Trius Investments Inc. (TSXV: TRU) (“Trius” or the “Company”) is

pleased to announce that its wholly-owned subsidiary (the

“Subsidiary”) has entered into a mineral property acquisition

agreement (the “Purchase Agreement”) with five arm’s length

individual vendors (collectively, the “Vendors”), including several

members of the Stares family which received the Prospectors and

Developers Association of Canada’s Bill Dennis Prospector of the

Year Award in 2007.

Pursuant to the Purchase Agreement, the Company

will indirectly purchase 7 exploration-stage mineral claims located

in Toogood Arm in Newfoundland (the “Toogood Arm Property”), along

with all related permits and technical data (collectively, the

“Purchased Assets”).

Toogood Arm Property The Toogood Arm Property

consists of 247 units covering 6,175 hectares and expands Trius’

Newfoundland land package, following Trius’ acquisition of the

Gander West Property as announced on September 21, 2020.

The Toogood Arm Property is largely unexplored.

At the Wild Cove claims which form part of the Toogood Arm

Property, historical grab samples from the massive, banded

sulphides within Zone 1 returned assay values up to 25.0% zinc

(Zn), 2.4% copper (Cu), 86 g/t silver (Ag) and 1.9 g/t Au, and grab

samples of stringer mineralization returned values up to 9.1% Zn,

1.8% Cu, 2.51 oz/t Ag and 1.9 g/t Au. An average value based on 10

selected samples from Zone 1, including massive, semi-massive,

stringer and disseminated mineralization, is 11.91% Zn and 1.33%

Cu. Historical diamond drill hole WC-96-01 was collared in Zone 1

mineralization and returned an average assay value of 5.7% Zn, 1.2%

Cu, 40 g/t Ag and 1.0 g/t Au over an interval of 4.0 meters.

(Reference National Mineral Inventory Number: 002E/10/Cu 004,

Record ID Number: 264)

Note that grab samples and drill hole results

are select samples and are not necessarily representative of

mineralization on the Toogood Arm Property. The diagrams and

technical information herein relating to the Toogood Arm Property

have been supplied by the Vendors and have not been independently

verified by Trius.

Joel Freudman, President and CEO of Trius, said,

“We continue to invest in Trius’ Newfoundland land package,

following the major gold discovery in the region by New Found Gold,

and are thrilled to do it by partnering with the renowned Stares

family. The Toogood Arm Property is under-explored, yet still has

enough historical work to serve as a strong starting point for

advancement.”

Purchase Agreement Pursuant to the Purchase

Agreement, the Vendors will receive the following consideration for

the Purchased Assets: (i) the issuance by Trius of an aggregate of

6,000,000 common shares in the capital of Trius (each, a “Trius

Share”) at a deemed price of $0.20 per Trius Share; and (ii) the

granting by the Subsidiary to the Vendors of a 2.0% net smelter

returns royalty from any future mineral production at the Toogood

Arm Property, of which 1.0% can be repurchased by the Company for

$1,000,000. Trius will also reimburse the Vendors’ non-material

staking costs.

Further, the Vendors will be issued up to an

additional 500,000 Trius Shares if the Company defines at least

500,000 ounces of gold equivalent at the Toogood Arm Property in a

technical report prepared in accordance with National Instrument

43-101, and a further 1,000,000 Trius Shares if the Company defines

a further 500,000 ounces of gold equivalent in such a technical

report. All Trius Shares issuable under the Purchase Agreement are

subject to a hold period expiring four months and one day from the

date(s) on which Trius Shares are issued.

The acquisition of the Purchased Assets will be

completed as soon as is practicable based on governmental claims

transfer processing times, and remains subject to regulatory

approval by the TSX Venture Exchange.

The Purchased Assets will be a second novel,

direct mineral exploration holding within the Company’s broader

investment portfolio. Trius is acquiring the Purchased Assets as a

passive investment, and does not intend to operate the Toogood Arm

Property directly. However, Trius may engage third party technical

and exploration consultants to advance its mineral property

holdings so as to increase their monetization potential.

The Company has recently become aware that

another public company has acquired the mineral claims adjacent to

and to the west of Trius’ Gander West Property, evidencing demand

for mineral exploration assets in the region.

Mr. Freudman added, “We think our growing

collection of exploration investments in Newfoundland will give our

portfolio exploration and monetization potential, which could

ultimately deliver returns for our shareholders. We remain on the

lookout for other prospective Newfoundland assets, especially those

sourced from seasoned geological teams and that we can acquire at

reasonable prices.”

Qualified Person and National Instrument 43-101

Disclosures Dean Fraser, P.Geo. is a qualified person as defined by

the Canadian Securities Administrators’ National Instrument 43-101,

and has reviewed and approved the contents and technical

disclosures in this press release. Mr. Fraser is a technical

advisor to the Company and owns securities of the Company.

About Trius Investments Inc.

Trius is an investment issuer increasing its exposure to the

precious metals sector through a variety of novel investment

structures, including acquiring gold exploration properties in

Newfoundland. Trius’ common shares trade on the TSXV under the

symbol “TRU”.

Trius is a portfolio company of Resurgent

Capital Corp. (“Resurgent”), a merchant bank providing venture

capital markets advisory services and proprietary financing.

Resurgent works with promising public and pre-public

micro-capitalization Canadian companies.

For further information, please contact: Joel

Freudman President & CEO Trius Investments Inc. Phone: (647)

880-6414

Cautionary Statements Regarding Forward-Looking

Information

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

This press release contains certain

forward-looking statements, including those relating to acquiring,

exploring, and monetizing the Toogood Arm Property and the

Company’s other exploration investments in Newfoundland, and

acquiring other mineral exploration investments. These statements

are based on numerous assumptions regarding the Purchased Assets

that are believed by management to be reasonable in the

circumstances, and are subject to a number of risks and

uncertainties, including without limitation: mineralization hosted

on adjacent and/or nearby properties is not necessarily indicative

of mineralization hosted on the Company’s properties; the

exploration or monetization potential of the Purchased Assets and

specifically the Toogood Arm Property; challenges in identifying,

structuring, and executing additional investments and acquisitions,

on favourable terms or at all; risks inherent in mineral

exploration activities and investments in the mineral exploration

sector; volatility in financial markets, economic conditions, and

precious metals prices; and those other risks described in the

Company’s continuous disclosure documents. Actual results may

differ materially from results contemplated by the forward-looking

statements herein. Investors and others should carefully consider

the foregoing factors and should not place undue reliance on such

forward-looking statements. The Company does not undertake to

update any forward-looking statements herein except as required by

applicable securities laws.

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/81a904c8-ce2e-4311-a732-dcaf982d39c1

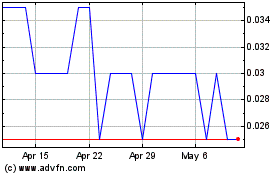

Tru Precious Metals (TSXV:TRU)

Historical Stock Chart

From Nov 2024 to Dec 2024

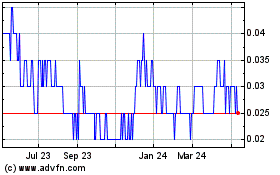

Tru Precious Metals (TSXV:TRU)

Historical Stock Chart

From Dec 2023 to Dec 2024