November 5, 2021 -- InvestorsHub NewsWire -- via Hawk Point

Media --

Benzinga

iQSTEL Inc.’s (OTCQX:IQST)

market cap of $62M is absurdly low. In fact, 2021 revenues, if they

continue on the current trajectory, could surpass the entire market

cap by the end of the year. So, why the disconnect? There’s a

relatively simple answer. IQST is under the radar of most and lacks

institutional coverage provided by pay-to-play analysts. Still,

that’s not entirely bad news. With value staring investors in the

face, it also exposes the opportunity to invest in a rapidly

growing diversified company at relatively ground floor prices.

Better yet, investors would be buying into a company in a

hyper-growth mode whose value proposition is made strong from

revenue streams from partnerships involving companies as small as

micro-caps to Fortune 500 behemoths. The better news is that

momentum is on its side. Last month, IQST reported another robust

revenue update and confirmed guidance to potentially surpass $60

million in revenues by the end of 2021.

The most important part of that update is that IQST is expanding

its business interests rapidly and efficiently. Its recent

financials proved that point.

Rapid Growth, Accretive To Balance Sheet

In fact, IQST’s most recent financials not only show a company

in motion but one that is positioned for potentially exponential

growth. The company is entirely debt-free and, more importantly,

eliminated all toxic debts, convertible loans, and warrant

obligations. Moreover, beyond strengthening its balance sheet, that

accomplishment positions them ideally to uplist to the NASDAQ

markets as early as Q1 of next year. That’s their

intention.

But more than debt was eliminated. From an assets perspective,

IQST increased those by about 33% to roughly $7.4 million. Even

better, while IQST did sell some equity to accelerate its strategic

initiatives, the dilutive consequence should have less impact than

many might expect. In fact, IQST’s shareholder equity actually

increased over the first half of the year by nearly $6 million,

reaching positive equity in the process.

Now, with those accomplishments booked, IQST’s next initiative

is to capitalize on a strengthening global telecom, Fintech, and EV

market to increase its margins. And as global markets recover from

a debilitating pandemic, they are ideally positioned to accomplish

that goal.

And if they can do so, expect share prices to surge sooner

rather than later. Keep in mind, they already have the assets in

place to drive operating margins higher by maximizing the value of

its subsidiary interests.

Maximizing Subsidiary Value Through

Cross-Selling

That’s happening now. IQST management is actively reorganizing

its subsidiary operations to capitalize on overlapping market

opportunities where the services of one subsidiary can be sold into

the existing customer base of another and vice versa. That mission

drives revenues and makes income more impactful by reducing

subsidiary redundancies to achieve operational efficiencies and

improve operating margins.

Success in doing so may cause history to repeat. In 2020,

investors responded enthusiastically to its expansion by sending

share prices from $0.05 to $2.00. While the price has since

retraced to the $.0.45 level, it’s important to note that the

company is better positioned operationally today compared to when

shares were appreciably higher. Further, to prepare for a more

senior market listing, IQST has also enhanced its public reporting

standards by implementing an independent board of directors, moving

from the OTC Pink reporting standard to the OTCBB, and then

recently to the OTCQX. Thus, on all fronts, IQST is laying the

groundwork to justify its expected surge.

But, having the pieces in place is one part of the equation.

They are also putting the substantiating evidence front and center

to prove the current valuation disconnect. And rather than spend

2000 words providing that information, a simple click to its SEC

filings provides all the necessary information to indicate that

IQST has outgrown its current valuation. It presents a bullish case

for investment consideration.

And while there’s plenty in those filings, there’s more to like

from a near-term catalyst perspective.

Planned NASDAQ Uplist

The most important catalyst in the coming weeks may have more to

do with its planned NASDAQ uplist than with record-setting

revenues. Indeed, it could generate substantial interest and open

the investment opportunity to an entirely new investor class.

Remember, many brokerage houses exclude trading in many OTC stocks.

And while IQST trades on the QX, there are still some limitations.

An uplist removes those barriers.

Moreover, if they get approved, expect that its current 1X

expected 2021 revenues multiple will be met with broad investor

interest. An update on margin expansion could add an additional

multiple as well. Here’s better news. It wouldn’t be surprising to

see a definitive NASDAQ uplisting announcement during Q1 2022 after

the company publishes its audited annual report. There’s still more

to like.

Another catalyst could come ahead of its listing application if

IQST announces entering a relationship with a sponsoring investment

bank for the planned uplisting. An announcement on that front

could, in fact, be imminent. Historically, news of that nature has

a significant impact on company valuations.

Seizing Short And Long-Term Opportunity

Thus, IQST is attractive to both short and long-term traders.

And while a perfect storm of business opportunity supports the

long-term perspective, an appreciable increase in share price could

come sooner from IQST having less than 150 million shares

outstanding, no convertible debt on the books, and $60 million in

audited annual revenue anticipated to be reported for

2021.

Moreover, if IQST does announce a relationship with a sponsoring

investment bank, IQST’s share price could reach the minimum listing

requirement without a recapitalization. That is not only likely but

also would represent a more than 100% increase from current levels.

Hence, with momentum at its back and several potential catalysts

ahead, IQST stock at these levels may present a timely proposition.

Better still, acting on that consideration takes advantage of an

apparent and massive valuation disconnect.

Disclaimers: Hawk Point Media Group, LLC. (Hawk Point Media)

is responsible for the production and distribution of this content.

Hawk Point Media is not operated by a licensed broker, a dealer, or

a registered investment adviser. It should be expressly understood

that under no circumstances does any information published herein

represent a recommendation to buy or sell a security. Our

reports/releases are a commercial advertisement and are for general

information purposes ONLY. We are engaged in the business of

marketing and advertising companies for monetary compensation.

Never invest in any stock featured on our site or emails unless you

can afford to lose your entire investment. The information made

available by Hawk Point Media is not intended to be, nor does it

constitute, investment advice or recommendations. The contributors

may buy and sell securities before and after any particular

article, report and publication. In no event shall Hawk Point Media

be liable to any member, guest or third party for any damages of

any kind arising out of the use of any content or other material

published or made available by Hawk Point Media, including, without

limitation, any investment losses, lost profits, lost opportunity,

special, incidental, indirect, consequential or punitive damages.

Past performance is a poor indicator of future performance. The

information in this video, article, and in its related newsletters,

is not intended to be, nor does it constitute, investment advice or

recommendations. Hawk Point Media strongly urges you conduct a

complete and independent investigation of the respective companies

and consideration of all pertinent risks. Readers are advised to

review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider

reports, Forms 3, 4, 5 Schedule 13D. For some content, Hawk Point

Media, its authors, contributors, or its agents, may be compensated

for preparing research, video graphics, and editorial content. Hawk

Point Media LLC has been compensated up to four-thousand dollars

cash via wire transfer by a third party to prepare and syndicate

content for iQSTEL, Inc.. for a one-month period. As part of that

content, readers, subscribers, and website viewers, are expected to

read the full disclaimers and financial disclosures statement that

is part of this content.

The Private Securities Litigation Reform Act of 1995

provides investors a safe harbor in regard to forward-looking

statements. Any statements that express or involve discussions with

respect to predictions, expectations, beliefs, plans, projections,

objectives, goals, assumptions or future events or performance are

not statements of historical fact may be forward looking

statements. Forward looking statements are based on expectations,

estimates, and projections at the time the statements are made that

involve a number of risks and uncertainties which could cause

actual results or events to differ materially from those presently

anticipated. Forward looking statements in this action may be

identified through use of words such as projects, foresee, expects,

will, anticipates, estimates, believes, understands, or that by

statements indicating certain actions & quote; may, could, or

might occur. Understand there is no guarantee past performance will

be indicative of future results.Investing in micro-cap and growth

securities is highly speculative and carries an extremely high

degree of risk. It is possible that an investors investment may be

lost or impaired due to the speculative nature of the companies

profiled.

Source - https://www.benzinga.com/pressreleases/21/11/ab23851289/iqstel-inc-has-catalysts-on-deck-that-expose-a-valuation-disconnect-of-roughly-100-heres-why-that

Other stocks on the move include

AABB,

IPIX,

NWBO.

SOURCE: Hawk Point Media

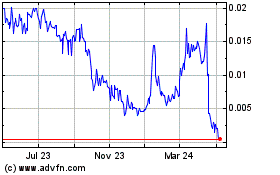

Innovation Pharmaceuticals (CE) (USOTC:IPIX)

Historical Stock Chart

From Nov 2024 to Dec 2024

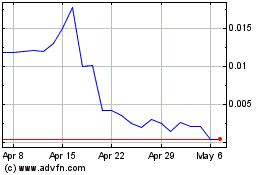

Innovation Pharmaceuticals (CE) (USOTC:IPIX)

Historical Stock Chart

From Dec 2023 to Dec 2024