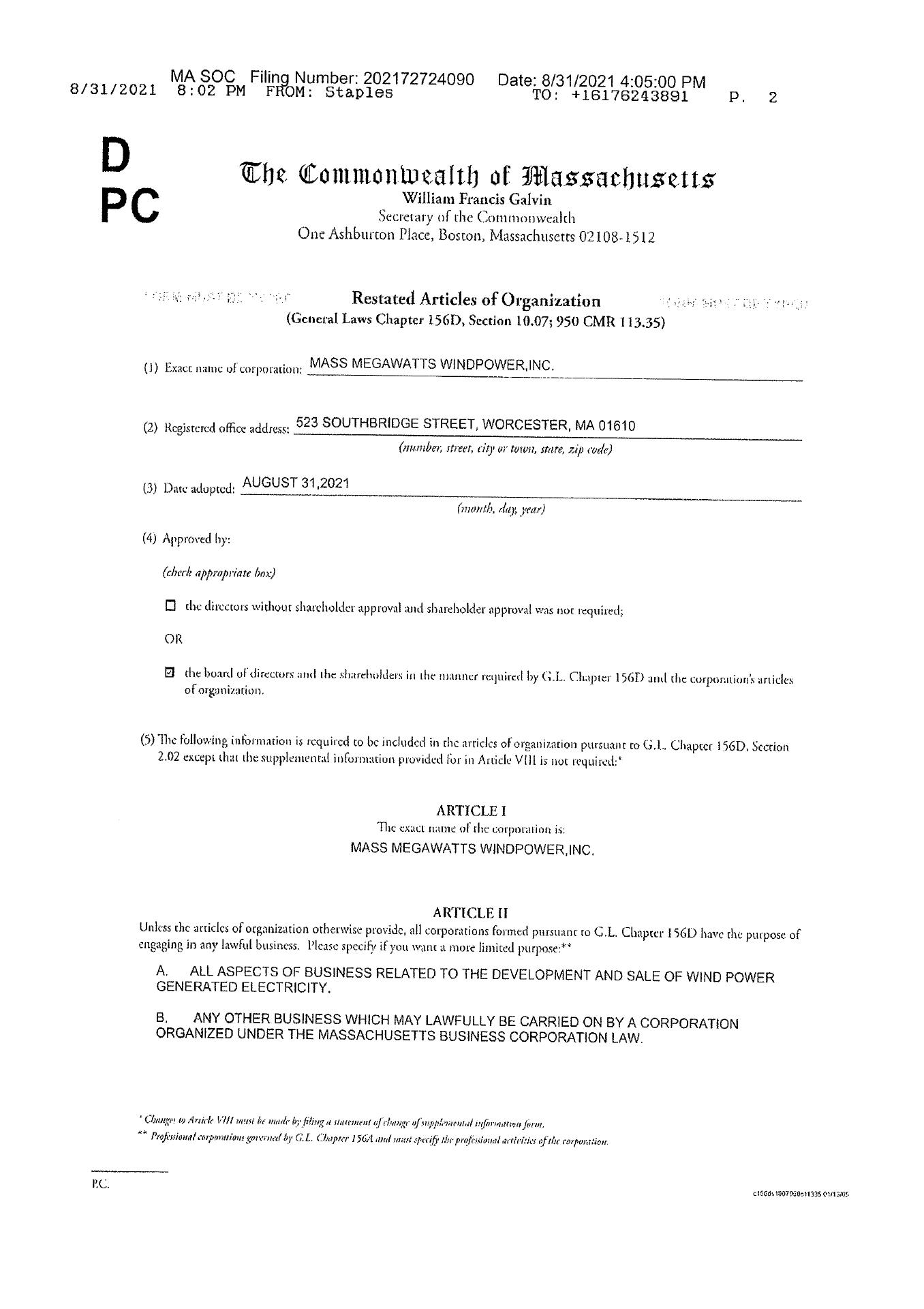

Mass

Megawatts Wind Power Inc., a Massachusetts Corporation, (“ Mass Megawatts” or the “Company”) was organized as

Mass Megawatts, Inc. under the laws of the Commonwealth of Massachusetts on May 27,1997. Mass Megawatts, Inc. changed its name from Mass

Megawatts, Inc. on January 2, 2001, to Mass Megawatts Power, Inc. On February 27,2002 the Company changed its name from Mass Megawatt

Power, Inc to Mass Megawatts Wind Power, Inc.

There

has been no bankruptcy, receivership or proceeding in the Company’s history. Mass Megawatts never had a reverse split or forward

split of its Common Stock. No event occurred involving material reclassification, merger, consolidation, or significant amount of assets

purchased or sold not pertaining to the ordinary course of business. Mass Megawatts has not recorded any significant revenue since its

inception and there is substantial doubt about the going concern status of the company without additional funding. There have

been no trading suspension orders issued by the SEC concerning the issuer or its predecessors.

DESCRIPTION

OF BUSINESS

Issuer’s

Business, Products and Services

Summary

of Business

Mass

Megawatts’ principal line of business is to develop a solar tracker for production to produce sales in the near term and wind energy

production equipment for potential applications in the longer term. Currently, we have only solar tracker prototypes for the purpose

of testing and finalizing the design before any commercial or mass production. The patent filings related to the solar trackers are pending

and not yet granted. The Company is currently finding locations for suitable operating facilities for its solar project using the solar

tracker technology. In addition to its solar projects, the company intends to build and operate wind energy generated power plants utilizing

proprietary MultiAxis Turbine technology after the solar tracker technology develops to a level of consistent sales to be able to be

profitable or close to profitable. Mass Megawatts built several wind energy power plants to test and develop the new technology. However,

we have not achieved a final product for commercial production of the wind power plants.

Solar

Tracker Business Background

Over

the past 15 years, Mass Megawatts has continually strived to innovate and improve alternative energy systems and technologies. This includes

new innovations that significantly improve the efficiency of solar power systems. Our latest innovation, the Mass Megawatts Solar Tracking

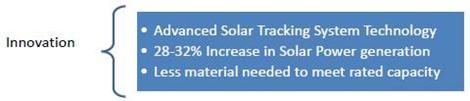

System (STS), is designed to increase solar energy production by 30%.

The

patented pending STS technology is designed to automatically adjust the position of solar panels to receive an optimal level of direct

sunlight throughout the day. Unlike other solar tracking technologies, the Mass Megawatts STS utilizes a low-cost structure that adds

stability to the overall system while improving energy production levels.

The

STS utilizes an innovative structural design that combines a simple, yet robust, A-frame design with a low-cost, protective outer-wall.

Using a non-electrical, and passive, tracking technology, the solar panels are automatically repositioned throughout the day as the sun’s

position travels from east to west. With ground fittings secured at multiple points, the system is designed to handle extreme weather

and winds up to 120 mph.

The

tracking technology allows the panels to receive more direct sunlight and to generate more solar power for the customer. With this system,

solar power production is increased by up to 30% as compared to stationary configurations. Future versions of the STS will also offer

a dual-tracking capability, which can further improve solar power generation levels by an additional 10%.

The

STS allows Mass Megawatts to lower material costs and reduce the number of solar panels needed to generate the rated capacity. Due to

this advantage, Mass Megawatts can deliver more solar power production at a price similar to lower-capacity, stationary systems. Specifically,

we plan to offer solar tracker systems sized to the optimal use of the customer. The additional cost of the solar tracking system is

less than 10 percent additional cost of a conventional stationary solar project of the same size . The power output of the solar tracking

system is greater than 30 percent than a conventional solar power system of a similar size.

A

Mass Megawatts STS system is appropriate for ground-level, residential and business sites, as well as, commercial, roof-top installations,

and has a rated life expectancy of 20 years. Installation can be completed in a few business days, and there is no annual, routine maintenance

to perform. Mass Megawatts coordinates all aspects of system delivery, including permitting, installation, and working to obtain any

available tax incentives. They monitor the performance of each system, and provide a full, performance guarantee.

Solar

Tracker Technical Details

The

STS utilizes a revolutionary, patent-pending framework that significantly reduces the torque required to adjust the position of solar

panels throughout the day. Unlike other tracking technologies that apply a vertical, up-and-down motion, the STS rotates the solar panels

into position using a horizontal motion. The amount of torque needed to accomplish this movement is minimal, and can be accomplished

with a simpler, lower-cost design.

The

STS framework also allows multiple solar units to share the same tracking mechanism. Instead of applying a separate tracker to each independent

solar unit, many solar-power units can be ‘daisy-chained’ together to share the same tracking mechanism with the same actuator.

This dramatically reduces the cost to implement a solar tracking solution at larger capacity installations, with costs projected to drop

from 30% to 5%. A substantial savings that significantly improves ROI and shortens the payback-period. With the Mass Megawatts STS, you

get a 28% increase in solar-power generation with a minimal increase in capital expenditures.

SOLAR

TRACKER TECHNICAL DESCRIPTION

The

tracker uses a cable and sheave system to move a platform of solar panels to follow the sun throughout the day in order for the panels

to directly face the sun for maximum output. It comprises a motor that would act similar to moving the tracker with moving rope or belt

in order to correctly position the solar tracker to face the sun. Walls on both sides of the platform are part of the means to reduce

static loading in high wind events. A spring loaded universal joint means can be connected between the wall and motor and belt system.

The sheave is braked or stopped moving when the pulled cable holds the sheave against the wall during high wind. The purpose of the side

braking means using a spring to allow the platform to hit the wall and shut off power and at the same time hold or brake the wire in

order to reduce dramatically or even eliminate static loading on the platform. The gear belt connected to the sheave would not move and

therefore avoid excessive static loading from the high wind on the actuator. The low amount of both dynamic loading and static loading

from this pivot, cable and wire solar tracker system would reduce the need for additional or more powerful actuators in a major way and

at the same time avoid the damage from the wind , weather elements, and actuator side movement damage which is eliminated with this invention.

The

movement of the belt and actuator area and movement description with the arrows are illustrated with the actuator related components

moving sideways in high wind in order stop the electric movement by hitting a stop switch, halting the sheave movement and stopping wire

movement of the platform.

The

circumference is equal the total distance of travel for the belt from sunrise to sunset position. A reduction of static loading would

allow for less powerful and less actuators and therefore reducing the cost of the solar tracker. A dual direction damper shock absorber

is connected in a manner that eliminates or virtually eliminates static loads imposed upon the shock absorber damper and other components

of the pulley and belt system. The solar tracker also eliminates or substantially eliminates dynamic loads of the components. The solar

panel in full position of sunrise or sunset or a heavy wind condition whereas the panel is leaning on the bumper to avoid further movement.

The solar panel is leaning on the bumper in sunrise position or a time of a heavy wind.

SOLAR

TRACKER COMPETITIVE ADVANTAGE

The

Mass Megawatts ‘Solar Tracking System’ (STS) Advantage

Based

in Central Massachusetts, Mass Megawatts Wind Power, Inc. (OTC: MMMW) is taking part of the $12 billion, US solar power market with the

development of a new solar tracking technology that significantly increases the level of energy produced by solar power systems. This

innovative design, combined with substantial government incentives, has created an unprecedented opportunity for residential and commercial

electric users.

The

patent pending, Mass Megawatts ‘Solar Tracking System’ (STS) is a complete solar power system that’s designed

to continually adjust the position of solar panels to receive the optimal level of direct sunlight throughout the day. Unlike other solar

tracking technologies, the Mass Megawatts STS utilizes a low-cost structure that adds stability to the overall system while improving

solar energy production levels for the customer by 28 to 32%. Recent modifications on racking and panels can boost output about 60 percent.

In

addition, substantial federal, state, and local incentives can significantly reduce the total cost of a solar power investment. With

these favorable government incentives, a large percentage of capital costs can be recouped in the first year of service, while providing

for additional, ongoing revenues. This provides an excellent return on investment with payback projected to occur in the third year for

most customers.

A

Mass Megawatts STS system is appropriate for home and small business locations and can be scaled to meet capacity requirements at commercial

installations. Mass Megawatts coordinates all aspects of system delivery, including permitting, installation, and working to obtain any

available tax incentives. They monitor the performance of each system, and provide a full, performance guarantee.

Impact

of Government Incentives on the Total Cost of an STS

The

value of Federal, state, and local incentives for solar power customers cannot be understated…

| |

● |

Substantially

reduces the total cost of a solar power system. |

| |

● |

Improves

the return on investment (ROI) and shortens the payback-period. |

| |

● |

Aids

in securing third party financing for a solar power system. |

With

favorable rebates and tax incentives, a large percentage of capital costs can be recouped in the first year of service, while providing

for substantial, ongoing revenues.

The

Power of Solar Renewable Energy Certificates (SRECs)

In

several states, solar power owners can generate income from the sale of Solar Renewable Energy Certificates (SRECs), which are the positive

environmental attribute of the clean energy produced by a solar system. These are tradable certificates based on the production of the

system. Participating states will qualify eligible solar projects, allowing the owner to sell their generated SRECs in the market to

electricity suppliers (usually utilities).

Energy

Savings with Net Metering

While

it’s well known that solar power/photovoltaic (PV) owners can use the electricity produced by their system to directly offset their

electricity usage from the utility/grid, additional cost benefits can also be realized through Net Metering.

Net

metering is a state regulation that allows customers generating their own electricity to be credited at nearly the retail rate for the

energy they generate but do not use. A customer’s electric meter will run backward whenever the site is producing more solar power

than is being consumed, and their utility account gets net metering credits for net excess generation.

Most

states have net metering programs, and a 2005 Federal law requires all public utilities to offer net metering upon request. If your solar

power system was designed appropriately, your entire electric bill for the year should be minimized. The net metering programs offered

by utilities can vary, including limits on capacity and different policies regarding how surplus energy is credited.

Another

method of financing is the use of a Production Power Agreement. With a PPA, Mass Megawatts would own the STS system on your site. We

would install and maintain it, no cost to you, and you would pay us for the electricity generated (at a rate that’s below your

current energy costs). In that manner, you have no up-front costs, yet still receive savings from the clean, solar power the system is

generating. Other, modified PPA plans can also be setup to allow the customer to provide an initial, up-front payment, which would secure

a lower rate on the electricity they receive in the future. Similarly, with a lease program, you would avoid any large deposits or up-front

payments. Mass Megawatts would install and maintain the system, for free, at your site. The main difference between a PPA and lease plan

is that with a PPA, you are paying for the actual amount of energy generated by the STS (i.e. number of kilowatt-hours / month) verses

a lease arrangement, which requires a fixed monthly payment regardless of the level of energy produced.

Both

PPAs and lease programs provide a great way to avoid a large, up-front investment, while still allowing consumers to realize immediate

energy savings when an STS is installed. With energy costs projected to increase going forward, the savings and investment return for

a customer will continue to grow throughout the expected lifetime of the unit (30+ years). Both programs also provide an option to purchase

the STS outright after a specified amount of time.

| ● | Favorable

financing options with third-party lenders. |

Securing

third-party financing for a Mass Megawatts Solar Tracking System (STS) is aided by the guaranteed receipt of future government incentives.

This includes the 30% Federal tax credit, along with, state rebates and local incentives, which are received starting in the first year

of service. These guaranteed, no risk, receipts are recognized and valued by third-party lenders, and help to secure financing.

| ● | Full

warranty, repair service, and performance guarantee provided for the first 10 years. |

The

STS comes with a full warranty protecting against defective equipment and workmanship during the first 10 years. Mass Megawatts also

provides any needed repairs during this time. While no routine, annual maintenance is required, the expected life of the inverter is

10 years. Any needed repairs will be completed by Mass Megawatts over the first 10 years.

The

operational performance of the STS is also guaranteed during the first 10 years. If the system does not generate the expected, and documented,

level of energy, the customer will be credited for the difference in lost revenue. Mass Megawatts is committed to delivering a high-quality

product with exceptional service to each customer.

| ● | STS

Delivery and Performance |

| During

construction and installation |

|

A

performance bond is secured by Mass Megawatts to guarantee satisfactory delivery and completion

of the project. This insures the value of the STS, for the customer, during the construction

and installation period. If, for any reason, the project is not completed successfully, the

investor will receive full compensation from the bond issuer.

|

| |

|

|

| After

installation – Performance Guarantee |

|

Once

installed, the operational performance of the system is monitored and guaranteed for 10 years.

If the unit doesn’t generate the projected level of output (energy), the customer will

receive a credit to compensate for any loss in revenue due to substandard operational performance.

|

| |

|

|

| Maintenance |

|

Any

needed repairs will be performed by Mass Megawatts during the first 10 years of operation.

|

| ● |

Mass

Megawatts provides continued support to the customer throughout the entire sales and installation process. |

Mass

Megawatts utilizes their industry knowledge and in-house resources to provide continued support to the customer throughout the sales,

design, installation, and operational lifetime of the STS. From the initial

site evaluation, through the sales proposal with full disclosure of costs, incentives, and projected ROR, to the complete installation

and support of the STS, Mass Megawatts will be there to oversee the process to ensure a successful implementation. Mass

Megawatts will use their industry knowledge and in-house resources to provide the following.

| |

1. |

Perform

a site evaluation to confirm the optimal STS design. |

| |

2. |

Research

and verify eligibility for all tax incentives, grants, and explore financing options. |

| |

3. |

Provide

a written sales proposal with full disclosure of all costs and incentives, as well as the projected rate of return and payback-period

for the STS investment. |

| |

4. |

Work

through the process to formally apply for these tax incentives, and grants. |

| |

5. |

Handle

the complete installation of the STS. |

| |

6. |

Monitor

system performance and provide any needed servicing. |

Projected

Timeline

The

length of time to complete the process of evaluating, purchasing, and installing an STS system can vary and depends on a number of factors.

However, most customers can expect to have their Solar Tracking System installed and operational within a 2 to 6 week period.

Mass

Megawatts SUMMARY of Secondary Business (Wind Power)

Mass

Megawatts has continued development efforts in wind power technology to bring a product to the renewable energy marketplace capable of

producing electricity at a cost 30% lower than other wind power equipment. Designed on a paradigm that ‘lower height, lower wind

speeds and lower costs equal higher profits’, this technology puts MAT electricity generation on a competitive footing with fossil

fuels, such as coal and natural gas.

A

‘Smart Grid’ Energy Solution: MAT technology fits perfectly into the localized ‘distributed energy models’ that

have been adopted by Federal and State agencies to promote energy independence and the re-design of our power transmission and distribution

network into a national ‘Smart Grid’.

Energy

planners nationwide have been seeking an adaptable, scalable ‘wind power solution’ that will be welcomed by local communities.

Mass Megawatts MAT technology meets this challenge on every level. Adaptable to both high and lower wind resource regions and economically

scalable to meet electric supply requirements from small users to large utilities, the MAT technology is the first wind power technology

that allows purchasers to size their electric generation facility to fit their usage needs.

Traditionally,

wind power adopters have found themselves in the position of having to purchase systems that either provided more generation capacity

then they needed, or, conversely, walk away ‘shorthanded.’ The MAT’s modular technology basis puts the ‘sizing’

decision making on the customer’s side of the table, not the vendor’s. Uncounted numbers of municipal, agricultural and business

wind power projects have been abandoned on the basis of the purchaser’s not being able to acquire equipment that could be sized

to their needs and budget.

Low

Height = Community Acceptability: Mass Megawatts is recognized as the vendor of choice for utilities, communities, businesses and other

wind power generation adopters who are seeking a lower cost, community friendly, renewable energy solution. MAT technology is readily

accepted by local communities, where resistance to ‘tall tower’ wind farms is legendary. Ranging between 50 feet to a maximum

of 80 feet in overall height, MAT units boast extremely productive generation capability in areas with lower wind speeds, where ‘tall

tower’ utility-scaled projects simply are not financially feasible or successful.

Durability

& Low Cost Maintenance: This winning equation is further enhanced by the overall ruggedness and low maintenance requirements of the

MAT units. Our equipment is rated to withstand winds of up to 120 mph, with all mechanical and electrical components located close to

ground level. Projected maintenance costs are 50% less than the wind power industry’s average.

Unlimited

Potential: The geographic footprint of lower wind speed regions both suitable and profitable for MAT technology is several times greater

than that of ‘tall tower wind,’ with its requirement for extremely high wind resources.

Wind

Power Business

Mass

Megawatts built several wind energy power plants to test and develop the new technology. However, the Company has not achieved a final

product for commercial production of the wind power plants. The Company’s MultiAxis Turbosystem (MAT) technology (multiple patents

pending) will establish constantly renewable, clean, cost-competitive wind energy. Based on MAT’s performance, the Company is projected

to produce power at a cost of 2.4 per kWh. The Company anticipates being able to sell electricity at a price of $3.00 per megawatt/hour.

If

Mass Megawatts chooses to work through power brokers, the Company believes it could potentially sell the environmentally correct “green”

power for as much as $6.50 per megawatt/hour.

The

Wind Power Product (Multiaxis Turbosystem)

The

Mass Megawatts leading product is the MultiAxis Turbosystem (“MAT”),proprietary technology licensed from the Company’s

Chief Executive Officer and Chairman, Jonathan C. Ricker with the details of the license agreement as an Exhibit at the end of this Form

1-A. The license agreement gives Mass Megawatts the territorial right to use the technology in half of the United States of America.

The licensed states are Massachusetts, New York, New Jersey, Pennsylvania, California, Illinois, Kansas, Michigan, Minnesota, Nebraska,

North Dakota, South Dakota, Texas, Vermont, Washington, and Wisconsin. The licensor is paid two percent of net sales during the life

of the patent of each product. The agreement can be terminated by Mass Megawatts, the licensee, at the end of any annual period by thirty

days advance notice to the Licensor.

Wind

turbines take advantage of a free, clean, inexhaustible power source to convert wind energy into electricity. Each MAT consists of a

rectangular fabricated steel frame 80’ high x 80’ long and 40’wide, elevated 50’ above ground level for improved

wind velocity, and secured to footings at ground level. Each frame houses 16 shaft 4-tiered stacks, and onto each stack is mounted 8,

4’ wide x 18’ long blades. Each stack is connected to two generators mounted on the ground level footing. The generators

feed to a power collector panel which, in turn, connects to the power grid. Each MAT unit is rated at 360 kWh.

In

order to generate large amounts of cost-efficient energy, conventional turbines (airplane propeller style) require massive, and expensive,

rotors to turn the huge blades. These blades must be of a diameter sufficient to increase the airflow impacting the blade’s surface

area. As the diameter of the blade increases, so too does the cost of other components. Large blades also create structural stress and

fatigue problems in the gearbox, tower, and in the yawing system which turns the turbine into the optimal wind direction.

The

MAT reduces blade cost by using a geometrically simple, smaller blade which addresses problems associated with vertical axis turbines.

Vertical axis turbines suffer from severe structural stress problems caused by the forces of lift which push the blades back and forth

causing heavy cyclical loads. As vertical turbines rotate, wind contacts them first from the left side, then from the right. This constant

repetitive motion causes fatigue. The popular propeller, or horizontal version, also has horizontal lift stresses, although at a reduced

level since the lift forces are not constantly reversing. MAT’s small blade units eliminate the structural fatigue of longer, heavier

blades. It also enables MAT to more efficiently gather the mechanical power of the wind and transfers it to the generators for the production

of electrical power. This innovation also allows other critical parts of the wind turbine to be repositioned, thus reducing the structural

complexity and cost of construction. For example, the heavy generator and shaft speed increasing device, can now be placed at ground

level rather than mounted atop the tower. In conventional wind turbine design, the shaft speed increasing device is typically a heavy

gearbox which must be sufficiently rugged to withstand the vibrations of the tower caused by the large blades. The combination of vibrations

and yaw (the action of turning the turbine into the wind), causes structural stress.

By

locating the drive train and generator at ground level, components with considerable weight or mass can be used. For example, a direct

drive generator can be used, eliminating the need for a gearbox. This provides the advantages of variable-speed operation which increases

power output at a lower cost. Ground level construction also allows easier access, which reduces maintenance costs.

The

MAT design enables power output to be achieved at a much lower windspeed, providing a more consistent power output to the utility power

grid. This potential for consistent output provides utilities with planning advantages, and fewer power fluctuations allow for better

power quality. Coal, oil and gas generators are always at full capacity when needed. Wind energy, using conventional turbines, cannot

reach full capacity unless weather conditions are favorable.

MAT’s

improved method of delivering electricity will allow wind energy generated power to demand a higher competitive bid price due to the

more consistent supply. Other environmental advantages specific to MAT include its noiseless turbines which will ease site permitting,

and its high visibility to birds which will prevent them from flying into the rotation area.

Technical

Advantages of MAT Technology

Traditionally,

wind turbines were supported by a single tower and in many cases with guy wires leading to a multitude of vibration and frequency related

problems. The blades of vertical axis turbines were large and therefore limited in their design and the material. For example, aluminum

extrusion and fiberglass pultrusion were used in the two most serious commercial applications of vertical axis turbines. Due to the large

size of the fiberglass blades, transporting them required a straight shape. The strength was limited for the purpose of being able to

bend the blades at the place of installation. In other vertical axis wind technology, the aluminum blades could not form a true aerodynamically

optimal shape. The blades had to be made of significant length and the available extrusion equipment for the long length and large profiles

are not available for producing a structural and aerodynamic blade at a cost competitive price. The patents of both serious commercial

prior applications of vertical axis technology are described in “Vertical Axis Wind Turbine” Patent number 4,449,053 and

“Vertical Axis Wind Turbine with Pultruded Blades” in Patent number 5,499,904.

The

MAT overcame the size related disadvantages. One such manufacturing advantage of the MAT includes the cost reduction of using smaller

components instead of larger and fewer components. Other advantages include more solid blades which help to resolve cyclical stress advantages

and inexpensive repair and maintenance with components like the generator, heavy variable speed equipment and gearbox on the ground level

while elevating the rotor high above the ground in order to avoid turbulence. The MAT can provide a longer life for the bearings by reducing