false

0001498148

0001498148

2024-10-16

2024-10-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): October 16, 2024

| ARTIFICIAL

INTELLIGENCE TECHNOLOGY SOLUTIONS INC. |

| (Exact

name of registrant as specified in its charter) |

| Nevada |

|

000-55079 |

|

27-2343603 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

10800

Galaxie Avenue

Ferndale,

MI 48220 |

| (Address

of principal executive offices) |

| (877)

787-6268 |

| (Registrant’s

telephone number, including area code) |

| Not

Applicable |

| (Former

name or former address, if changed since last report.) |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| N/A |

|

N/A |

|

N/A |

When

used in this Current Report on Form 8-K, unless otherwise indicated, the terms the “Company,” “our,” or “we”

refer to Artificial Intelligence Technology Solutions Inc. and its subsidiaries.

Item

2.02 Results of Operations and Financial Condition

On

October 16, 2024, we will be issuing a press release titled “AITX Announces Continuation of Exponential Growth in Q2 FY 2025 Financial

Results”, which press release is attached hereto as Exhibit 99.1.

Item

8.01 Other Events

The

information set forth under Item 2.02 of this Current Report on Form 8-K is incorporated by reference herein.

The

information in this Current Report on Form 8-K with respect to Item 8.01 (including the press release attached hereto as Exhibit 99.1)

is being furnished pursuant to Item 8.01 of Form 8-K and shall not be deemed to be “filed” for the purposes of Section 18

of the Securities Exchange Act of 1934, as amended (“Exchange Act”), or otherwise subject to the liabilities of that section,

nor shall it be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act.

This current report on Form 8-K (including Exhibit 99.1) will not be deemed an admission as to the materiality of any information contained

herein.

ITEM

9.01. EXHIBITS

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date:

October 16, 2024 |

ARTIFICIAL

INTELLIGENCE TECHNOLOGY SOLUTIONS INC. |

| |

|

|

| |

|

/s/

Steven Reinharz |

| |

Name: |

Steven

Reinharz |

| |

Title: |

Chief

Executive Officer |

Exhibit

99.1

AITX

Announces Continuation of Exponential Growth in Q2 FY 2025 Financial Results

Revenue

and Gross Profit 3X of Same Quarter Prior Year

Detroit,

Michigan, October 16, 2024 — Artificial Intelligence Technology Solutions, Inc., (the “Company”) (OTCPK:AITX),

a global leader in AI-driven security and productivity solutions along with its wholly owned subsidiary, Robotic Assistance Devices,

Inc. (RAD), today announced its financial results for the second quarter of fiscal year 2025, which ended on August 31, 2024. AITX Q2

FY 2025 revenue increased to 348% compared to FY 2024 Q2 revenue and Q2 FY 2025 gross profit increased to 301% of FY 2024 Q2 gross profit.

Management

encourages all AITX investors, fans, and followers to thoroughly review the full SEC filing at https://tinyurl.com/aitxq2fy25

and wishes to highlight five critical areas of performance:

| 1. | Strong

Revenue Growth Paves the Way for Operational Profitability: |

AITX

reported an impressive total revenue growth of 348% for the three months ended August 31, 2024, reaching $1,344,183, compared to $386,363

for the same period in 2023. This significant increase is driven by substantial growth in monthly recurring rental revenue.

Steve

Reinharz, CEO and CTO of AITX, said, “Our continued outstanding growth in revenue highlights the growing demand for our AI driven

solutions and the unwavering commitment of our team. With us just six weeks into the second half of the fiscal year, we’re driving

as hard as possible to both surpass the operationally profitability goal and hit the ambitious goal of having $1 million in recurring

monthly revenue when we add deployed RMR to contracted backlog RMR. With deliveries of RADCam™ expected to begin in December,

it could be a nice boost to our year end numbers. As our AIR™ technology populates through our 4th generation

solutions, I believe sales activity will get even more exciting. These new developments will expand our product offerings and elevate

industry expectations. Lastly, you can always count on some surprises on the solution and sales front.”

| 2. | Unprecedented

Profit Growth Reflects Operational Efficiency: |

AITX

achieved a gross profit of $559,218 for the three months ended August 31, 2024, representing a 301% increase of the $139,437 reported

for the same period in 2023. This growth underscores the Company’s ongoing improvements in operational efficiency and its ability

to manage costs while substantially expanding its revenue base.

“Having

our gross profit at 41% of revenue is a significant improvement but we still have many efficiencies to gain,” Reinharz noted. “We

are driving towards continued improvements in this number, particularly next fiscal year.”

| 3. | Significant

Market Valuation Growth: |

The

Company’s Q2 FY 2025 market capitalization increased by 43% over Q2 FY 2024 market capitalization of approximately $26.3 million.

This growth reflects AITX’s financial stability, as well as the rising confidence in the Company’s innovative strategy, transparent

operations, and consistent communication with its investors.

Reinharz

commented, “The notable increase in our market value underscores the confidence investors have in our vision, mission, and the

impact our solutions are making. We remain committed to sustaining this upward momentum by driving innovation and consistently delivering

high-quality products that exceed the evolving needs of our customers. Our focus is on creating long-term value for both our shareholders

and the broader market.”

| 4. | Record

Order Intake Drives Growth Momentum: |

During

the quarter, RAD recorded its largest order intake, as announced on September 3, 2024, with 172 units ordered, which, when fully

deployed and accepted equals $212K in recurring monthly revenue. This rise in orders reflects the growing demand for the Company’s

security and safety solutions and highlights the effectiveness of its sales and distribution efforts. The strong order intake positions

the Company for continued growth in the second half of the fiscal year.

| 5. | AITX

Targets $1 Million in Recurring Monthly Revenue by Fiscal Year-End: |

The

Company is aggressively working toward its goal of reaching $1 million in contracted and deployed recurring monthly revenue (RMR) by

February 28, 2025, the end of its fiscal year. By focusing on increasing order intake and swiftly deploying its security solutions, the

Company is positioning itself for sustainable, long-term growth. Achieving this milestone will further validate the effectiveness of

AITX’s business model and its ability to secure consistent, recurring revenue streams.

Reinharz

concluded, “Looking ahead, I’m excited about the path we’re on. Our strong first-half performance, new solutions, and

our push for $1 million in RMR position us to end the fiscal year on a high note. With a solid foundation in place, we’re ready

to accelerate growth. I believe AITX is just getting started, and I am eager to see how we’ll continue delivering value to our

investors and customers.”

The

Company’s rental revenue is classified as Recurring Monthly Revenue (RMR), which provides a stable and predictable income stream.

RMR is money earned from customers who pay for a subscription to a service or product. RAD’s solutions are generally offered as

a recurring monthly subscription, typically with a minimum 12-month subscription contract.

AITX,

through its subsidiary, Robotic Assistance Devices, Inc. (RAD), is redefining the $25 billion (US) security and guarding services

industry through its broad lineup of innovative, AI-driven Solutions-as-a-Service business model. RAD solutions are specifically designed

to provide cost savings to businesses of between 35%-80% when compared to the industry’s existing and costly manned security guarding

and monitoring model. RAD delivers these tremendous cost savings via a suite of stationary and mobile robotic solutions that complement,

and at times, directly replace the need for human personnel in environments better suited for machines. All RAD technologies, AI-based

analytics and software platforms are developed in-house.

RAD

has a prospective sales pipeline of over 35 Fortune 500 companies and numerous other client opportunities. RAD expects to continue to

attract new business as it converts its existing sales opportunities into deployed clients generating a recurring revenue stream. Each

Fortune 500 client has the potential of making numerous reorders over time.

AITX

is an innovator in the delivery of artificial intelligence-based solutions that empower organizations to gain new insight, solve complex

challenges and fuel new business ideas. Through its next-generation robotic product offerings, AITX’s RAD, RAD-R, RAD-M and RAD-G

companies help organizations streamline operations, increase ROI, and strengthen business. AITX technology improves the simplicity and

economics of patrolling and guard services and allows experienced personnel to focus on more strategic tasks. Customers augment the capabilities

of existing staff and gain higher levels of situational awareness, all at drastically reduced cost. AITX solutions are well suited for

use in multiple industries such as enterprises, government, transportation, critical infrastructure, education, and healthcare. To learn

more, visit www.aitx.ai, www.radsecurity.com, www.radcam.ai, www.stevereinharz.com, www.radgroup.ai,

www.raddog.ai, and www.radlightmyway.com, or follow Steve Reinharz on Twitter @SteveReinharz.

CAUTIONARY

DISCLOSURE ABOUT FORWARD-LOOKING STATEMENTS

The

information contained in this publication does not constitute an offer to sell or solicit an offer to buy securities of Artificial Intelligence

Technology Solutions, Inc. (the “Company”). This publication contains forward-looking statements, which are not guarantees

of future performance and may involve subjective judgment and analysis. As such, there are no assurances whatsoever that the Company

will meet its expectations with respect to its future revenues, sales volume, becoming cash flow positive, ARR or RMR. The information

provided herein is believed to be accurate and reliable, however the Company makes no representations or warranties, expressed or implied,

as to its accuracy or completeness. The Company has no obligation to provide the recipient with additional updated information. No information

in this publication should be interpreted as any indication whatsoever of the Company’s future revenues, results of operations,

or stock price.

###

Steve

Reinharz

949-636-7060

@SteveReinharz

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

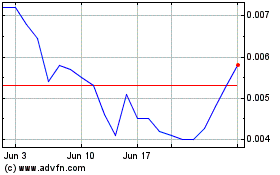

Artificial Intelligence ... (PK) (USOTC:AITX)

Historical Stock Chart

From Oct 2024 to Nov 2024

Artificial Intelligence ... (PK) (USOTC:AITX)

Historical Stock Chart

From Nov 2023 to Nov 2024